No matter which industry you’re in, collecting customer payments will always be a priority.

Your brand needs tools that can collect payments securely and reliably.

But not only that. It should also act as a customer account management tool and make your payment collection workflows seamless.

That’s why the billing software you choose can mean the difference between hours of wasted time, constant headaches, and missed revenue—or streamlined billing processes that scale with you.

In this article, we’ll walk you through the features all the best customer billing software options have in common.

Then, we’ll introduce you to twelve of the most popular tools on the market today.

- What to Look For in Billing Software

- Examples of Good Billing Software

- Which Billing Software Will You Choose?

What to Look For in Billing Software

The best billing software is a combination of user-friendly and feature-rich.

Your software should free you up to spend your time on what you’d likely rather be doing, like improving your product or developing new business solutions.

Whatever electronic billing system you choose, it should be simple and easy to use.

The process of calculating taxes, incorporating discounts, and prorating subscriptions can quickly become complicated.

Your billing software should handle the heavy lifting for you.

Make sure the interface seems intuitive, too.

Check out screenshots of the software—or sign up for a trial—to make sure the navigation makes sense and you’ll be able to use the tool without too much of a learning curve.

Another extremely important feature is security.

You’ll be trusting this software with your and your clients’ sensitive information, so you’ll need a billing solution that’s up-to-date on the latest compliance regulations.

For example, Regpack is PCI compliant Level 2 and uses disk-level encryption to ensure that all user data is protected.

Finally, you’ll want billing software that can help you recover late or missing payments.

Dunning management involves tracking overdue invoices, sending recovery emails to clients, and ensuring that missing revenue is recovered.

Examples of Good Billing Software

Now that we’ve described the features you should look for in your billing software, we’ll go over some examples and compare the features those solutions offer.

We’ll also look at the pricing, to help you make the right choice for your company.

Regpack

If you have a business, you probably already have your own website—and it’s your home base. So why not find a payment processing software that integrates with your website?

Regpack serves as online payments software that prioritizes saving time, improving customer relationships, and streamlining billing.

Source: Regpack

You can use Regpack to process payments, manage customer communications, register clients, and automate workflows.

The ability to embed secure payment forms on your website means you won’t have to send prospective customers to a third-party payment processor’s site.

Many consumers get spooked when they’re redirected to a webpage they don’t recognize.

Letting customers stay on your site to complete their transaction is essential for earning their trust and starting your customer relationship on the right foot.

Regpack is also much more than a billing platform.

You can easily manage and automate much of your client relationships, including with conditional logic in your onboarding flow, built-in reporting tools, and automated email communications.

With our easy-to-use interface, automated billing, and integrated payments, Regpack’s online payments software has everything you need to onboard and charge clients hassle-free.

Regpack Features:

- Automated billing and email communication system

- Customizable payment forms

- Online invoicing

- Accept payments on mobile, tablets, and computers

- Subscription and recurring billing

- Monthly payment plans for customers

- Dunning management tools

- Option to create a custom buying experience for every client

- Accept multiple payment methods including ACH and credit card

- Custom online payment processing reports

- Streamlined and intuitive client portal

- Onboarding and payment automation

- Embed payment and registration forms on your website

- Purchase protection that lets you keep registrant fees even if they cancel

Regpack Pricing:

Plans start at $125 per admin per month. Contact our sales team now to get a customized quote!

