As of the end of 2020, there were 365 million open credit card accounts in the U.S.

With so many customers choosing this payment method, merchants have to know the different ways of accepting credit card payments.

This post will explain the methods to accept credit cards and provide an overview of the devices needed.

Security is one of the customers’ top priorities, so we’ll also tell you which steps you can take to ensure credit card info safety.

By the end of this post, you’ll be able to pick the perfect credit card solution for your business, so let’s dive in.

Jump to section:

Use a Point-Of-Sale System

Use Third-Party Processing Tools

Invest in Mobile Credit Card Processing

Leverage Email Invoices

Schedule Recurring Credit Card Payments

Set Up an Online Storefront

Use a Point-Of-Sale System

The most convenient way to accept credit card payments in person is by a Point of Sale (POS) system. In addition to accepting payments, POS lets you track your sales.

Let’s start by breaking down the POS system.

Its software is the system that allows transactions between customers and the business.

POS hardware refers to the physical components required to get your POS up and running. The essential pieces of hardware are credit card terminals or readers.

© bizoo_ via Canva.com

There’s usually a POS receipt printer, either integrated into the terminal or as a separate device.

In recent years, you may also have seen merchants using portable POS terminals attached to their phones.

Portable POS terminals allow you to conduct your business anywhere. Pop-up stores, tent sales, special events–you can sell your products regardless of location.

This is especially helpful for those in service-based businesses. For instance, if you have a dog-walking business, it’s helpful to collect the payment every time you return a dog. The same goes for companies offering activities or educational trips.

Bring the POS terminal, and let your customers choose between swiping their credit card or paying contactless by touching the terminal with their NFC-enabled smartphone.

All POS systems function the same way, but there are some differences between providers in terms of features and ease of use.

If you’re aiming to optimize your business, you have to choose a POS solution that your employees can use quickly and effectively.

