In the past couple of decades, the popularity of online purchases and subscriptions has surged, with millions of consumers now subscribing to a wide array of products and services across all industries.

Consequently, recurring payments and invoices have quickly made their way into nearly every industry.

The fact is that automated payment processes not only save you time but also enhance efficiency and accuracy, eliminating the possibility of manual errors.

Therefore, business owners should be aware of the importance of automation in transforming their business operations.

This article helps with that by covering all the basic aspects of recurring billing systems and the difference between recurring invoices and recurring payments.

If you intend to attract and leverage the benefits of recurring billing software, keep reading.

What Are Recurring Payments

Recurring payments—often called subscription payments or automatic billing—are when customers give a service provider permission to regularly withdraw a set amount from their account, whether weekly, monthly, or annually.

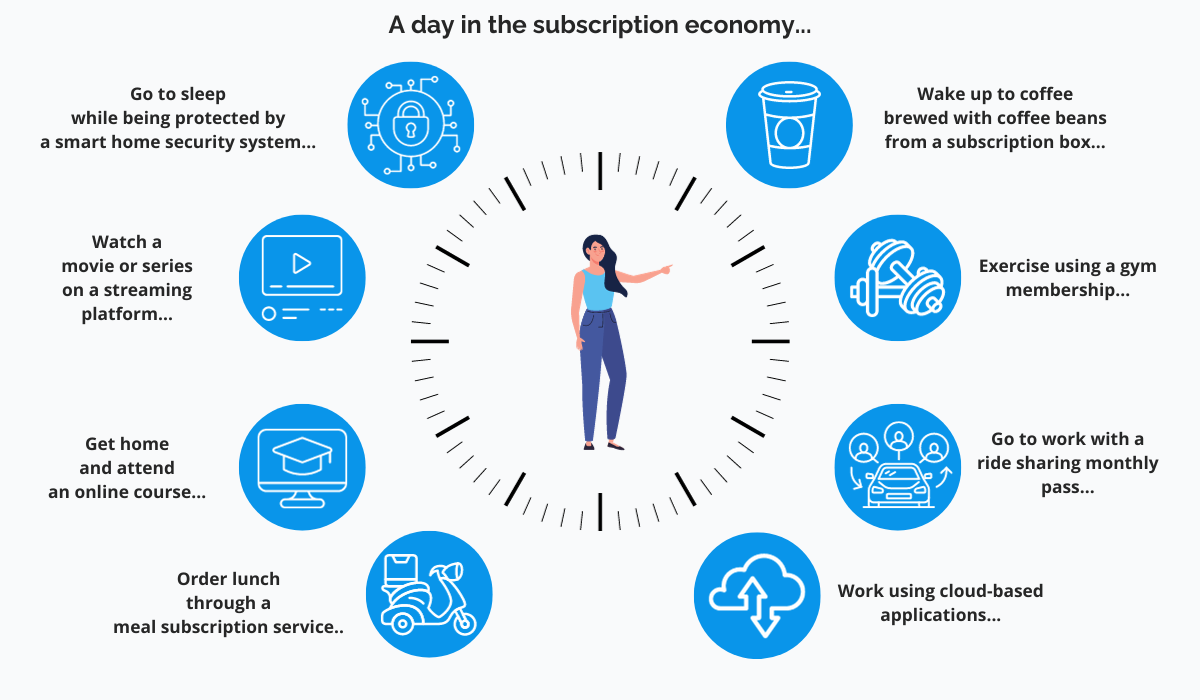

This payment model, once limited to gym memberships and magazines, is now prevalent across various industries.

From subscription box services to SaaS products and utility bills to streaming services, many businesses are leveraging recurring automated payments to improve the customer checkout experience.

Recurring payments are fundamental to the growing subscription economy and can significantly benefit companies when executed correctly.

In fact, recent research shows that 70% of businesses see membership and subscription models as the future for further commercial growth. This is mainly due to the solid and predictable cash flow they can produce.

As a matter of fact, in the last nine years, the subscription economy has surged by 435%, and it’s projected to reach a market worth $1.5 trillion by 2025.

And there’s no indication that this trend will slow down; to the contrary, it’s becoming increasingly entwined into our daily lives, as shown in the illustration below:

But how do recurring payments actually work?

