Did you know that the average small business spends 12 days a year chasing debts?

If you’re feeling the impact of getting paid late or not getting paid at all, you’re clearly not alone.

Nevertheless, you shouldn’t accept this as the new normal and continue wasting time chasing payments. Instead, revisit your invoicing practices and find ways to improve them.

We’ll go through the six most common customer billing mistakes that might be costing you more than you know.

If you want to speed up your payments and make sure you actually get your money on time, take a look and see if you’re making some of these mistakes yourself!

Jump to section:

Not Defining the Billing Terms in the Contract

Waiting Too Long to Bill the Customer

Failing to Clarify the Payment Terms on the Invoice

Sending Out Invoices With Errors

Accepting Too Few Payment Options

Letting Late Payments Slip

Not Defining the Billing Terms in the Contract

Not stating your terms and conditions (T&C) is one of the biggest mistakes you can make in billing.

Without them, the customer can’t understand what they’re paying for or which rules apply to the purchase.

If you don’t specify those, you shouldn’t be surprised if the customers simply don’t abide by the terms or skimp on paying.

Let’s say your contract states what you are offering the customer and what amount of money you expect in return. That’s pretty basic.

However, if it doesn’t display other terms like the payment date, the customer can pay you whenever they want. After all, there’s nothing in their contract to stop them.

Source: Regpack

Failing to specify the billing terms in the contract can also be a massive disadvantage in case of a payment dispute, which will inevitably happen when customers don’t pay you.

The court will not rule in your favor unless the terms and conditions are clearly listed in your contracts.

Therefore, the T&C section protects your business from customers trying to get off without paying, so it’s essential that you clearly state them in your contract.

If you’re unsure what the T&C section of the contract should look like, here’s an excellent example from a gym. In it, the owners explained:

- Different types of memberships, including how to renew, freeze, or cancel them

- Current offers, seasonal discounts

- Gym rules and working hours

- Payments, including late fees and discounts for advanced payment

In other words, the gym owners detailed everything the customer gets by signing the contract and all the rules they agree to follow.

For instance, if a customer cancels their membership on January 20th, and gets the bill on February 1st, then files a complaint about it, it would be difficult to prove that he or she is in the wrong without referring back to the terms defined in the contract.

But, if you read the gym’s T&C, you will see that they ask the clients to give “no less than 30 days notice” for cancellation. Therefore, the customer needs to pay the February bill.

Stating at least your basic T&C will help protect your business from customers who don’t intend to pay you.

Waiting Too Long to Bill the Customer

Another big mistake businesses are often guilty of is not billing the customer as soon as they deliver the product or service.

The truth is, the sooner you deliver the bill, the faster you will get paid.

If you wait for days or even weeks to invoice your customer, they probably won’t see it as something urgent, and you will not be getting your money as soon as you’d hoped.

Of course, you can invoice a client later down the line and pursue the debt for anywhere between 3 and 20 years, depending on the state you’re in.

Even if the contract isn’t a written one, you’re allowed to pursue it for a minimum of 2 years in all states. However, debt collecting consumes your time and energy and is often more expensive than simply writing the debt off.

Source: Regpack

But, this doesn’t mean you should accept non-payments as a fact of life. As we’ve said, you can prevent them by invoicing immediately after delivering the product or service, as this improves your chances of getting paid.

If you’re in the type of business where the client is on-site with you, try to invoice them in person right away.

When you’re online-based, this simply won’t be possible. In that case, you can just email the invoice as soon as you deliver the product or service.

It might be impossible to stay on top of same-day invoicing if you’re understaffed or have to generate too many bills at once.

Luckily, technology has evolved and now has a perfect solution in terms of billing and payment software which allows you to automate not onlyinvoice creation, but also the payment process.

In any case, it’s crucial to invoice ASAP.

Failing to Clarify the Payment Terms on the Invoice

Unclear terms are better than no terms, sure, but this doesn’t mean you should only write down the very basics and leave the customers to fend for themselves. This can also delay payment.

Instead, put yourself in your clients’ shoes and think about what you would want to see on the invoice. What terms would interest you?

