You have a thriving business that boasts healthy, steady growth, and a rising number of satisfied customers. However, when you look at the endless spreadsheets in front of you, there is that feeling: something’s not right.

One part of your business might still be outdated and holding back everything else, and that is your billing system.

Like every other part of your business, the billing system has to continually improve for your company to thrive.

In this article, we’ll cover five signs you need a recurring billing system and why it’s important not to ignore them. Let’s dive in!

Jump to section:

You Need to Accommodate a Variety of Packages

You Accept Different Payment Methods

You Can’t Efficiently Scale Your Finance Team

You Often Deal With Invoice Errors

You Struggle to Maintain Accurate Financial Records

You Need to Accommodate a Variety of Packages

Do you offer multiple variations of your services, and lots of different products, or are you simply flexible and provide your customers with options that they can change? If the answer is yes to any of that, you need a recurring billing system.

Recurring billing puts your customers’ minds at ease and saves them from having to worry about paying for your services every week, month, or year.

Many businesses offer different plans, packages and options to their customers to use over time instead of selling a one-time product.

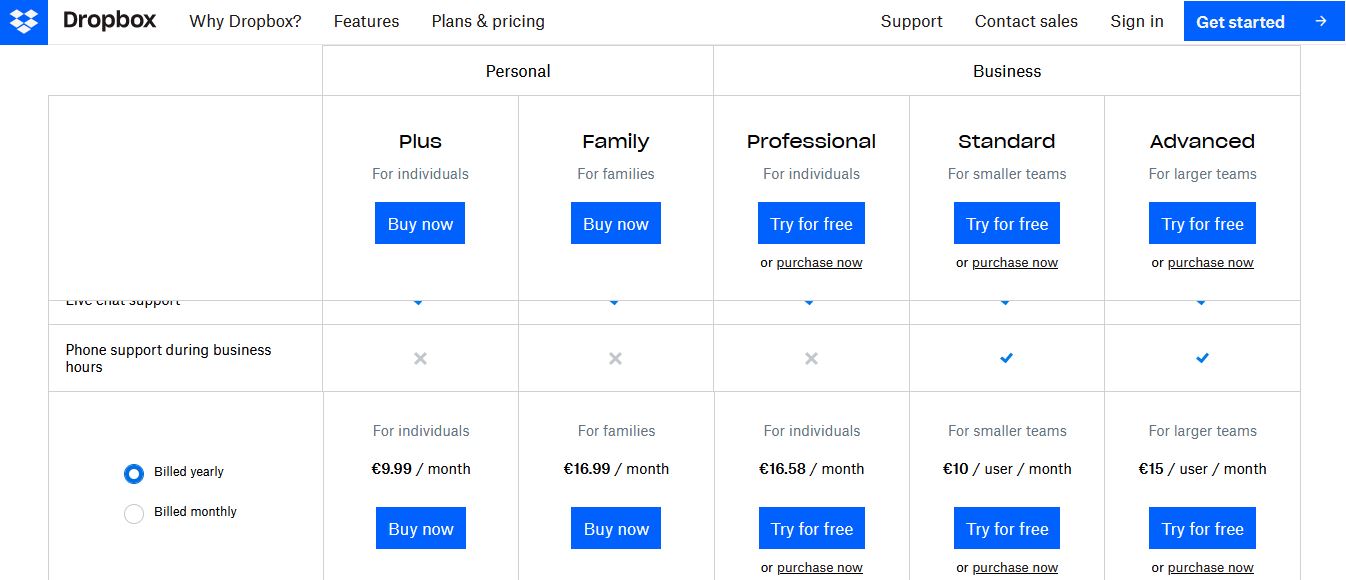

For example, the cloud-based storage solution Dropbox offers a variety of plans with different options and pricing. And with more than fifteen million users, keeping track of the entire service would be impossible.

So Dropbox, naturally, relies on recurring billing to make sure every user is billed automatically, according to the correct plan, and on time.

