As someone who runs a company, you have surely asked yourself why so many invoices get paid so late. The more overdue invoices you face, the more they affect your cash flow and, therefore, your entire business.

Yet, it seems that most industries have learned to accept that some invoices are simply paid late.

That, of course, doesn’t mean that you should accept it quietly. Instead, you should focus on encouraging your customers to pay on time. You have delivered them a product or a service, and you should get your hard-earned money.

We’re here to give you six tips to speed up your payments and have customers pay you ASAP!

Jump to section:

Prevent Invoice Mistakes to Reduce Delays

Shorten the Payment Due Date

Send Invoices Out Immediately

Make It Easy for The Customer to Pay

Know Why Your Customers Are Paying Late

Reward Customers Who Pay On Time

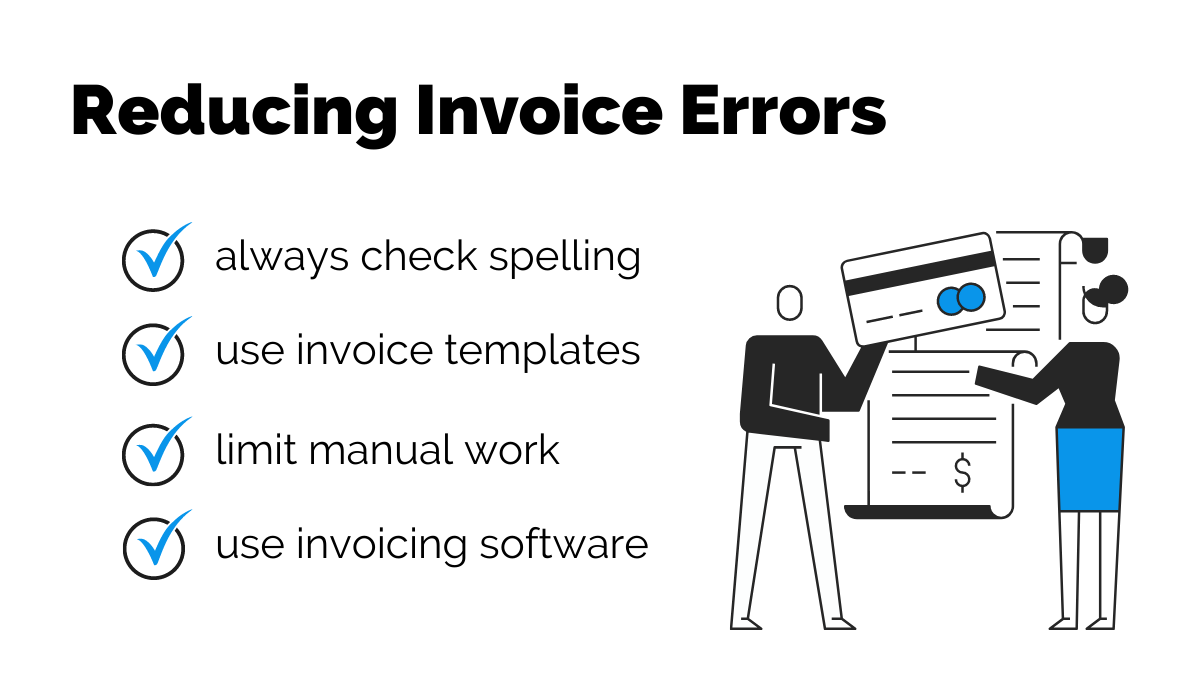

Prevent Invoice Mistakes to Reduce Delays

If you want your customers to pay on time, put in the work to make your invoices flawless.

Inaccuracies are one of the main reasons for overdue invoices. In fact, research shows that 61% of outstanding payments were late precisely because of an inaccurate bill, which means you should put more effort into the invoicing process.

Source: Regpack

Let’s look into how you can ensure that your invoices are always correct, so you get paid on time.

Firstly, focus on the spelling. A simple typo could mean significant discrepancies in the payment amount or details such as the account number or the due date.