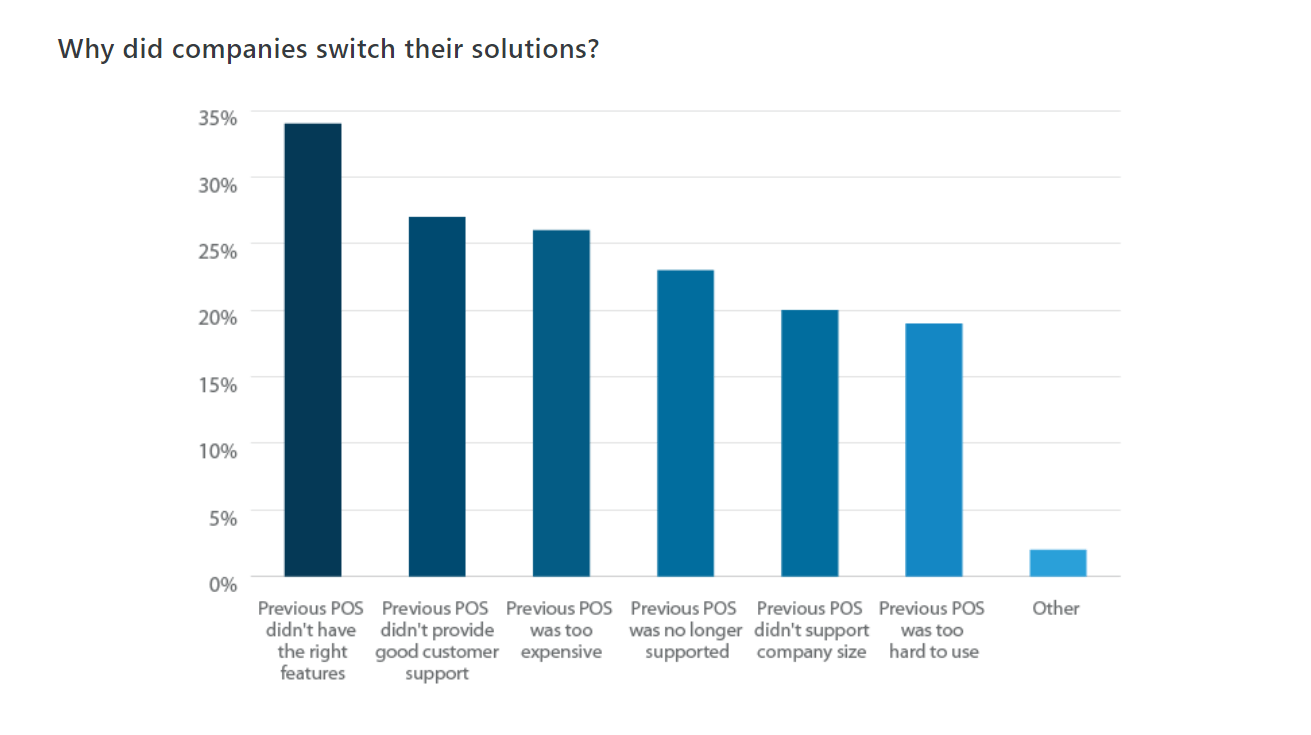

The top two reasons why companies change POS solutions are inadequate features and poor customer support. You can learn from the mistakes of others and ask your POS providers about their features.

Source: Capterra

Once you find a POS system that fits your needs, you’ll improve the experience for both your employees and customers. Everybody likes reduced waiting time and quicker payments.

POS systems are as useful for service-based businesses. If you don’t have a store but visit your customers at their locations instead, you can still accept credit card payments.

The solution is to attach a portable POS terminal to your phone, and you’re good to go, but more on that later.

We’ve found some POS systems that work well for small businesses to make the selection process easier for you. Here are our top picks:

- Square

- Shopify

- eHopper

- Vend

- Lightspeed

You should do your research and choose the POS system wisely because you will be using it every day.

