The future of billing is digital, and small-business owners are aware of it.

Electronic billing is becoming a standard, pushing out manual invoicing. Experts estimate that the e-invoicing market will grow by $15.5 billion between 2021 and 2025, and there are good reasons for such a staggering increase.

Implementing an electronic billing system will save you time and money on activities you’d otherwise have to labor over for hours.

A simple change can transform your payment management practices, and it can also make the payment process easier for your customers.

So, let’s see what makes investing in electronic billing worth it.

Jump to section:

Offers Flexibility in Payment Options

Facilitates Faster Payments

Reduces Invoicing Costs

Provides Better Fraud Protection

Enables More Accurate Financial Planning

Helps Maintain Better Financial Records

Offers Flexibility in Payment Options

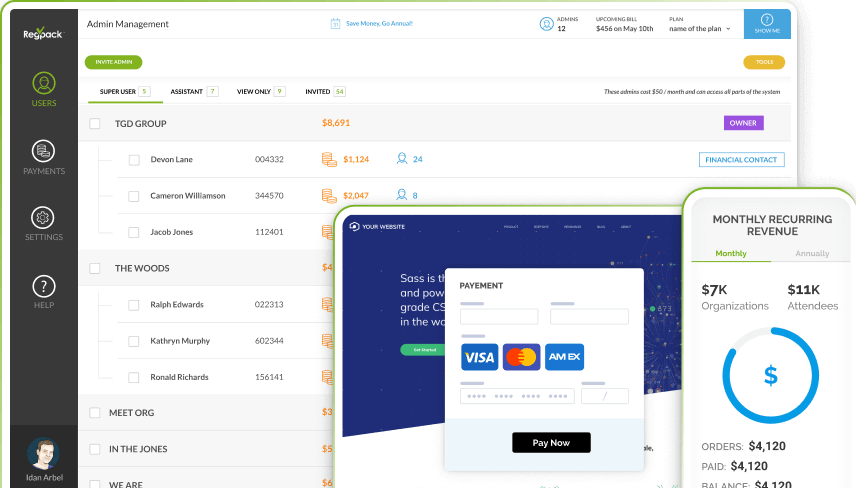

Customers like having control over their payments. If you want to offer them flexibility and convenience regarding payment options, you should consider using an electronic billing system.

They will value the ease of access to their financial information, now more than ever.

A 2020 financial survey has shown that 78% of consumers want real-time access to their financial information, and 62% want to be alerted about bills due via mobile or email.

Businesses have a hard time meeting such demands without utilizing electronic billing systems. They grant your customers an instant overview of their balance, and that is the convenience customers are looking for.

