Have you ever stepped into one of those hole-in-the-wall sandwich shops only to find that they accept cash, a form of payment that you never carry?

The owner points to the gas station down the street and says, “They have an ATM.”

Now, some people won’t care about this anachronism. But some will.

Some won’t be as excited to eat that sandwich as they were when they first caught that glorious whiff of freshly baked bread.

That’s how a whole lot of customers of service businesses feel when they’re unable to pay for a service through online means.

“These people want me to send them a check? Seriously?”

And a service website doesn’t have the charm and aroma of a tiny sandwich shop, so the potential buyers are less forgiving.

Besides being a way to keep your buyers happy, accepting online payments results in many other major advantages for your business—six to be exact—and we’ll cover them in this article.

- Reduced Operational Costs

- Optimized Cash Flow

- Increased Sales

- Alignment with Customers’ Preferences

- Higher Customer Retention Rate

- Increased Customer Trust

- Conclusion

Reduced Operational Costs

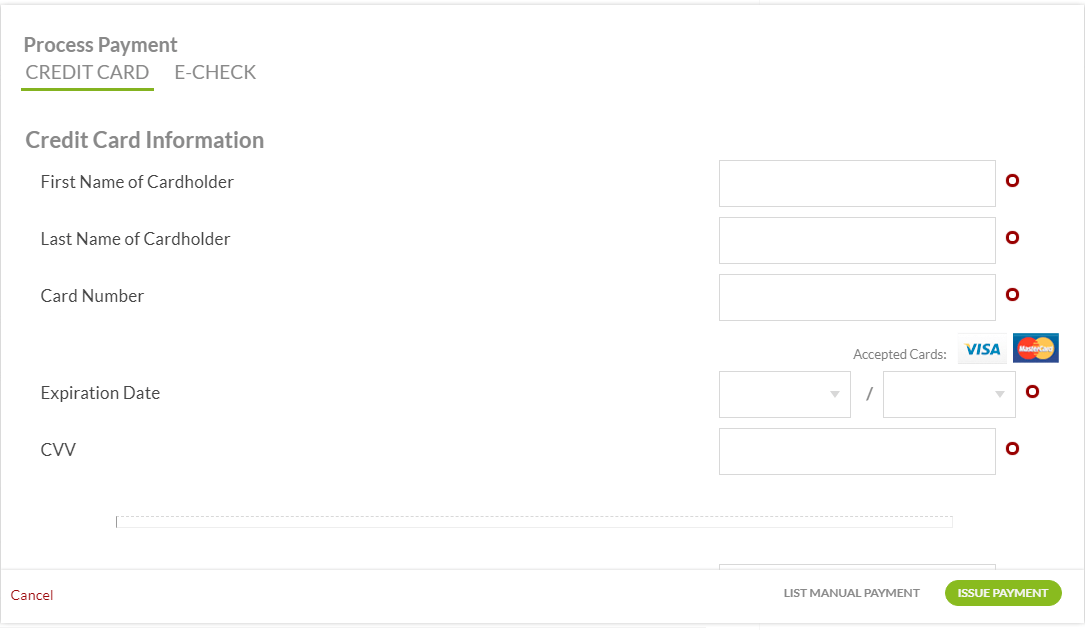

After setting up online payments on your website, payment collection from customers shopping online will be fully automated.

The automation extends past the processes of accepting credit cards and online checks from customers at checkout.

Many online payment platforms will also empower you to set up automations for tasks like sending invoices or receipts to customers.

That way, after a customer makes a purchase, your software will automatically create a personalized invoice or receipt and send it to them via email.

This reduces the operational costs involved with invoicing customers.

And it saves your team plenty of time that you can then spend on more profitable activities, like process improvement or a new marketing initiative.

Automating payment collection processes enables you to reduce the administrative and operational costs of your business in many other ways as well:

| Decreased labor costs. | Unlike a cash register, no one needs to stand ready to accept payments at an online store. Customers can pay by themselves without interacting with any of your staff. |

| Less human error. | Mistakes at checkout can waste time and frustrate customers. Without humans involved, errors are rare in online payment. |

| Lower paper costs. | Online payment processing doesn’t require stamps, paper receipts, or printing materials, making it more cost-effective than paper-based methods. |

| More customer data. | All transaction and payment data is stored within your online payment software, and you can use this data to analyze your processes and come up with more cost-efficient ones. |

With those additional profits, you can invest in your equipment, marketing and sales strategies, or personnel.

