Whether you’re selling products or services, not being paid on time is probably one of the most uncomfortable situations you have to deal with as a business owner or manager.

However, since late payments from clients negatively affect your business’s cash flow, such situations must be swiftly addressed and non-paying clients skillfully managed.

There are many ways to speed up your client’s invoice payments before they become due, thus minimizing the number of late payments and strengthening your cash flow.

Here are twelve of them.

- Define Clear Payment Terms

- Offer Multiple Payment Options

- Consider Adjusting Your Payment Terms

- Request Upfront Payment

- Send Invoices on Time

- Establish a Regular Payment Schedule

- Automate Your Payment Processes

- Send Payment Reminders

- Provide a Small Incentive for Fast Payments

- Include a Late Payment Fee

- Remain Polite in Your Correspondence

- Maintain Positive Relationships With Clients

- Conclusion

Define Clear Payment Terms

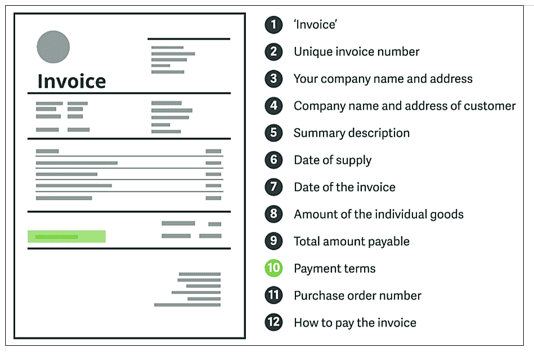

Clearly defined payment terms are the starting point toward ensuring your clients pay invoices promptly.

In whatever form they’re specified, payment terms inform your clients when the invoice will be sent, how they can pay it, and how long they will have to do so (the due date).

Depending on the type of business you’re in, payment terms can be stipulated in a formal contract you and your client signed or less formally communicated via e-mail or other means during the pre-ordering process.

A formal contract between you and the client is always preferable, but e-mails or text messages can be accepted in place of one.

Either way, you should ensure that your client confirms they understand and agree to your payment terms prior to sending any invoice.

However, you should remind the client of those terms when delivering the invoice as well.

In fact, payment terms are one of the essential elements of any invoice issued for the services or products your business provides, as highlighted in this list of main invoice components:

Source: Sage

Hence, having an invoice with clear and concise payment terms, including bank account details, payment methods, and the due date, keeps your clients informed and helps them make speedier invoice payments.

This will prevent any misunderstandings or potential conflicts when it’s time to pay the invoice, as well as provide relevant evidence in case of a payment dispute.

In summary, clearly defining payment terms, making sure that clients understand and accept them in advance, and always listing them in your invoices, is the first step to speedy invoice payments.

Offer Multiple Payment Options

Another way to speed up invoice payments is to make it easier for clients to pay them by offering multiple payment options.

Being surrounded by various digital payment options, such as credit and debit cards, payment apps like PayPal, Apple Pay, Cash App, and others, one would think that offering multiple payment methods is commonplace in today’s world, especially after the pandemic.

Source: eBay

Despite that impression, there are still many small-to-medium-sized businesses that will accept only cash or a direct deposit/wire transfer to their bank account.

Because clients always favor convenience and increasingly prefer credit over cash, such limited payment options neither help sales nor make it more likely that clients will pay invoices on time.

Thus, although accepting credit cards and other digital payment options does come with a fee, such payment methods make it easier for clients to pay their invoice, which increases the likelihood of them paying quickly.

To sum up, offering multiple payment options will provide your clients with more convenient ways and stronger reasons to pay the invoice before the due date.

Consider Adjusting Your Payment Terms

When a trusted client encounters difficulties in paying their invoices on time, consider adjusting your payment terms to strengthen your relationship with that client while ensuring your business still gets paid in full.

The main logic behind this, confirmed by different statistics, is that it’s easier, cheaper, and often more profitable to retain a loyal client than to get a new one.

So, when your repeat customer who used to always pay on time starts being late with payments, it might be worth offering them to pay overdue invoices in installments.

Likewise, it might be wise to consider temporarily adjusting your payment terms (e.g., extending the payment period) for future purchases.

Of course, you should first assess the situation, which you can do by contacting the client directly (either by calling or sending a personalized e-mail) to ask about their situation and show you’re willing to discuss payment options, both in terms of their late payments and future orders.

