Accounts receivable are one of the building blocks of your business, but unfortunately, they can quickly turn into stumbling blocks. The more money your customers owe you, the more you are in danger of running out of funds, putting you at risk of closing shop for good.

So, to keep your business afloat, you need a steady flow of funds into your business. One way to do that is by ensuring your customers are paying on time by automating the process of handling accounts receivable.

Automation makes it easier for your employees to handle issues that arise with managing accounts receivable.

By leaving the more tedious, routine administrative aspect of the process to software, you eliminate most related errors, delays, and inaccuracies, allowing your team to put their energy into more meaningful tasks.

If you want to know more about accounts receivable automation and how it can help your business, then check out the rest of this article.

Jump to section:

Basics of Accounts Receivable Automation

Accounts Receivable Automation Market

Accounts Receivable Automation Benefits

Accounts Receivable Automation Best Practices

What to Consider When Choosing a Service Provider

Basics of Accounts Receivable Automation

You’re probably already familiar with the term account receivable, which refers to the payments you collect from customers. Now let’s see what the process of managing them entails, or, in other words, what exactly you would be automating.

Here are some standard steps in the process of handling accounts receivable:

- Setting payment expectations (payment options, dues dates, late payment fees, etc.)

- Sending invoices (digital, paper)

- Tracking payments

- Enforcing dunning procedures for late payments

Many of the essential tasks associated with each step of this process can be simplified with accounts receivable (AR) automation.

Accounts receivable automation is a more streamlined system of automating repetitive tasks to help companies save time and get paid faster.

The tasks you would usually do manually, such as creating invoices, tracking payments, or sending reminders, can be handled by software.

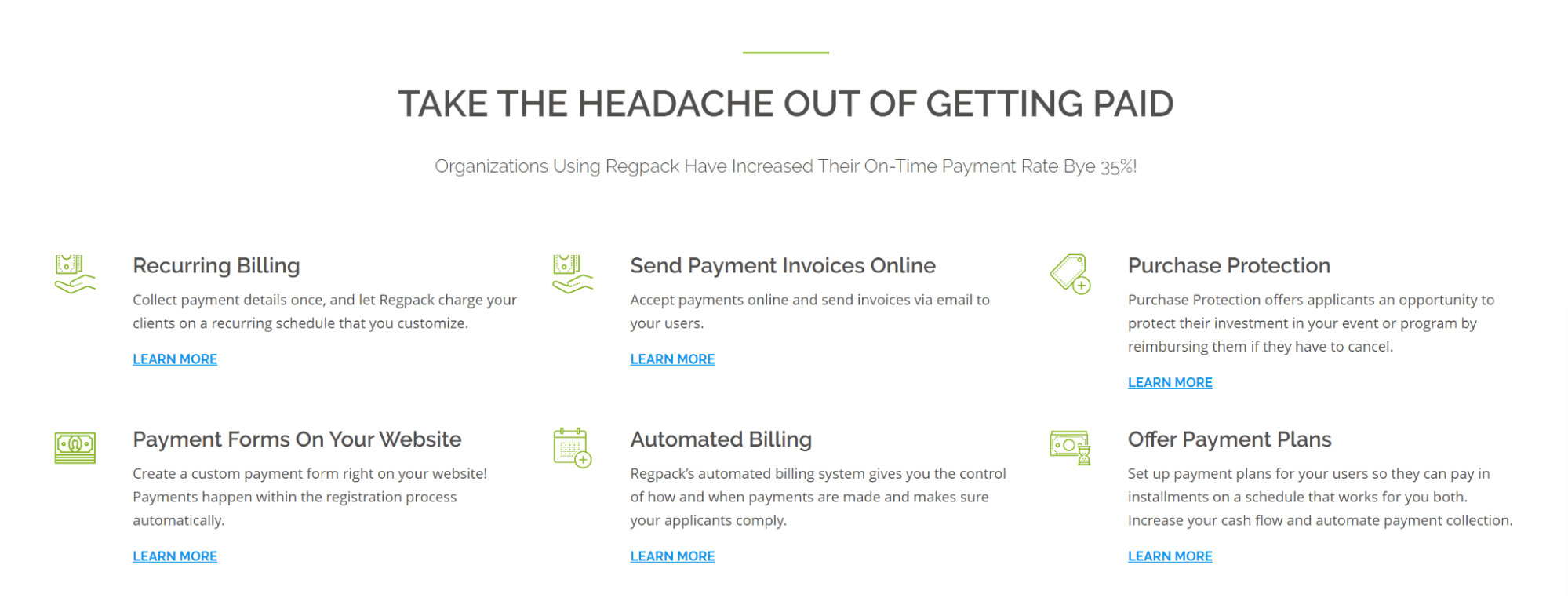

Source: Regpack

In fact, this is a game-changer for many companies to address core issues regarding payment collecting and management. According to recent research, almost two-thirds of companies are implementing AR automation to improve their business procedures.

