If this is your first time researching recurring billing solutions for your business, you may feel somewhat overwhelmed having to choose between the countless available options.

After all, the right billing platform has the potential to significantly affect the direction of your business in the coming years, for better or worse.

To make it easier, we have listed the 9 top-rated and most-used recurring billing platforms, along with their advantages and drawbacks.

This will give you a more accurate understanding of the existing options, and ultimately help you make a better decision.

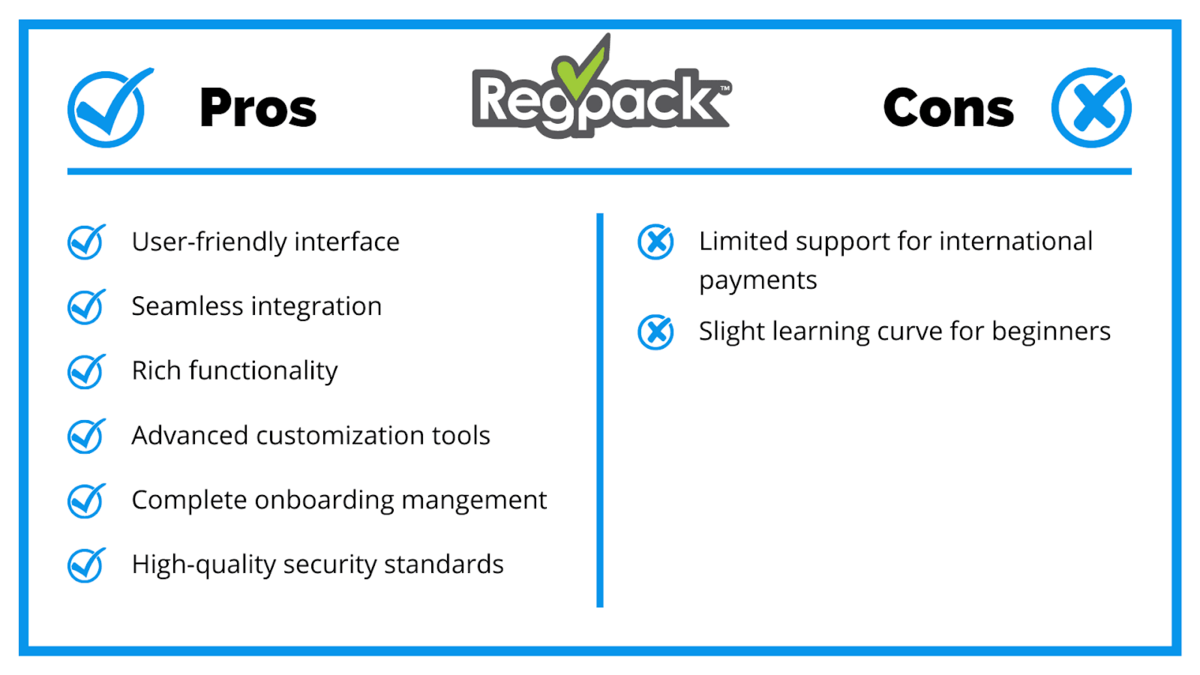

Regpack

Regpack is a comprehensive online subscription software that offers a complete set of advanced capabilities for every part of the onboarding process.

This includes registration, payment management, billing procedures and data analytics.

Most of the available features can be configured through a user-friendly interface, allowing businesses to tailor the system to their unique needs.

Customizable registration forms, support for various payment models, flexible recurring billing, and numerous data filtering options are just some of the examples.

Source: Regpack

Additionally, Regpack already provides a wide range of ready-made solutions designed for service- and subscription-based businesses, educational programs and travel arrangements.

For instance, in the niche of education, there are subscription models available for e-learning, after-school activities, adult education and training, as well as various courses and art classes.

All in all, Regpack is a versatile, secure subscription management platform you can use to process recurring payments regardless of the type and size of your business.

Key Features

- Modifiable subscription and billing cycles

- Custom onboarding flow

- Invoice personalization

- Automated messaging

- Payment insights and metrics

- Churn management tools

- All-in-one solution

- Registration management

- Level 2 Payment Card Industry (PCI) compliance

Let’s take a look at its pros and cons.

Source: Regpack / Illustration: Regpacks

As for the pricing, Regpack offers a single plan, encompassing all products available on the site for unlimited team use, regardless of the number of projects and the number of users.

The price starts at $125 per month per admin, and has a 2.1% payment processing fee.

For alternative pricing plans, you can connect with Regpack’s team and work out a deal that would best suit your business.

