As harmless as they sound, invoicing mistakes can lead to frustrating payment delays for your B2B business.

Today we’ll cover seven of the most common ones, from leaving out required payment information to sending your invoices to the wrong department.

We’ll also share some strategies and tools you can use to avoid these mistakes and make sure you get your money on time, every time.

- Relying on Invoicing Clients Manually

- Neglecting to Check the Invoices for Errors

- Leaving Out the Required Payment Details

- Not Specifying the Payment Due Date

- Ignoring the Client’s Invoice Requirements

- Failing to Send the Invoices on Time

- Sending Invoices to the Wrong Department

- Conclusion

Relying on Invoicing Clients Manually

Manually invoicing your clients opens your business up to so many human errors that can result in uncaptured revenue.

Manual invoicing can work only when you have 2-5 invoices per month and a handful of clients.

Even then, your process is prone to errors and takes away your time that could be spent on more important, strategic things.

Source: Regpack

But when you scale the number of clients and need to issue a lot of invoices, the manual process starts uncovering various problems.

For example, doing it manually is difficult to track. a team member could forget to send an invoice on time or leave out a required payment detail.

And you might not realize that until it’s too late.

Many of these mistakes are entirely preventable through automated systems, which also save you a lot of time by handling the process for you.

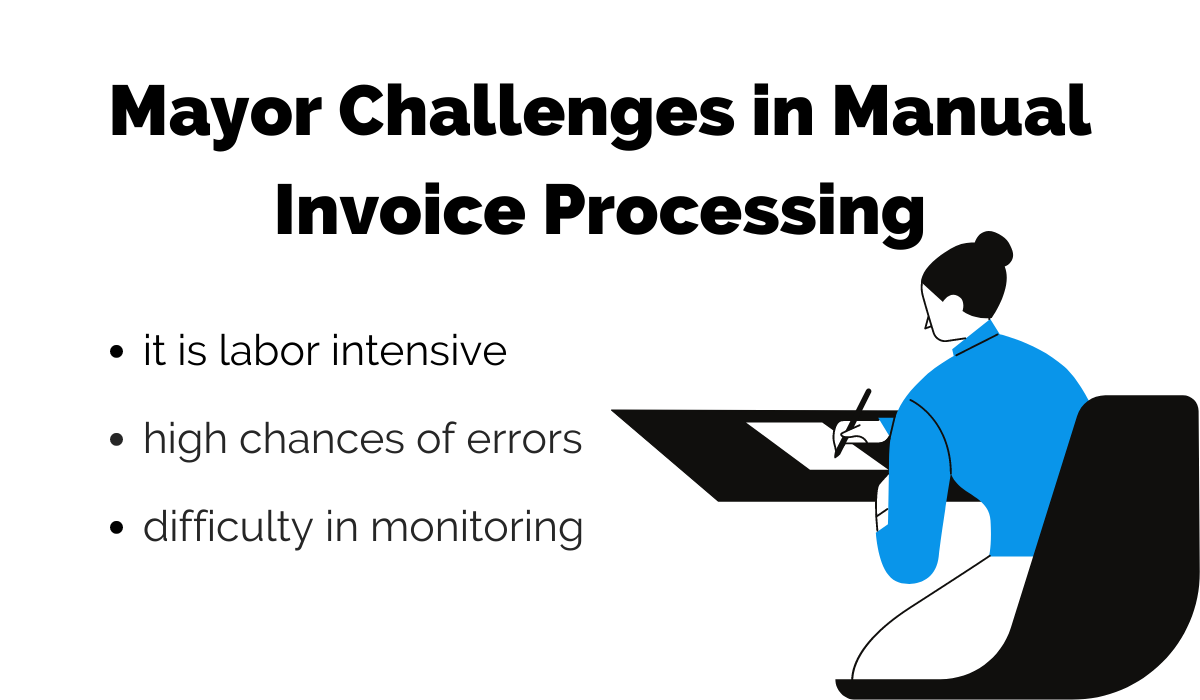

Small businesses use payment processing software like Regpack to automate and digitize invoicing.

