Everybody knows that a good billing solution can help you manage your payments quickly and efficiently. However, a resourceful business owner can derive so much more value from billing software than simply issuing invoices.

This post will teach you what else you can do with your software and instruct you what to look for when choosing the right solution for your business.

Let’s see how you can make your business easier to manage with the right billing management software!

Jump to section:

Setup and Automate Recurring Billing

Collect and Process ACH/EFT Direct Debit Payments

Facilitate Document Creation

Automate Your Communication With Customers

Track Monthly Payments and Revenue

Store and Manage Customer Information Securely in the Cloud

Setup and Automate Recurring Billing

Creating invoices month after month for the same customer is one of those tedious administrative tasks that two-thirds (67%) of small business owners see as “preventing them from focusing on their businesses’ primary purpose.”

Automating recurring billing reduces the time you spend on this task and makes payment easier for your customers. It’s the perfect solution for everybody involved.

Setting up a billing system once and letting it collect monthly payments for you trims the time you’d spend issuing individual invoices.

Also, rather than entering their card information each month, with a software solution customers can enter their data at their first purchase and then let recurring billing take care of future renewals. Both parties can stop worrying about forgotten payments.

Recurring billing is especially useful if you offer multiple pricing tiers.

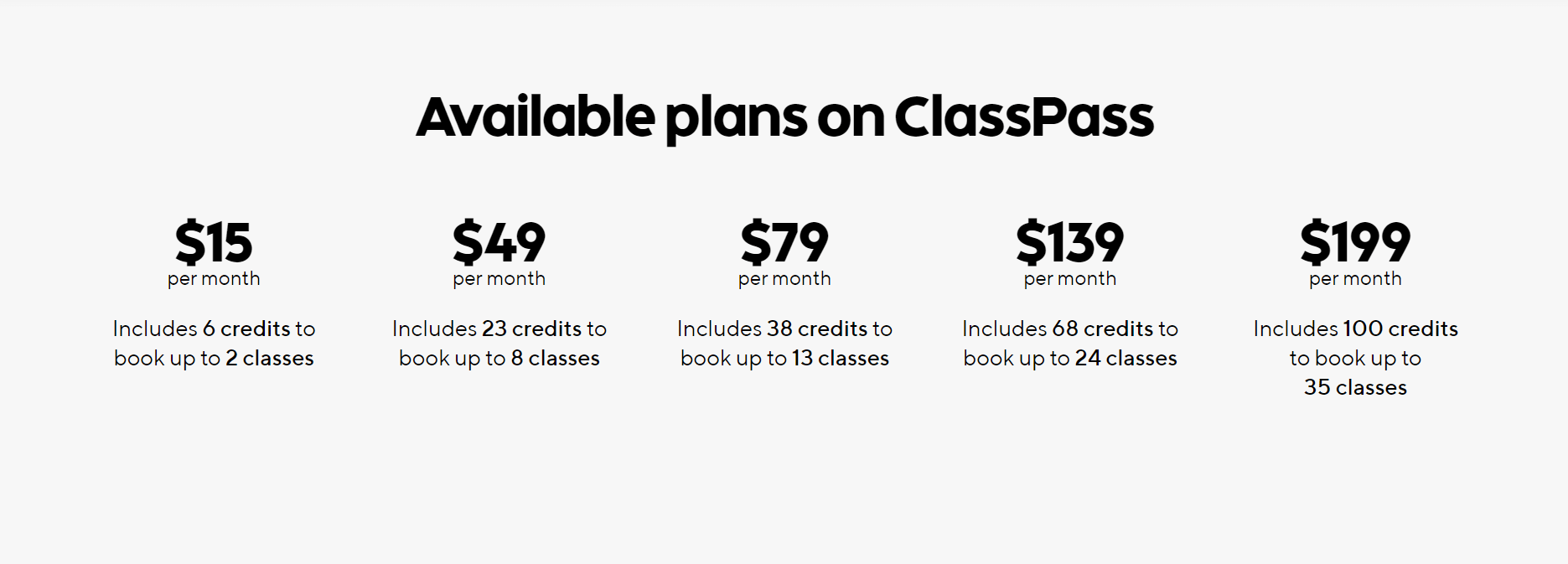

For instance, take a look at the membership tiers that ClassPass offers:

Source: ClassPass

Customers can choose between several plans, depending on how many fitness classes they want per month.

