Overdue payments and unpaid invoices aren’t just irritating, they’re harmful to the cash flow and profits of your business.

Therefore, it’s important to learn how to prevent late payments from happening and how to handle the situation effectively when they do.

In this article, we’ll discuss eight steps your company can take to deal with late payments.

Some are proactive and preventative, while others are reactive and help you get the money you’re owed.

By following these steps, you can ensure that your revenue always reflects the services you provide for your customers.

- Make Your Payment Terms Clear

- Send the Invoice on Time

- Offer a Wide Range of Payment Options

- Send a Polite Overdue Invoice Reminder Email

- Contact the Customer by Phone

- Consider Adjusting Your Payment Terms

- Charge Interest on Late Payments

- Consider Taking Legal Action

- Conclusion

Make Your Payment Terms Clear

First, ensure that you have clear payment terms expressed in your contract.

By terms, we mean the payment due date, accepted payment methods (credit card, ACH, etc.), and any instructions for how and where to make the payment.

You can also consider including the following:

- Penalties for late payment

- Early payment discounts

- Credit policies

- Staggered payment options

Being clear about your payment details reduces the chances customers will fail to pay because they misunderstood how or when they were supposed to.

In addition to clearly stating your terms in your contract, it’s also a good idea to mention them in conversation, over email, or on a phone call with your new client. This way they fully understand the invoice details.

Sometimes people’s minds shut off while reading a contract. This is far less likely to happen when they’re talking to someone or reading a short, important email.

Having and sharing your payment terms ensures that your customers have all the information they need to make timely payments.

Send the Invoice on Time

Sending invoices promptly after a service has been completed is a key strategy for service providers looking to expedite payment processes and reduce overdue invoices.

This approach gives customers ample time to pay the invoice and capitalizes on their immediate gratitude for service, increasing the chances of timely and happy payments. It’s one of the best ways to speed up invoice payments.

Verifying the invoice contains all necessary information is equally important for ensuring outstanding invoices are paid on time. You should double-check details like the recipient’s name, due dates, service descriptions, and invoice numbers to avoid any confusion for you or your accounting team.

Often, the fastest way to send accurate invoices is through digital invoicing.

Consider using a tool like Regpack, which helps you streamline the invoicing process and reduces human error. This tool allows your customers to track and make their payments through an online portal so that they don’t forget about their obligations as easily:

Source: Regpack

These practices, from immediate invoicing to the adoption of digital invoicing tools, work together to limit late payment issues, making the entire process smoother for both the service provider and the customer.

Offer a Wide Range of Payment Options

The more payment options you offer your customers, the less often you’ll hear “I just can’t pay that way”—one of the more frustrating late payment excuses.

These days, customers expect to be able to pay using whichever method they prefer, whether that’s via ACH transfer or credit cards. One thing is for sure, they want to be able to make these payments online.

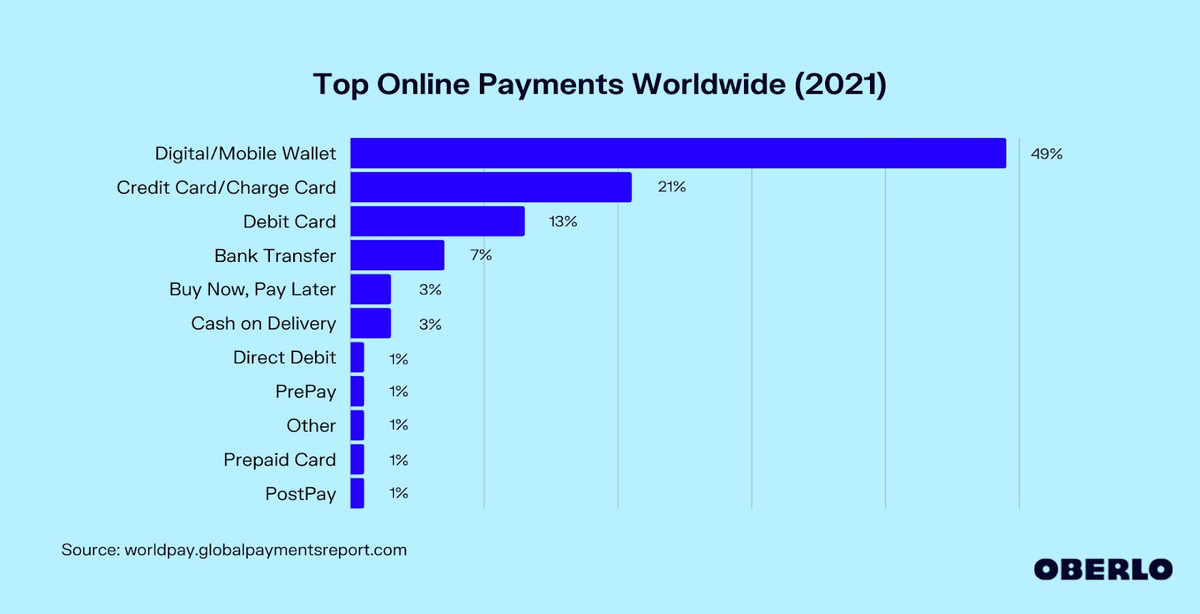

Therefore, along with creating an online payment option, you should aim to expand your accepted payment options to include the following methods, prioritizing the ones at the top, like mobile wallets and credit cards:

Source: Oberlo

Of course, your industry might have different payment preferences compared to others, so it’s important to listen to your customers.

