Recurring payments have been around for a while, but they didn’t become popular until the era of subscription-based services such as Netflix and Spotify.

Once it caught on, even those who initially doubted being charged automatically were suddenly drawn to this set-and-forget method.

The main reason is that it provides users with the service they want at regular intervals, hassle-free, without moving a muscle.

If you’re still on the fence, we’re here to explain the recurring payment method and how your business can benefit from it.

- What Do We Mean by Recurring Payment?

- Examples of Recurring Payments

- How Does Recurring Payment Work?

- Benefits of Recurring Payments

- Recurring Payment Challenges

- How Regpack Can Help With Recurring Payments

- Conclusion

What Do We Mean by Recurring Payment?

Recurring payment is a payment model in which a client gives permission to a goods or services provider to automatically collect a specific amount of money from their bank account on a regular basis.

The permission is granted once, and then the amount is charged weekly, monthly, quarterly, or annually for a fixed period or until the client cancels it.

It’s convenient because it’s typically fully automated. Neither the client nor the user must be present for it, further simplifying the process and saving time for both.

The fact that it’s so simple has made it hugely popular. In 2021, recurring transactions accounted for USD 473 billion in the USA.

Source: Regpack

That’s not all–according to BusinessWire, the trend shows no sign of stopping, and the recurring billing management market is expected to reach USD 10,772.14 million by 2025.

Types of Recurring Payments

There are two basic types of recurring payments: fixed and variable. In the following sections, we’ll go over them and explain their differences.

Fixed Recurring Payments

As their name suggests, with fixed recurring payments, the amount charged is the same each month, no matter how much you use the service.

This category includes streaming services and subscription businesses such as Netflix and Spotify.

The underlying principle is that the quantity of a service (e.g., the number of episodes of a TV show you watch in a month) does not affect the price.

Consequently, the price you pay is always the same.

Insurance policies, magazine subscriptions, gym memberships, and learning courses also fall into this category.

Variable Recurring Payments

With variable payments, you pay what you spend or use.

A good example of this model is your gas bill, which you have to pay every month, but it will be higher in winter than in the summer because you spend more gas on heating.

Investopedia further divides variable payments into usage-based (our gas bill example) and quantity-based.

In quantity-based billing, a user pays for a quantity agreed upon beforehand.

An example is a prepaid data plan, in which a specific sum gets you a certain amount of data, texts, and minutes. If you want more data, you get a more expensive plan.

Source: Regpack

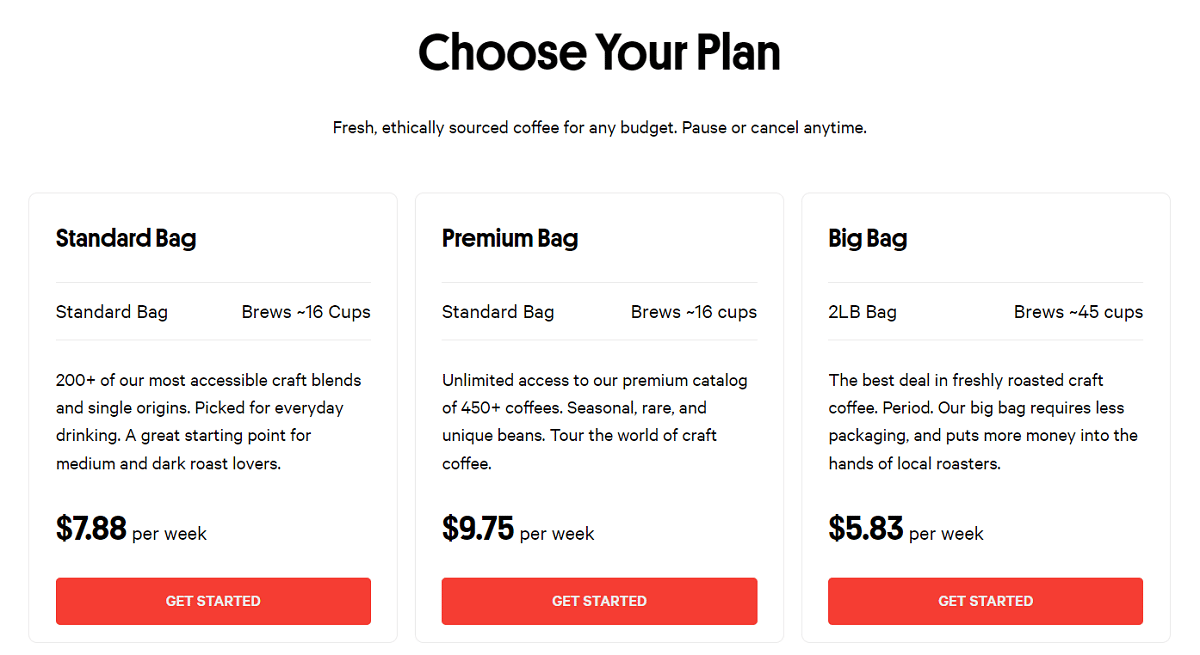

Although we typically think of recurring payments as being related to services, they can also cover goods.