Also, you don’t have to have as many users as ClassPass to make use of recurring billing or pricing tiers.

Small businesses can also introduce recurring billing. Whether you offer gym memberships, dog-walking, or teaching classes online, you can use billing management software to simplify the billing process.

If you introduce pricing tiers, your customers can choose a suitable plan as soon as they register, and it’s smooth sailing from there. You receive the payments, and they can continue using your services without worrying about the subscription renewals.

Automating doesn’t have to be utilized for simple transactions only. Good billing software can handle complex, recurring payments, which you can easily oversee and manage.

Collect and Process ACH/EFT Direct Debit Payments

One of the first features you should look for when choosing your billing management software is what kind of payments it processes. ACH/EFT direct debit payments are the most popular, which isn’t surprising, considering their low fees.

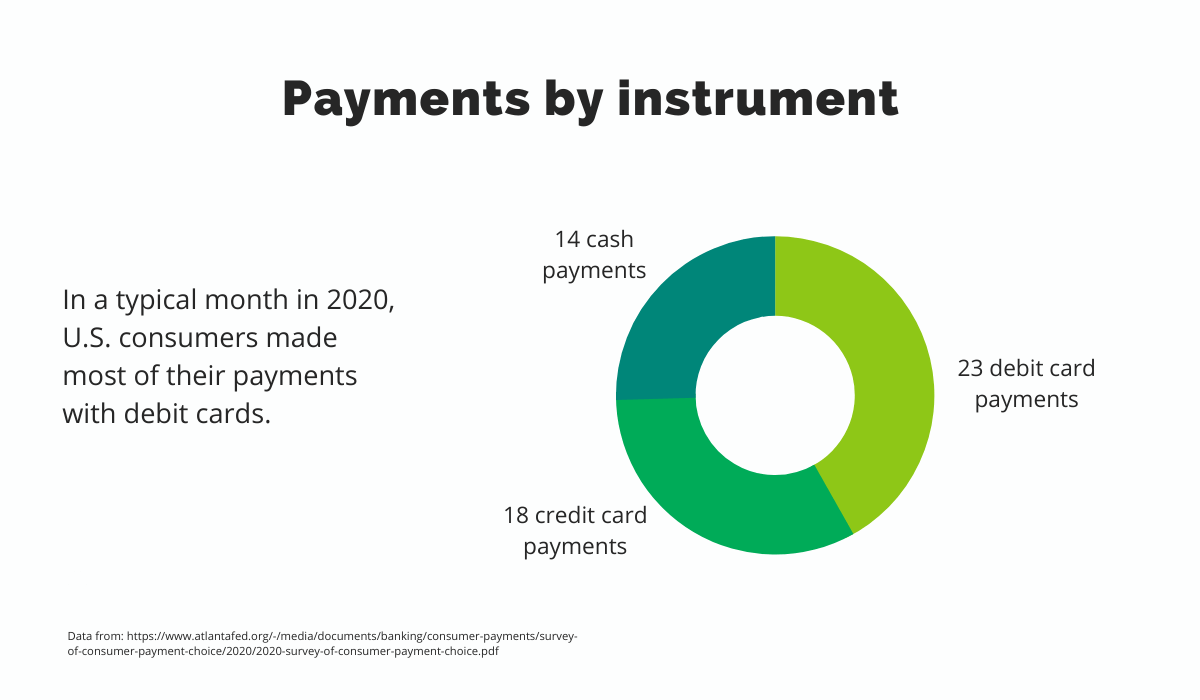

When deciding on the payment methods for your business to accept, you should consider not only which methods are easy to implement, but also think about which ones customers use the most.

Among U.S. consumers, debit cards were the most frequently used payment instruments in 2020, followed by credit cards.

Source: FRB Atlanta

Debit cards are processed in real-time. For business owners, this means that the funds they receive are available sooner.

On the other hand, the processing fees that come with debit card transactions can get pricey when they accumulate. If you’re looking to lower the fees, ACH payments might be a good choice.

As we wrote in an earlier post, electronic funds transfers (EFT) move money at a lower cost compared to other payment methods. One of the most frequently used sub-types of EFT is automated clearing house (ACH).

ACH is a network used for electronic money transfers between U.S. bank accounts.

More and more transactions are made with ACH every year; the payment volume on the ACH network increased 7.7% in 2021 compared to the previous year.