Alternatively, you can directly ask each one about their preferred payment method and then work to accommodate those preferences.

For instance, if many of your customers express a desire to pay via PayPal, prioritize making that option available before adding others.

Customers value convenience highly; by offering them the easiest payment method, you reduce the likelihood of procrastination and reduce the amount of late payments.

Send a Polite Payment Reminder

Even after enacting all your proactive approaches, some customers are still likely to be late on their payments.

Most of the time, this tardiness is accidental, with the customer having simply forgotten to make the payment.

If that’s the case, compose an overdue invoice email that includes the following relevant information:

- The payment’s due date

- The total amount due

- How to make the payment

- Any late policy

Write the email in a friendly and polite tone so that the customer doesn’t feel any hostility from your end. A forgiving and adaptable approach will likely earn you their goodwill in the future. Consider using one of our late email templates for guidance and inspiration.

It can also be helpful to remind the customer about the payment a day or two before the deadline. This can significantly reduce the likelihood of overdue invoices and late payments.

For more on this topic, explore our article on how to write late payment emails that get you the money you’re owed without causing any waves in your relationship.

Contact the Customer by Phone

If your payment reminder emails go unanswered, it’s time to call your customer to identify the problem.

Approaching the conversation with politeness and an intent to understand rather than criticize can help you to get to the bottom of the issue and find a mutually beneficial solution that involves you getting paid.

Occasionally, a customer may have simply forgotten to pay, which is an easy fix.

However, other times, there may be more complex issues, such as cash flow difficulties. In that case, collaborating with the customer to devise a suitable payment plan can be effective.

In other words, help them help you.

If you find that they can’t pay through your existing payment methods, explore alternative options that will suit both of you. Often, a solution can be found with a little bit of online research, offering a compromise that meets both your needs and is easy to implement.

Direct contact is typically the most efficient way to resolve such issues. Phone conversations, in particular, quickly address and rectify payment problems.

This hands-on approach accelerates the resolution process and demonstrates your commitment to maintaining a positive business relationship.

Consider Adjusting Your Payment Terms

If you’re working with a customer known for paying their invoices on time but suddenly finds themselves behind schedule for a valid reason, you might want to consider revising your payment terms to accommodate their situation.

This could involve extending their payment deadline or setting up a payment plan that allows them to settle their balance in installments over an agreed-upon timeframe.

For example, if a customer owed you $1,000, but was currently strapped for cash you could give them the option to pay $500 now and $500 next month.

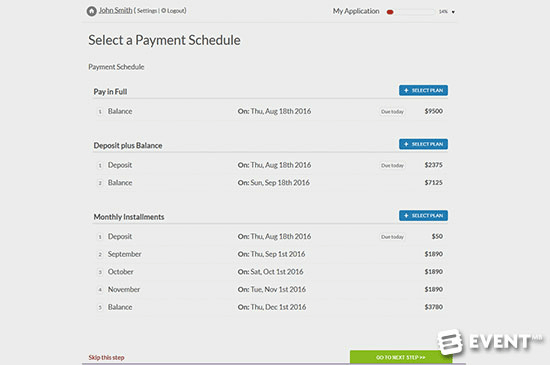

Offering a customer a payment plan at the start of your relationship is another good way to prevent late payments. This way customers can manage their payments in a way that aligns with their financial capacity.

Many large and small businesses use Regpack to create and offer these personalized payment plans to their customers:

Source: Regpack

The above example offers customers the option to pay in monthly installments, make two payments, or pay in full with a single payment.

While changing your payment terms might not be great for your current cash flow, at least you’ll still get the money you’re owed and maintain a strong, long-term relationship with one of your loyal customers.

Charge Interest on Late Payments

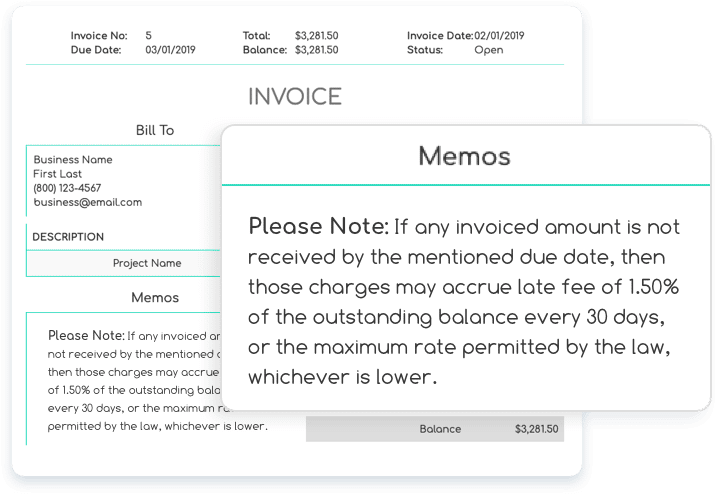

Creating a late penalty or fee for overdue invoices will incentivize customers to pay you on time.