Most likely, this is the information you’d find necessary to proceed with the payment:

- Required amount

- Available modes of payment

- Payment deadline

- Discounts for early payments

- Fines for late payments

Most of these items are pretty self-explanatory. The customer has to know how to pay and how much.

We’ll touch on why it’s important to offer different payment methods later, but keep in mind that it’s necessary to define which methods you accept.

Of course, as mentioned earlier, without the deadline, you can’t expect people to pay on time. No deadline means they can pay whenever they want, which won’t do much good for your business.

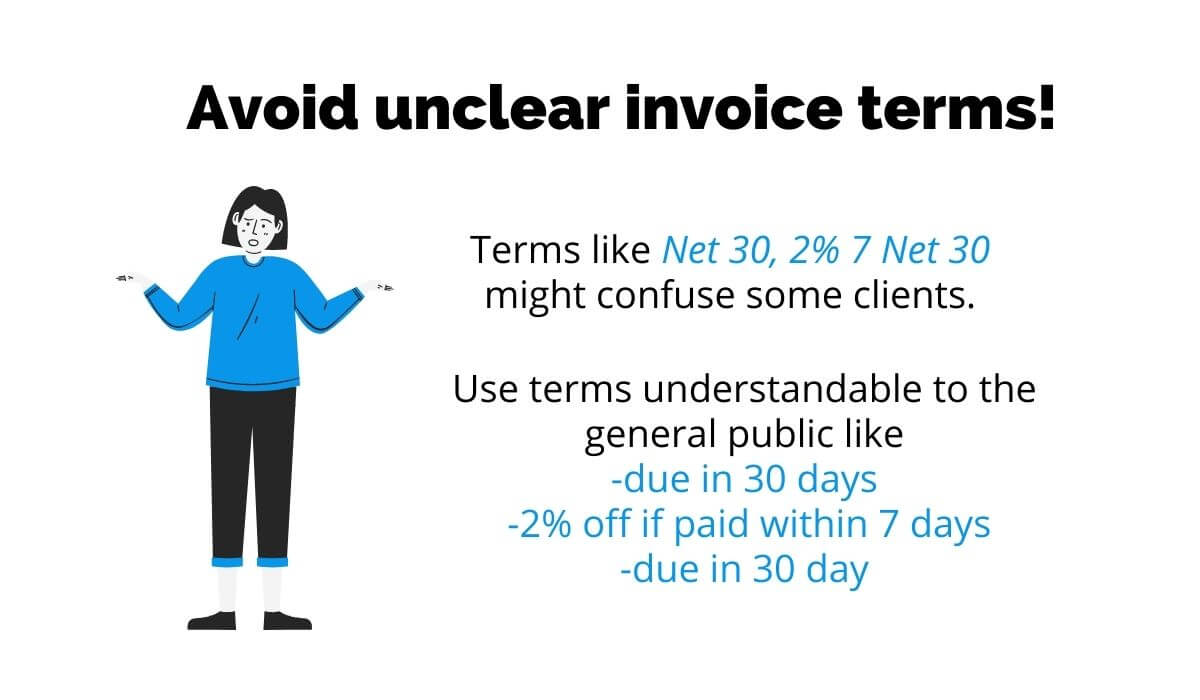

So, adding a simple “Due in 30 days” clause will help you tremendously. Some companies opt to simply phrase it as “Net 30”, but if your customers aren’t familiar with this language, maybe it’s best to use layman’s terms.

Source: Regpack

The same goes for any discount you offer for early payment or fines you will charge in case of late payments.

For example, “2% 7 Net 30” might confuse some of your customers, who will not understand that this means they are eligible for a 2% discount if they pay within the first week of getting the invoice.

However, if you write something like “2% discount for payment within 7 days”, this will likely motivate more customers to pay early.

Here’s some food for thought: a survey showed that 58% of the invoices containing the term “7 days” actually get paid within seven days. At the same time, only 40% of invoices with the expression “30 days” actually get paid on time.

Therefore, the shorter the deadline, the higher your chances of getting paid. Take that into account when setting and clarifying your payment terms.

