Automating your accounts receivable (AR) streamlines the processing of customer invoices and empowers your accounting team to focus their time and energy on more impactful work that can improve your bottom line.

Fortunately, this automation is pretty simple to set up if you use the right tools.

In this article, we’ll walk you through how to automate your accounts receivable in five steps.

Then we’ll cover the three main ways that automating your accounts receivable will benefit your service-based business.

- How to Automate Your Accounts Receivable

- Why You Should Automate Your Accounts Receivable

- Conclusion

How to Automate Your Accounts Receivable

Below we’ve outlined a step-by-step process you can follow to automate your accounts receivable while minimizing hiccups that can occur along the way, like low employee buy-in or poor software fit.

1. Map Out the Workflow

As you switch over to accounts receivable automation (AR automation), a primary goal should be to reconfigure your AR management process for efficiency.

You’re not just digitizing your current process as you would if using an ERP.

Therefore, it’s best to start by mapping out your current AR management workflow—the steps your team takes to process an invoice.

As you do this, be on the lookout for inefficiencies.

Here are some questions to ask your AR team as you analyze your current process:

| How do we receive AR information from customers? |

| What data do we collect from customers? |

| How do we enforce our payment terms? |

| How do we send out invoices? |

| What do we do if a payment is late? |

Mapping out your workflow not only helps you spot bottlenecks you can fix to improve your AR process. It also helps you figure out which tools will be the best fit for you later on.

The right tools will be the ones that have features that solve your current inefficiencies.

For example, if you find that your current process suffers from poor communication with clients and payment conflict issues, then you might want to invest in a tool with a payment portal and live chat support functionality, which customers can use to quickly get in touch.

Additionally, after an analysis you’ll know which tasks can be automated and which might need a personal touch.

And knowing the common bottlenecks and challenges with your current process will help you sell your stakeholders on switching to AR automation.

2. Involve Your AR Team in the Process

Your accounts receivable team knows your AR management process and its inefficiencies better than anyone else in your company.

They might tell you, as many AR departments do, that AR processing speed is a serious holdup, or that they’re struggling to collect late payments.

Use that knowledge to strategically transition to AR automation.

And involve the team in the rest of the transition process as well.

Ask them for their input often, especially when selecting an AR automation tool, as they’ll know which features will make their jobs easier and the team more effective.

Involving them in software demos and evaluations is crucial because your AR team will be the ones working with the platform.

You therefore want them to like the tool and feel like they had a part in choosing it. And a tool is only good insofar as your team uses it.

In a survey, 20% of employees said their company’s leadership doesn’t know what to do with digital transformation. You don’t want to have AR employees feeling this way.

They’ll become cynical about your decision and apathetic about the software.

Furthermore, ask your AR team member to design their ideal AR management process and to send you a copy of it.

Even if it’s not entirely doable, there still will likely be some gems of ideas in their drafts that you can use to improve your AR process and pick the right tool for your team.

3. Define the Goals You Want to Achieve

After you’ve mapped your workflow and gained some insight into your current process, start thinking about the main goals you want to accomplish by transitioning to AR automation.

Here are a few examples of common accounts receivable goals:

| Speed up payment processing. |

| Make it easier for customers to pay by adding self-service options. |

| Collect more receivables data and become more analytical. |

| Improve the job satisfaction of the AR team. |

Defining a few key goals will make you faster and more strategic in your software evaluation process.

You’ll be able to narrow down your search from thousands of options to a few promising software tools, which you can then put onto a shortlist.

Having clear goals also allows you to formulate smart questions to ask vendors. One such question is, “how will this tool help me achieve {goal}?”

Or, “can you tell me about a time you helped a client with {goal}?” That way, in discussions with the vendor, you’ll quickly know if a platform is a good fit for your team or not.

4. Pick the Right AR Automation Tool

Once your team has established what issues concerning your accounts receivable you want to overcome and what goals you want to achieve, it’s time to pick an AR automation tool that meets these requirements.

Start by creating a shortlist of 3-5 vendors that seem like a good fit for your needs.

You can find these companies by googling industry best lists and then reviewing the promising vendors’ online reviews and feature sets on their websites.