Note that as opposed to debit card transfers, it can take up to a few business days for an ACH transaction to get processed, so consider that when planning your business activities. However, the upside of ACH is inexpensive fees.

All things considered, small businesses should adapt to their customers’ payment preferences and enable debit card and ACH payments. Make sure to find a billing system that supports both, so that you can collect and process your payments with ease.

Facilitate Document Creation

Billing management tools are versatile; there is more than one way they can upgrade your business. In addition to helping you with payments, such software can create invoices, receipts, templates, and other documents.

We’ve already established that a solution for repetitive payment management tasks lies in automation. The same goes for handling the corresponding documentation.

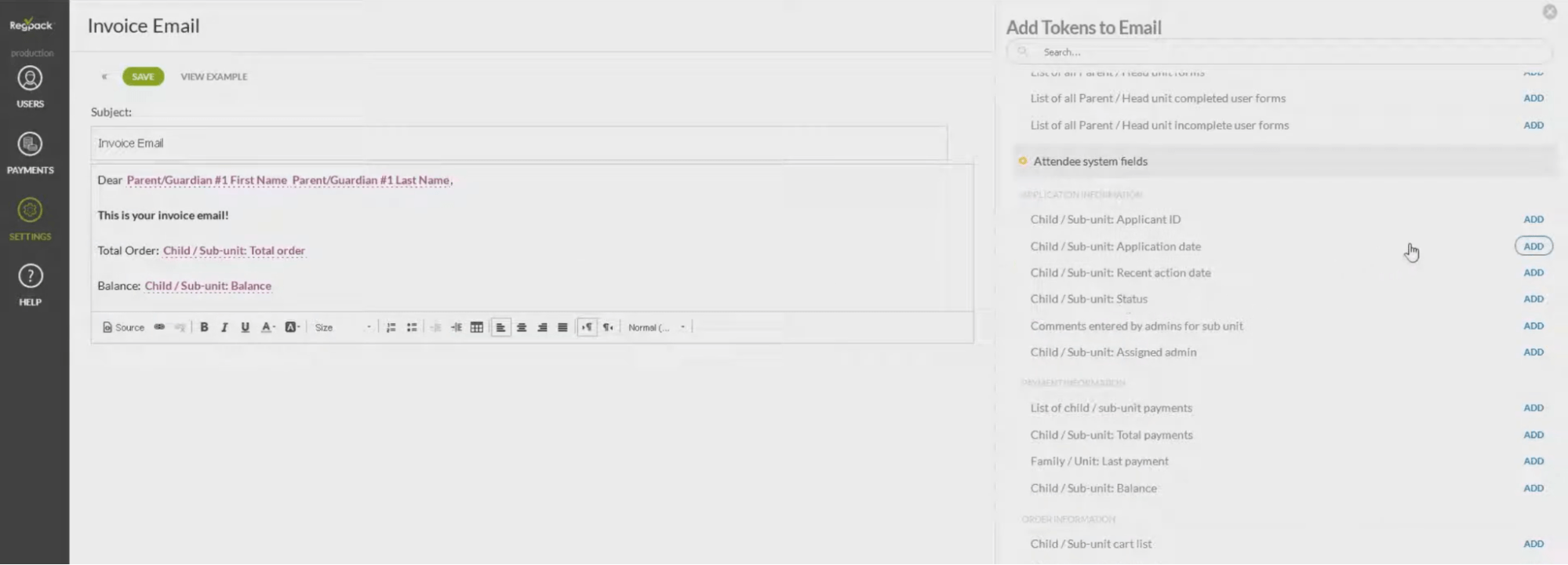

For instance, Regpack’s automated billing software lets you accept payments and send invoices online. You can use our automatic emails for sending invoices to inform your customers of what they ordered and how much they paid.

But if you wish to provide additional information or send personalized messages, you can also do that via templates.

It is easy to create templates for different types of orders or customers. That way, you don’t have to compile emails from scratch every time you want to include more details in an invoice. Fill in the parameters once, and simply build on that next time.

Let’s say you’re composing an invoice email to let your customer know some additional details concerning their purchase. To do that, you first have to list information on payment and purchased services.

Instead of retyping those details from somewhere else, Regpack allows you to use categorized tokens and extract all the info you need with one click.

Source: Regpack

You can include as much information as you like in no time.

Not all the documents you create with the help of billing software have to be related to communication with customers. You can also create internal reports for a clear overview of sales and customers.

