If you want your business to succeed, you have to constantly adapt to the ever-changing market.

Twenty years ago, it was difficult to imagine that most transactions today would be cashless.

Fifteen years ago, many people didn’t believe that future businesses would have to have a website if they wanted to survive.

But now, we can’t imagine our lives any differently.

Similarly, there have recently been some major changes in how businesses process payments online.

We aren’t talking about walking androids collecting cards from your customers. Although the trends we’ll describe in this post rely on state-of-the-art technology, they are accessible to regular business owners, so some of them may find a place in your store as well.

Since it’s better to anticipate a trend than to try to catch up with it once it’s everywhere, we’ve compiled a list of six payment processing trends that have been growing in popularity recently.

So, don’t leave your business to chance; familiarize yourself with the new trends before your competition does.

Jump to section:

Buy Now, Pay Later (BNPL)

Embedded Payments

Digital Wallets

Artificial Intelligence

Cross-Border Payments

Instant Payment Processing

Buy Now, Pay Later (BNPL)

One of the leading trends in payment processing is buy now, pay later (BNPL).

This type of short-term financing makes products more accessible to customers and allows businesses to reach more buyers.

Before we get into the benefits of BNPL, let’s first see how it works.

First of all, it’s worth noting that the delay in payment doesn’t have a negative effect on you as a merchant.

Even though customers don’t pay the entire amount immediately, the BNPL provider usually sends the merchant the full payment within a few business days. The customer then pays the rest to the provider.

Some of the most popular BNPL providers are Affirm, Klarna, Afterpay, and Splitit.

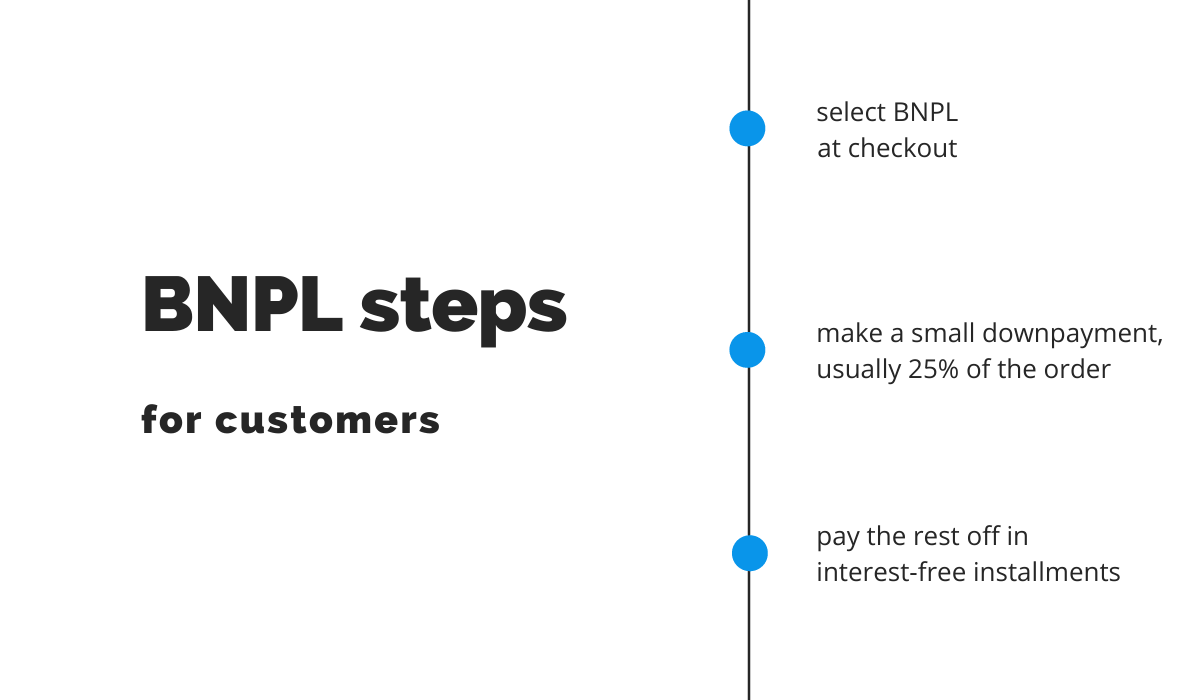

From the customer’s perspective, the process isn’t too different from making a regular payment. They select the BNPL option at checkout, and if it’s approved, they make a small downpayment.