If all goes well, adjusting your payment terms can allow you to get paid in full and retain a trusted client while reinforcing their loyalty and your future income.

Request Upfront Payment

This method is best suited for longer-term, recurring, or one-off larger projects where you reduce the risk of not getting paid on time (or at all) by asking clients for partial payment before starting or finishing a project.

The effect of upfront payments is twofold.

First, it ensures that part of the agreed-upon amount is already paid, thus improving your business’s cash flow.

Second, any upfront payments already received make it more likely that the client will also pay the remaining amount on time.

Partial upfront payments can be set in a fixed amount or as a percentage of the total estimated amount or, in some cases, as a retainer fee.

Source: Investopedia

So, upfront payments can refer to payments made before any work starts and payments received before a project/service is completed.

As such, the timing of upfront payments can vary.

For instance, you can negotiate one payment at the start of the project and subsequent payments when specific milestones are reached or progress payments on a weekly, monthly, or quarterly basis.

Overall, asking clients to pay upfront ensures you’re partially compensated before delivering a service or product, while also reducing the risk of overdue payments.

Send Invoices on Time

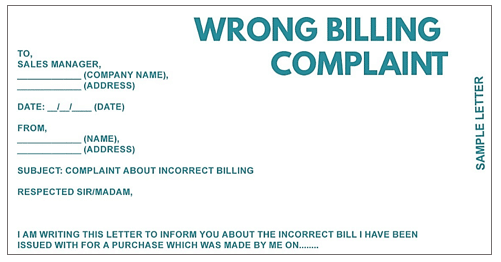

This may seem obvious, but it bears repeating: the sooner your clients receive the invoice, the sooner they can pay it.

In other words, any delay in sending the invoice extends the period between delivering a service/product and getting paid.

Therefore, sending invoices on time, for example, right after finishing a project, is essential for receiving timely payments from clients.

Naturally, there’s more than meets the eye behind this apparently simple concept.

Namely, you should ensure the client’s information on the invoice is correct, as more than 60% of late payments are related to incorrect invoices.

Source: LettersinEnglish

To avoid complaints and the resulting late payments, you should find out the client’s information in advance, including any special requirements, such as listing specific line-item descriptions or the number of their branch office for accounting purposes.

You should also ask about their preferred invoice delivery method (e-mail, post, e-invoice, etc.).

Thus, sending invoices on time is critical for receiving faster payments from clients, but it should always be preceded by careful invoice preparation.

Establish a Regular Payment Schedule

When your client makes payments on a recurring basis, establishing a regular payment schedule can help your business to get paid faster.

For instance, you can agree that you’ll deliver the invoice for your monthly services on the first of each month for the past month.

That way, the client knows when they can expect an invoice, which will reduce any potential confusion about due payments and encourage timely payment.

Thus, establishing a regular payment schedule could mean the difference between timely and overdue payments.

As explained below, handling recurring payments is usually related to automating the payment process.

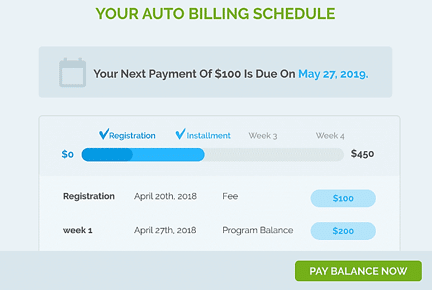

Automate Your Payment Processes

Another way to speed up the process of asking for and receiving payments is automating your payment processes by using invoicing software.

When a business grows and invoicing starts to take more of your or your staff’s time, automated billing software can save time and improve your cash flow by making recurring payments more convenient for your clients.

For example, if you’re offering a subscription service that will be paid monthly, quarterly, or annually, you can offer clients to establish an automatic billing schedule.

For instance, our billing software Regpack allows your business to streamline such processes, i.e., create custom payment plans and automate recurring payments.

Source: Regpack

According to users, this auto-billing feature saves them up to 60 hours a month while giving them both security and convenience when paying their invoices.

In any case, automating your payment processes will reduce the risk of late payments and strengthen your cash flow while giving your clients the convenience of signing up and providing their payment information just once.

Send Payment Reminders

A great way to ensure the client is aware of the approaching payment deadline is to send a payment reminder a few days before the payment is due.