2Checkout

2Checkout (now Verifone) is a digital commerce and payment platform offering recurring payments to Saas and online service companies worldwide.

Primarily used as an alternative to PayPal for selling digital goods, 2Checkout also provides some tools for subscription businesses, such as flexible pricing and packaging, free or paid trial activation, email marketing tools and churn management.

Source: 2Checkout

However, its comprehensive support for international merchants stands out the most.

2Checkout is available in over 180 countries and territories worldwide and offers support for over 30 languages. Furthermore, it can process 45+ payment methods and 101 currencies.

Key Features

- Global payment support for recurring billing

- Customizable subscription plans

- Multicurrency and multilanguage support

- Various payment methods

- Level 1 Payment Card Industry (PCI) Data Security Standard compliance

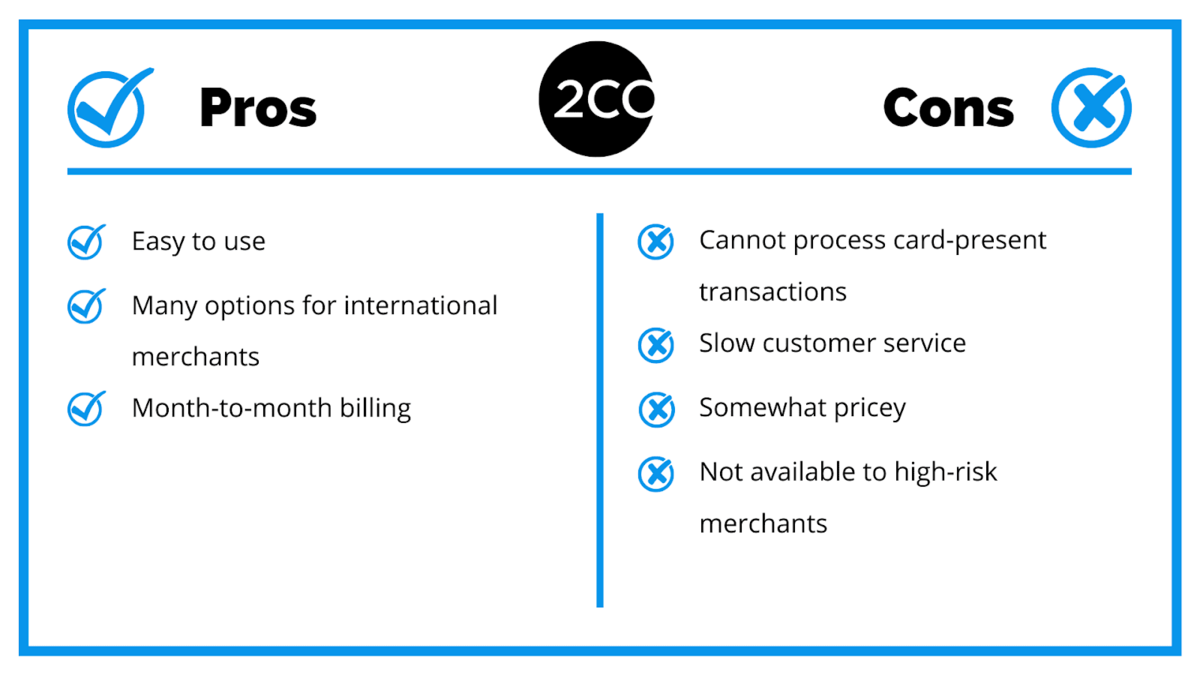

Here’s an overview of some of its main advantages and disadvantages.

Source: 2Checkout / Illustration: Regpacks

2Checkout offers four pricing plans, all of which provide support for recurring payments. Instead of a monthly rate, you pay transaction fees for each sale you make.

Their basic plan is 2SELL. Aimed primarily at eCommerce platforms, it will set you back 3.5% + $0.35 per sale.

2SUBSCRIBE costs slightly more—4.5% + $0.45 fee per sale—but unlocks access to additional subscription management and analytics tools.

For merchants that want to sell digital products globally, there is 2MONETIZE, which goes for 6% + $0.60. They also offer a premium plan with custom pricing, called 4ENTERPRISE.

