The era of recurring payments has witnessed an unprecedented surge in popularity.

We find ourselves immersed in a world of Netflix marathons, Spotify soundscapes, and Amazon Prime Video binges—all made possible through recurring payments.

It’s the epitome of simplicity and convenience—we effortlessly indulge in these services without lifting a finger.

However, the allure of recurring payments extends far beyond consumer satisfaction.

As business owners, you can establish a predictable cash flow and eliminate the worries of missed payments through automation, among many other benefits.

But to start with recurring payments in your organization, you need to know how.

That’s where we come in.

In this article, we will guide you through the process of setting up recurring payments for your business, from what you need to how to do it.

So, buckle in, and let’s start.

What You Need to Set Up Recurring Payments

To set up recurring payments, you’ll first need the right tool to do so.

While some payment gateways offer recurring payment options, it’s best to implement a software solution that doesn’t rely on third-party integrations and is developed exactly for this purpose.

So, the first step is finding the perfect recurring billing software that caters to all your needs.

As opposed to payment gateways, recurring billing software will, in addition to periodically collecting payments, allow you to manage your payment plans and billing frequencies, payment emails, customer base, and crucial business analytics.

But before selecting the ideal software, you have to evaluate your internal workflows and identify your billing pain points to know which industry-specific automated billing solution will cover all your requirements.

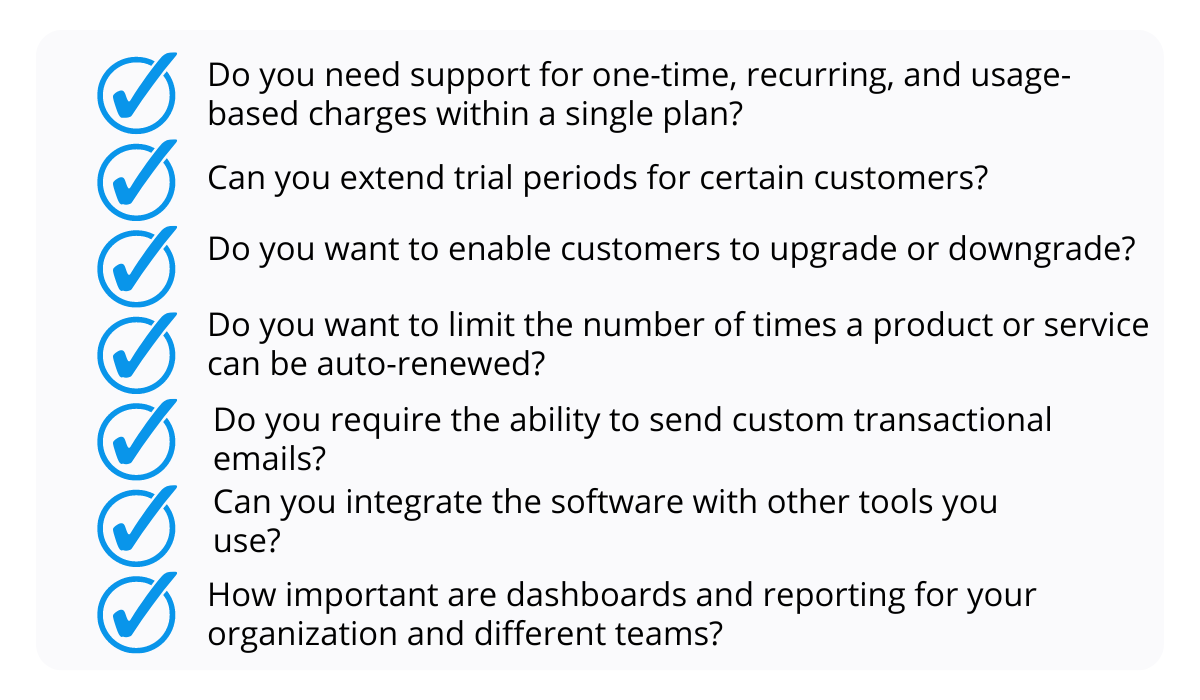

Here are some key considerations to address during this process:

Source: Regpack

Recurring billing software should answer these and encompass features like automated invoicing, automated payment reminders, multiple payment methods, multi-currency support, and secure payment processing.

Moreover, you will need analytics, reporting, and multiple integration options for recurring payments to run smoothly in your company.