Basically, this helps companies avoid mistakes due to human error, reduce costs and delegate burdensome tasks to an automated solution. That way, they can address delayed payments and control their cash flow more efficiently.

In the end, the central premise of accounts receivable automation is to establish efficient end-to-end payment management to help businesses grow.

Accounts Receivable Automation Market

Because many companies are switching to accounts receivable automation to improve their business processes, it comes as no surprise that the market is booming.

In fact, research shows that the accounts receivable automation market garnered $1.7 billion in 2019. And with an annual growth rate of 12.1%, it’s estimated that it will reach $3 billion by 2024.

Now, what are the key drivers of this exponential market growth?

First, even though revenues declined globally at the start of the COVID-19 pandemic in 2020, many industries are now catching up and facing a growing volume of financial transactions.

What’s more, customers are adopting new purchasing habits, which further prompts companies to adjust how they approach accounts receivable processes.

© juststock via Canva.com

To put it simply, the main focus is on cash flow improvement and reduction in days sales outstanding (DSO). That is why 83% of B2B companies have switched from physical invoices to digital invoicing.

Automating workflows makes them more adaptable to changing market trends and accommodating their customer’s needs.

So, as global companies seek ways to adjust to the market and meet customers’ demands, it’s safe to say that many have found a solution in accounts receivable automation.

Accounts Receivable Automation Benefits

Even though the largest share of the accounts receivable automation market belongs to large companies, everyone can profit from streamlining their payment processes.

So, let’s look over some of the essential benefits of accounts receivable automation.

Saving Time on Handling Invoices

Anyone who’s had to deal with invoicing knows how tedious and time-consuming this process can be. Especially if you have to do it manually.

In some companies, like Peak Cashflow, staff had to dedicate an entire day each month to deal with accounts receivable. This included creating invoices (with distinct layouts for different customers) and sending them to the right customers.

© Casper1774Studio via Canva.com

But by automating, you can relieve your AR department of some of the burden, so they can spend time working on more important tasks. They no longer have to look for customer data or handle disputes caused by human error.

In essence, their workflow is more efficient, and they’re helping the company thrive with streamlined payment management.

In the end, your employees will save time handling invoices and shift their skill set in working proactively for the company.