In contrast to installment loans, BNPL systems often don’t charge interest.

Source: Regpack

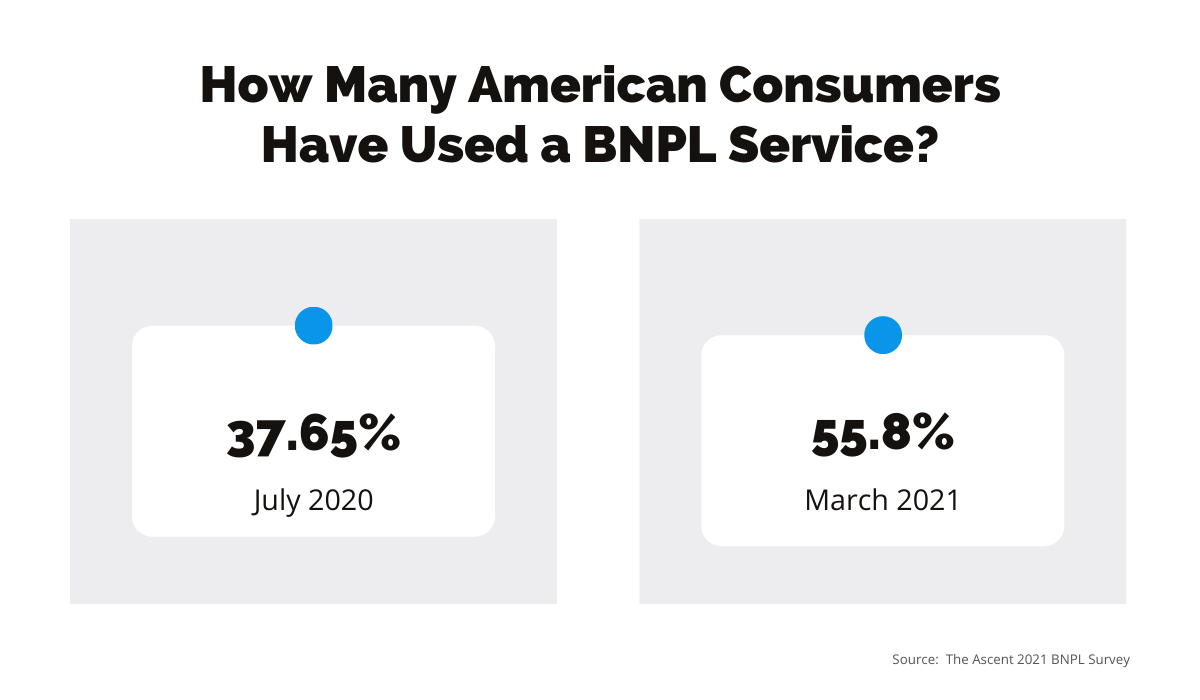

Since the process is so straightforward, it’s no surprise that this payment processing trend is booming.

Customers see it as an opportunity to make purchases that they can’t afford at the moment but will in the future.

The service is so popular that its usage has doubled within a year; a Motley Fool survey found that half of Americans used BNPL payments in 2021. The age group leading in the BNPL adoption is millennials.

Source: Regpack

It’s not only the customers that benefit from BNPL. Retailers also reap benefits from this new payment trend.

For instance, the Motley Fool survey we’ve previously mentioned found that 30% of BNPL users trust providers more than credit card companies, which extends to retailers who support BNPL payments.

Since brand trust contributes to consumer loyalty, BNPL payments can get you returning customers—the ultimate goal of every business.

Furthermore, this way of financing allows you to introduce your business to a wider audience because customers don’t have to pay the full amount right away, making your products or services more accessible.

