More and more businesses are choosing to implement recurring payments. You may not be offering them at your company yet, but even so, you’re probably already using them elsewhere as a customer.

Recurring payments aren’t reserved for certain industries only; they can be found in all sorts of businesses.

If you have customers who buy the same goods or services from you regularly, you can also implement recurring payments regardless of your industry.

This post will give you an overview of four significant advantages of this payment method. We’ll also tell you how to select the right solution for your business, so keep reading.

Jump to section:

Increased Customer Retention

Reduced Late or Missed Payments

Minimized Administrative Tasks

Secure Payment Process

How to Select a Recurring Payment Solution?

Increased Customer Retention

If you’re considering implementing recurring payments, you probably have customers who order the same service repeatedly.

By using recurring payments to make the payment process more convenient, you can turn your satisfied customers into regular customers, the most prized asset of any company.

Let’s kick off the story about the benefits of recurring payments with some examples you probably already use yourself. Chances are you have an account at one of the following services:

- Netflix

- Dropbox

- Office 365

- Amazon Prime

The features that all these giants have in common are recurring billing and a good relationship with customers. Both factors contribute to customer retention.

Another company that increased customer retention as a result of recurring payments is FreedomPop, a wireless Internet operator.

FreedomPop offers monthly, multi-monthly, and annual recurring payment options.

Recurring payments can get complex, and with so much billing to handle, FreedomPop had to perfect the way they collected their money. When they did, they managed to cut involuntary churn by nearly 50%.

Source: Regpack

You should jump at all opportunities to increase customer retention because that’s a sure-fire way to increase your profits. In fact, increasing customer retention rates by 5% can increase profits by 25% to 95%.

Imagine that, boosting your profits by almost 100% simply by retaining 5% more of your customers.

If you’re wondering how that works, let us break it down.