For instance, Dollar Shave Club delivers personal grooming products such as razors to users by mail on a monthly basis, while Trade delivers coffee beans weekly.

Source: Trade

Even the industries you typically wouldn’t associate with this model are starting to tap into its potential, motivated mainly by the financial insecurity caused by the Covid-19 pandemic.

This was true especially for the travel industry, as it suffered a major blow during the pandemic.

Businesses needed revenue regularly, so they devised creative ways to secure it by using the benefits of recurring payments.

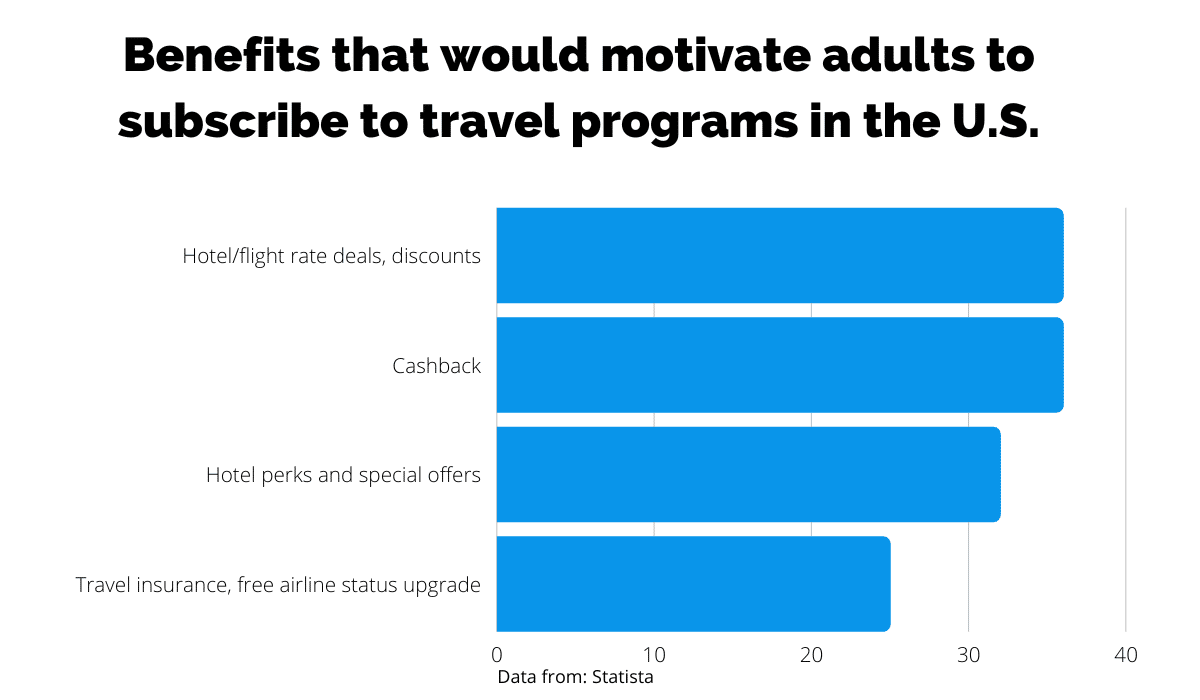

Statista’s November 2021 research found that hotel deals and the opportunity to get cashback when traveling were the main factors that motivated adults in the USA to subscribe to travel programs.

Source: Regpack

And the industry listened.