G2 is a great site for finding online reviews and ratings of any given AR automation tool. Along with written reviews by customers, you can also find video reviews sometimes:

Source: G2

It can also be used to filter the lists of AR automation software by the ease of use, price, rating, and other factors that are important to you:

Source: G2

Next, set up web demos with these businesses and ask them questions that will help you decide if they’re truly the right fit.

Consider inviting your most experienced AR team members to join. It’s also a good idea to have a list of must-have features before hopping on the call.

Here are some questions to ask during your meetings:

| What types of businesses do you usually work with, and how large are they typically? |

| Does your software have features X, Y, and Z—can you show me how they work? |

| Based on the fact that I’m using X tool, how long will transitioning to your system take? |

| Can you tell me some stories about how your tool helped companies achieve {goal}? |

| Can the invoices be customized based on our brand guidelines? |

| How will this tool help us solve current AR management issues X and Y? |

No AR automation tool is a one-size-fits-all solution. There are solutions out there that will help you achieve your goals more effectively than others.

So it pays to be deliberate and thoughtful in your evaluation of various software products until you find an exceptional match.

5. Integrate Your Accounting Software and the AR Automation Tool

Now that you’ve chosen your AR automation tool, the last step in the transition process is integrating your accounting software and the AR automation tool so that they seamlessly transfer data between one another.

By giving the AR automation tool access to accounting data, you’ll enable your business to sync invoices and customers, send automated payment reminders based on due dates, and automate billing and collections via different payment methods.

And your AR team won’t have to spend their valuable time doing data entry.

When you update a customer’s email address in your AR automation tool, it will immediately appear in your accounting software as well, and vice versa.

This saved time can be used for more strategic work, like thinking up ways and spearheading projects to improve your business’s cash flow.

Why You Should Automate Your Accounts Receivable

Now that you know the process for transitioning smoothly to AR automation, let’s look at some of the greatest benefits your business will receive after making the switch, the main ones being faster payment times, a simplified workflow, and predictable cash flow.

Faster Payment Times

Manually handling your AR is cumbersome work that often involves multiple administrative tasks, from sending out reminder emails to even mailing the invoice to your customers.

When you switch to automated AR, the above tasks and others are handled by computer software, allowing you to process invoices faster and, as a result, get paid for your work more quickly.

Aside from task automation, AR automation tools also give you access to features that can make the customer payment process more convenient.

And when it’s more convenient, they’ll pay more quickly.

For example, the tools often enable you to let them pay in multiple ways. They can then choose the one that’s best for them, be it with ACH transfer, credit, debit, or check.