Regpack offers online invoicing that automatically generates invoices with all the necessary information needed to process them.

A simple, automated invoicing process leads to all types of benefits for the business: from more completed orders to increased cash flow and better client retention.

Source: Regpack

A tool like Regpack can also take the burden for your recurring billing needs because it can send invoices automatically to clients via email at a time determined by the rules you’ve set up in the system.

This ensures that all invoices reach the right person at the right time and are free of mistakes.

As a result, you get paid on time and never have to worry about this tedious aspect of work.

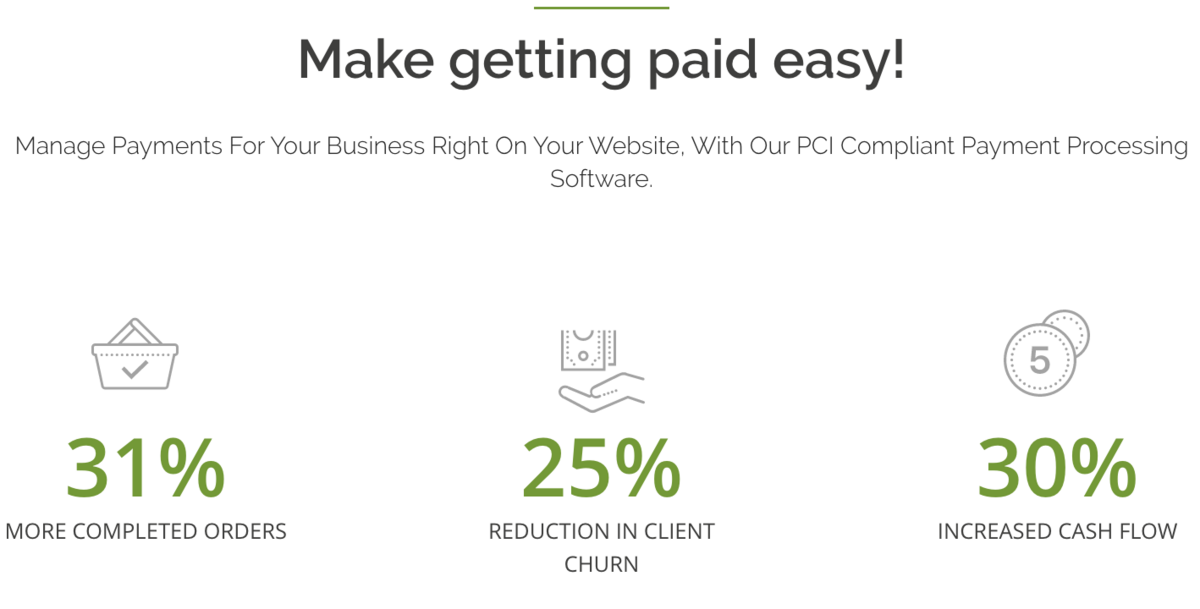

Neglecting to Check the Invoices for Errors

This mistake is costly – 61% of late invoices happen because of mistakes on the invoice:

Source: Regpack

Even a tiny error on the invoice can cause a significant delay in payment, especially if your client has requirements you need to follow.

Here are some common errors to watch out for:

- sending it to the wrong email address

- misspeling the invoice approver’s name

- failing to match the client’s invoice formatting requirements

- making mistakes when totaling the cost

- including items that the customer didn’t buy

Using an invoicing software will make it easier to avoid these invoicing errors because clients can enter their own company information, or you do it only once.

Plus, the system can automatically detect some mistakes in its fields.

For example, the software can tell when a due date field doesn’t follow the desired format, and it will alert you to your mistake.

Also, you can set up algorithms that automate the invoice creation process and, as a result, further reduce the chances of human error.

For instance, if your payment terms were net-30, you could set the invoice template to automatically fill in the “due date” field by adding 30 to the number in the “invoice creation date” field.