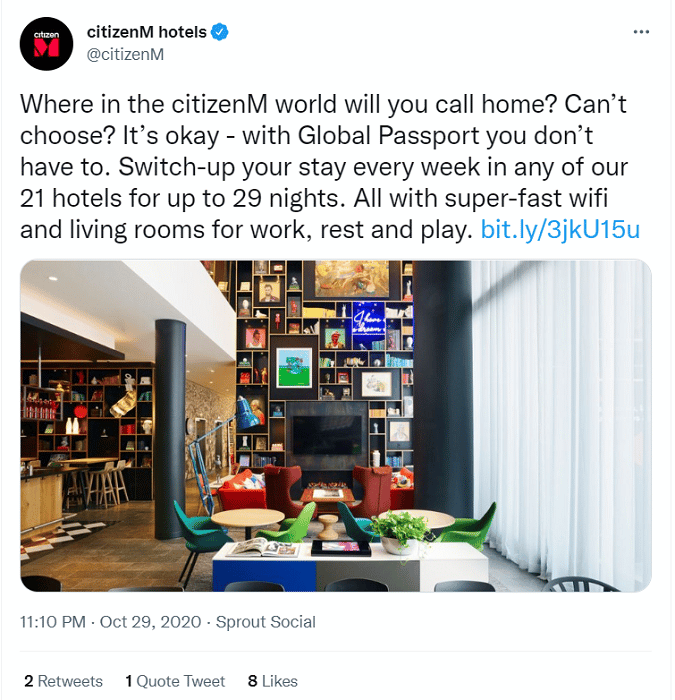

The CitizenM hotel chain targeted digital nomads with its Global Passport, offering a 30-day stay at their hotels for USD 50 per night.

Source: Twitter

Judging by the fact that it’s currently sold out, the initiative was a success.

How Does Recurring Payment Work?

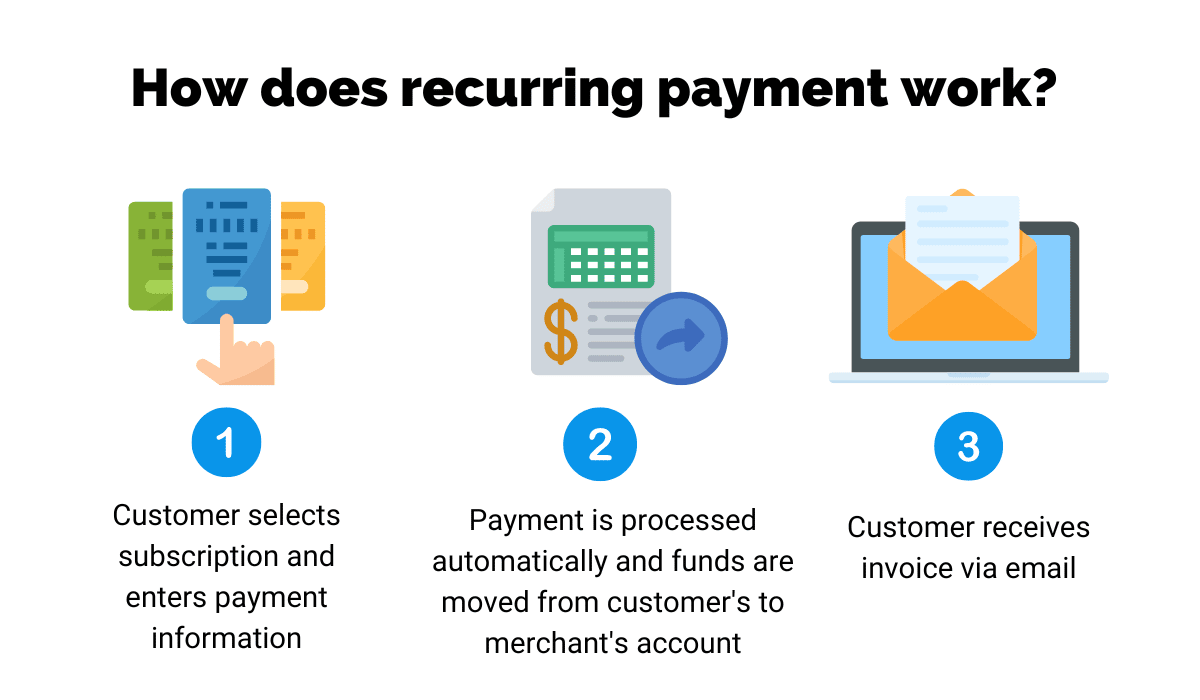

The recurring payment process is pretty straightforward and can broadly be divided into three steps.

1. Subscription

This is the initial stage when a customer visits a merchant’s website and selects a subscription payment option.

Once the option is selected, the customer enters credit or debit card information for the first and only time, as all payments will be automatic from then on.

The customer also agrees to have his payment information stored securely by the company’s recurring billing software to be used for future transactions.

In addition to entering card information, the client must accept the terms and conditions to authorize the merchant to start charging their account.