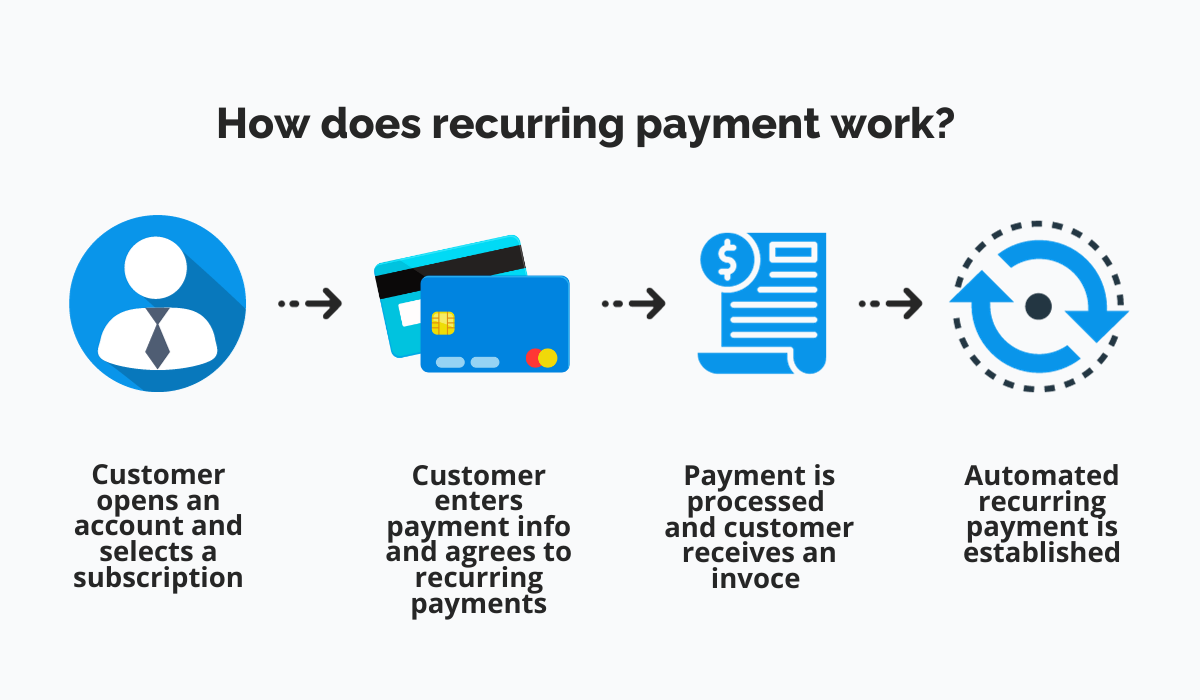

Basically, subscribing to a service online involves several steps.

Firstly, customers visit a merchant’s website to select a service or subscription plan and proceed to choosing their preferred payment option.

Next, they enter their credit card information and they only do it once. This data is securely stored by the company’s recurring billing software, ensuring all future payments are automatic.

At this stage, the customer must accept the terms and conditions, authorizing the merchant to charge their account as agreed upon, including the payment amount, schedule, and expiration date, if any.

Once authorization is granted, the merchant can initiate payment collection, also known as billing.

This requires a payment processor and a designated merchant account for receiving funds. Some software solutions integrate payment processing functions, avoiding the need to employ a separate one.

The payment processor then seeks authorization from the acquiring bank, credit card network, and the issuing bank.

Upon approval, funds are transferred from the customer’s account to the merchant’s account, finalizing the transaction.

Below, you’ll find a visual overview of the process.

The recurring payment model offers numerous advantages for businesses. It eliminates late payments, enhancing financial stability and allowing better cash flow management.

Customers benefit, too, as recurring billing makes it easier to enjoy the service without remembering due dates and repeatedly entering payment details. This also reduces the chances they will abandon the service.

Canceling subscriptions is also effortless, requiring only a few clicks.

In essence, recurring payments offer convenience, reliable income, and improved financial planning for businesses while providing a seamless experience for customers.

What Are Recurring Invoices

Recurring invoicing is a straightforward concept. It’s when a customer regularly orders the same products or services, and you send them the same invoice repeatedly.

If this is your business setup, recurring invoicing might be an excellent solution to simplify your financial processes.

Thanks to modern software, you no longer need to set reminders or undertake bulky administrative processes to send invoices; the software handles it for you.

Recurring invoicing is most effective when your business consistently provides routine offerings. Consider these examples:

- Equipment rentals: Companies that rent out equipment on a recurring basis can benefit significantly from recurring invoicing. Whether it’s construction machinery or office equipment, sending automatic invoices saves time.

- Subscription-based services:Businesses offering subscription boxes, digital streaming services, or software as a service (SaaS) considerably simplify their billing with recurring invoices.

- Monthly contracts:Service providers with monthly service agreements, such as marketing agencies or landscape maintenance companies, can automate their invoicing, ensuring timely payments.

- Maintenance service packages: Businesses offering maintenance packages for systems or equipment (e.g. IT services), vehicles, or property with recurring invoicing can bill their clients timely and efficiently.

- Memberships: Gyms, clubs, and associations can streamline membership fee collection with recurring invoices.

To initiate a recurring invoice system, begin by selecting the right software.

In this context, look for invoicing software equipped with automation features and customizable options tailored to your business needs.

Moreover, many of these software solutions offer ready-made recurring invoice templates and options for automatic personalization for your convenience.

As a matter of practice, businesses often include recurring billings in their end-of-month invoicing routine.

Nonetheless, issuing these invoices just slightly ahead of time can lighten your workload during the busy time of the month’s conclusion.