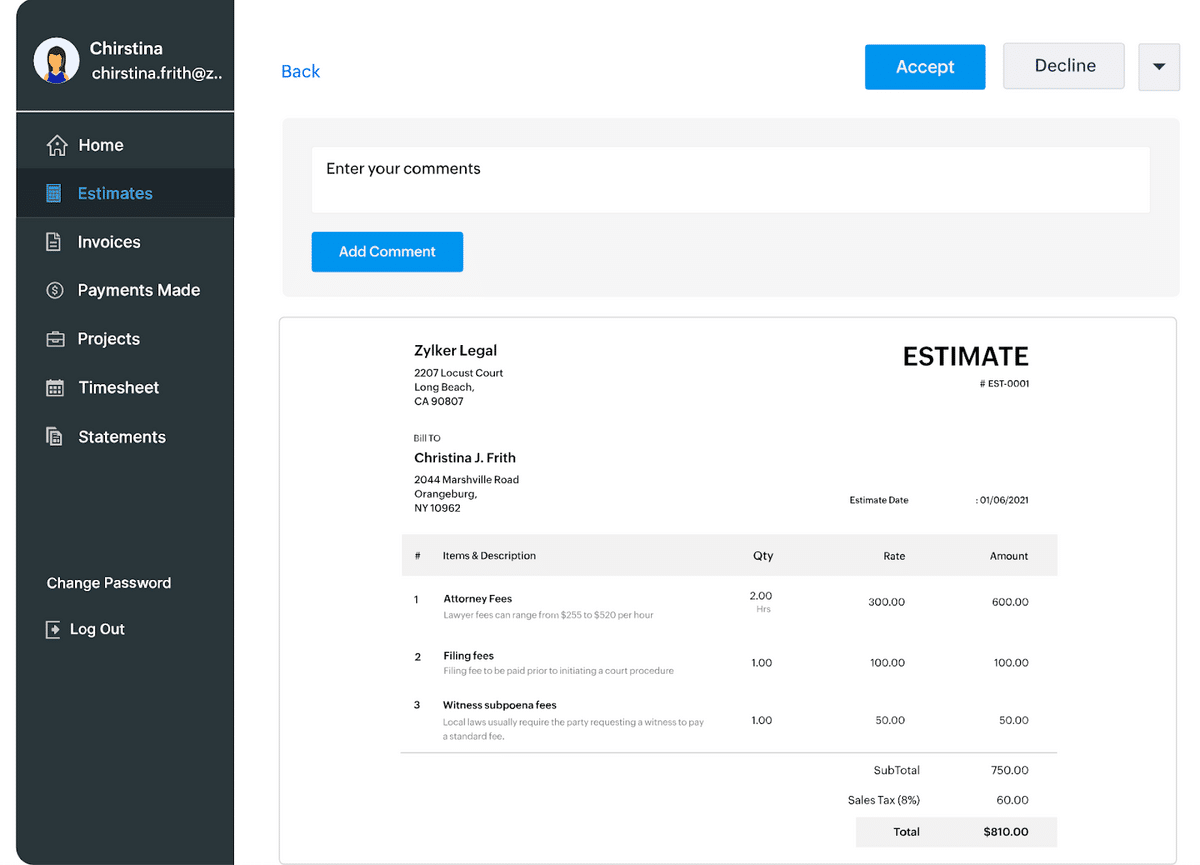

Zoho Invoice

Zoho is a software suite that offers a collection of tools for business owners, from a CRM platform to automation tools to scheduling software.

Source: Zoho Invoice

The company has also branched into accounting tools, including free invoicing software that provides basic invoicing and accounting functionality for small businesses.

Zoho Invoice Features:

- Windows, macOS, iOS, and Android apps

- Templates and branding options

- Multilingual and multi-currency invoicing

- Digital signatures

- Recurring invoices

- Sharing through print or email

- Email scheduling

- Reporting and data analytics

- Discounts at the item- or invoice-level

Zoho Invoice Pricing:

This tool is completely free to use.

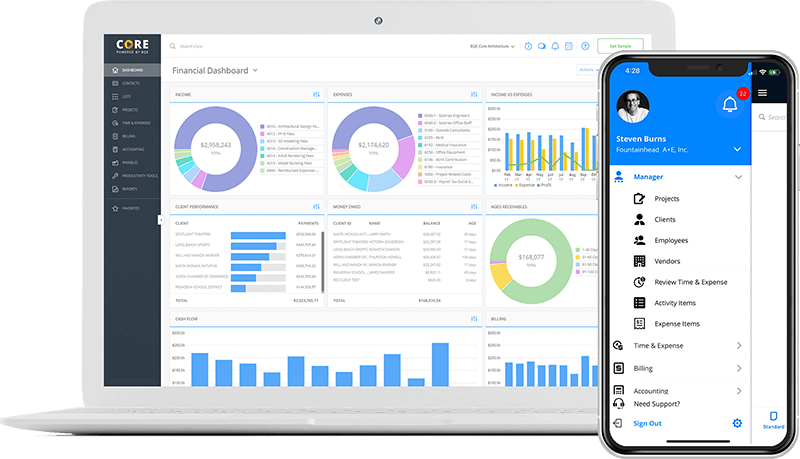

BQE Core

BQE Core is another suite of business tools, this time from the makers of BillQuick and ArchiOffice.

The platform features tools like project management software, HR solutions, data analytics, and time and expense tracking tools. BQE Core also offers billing and accounting functionality.