More Control Over the Cash Flow

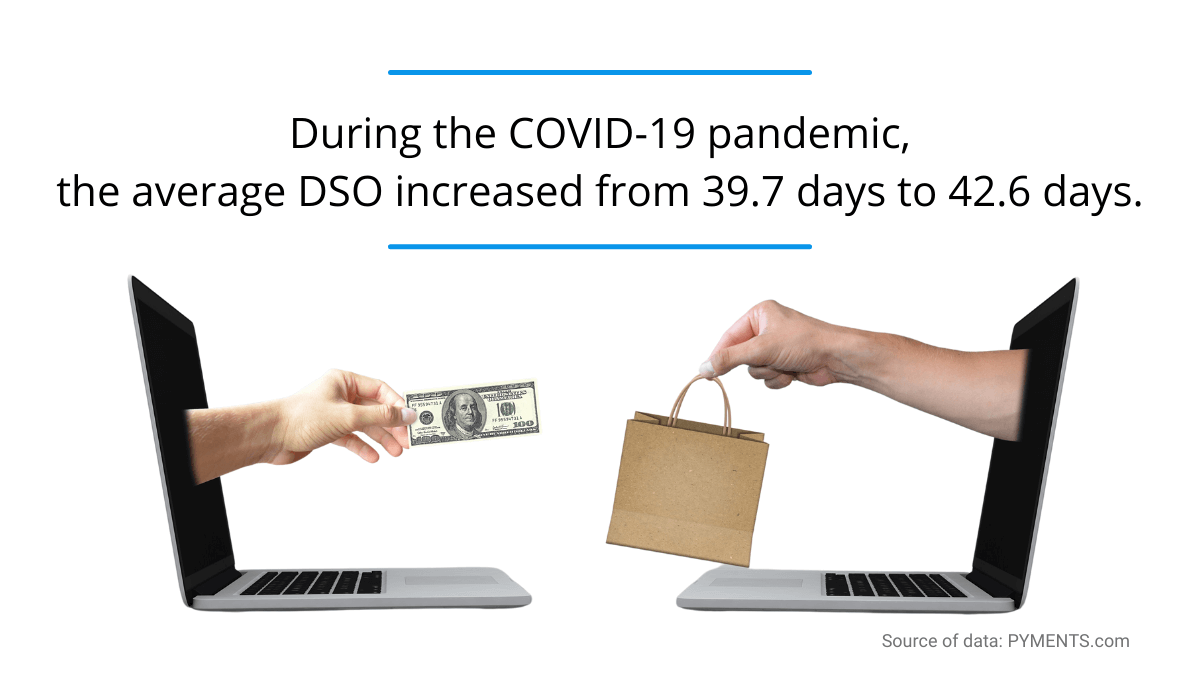

One of the biggest challenges during the COVID-19 pandemic was dealing with increasing Days Sales Outstanding (DSO). The average DSO went from 39.7 days to 42.6 days, which meant that companies were paid nearly three days later than usual.

It might not seem a lot to an average person, but for businesses, it significantly affects their cash flow control. After all, companies need to cover their expenses and maintain a good credit score and reputation for future investors. So, the sooner they get paid, the better.

Source: Regpack

With automation, you’ll have better control over the money that goes in and out of your accounts. The right software solution will help you track late payments, send reminders, and ensure your customers are notified on time about their financial obligations.

Scheduling automatic reminders will cut down delays and contribute to eliminating bad debts. In turn, you will be able to predict cash flow more accurately and keep your business afloat.

It’s bad when one customer doesn’t pay on time, but if multiple invoices are not paid, that’s a sign of extreme concern.

So, if you want to minimize late payments to stay in business for a long time, you need accounts receivable automation.

Greater Invoicing Accuracy

Another great benefit of AR automation is that it increases the accuracy of your invoices. Employees often make mistakes, especially when systems get more complicated or you have an extensive customer list that they need to take care of.

Once you automate your accounts receivable, there will be no more sending invoices to the wrong customers or entering incorrect customer information.

Not to mention you’ll avoid having to handle disputes because employees made a mistake on an invoice and the customer refuses to pay.

© milan2099 via Canva.com

In short, offering more accurate and timely invoices can improve your relationship with your customers, as you will seem more professional, detail-oriented, and reliable.

AR automation can help you position yourself as a partner to your customers, so if they’re successful, then you’ll be as well.

Accounts Receivable Automation Best Practices

To realize some of the benefits of accounts receivable automation, you’ll need to adopt a few best practices. These range from straightforward ones, like improving communication with your team, to others that will require a more strategic approach.

Let’s check them out!

Get the Accounting Team on Board

Once you decide to invest in AR automation, you’ll need to talk to your accounting team. They’re the ones who will have to use the new system, so it’s best they’re informed about the changes first.

What’s more, they can give their insights about the significant pain points in their daily workflow when managing accounts receivable, enabling you to find the best solution for your company.

© NicoElNino via Canva.com

Look for specific tools and features that can answer your accounting team’s biggest concerns. You can figure out how to simplify some essential steps and optimize your billing process to make everyone’s lives easier.

Following that, it might be good to appoint a team leader once you implement an AR automation system. They’ll be your team’s main point of contact and manage the AR automation process to ease the department into a new workflow.

Also, they’ll oversee training for the employees, check that the software is meeting the expectations some time down the line, and address any concerns with the higher-ups at the company.

All in all, your team is crucial in making AR automation implementation work and helping you achieve your goals.

Automate the Invoicing

As mentioned before, better cash flow control starts with automating your invoicing.

To put it simply, the software can monitor and extract information from different platforms to generate and send invoices to your customers according to a specific schedule. Additionally, it can also create follow-up notices and assist you in the reconciliation process.