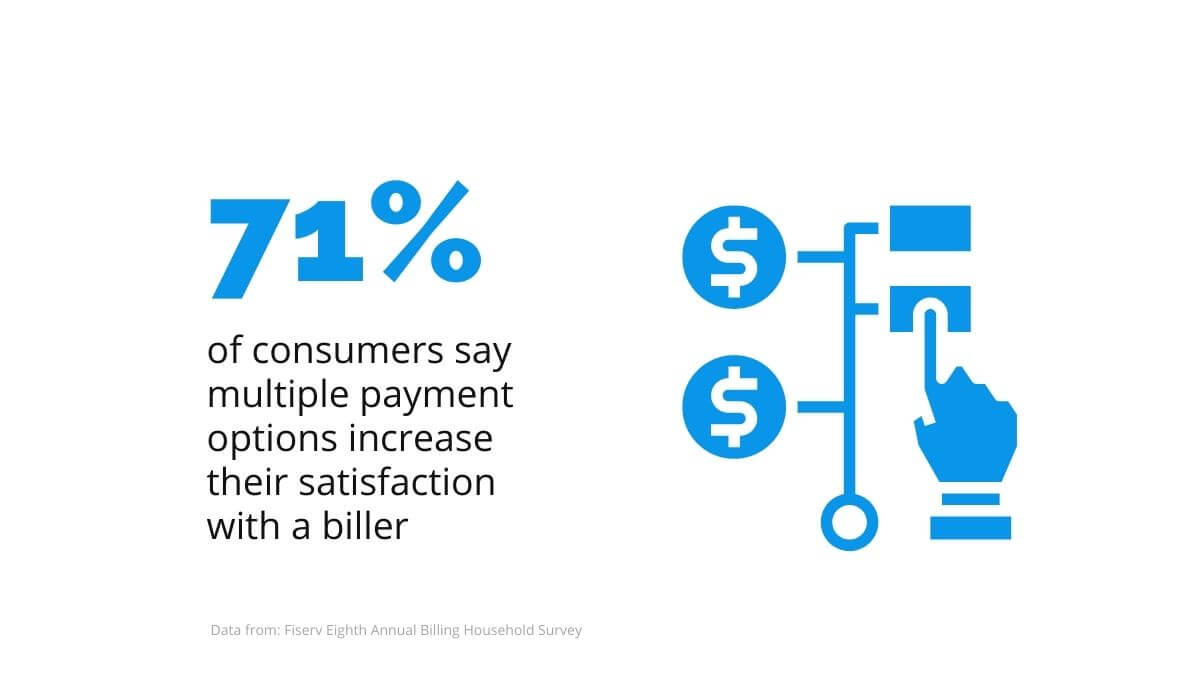

Similarly, customers appreciate being able to choose among several payment options. More than two-thirds of consumers say being offered multiple ways to pay increases their satisfaction with a service provider.

Source: Regpack

If you fail to fulfill your audience’s payment requirements, they won’t hesitate to take their business elsewhere.

But when you adjust your billing methods according to your customers’ preferences and give them the flexibility to pay however they want, you’ll get satisfied and loyal purchasers in return.

So, polishing your payment practices prevents your customers from looking for other vendors. Electronic billing systems can get you a leg up on the competition. They make the payment process easier and more flexible.

Your customers can decide how to pay and authorize the payment wherever they are, which makes it easier for them to manage their finances.

In addition to the flexibility of payment options, electronic billing lets your customers pay whenever they want, which leads to faster payments. Keep reading to find out how.

Don’t Limit Your Customer Pool!

Offer Multiple Payment Options Seamlessly

Facilitates Faster Payments

You can minimize the risk of late or missed payments by ensuring that your customers don’t have to wait for the invoice to arrive days after their order.

For instance, automatically generated electronic invoices let your customers see how much they have to pay right away, so they can settle the bill as soon as possible.

A significant benefit of electronic billing is that it allows you to skip several steps in the process. You no longer have to wait for an employee to confirm the order, generate the invoice, and then mail it.

Instead, you can automate the billing process and cut the time spent on initiating the payment.

Businesses aren’t the only party benefiting from no-delay payments.

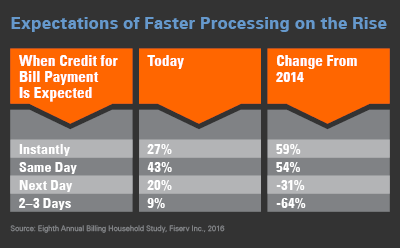

Did you know that customers also want their payments to be finalized quickly? Speedy finalization used to mean a couple of days, but nowadays, almost half of the customers expect same-day payment processing.

Source: Fiserv

Customers who are eager to complete their payment quickly are an asset to every business. If you have them, you should strive to keep them.

Selecting a reputable electronic billing company can help you with that. Customers like knowing what is going on with their money, so reassure them that their transactions are processed swiftly and securely.

Unfortunately, not all customers are that quick to pay the bill. Here, electronic billing comes to the rescue once again, this time with payment reminders.