Source: BQE Core

This tool is geared more towards enterprise businesses. Smaller brands may find the pricing prohibitive and may not need all of the features provided.

BQE Core Features:

- Automatic billing

- Customizable templates

- Multiple contract types

- Recurring invoices

- Email invoicing

- Billing schedules

- Split billing

- Submit and approve workflow

- Native iOS and Android apps

- Integrations with third-party tools

BQE Core Pricing:

Unfortunately, there is no pricing listed on BQE Core’s website. You’ll need to contact their sales team to get a custom quote.

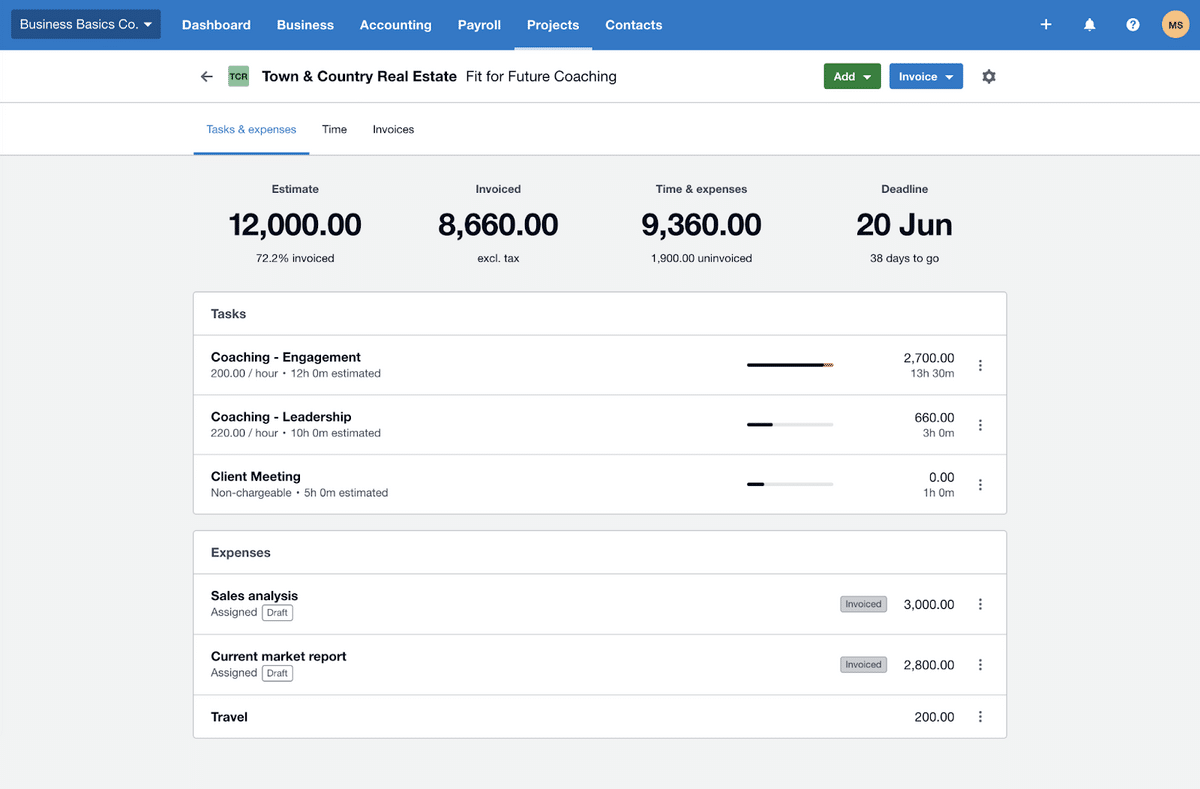

Xero

Xero aims to be an accounting tool for “everyday businesses.” It focuses on small businesses, solo bookkeepers, and small accounting teams.

Source: G2

The majority of the platform’s users are located in New Zealand, Australia, and the United Kingdom.

Xero Features:

- Bill payment

- Invoicing

- Expense management tools

- Multi-currency transactions

- Secure bank connections and bank reconciliation

- Payment processing with Stripe, GoCardless, and others

- Project tracking

- Syncing with Gusto payroll software for an additional fee

- Contact management

- Data capture using Hubdoc

- Online file storage

- Reporting and data analytics

- Inventory management

Xero Pricing:

There is no free plan. Paid plans start at $12 per month for solopreneurs and $34 per month for small or growing businesses.