And these investments will help you grow your business and increase revenue.

Optimized Cash Flow

One of the top reasons for accepting online payments is that you’ll receive your money more quickly, thus optimizing cash flow.

Online payments are instant. They aren’t slowed down by physical distance or a customer’s inability to come into the store.

Unlike checks that must be sent in the mail, online payments provide you with your funds almost immediately.

Depending on the customer’s payment method and your bank, it might take a few days for the successful payment to be reflected in your business bank account.

But the delay usually won’t be long enough to harm your cash flow.

Another way that accepting online payments can help optimize a business’s cash flow is by automatically charging for subscription services through recurring billing and autopay.

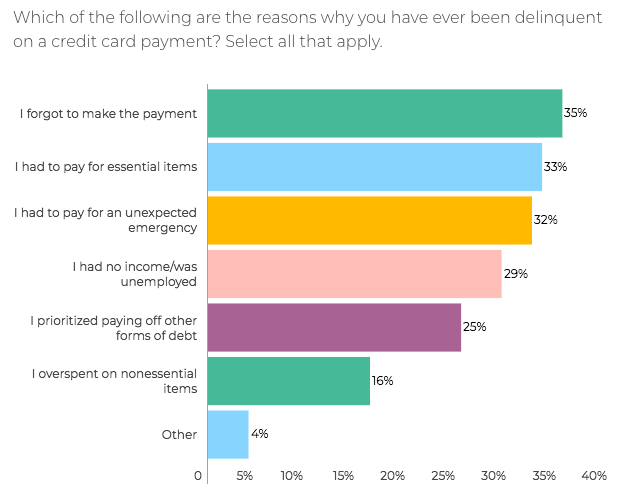

This enables you to reduce late payments by all but eliminating the chances that a customer forgets to pay, which is the leading cause of late payments:

Source: NGPF

Also, you can offer flexible payment options. If their credit card is declined, the customer can easily switch to PayPal, bank transfer, or some other method you offer.

This is much better than them deciding to take their business elsewhere because you couldn’t accommodate them.

By facilitating the process of payment for your customers, you’ve also made sure you’ll get your money quickly.

And this will ensure that, at all times, you have the cash you need to effectively run and expand your business.

Increased Sales

Marketing and sales aren’t the only two levers you can pull to boost sales at your business. Tweaking your payment collection strategy can also give you that uptick you’re after.

Accepting online payments empowers you to increase sales in various ways:

| Enhance the customer journey. | Even if customers don’t make a purchase through your online store the first time they check it out, they can use the store to research your offerings, pricing, and payment plans. |

| Reach a wider audience. | Sell to target customers anywhere in the world, not just those who live nearby your physical location. Many online payment platforms also help you attract cross-border clients by allowing them to pay in their local currencies. |

| Make buying more convenient. | By offering customers the ability to purchase from the comfort of their homes using a variety of payment methods you reduce the friction involved in buying from your business. |

| Offer add-ons during checkout. | Many online payment platforms enable you to automate relevant service recommendations to customers as they check out. This can lead to larger purchases. |

| Keep your store open 24/7. | When you have an online store, customers can browse your services and make purchases at any time of day or night. |