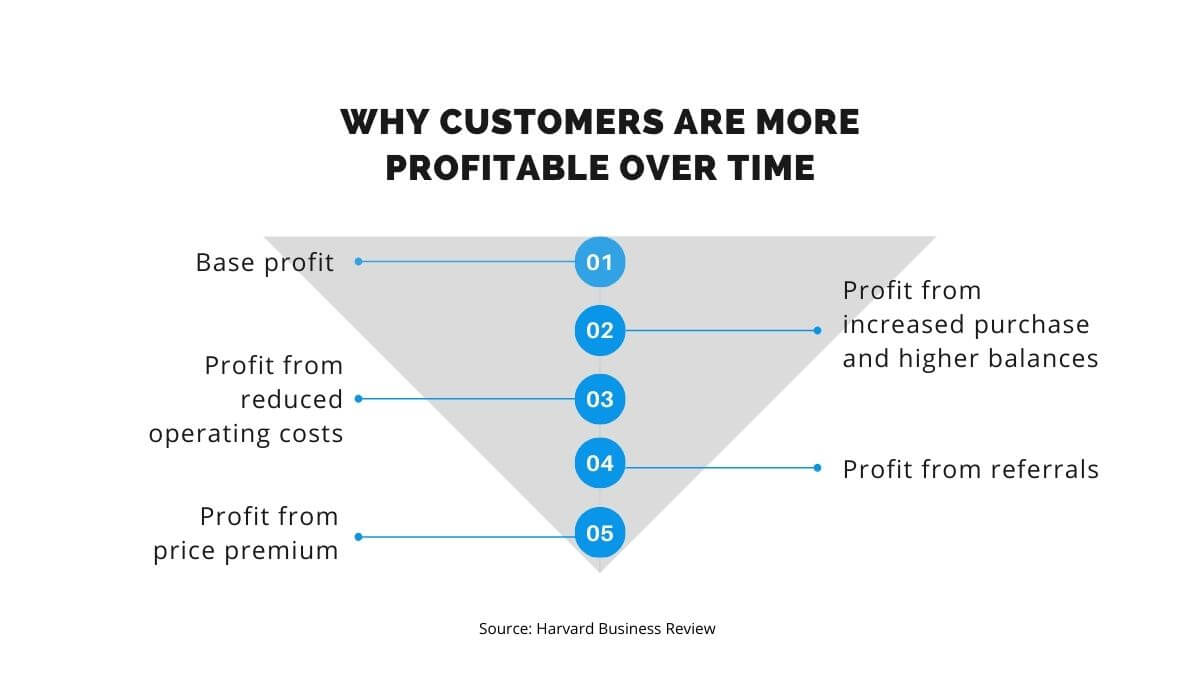

A study by Harvard Business Review explains that returning customers become more lucrative over time because they help you generate profit through increased purchases and higher balances.

Additionally, customers whose payment processes are already set up incur fewer operating costs–this is especially true for automated recurring payments.

Moreover, if your long-term customers are satisfied with your service, they’ll likely bring you profit from referrals.

Here’s a recap on a chart for all visual learners out there:

Source: Regpack

Recurring payments, in particular, can increase your customer retention because they shift the focus away from the act of payment. This out-of-sight, out-of-mind approach removes an obstacle between you and your customers.

The customers set up the payment once and keep on enjoying goods or services you provide—there’s no discussion about payments each month.

All of this is good news even for small business owners interested in offering the option of recurring payments because a large customer base isn’t a prerequisite to success.

Instead, you need returning customers, as recurring payments essentially rely on consumers willing to purchase goods or services multiple times.

Remember, if you want to use recurring payments in a way that retains customers, you have to implement them properly. This requires a well-designed solution both you and your customers can use with ease.

Communication about recurring payments has to run smoothly as well. We’ll tell you more about how to achieve that in the last paragraph.

Reduced Late or Missed Payments

The most effective way to deal with late or missed payments is to prevent them from happening altogether, which you can do with recurring payments.

Small businesses often don’t have the luxury of a large safety net that can get them through the year as big enterprises do. Instead, they have to rely on receiving regular payments for their services.