Tipalti

Tipalti is a billing automation tool that prioritizes streamlining the bill-to-pay-to-reconciliation cycle.

Source: Tipalti

The tool is engineered to help businesses scale sales without adding more staff to manage billing.

Tipalti Features:

- Invoice, supplier, and purchase order management

- Self-service supplier management

- Multiple payment options and 120 currencies

- Multilingual supplier portal

- Tax forms collection

- Automatic ERP reconciliation

- Built-in compliance tools

- Payments API

- Artificial intelligence and automation functionality

Tipalti Pricing:

There is no free plan. Paid plans start at $149 per month.

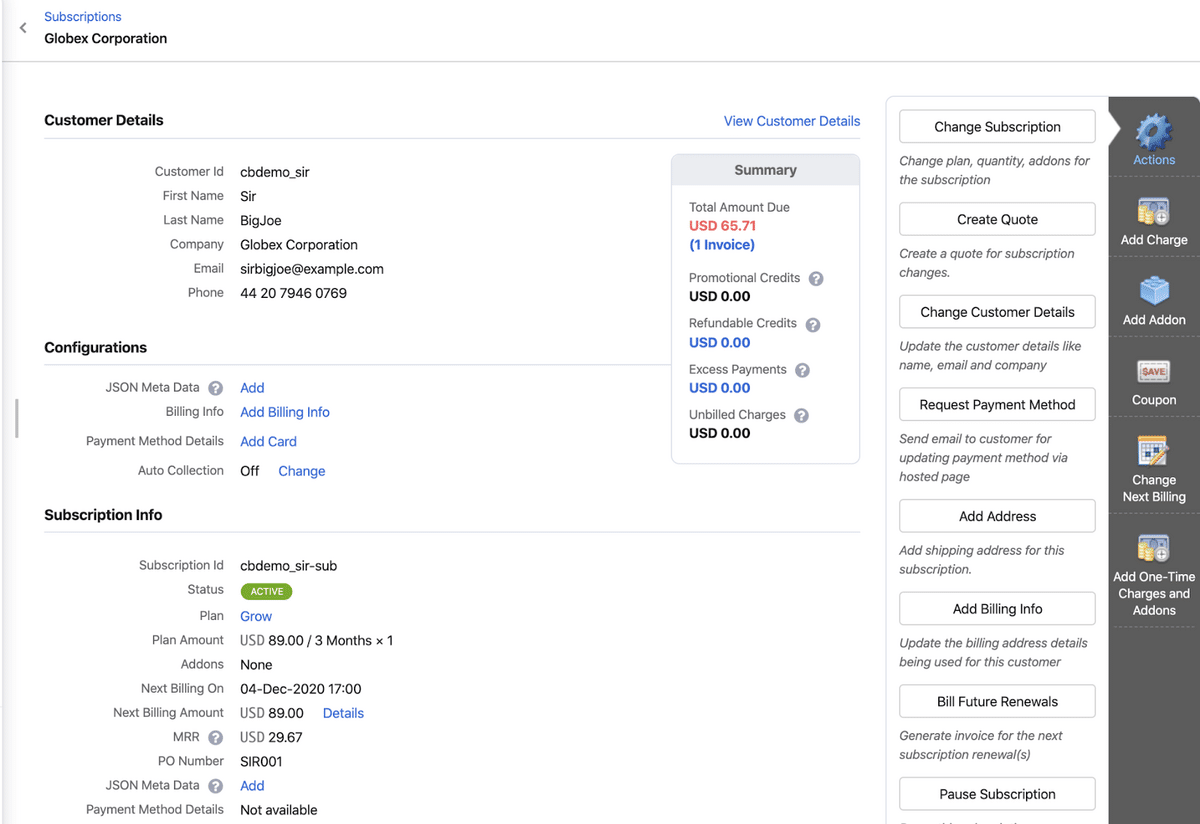

Chargebee

Chargebee is a subscription billing and revenue management platform.

While the cheapest paid plan is one of the most expensive on this list, the free plan is likely adequate for some small businesses with less than $100,000 in revenue.

Source: G2

If your business brings in more than that, you’ll be looking at a hefty price tag for a Chargebee account—which is why Chargebee’s target customers are mid-size and enterprise businesses.