Still, a large part of every manager’s tasks has to do with customer communication. Let’s see how you can utilize billing management software to make communication more efficient.

Automate Your Communication With Customers

Good communication with customers can amplify the quality of products or services you’re selling. However, that doesn’t mean you should spend ten hours a day typing emails; let the software work for you.

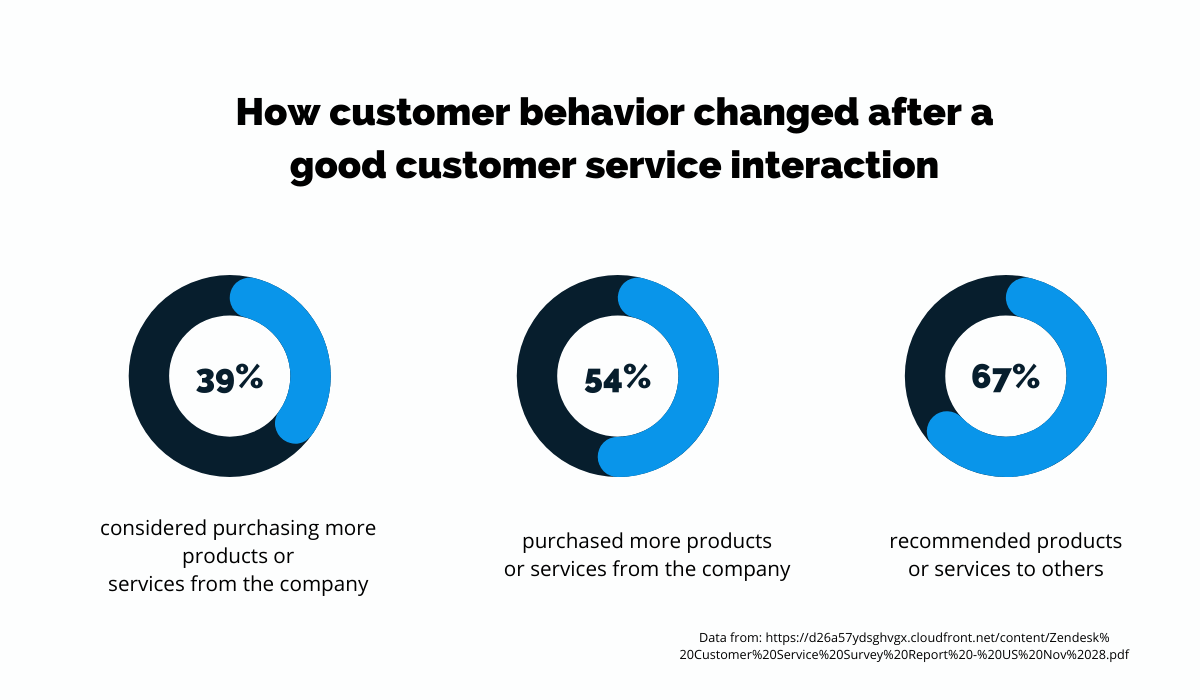

A Zendesk study on purchasing habits found that 87% of customers who had a good customer service experience with a company changed their future buying behavior in a positive way.

Sixty-seven percent of them reported recommending the company to other people, and more than half (54%) purchased more products or services later.

Source: Regpack

Communicating with the customers involves more than resolving issues with customer service. Ideally, it starts as soon as customers register with you.

A well-written welcome email sets the tone of your relationship with the customer. According to InboxArmy, customers who receive welcome emails show 33% more engagement with the brand.

However, welcome emails are not the only ones to send to engage with your customers.

We’ve already written about the importance of other types of emails you should send, and different types of emails related to payments, such as payment reminders or notifications of failed payments, are in that category.

For example, let’s say a customer’s card expires, and your transaction cannot be processed. When you have all billing information and email communication in one system, you can schedule automatic grace period offers and use templates for quick follow-up emails.

In short, the right billing software can help you manage this type of communication with your customers.

Regpack’s automatic communication system includes email templates that you can adjust according to your needs. You can also filter users to make sure each customer receives emails directly related to their needs.

Track Monthly Payments and Revenue

The feature that really puts billing management tools above manual invoicing is the ability to create reports that give you insight into your revenue.

When you write invoices by hand, you set them aside after the transaction and probably never look at them again. That way, it can be difficult to appraise the state of affairs.