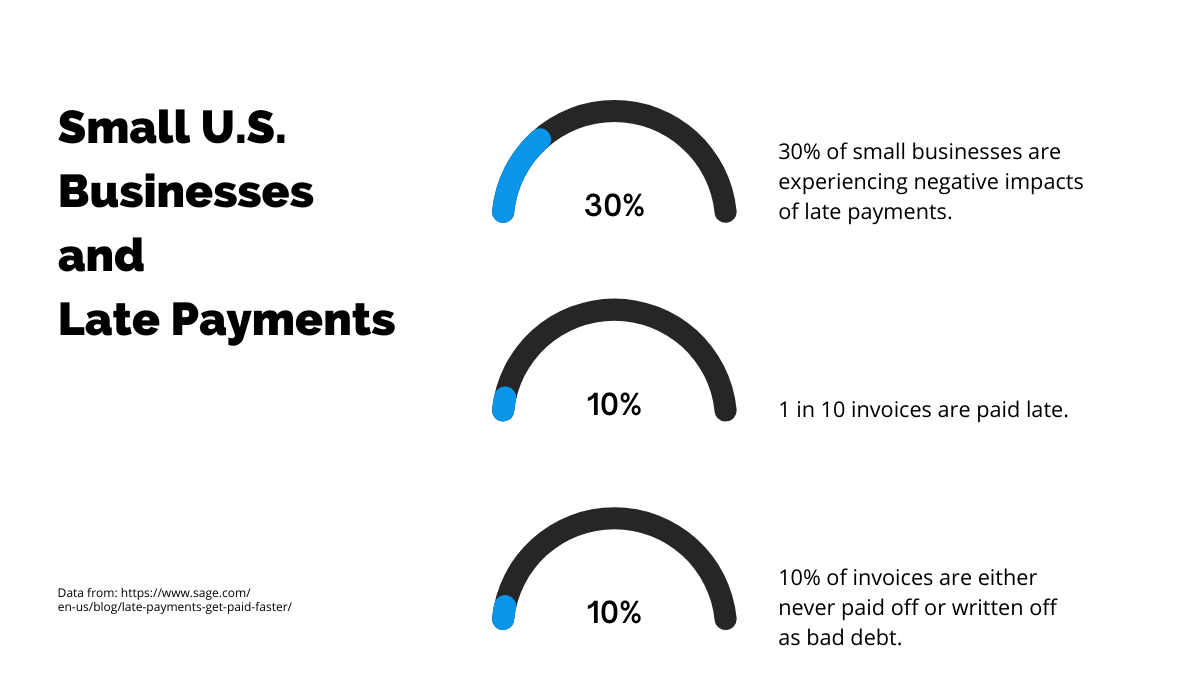

Yet, over 30% of small businesses are experiencing the negative impacts of late payments. Unfortunately, it’s a regular occurrence for small businesses to write off 10% of their invoices as bad debt.

Source: Regpack

While a zero rate of non-payment is hard to achieve, recurring payments help minimize delays.

With recurring payments, customers authorize you to pull a predetermined amount of funds from their bank account at regular intervals, thus virtually eliminating late payments.

Once customers select a payment plan, they don’t have to manually make a payment each month; the recurring payment system does that instead.

This is a feature that the users of our billing solution, Regpack, particularly enjoy. Here’s what they noticed after using the recurring billing functionality:

- 75% decrease in non-payment

- 25% improvement in cash flow

- Increased payment rate by 35%

Sometimes it’s not the customers’ fault that their payments are late. When your business expands, keeping up with invoicing can get challenging, so some customers never receive their invoice.

According to a study conducted by Fusebill, On The Map, an internet marketing company, had to deal with such a challenge when they hit their growth phase.

When they adopted recurring billing, they were able to recover an average of $600,000 a year.