That way, you avoid silly math mistakes that cause payment delays. You also save your team the trouble of checking for their mistakes, a very tedious process they’ll happily outsource to a machine.

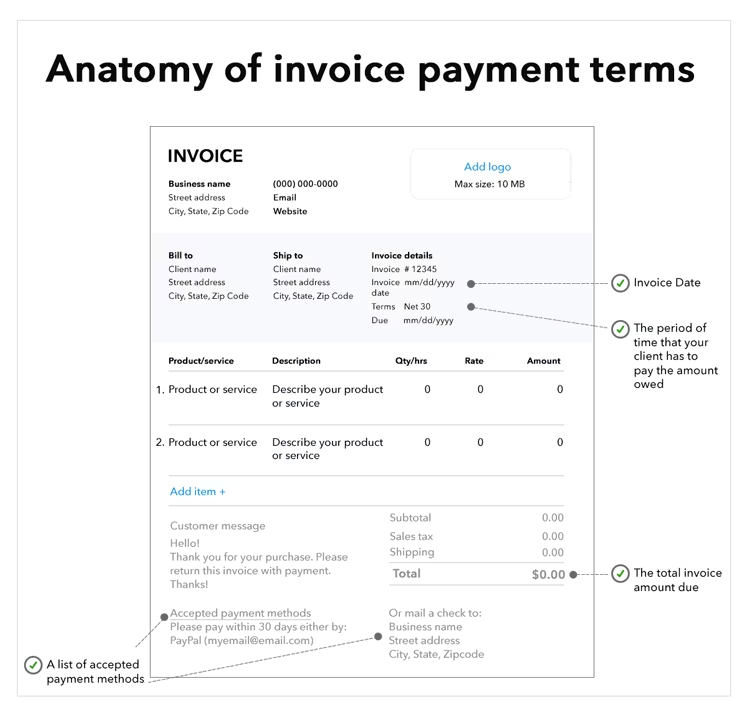

Leaving Out the Required Payment Details

If you leave out the necessary payment details on the invoice, you risk delaying the payment process.

For example, if you wanted your client to pay you through a bank transfer but forgot to include your bank’s name or account number, then the client might not be able to make the transfer.

They’d have to email you to get these details. And, the more back-and-forth communications you enter into, the longer a process takes.

If you accept multiple forms of payment, list each one on your invoice under a heading titled “Accepted Payment Methods.” Next to each method, write the corresponding payment details.

Here’s a good invoice template to emulate for listing payment details:

Source: Quickbooks

In this specific example, the vendor allows their customers to pay using PayPal and check.

Therefore, they list their PayPal email address and their bank information so the business knows who to make the check out to.

If you’re ever curious about what information is generally needed to process payments for a specific method, and which methods payment are available, check this article we wrote: Different B2B Payment Methods to Know

You can also ask your clients directly what information they require. They won’t mind answering, as having the right information to do their work makes their lives easier.

After sending the invoice to the customer, it’s best practice to write something along the lines of “Please let me know if you need any additional information from me to process the invoice.”

That message reminds them to look it over now versus later. If something’s missing, you can correct it sooner and avoid payment delays.