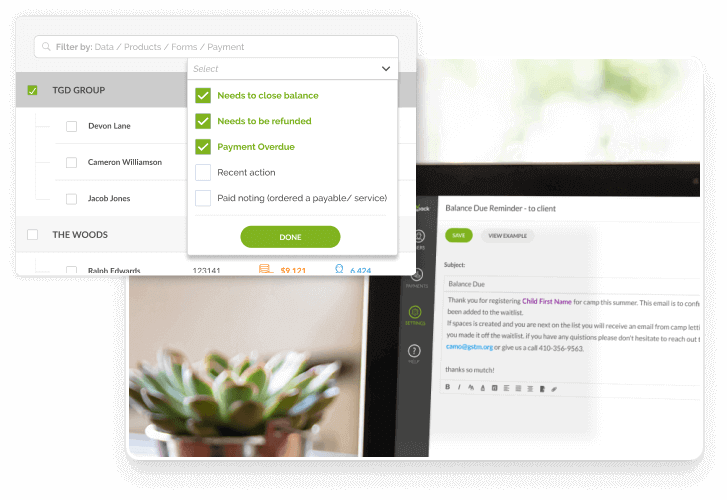

Source: Regpack

Having an overview of all payments and the clients’ payment history is an advantage that puts electronic billing above old-school billing methods.

When you have a clear display of who owes you what, you can effortlessly compose reminders to facilitate payments faster.

All businesses want to get paid fast, but small businesses especially depend on timely payments.

Using ongoing payments to cover future costs instead of relying on accumulated savings means it’s in your best interest to collect payments faster.

This is why you have to choose an electronic billing provider that can make fast payments possible, while also offering solutions to any hiccup that may occur anywhere in the payment process.

Reduces Invoicing Costs

Running a profitable business means having to find ways to cut costs while maintaining your service quality. Thankfully, one of the benefits of electronic billing is a considerable reduction of invoicing costs.

Let’s start this section by breaking down the costs that go into traditional paper invoicing. To issue an invoice, a business has to cover the following:

- Staff time

- Processing work

- Cost of paper

- Printing

- Buying envelopes

- Postage

- Storage costs

- Reconciling errors

As you can see, it’s a lengthy process, and if an error occurs, you have to start the cycle anew—multiplying the cost.