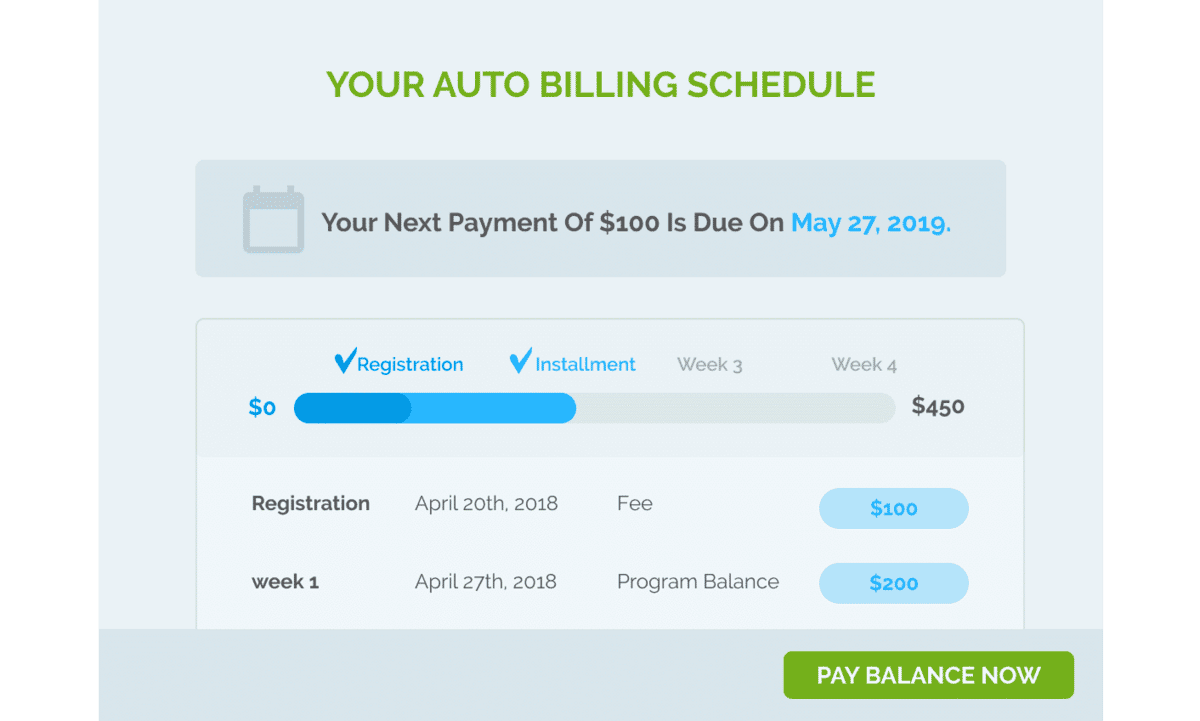

Users can also set up customer payment portals, where customers can make their payments without interacting with you or your staff:

Source: Regpack

Customers simply sign in, review their balance due, and make the payment.

Better yet, they can set up autopay so that it all happens automatically, thereby reducing the likelihood that clients are late.

And if there’s a problem, most portals have a way for customers to easily reach out to you so that you both can resolve the issue easily, without back-and-forth email or games of phone tag.

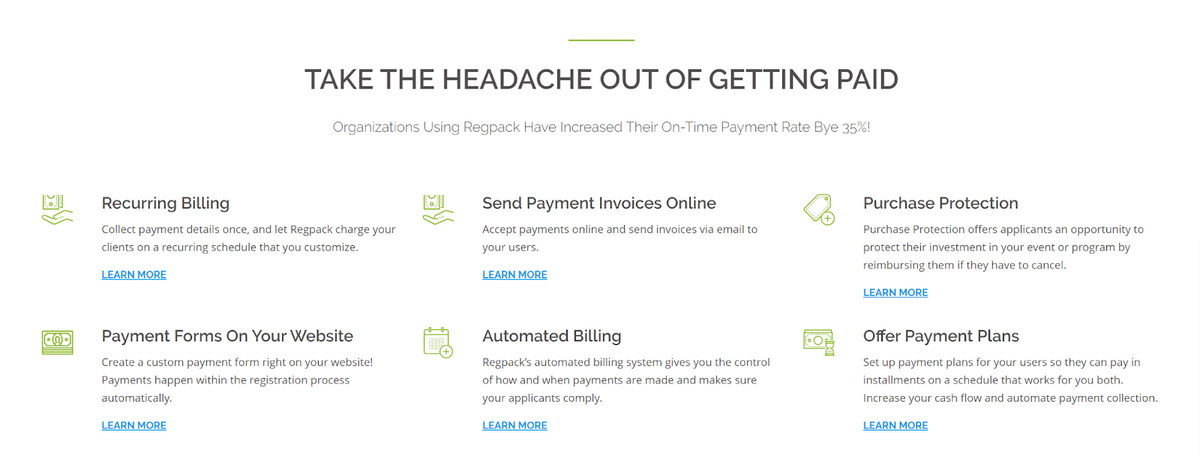

Here are some other payment-related features AR automation tools offer:

Source: Regpack

When you shrink the average payment timeline, your business has more cash available to fund operations, seize investment opportunities, and grow the business.

Simplified Workflow

The human brain wasn’t designed by natural selection to derive pleasure from accomplishing repetitive, simple tasks.

Data entry and admin work often leave us feeling drained and unsatisfied. We feel our best when we do something challenging, something that requires the best of ourselves.

With automation automatically tracking payments, sending emails and invoices, transferring data, and handling other repetitive tasks, AR team members can focus on work that needs a skilled human at the helm.

They can use their cultivated knack for numbers, strategy, and analysis to construct long-term plans to improve profitability or uncover payment bottlenecks and find ways to remove them.