Source: Dropbox

As you can see in the screenshot above, they offer monthly and yearly billing, as well as a variety of plans to suit different needs.

But it’s not just software and cloud solutions that can reap the benefits of recurring billing. Other industries can use it too.

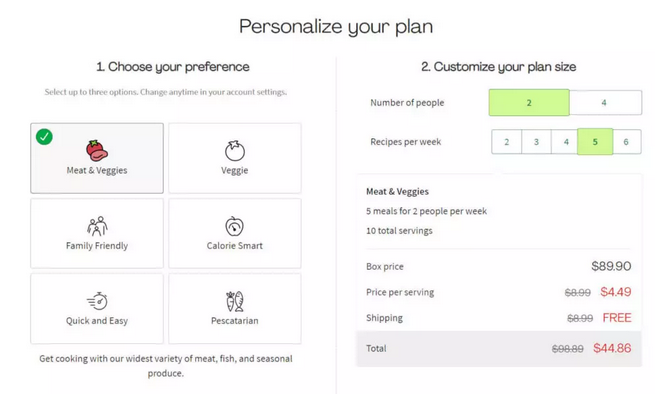

For example, HelloFresh offers subscriptions on meal ingredients that they deliver to your door.

It provides options in accordance with your eating habits and preferences, the number of people you want to feed, how many recipes you prepare per week, and more.

Plus, if you change your mind and decide to become a pescatarian overnight, you can adjust even that whenever you like.

Source: HelloFresh

The point is, HelloFresh has many moving parts to their service, as well as many customers. Recurring billing helps them automate the process and stay on top of their users’ needs.

If this reminds you of your own business, you may also want a system that’ll bill your customers regularly and correctly, whether you offer software as a service (SaaS), a meditation program, an online magazine, or even if you’re not subscription-based at all.

Regarding subscriptions, it’s important to highlight that that term is often used interchangeably with recurring billing. That’s because virtually all subscription businesses use recurring billing.

That being said, recurring billing is simply a billing mechanism, and all sorts of businesses can use it.

For example, even if your business isn’t subscription-based but you have long-term clients, the benefits of recurring billing are the same.

Some customers want to pay weekly, some need only one of your services every other month, and some want everything you offer for the next two years. With a good system in place, you can accommodate them all.

On the other hand, customizing manually for every client, sorting through spreadsheets and notes, and tweaking everything according to clients’ needs isn’t the most efficient system.