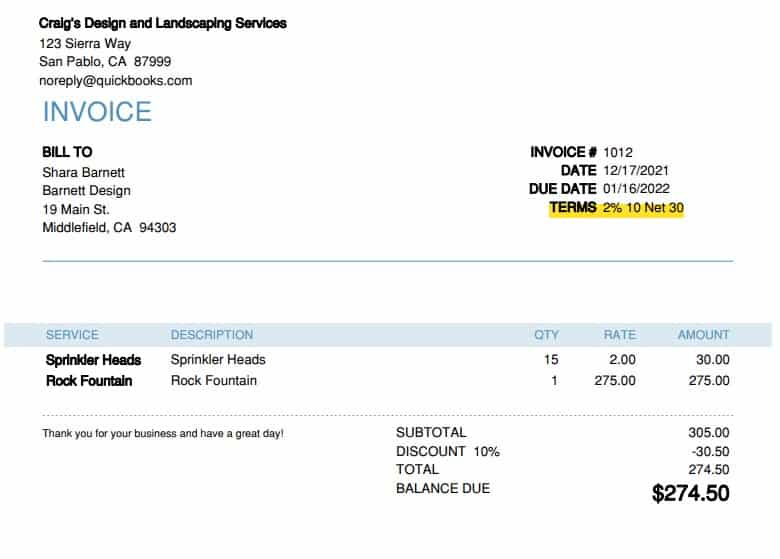

Not Specifying the Payment Due Date

If you don’t specify the due date, there’s a good chance you’ll receive the payment later than you wanted.

Clients tend to prioritize invoices that have a due date, especially if there’s a late fee attached to missing it.

Sometimes, out of carelessness or out of a self-interested desire to maintain their own business’s cash flow, they’ll purposely drag out paying an invoice that doesn’t specify a due date.

Therefore, it’s important to put one on your invoice, usually right underneath the date the invoice is sent, as is done in the invoice below:

Source: Fit Small Business

When it comes to due dates, you and your client should try to agree what should be applied to each invoice.

For example, many businesses use net-30 payment terms, meaning that an invoice must be paid within 30 days of receipt. Otherwise, it’s considered late.

If you make this agreement early on, clients will be aware of how soon you require payment after sending them an invoice. They’ll get into the habit early.

Other payment terms include net-7 or net-14. If you need money ASAP, you can even make your payments due immediately upon receipt.

Getting your desired payment terms might require some negotiations, but most of the time, if it’s reasonable, the client will accept it without asking for something in return.

If you want to encourage clients further to pay you on time, create some consequences for late payments, such as a late fee that grows as time passes.

| Advantages of charging late payment fees | Disadvantages of charging late payment fees |

| Encourages clients to pay on time | May discourage some clients |

| Helos ensure tat you have cash on hand | May be costly when managing disputed fees |

Note that you must explicitly outline, and make them aware of, this late fee term in your contract or else you risk angering the customer or failing to get them to comply.