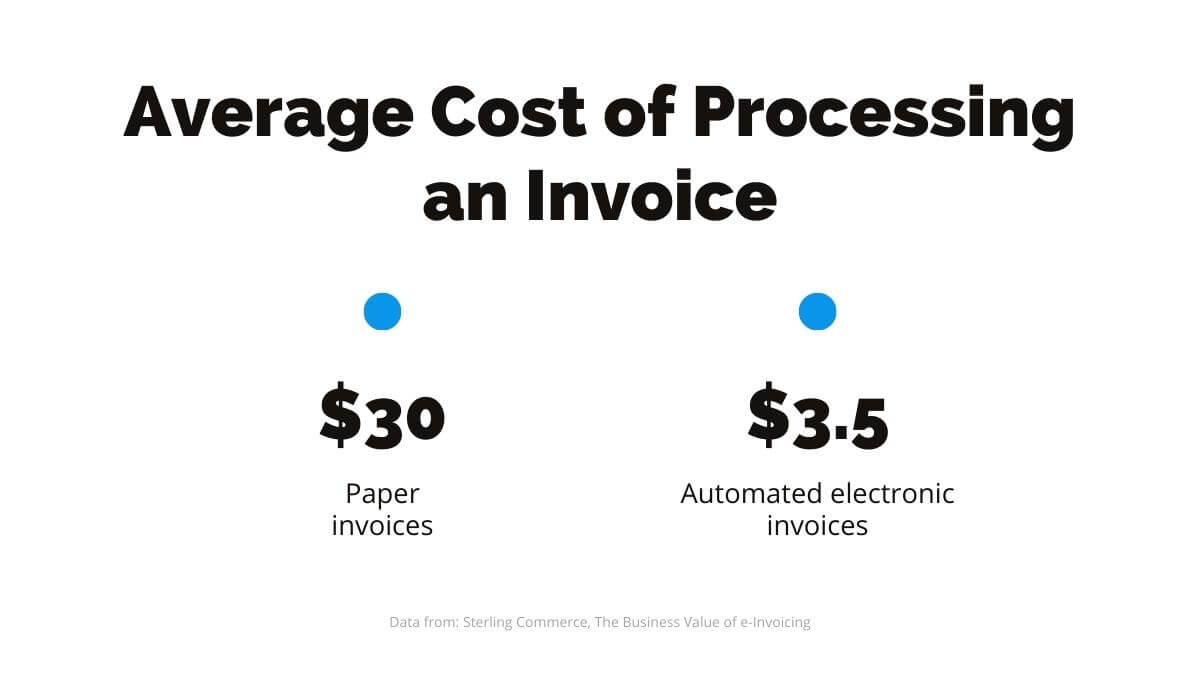

Financial analysts from Sterling Commerce were interested in the true cost of paper invoices compared to electronic ones. They found that the average cost of processing a paper invoice is $30.

On the other hand, it takes only $3.5 to process a fully automated electronic invoice.

Source: Regpack

Based on this data, electronic billing allows you to lower invoicing costs by as much as 90%.

If you still aren’t sold on electronic billing, maybe the following finding manages to convince you.

Each paper invoice error costs companies $53.50 to rectify, according to the paper.

With electronic invoicing, the chances of error are much lower. However, if errors do occur, they certainly don’t cost as much to amend.

The cost-effectiveness of electronic billing systems is noticeable in more than the money you save on envelopes. The process is more environmentally friendly, which younger generations value highly.

In fact, 62% of online bill payment users claim that the environment is a key factor in the decision of how to receive and pay bills.

So, besides saving money on invoicing, electronic billing could also get you additional profits from the new customers you attract by advertising your green payment practices.

Decrease Non-Payment By 75%

With Flexible Payment Plans!

Provides Better Fraud Protection

Electronic billing systems minimize the risks to your customers’ financial data. Whether you’re concerned about malicious attacks or damage caused by human error, moving your invoicing to the digital space is a safer option.

We’re not going to sugarcoat. Electronic transactions can’t guarantee 100% security–no payment method can.

However, an electronic billing system certainly is more secure than snail-mail invoicing, especially if you take caution with how you process card payments.

Since small businesses often rely on third parties to process payments, it’s essential to select a provider that complies with all legal payment requirements and has strategies in place to ensure data security.

Encryption is also essential. Even if an unauthorized party gains access to your data, if it is encrypted, they will not be able to read it.

Source: Regpack

Of course, not all monetary losses happen due to fraud or cyber-attacks. Human error can also cost businesses millions of dollars.

Earlier, we mentioned the high cost of rectifying erroneous invoices. To paint a picture of how disastrous such mistakes can be, let us tell you about the time when the government mailed 500,000 absentee applications with inaccurate information.

In August 2020, a Center for Voter Information worker incorrectly aligned a spreadsheet that matched the voters with their local election office, and the documents were mailed like that.

After the mistake was noticed, all the absentee applications had to be reorganized and resent.

Even if a new application only cost a dollar to mail again, we’re still talking about half a million dollars lost.

Hopefully, you’ll never get into a position of racking up such a cost, but this story just goes to show that manual data entry errors can be as harmful as costs incurred by fraud.

On top of that, human error is almost always present in fraud cases and internet security violations. A 2019 cybersecurity analysis has shown that human error accounted for 90% of data breaches.

All in all, you can protect your business against fraud by ditching manual billing and working with a high-standard billing system provider. Requiring your staff to handle the data safely and securely will further contribute to fraud protection.