Chargebee Features:

- Recurring billing

- Invoicing automation

- Automated prorations

- Customizable billing cycles

- Usage-based billing

- Multi-decimal support

- Quotes and proforma invoices

- Net-D, consolidated, and advance invoicing

- Customer account hierarchy

- Reporting and data analytics

Chargebee Pricing:

The free plan covers users up to $100K in revenue. Paid plans start at $249 per month.

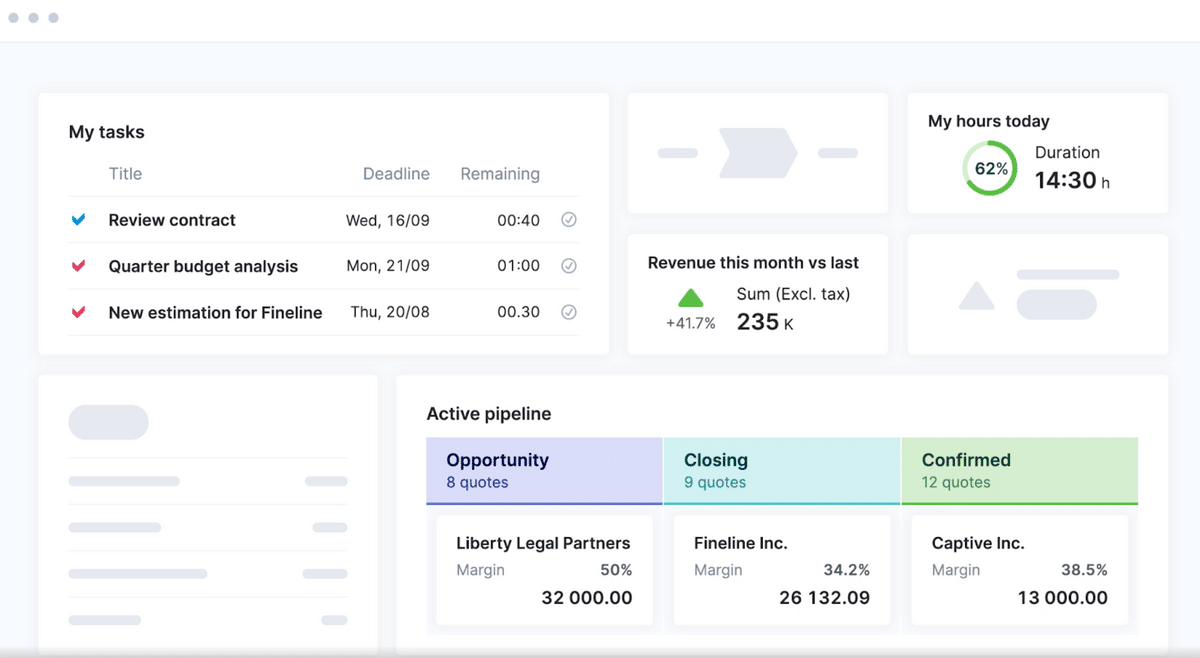

Scoro

Scoro attempts to answer businesses’ need for end-to-end work management software.

It helps users with time management, project management, sales and CRM, finances, reporting, and integrations.

Source: Scoro

Here’s what you can get with this solution.

Scoro Features:

- Automated billing

- Scheduled and recurring invoices

- Partial invoicing and prepayment options

- Budget reports

- Multiple currencies

- User permissions

- Projects, calendars, and task lists

- Time tracker

- Customer relationship management

- BIllable time

- Activity-based billing

- File management

- Data analytics and robust reporting

- API tools and integrations

Scoro Pricing:

Scoro doesn’t offer a free plan. Paid plans start at $26 per user per month (with a minimum of 5 users).