Use Third-Party Processing Tools

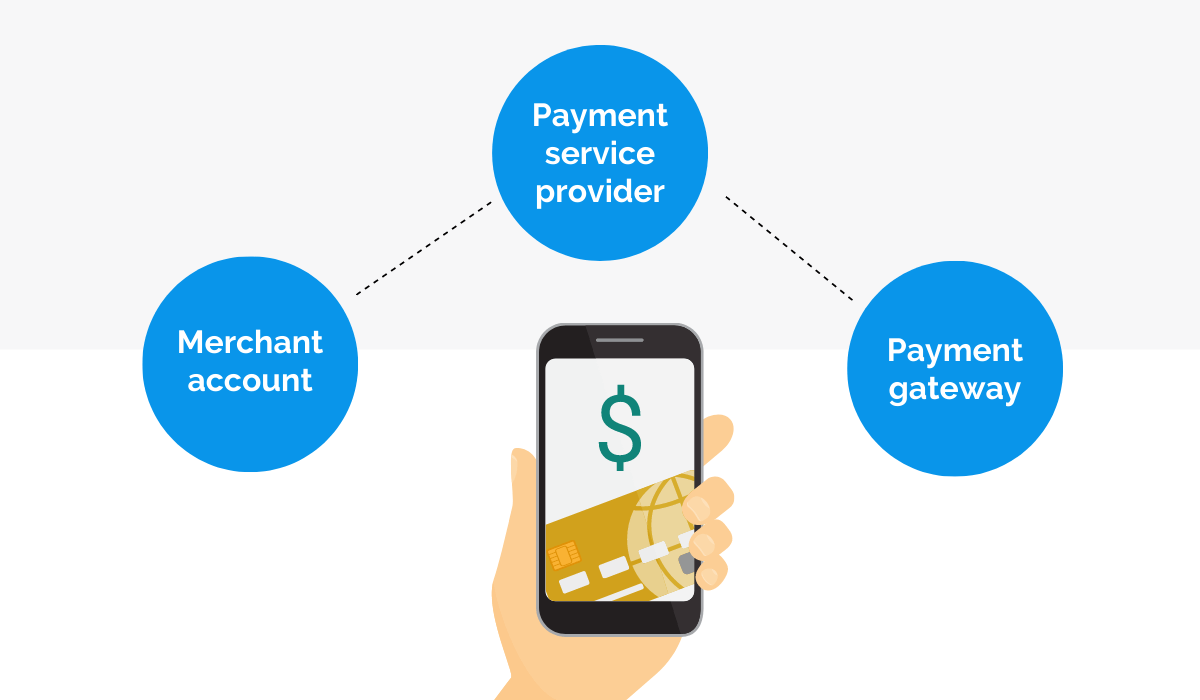

Transferring money from customers to businesses is a tad more complicated than between private users. To process credit card payments smoothly, you can use third-party tools.

The most commonly used third-party processing tools are merchant accounts and payment gateways. They allow you to accept electronic payments and make the process secure. Let’s see what they can do for your business.

Source: Regpack

A merchant account is a bank account that allows businesses to accept and process electronic card transactions. It’s not necessary to have one; some brick-and-mortar stores that only accept cash don’t.

But all businesses that want to accept credit card payments should get a merchant account. After all, credit cards account for 23% of all payments in the US, and you don’t want to miss out on that.

Payment gateways are used as a liaison between a customer’s and a business’s account. They facilitate the transfer between a website or a mobile phone and the acquiring bank.

During the process, gateways encrypt customer information and minimize the risk of credit card fraud.

They are essential for businesses that rely on online transactions or eCommerce businesses. You’ve probably heard of some of the frequently used payment gateways, such as PayPal.

None of these tiny details about implementing encryption protocols correctly have to worry you if you opt for an integrated payment solution, such as Regpack.

You can elegantly embed a Regpack payment form into your website with a line of code and let the software process the credit card payments for you.

Source: Regpack

We work together with Bluesnap, a top-performing payment gateway provider, to process your payments quickly and securely.

A drawback of payment gateways is that they are not always universal, i.e., they don’t accept all cards. Still, our solution works with all major credit and debit cards: Visa, MasterCard, American Express, Discover, Diners Club, and more.

Invest in Mobile Credit Card Processing

The use of mobile payments is on the rise. If you want to attract customers interested in cashless and cardless payment, you should invest in mobile credit card processing.

Mobile payment is a term used to describe payment services processed via mobile devices, such as tablets and smartphones. This option is becoming increasingly popular among American consumers, with a 29% year-over-year growth in 2020.