Such a small error can lead to the money being wired to someone else’s account, or you could get paid significantly less. Therefore, double-check all the details before sending that invoice.

A great way to avoid manual errors is to stick to an invoice template instead of retyping the same details repeatedly.

Certain things, like your company and payment information, tax, due date, and terms and conditions, always stay the same, so adding them to the template will save you a lot of hassle.

Source: Regpack

Wherever there’s manual work, mistakes are inevitable. An employee’s ability to focus in their first hour of work far surpasses their ability to do so in the seventh, which is why you shouldn’t be shocked to find any manual invoice inaccuracies.

However, you can prevent them by using software that lets you make and use your invoice, reminder email, and late payment letter templates.

Suppose you allow the customers to enter their personal information online. In that case, the system will pull the data and paste it into the invoice, along with all the product and purchase-specific details.

That way, you’ll create the entire invoice automatically, lowering the chance of manual errors.

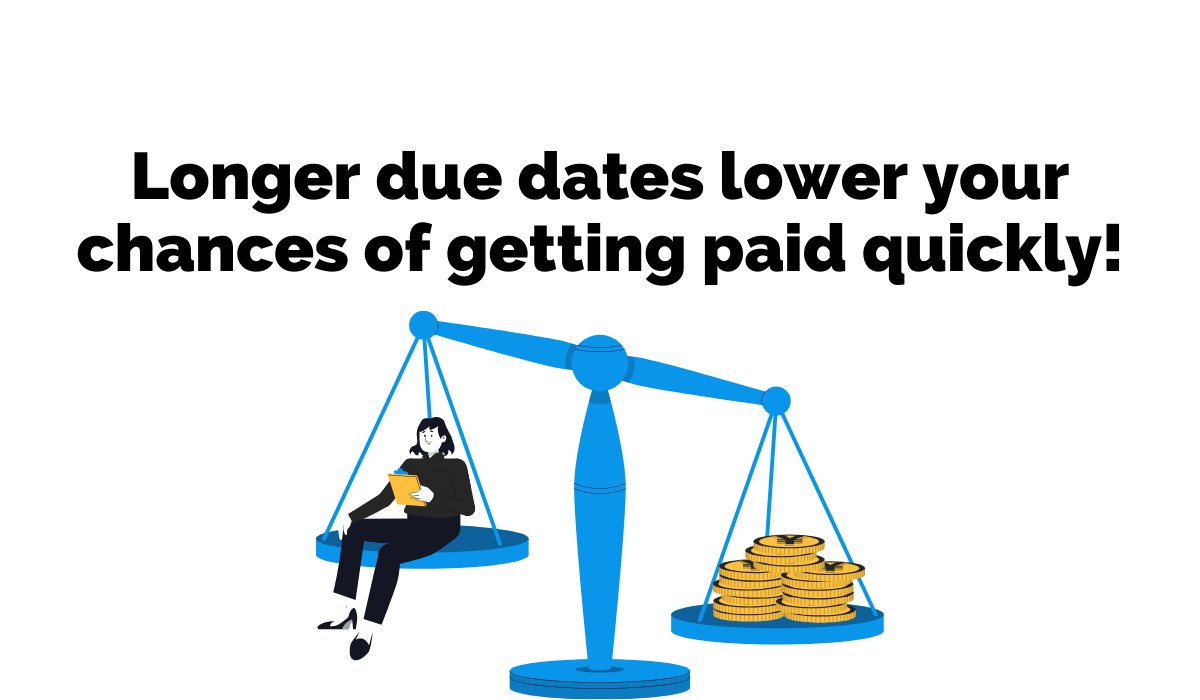

Shorten the Payment Due Date

When you notice a trend of late-paying customers, it’s time to change the due date.

Usually, businesses stick to the 30-day payment rule, which means the customers have 30 days from the day the invoice was created or the receipt date to pay for the product or service they’ve received.

However, the industry seems to agree that this long of a due date is becoming useless nowadays when you can deliver the invoice in a single click and pay one the same way.