Regpack, our all-in-one recurring billing software, excels in each of these areas, addressing the questions mentioned above.

Source: Regpack

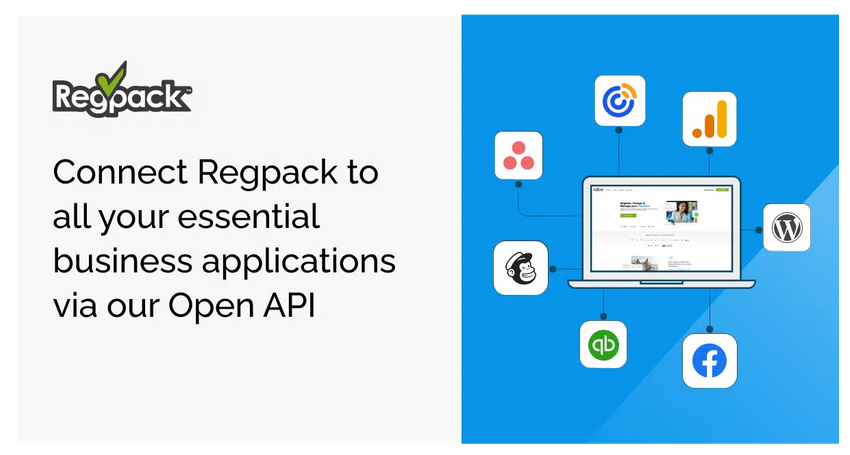

After identifying a software solution that meets your needs, the next step involves integrating it with your organization’s other essential tools.

We dare say the most critical integration is with your accounting software. Like QuickBooks, for instance.

Regpack achieves this integration through an application programming interface (API).

This integration ensures real-time data synchronization across systems, guaranteeing your data remains up to date. This makes life easier for your teams, especially accountants.

To summarize, you should start by identifying your billing pain points and researching solutions that offer the necessary features to address them effectively.

Then, once you have found the right automated billing software, you have to integrate it with other tools you use to create a seamless flow of data across different platforms.

Doing so will set the stage and provide you with everything you need to set up recurring payments for your business.

Once you have thoroughly assessed your requirements, identified crucial features, and selected the ideal recurring billing software for your business, it is time to begin setting up recurring payments.

In the next chapters, we will walk you through four essential steps to facilitate this process effectively.

These steps include creating recurring payment plans, configuring electronic invoicing, setting up automated customer notifications, and ultimately launching a customer payment portal.

Without further ado, let’s dive in.

Create Your Recurring Payment Plans

Once your software is set up and operational, the next step is to establish payment plans, which form the foundation of recurring payments.

These plans define when and how you will bill your customers.

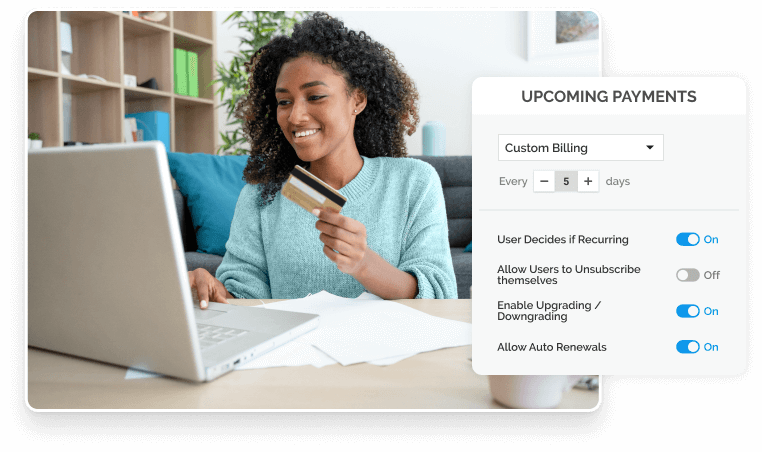

During this phase, you will configure billing rules and select the payment methods your recurring payments will accept.

The rules encompass various aspects such as payment frequency (e.g., twice per month, once per month, or once every four months) and the payment amount, including deposits.

The specific parameters depend on your business services, needs, and customer preferences.

Source: Regpack

While different software may have different procedures, they all require you to set up similar parameters.

The first decision to make is whether your payment plans will be admin-facing or user-facing.