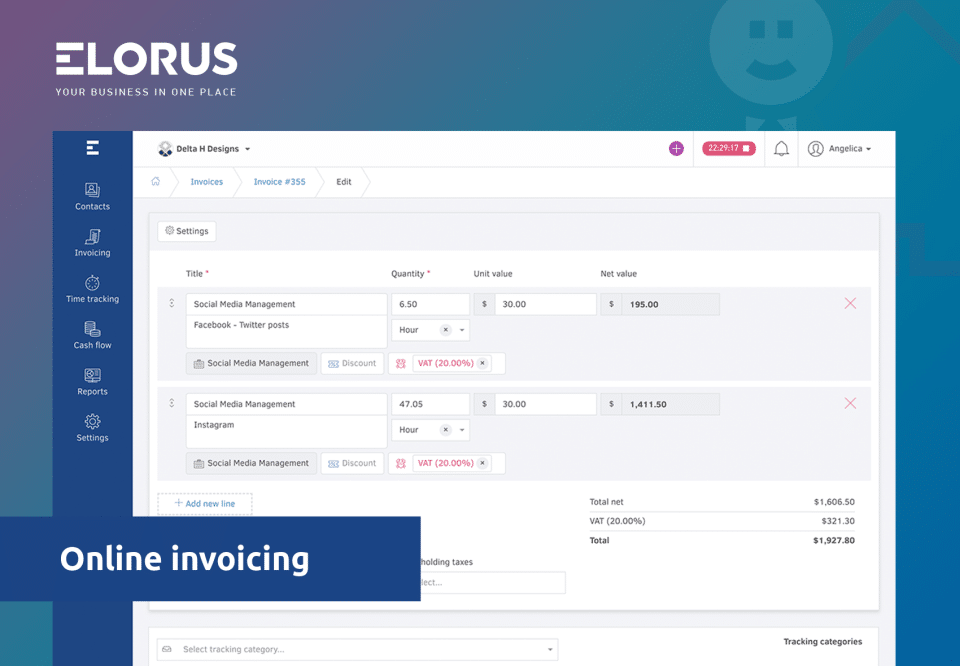

Elorus

Elorus is an all-in-one tool for invoicing, time tracking, and expense management. It allows for customizable as well as automated invoicing.

For work done based on hourly rates, Elorus can automatically calculate the invoice based on the time and rate.

Source: G2

This solution may be particularly attractive to international businesses, as it can handle multiple currencies and create invoices in 7 different languages.

Elorus Features:

- Branded invoices

- Accept credit card payments

- Recurring billing

- Automatic late payment reminders

- Time tracking

- Project management

- Weekly timesheets

- Client portal

- Expense tracking

- Reporting and data analytics

Elorus Pricing:

A free plan is available for up to five active clients. Paid plans start at $7 per month.

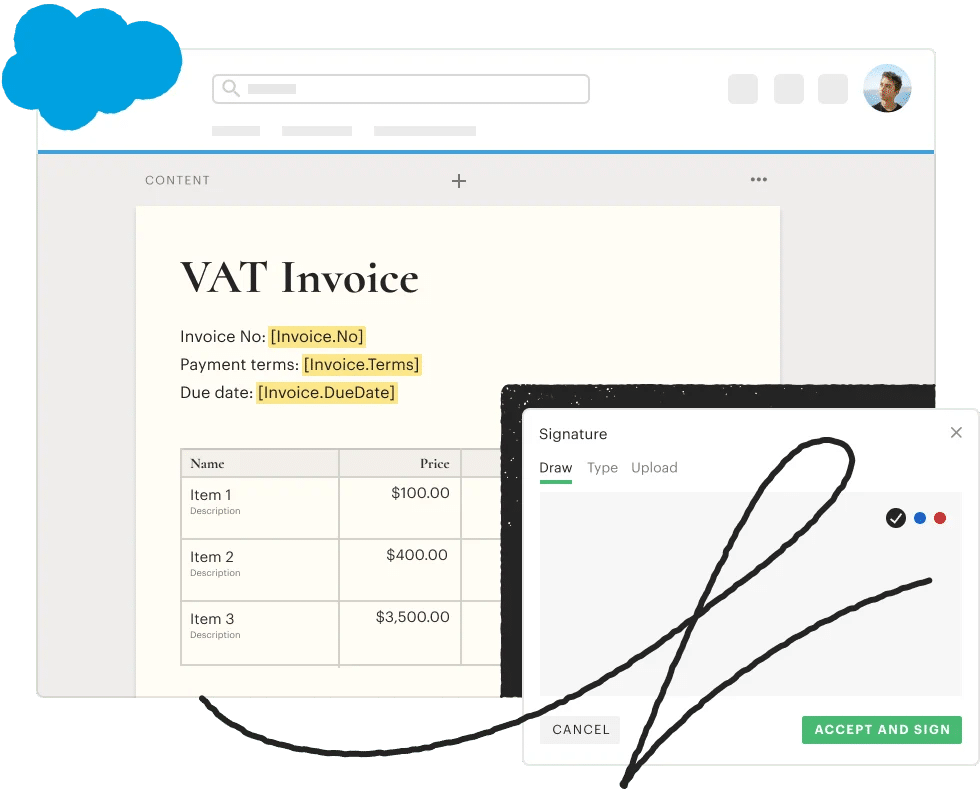

PandaDoc

PandaDoc is a document management system for businesses that integrates secure communication, signatures, and billing.