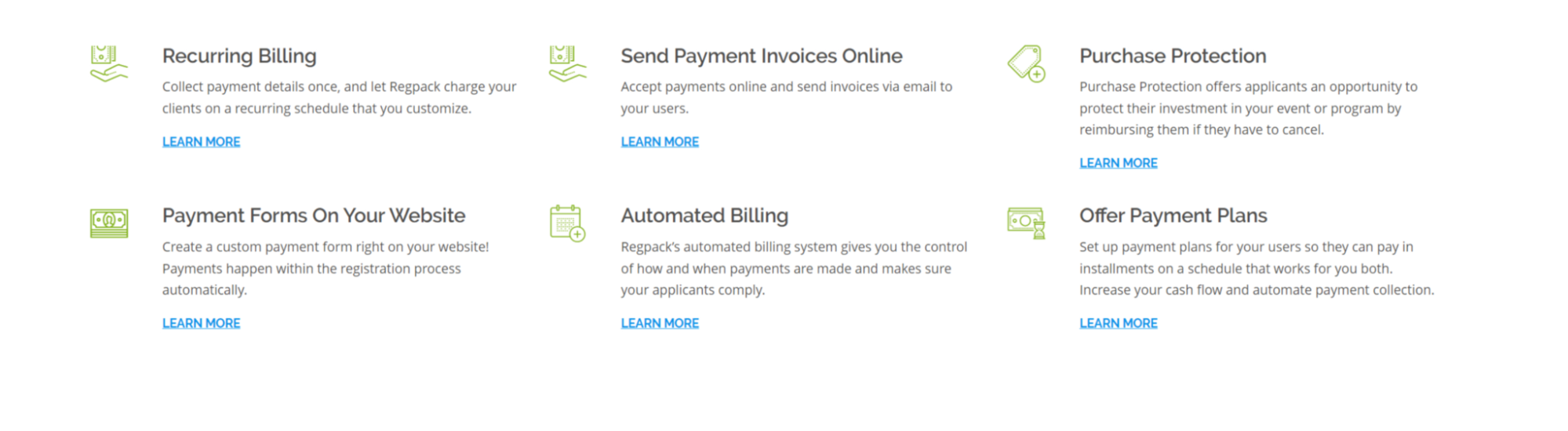

There are plenty of automation software solutions these days that let you set up every little detail about recurring billing. Our own solution, Regpack, offers recurring billing, along with a myriad of other features.

Source: Regpack

The bottom line is simple—if you have recurring services, long-term clients, products that you sell regularly, and a varied offer, you and your customers will benefit from a recurring billing system.

You Accept Different Payment Methods

If you conduct your business internationally and accept a variety of payment methods, recurring billing can help you keep all of these payment details memorized and applied without error every time you collect payment.

Here’s why: doing business in other countries means that you have a myriad of currencies to deal with.

That doesn’t mean that you should accept all 180 of them, but be aware of where your customers come from and what currencies they use.

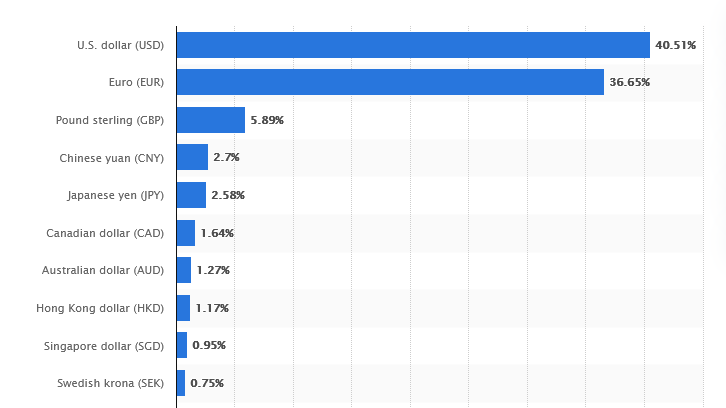

Below is the chart from Statista that shows the distribution of currencies worldwide in December 2021. It’s based on SWIFT payments, the global standard for payment, with over 35 million transactions per day.

Source: Statista

With so many options, billing can become very complicated very quickly. However, with a recurring billing system in place, customers can set their currency preference once and have it remembered for every transaction.

Furthermore, offering a variety of payment options goes hand in hand with allowing multiple currencies.

Enabling customers to use multiple payment options is important because you want to accommodate as many people as possible, reducing the chances they’ll take their business elsewhere.

In fact, 42% of US customers said they would leave a service if their preferred payment option wasn’t available. That shows that there’s no room for skimping on payment options.

With more payment options, you can significantly reduce churn and increase the customers’ satisfaction with your service.

Source: Regpack

There are benefits for you, too. More satisfied customers lead to maximizing conversion rate—in other words, they mean more revenue coming your way.

Taking all that into account, what payment options should you include? Credit and debit cards are consistently among the most popular options for consumers. Then, there are popular digital wallets like PayPal or Alipay too.

Moreover, checks and wire transfers still have their purpose; for example, 80% of B2B payments in 2020. were done using checks. Cash may still be a preferred method for some clients, too, so you should keep that in mind as well.

When we put all of that together, an automated recurring billing system is necessary when dealing with multiple payment options.

As with different currencies, recurring billing systems can memorize the customer’s favorite payment option, store their payment information and bill them with the same method every billing cycle.