In that case, why give customers so much time? Research shows that invoices get paid later the more time the customers have for payment.

In other words, invoices with a 7-day due date get settled within two weeks, while 30-day invoices usually take a whole month to pay. The less time you give your customers to pay, the faster you’ll get your money.

Source: Regpack

Obviously, the key is giving your customers enough time to pay without going overboard. The same research shows that most invoices nowadays ask for payment within two weeks, which is reasonable, so there’s no need to stick to the outdated 30-day time frame.

Of course, this change to the due date, especially if you’re going to do it for all purchases, should be visible in the terms and conditions.

If some of your products are a lot more expensive than others, you can think about setting different due dates based on the total amount of the invoice.

If you sell your products or services online, you should clearly state the change on your website. This way, the change to your due date is not a surprise to anyone.

Send Invoices Out Immediately

Sending an invoice as soon as you deliver the product or service increases your chances of getting paid.

This is because the due date is usually applied from when the customer receives the invoice. So, even if your due date is seven days, your customer can’t pay within the agreed timeframe if they don’t receive the invoice in the first place.

Sharon Pocock, Chief Innovator at Kinder Pocock and a certified accountant, thinks sending the invoice immediately is the most vital part of the invoice process. Experience has taught Pocock that email is perfect for quick billing.

Source: Regpack

However, Pocock also says that an app that allows you to invoice immediately is an even better option, where applicable. Software that lets you create and send invoices will undoubtedly make this part of the payment process a breeze.

Other than sending the bill once you deliver the product or service, GoCardless suggests some alternative moments that make good opportunities for sending an invoice, like:

- In advance

- When agreed with the customer

- Recurringly

It won’t always be possible to charge a customer in advance, as this is usually done when the total cost of the purchase is high, and you need the funds to start working.

You can always agree with the customer on when it suits you both best to invoice them, but bear in mind that this is possible when you don’t have that many clients. Keeping up with the invoicing schedule might be challenging if you have hundreds of customers.

Source: Regpack

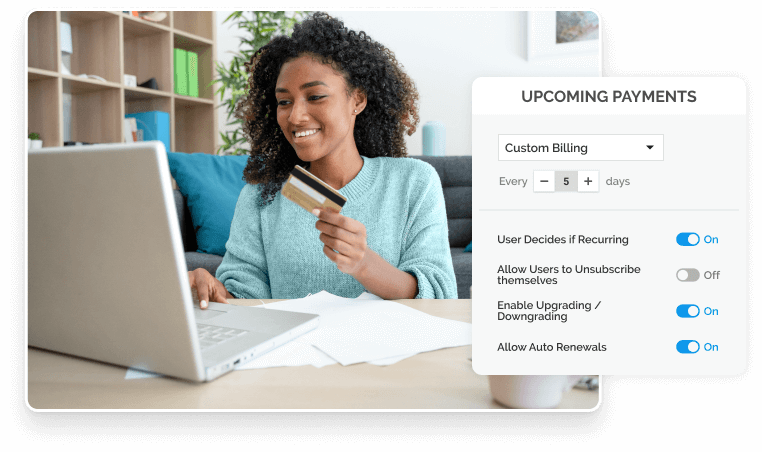

The final option, recurring billing, is popular in the SaaS industry or with companies that offer the same type of product or service regularly.

This type of billing allows you to collect the customer’s payment data once and then continue charging them using the same information regularly until they cancel their subscription to your service.

Make It Easy for The Customer to Pay

The easier you make it for your customers to pay, the faster they will do so. It’s as simple as that!

Some companies let the clients log into their order status or user account to download the invoice. Others might find this system complicated and frustrating, which is why they email the bills as a pdf attachment.

Of course, if you use software, the system can create and send the invoice for you. Each of these options works well nowadays, but the last one is the cheapest for your company.

Source: eInvoicing

Some companies send the invoices the old-fashioned way, by post, but the process takes a long time to finish and is pretty outdated. An email invoice or one available for download online ensures that the customer gets it the second you send it.