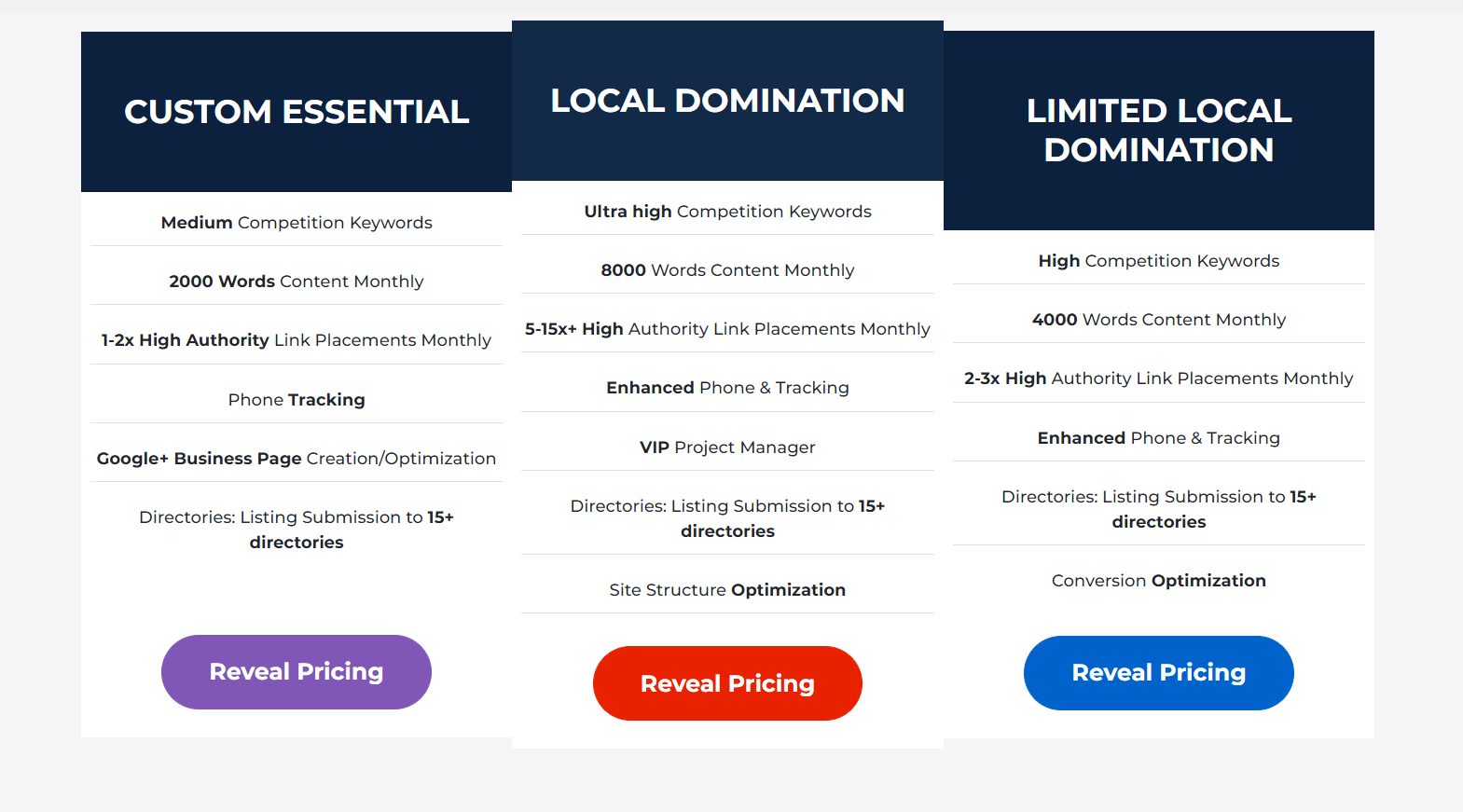

Here’s what their payment model looks like now:

Source: On The Map

Their customers can choose between several plans, set up recurring payments, and continue using the service without worrying about forgotten invoices.

For the company, this means that they can count on a monthly payment from each of their customers, which brings us to an additional benefit of recurring payments.

Besides eliminating reduced late or missed payments, an additional advantage of recurring payments lies in predictable revenue.

Unlike one-off sales, recurring payments give you a higher level of certainty regarding your future revenue. The stability that comes with recurring payments helps you build financial and strategic plans.

Minimized Administrative Tasks

Running a business always includes dealing with administration, namely invoicing and business reporting. If done right, recurring payments can reduce the time and money you’d otherwise spend on such tasks.

A Sage report aptly named Sweating the Small Stuff: The Impact of the Bureaucracy Burden has shown that small and medium businesses spend between 230 and 240 days per year on administrative work.

According to the report, accounting accounts for over 20% of administration time, followed by generating invoices and processing the invoices received.

Now, you can’t completely avoid administrative tasks, but you can significantly reduce their number through automation. Numerous companies have seen a decrease in time spent on manual invoicing after implementing recurring payments.