And this is another useful feature Regpack offers to its clients.

Customers are allowed to choose between multiple payment methods when giving their payment details and the system automatically bills them using the same method every time.

Offering your customers plenty of options for payment and a range of currencies means that you aren’t leaving anything to chance when it comes to customer satisfaction and your own financial benefit.

And with a recurring payment system in place, you can rest easy knowing that every customer is billed in their own currency, using the method they selected.

You Can’t Efficiently Scale Your Finance Team

When your business grows, every aspect of it should grow proportionately. That means scaling your finance team, too, or looking for another solution.

Consider this: if your business grows, that means that you have more customers. More customers mean more business, which, in turn, means more invoices you need to send out.

That, naturally, leads to more payments heading your way and landing right onto your finance team’s desk.

Every new customer you have, every new service you offer or market you go into will mean more obligations for your finance team. Of course, handling a few dozen invoices is not even comparable to handling a hundred or a thousand.

If you don’t scale your finance team along with the rest of your business, that can very likely spell trouble.

Sure, you can hire more and more people to keep up, but how financially feasible would that be? Besides, there’s a likely increase in errors, mental fatigue, reduced accuracy, motivation, and speed with an increase in workload.

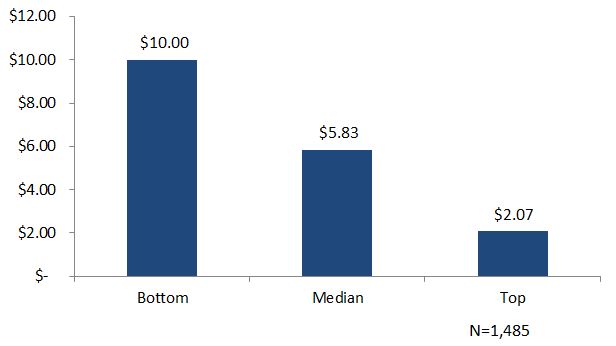

The new staff members are not the only cost of manually handling payments. According to Kofax, 11.57$ is the average cost of processing an invoice using traditional methods.

Furthermore, research from CFO showed a big difference between those who spend the most and those who are careful with their invoice-processing money.

Source: CFO

The worst performers need 10$ or more to process one invoice, whereas the best ones spend only 2,07$—five times less.

The important takeaway is that those who spend less use an automated recurring billing system, while those who spend more are less familiar with automation.

Why? Because a recurring billing system enables teams to automate key tasks, store information safely, and collect payments in cycles, without much interference from individual members.

That doesn’t mean that you should buy a piece of recurring billing software and sack your entire financial department.

Automation can serve as a boost for your team and make them more efficient and productive, all while reducing the need to scale your finance team by hiring more and more people to keep up with your growing business.

Setting up a recurring billing system can save the time usually spent on manually searching for information, and combing through documents and spreadsheets.

This way, the finance team has more time to focus on other essential tasks.

Furthermore, a recurring billing system can automate many aspects of your business, such as:

- customer information

- keeping track of paid and unpaid invoices

- dunning e-mails

- contracts

- discounts

- various updates

All of these details, when handled manually, can be a real pain point for the overworked and improperly scaled finance teams.

Source: Regpack

In conclusion, if your finance team is struggling to keep up in any way, it’s a sign that you need a recurring billing system.

Moreover, with recurring billing, your team can collect a much larger number of payments more efficiently, and without error. We delve into that last point more in the following section.

You Often Deal With Invoice Errors

Invoice errors can cost you a great deal of money and prompt customers to find the service you provide elsewhere. If there’s any indication of that happening, you need a recurring billing system.

The invoice is supposed to be simple, straightforward, easy to understand, and have all the necessary information so that customers can pay without any hassle. Of course, it should also be error-free.