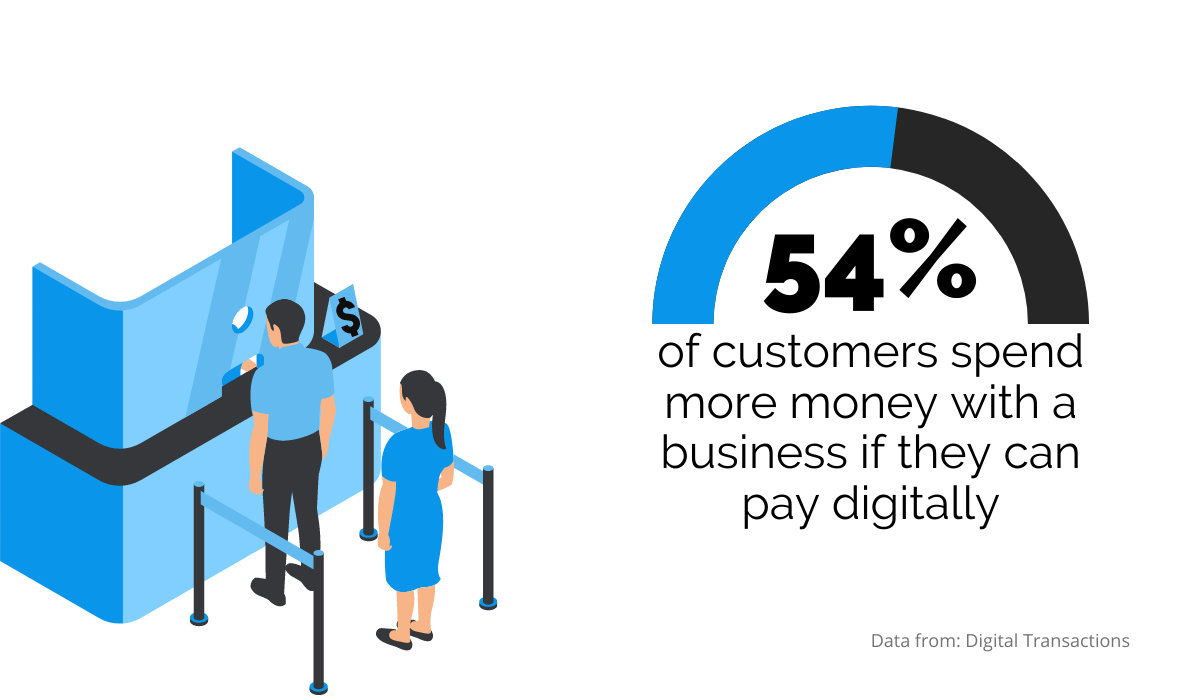

Another way to make payment easier is to offer as many payment methods as possible. Nowadays, many customers use their digital wallets to pay wherever they go—in stores, restaurants, or when shopping online.

Offering this option will make paying for goods and services easier for your customers. Besides, more than half of customers say they spend more money if digital payments are an available payment method.

Source: Regpack

QR codes are also an excellent payment asset for customers and companies alike. For companies, such technology is affordable and easy to implement, while the customers find it easy to pay using QR codes.

After all, clients scan the code, and the payment website opens on their phone, allowing them to enter or load their payment data.

The bottom line is, if the customers find your payment process convenient, they are more likely to pay instantly.

Know Why Your Customers Are Paying Late

If you know why your customers usually pay late, you can speed up the payment process by addressing those issues.

One of the most common reasons for late payments in the B2B space is that companies often simply follow their industry-specific payment schedule.

For example, PWC states that it takes 54 days on average for construction companies to receive compensation for their work.