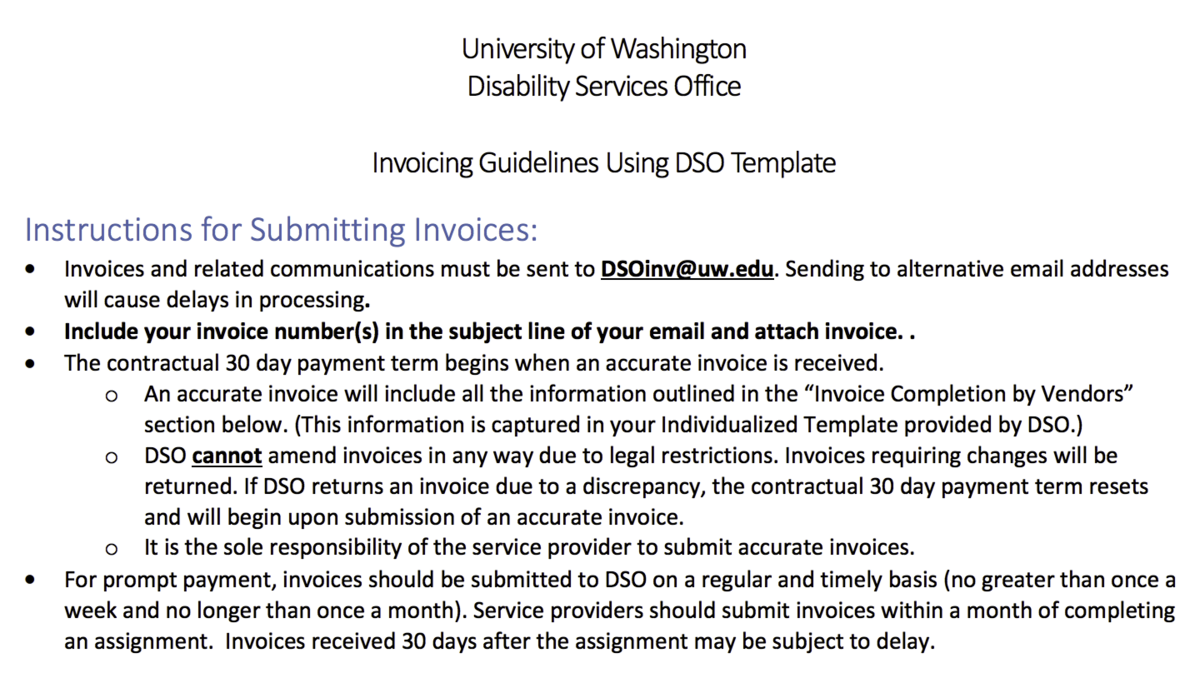

Ignoring the Client’s Invoice Requirements

Sometimes your clients may use an automated system to process vendor invoices. When this is the case, they often require vendors to structure their invoices in a certain way.

If you don’t include the right information, use the right margins, and follow the other necessary formatting rules, the software might fail to recognize and process your invoice.

Any failure to follow their specified format will lead to delays and all the frustration that comes with it.

Usually, if a client has any invoicing rules, they’ll tell you in advance and give you instructions for how to submit invoices, just as University of Washington does below:

Source: UW

Follow these standard procedures to a tee to avoid messing up the process. If the business requires you to write the date as dd/mm/yy, don’t write 2023 in the year column; write 23.

A mistake as small as this can delay the processing time and keep you from getting the money.

Sometimes they’ll want you to include information that you don’t normally include on invoices, like your business’s tax identification number.

If it’s information you don’t mind giving away, include it. If you have hesitations, ask them why they need it. It’s always okay to ask if something sets off your mental security alarm.

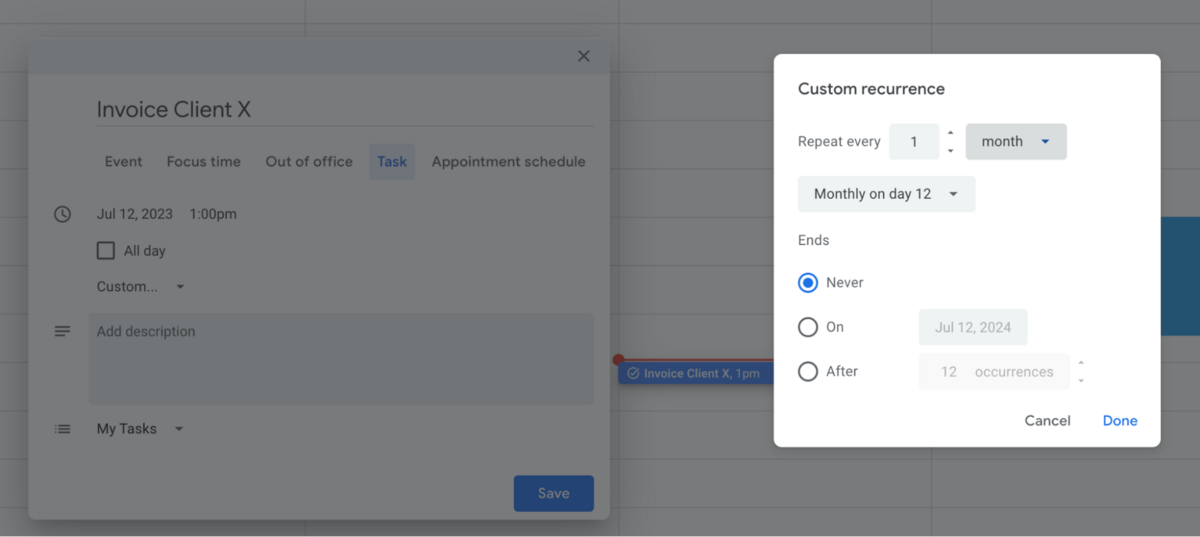

Failing to Send the Invoices on Time

It’s recommended that you send an invoice immediately after completing your service, or on the recurring date you and your client have agreed upon.