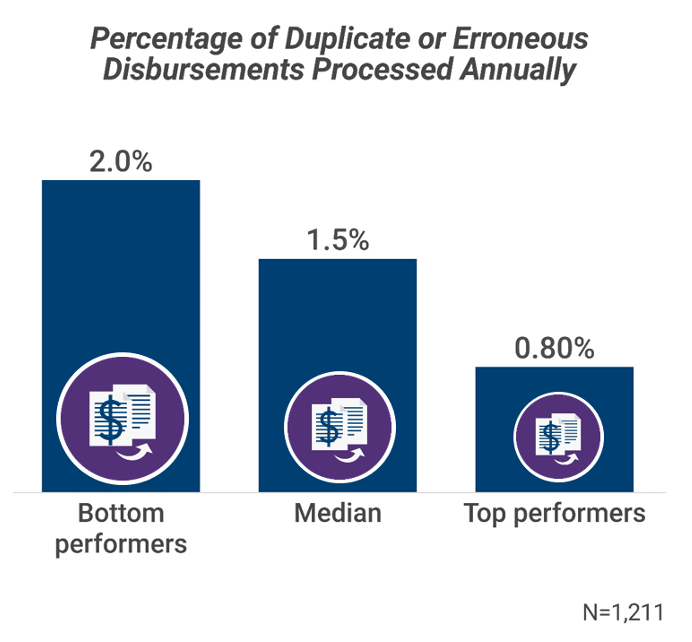

The cost of errors for your business could be high. According to data from APQC’s survey, even the most diligent companies annually have 0,8% of duplicate or erroneous payments. For those less careful, that number can go up to 2%.

Source: CFO

That might not sound like much, but 2% of annual payments can add up and silently eat away at your financials.

The errors can be deceptively simple; one wrong letter or number and the invoice might never reach the customer at all.

Having wrong customer information can present you as unprofessional. The customers might think that they’re not even important enough for you to pay attention to their name, address, account number, and the rest of the crucial pieces of information.

The invoice you’re sending should also have listed services you’re billing; not including them is another one of unwelcomed mistakes.

If you want to get paid on time, you should include a due date on your invoice. Without it, a customer might just put your invoice on a “for later” pile and forget it even exists.

There are more invoice errors that can occur, but there’s good news —you don’t need to memorize them and check for them every time you send an invoice.