Finally, the adoption of new technologies will help you stay competitive. If you implement BNPL, you’ll show you’re keeping up to date with the latest trends.

Embedded Payments

Reducing the number of steps customers have to make to buy a product is at the heart of the recent payment trends and technologies.

Embedded payments, a payment system where a customer doesn’t have to leave the website they’re shopping on, constitute one such trend.

For instance, have you ever taken an Uber?

If you have, you’ll recall that you didn’t have to reach into your wallet for cash or cards to pay the driver.

Instead, you made your payment in the same app you used to order the ride. In other words, you used an embedded payment system.

The appeal of embedded payments lies in their convenience.

And since over 9 in 10 customers choose a retailer based on convenience, you may want to introduce embedded payments into your webshop.

That way, your customers would go through fewer redirects and make their purchases with less hassle.

If this sounds good, wait until you hear how easily you can implement this technology into your webshop.

For example, here’s a walkthrough of Regpack’s process of embedding a payment form.

Source: Regpack

As you can see, it only takes a few steps to make your customers’ lives easier.

Regpack processes payments through BlueSnap, a reputable payment platform with high security standards.

However, your customers won’t be redirected from your website because the payment form is already embedded there.

An example of a company that streamlined their payment processing with embedded payments is Veracross, a school information management system.

Before, their clients used to have several payment processors across departments, a practice that led to numerous errors and required reconciliation work.

After integrating BlueSnap, the clients have been able to reduce reconciliation time from days to minutes.

So, whether you sell products, services, or software, your business is likely to benefit from embedded payments. The smoother the checkout process, the higher the number of completed purchases.

Digital Wallets

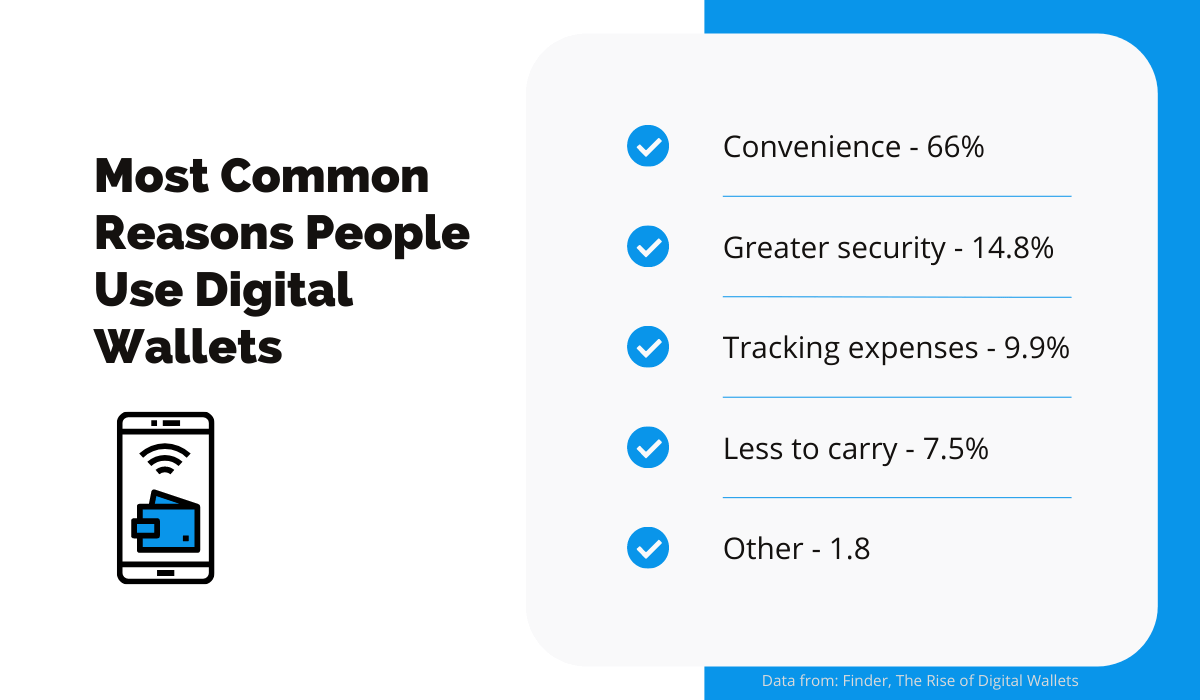

If you want to make the payment process as fast as possible, accepting digital wallets might be the right choice for your business.