For example, it’s common in B2B partnerships for ongoing services to determine a day of each month (e.g., the 25th) to be the day when the vendor sends the invoice.

If you miss the date, you might have missed the day that the accounting team handles all accounts payable, and you might get your money later than you wanted.

Even if this isn’t the case, sooner is always better.

The earlier the client receives the invoice, the sooner they can start processing it, and the sooner the clock starts ticking for your payment terms.

A good way to make sure you send your invoices on time is to set recurring reminders in your online calendar.

Source: Private calendar / Regpack

A better way is to use some sort of automated invoicing software that will create and send invoices for you — at the right time, every time.

That’s what Regpack does. It streamlines customer onboarding and invoicing through one system. Let’s say you run a Yoga class.

Regpack let’s you have class signup forms on your website where you set up the rules, clients onboard themselves and the system automatically charges them each month and sends the payment receipts.

Source: Regpack

Nothing much for you to do.

In sum, try to set up mechanisms that ensure your invoices are sent on time. Otherwise, you risk getting payments later than expected, and this can damage cash flow and operations.

Sending Invoices to the Wrong Department

In B2B relationships, you’re often working with several different people in a single company.

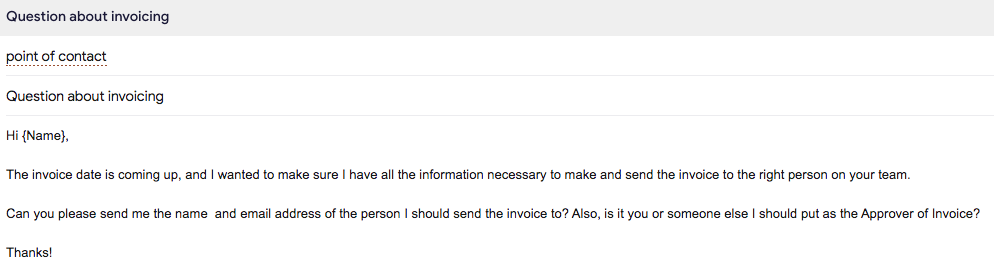

It can be hard to know who should receive your invoices. So the scenario described below is, unfortunately all too common.

Say you’re a business handling an advertising campaign. You’re working directly with the marketing department.

So you send your invoice to one of your points of contact on the marketing team. They see it, but aren’t in charge of invoicing. That’s accounting’s job.

So they make a mental note to ask their manager later about who to forward the invoice to, and then completely forget because invoices aren’t their usual job.

The invoice is sitting there in the inbox, unattended to, and unless you’re paying close attention and follow up, in spite of all the other stuff you have to do, the invoice will remain sitting there until the due date has passed and you’re wondering what went wrong.

To avoid this mishap, ask your point of contact for the name and email address of the person you should send your invoices to.

Also, ask for any other information you might need to generate the invoice correctly.

Here’s an example email doing exactly this:

Source: Private inbox / Regpack

Usually it’ll be someone on the accounting team, or the owner of the company if it’s small enough.

Get this information early in the relationship or at least before the day you’re supposed to send the invoice.

That way, you’ll have all the information you need when it comes time to send the first invoice.

At invoicing time, you don’t want to have to wait around for your point of contact to reply to your email and tell you the right person’s name and email address.

For all you know, your point of contact might not get back to you for days. And that’s time wasted and money not collected.

The longer it takes for the invoice to hit the person in charge, the longer you have to wait for your money.

Conclusion

Relying on manual invoicing, leaving out critical information, and not listing a due date on the invoice — these are all mistakes you can easily avoid.

And doing so will lead to faster invoice processing, fewer late payments, and less busy work on your end.

One of the fastest ways to eliminate these mistakes is by investing in an online payment tool with auto bill functionality.

To learn more about how your business can benefit from this, check out Regpack’s features and see how it can help your business.