If you opt for user-facing plans, your customers will have the freedom to choose the payment plan that suits them best rather than having it determined by you.

Additionally, you will need to decide whether the payment plan will apply to the customer’s entire order or only specific products and services.

In the latter case, multiple plans will be automatically consolidated into a single plan encompassing the customer’s complete order.

Source: Regpack

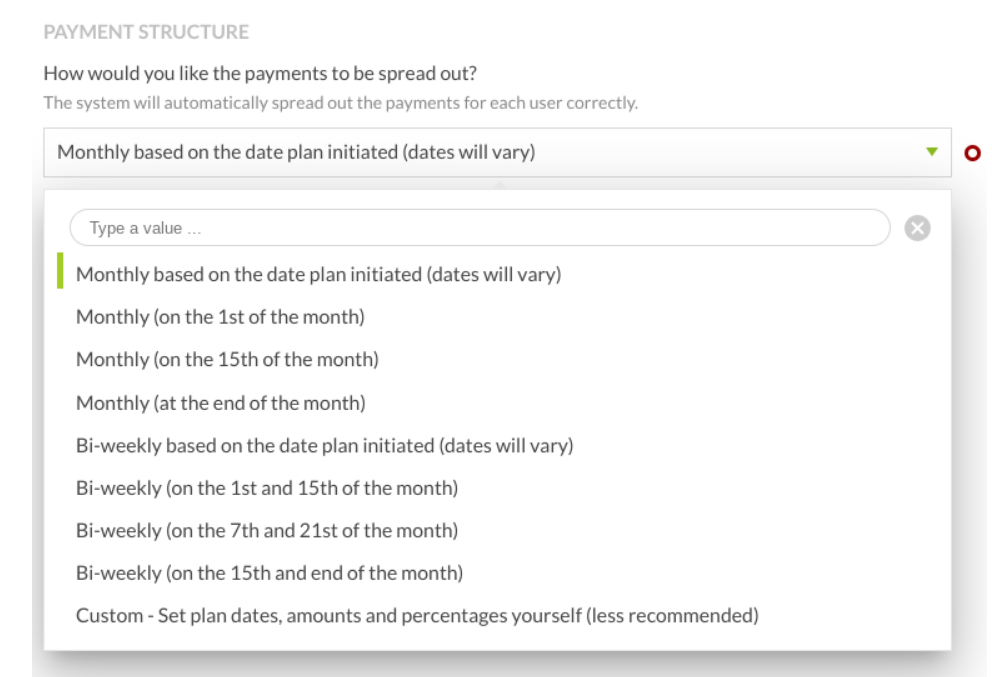

Once these decisions are made, you can proceed to establish a payment schedule.

During this step, consider the start and end dates, the availability of a deposit option (if desired), the dates on which charges will occur, and how you want the payments to be distributed over time.

The screenshot above provides a visual representation of the payment schedule options in such software.

By defining all these parameters, you will have successfully created a payment plan for recurring billing.

However, the setup process is not yet complete, so let’s move on to the next step—setting up electronic invoices.

Set up Electronic Invoicing

Setting up automated invoicing is the next crucial step in establishing recurring payments.

Why should you consider electronic invoicing alongside automated recurring payments in the first place?

The answer lies in the drawbacks of manual invoice creation and the prevalence of late payments caused by incorrect invoices (which account for 61% of cases, to be precise).

In short, manual invoicing is susceptible to human error while electronic invoicing isn’t.

Because invoices will be automatically generated, they will be accurate and your team will be more efficient, which saves you valuable resources.

Now, let’s explore how you can set up this essential feature.