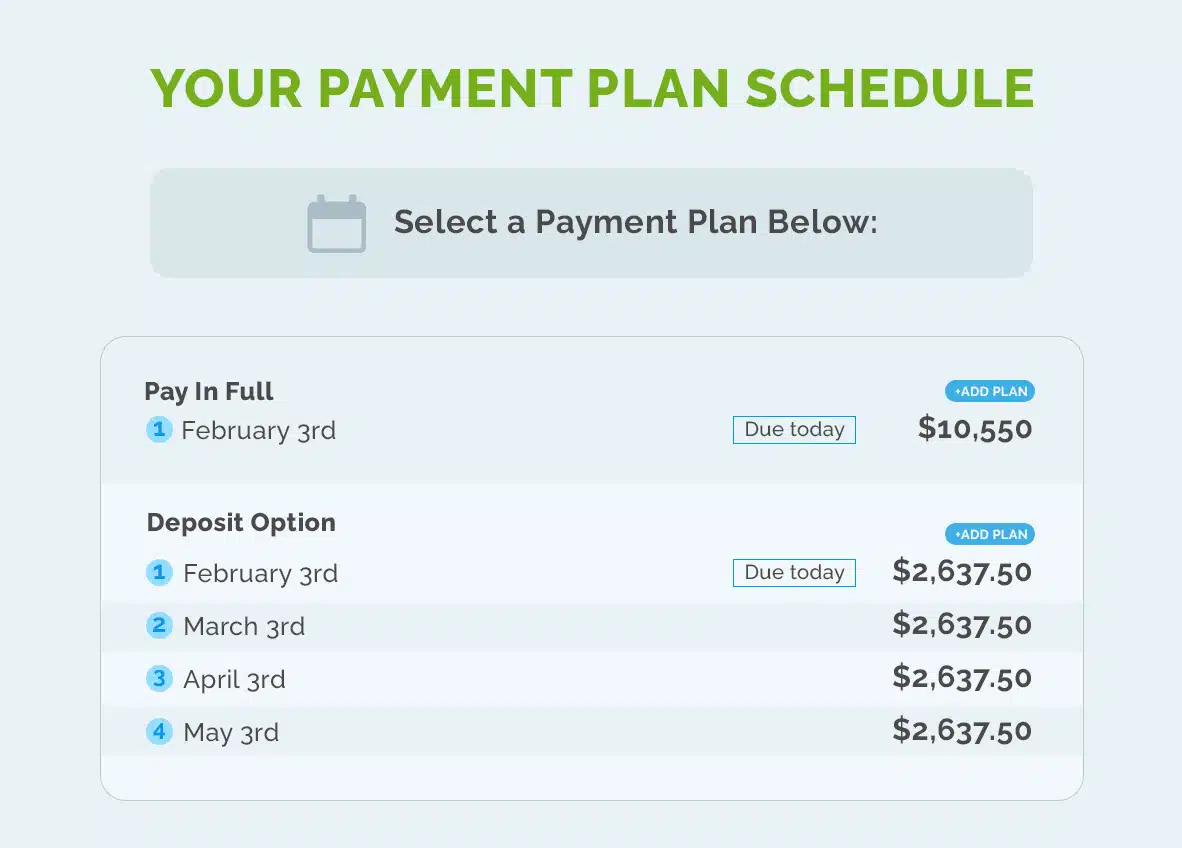

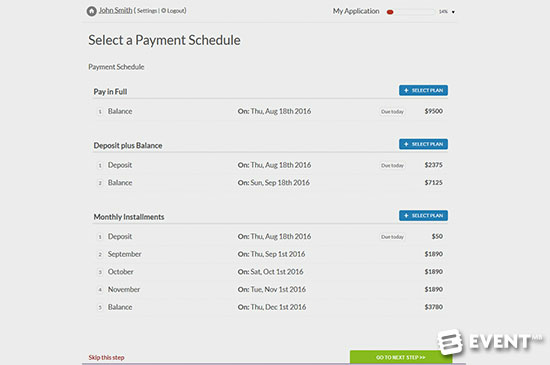

Offering your customers convenient payment methods like recurring billing or personalized payment plans (shown below) can also help you stand out from your competition.

Source: Regpack

If a prospective buyer is having trouble determining which service is of the highest quality, they have to use another factor to make their pick.

Often, this factor will be which business will be easiest to work with. If you offer incredible flexibility around payments, that might be enough to win them over.

Alignment with Customers’ Preferences

Inverting business conventions is only satisfying to a customer if you have something better in store for them. Take the below example.

“Sorry, we don’t accept online payments.”

“Ah, really? Everyone else does.”

“Nope, we don’t. But we do give away our service for free!”

“Wow! This is great!”