Likewise, if the payment date has passed, you should send a late payment reminder immediately after the due date instead of waiting for days or weeks in the hope they’ll remember to pay you.

Both types of reminders, when sent at the right time (not too frequently), can be just what the client needs to honor their obligation to you.

If you’re already using billing software or contemplating getting one, many software solutions will also allow you to automate reminder e-mails.

Source: Regpack

Of course, reminders should be personalized, and those sent after the due date should allow for the possibility of a system error, i.e., the event that the client has already paid, but your system hasn’t processed their payment.

In any case, sending reminders is a great way to speed up payments.

Provide a Small Incentive for Fast Payments

Another good idea is to offer a small incentive for clients who pay their invoice faster, i.e., within a certain period before the due date.

This is an excellent method for clients who are ready to pay but would pay sooner if it meant they would pay less.

An early payment discount doesn’t have to be high (e.g., 1-2% of the total amount).

Moreover, it doesn’t have to include any discount on the purchase they made, but can consist of a discount or coupon for future purchases.

Whichever form of early payment incentive you opt for, it will not only encourage the client to pay their invoice faster but also to continue doing business with you.

Include a Late Payment Fee

If the above section is a “carrot,” this one is a “stick.”

In other words, similar to how small incentives for fast payments aim to reward clients for early payment of their invoices, late payment fees aim to penalize them for not keeping their end of the bargain, i.e., not paying on time.

However, any late payment fees must be clearly defined in the contract (or another written agreement) and communicated to clients at the very beginning, so there are no surprises later on.

Likewise, they should be reasonable, whether flat rate (e.g., $10 or $25) or percentage based (e.g., 1-1.5% of the due amount).

When considering the amount of your late fee, keep in mind that different states have specific rules regarding the maximum amount business owners can charge for overdue payments.

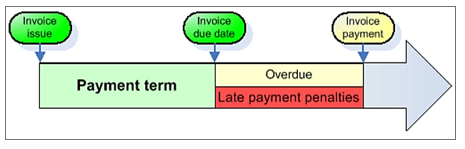

Also, remember that late payment penalties, usually based on the number of days or weeks a client is behind on their payment, will be calculated from the invoice due date until the debt is settled, as shown below.

Source: Credit Management tools

As such, late payment fees work best for recurring payments because you can charge a late fee for the previous invoice on the next invoice.

However, they can help with all types of purchases by motivating clients to pay their invoices quicker to avoid a late payment fee.

Remain Polite in Your Correspondence

When it comes to speedy payment, businesses should always remain polite and professional in their correspondence with clients, regardless of the circumstances.

Doing so can go a long way in leaving a positive impression on the client, thus motivating them to pay their dues on time.

Including lines such as “We appreciate your business” or “Thank you for your timely payment” in your correspondence with clients reinforces your relationship with them and makes prompt payments more likely.

Here’s an example of a thank you e-mail after the client has paid, which is used to encourage them to quickly pay future invoices sent by Wistia.

Source: Automizy

However, when the invoice hasn’t been paid and the due date is getting close, contacting your client to ask if they, for instance, received the invoice can be enough to jog their memory and get you paid on time.

Likewise, even after the due date has long passed, you should stay calm and remain polite in your correspondence because your primary goal is to collect what you’re owed, not just prove your point.

Maintain Positive Relationships With Clients

Finally, businesses should strive to maintain positive relationships with clients in all their dealings with them.

As such, this suggestion is closely tied to the previous one, and both are focused on creating and nurturing strong business relationships with your clients because that:

- increases the likelihood of the clients making their payments on time

- helps you and the client to resolve any problems more quickly if late payments do occur

Thus, establishing open communication with new and existing clients is essential for building positive relationships and creating mutual trust, which in turn improves your chances of getting paid on time.

Conclusion

So, we’ve taken a tour of twelve ideas that can speed up client invoice payments.

Many of them should be established before invoicing, such as clear payment terms, multiple payment options, early payment incentives, and late payment fees.

Others, like establishing a regular payment schedule or automating your payment processes, come after the initial client payment has been made, i.e., for recurring payments.

When the invoice has not been paid on time, sending payment reminders or adjusting payment terms may help address this issue.

Finally, you should remain polite in your correspondence and maintain positive relationships with clients at all times.

Whether alone or combined, these ideas can help you receive client invoice payments faster, thus strengthening your cash flow and minimizing late payments.