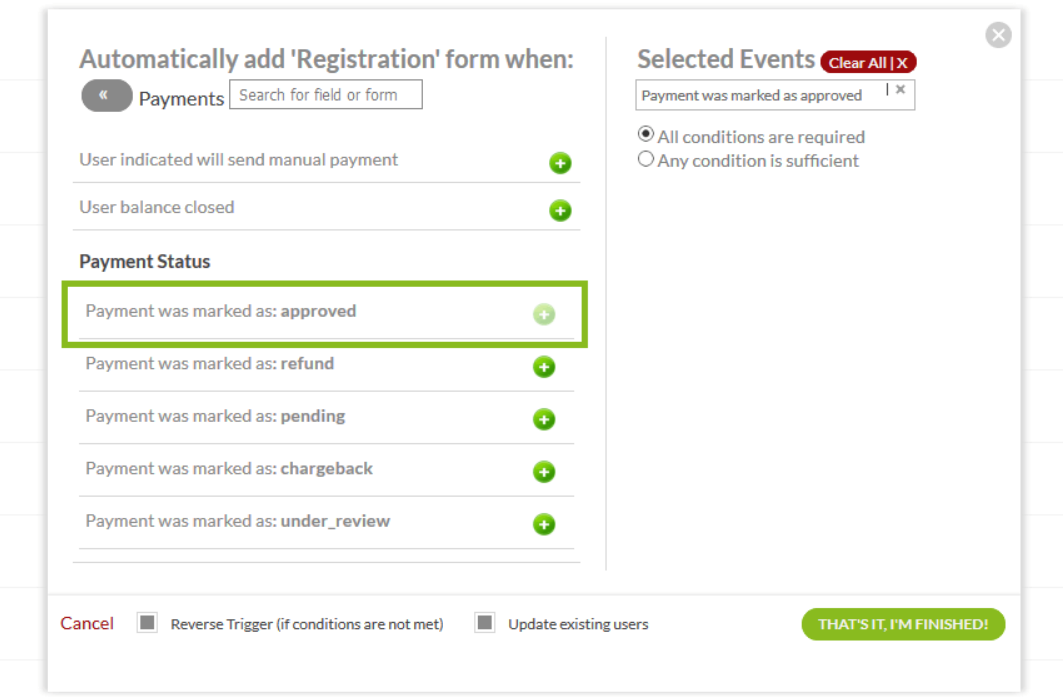

Source: Regpack

When selecting an automated billing software, ensure it includes the functionality to generate automated recurring invoices that can be emailed to customers.

This convenient feature allows invoices to be promptly delivered whenever a payment is made.

It relies on triggers within the software that operate on a simple principle—when specific conditions are met, an email is triggered and sent.

For instance, one condition you can set up could be “payment approved,” as illustrated in the photo above.

When this condition is fulfilled, the customer receives an electronic invoice containing details about the payment.

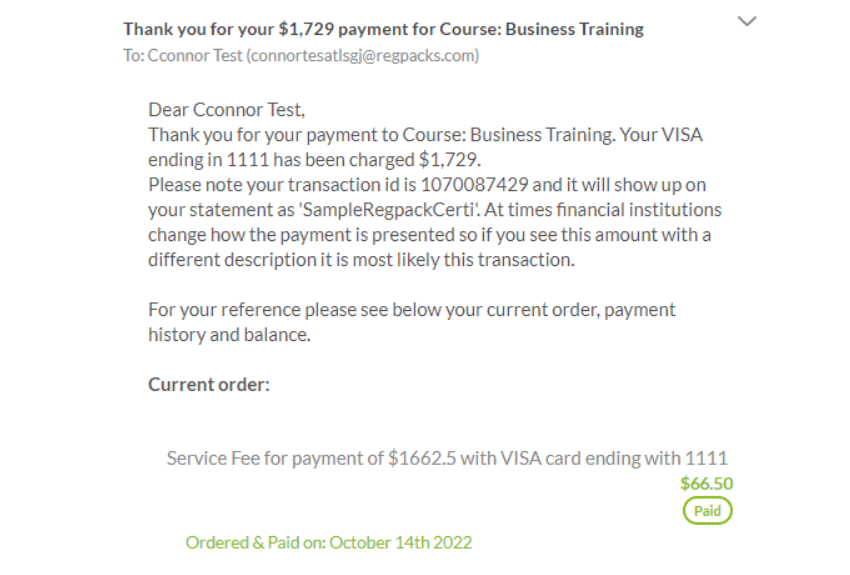

These invoices include a comprehensive payment summary featuring their name and your business’ name, a payment description, the last four digits of the payment method, the payment amount, and a unique transaction ID.

Source: Regpack

Additionally, the email notification will indicate whether the user’s purchased products have been paid for in full.

It can also provide a comprehensive list of previous payments associated with the user’s account.

All these details are crucial for you and your customers to easily track their payments.

Setting up automated electronic invoicing can be done in just a few clicks and brings many benefits for you and your customers.