A digital wallet is an online payment tool, usually a phone app, that stores virtual versions of a customer’s credit and debit cards. It allows customers to make payments with their smartphones; no cash or physical cards are needed.

The technology has been getting increasingly popular in recent years, and the COVID-19 pandemic in 2020 accelerated its adoption even further because customers aimed to reduce physical contact in payments.

According to Juniper Research, there were 2.6 billion digital wallet users globally in 2020, and the number is predicted to exceed 4.4 billion in 2025.

So, if small businesses don’t want to miss out on such a large market, it’s time to join the digital wallet and mobile payment trends.

After all, the most frequent reason people use digital wallets is convenience, so it’s likely they’ll also prioritize businesses that support their preferred payment methods.

Source: Regpack

An additional benefit of digital wallets is increased security. They don’t require entering credit card data and other sensitive information at checkout, which lowers the chances of fraud.

Moreover, digital wallets have not only transformed how people pay, but they’ve also opened the door to new means of payment, such as cryptocurrencies.

Still, before you rush headfirst into accepting a novel currency, you first have to assess if it makes sense for your business.

Many businesses now accept cryptocurrencies because of lower fees. Also, cryptocurrency transactions are irreversible, so you don’t have to fear chargebacks.

On the other hand, the IRS doesn’t recognize them as currency; instead, cryptocurrency is considered property for tax purposes.

This means that managing taxes gets more complicated because you have to keep track of the value of each cryptocurrency on the day of the transaction, and they are known for their volatility.

All in all, accepting digital wallets is a safe bet both online and in-store. However, you may want to consult a financial advisor before committing to cryptocurrencies.

Artificial Intelligence

A rising payment processing trend worth noting is artificial intelligence (AI). It uses large amounts of data to produce human-like conclusions, saving customers time spent on making payments.

What seemed like a distant future not so long ago is now an everyday occurrence. Take your email inbox, for example.

You may have noticed that it now filters spam way better than it did ten or fifteen years ago. That’s because email providers use AI to detect and remove spam from your inbox.

If you’ve ever used a voice-controlled smartphone assistant to set a timer or add an item to your grocery list, you’re familiar with AI.

The point is, AI is infiltrating different spheres of life, and we can also see it in payment processing.

For instance, Amazon has opened physical convenience stores with no cashiers or even self-checkout registers. Instead, the just walk out system is powered by surveillance cameras equipped with object identification engines.

The customers pick their items and simply walk out of the store—AI emails them the receipt later.

Source: Pocket Lint

We’ve already pointed out how important convenience is for modern customers. It turns out that AI can also make shopping and paying run smoother, using the following systems:

- Voice-activated payments

- Facial recognition payments

- Biometric banking

These systems do all the work instead of the customers. They no longer have to swipe cards or enter their PIN.

Instead of that, the AI recognizes the customer and approves the transaction, which makes for a frictionless checkout experience.

In addition to improved customer experience, AI can also protect you from fraud. It can analyze previous transactions, flag unusual purchases, and prevent card fraud.

So, while equipping a store with smart cameras like Amazon may not be a reality for most businesses, AI will certainly contribute to online payment processing in the future.

