Payment processing errors are seemingly minor inconveniences but can be quite a hurdle when dealing with the financial aspect of your business.

Those errors can lead to customer disputes, revenue problems, time-wasting, and overall damage to your business.

Therefore, it’s best to avoid them as much as possible.

But, many errors can happen during payment processing. How to avoid them? By learning about them, how they occur, and what you can do about them.

That’s why we advise you to keep reading.

- Declined or No Authorization

- Late Presentment

- Incorrect Transaction Code

- Incorrect Currency

- Incorrect Account Number

- Incorrect Transaction Amount

- Duplicate Processing

- Conclusion

Declined or No Authorization

Being authorized to process a transaction is one of the most essential parts of the payment process.

What does that mean? Well, it essentially means you request bank permission to process a transaction.

If you don’t do that, you might face a declined or no authorization payment processing error.

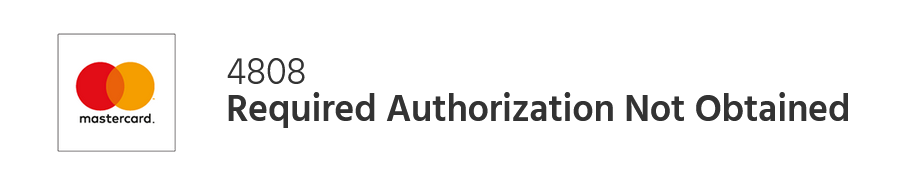

For example, if you’re dealing with Mastercard without authorization, a screen like the one below might come up.

Source: Chargebacks911

Let’s quickly break down what you can see above.

The 4808 number is a reason code or a string of symbols, in this case, numbers, that financial institutions use as an identifier for a particular error.

So, if you process a payment with Mastercard without authorization, one of the reason codes that you can see is for the “Required Authorization Not Obtained” error.

Regardless of the financial institution you deal with, you should do whatever you can to avoid this processing error.

By requesting authorization, you protect yourself from many possible issues that can happen if the card has been stolen from your customer or if they simply don’t have sufficient funds in their account to pay you.

Source: Github

In addition to ensuring that the payment goes through, you should ask for authorization because, without it, you aren’t protected if the customer disputes the payment for some reason—you tried to bypass the proper channels.

Simply put, this is an error you should avoid under any circumstances.

Late Presentment

Payment processing might be authorized, but that doesn’t mean you can’t run into more payment processing errors. One of them is a late presentment.

A late presentment simply means that you’ve missed a deadline for submitting a transaction.

As you can probably tell by that description, a late presentment is an error on your part. If you don’t complete and submit payment in time, you will face chargebacks.

Therefore, a way to avoid the late presentment payment processing error is to be punctual and honor the deadlines you have for finalizing a transaction.

How long you have depends on various factors, like a financial institution and its policies or the type of contract.

However, regardless of those factors, acting as quickly as possible will undoubtedly avoid this processing error.

For instance, Midigator, a chargeback management software company, provides advice like this one below:

Illustration: Regpack / Source: Midigator

Usually, you have more time than only one day, but it’s better to be safe than sorry.

What can happen if you are late with processing transactions? Well, first of all, you could lose revenue.

For example, if the bank has a specific timeframe and you miss it, you’ll encounter a late presentment payment processing error and won’t get your hard-earned money.

Contesting that error is difficult because you need evidence that missing a deadline isn’t your fault, which might be challenging to prove.

Incorrect Transaction Code

One of the payment processing errors that can be easily avoided if you and your team have sufficient knowledge and focus is the mistake of entering an incorrect transaction code.

As you probably already know, there are many different types of transactions.

Each of them has its code, and when you submit that code to the financial institution you deal with, it needs to match the code that was authorized earlier.

If it doesn’t match it, an incorrect transaction code error occurs.

How can a discrepancy between codes like that happen? There could be multiple scenarios:

- You processed a debit card instead of a credit card or vice versa

- You needed to process a reversal, and you entered a code for a different type of payment

- You mistyped a code for a payment adjustment

Those are only some of the possible reasons this payment processing error can occur.

What they all have in common is entering the wrong transaction code for a payment you want to process.

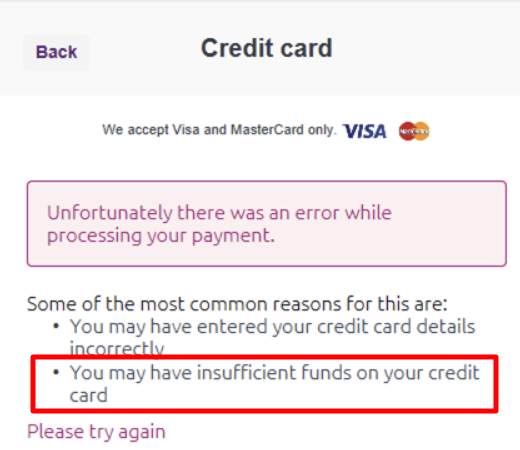

For instance, imagine if you processed a debit card instead of a credit card.

As Sabrina Jiang illustrated for Investopedia, there are significant differences between them, so there’s no wonder that they need to have separate codes.

Source: Investopedia

So, how can you and your team avoid mixing all the transaction types up and submitting incorrect transaction codes?

By being extra careful and by educating your team and yourself on how to process different payments and which codes to use.

It might take some time and effort, but it’s the most reliable way to avoid this error.

Incorrect Currency

If you deal with multiple currencies in your business, you should take steps to avoid the error of using the incorrect currency for payment.

In other words, if your customers have a choice between several different currencies, that is an additional factor you should consider during payment processing.

Here’s the advice from the online payment processing company Payment Options:

Merchants who perform purchases in several currencies must ensure that they’re using the currency form that the consumer chose to pay.