Source: PandaDoc

With the higher payment tiers, you can also integrate PandaDoc with your CRM platform, as well as with tools like Salesforce and Zapier, and create a custom content library for your workflows.

PandaDoc Features:

- Custom templates with smart fields

- Approval workflows

- eSignature technology

- Automatic follow-up reminders

- Payment processing

- Integrations with third-party tools

PandaDoc Pricing:

The free plan allows for eSignature and payment collections. Paid plans start at $19 per month per user and entails features like templates, a document editor, and custom branding.

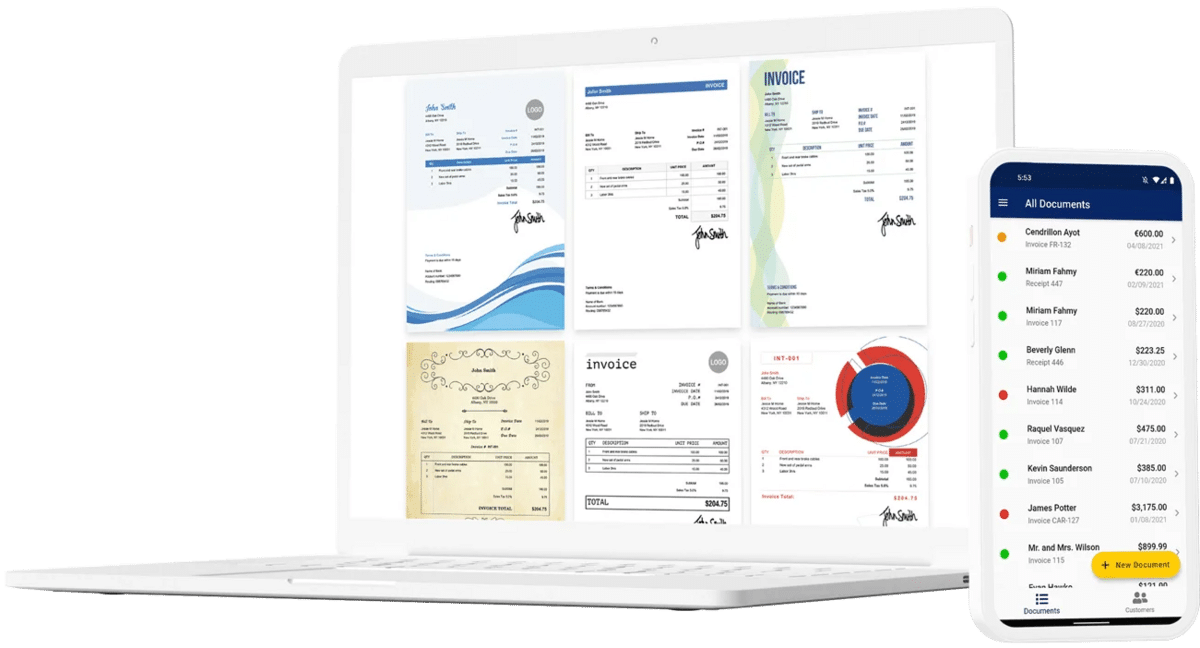

Invoice Home

Invoice Home is one of the more minimalistic choices on this list. If you just need basic invoicing, this platform may meet your needs.

Source: Invoice Home

Invoice Home is essentially a collection of invoice templates—of varying levels of complexity—that you can customize to suit your business’s needs.

Upload your brand’s logo to create custom invoices, store invoice and customer data securely in the cloud, and print or email your invoices to clients.

Invoice Home does let you accept digital payments directly from your invoices using PayPal, Authorize.Net, and Stripe.

But if you need more than basic invoicing functionality—such as advanced billing and finance features—you may want to look elsewhere.

Invoice Home Features:

- Customizable invoice templates

- Payments through PayPal, Authorize.Net, and Stripe

- Mobile apps

- Export reports to Excel

- Free professionally designed logos

- Multiple taxes on a single invoice

- Printer-friendly invoicing

- Unlimited cloud storage

Invoice Home Pricing:

With the free plan, users can invoice up to $1000 per month. The paid plan allows unlimited invoicing for $9 per month.