So, don’t overlook this step when setting up recurring payments for your business.

Configure Automated Notifications for Customers

When setting up recurring payments, a vital step is configuring automated notifications to keep your customers informed and engaged.

Let’s explore the reasons for setting up such notifications.

Automated notifications provide a convenient way to inform customers about upcoming payments, successful payments, and payment failures that prevent successful transactions.

By automating these notifications, you can save time and effort compared to manually typing up individual emails for every customer.

Additionally, addressing issues such as late payments or unsuccessful charges can be tricky, making automated notifications a more comfortable solution.

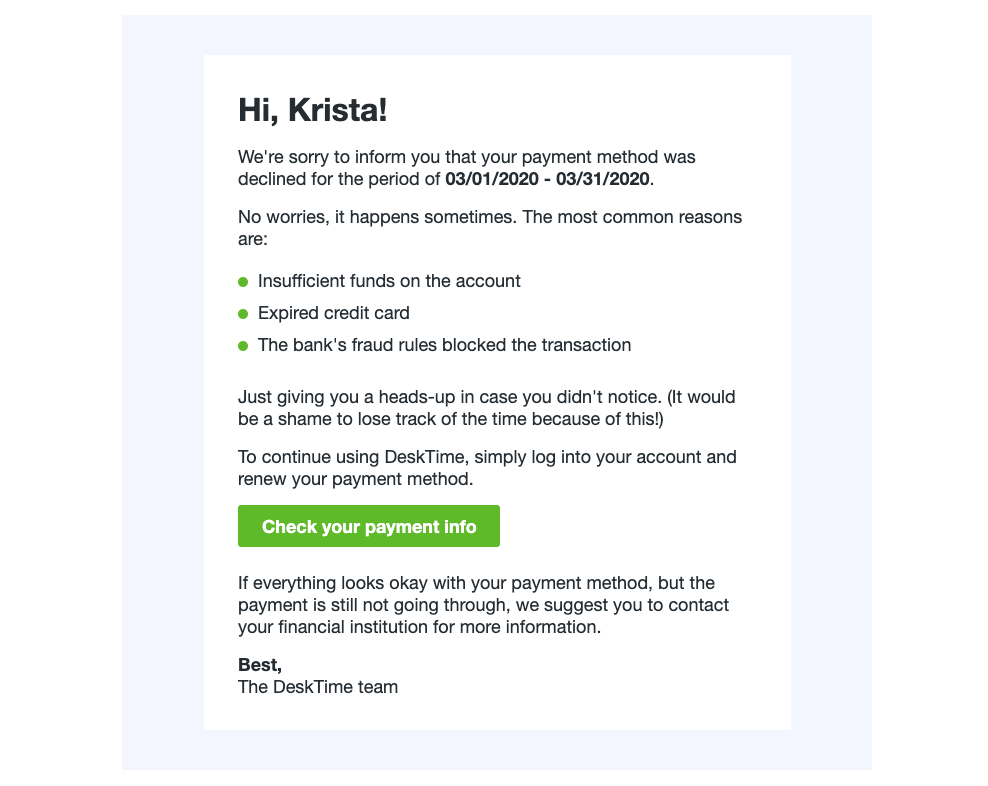

In the screenshot below, you can see an example of an effective email notification about a failed payment by DeskTime:

Source: Baremetrics

With the right software in place, these email notifications operate based on specific trigger conditions similar to the electronic invoicing we mentioned before.

For example, when a trigger condition, such as “payment failed due to expired card,” is met, the intelligent software immediately sends a notification to the customer.

This notification prompts them to update their card details, ensuring the seamless continuation of their recurring payments.

However, automated notifications go beyond delivering unpleasant news.

They also play a crucial role in keeping customers informed about their billing status and establishing a consistent line of communication.

By regularly updating customers through automatic emails, you create a routine of communication that helps maintain a long-term relationship with your customers.

Automated notifications serve as a means to convey important information, build trust, and engage with customers throughout their journey with your business.

Launch a Customer Payment Portal

After completing all the necessary steps to set up your recurring payments, there is one final task to initiate the process—launching a customer payment portal.

The customer payment portal serves as a self-service platform where customers can conveniently manage their recurring payments without the need to contact you every step of the way.