How can the error of using an incorrect currency happen? There are several scenarios, but what they all have in common is that the responsibility for the error is on your end.

It could be really simple as a typo, like if you use the wrong currency reason code.

On the other hand, the reason can be more complicated, like if the customer doesn’t agree to the Dynamic Currency Conversion (DCC) feature, which often brings additional fees.

Regardless of the reason, the best way to avoid this payment processing error is to be precise and to ensure that the customer agrees with any features that might come with additional fees.

If you run a business, especially a small one, dealing with multiple currencies can be challenging.

One of the solutions can be to open a bank account in a country where your customers reside, but the costs of that can add up significantly.

A better solution is to use payment processing software like Regpack, which allows you to accept online payments in various currencies.

Source: Regpack

Not only that, but Regpack makes things simple by making every currency-related fee transparent, so you don’t need to keep that in mind at all times.

The only thing you should do is to avoid the incorrect currency error.

Incorrect Account Number

As you probably already noticed from previous sections, a simple human error can cause various payment processing errors.

And you’d be hard-pressed to find a more fundamental error than typing a wrong number.

Entering an incorrect account number is a common error that can cause chargebacks and cause unwanted payment delays.

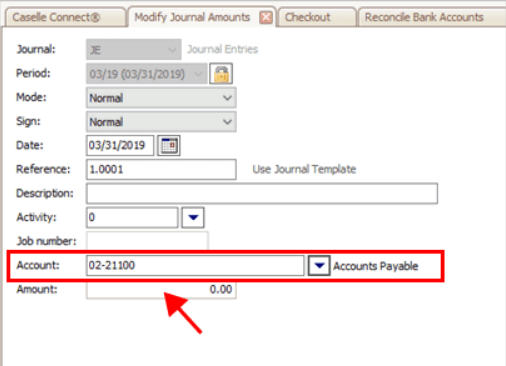

How easy is it to make this mistake? As easy as filling out the form like this one below incorrectly.

Source: Caselle

As you can see, one incorrectly filled text box like that one can cause issues.

However, not all incorrect account number mistakes are the same.

For example, you can mistype a digit and accidentally enter an account number that doesn’t exist.

According to Derri Dunn, a former managing director at Go.Compare, that is a relatively harmless scenario.

The best-case scenario if you enter incorrect details is that they’ll be for a non-existent account, in which case the payment should simply bounce back into your account within a few days.

On the other hand, you should avoid making this error because you could mistakenly enter a genuine account number.

In that case, the situation becomes more complicated because the funds will end up in that account, but the account is wrong, so you would need to reclaim the money, which can be tedious and time-consuming.

All in all, avoiding this payment processing error can certainly save you time and potentially even money.

Incorrect Transaction Amount

Similar to the previous payment processing error we’ve discussed, an incorrect transaction amount error is usually caused by a human mistake of entering the wrong data.

It goes without saying that customers aren’t happy if you try to charge them the amount you didn’t agree on.

That’s why this error often ends up in a dispute. According to Chargeback Gurus, a customer has solid ground for raising such a dispute if you make that error.

Illustration: Regpack / Source: Chargeback Gurus

Therefore, if you avoid the error of entering an incorrect transaction amount, you can avoid disputes with customers in which they can easily prove the discrepancy between the amount on the invoice and the amount you’ve agreed upon.

If you use automated payment processing solutions, this error is rare. However, it can still happen when you need to enter the amount manually.

For example, according to the data from Pymnts, about 25% of payment declines happen because of incorrect payment information being entered into the system.

Illustration: Regpack / Source: Pymnts

Entering an incorrect transaction amount can certainly be put into that category.

Therefore, avoiding that mistake can spare you disputes with customers, and all that it takes is to focus on the amounts you charge.

Duplicate Processing

If you charge a customer more than once for a single transaction, you’ve made a duplicate processing error.

That can happen for various reasons, like:

- You’ve entered the same transaction more than once

- You’ve created more than one receipt for one purchase

- You’ve deposited receipts for one transaction to more than one bank

- You’ve processed a credit card payment after a customer canceled it

- There was an accounting error or a processing glitch

And those are only some reasons you can make a duplicate processing error.

It’s best to do everything possible to avoid errors like that because they can lead to customer frustration or even damage your reputation if they happen often.

Sooner or later, it’s likely that customers will start to think that you are unprofessional or, in the worst case, trying to charge them more on purpose.

Good payment processing software can help you avoid duplicate processing and those consequences.

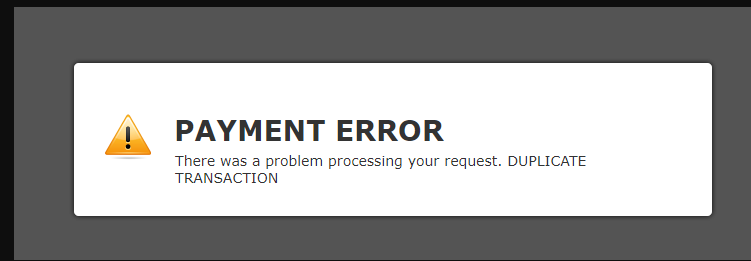

For instance, it can warn you about an error like this:

Source: Jotform

It can also detect double invoicing, automate payments to reduce the risk of duplicate payments and provide you with a central platform where you can oversee all payment processing.

With that, you can significantly reduce the risk of duplicate processing errors.

Conclusion

Payment processing errors can happen to anyone.

A wrong number here, a mistake on an invoice there, and you have a problem on your hands that can grow from a minor error to a potentially costly issue.

That’s why it’s best to be prepared.

Payment processing errors we’ve examined in this article are common, so learning as much as you can about them will undoubtedly help you avoid them.