Billsby

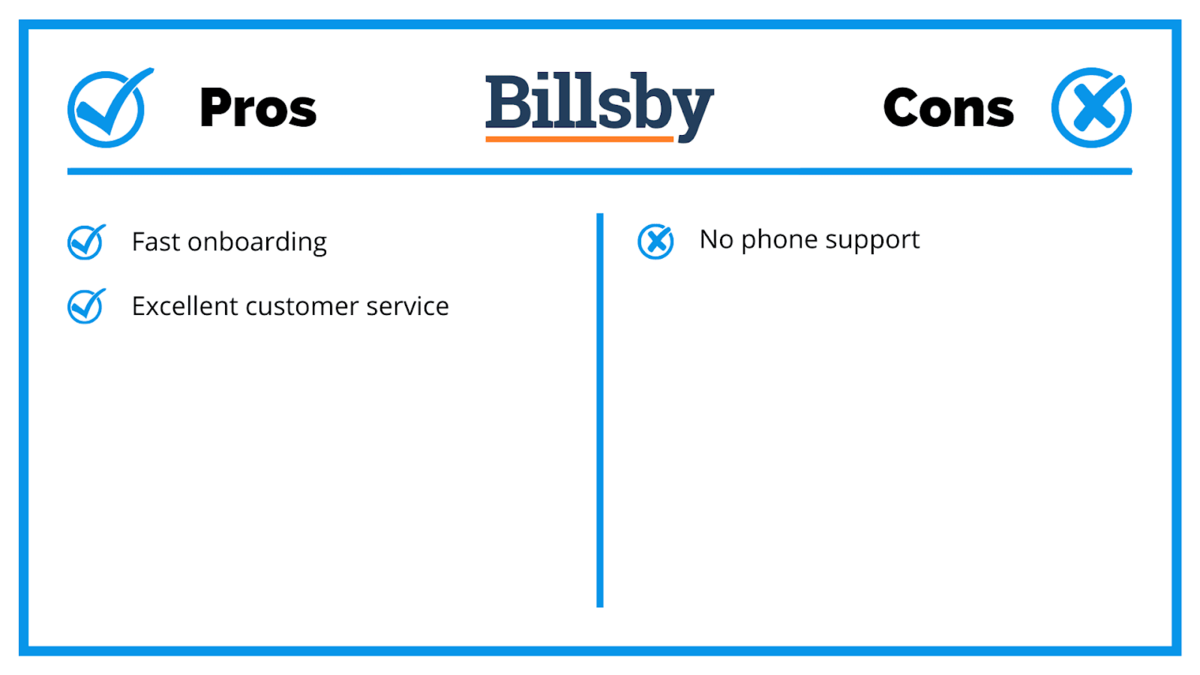

Problem-solving, quick learning and providing superior customer service are some of the core values Billsby is founded on. And it shows.

Most online reviews for the site highlight fast and responsive customer support as one of the most noteworthy features.

The only drawback, albeit a minor one, is they do not offer support via phone.

Source: Billsby

Other than that, Billsby provides recurring billing features akin to others in the market.

Dunning management, multiple payment getaways, automated global tax calculations and collection are the ones that stand out the most.

Lastly, start-ups can use their free plan to take as much time as they need for testing and preparation before launch.

Key Features

- Unlimited invoices and customers

- Usage billing

- Support for ACH payments

- Advanced invoice customization

- Automated dunning management

Briefly, here are some of its pros and cons.

Source: Billsby / Illustration: Regpacks

Pricing plans for Billsby start with a free trial option. Interestingly, it is not time-limited. You can set up your system as long as you want.

You only have to switch to one of their other three tiers when you are ready to start selling for real.

The Core plan costs $45 a month, plus a 0.4% fee on revenue exceeding $15,000 a month.

In case you need advanced features like ACH payment processing, multiple payment getaways and full API access, they have a Pro tier for 135$ and 0.5% of revenue exceeding $30,000 per month.