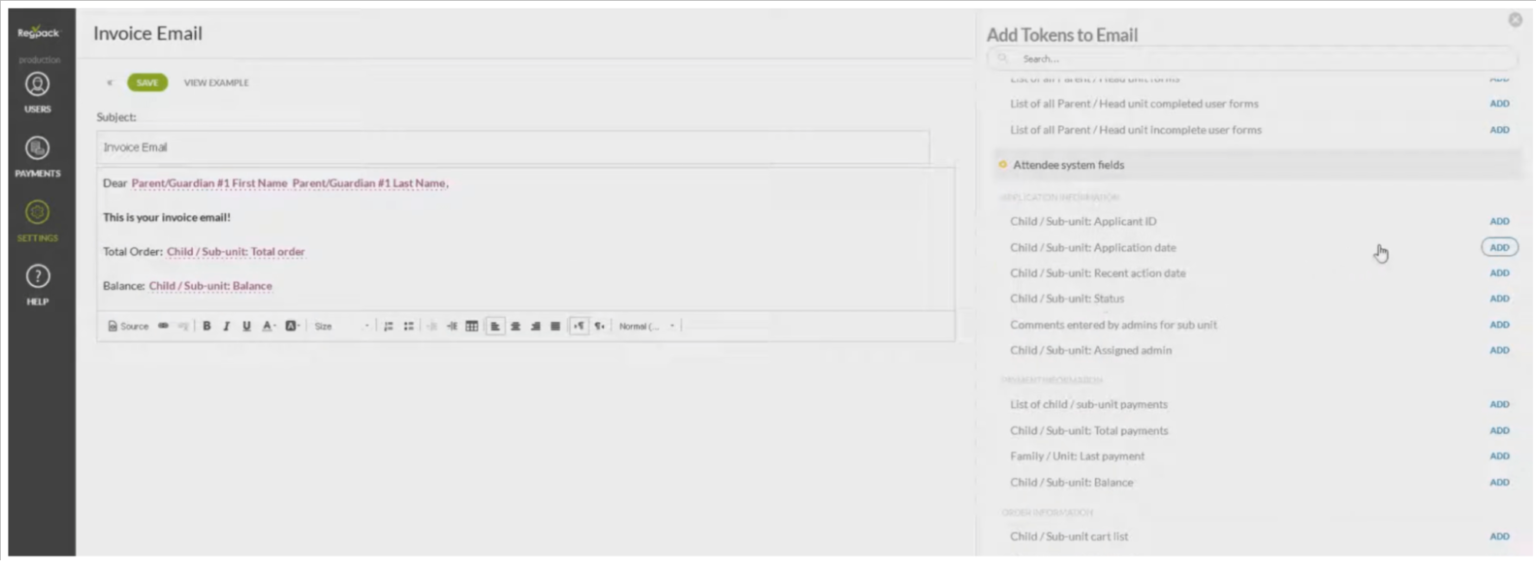

With recurring billing, customers only need to enter their information and payment details once, and then the system takes it from there.

The customers are billed at the end of every cycle with the same information, leaving very little room for error. And this cycle repeats itself until you or your customer change the details.

But there’s more. Recurring billing software, like RegPack, allows you to create invoices and automatically fill up needed information on every invoice, thus eliminating the chances of a wide variety of possible errors.

For example, Regpack offers tokens to insert all the needed information with one click.

Source: Regpack

So, keep in mind that errors and mistakes, while unavoidable in any line of business, can be significantly minimized when quality software and good computing systems are put in place.

With regard to billing and invoicing, a lot of errors can be prevented using recurring and automated billing, keeping your reputation and revenue intact.

You Struggle to Maintain Accurate Financial Records

Having accurate financial records is one of the pillars of a sustainable, serious business. If your financial records are all over the place, that’s another sign you need a recurring billing system.