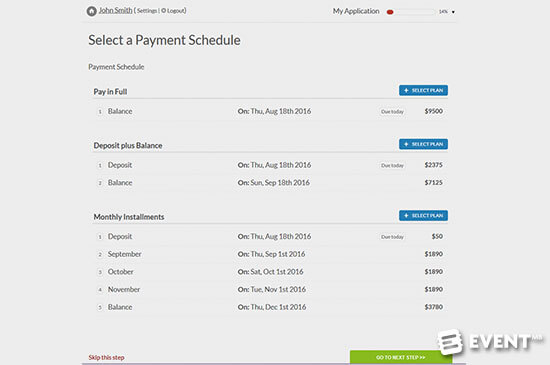

Source: Regpack

What’s more, an automated system is much faster and more efficient than an employee.

An average AR clerk takes 12 minutes to handle an invoice, from pulling the correct customer data, manually entering it into a Word doc or PDF, to proofreading, and sending it to the customer.

In contrast, an automated AR system can finish those tasks in 2 minutes! Therefore, you’re not just benefiting from more accurate invoices, but you’re processing more of them faster.

So, if you want to process your invoices faster and get paid on time, you need an accounts receivable automation to automatically send electronic invoices.

Establish a Dunning Management Process

Sometimes, the worst can happen, and you’re not going to receive the payment for your services on time. Then, you need to establish methods to chase late or unsuccessful payments to avoid further delays.

This is referred to as dunning. Simply put, it’s a way of communicating with your customers about failed payments to mitigate potential financial risks, such as bad debt, lengthy disputes, and extended DSOs.

When it comes to failed payments, you’ll most likely face expired credit cards, minor payment gateway processing problems, or insufficient funds in customers’ accounts. If you have an AR automation solution, it’ll handle these issues without you lifting a finger.

The software will process credit cards again or send a payment reminder to the customer to resolve the issue (e.g., by adding funds to their account, changing credit card info, or taking a similar necessary action) on time.