Sending Out Invoices With Errors

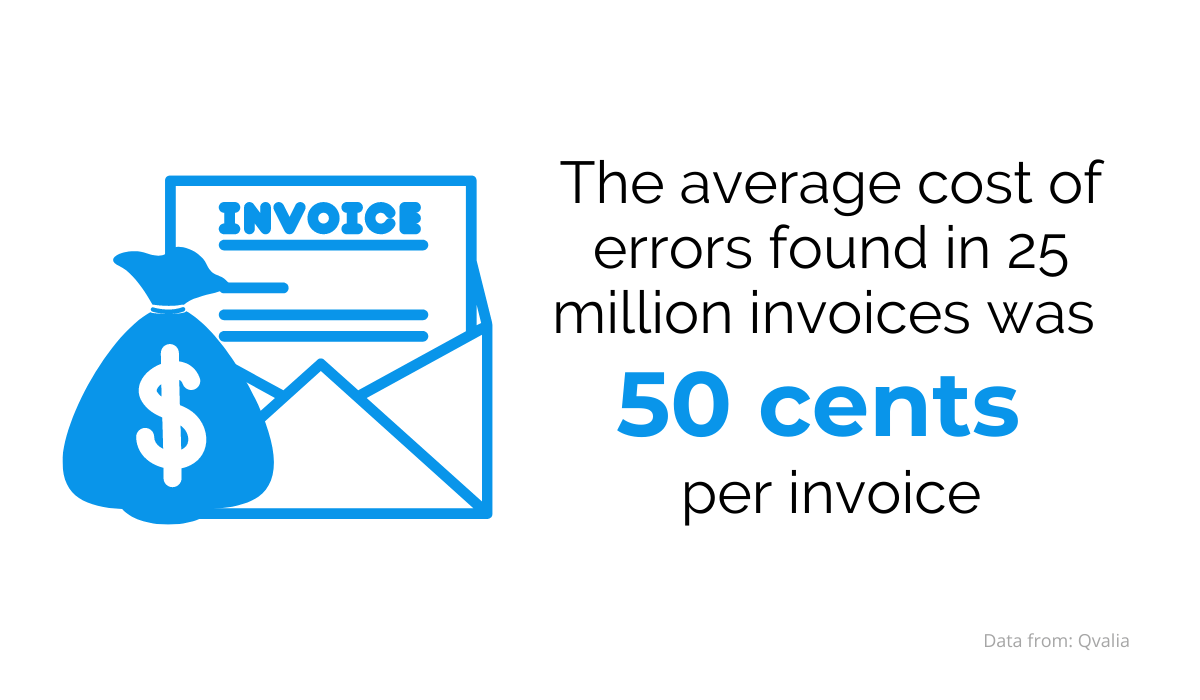

Did you know that 61% of US invoices contain at least one error?

A typo or two might not make or break your business, but numerical errors within your invoices just might.

Although a misspelled word will not interfere with the customer’s ability to pay you, it will negatively affect their satisfaction with your brand.

If a customer notices spelling errors in your invoice, they are likely to lose trust in your company, research shows.

Numerical errors are even worse: if your customers end up paying more than they should have, your customer satisfaction will suffer. On the other hand, if they pay you less because of your mistake on the invoice, your bottom line will suffer.

Qvalia has inspected over 25 million Nordic invoices issued by around 100 organizations and found that the average loss of undetected invoice errors was €0.44—or roughly 50 cents—for every managed invoice.

Source: Regpack

These are entirely avoidable costs, and they just prove that even the smallest errors in invoicing can lose you money in the long run.

When the invoice errors are related to the payment terms or bank details, the customer will postpone paying until they get the correct information, which might take a while.

In that way, you’re the one responsible for the fact that the payment is delayed, so you can’t really charge such customers the late payment fee.