Chargebee

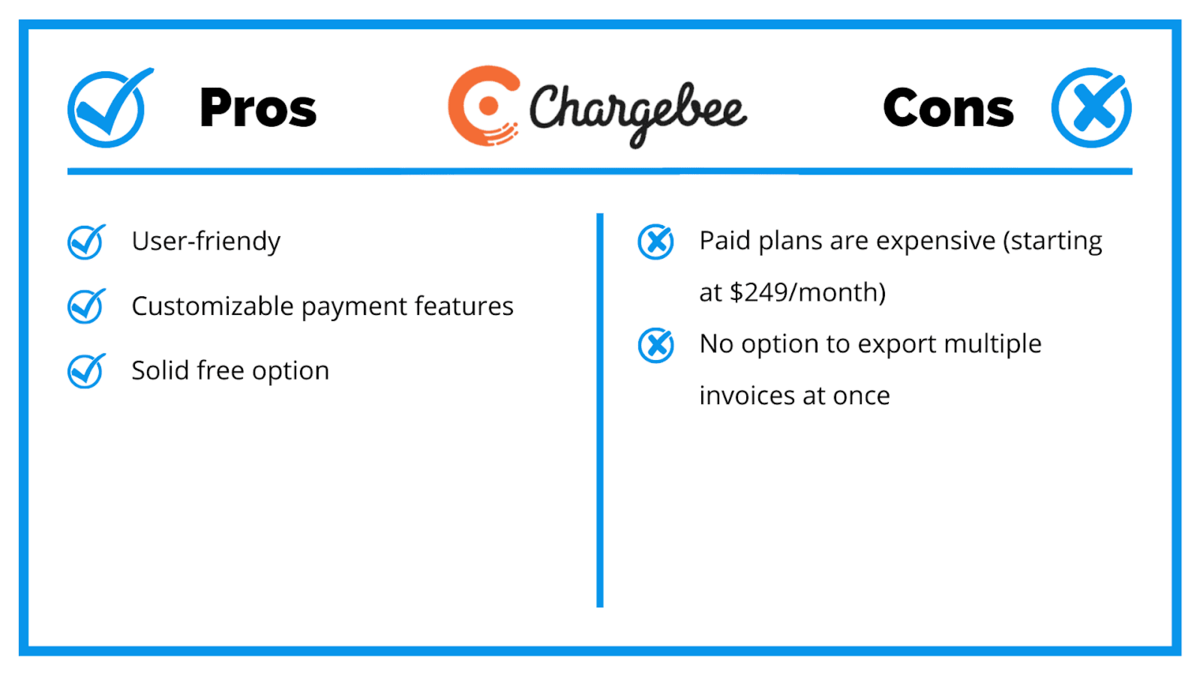

Another recurring billing provider offering a free starting plan is Chargebee. Their pricing structure is tailored for small and medium businesses.

However, their price might be too steep for companies with larger transaction volumes.

Source: Chargebee

Chargebee offers a user-friendly experience with features such as customizable checkouts, simple chargeback management and modifiable billing options.

Furthermore, it can be integrated with 25+ payment getaways, such as Stripe, GoCardless and PayPal.

In addition to supporting card payments, it also allows you to accept offline and bank-based payments, digital wallets and Direct Debit.

Key Features

- Customizable checkout experience

- Third-party integrations

- Support for over 100 currencies across 150+ countries

- Multiple online and offline payment methods

- Metered billing

- Tax profiles and reports

- PCI Level 1 certified

Let’s take a look at the kind of experience you can expect from Chargebee.

Source: Chargebee / Illustration: Regpacks

Let’s talk pricing.

As mentioned, signing up for the Launch plan is free. Despite its limited functionality, this allows businesses to familiarize themselves with the system when starting out.

After $100k in sales, the plan is automatically upgraded to a $99/mo + 0.5% overage revenue pricing structure.

Other plans with more advanced options include Rise for $249 a month plus a 0.6% fee for an annual revenue over $600K, and Scale for $549 a month plus a 0.75% of revenue over $1.2M.

It should be noted that the prices are for annual billing. If you want to pay on a monthly basis, you will have to pay an additional $50 a month.

Maxio

Maxio was created in 2022 as a result of a merger between Chargify and SaaSOptics.

The former was a billing and subscription management solution, and the latter focused primarily on financial operation automation and streamlining order-to-revenue processes.

Combining features from both, Maxio aims to provide businesses with an end-to-end solution for achieving sustainable growth.

This includes recurring billing and flexible pricing capabilities usually found in the services making up this list.

However, Maxio’s financial operations tools, such as advanced revenue management, expense amortization and comprehensive reporting options, set it apart from the rest.

Source: Maxio

Some businesses will appreciate all the customizable reporting options.

On the other hand, it must be pointed out that many reviews of the service describe its report system as overly complex and overwhelming, especially for start-ups.