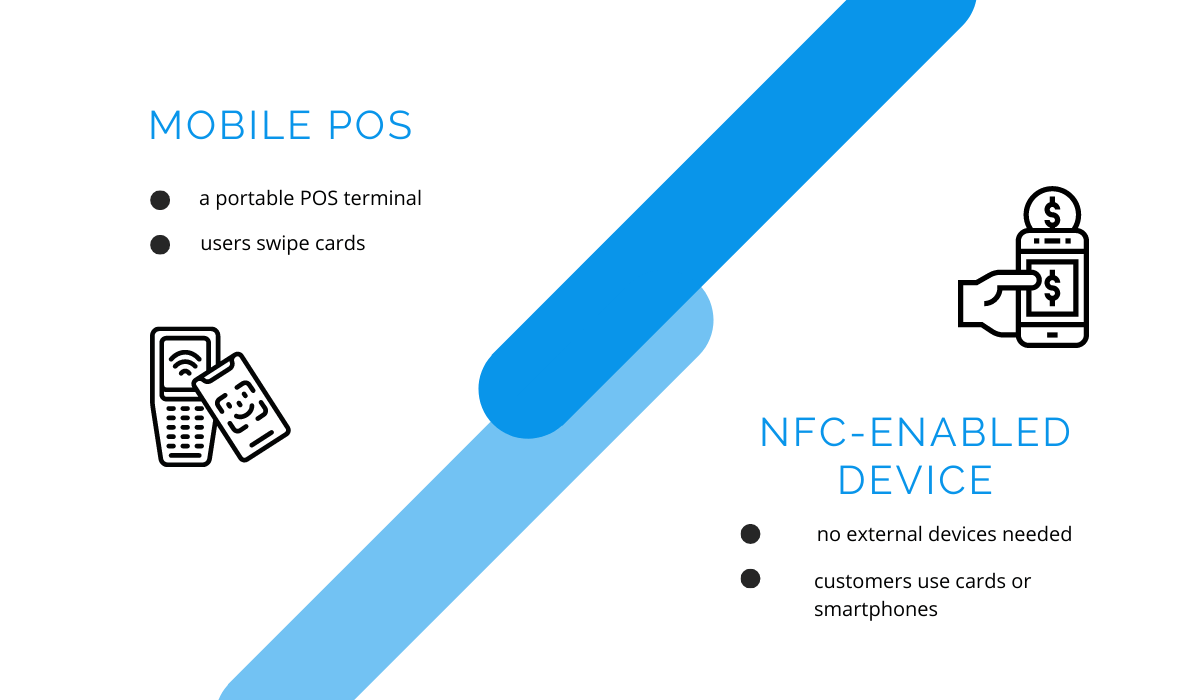

There are two major types of mobile payments. One requires business owners to utilize a portable POS terminal, which we mentioned at the beginning. The other type refers to the NFC (near field communication) technology.

Source: Regpack

To use your phone as a POS terminal, you have to have NFC on your smartphone, and a card swiping app, such as Visa Tap to Phone, to turn your phone into a POS terminal.

This way, a merchant can hold out their phone, and the customer pays either by tapping their card or their smartphone with the mobile wallet enabled.

© EXTREME-PHOTOGRAPHER via Canva.com

When users install a mobile wallet and enter their card information, they can use their smartphones or smartwatches for payments. Mobile wallets with the highest numbers of users are:

- Apple Pay

- Starbucks

- Google Pay

- Samsung Pay

Seeing that more than 150 million Americans have used a digital wallet at some point, it’s worth integrating a mobile payment solution into your business.

Mobile payments are fast, secure, convenient, and fully digitalized.

COVID-19 has revealed another benefit of the technology: people don’t like touching cash or cards, so contactless payment is the way to go.

Leverage Email Invoices

There is a lot more to emails than just sending messages. You can utilize them to automatically send invoices as soon as your customers order your goods or services. And if you leave the payment method up to customers, they will probably pay with a card.