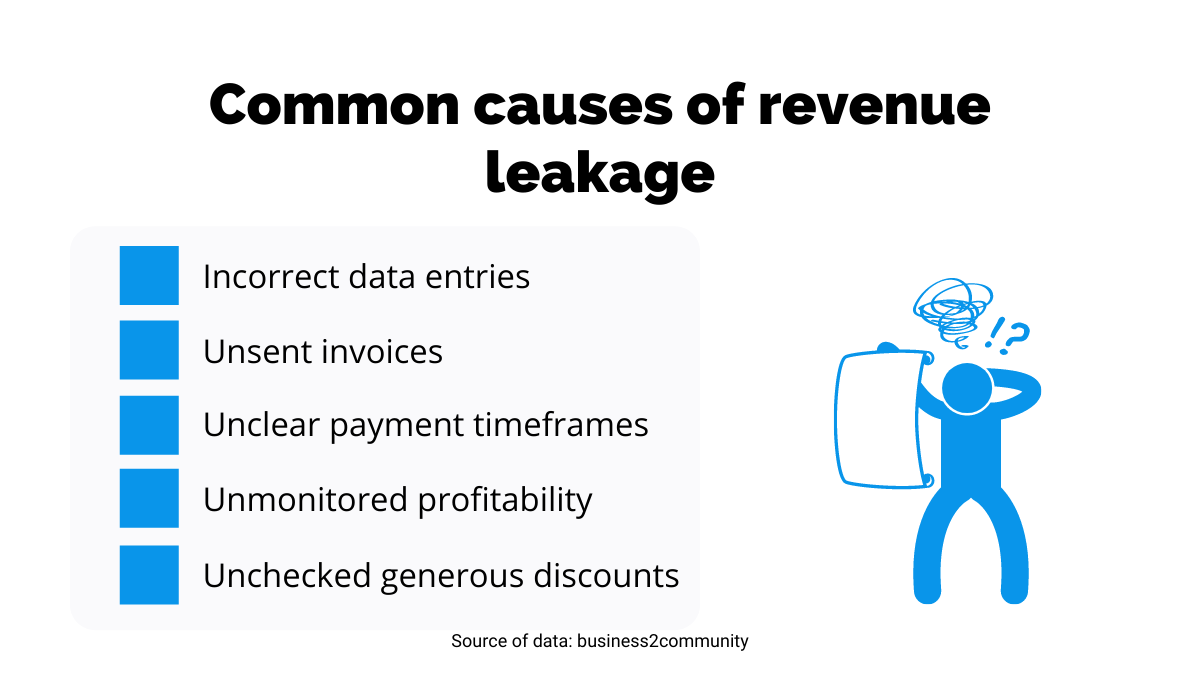

One cause of inaccurate financial records could be revenue leakage. As often is the case with leaks of any kind, the source of leaking revenue is hard to find and can cause trouble.

If your business is losing revenue unintentionally or without noticing, it’s most often down to billing errors, according to Fundera. That can mean under-billing, failed payments, or any other reason that leads to you simply not collecting the money from your customers.

If you use manual methods for billing, like spreadsheets, it can be tough to find where the leak occurred. The amount of information you have to go through might be enormous, and the amount of time it can eat up is significant.

In the image below, you can find some of the most common reasons your revenue may be leaking, according to B2C:

Source: Regpack

Sounds familiar? Yes, we’ve already mentioned most of these areas as instances where automation can help a great deal. You can easily keep an eye on all of that with automated billing software and prevent unwanted leaking.

Another thing that contributes to maintaining accurate financial records is predicting your cash flow accurately.

Predicting your cash flow is much easier when you have a recurring billing system in place.

The system allows you to easily access:

- the type of contract you have with each customer

- payment schedule

- the status of their contracts or payments

- personal and other relevant information about your customers

Setting due dates in your invoices and sending reminders when the payment is overdue are some examples of important tasks that can easily slip past you and make your financial management needlessly complicated.

That’s why it’s good to have a recurring billing system that you can “set and forget”.

Furthermore, one unwanted effect of inaccurate financial records can be tax problems. After all, if you don’t know exactly how much you earn and where that money is, how can you know how much you owe in taxes?

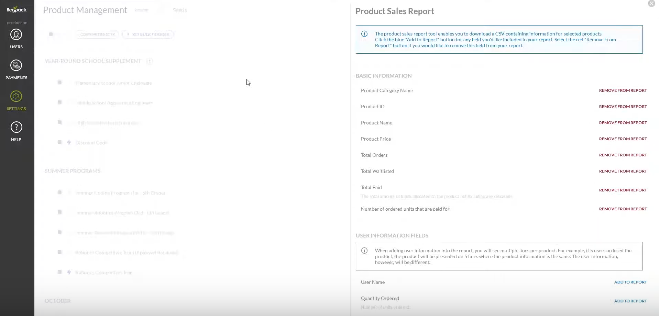

Automated billing software comes in handy there too. Accounting is way easier when you can find payment reports and records of transactions, or access reporting tools and analytics in a few clicks.

Source: Regpack

In this section, we’ve covered why you might struggle with maintaining accurate financial records and how a recurring billing system can help that. It’s now up to you to implement these solutions in your business.

Conclusion

Offering various services and packages, different payment methods, inability to scale your finance team, invoice errors, and inaccurate financial records are signals something’s got to change.

If you recognize these signs we described in this article, it’s time to set up a recurring billing system.

You’ll quickly see that convenience, accessibility and the number of possibilities at your fingertips is incomparable to the manual ways of billing.

When you implement a recurring billing system in your business, don’t be surprised if you find yourself wondering how you ever accomplished anything without it.