Team members can spend time coming up with ways to improve the collections process or research better payment terms that will incentivize on-time payments.

This is so much more valuable to your business than the work that a computer can do.

Additionally, AR staff, your cash flow, and your clients won’t be burdened by the mistakes that inevitably occur when a human is handling a repetitive task and the mind wanders from its boring, shallow work.

Automation fixes this, leading to fewer mistyped money owed sections or incorrect due dates on an invoice.

A conditional logic algorithm doesn’t daydream while filling out an invoice because it’s bored. It just does the work correctly.

In sum, with this simplified accounts receivable management workflow, your team’s morale and productivity will rise, human error will fall, and you will have awoken human talent that was beforehand dormant.

Predictable Cash Flow

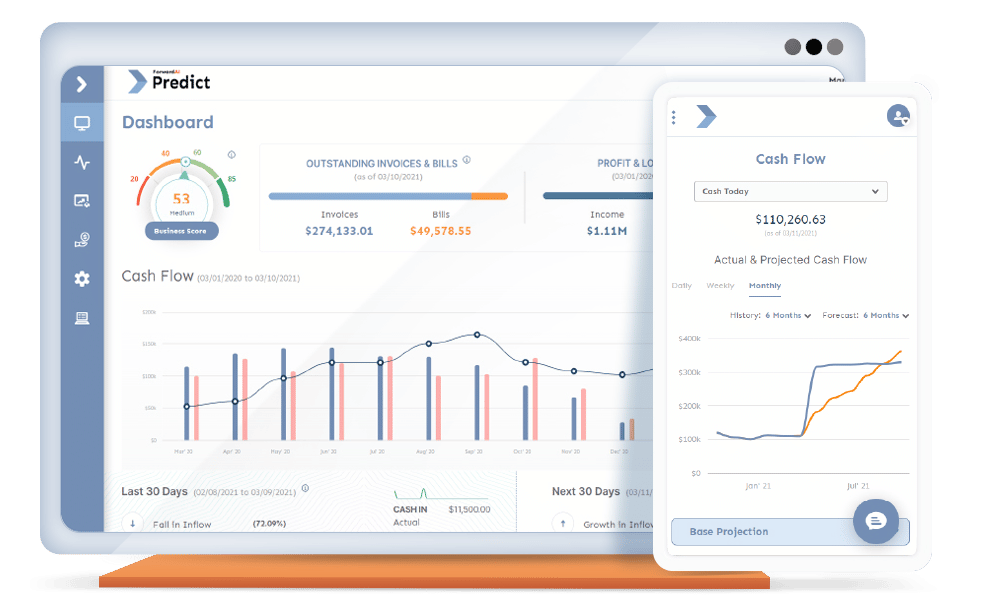

Many AR automation platforms use AI algorithms that analyze all relevant billing information to make predictions about cash flow over the course of the upcoming months.

Some are so advanced that they can predict with impressive precision how much cash will be returned to your business on any given day over the next 60 days.

Source: quickbooks

Sometimes the tools also predict which payments are unlikely to be made on time, allowing your team to take extra effort on those accounts, sending reminder emails and streamlining the payment process for the customer.

If a tool doesn’t serve your purposes completely, it will, at the very least, give you features like pre-built reports or report-building wizards that make it easy for you to use your billing data to make accurate cash flow predictions.

When you know how much money will be coming back to your business over the next few months, you’ll be better at making intelligent investment decisions, which save you from potential cash flow mismanagement, a leading cause of failure for small businesses.

Source: americassbdc

If you can see that money is going to be tight in November, you can hold off on an investment and save cash to fund operations during November, rather than making the purchase, and then scrambling for a business loan or cash advance.

Conclusion

Accounts receivable automation software automates administrative work and provides you with other tools that can be used to reduce payment timelines and improve cash flow.

Even when aware of its benefits, many small business owners hesitate to make the transition because they worry about the associated costs and difficulty of implementation.

But these worries are unfounded.

There are numerous small business AR automation tools out there that are affordable and designed for users with little technical experience.

Check out how Regpack can help you achieve your AR goals and satisfy customers in the process.