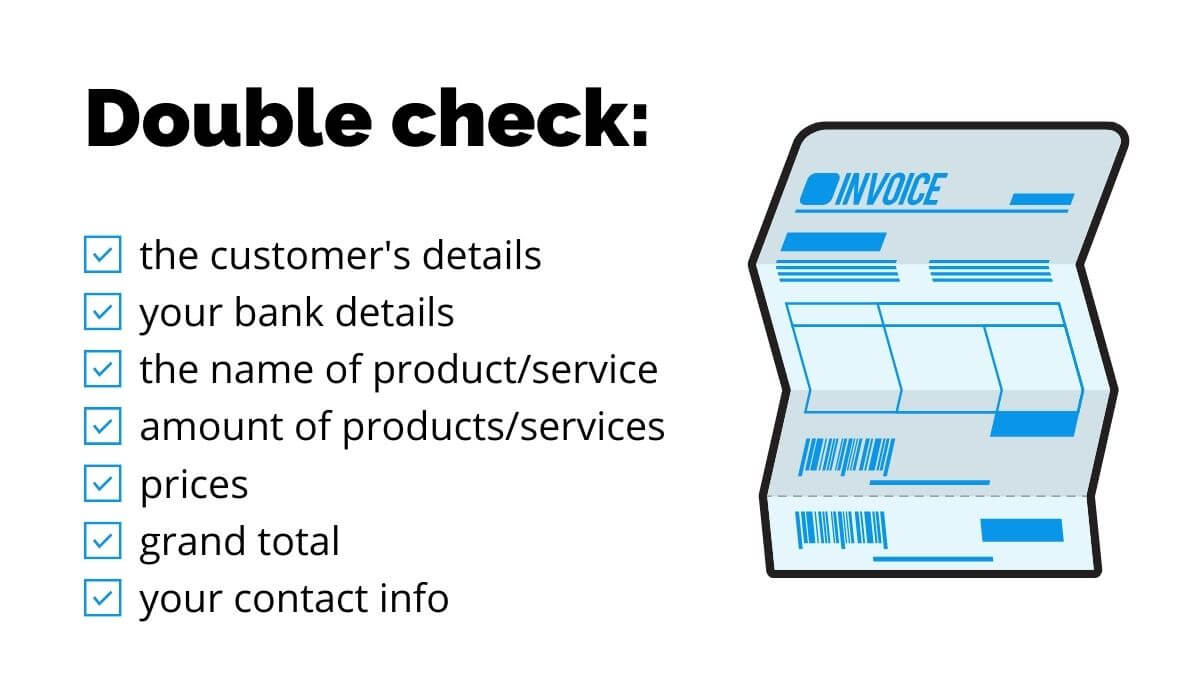

Therefore, here are some of the most important things you should always double-check before invoicing someone:

Source: Regpack

The customer’s details must be correct if you want the invoice to reach the person who owes you money.

Of course, your bank details are crucial for payment. With incorrect bank details, the customer simply cannot pay you.

Moreover, the product or service details should be accurate, too, as any deviations might prevent the client from paying. After all, why should they pay an invoice that claims they’ve purchased more or less than what they actually did or something completely different?

Finally, omitting your company’s contact information will make it difficult for your customers to contact you if they have any questions or concerns regarding their invoices. So, always make sure to double-check the contact details.

If you notice an error in your invoice process that affects its accuracy, work on fixing it immediately.

CFO reports that top-performer companies manage to solve the root cause of such issues in no more than three days, while the lowest-performing ones do it in at least seven.

How long does it take you to spot and fix an invoice error?

Accepting Too Few Payment Options

The key to getting paid on time is offering an option that makes payment easy.

The easier you make it to pay, the higher your chances of getting your money.

What is easy, though? Of course, the answer differs from person to person, but some general trends can help you figure out whether you’re on the right track.

During the pandemic, many people who used to stick to cash had to start using digital payments, which seem to be the way of the future.

After all, there were 1.2 billion digital transactions in 2020, and the number is supposed to grow 6X in the next three years, and reach 7.4 billion in 2025.

Therefore, if your invoice offers only cash-on-delivery, you’re missing out on the vast potential of online payments.

Companies that invoice customers over email can incorporate a “pay now” button, which immediately takes the customer to a payment form. These forms offer different payment methods, such as credit and debit cards, PayPal, or electronic bank transfers.