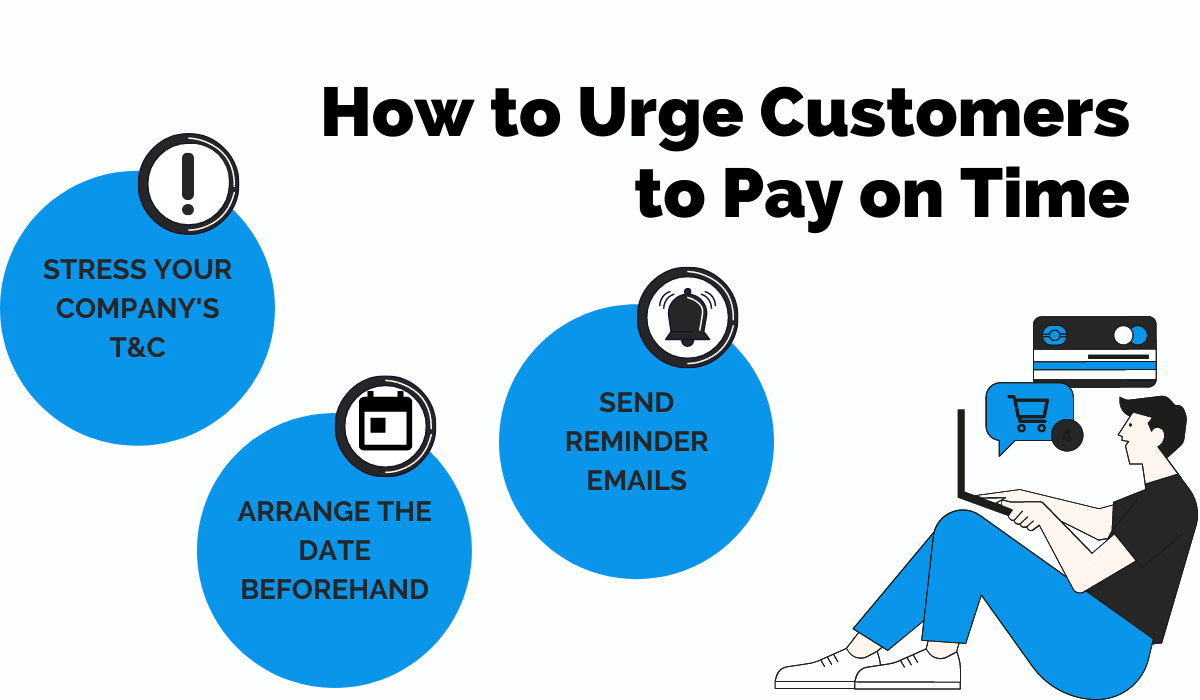

However, just because a company is used to paying late doesn’t mean you should allow them to do it and let your cash flow suffer. Instead, be sure to communicate your terms and conditions and stress when you expect your clients to pay, regardless of what is appropriate in their industry.

Source: Regpack

Maybe your customers oversee your invoice and need a reminder or two, which is why you get paid late. In that case, you can set up a schedule for sending reminder emails before the due date.

If you use invoicing software, this is something you can do automatically, so you never have to worry about failing to remind the customer of their invoice periodically, even once it turns into an outstanding payment.

Some people prefer to pay their bills at the beginning of the month while others do it at the end. If you set the same due date for both types, you’re going to get some late payers.

Instead, you can simply check with your clients to see what their preferences are, and adjust their due date accordingly to ensure all your payments come in on time.

Companies that discuss the payment terms with customers beforehand will receive more on-time payments because they will know what works best for them and the clients.

Adapting to your customers’ needs is always a good strategy, especially if it means little to no sacrifice to your business.

Reward Customers Who Pay On Time

Your on-time payments should see an increase when you offer an early payers incentive.