By utilizing a piece of billing software, not only are you only making the billing process quicker; you’re also building a database of information you can later use to examine the details of your business.

You can’t know how well your business is doing without analyzing the right, current data. Tracking data on payments and revenue is also important for planning future business activities.

Using one tool for managing your customer information, registration, and payment means there’s no need to copy and paste information from different sources and spreadsheets. All the data you need is in one place, waiting for you to generate reports whenever you want.

Source: Regpack

Also, creating monthly reports can shape how you operate your business. You can utilize your billing software to make sense of all your data.

With a system like Regpack’s, you’ll be able to use the statistical analysis engine to generate reports and graphs with only a few clicks.

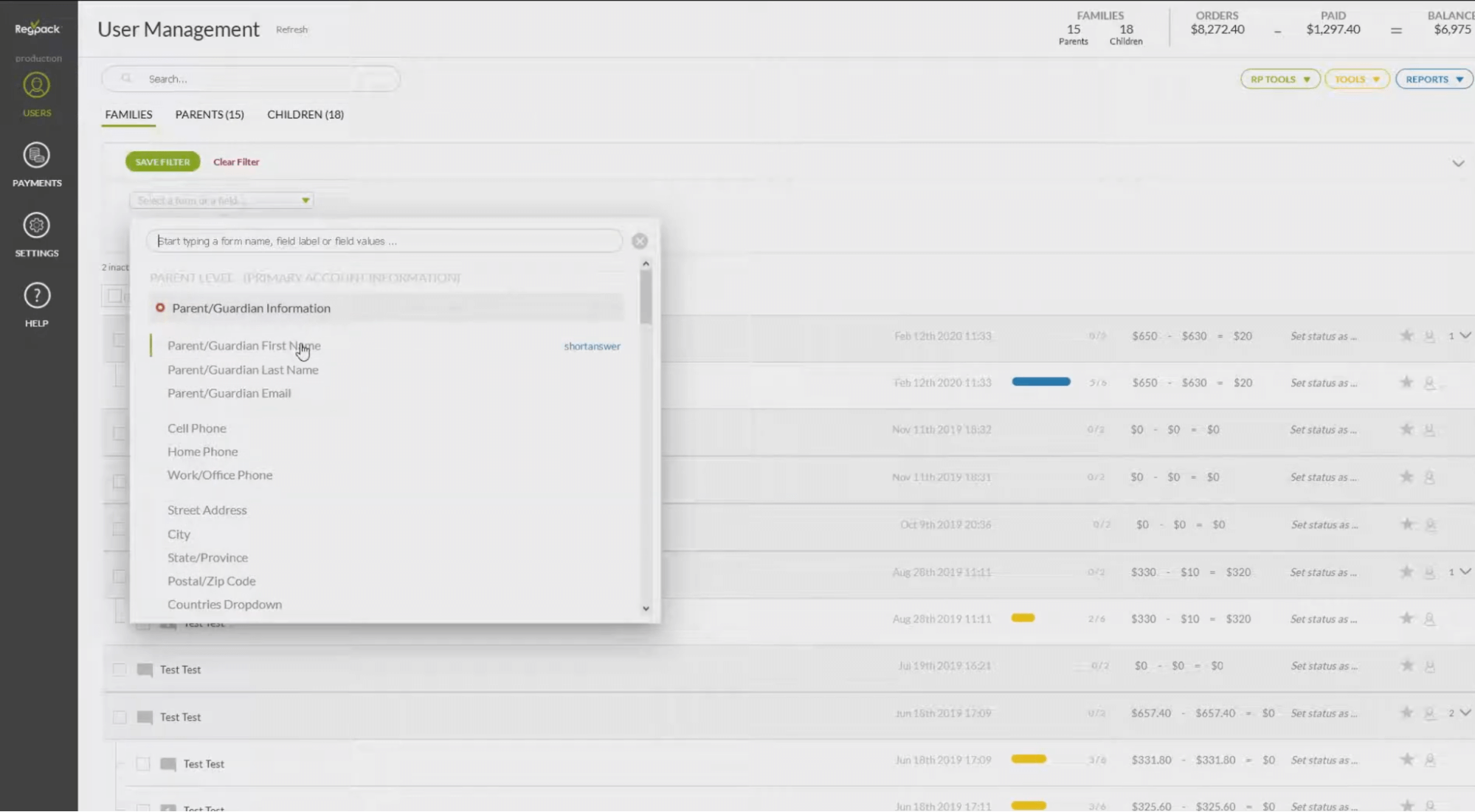

Finally, customizability is a must-have feature for your billing software. Not all data is equally important for all aspects of your business, so you have to be able to filter relevant information.