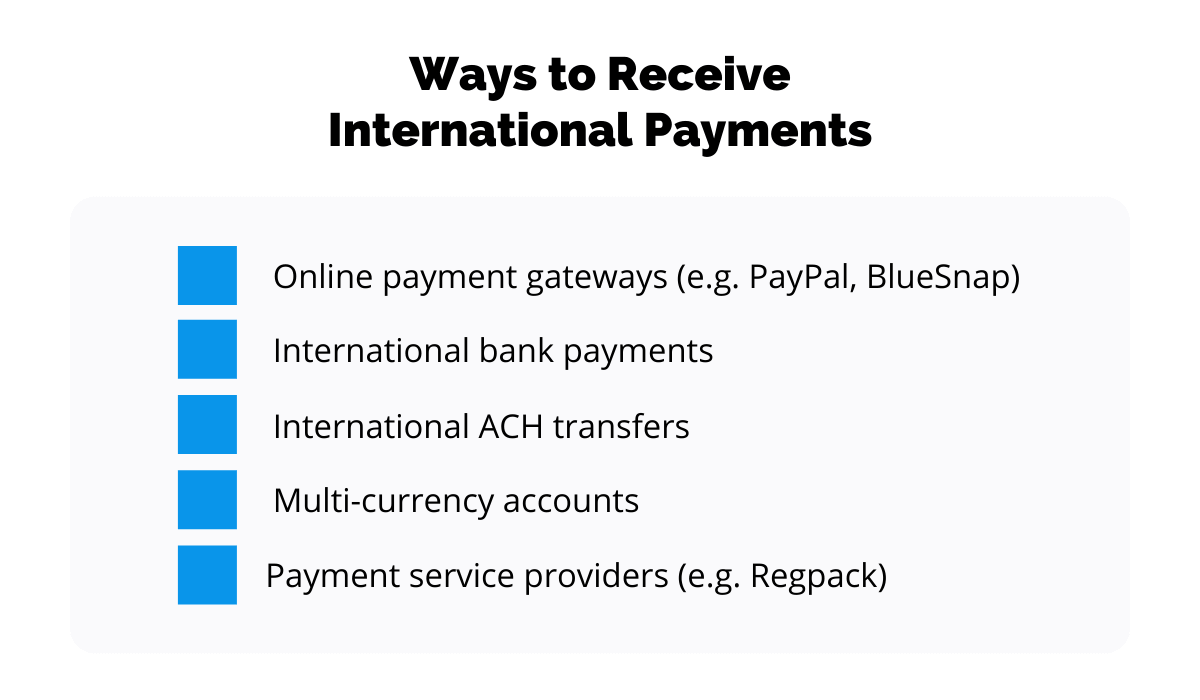

Cross-Border Payments

Digitalization has made borders almost irrelevant when it comes to shopping. Thanks to cross-border payments, customers can now purchase goods from all over the world with zero complications.

You have probably already bought numerous products or services from other countries, or even sold yours, without thinking twice. A product is selected, the payment is made, and that’s it.

But it wasn’t always so simple.

Back when international payments were unreliable and costly, merchants were limited to their local markets only.

The introduction of the SWIFT system in 1973 made cross-border payments more accessible, but the process advanced even further in recent years with the rise of online payments made through PayPal or similar gateways.

Thanks to these services, you can now sell your products or online services worldwide without having to pay exorbitant fees.

Source: Regpack

The new fintech advancements have enabled faster and easier payment processing across countries, but not at the expense of payment security; security standards match those of domestic payments.

Such advancements have also contributed to streamlined financial regulations.

For instance, the European Union unrolled the Single Euro Payments Area (SEPA), a payment integration initiative, in 2008.

SEPA has enabled customers to make cashless euro payments across Europe regardless of differences in financial regulations of all county members.

Similarly, American citizens can make secure international transactions via the Nacha network.

The value of global cross-border payments was $37.15 trillion in 2020, and it’s expected to grow to $39.9 trillion by 2026. These numbers testify that international payments are more than a trend; they are here to stay.

On the whole, both customers and merchants see the need for easy and secure cross-border payments.

So, if you want to expand your market internationally, implementing a solution that supports doing business with other countries will make payment processing smoother.

The process is as secure and convenient as with regular payments, meaning that there’s no reason to limit your business with borders when you can go international so easily.

Instant Payment Processing

Neither businesses nor customers have time for payments that take days to process, which is why instant transactions are becoming a huge trend in payment processing.