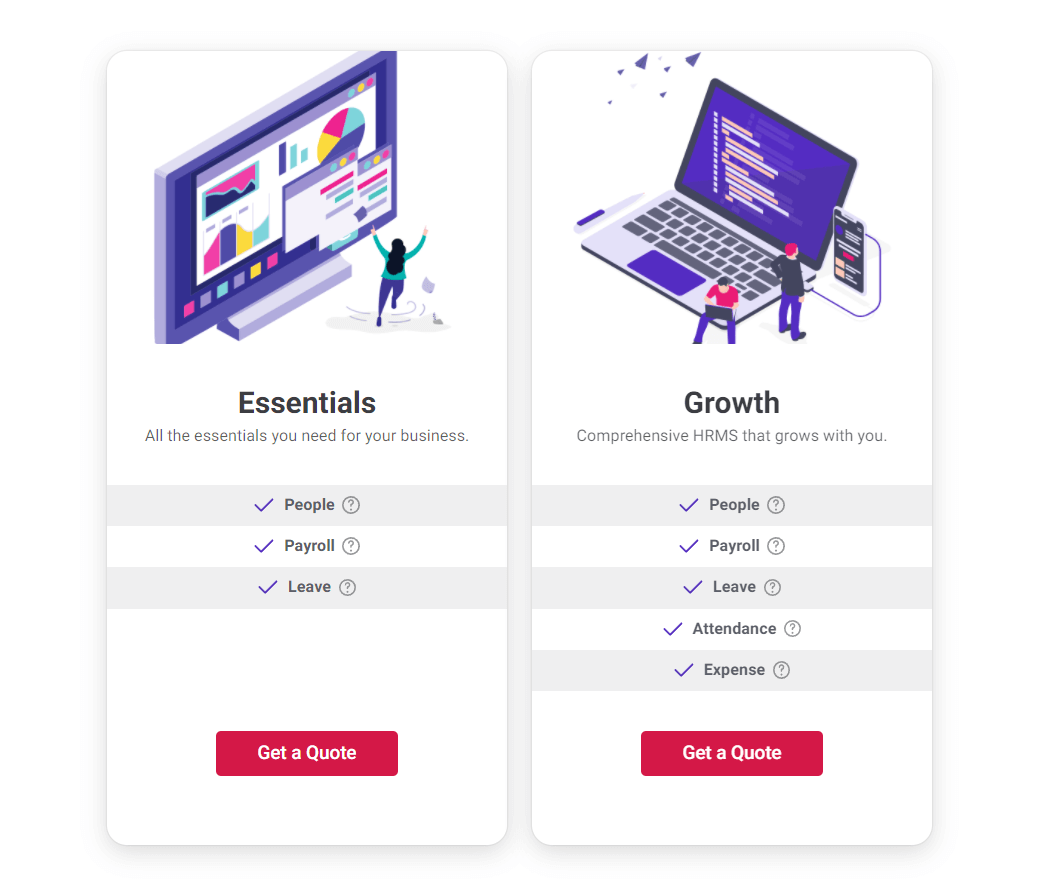

One such company is JustLogin, an HR software solution.

According to Fusebill’s study we quoted earlier, after switching to an automated billing system, JustLogin saved time spent on billing by 90% and managed to grow the company 3X with the same number of employees.

Here’s what their subscription options look like:

Source: JustLogin

As you can see, their prices are not fixed. They depend on the needs of an individual client. If you offer a multi-tiered service as they do, you’ll want to select a customizable payment solution.

But how exactly do recurring payments help you streamline the administration process?

Instead of assigning an employee to send out the same invoice month after month and then waiting for the customer to pay, the recurring payment system does that for you.

At their first purchase, customers authorize you to pull a predetermined amount of money from their bank account every month, so you can collect recurring payments as long as you or the customer don’t change billing information.

Even if a customer does happen to change their info, or if their card expires, or anything else puts a pause in regular payments and burdens your staff with administration, your recurring payments solution should also be able to automatically manage dunning.

A recurring billing system can also facilitate creating reports, as long as it keeps data on the payments it processes.

Source: Regpack

When you run a business, you need reports on your finances to gain insight into operations and determine your next steps. However, if you enter a single number inaccurately in the data input stage, your final report may not reflect the actual state of your business.

Automated reporting reduces this risk. All data is processed as is, with no middleman involved; another big administrative task reduced.

You only have to filter which pieces of data you’re interested in, and the system does the calculations for you.

All in all, recurring payments save you the trouble of manually processing invoices and creating reports on them. So, automatize these administrative tasks and use your time for assignments that truly need your expertise.

Secure Payment Process

To accept recurring payments, you have to use third-party processing tools, which usually come with strong security protocols. Therefore, you should choose a reliable processor to protect you and your customers’ data.

If you’re looking into a way to implement recurring payments into your business, you’re probably already familiar with ways to do so by accepting credit cards. However, you may want to make the payment process more effective and secure.