Unfortunately, the above approach won’t work for most businesses, for reasons we doubt need explanation.

In most cases, you’re going to want to deliver on what the customer is expecting, and when it comes to buying your services, they expect online payments.

They want it too. Digital transactions have been on the rise for some time now.

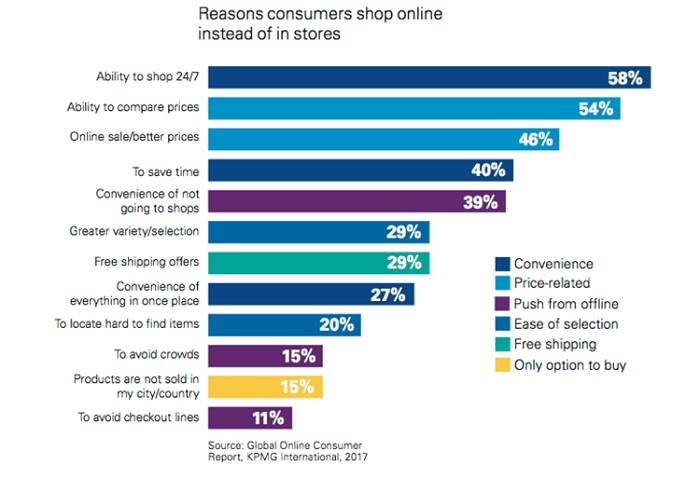

And a high number of shopping begins online these days. It’s often just more convenient than heading out to a store.

Online buyers can avoid lines and crowded stores, easily compare features and prices across brands, and locate all the information they need in one place, without getting in the car or, for that matter, putting on a pair of pants.

Most of all, they can shop 24/7, which is great for your business’ sales numbers:

Source: Smart Insights

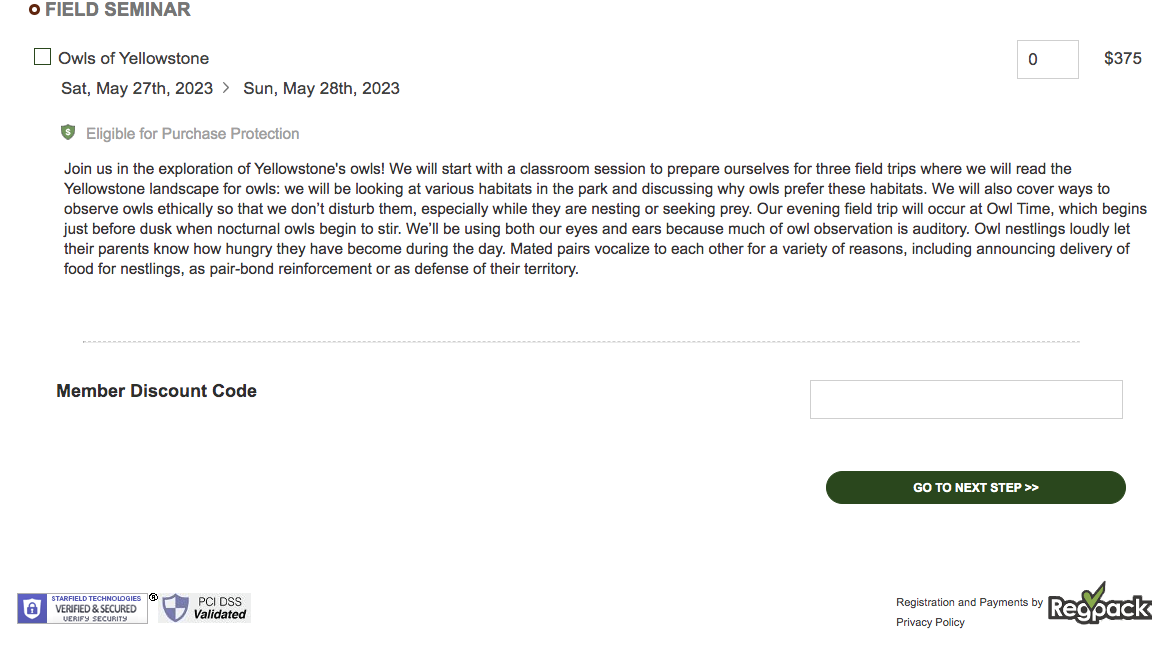

Therefore, to align with your customer’s preferences and give them a great buying experience, create an online store and enable customers to make payments online.