When looking for payment processors, people usually research prices and security features. However, the speed of payment processing is becoming an increasingly desirable quality.

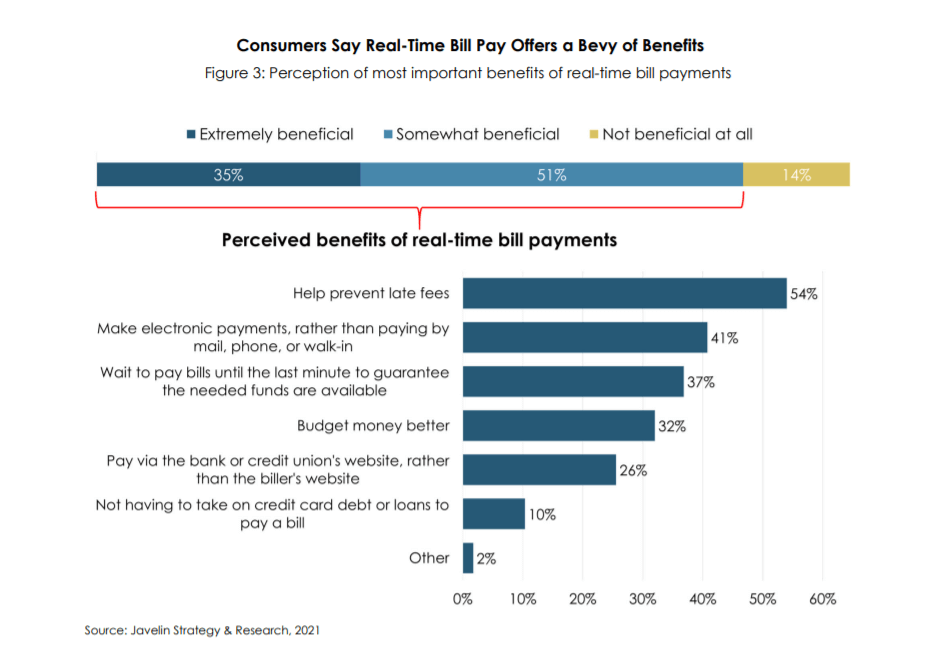

According to a survey on real-time payments, 86% of consumers consider instant payments beneficial. The chart below shows a breakdown of the most commonly cited reasons behind such widespread acceptance.

Source: Javelin Strategy & Research

As the graph shows, quickly processed payments allow customers to improve their financial management by paying exactly at the right time.

When they pay immediately, there are no late fees. Being able to rely on instantly processed payments also allows customers to time their payments for the right moment in accordance with their budget.

Instant payment processing benefits businesses as well.

Here are some of the ways it can boost your business:

- Speeding up the payment

- Receiving payments around the clock

- Reducing late payments

- Paying your suppliers quicker

- Improving cash flow

Bear in mind that instant payments aren’t literally instantaneous. In some cases, they can take minutes, but the time varies to up to one hour.

Still, that’s much quicker than it used to be.

Even large financial institutions such as Nacha have recognized how vital real-time transactions are for the economy. Since Nacha introduced same-day ACH payments in 2016, it has seen the growth of same-day payment volume year after year.

In a fast-paced age, customers expect more of merchants, and merchants expect more of their payment providers.

Since both sides profit from quick and convenient transactions, you should look into a payment processor that supports instant payments to take your business to the next level.

Conclusion

Just like following the latest marketing strategies can keep your business thriving, staying on top of payment processing trends can help you attract new customers and maintain the existing ones.

If you make providing a convenient shopping experience a priority, you’ll notice an increase in the number of satisfied, returning customers. BNPL and embedded payments can help you with that.

For those interested in increasing payment security, digital wallets and AI-powered transactions are the way to go.

Finally, if you want to reach customers across the globe, consider implementing cross-border payments.

Our online payment software, Regpack, can help you collect payments in different global currencies without managing multiple bank accounts. Contact us today; we’d love to tell you more.