Source: Regpack

If you’re compiling a list of customers who are yet to pay their installment for the ongoing month, you aren’t interested in their age or location.

Regpack allows you to filter the data easily so you can generate straightforward reports. You can export the data in all the commonly used formats, such as XLS or PDF, and share them with your accountant or other staff.

Store and Manage Customer Information Securely in the Cloud

With so many billing solutions out there, it can be difficult to find the best one for your business. A feature that should be high on your priority list when looking for the perfect solution is data security.

If you want to ensure that the customer information you’re handling is enjoying maximum protection, you should store the data in the cloud, properly encrypted.

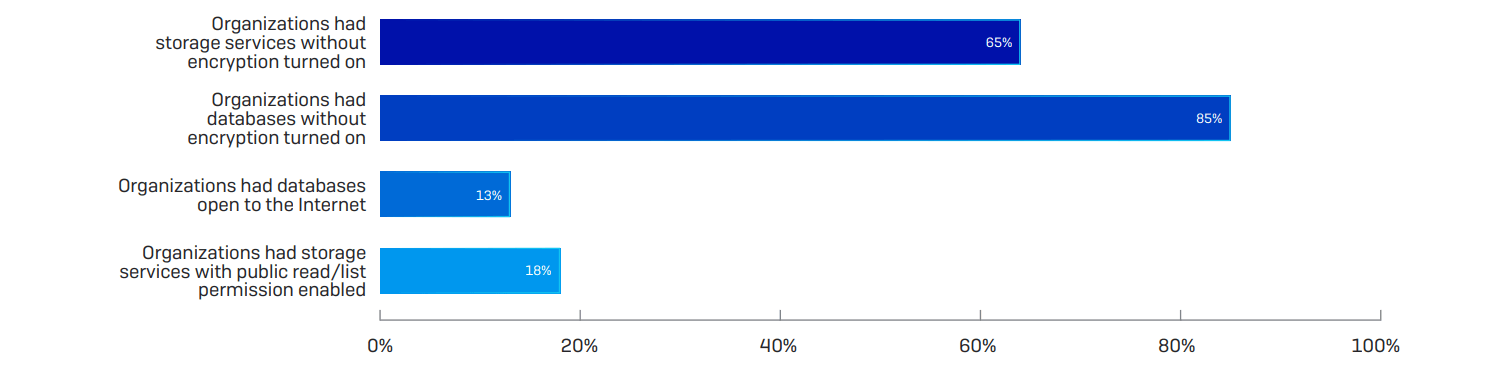

Of course, there is no 100% secure solution for storing data; even the Pentagon has been hacked. Still, the leading cause of data breaches is not the hackers’ cunning; it’s the fact that organizations leave information unprotected.

A study by Sophos has found that more than 65% of organizations left their storage services and databases unencrypted.

Source: Sophos

Leaving your data unprotected in this way makes it easy for attackers to see and read your information. Customers care about their privacy, and you should too. Therefore, a good place to start is choosing billing software from a company that prioritizes security.

At Regpack, all sensitive information is encrypted with a unique key per user. In other words, no one can view or use information without the key algorithm connected to the specific project, user, and server.

In addition to increased security, cloud storage makes authorized access to your data easier. COVID-19 has proven the importance of the ability to access data from different devices and locations.

Depending on the size of your company, it may be helpful for multiple employees to access and manage your clients’ registration and payments.

Additionally, when choosing a billing management system, make sure it has automatic backup to keep your data safe and updated.

All in all, storing data online can reduce security and access issues. A billing solution you choose has to follow security protocols and back up your data periodically, so no information is lost.

Conclusion

Who would’ve thought that billing software can have so many benefits, right? Now that you’re familiar with its many uses, perhaps it’s time to put your software to work in more ways than before.

Recurring billing can save service-based businesses time, and it also eradicates the possibility of a customer forgetting to pay an installment.

You can also use your billing solution to generate reports and other documents, as well as automate communication. In fact, automation is an excellent time-saving method.

Finally, you can tie all these features together by choosing a reliable, secure software solution.

Interested in hearing what else Regpack can do for your business? Call us today.