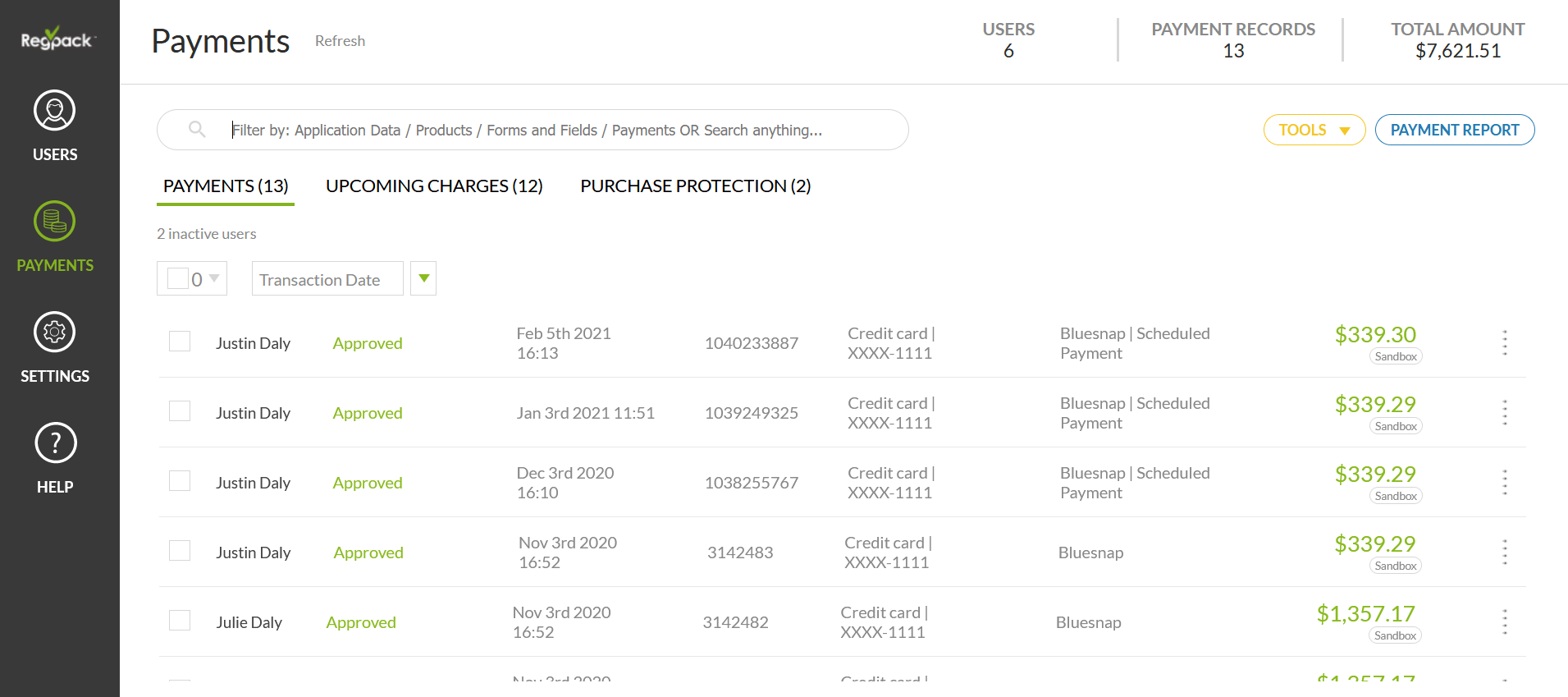

Source: Regpack

What’s important is to inform your customers about the invoice follow-up policy.

For customers that have trouble paying on time, you can set scheduled reminders, for example, the first one within five business days after the due date passes and the next one after ten or more days.

You can also put late payment fees into your contract to incentivize troublesome customers to pay on time. If all else fails, contact lawyers or collection agencies to discuss your options.

It all boils down to mitigating potential financial risks that could jeopardize your company if customers don’t pay on time or at all. AR automation can solve minor problems, but if the non-payment issues escalate, ensure you have efficient procedures for collections.

Keep an Eye on Your AR Data

One important aspect of running a successful business is providing regular and correct financial reports. This process is more straightforward with an automated AR solution.