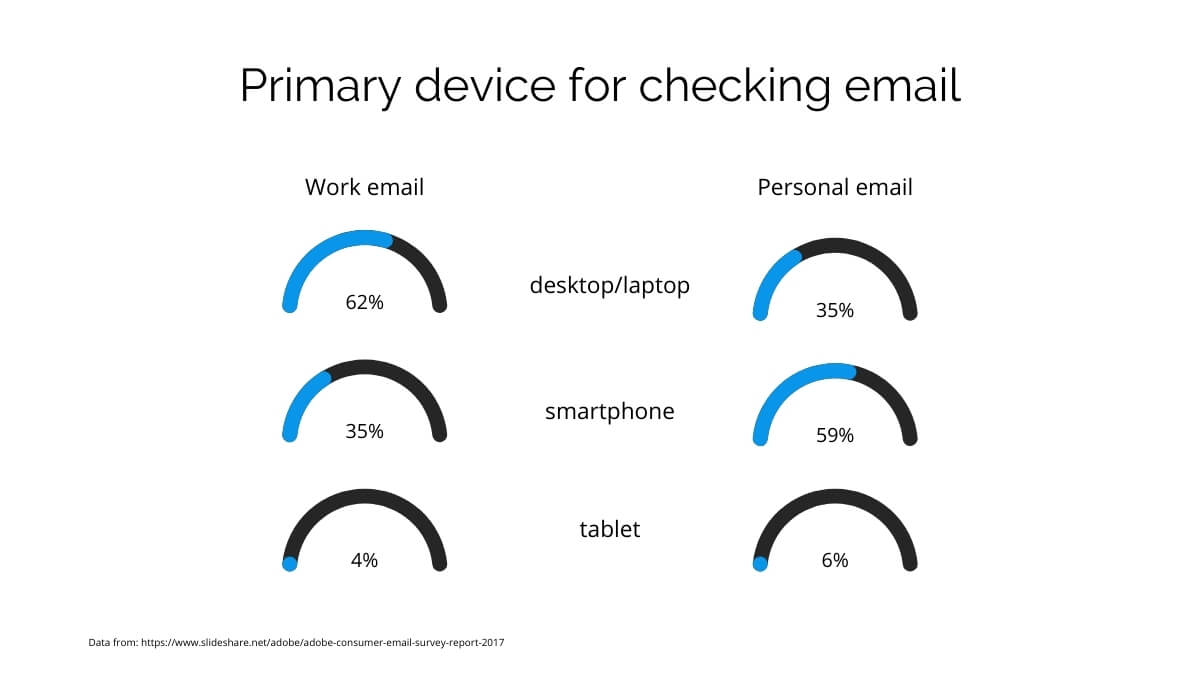

Almost 4 billion people use email; that’s more than half of the total population. According to an Adobe email usage study, people check their personal and work email every day.

These pieces of information show that if there’s a way to get people to pay you, it’s through email.