It provides them with a centralized hub to monitor their payments, access various payment methods (such as debit cards, credit cards, and ACH), and maintain control over their payments.

Furthermore, customers can leverage the portal to manage their account details, update their payment information, and view their billing history.

It also enables them to access and download invoices, ensuring transparency and convenience.

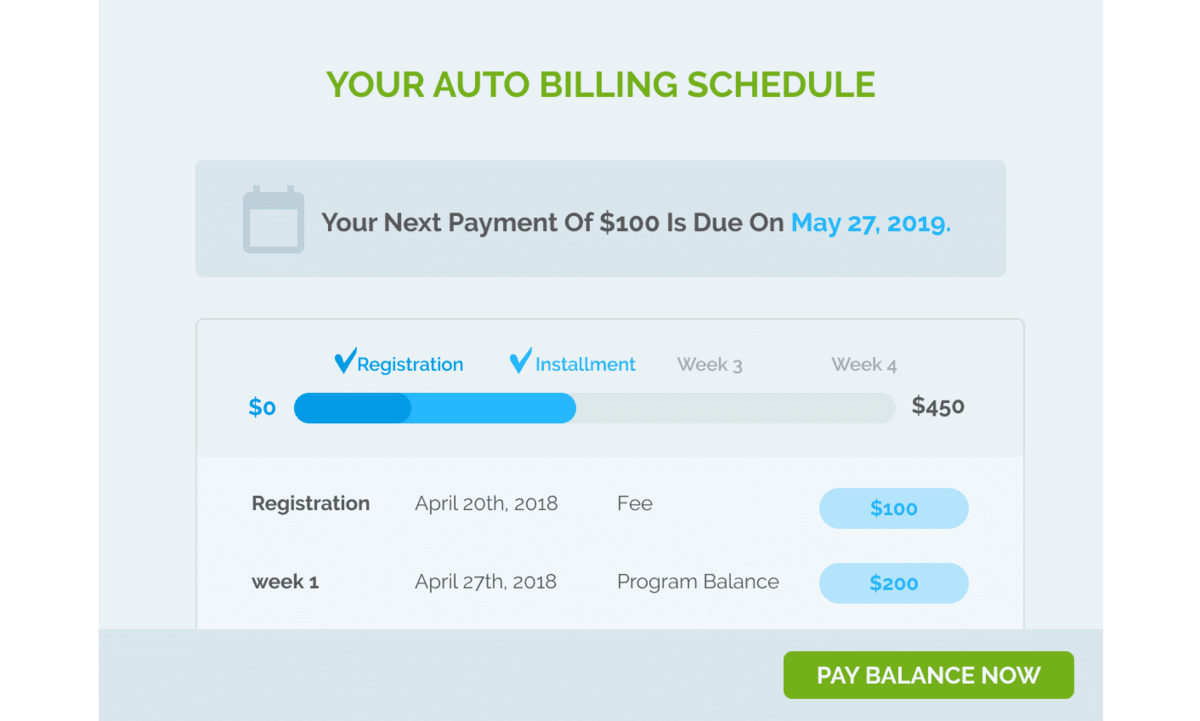

The photo below showcases an example of such a payment portal in action.

Source: Regpack

Launching a customer payment portal offers significant benefits for both customers and your business.

It enhances the overall customer experience by giving them a clear overview of their payments while reducing their reliance on customer support for routine inquiries.

From your perspective, the portal saves time and effort for your team, streamlines payment management, and reduces late payments.

Setting up a customer payment portal is straightforward, especially when using automated billing software.

Such software will also provide customization options to align the portal with your branding and seamlessly embed it directly onto your website.

This step is vital in establishing trust for customers, as they will feel more secure when entering their payment details into a portal bearing your name and logo.

Therefore, launching a customer payment portal is the final step before you can begin accepting recurring payments.

Once you’ve done that, you are ready to reap the benefits of recurring payments for your business.

Conclusion

We hope this guide has provided you with valuable information and guidance as you set up recurring payments for your business.

Let’s summarize.

First and foremost, you must assess your business’s specific needs and select reliable software that offers comprehensive features, including multiple payment methods and secure payment processing.

Next, create well-defined recurring payment plans, configure electronic invoicing, and set up automated customer notifications.

Finally, launch a customer payment portal to ensure smooth and efficient recurring payments for you and your customers.

Good luck!