Source: Regpack

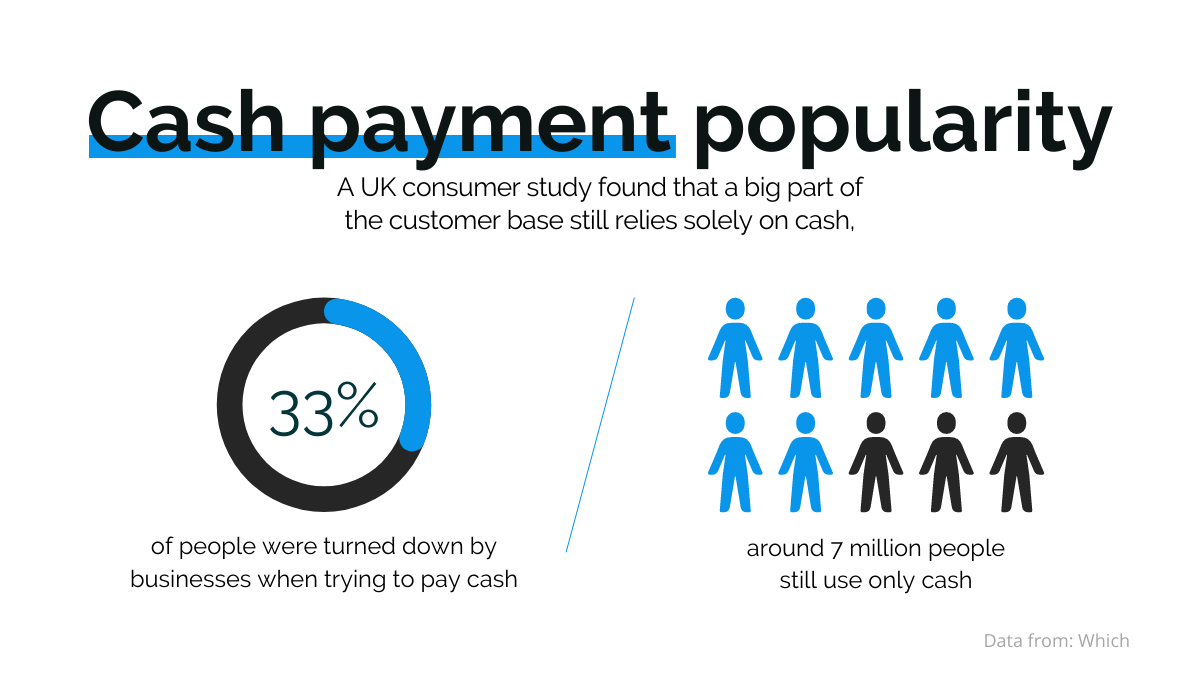

However, this switch to paperless payment doesn’t mean that you should stop accepting cash as a payment method. Some people, especially the older, less tech-savvy generations, still swear by it.

In the UK, a third of customers got refused when trying to pay cash, which means that companies lost revenue because of the inability to cater to their customers’ needs.

Source: Regpack

Furthermore, around seven million people said they use cash payment regularly and struggle with different methods. Why alienate that big chunk of your customer base?

The best thing you can do for your business is to implement both cash payments and digital payment methods, such as the mobile wallet, credit/debit card, and bank transfer, which were the most popular in 2020.

Letting Late Payments Slip

One of the worst things for your finances is letting customers get away with not paying their invoices.

It happens to the best of us, but if you keep relying on manual invoicing, it will keep happening. Such invoices are complicated to follow through to completion, and it often takes a long time for your employees to even realize that an invoice hasn’t been paid.

Manually chasing each late payment takes time and energy and costs you in the grand scheme of things.

It’s often easier to forgive a debt than keep contacting the customer manually over and over again.

Here’s where payment and invoicing software comes in handy.