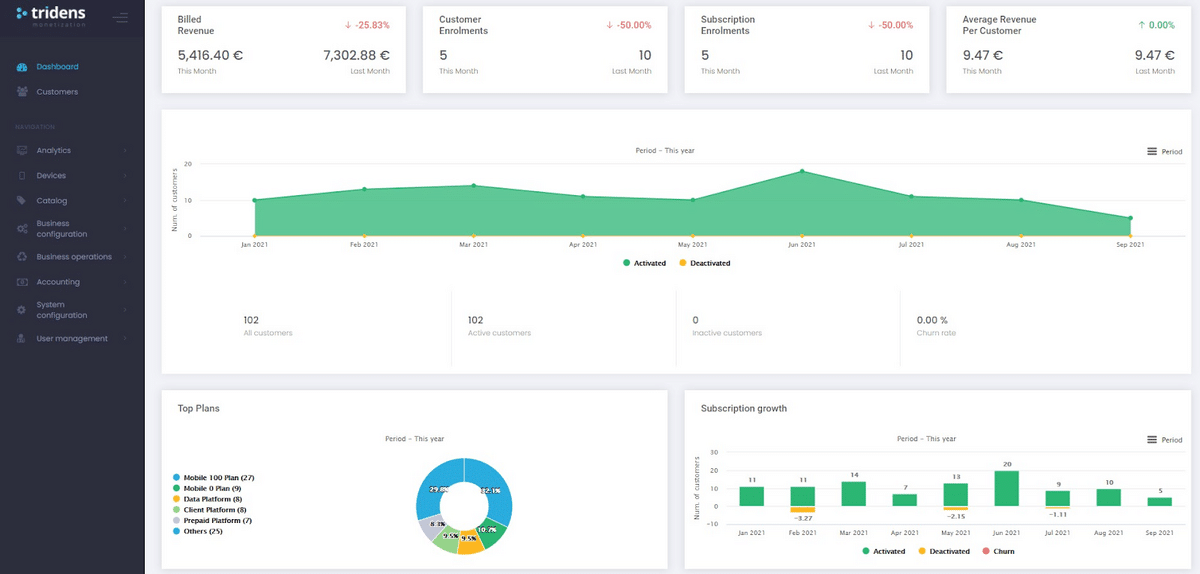

Tridens

Tridens Technology is a tech company that specializes in innovative business tools.

They offer a pay-as-you-go insurance software solution, a software solution for Charge Point Operators and e-Mobility Service Providers, and a monetization platform.

Source: Tridens

The Tridens Monetization tool is a convergent charging and cloud monetization software for larger businesses.

Tridens Features:

- Real-time analytics

- Pre-integrated payments

- Personalized offers and promotions

- Real-time balance management

- Supports REST APIs for integration with third-party applications

- Automated invoicing

- Automated customizable taxation and financial reports

Tridens Pricing:

Tridens doesn’t list pricing on its website. If you’re interested, you’ll need to get in touch with their team for an estimate.

PayPal

PayPal is a big name in the online payments space. Consumers use it to make payments and process their credit card transactions with greater security online.

But did you know that PayPal also offers a platform for businesses looking to accept payments?

Source: PayPal

With a PayPal merchant account, businesses have several invoicing options beyond the standard online payment portal.

PayPal supports customizable invoices as well as automated recurring payments and subscription-based options.

Customers can also pay in installments using one of PayPal’s buy now, pay later features.

PayPal Features:

- Accept payments online or in-person

- Buy now, pay later option

- Recurring payments and subscriptions

- Invoices and estimates

- Global and local payment options

- Payments in over 100 currencies

- Sell on Social feature lets you sell products on various social media platforms

- Accept credit and debit cards

- QR code for touch-free payments

PayPal Pricing:

PayPal charges a per-transaction fee for most features. For example, invoicing costs 3.49% of the bill plus a fixed fee for commercial transactions.

Which Billing Software Will You Choose?

There are many electronic billing tools available these days, but not all are created equal—or at least, not every tool will be right for you. Before deciding, take a look at your own needs.

Do you just need a simple invoicing tool? Or are you looking for an end-to-end client management system?

Or perhaps you just need a reliable way to track invoices, accept payments, and send email reminders.

As a business owner, you’re probably prioritizing tools that make your accounting tasks easier.

After all, you don’t have time to spend hours every week tracking down invoices or sending manual payment reminders.

If that sounds like you, Regpack’s automated billing software may be the perfect solution. Give it a try today with a free demo and see for yourself!