At this point, the customer also agrees to the amount charged, the payment schedule, and the expiration date (if there is one).

2. Billing

Now that the merchant has the authorization and the necessary information, they can start collecting the recurring monthly payment.

To do so, they will need a payment processor and a dedicated merchant account for receiving funds.

Some invoicing software, such as Regpack, has an integrated payment processor, so a separate one is not needed.

The rest of the process functions as a regular credit card transaction: the payment processor requests authorization from the acquiring bank, credit card network, and the issuing bank.

Upon receiving authorization, the funds are transferred from the customer’s account to the company’s merchant account, and the transaction is complete.

3. Invoicing

After each successful transaction, the client is notified and receives an invoice via email.

If there’s a problem with the transaction, the client gets instructions on how the matter will be resolved.

A visual summary of the process is presented below.

Source: Regpack

The process then continues until the client cancels his subscription or it expires.

Benefits of Recurring Payments

Source: Regpack

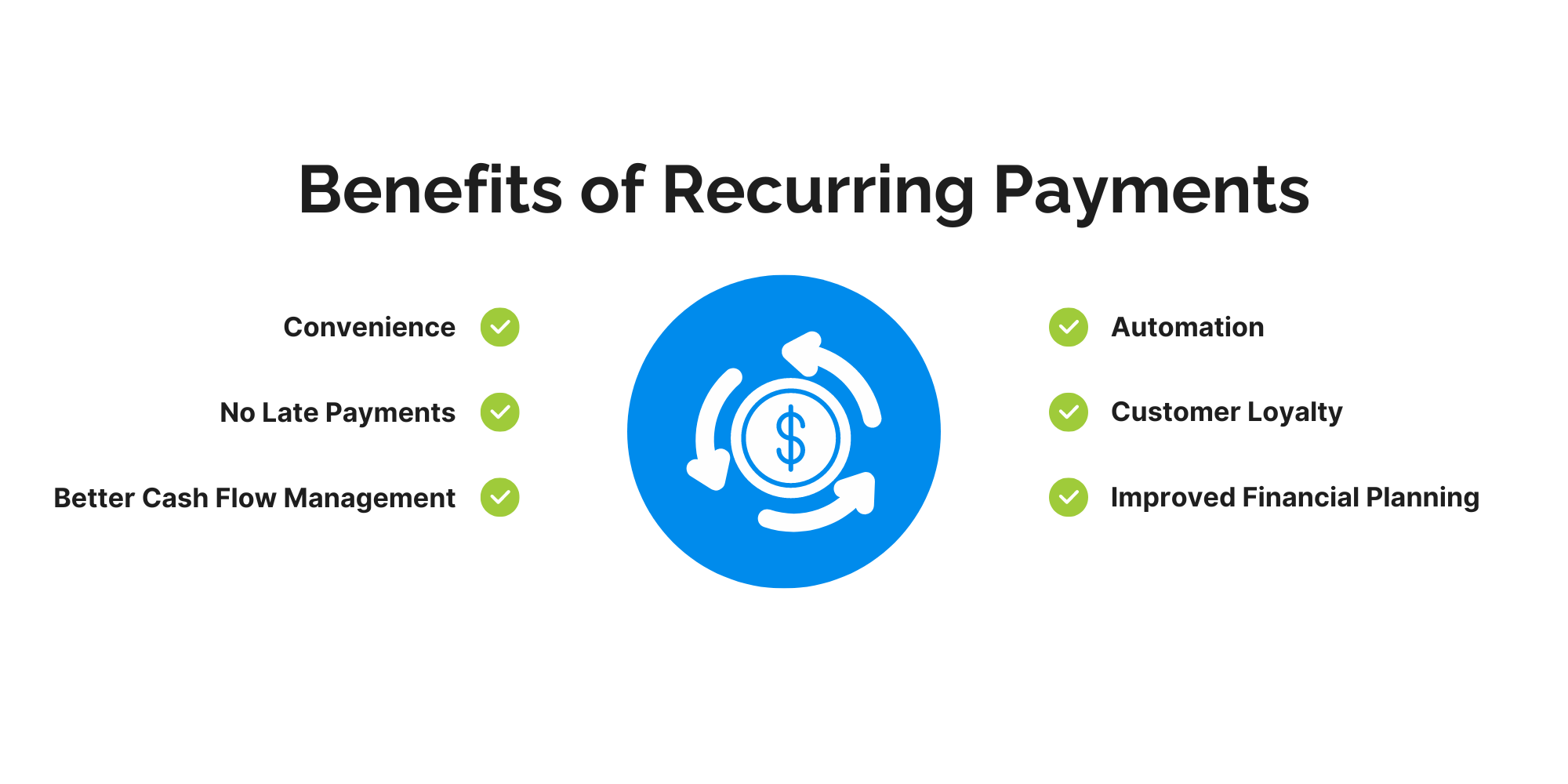

In addition to being convenient, the recurring payment model has several other benefits for your company.