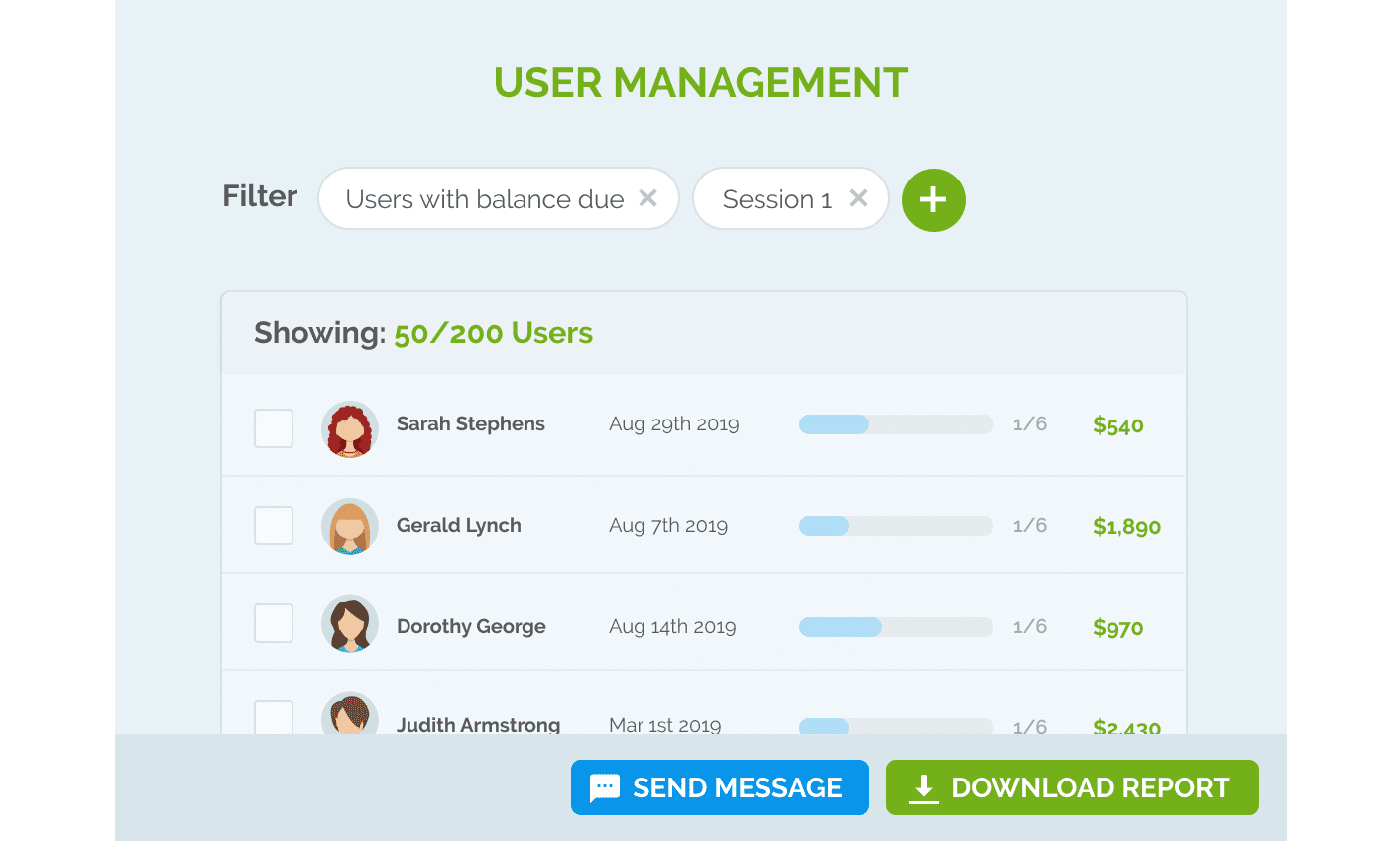

Such software automates invoice creation, thus decreasing the risk of errors. It also automatically sends the invoice and collects payments, and can even send reminders before, on, and after the due date.

Source: Regpack

Therefore, manual work is minimal, and the software does most of it on your behalf, immediately notifying you of which customers have an outstanding bill.

Yooz’s research into such automation showed that 45% of users found it a lot easier to spot unpaid bills on time.

Once you implement the technology that does this for you, you can just wait for the payments to come in.

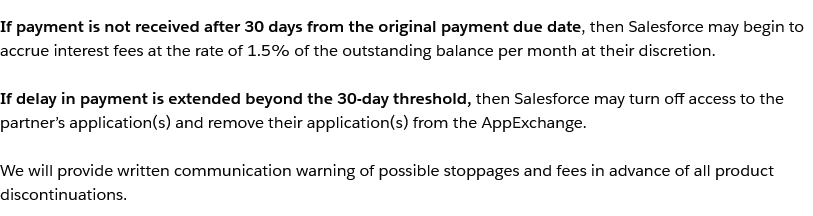

If you want to do more to incentivize early or on-time payments, introduce fees and explain them to customers beforehand.