For example, you might create a policy that states customers incur a fee equal to 5% of the total invoice amount for every month they’re late settling their overdue accounts.

Putting something like this in your contract will discourage customers from letting their payment slide past the due date.

Here’s an example email of a business informing a customer about their late fee policy:

Source: billergenie

A late fee policy goes beyond just including it in your contract; it’s crucial to communicate this policy with your customers directly, whether in person, over the phone, or by email.

That way you can also address any customer concerns and explain the significance of the policy in safeguarding your business.

Handling any objections upfront is preferable to enforcing a late fee on a customer who has missed a payment, a scenario that could lead to unnecessary complications.

An alternative to late fees is a prompt payment discount—when you give a slight discount to customers for paying a certain number of days before the actual due date.

This option is probably better for anyone who knows they’re going to be strapped for cash during a slow season and therefore want to shorten the payment window from net 30 to net 15 or some similar jump.

You must find ways to encourage your customers to pay you by the due date, and charging interest on late payments is an incredibly effective method.

Consider Taking Legal Action

If all else fails, the final step in dealing with late invoices that remain unpaid is taking legal proceedings.

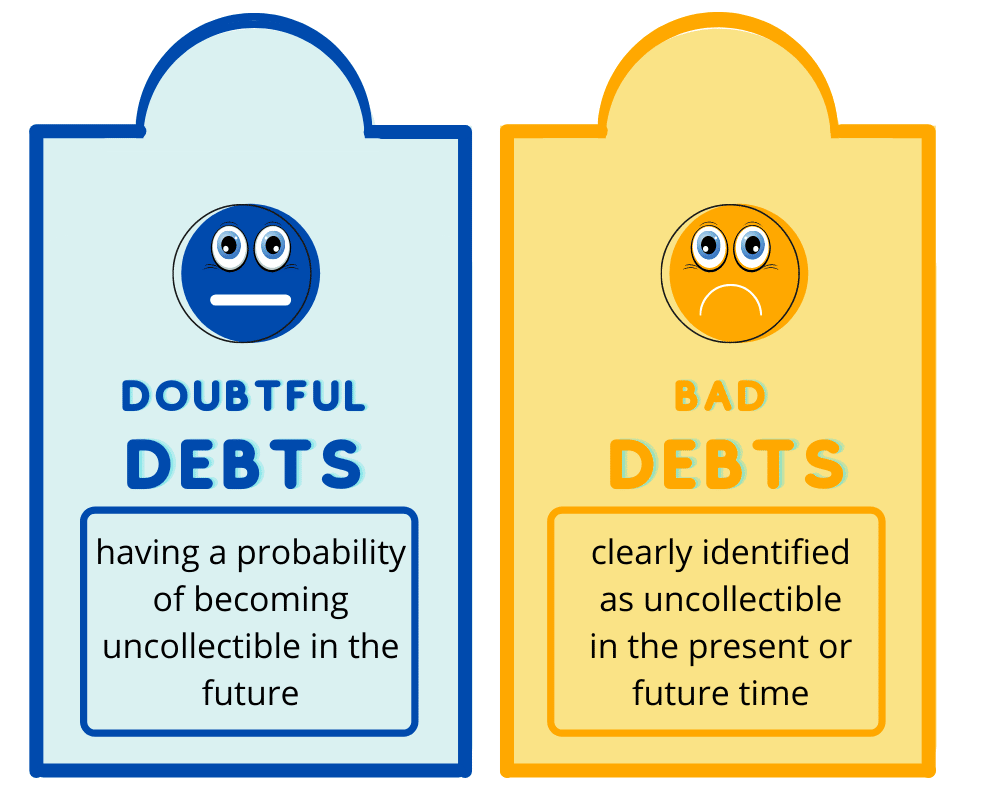

If there’s still a chance of recovering the debt, it’s called a doubtful debt.

Source: Wiki Accounting

In that case, you should try to contact your customer over the phone to talk things out and provide a final reminder before taking one of the following actions.

If you finally decide to call it a bad debt, make sure to let the client know that you’ll no longer be working with them in the future.

Take legal action only if the amount owed is large enough to warrant the lengthy and often expensive legal process.

If you choose this road, make sure that you have all the records that will serve as evidence to support your claim, including the contract between you and the client, the original invoice, your accounting documents, and any outstanding payments that have not been made.

Conclusion

There are many ways businesses can reduce the number of overdue invoices they receive.

They can start by making payment terms clear, creating a late penalty, and offering a wide range of payment options.

If a customer is late, businesses should send a polite reminder, call the customer, consider adjusting the payment terms, and perhaps even take legal action.

For more ways to prevent late payments and retrieve what you’re owed, check out our article on 15 creative ideas for handling late-paying customers..