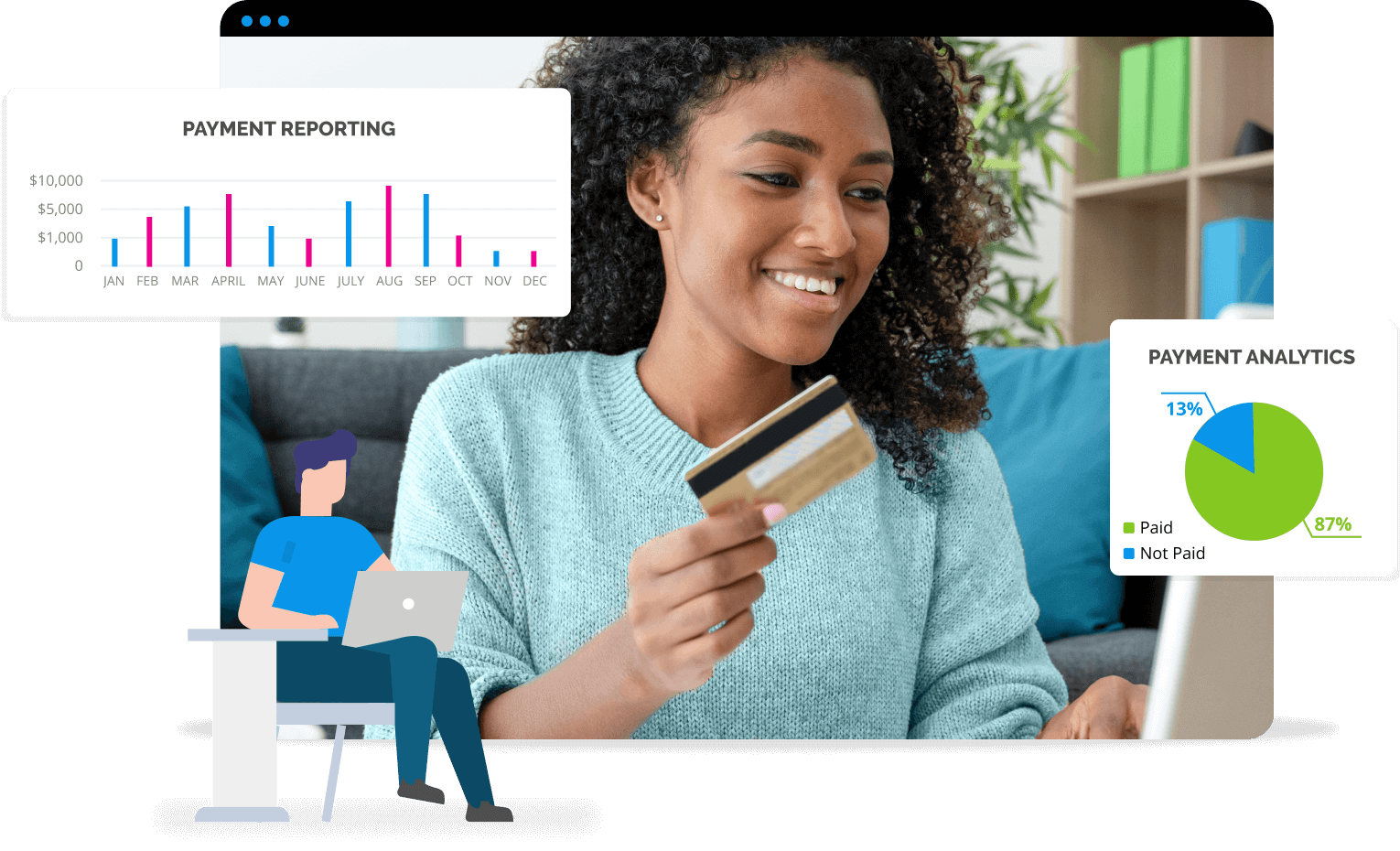

This is because a robust AR automation solution collects important customer payment and financial data, which you can use to generate comprehensive reports. These solutions can also track KPIs and provide analytics to help you make strategic financial decisions.

Source: Regpack

With AR analytics, you’ll be able to see patterns in your billing process and determine your company’s financial health. This means that you’ll keep a close eye on DSO metrics and pinpoint customers that deviate from the set benchmarks.

Suppose your goal is to minimize late payments to 5%. In that case, you can pull out relevant data from your AR automation solution’s dashboard and identify the biggest culprits that keep you from hitting that benchmark.

Then you can take action to improve your metrics and bring your collection goals in alignment with your company’s goals.

But to have a better overview of your company’s financial standing, it’s essential to maximize the use of your AR data with an automated solution.

What to Consider When Choosing a Service Provider

Now that we’ve established why accounts receivable automation is important for a business of any size, the next question is what to look for in an AR automation service provider?

Generally, you’ll want software that will help you with optimizing financial transactions and expedite invoicing. But which features will be beneficial to your company primarily depends on your business needs.

You don’t want to overpay for a solution and features you won’t even use, so you must thoroughly research the market and main providers.

Source: Regpack

But there are some things you need to keep in mind once you start this journey.

First, find an open platform that will integrate well with other systems you already have in place. You probably have a payment gateway or accounting software to handle your accounts receivable.

So, if you want to enhance your business operations and adopt an automation solution, ask if it’s compatible with your existing tools and software.

Next, look for solutions that have a presence in multiple countries—ideally, in the same countries that you’re doing business as well so you can conform to local legal requirements seamlessly.

This might mean distributing electronic invoices through local platforms or keeping track of changing tax regulations.

Now, let’s look at some useful features most automation providers should have:

- Document management: Keep your invoices, bills, statements, and other documents in one system so you can access them anytime and anywhere.

- Customer communication: In addition to invoices, your employees can send additional documents and reports to the customer from the AR automation software.

- Data consolidation: AR automation will pull data from different documents into a singular account snapshot to ease the workflow of the accounting team and customer service.

- Customizable and intuitive workflow: The AR team should work with the automation solution intuitively to give them greater visibility and control.

- Accurate reporting: Set filters and categories according to your needs to present reports with relevant information for different purposes.

- Invoices in all formats: Even though most companies are moving to digital invoicing, it’s good to have other ways to send invoices. Even paper ones.

Even with so many options available, consider Regpack’s solution to manage your accounts receivable better. No matter the struggle you’re dealing with regarding payments, you can solve it with intuitive and simple billing software.

Conclusion

Managing accounts receivable can be complicated if you don’t have the right solutions in place.

Ensuring your customers pay on time sometimes relies on implementing automation in your current systems so that you eliminate errors and outsource burdensome tasks. With account receivable automation, you minimize your efforts while reaping the most benefits.

In the end, this means better cash flow control and sustainable growth for your company.