One of the biggest benefits is that there are no late payments. Late-paying customers are not only a nuisance but, they affect your ability to pay others, especially if they’re constantly late.

When your clients pay late, you have to send emails and contact them frequently to get your payment which can lead to uncomfortable conversations and hurt your relationship, potentially even costing you a client.

With recurring payments, you don’t have to worry about any of that because you and the client defined everything upfront.

Additionally, knowing exactly when you will receive payment leads to a better cash flow.

With recurring payments, money comes into your company constantly, allowing you to have predictable cash flow and plan expenses accurately.

For instance, knowing that your recurring payments will be in your account on the 10th, you can set the billing cycle with your own vendors to start on the 12th.

That way, you will always have enough funds to cover your expenses, and your company will maintain a good cash flow.

From the customer’s point of view, recurring billing allows them to enjoy a service they like without thinking about logistics. Entering card information multiple times is an inconvenience that most people want to avoid.

With recurring payments, there’s no need for this because customers only need to enter their payment information once and it’ll remain securely stored.

Recurring Payment Challenges

No solution is perfect, so naturally, recurring payments come with their own set of challenges.

Yes, automatization speeds up everything, but if an error occurs, it’s much more complicated to fix.

Let’s say your recurring payment should be USD 10, but a zero is mistakenly added at the end, turning the amount into USD 100.

With traditional bills, you would simply send a new one, and that’s it, but with recurring payments, the only option is a refund after the amount has been drawn. Arranging one will require additional steps and take time.

In addition, some customers might take it personally. They could blame you for trying to trick them on purpose or even cancel their subscription.

Make sure to handle these cases carefully and offer an apology as soon as possible.

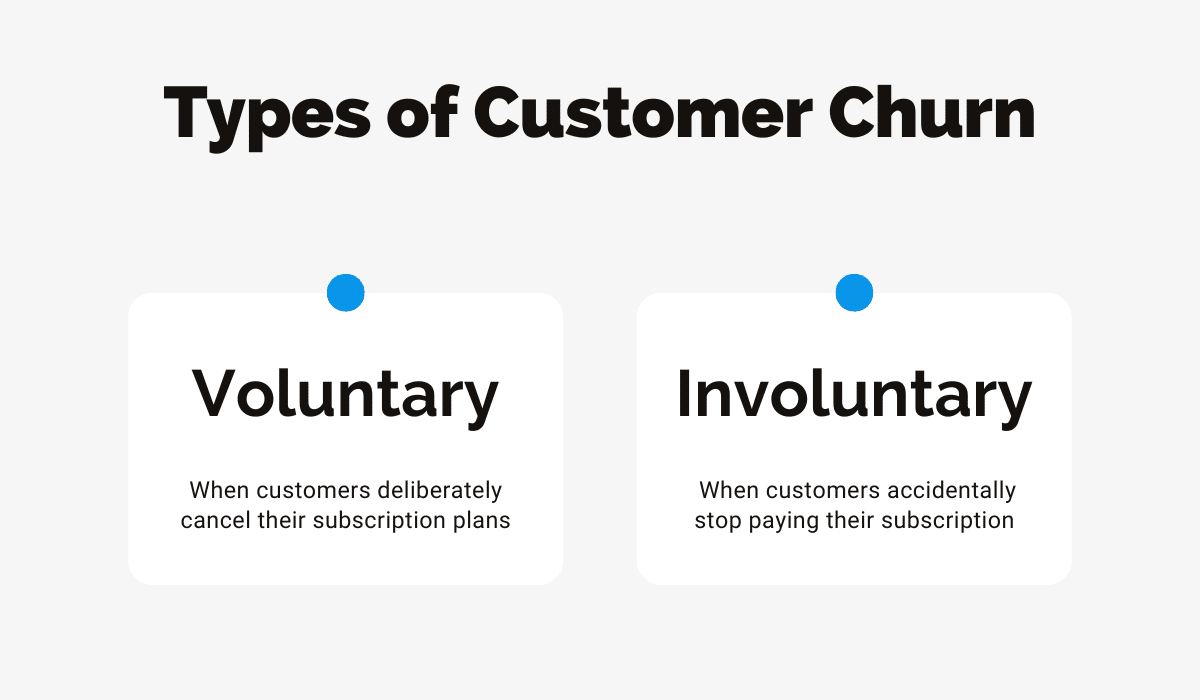

Another issue with recurring payments is customer churn, or the number of people who stop doing business with you.