Key Features

- Billing and pricing flexibility

- Support for 23+ payment getaways

- Saas metrics and analytics

- A/R management

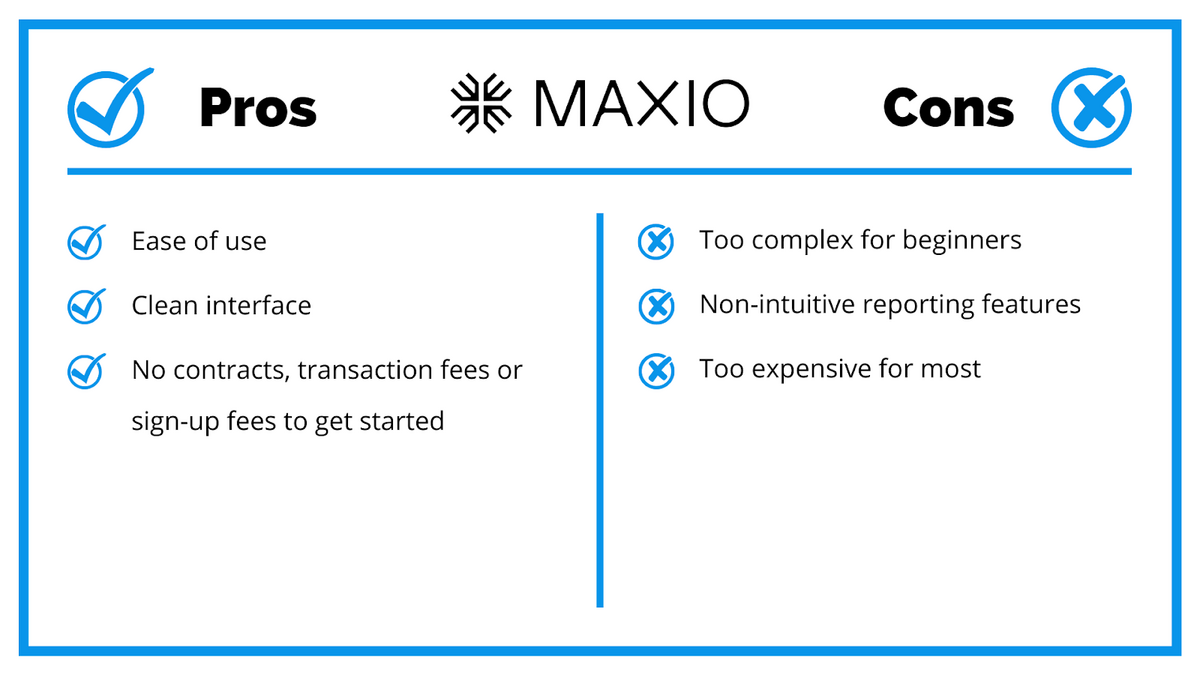

Its main pros and cons can be seen below.

Source: Maxio / Illustration: Regpacks

The pricing for Maxio is not as transparent as with other services on this list.

Of the three available pricing plans, only the Essentials one is priced – at $599 a month for up to $1M annual revenue.

The Growth and Scale plans unlock access to advanced billing and revenue management features, but you need to contact tier support for pricing information.

Paddle

If you need a recurring billing platform for your business, but do not want to deal with all complexities that come with it, Paddle could be the solution for you.

Let us clarify.

By signing up with Paddle, you authorize it to become your merchant of record.

That means it serves as an intermediary between you and your customers, taking on liability for all payments, as well as sales tax compliance.

Source: Paddle

Consequently, transferring liability to Paddle protects you from potential issues related to legal requirements, fraud attempts and chargebacks.

Also, it allows you to do business without opening a merchant account, which is beneficial for businesses in controversial industries.

Now, let’s take a look at some of its key features.