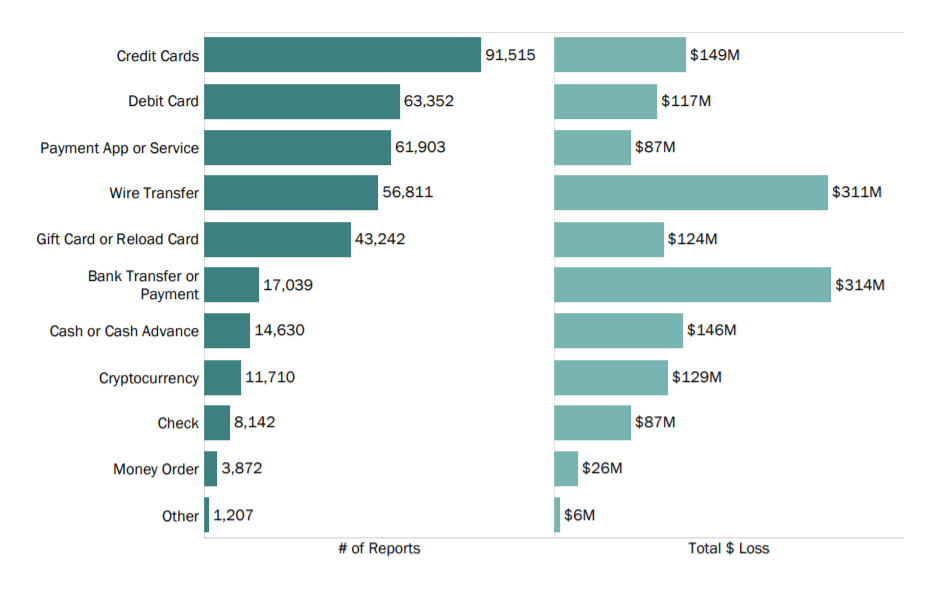

To illustrate the importance of security when it comes to accepting payments through credit cards, let us show you a graph with the most commonly reported instances of fraud by payment method.

Source: Federal Trade Commission

Accounting for more than 150,000 instances, credit cards and debit cards were the payment methods most commonly affected by fraud in 2020.

So, if you choose to accept card payments, you should ensure that the payment process is secure. This is especially critical for recurring payments because, through them, you’re building an ongoing relationship with your clients.

Because you need a third party to accept recurring payments, you have to be able to count on the fact that payment gateways are compliant with financial regulations. Your solution should have measures in place that ensure the security of your customers’ data and money.

As we’ve written earlier, sellers use merchant accounts and payment gateways to accept card payments. This means that you can influence the security of the payments when setting up your payment system. Don’t choose the cheapest provider; opt for the most secure one.

The same goes for selecting your recurring payments solution. Here are some of the security methods your processor should use to keep payments secure transaction after transaction:

- Data encryption

- Secure Socket Layer (SSL)

- Tokenization

- PCI Compliance

- Firewalls

Remember, all electronic (and even non-electronic) transactions involve a risk of fraud. But there’s no need to fear recurring payments if you select a reputable, secure recurring payment service provider.

Recurring payments can enhance security even in simple, mechanical terms. As opposed to entering their data at each purchase, recurring payments require the customers only to enter their data once.

This prevents the circulation of sensitive personal and financial information.

Letting the system carry out future payments is also an excellent way to prevent human error, which frequently factors in failed transactions. Automated billing helps you reduce duplicate payments or employee errors.

How to Select a Recurring Payment Solution?

Now that you know why recurring payments can be beneficial for your business, we’ll tell you how to implement them so you can reap the benefits.

As we’ve hinted throughout this post, it isn’t enough to just set up a recurring payment system and hope your customers will immediately accept this new way of making payments.

You should make recurring payments the easiest choice for your customers and keep up an open communication about all payments.