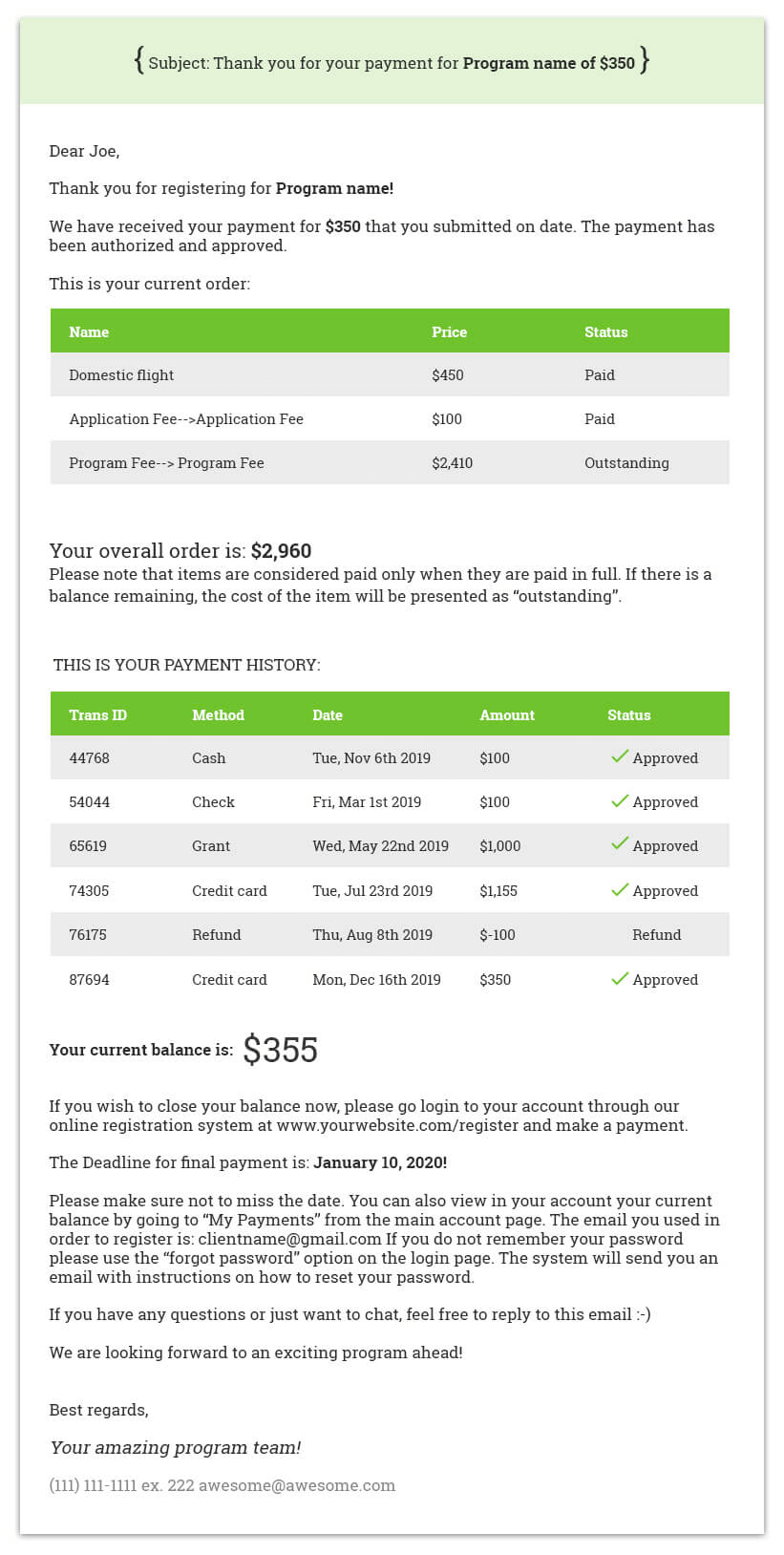

A great benefit of email invoices is that they show a clear overview of purchased items and the price, which is useful for customers. They can see the total cost and pay it immediately.

The appearance of your email invoice is as important as its content. Ensure that all essential elements are clearly displayed because you can’t know if the customer will read the email on desktop or mobile.

As you can see in the following picture, people read their work email on desktop, but the top choice for reading personal email is the smartphone.

Source: Regpack

An invoice should keep its shape across all devices, so emailing invoices as PDF documents is a good option.

You don’t have to spend a lot of time composing concise, good-looking email invoices. There are tools you can use to automate the process, such as email templates.

Source: Regpack

The first step of creating a template is to enter your company info, logo, and other elements that are the same at every purchase. Next, you need to enter a list of your services and prices, so you can simply select these items later instead of typing the data manually.

The process can be made even easier. If you integrate the communication system and your online store into one platform, the system can automatically generate invoices and email them after the checkout.

That way, customers get the accurate information they need to make a payment, and you get organized purchase documentation without effort.

Schedule Recurring Credit Card Payments

Yet another benefit of automatization can be seen in recurring payments. You set up the payment schedule, customers connect their credit cards, and forgotten payments are a thing of the past.

Recurring billing is a way for merchants to accept payments on a prearranged schedule instead of issuing an invoice each month. This method saves time and money that would otherwise be spent on generating individual invoices.

At the beginning of the recurring payment process, a customer permits the business to pull funds from their credit card at monthly or weekly intervals.

You don’t have to rely on customers making payments by hand; the process is automated, so the risk of late or missed payments is minimized.

Since you are guaranteed to get paid, your cash flow is more predictable, which helps you with long-term financial planning.

However, to reap all these benefits, you have to find a recurring credit card payment solution that both you and your customers can use with ease. This is something we can help with.

Regpack’s recurring billing software lets you create payment plans and control the payoff timeline.

It looks good on the customers’ end, too. Here’s how easily a customer can set up recurring payments:

Source: Regpack

Remember that all merchants who accept credit cards have to be compliant with PCI security standards. The standards ensure that the data is kept secure and private. For example, PCI forbids you from storing credit card information.

With us, your customer data is secure. Regpack is PCI compliant Level 2, and the PCI approval entity scans our system regularly.

Almost all businesses can make use of recurring payments. Those who sell physical products can explore whether their customers would be interested in subscription boxes.

It’s even easier for service-based businesses, such as gym memberships or landscaping services. When you enable recurring payments, your repeating customers will have one task fewer to think about each month.

Set Up an Online Storefront

From visual design choices to payment options, your website can work in your favor and attract customers, so make sure it’s professionally done. Pay special attention to the way you integrate credit card processing.

A well-made online storefront represents your brand as a whole. When customers enter your website, you have less than a second to leave a good impression. The elements you have to include to make online shopping a pleasant experience are:

- Clear product information

- High-quality product images

- Information about your business

- Search options

- Security protection

If your presentation is less than ideal in any of these areas, chances are that customers will not complete their purchase.