Key Features

- Merchant of record

- Metered billing

- Cross-border sales tax compliance

- Protection against fraud and chargebacks

- Automatic prorated payments

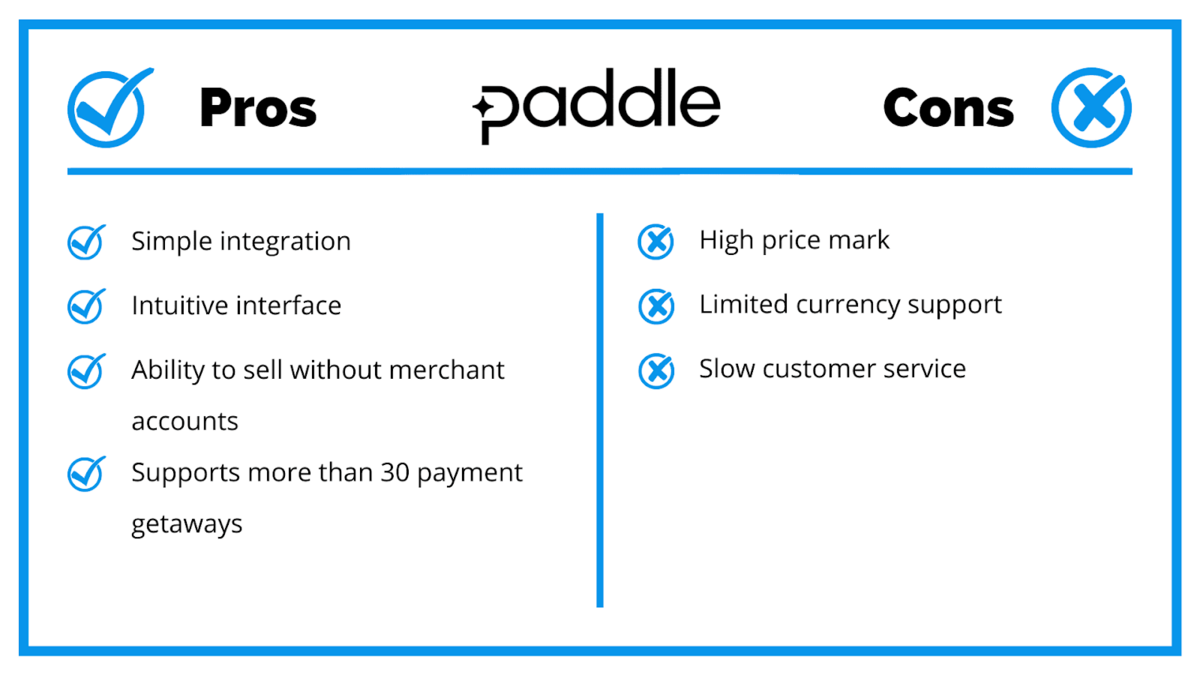

You can find a brief description of its pros and cons below.

Source: Paddle / Illustration: Regpacks

Paddle offers just two pricing plans.

The Pay-As-You-Go plan charges 5% of the transaction, along with a processing fee of ¢50, which can be on the expensive side for businesses selling low-priced products.

To use their Premium services, you need to contact sales, and they will set your pricing based on an ROI assessment.

Recurly

Recurly is a popular subscription and billing management platform catering to companies of all sizes.

It is used both by emerging businesses and some of the largest brands in the world, such as Showtime and Twitch.

Source: Recurly

Recurly’s goal is to provide simple, fast and flexible service tailored to the customers’ expectations.

To achieve it, Recurly provides advanced billing features, a variety of payment options and currencies, and useful customization tools.

That covers speed and flexibility. As for simplicity, reviews indicate a steep learning curve at the beginning, after which Recurly is as user-friendly as it aims to be.