If your service is something customers can sign up for on their own, allow them to do this without getting in touch with a sales rep.

Instead, make it super simple with an online payment form like the one below:

Source: Regpack

You should also make sure that you use an online payment software solution that allows you to create payment forms that adapt to mobile screens.

This way, your customers can also shop and make payments while they’re on the go

This is a crucial feature knowing that 50% of consumers shop more with their mobile devices than in-store:

Source: Oberlo

If you offer mobile-friendly online forms, customers can place purchases while waiting on the bus home from work, or while waiting for the water to boil.

By accepting online payments, you’ll improve the customer experience by a long shot. You’ll also shorten your average sales cycle length.

Customers can have their first encounter with your service, research it exhaustively, and place a purchase, all within an hour, often without having to speak to anyone on your team.

Higher Customer Retention Rate

Accepting online payments increases your customer retention rate for reasons other than its improvements to customer convenience and satisfaction.

When you accept online payments, your customers must submit their contact information into an online form to make the purchase.

This customer information that you collect is almost as valuable as the payment.

You can use this intel to do many things that delight customers, increase upsells, and build long-term relationships.

For example, you can use their email addresses to do the following techniques:

| Promote discounts and sales. | If you’re running a discount or sale and want customers to know about it, send them an email explaining how great a deal it is. |

| Send customer satisfaction surveys. | Ask customers to give feedback about your service so that you can tweak it to better satisfy your buyers. Customers also love being asked their opinion. |

| Run automated email campaigns. | Add customers to automated email campaigns that keep them engaged with your brand. Share recent blog posts, case studies, and service updates. |

| Add them to your newsletter list. | Build credibility as an expert by sending customers emails covering the latest industry trends, best practices, and news stories. |

| Recommend relevant services. | Email customers about services that are similar or complementary to the ones they’ve already purchased from you. |

All of these actions will strengthen the bond between your customers and your brand, not to mention make more sales.

Another way that accepting online payments leads to higher retention rates is that it reduces churn that’s a result of customers not being able to pay for your service.

Most online payment platforms, including our own solution, Regpack, will enable you to create custom payment plans for your customers, allowing them to pay in full or spread it out over multiple installments.

Source: Regpack

Overall, your customers are going to be a lot happier with your brand if you accept online payments.

You’ll be making their lives easy. And this means they’re more likely to stick around.

Increased Customer Trust

Having an online presence and taking online payments is an opportunity for businesses to build a relationship of trust with their customers.

Buyers associate online payments with credibility and professionalism. It’s a sign to them that your business is staying up-to-date and following industry best practices.

It demonstrates that you have your operations in order. It shows that you’re willing to make changes to improve convenience for your customers.

If, on the other hand, they see a business with a shabby website that wants customers to send them checks, that might be a red flag.

This trust you build with an online presence is amplified when your business also uses advanced online payment solutions that offer incredibly secure online transactions and protect sensitive financial information.

For example, your payment solution should be PCI-compliant, meaning it follows the standards set out by the payment card industry. It means your business uses security technology like antivirus software and techniques like tokenization.

When you highlight on the checkout page that your payment solution is highly secure, you’ll improve your brand’s trustworthiness.

For example, Yellowstone Forever places a badge in the bottom left-hand corner of checkout to show that its online payment tool is PCI certified:

Source: Yellowstone Forever

In sum, offering customers the option to pay online through a clean, secure, and professional-looking interface is a great way to increase your brand’s trustworthiness.

Conclusion

Accepting online payments from customers leads to numerous benefits for your service business.

You’ll improve cash flow, meet customer expectations, reduce operational costs, increase retentate rate, and boost your sales numbers.

And your team will be able to spend less time collecting payments and chasing down customers, and more time using their creativity and expertise to drive change and revenue.

If you’re interested in making the change to online payments, consider reading our article on the best payment processing software for service businesses, where we assess several popular tools and highlight their pricing and features.