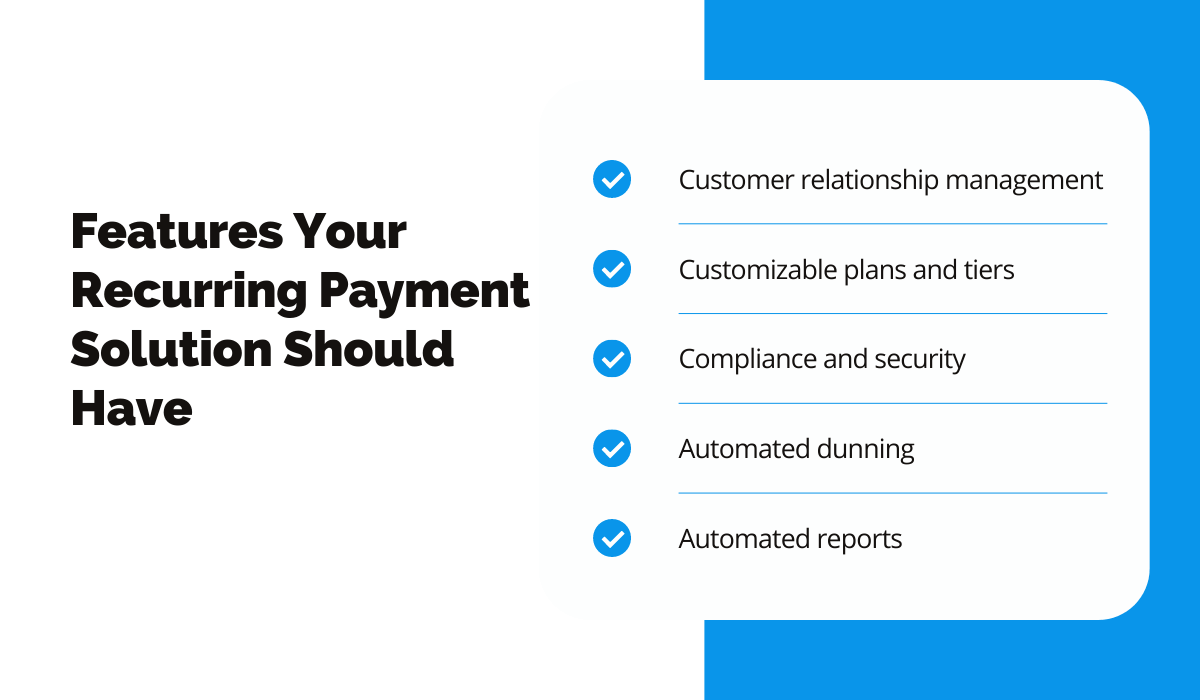

The first step towards accepting recurring payments in your business is the selection of recurring billing software.

Here is a checklist of features your recurring payment solution should have.

Source: Regpack

Nobody likes discussing payments when offering a service, but you still have to do it to keep your business transparent.

The process begins even before the initial transaction while you’re explaining the terms of service. Your customers have to understand what recurring payments involve.

Other than clearly defining the terms and conditions, you should always notify your customers of any changes in the transaction amount.

If you choose to accept recurring payments with Regpack, our automated communication system will make this task a breeze.

We can also help you with automating successful or failed payment emails.

Various industries have accepted recurring payments. Since payment needs vary from business to business, you should be able to tailor the payment plans you offer to your needs.

This is a feature that our clients especially appreciate. Here’s what they say about the customizability of Regpack’s payment solution:

“I like the flexibility that auto-billing gives me. I can turn plans on and off depending on what makes sense at the time.” — Camp Good News

“We were very pleased with the different options and the options for the monthly payment plans that we can offer our families.”— Stone Mountain Adventures

Don’t forget to ask your recurring payments processor about security protocols they have in place. Security can make or break the user experience, so don’t settle for mediocre solutions.

Finally, a well-designed recurring payment solution will let you automate as many tasks as possible.