Key Features

- Automated and manual recurring billing

- Invoice personalization

- Support for alternative payment methods

- Charges and credit customization

- Automatic tax calculations

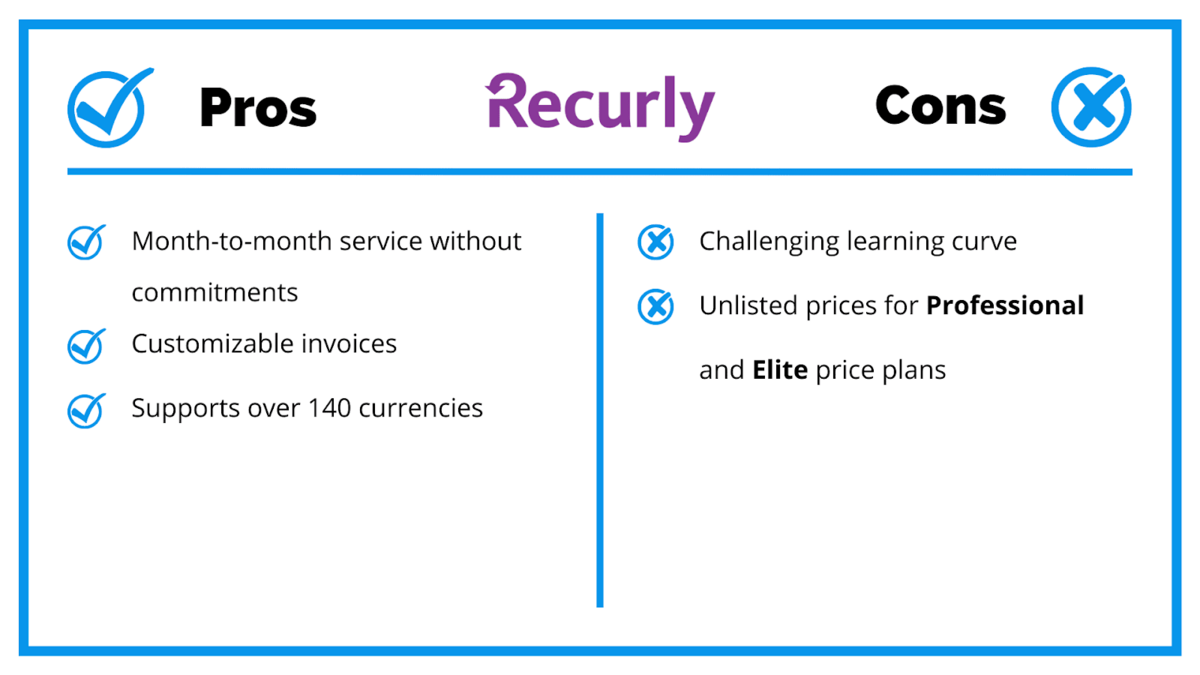

Its advantages and disadvantages can be summarized as follows:

Source: Recurly / Illustration: Regpacks

When it comes to pricing, there is little to say.

Businesses can sign up for the Core plan without paying a subscription + first $40k a month in revenue for 12 months.

The other two tiers, Professional and Enterprise, come with additional pricing, billing, payment and data options. To get a price quote, you need to contact their customer service.

Stripe

Stripe is one of the most popular payment processors used by companies of all sizes worldwide.

It offers a comprehensive set of products for online and in-person retailers, subscription businesses and software platforms, among others.

It provides similar recurring payment functions as Recurly. That being said, for businesses looking for additional products, Stripe offers Banking-as-a-Service (BaaS) capabilities.

Source: Stripe

Of those, the most notable ones are the ability to create and manage virtual cards for commercial programs and digital wallet support for customers.

Key Features

- Rich functionality

- Flexible billing options

- Easy-to-use interface

- Advanced fraud detection

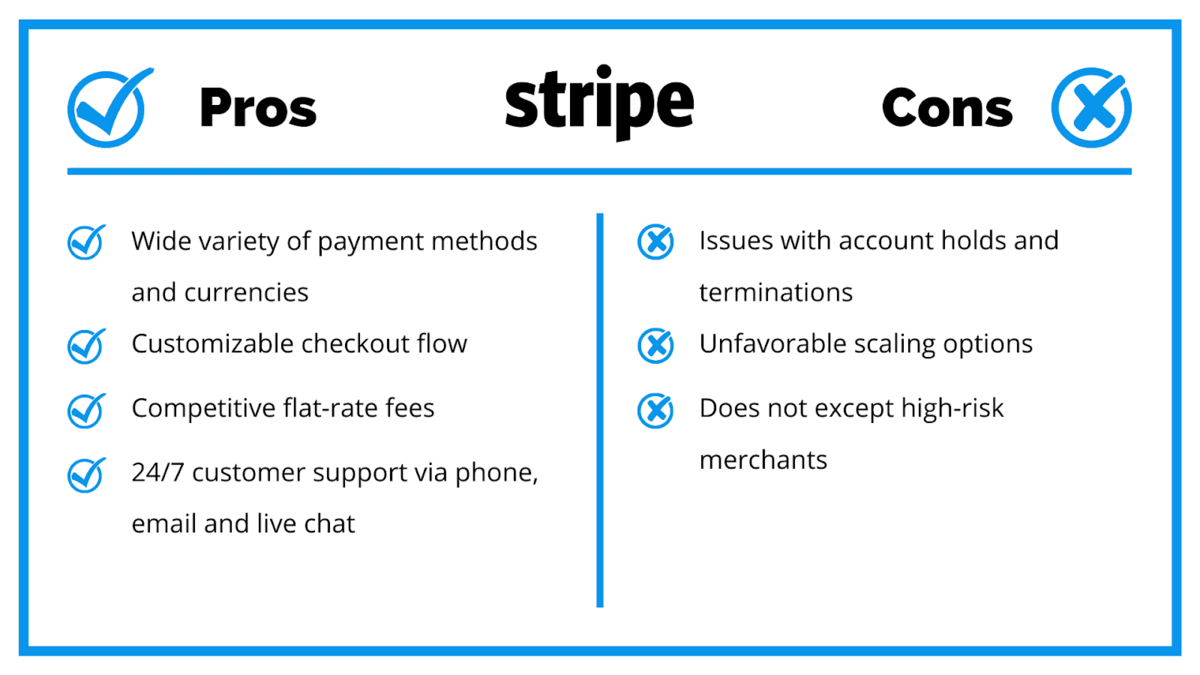

Now, let’s take a look at its pros and cons.

Source: Stripe / Illustration: Regpacks

Stripe offers affordable fee-based pricing of 1.5% + $0.30 per transaction.