Source: Regpack

Voluntary churn is a frequent occurrence in subscription-based businesses. Even though customers might like that they can end their subscription at any time, this is not good news for you.

It’s not only cancellations that cause a drop in recurring payments. There’s also forgetting to update payment information.

Many people simply forget to change their card details after receiving a new card.

Your profits depend on renewed subscriptions, so you should make an effort to keep your clients by reaching out to them before they inadvertently stop using your services because of the reasons listed above.

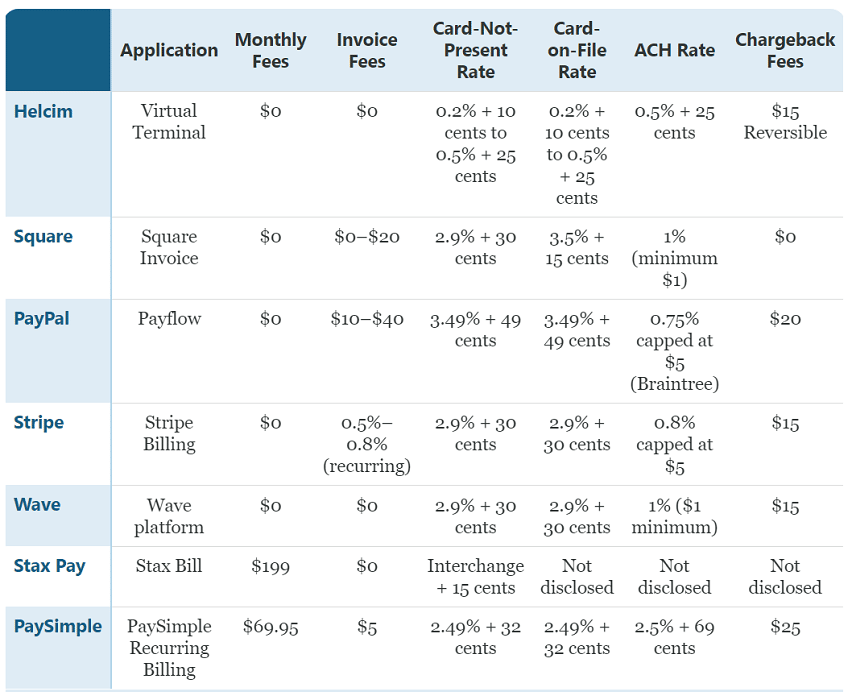

One final thing to consider is the recurring payment processing fees.

Most payment processors charge a monthly fee plus a percentage of the transaction, and there are also a card-not-present fee and an invoice fee.

Below are examples by Fit Small Business of what some payment processors typically charge.

Source: Fit Small Business

If we take Wave as an example, for a recurring payment of USD 100, you would have to pay USD 3.2 on top of that in fees.

It doesn’t seem much, but these things add up, so make sure to carefully consider all options before you reach your final decision.

How Regpack Can Help With Recurring Payments

Regpack is a multifunctional registration and payment software solution that will help you collect payments from your clients on an ongoing basis.

It allows you to:

- Collect and store payment details

- Charge clients on a customized prearranged schedule

- Create and manage automatic payment plans and schedules

- Manage online, virtual, and internet businesses

Regpack’s technology is integrated into your website using only one line of code, giving users a seamless experience without third-party redirects.

Source: Regpack

Its online payment forms are PCI-2 compliant, meaning your clients’ information is completely secure.

Regpack’s Subscriptions feature allows you to charge your clients on a recurring basis for services such as subscriptions, annual fees, memberships, donations, and more. It can also be modified if you need to pause or cancel it, or simply edit dates and amounts.

Even if mistakes happen, Regpack has automatic payment retries and tools that allow you to identify problems quickly. The system can also send failed payment notices if necessary.

Conclusion

Recurring payment system are becoming increasingly popular methods that allow businesses to get paid regularly and therefore have greater control over their cash flow.

They provide the security of knowing exactly when and how much you will get paid and eliminate the need for chasing down late-paying clients.

Paired with the right software solution, such as Regpack, recurring payments can help you manage your finances and make better-informed decisions about your company’s future.