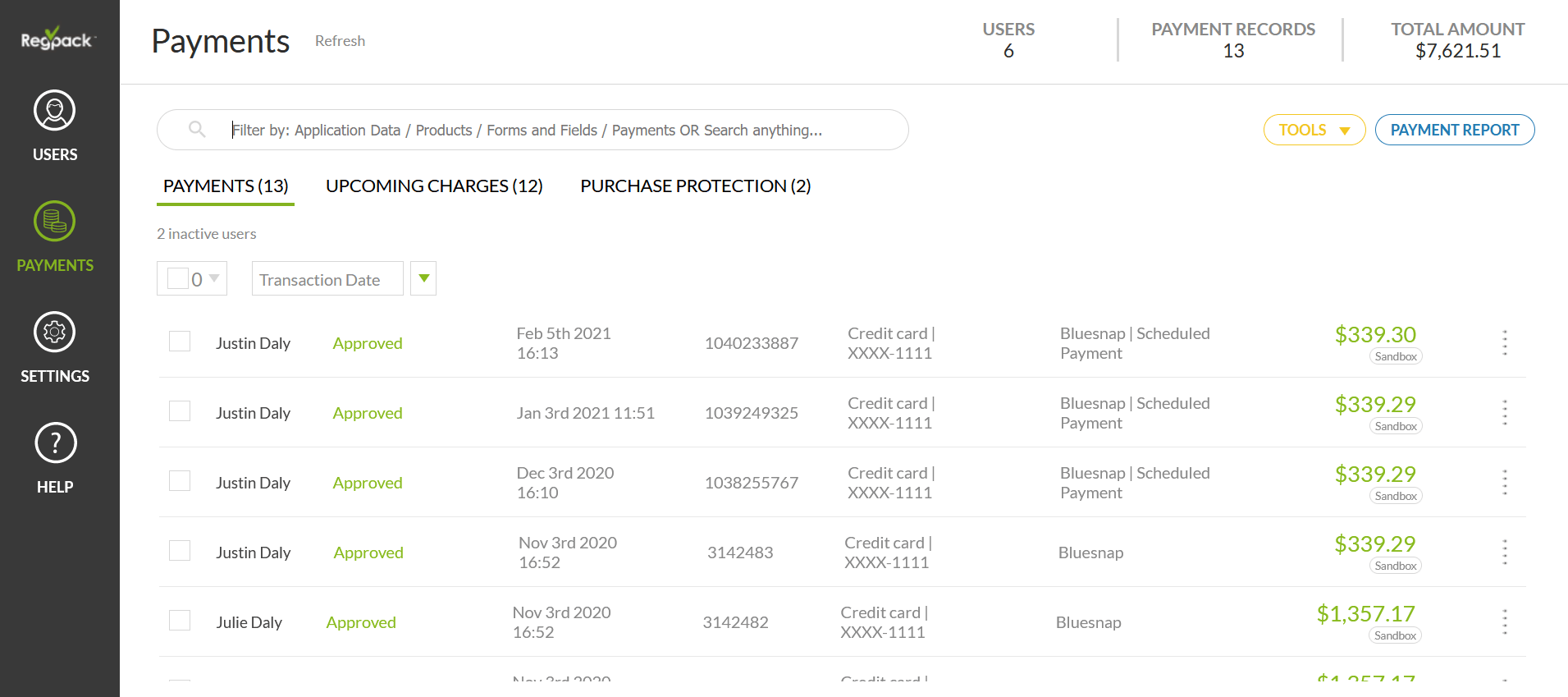

Most recurring payment solutions offer automatic monthly payments and emailing customers after completed transactions, but what sets average solutions apart from excellent ones is how they handle unsuccessful payments.

For instance, our system lets you see the payment status of each of your users.

Source: Regpack

You can use this data to set up automated dunning emails so you can collect what’s owed to you.

If you’re already running a successful business, including a new payment method doesn’t have to be a painful change.

In fact, it can boost your business. For example, Bitheads, a software company, had been in the business for years before adopting a recurring payment and dunning solution. But when they did so, they were able to recover 5–10% of their monthly revenue.

It’s never too late to start accepting recurring payments. If you have a business model that allows for repeated transactions, your automated payment solution will take care of the rest.

Conclusion

The most profitable benefit of recurring payments lies in customer retention. If your recurring payment process is smooth and transparent, you’re on a good path to keeping loyal customers. They are the ones who bring you the most profits over time.

Recurring payments will also increase your profits by reducing late payments and administrative tasks. Finally, with so many built-in security protocols, recurring payments enable you to safeguard transactions.

To reap these benefits, you have to find a recurring payment solution that fits your business. We hope this post brought you some clarity about what features to look for so you and your customers can have the best experience.