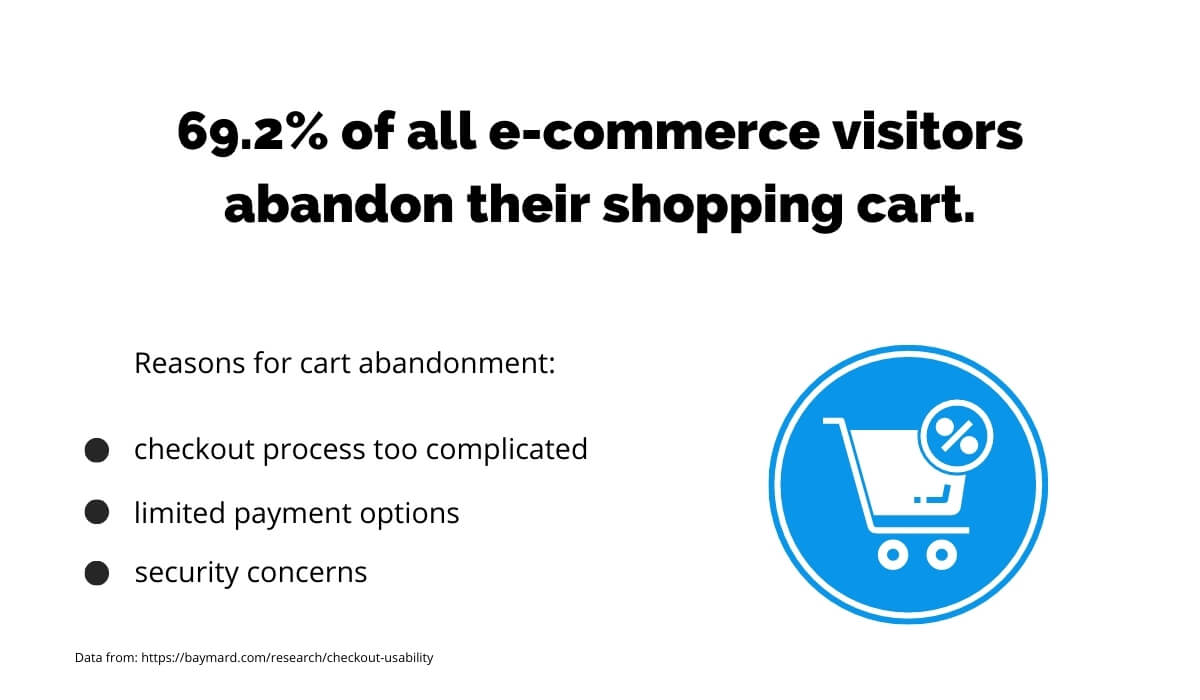

After tracking online shopping for 11 years, Baymard has found that at the moment, 69% of customers who add an item to their cart don’t finish the purchase.

The element that can make customers wary of a website is security. They will abandon their carts at the first sign of security concerns.

Source: Regpack

Seventeen percent of shoppers won’t complete the purchase if they don’t trust the site with their credit card information. To prevent that, you have to integrate secure credit card processing into your online storefront seamlessly.

Since PCI prevents merchants from storing cardholder data or sensitive authentication data, you need a third-party processing tool that protects customer data with encryption.

For instance, Regpack’s secure payment forms can easily be customized and embedded into your website. You get to keep your visual identity, and we help you protect the data.

Source: Regpack

Our billing system supports all major card networks, so your customers can choose between a number of payment options. We are PCI-2 compliant, so the customers can safely shop knowing their data is protected.

Conclusion

Credit cards account for a significant share of payments, so you want to be there for the customers who prefer this payment instrument.

There are different ways to accept credit card payments, and whichever method you choose, you have to implement it securely.

Customers won’t shop at your business unless they know they can trust you with their card information. This is why you have to partner with reputable payment processing companies and ensure your payment systems are at the top security levels.