Enables More Accurate Financial Planning

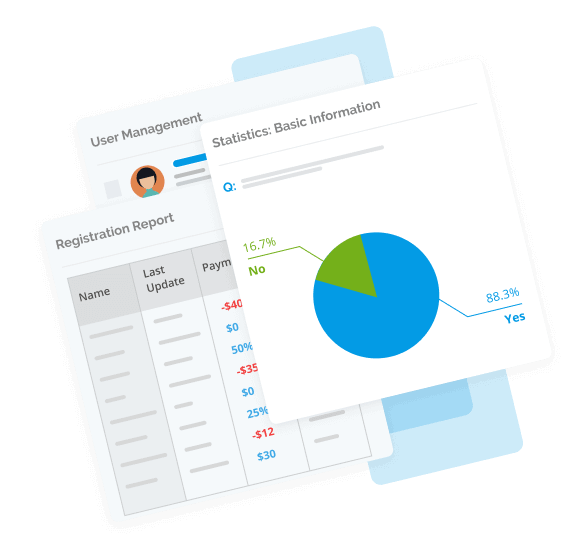

Rather than compiling payment info from different platforms, an electronic billing system can streamline the planning process by giving you an overview of all the payments in one place. A better overview of data allows for more accurate financial predictions.

Running a business is stressful, primarily due to the unpredictability of the market. This is why a responsible business owner has to know how profitable his or her endeavors are.

Calculating the future cash flow is even more critical.

According to a 2020 report on small businesses, 86% of firms would need to take some action to supplement funding or cut expenses if they faced a two-month revenue loss.

Seemingly negative, this piece of information still tells us that American businesses plan enough ahead to be able to tackle future challenges.

Still, you can’t plan for the future without an accurate insight into your financial situation. This is where electronic billing systems can help you greatly.