Here’s how Salesforce communicated their late payment terms on their website, thus letting their customers know what will happen if they fail to pay within the deadline:

Source: Salesforce

We’ve already mentioned that an early payment discount motivates customers to pay early and get a percentage taken off their grand total. Moreover, you can also introduce late payment fees, which will boost the number of on-time payments.

Think of it like this: without a motive to pay on time and no repercussions if they pay late, why wouldn’t your customers stall with making their payment?

However, if you warn your customers about non-payments and explain you’ll charge them more each week or month after the due date, it will inspire them to pay as early as possible.

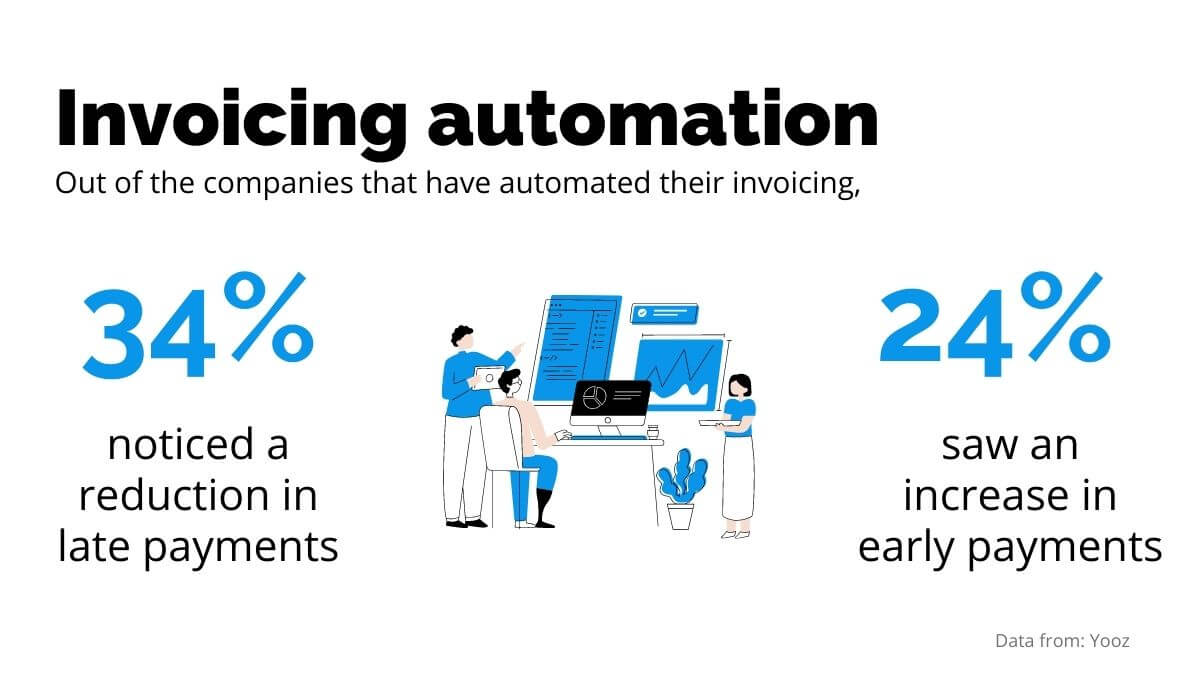

Yooz reports that 34% of companies that used software for these tasks saw a reduction in late payment penalties, and 24% of them noted an increase in early payments, meaning that these businesses got paid faster.

Source: Regpack

Automatic reminders are probably the reason behind this significant increase in on-time and early payments. The companies didn’t have to contact the clients manually—the software reminded them before and after the due date, reminding them of the possible fees.

Conclusion

Billing mistakes cost a lot of time and money in the long run, even if they don’t seem that big.

So, it’s in your best interest to review your invoice process and compare it to this article. Are you making any of these mistakes?

Once you’re sure that your invoice is detailed, grammatically and factually correct, and precise, you can start sending them as soon as the client receives the product or service.

The best way to go about this is to automate the entire process through billing and payment software, like Regpack.

Along with multiple payment options, early payer discounts, and late payer fees, these steps increase your chances of getting paid on time.