While seemingly simple, they have an extensive fee structure for using different payment methods, checkout channels, invoicing and billing features, and so on.

Depending on your billing practices, these fees could easily add up to be more than you expected, so make sure to go through the details on their pricing page.

Zoho Subscriptions

One of more than 40 applications from the Zoho product suite, Zoho Subscriptions is a recurring billing and subscription management solution with solid features and highly flexible pricing options.

For existing users of Zoho’s products, this is a no-brainer.

However, businesses using alternative services for, let us say, project management and marketing might find it not as compatible with the rest of their infrastructure.

Source: Zoho

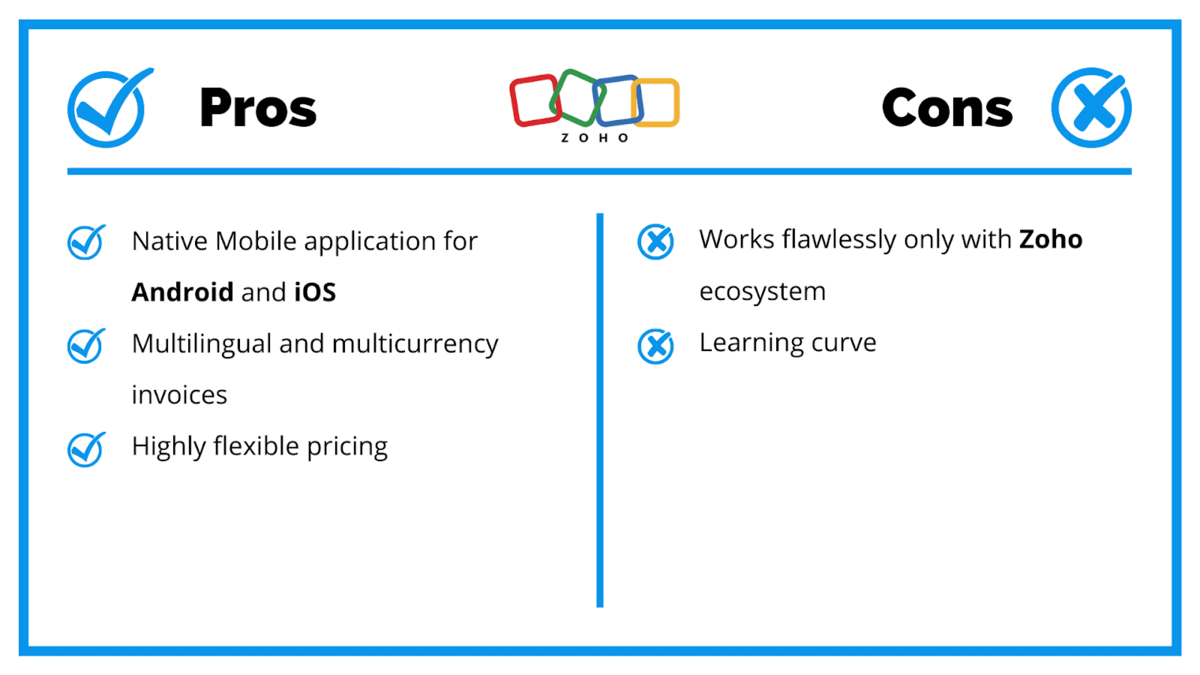

A useful addition to the standard set of recurring billing features is Zoho’s native mobile application for Android and iOS.

You can use it to manage operations from your phone, making it convenient for people working on the fly.

Key Features

- Easy dunning/churn management

- Multilingual/multicurrency support

- 35+ real-time reports

- PCI-compliant

- Automated proration

Let’s take a look at the pros and cons you can expect from this solution.

Source: Zoho / Illustration: Regpacks

And last, but not least, Zoho Subscriptions provides a flexible pricing structure based on the needs of your business.

Small businesses can start with a free plan, which supports up to 20 subscribers.

Basic and Standard plans cost $49 and $99 a month (billed annually) and allow up to 500 and 2000 customers, respectively.

To access the full range of features, there is the Professional tier, coming at $249 per month and capping out at 5000 customers.

Any more than that reaches the Enterprise tier, which is their custom price option.

Conclusion

There you go—these are the best recurring billing software solutions currently available. Sure, they all have a similar set of core features.

But if you read carefully, you will notice that each has something unique to offer, whether it be a flexible pricing structure, additional products, wider availability or excellent customer support.

Now that you have an idea of the spectrum of available recurring billing software, you will have an easier job deciding on which one has the best combination of features for your business.