When you know the exact amounts for each invoice, scheduling them to be sent days in advance is entirely feasible.

A bonus benefit is that promptness enables your customers to process them for payment sooner.

Another significant advantage of recurring invoicing is that it lowers administrative costs, as it replaces much of the work that would otherwise be done by hand.

According to an analysis by the McKinsey Global Institute, process automation can lead to average cost savings of up to 30% within five years.

Apart from the efficiency gains, implementing an automated system for recurring invoicing reduces the risk of human error to nearly zero, thus maximizing accuracy.

In sum, if your business offers products or services on a regular, recurring basis, embracing the power of recurring invoicing can simplify your operations and improve cash flow, ultimately enhancing your company’s overall productivity.

It’s a win-win both for you and your customers.

Recurring Payments vs. Recurring Invoices: Key Differences

The distinction between recurring payments and recurring invoices often causes confusion among business owners who seek to enhance their billing efficiency.

While these terms may appear similar, they serve different purposes and fulfill different business needs.

But for starters, let’s focus for a second on what they have in common—both recurring payments and recurring invoices are automated cloud-based solutions representing a form of cashless payment.

According to the Payment 2025 & Beyond report, global cashless payment volumes have risen steadily and are set to increase by more than 80% from 2020 to 2025.

Now let’s talk differences.

The basic breakdown is this:

- Recurring payments automatically charge the customer’s card on a preset schedule.

- Recurring invoices automatically generate and send invoices based on a predefined timetable; however, payment is only collected when the customer takes action.

In other words, recurring payments are fully automated, with money moving directly from the customer’s account to your business account.

With recurring invoicing, the customer needs to initiate the payment process by paying the invoice directly or using another payment method specified by the vendor.

In practice, recurring payments are ideal for any company that requires a fixed payment in regular intervals, for example, businesses offering subscriptions, such as meal kit services and streaming platforms.

Likewise, they’re an excellent fit for insurance companies—health, auto, or home insurance—that charge fixed premiums monthly or annually.

Recurring payments also make life easier for marketing agencies and other service-based businesses, like SaaS providers, by allowing hassle-free automatic billing.

Recurring invoices, on the other hand, work well for businesses that have slightly changing monthly costs or usage-based billing.

These include consulting or law firms with varying billable hours and companies that offer a range of monthly services at set prices, such as landscaping or IT support providers, just to name a few.

Another differentiating aspect is timing.

While recurring payments happen at set intervals (such as weekly, monthly, or annually), recurring invoices, in contrast, can be sent whenever services or goods are delivered.

In essence, both recurring payments and invoices help customers avoid late fees and missed payment dates, offering the convenience of automation.

Conversely, this time-saving feature liberates businesses from costly repetitive tasks, enabling them to focus on other important aspects of their operations.

Recurring Payments or Recurring Invoices: Do You Need Both

The goal of every business is to achieve a stable and secure monthly income.

Implementing an automated billing solution is a smart approach to achieving this goal, as it will undoubtedly boost your revenue and improve your financial stability.

As discussed in this article, recurring payments and recurring invoices have multiple benefits for both businesses and customers.

But do you really need both of these methods?

This largely depends on your scope of work and the type of services or products your business provides.

Here at Regpack, we took into account companies’ varying needs to develop an automated billing software that supports both recurring payments and recurring invoicing.

With our subscription feature, you can conveniently create recurring payments to bill your clients for services like subscriptions, annual fees, memberships, donations, and more.

It’s simple to set the amount and billing schedule, and you can even apply discounts or offer upgraded services as needed. You can also pause or cancel subscriptions or edit dates and amounts.

Once the recurring payment is processed, the system automatically sends payment receipts to your customers, notifying them about the completed transaction.

If a mistake occurs, Regpack offers automatic payment retry and user-friendly tools to help you spot and address issues promptly.

Moreover, if needed, the system can send notifications for failed payments, ensuring you stay informed about any payment hiccups.

Similar convenient features apply to the solution that generates automatic invoices—you will never miss the date to issue an invoice to your clients, and the amounts will always be correct.

Moreover, the system-generated invoice is accompanied by a customized payment email that goes straight to your customers’ inbox.

Whether you work mainly with subscription services and would benefit from recurring payments or need to adjust your billings with recurring invoices, the automated billing software follows your business’s specific needs.

In fact, the billing is done by your software solution, which is, hopefully, comprehensive and easy to use. What is more, the right solution will take care of the accounting and the reporting as well. This will allow you to focus on more demanding tasks.

It’s up to you to choose how you take advantage of these tech solutions and mix and match them to ensure your business goals are within reach.

Conclusion

As businesses grow and attract more customers, handling billing can get increasingly complex and time-consuming.

Automating the payment and invoicing process provides scalability, allowing companies to manage a higher volume of recurring transactions without compromising efficiency or accuracy.

Some businesses find recurring payments ideal, while for others, recurring invoices are a better fit. Some even use both, depending on their type of products and services.

Both options have their benefits, ensuring that neither you nor your customers need to remember the next payment date.