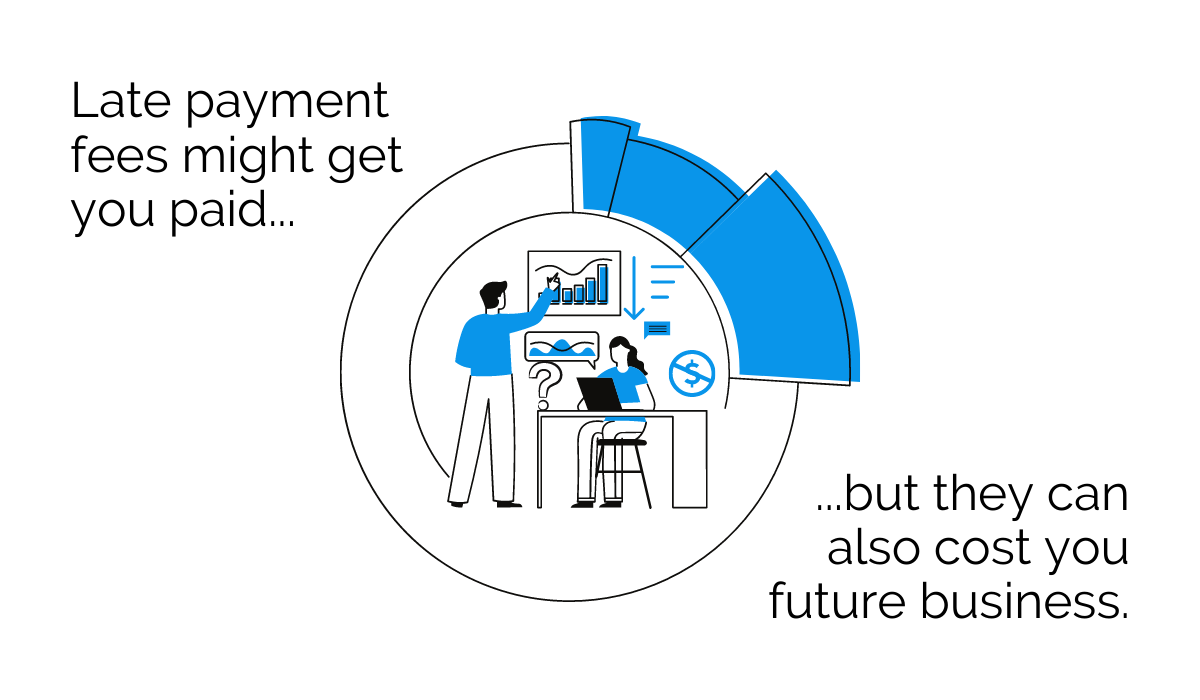

Many companies opt for late fees, which are supposed to incentivize customers by threatening to increase the total amount if they make payments after the due date.

Of course, this method often works, as clients are afraid of getting into even more debt, but it’s not always worth it.

Let’s say a customer who is usually a regular payer gets into financial trouble and can’t afford to pay their invoice this month.

If they get a 5% late fee for each week they are late, they will have to pay you a lot more than they normally would, and they might churn after that.

Source: Regpack

Therefore, offering rewards for those who pay early is often a better strategy.

It doesn’t always seem like the most affordable option for your company, but even a minor reward might be motivating enough for people to pay on time and ensure your cash flow stays consistent.

Some of the rewards you can offer are early-payer discounts, promotional codes for their next orders, gift certificates, or something similar that will let the customer know you appreciate them respecting the deadline.

Clearpay, a buy-now-pay-later UK company, decided to reward those who pay their invoices on time by offering them extra points in the official company app for every timely payment.

Source: Clearpay

According to Clearpay’s Nick Molnar, this type of incentive helps “encourage financial wellness and power an economy where everyone wins.” After all, it motivates customers to pay off their debts on time and thus allows your cash flow to stay consistent.

Have you thought about offering something similar? If not, you definitely should.

Conclusion

As a company, your main goal is to deliver the product or service in perfect condition and get paid fast to keep your business running.

Many believe that only the first part is in your hands, while the second depends on the customers and their readiness to pay.

However, as you can see from this article, that’s not exactly the case. You don’t have to sit idly while customers get away with not paying you promptly.

Instead, you can do your best to prompt them to pay by sending your (error-free) invoices as soon as possible, and setting a shorter due date. Then, you can facilitate payment by offering a variety of easy options and incentivizing those who pay on time.

If you implement these changes, your early payments should drastically increase.