Source: Regpack

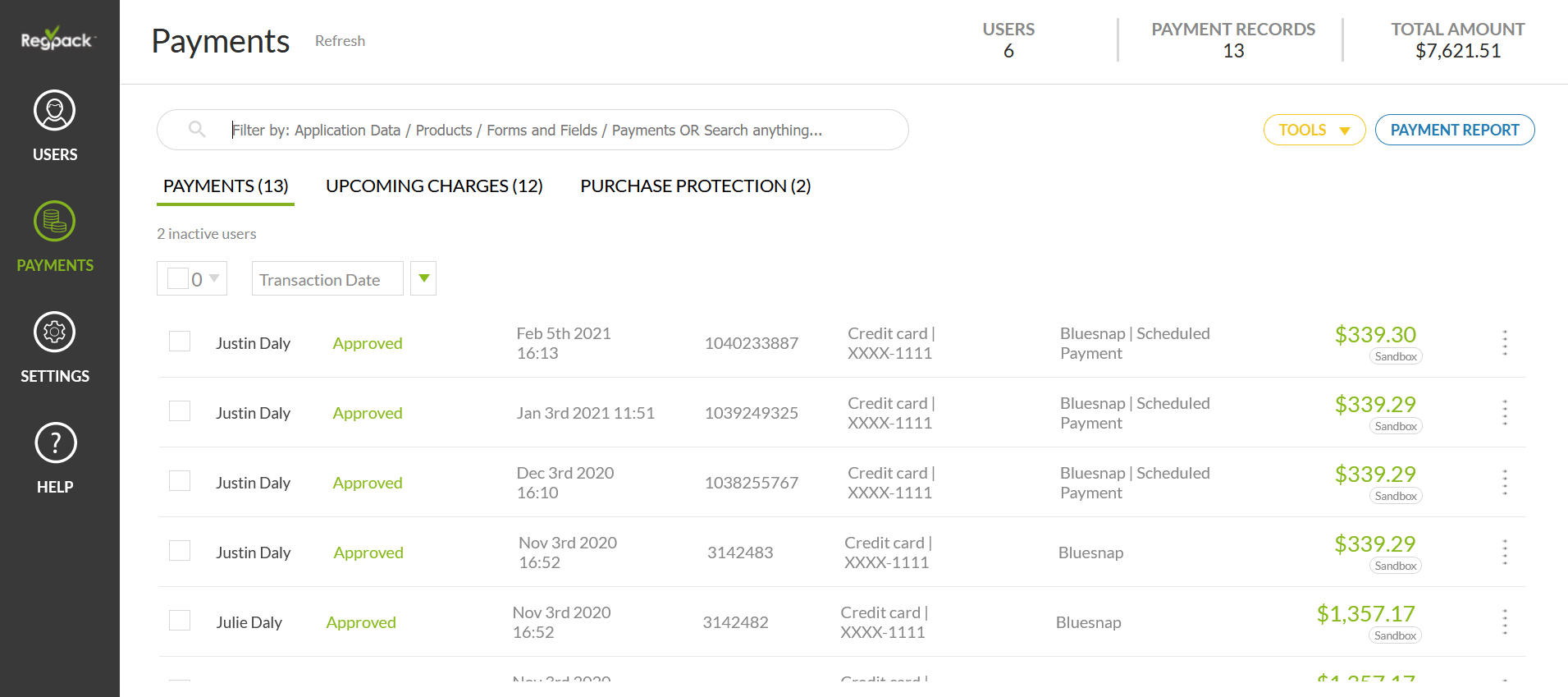

An electronic billing system like ours can show you the payment status for each customer.

Regpack displays all payments, transaction dates, and other details, as well as future charges your customers have scheduled with recurring billing. It also shows if there are any missed payments.

Utilizing an electronic billing system will benefit your financial planning process. It provides you with a clear representation of your finances in a matter of clicks.

Our automated billing software, Regpack, comes with a statistical analysis engine, which you can use to generate financial reports with ease.

Source: Regpack

A clear insight into payments helps you create a more accurate cash flow prediction, which is vital for organizing and planning your future activities.

Helps Maintain Better Financial Records

Just like with financial planning, electronic billing helps you keep financial records in line. It lets you see exactly when, how much, and how your clients have paid.

Planning any changes in your business calls for going through financial records. Well-organized records will also help you with:

- Monitoring your progress

- Preparing financial statements

- Identifying sources of income

- Keeping track of your expenses

- Preparing tax returns

If you were to do paper invoicing, you’d have to develop a complex filing system to be able to reach your documents when needed, and that still wouldn’t guarantee always finding the necessary invoice.

With electronic invoicing, you can pull all financial records you need in a few seconds, analyze them on your own, or forward them to your accountant instantly.

Source: Regpack

Keeping financial records is required by the law. The IRS requires companies to keep their records for up to seven years.

Imagine seven years’ worth of paper in your office; folders and boxes piling up all the way to the ceiling. You can easily avoid such organizational problems with an electronic billing system that stores your data and performs regular back-ups.

We’ve already mentioned that electronic billing reduces inaccuracies in invoices, resulting in fewer disputes.

However, if a dispute does occur, the electronic base of all payment information will help you quickly find the source of the dispute and settle it.

Accept Payments Online, Right On Your Website!

Streamline your checkout process, offer payment plans, and more!

Conclusion

Technological advancements in the financial sector have made manual invoicing and billing lose their appeal. Not only is manual billing more expensive, but it’s also more prone to errors.

In comparison, electronic billing offers numerous benefits.

It provides your customers with payment option flexibility, contributing to client satisfaction.

Once you set up an electronic billing system, you no longer need an operator to confirm orders and issue invoices, which cuts down on waiting time. Customers can see and pay the invoice immediately, getting you your payment faster.

Electronic billing systems also help prevent losses incurred by manual errors or fraud.

Finally, electronic billing can streamline the way you create financial reports and access your financial statements.

To reap these benefits, you should select a well-designed billing solution that will make payment management simpler. Choosing Regpack will help you spend less time on invoicing and more time on running your business.