Non-paying customers do more than bring awkwardness into communication. Sure, nobody likes to send emails requesting payment, but the real challenge of non-payment lies in your dented earnings.

To minimize the effect of non-paying customers on your finances, you should aim to reduce the chances of avoiding payment. We gathered five strategies you can implement to do so.

A lot of these functions can be automated, so you can focus on your business instead of chasing after non-paying customers.

Since there’s no sure-fire way to prevent non-payment completely, we’ll also tell you how to communicate with your customers effectively to retrieve your payments. Keep reading and find out how.

Jump to section:

Ask for Payment Preferences

Implement Mobile Payments

Send Invoices Right Away

Offer Discounts

Request Upfront Payments

Set Up Dunning Emails

Ask for Payment Preferences

Rather than asking what customers can do to make their payments on time, you should ask what your company can do to make the payment process more appealing to them. The answer sometimes lies in the payment methods your customers prefer.

It’s time we stopped taking the phrase cash is king too literally. Sure, a stable cash flow is and always will be crucial for your company’s success, but it doesn’t have to come from paper and coin only.

In fact, cash usage has decreased as people move to other payment methods.

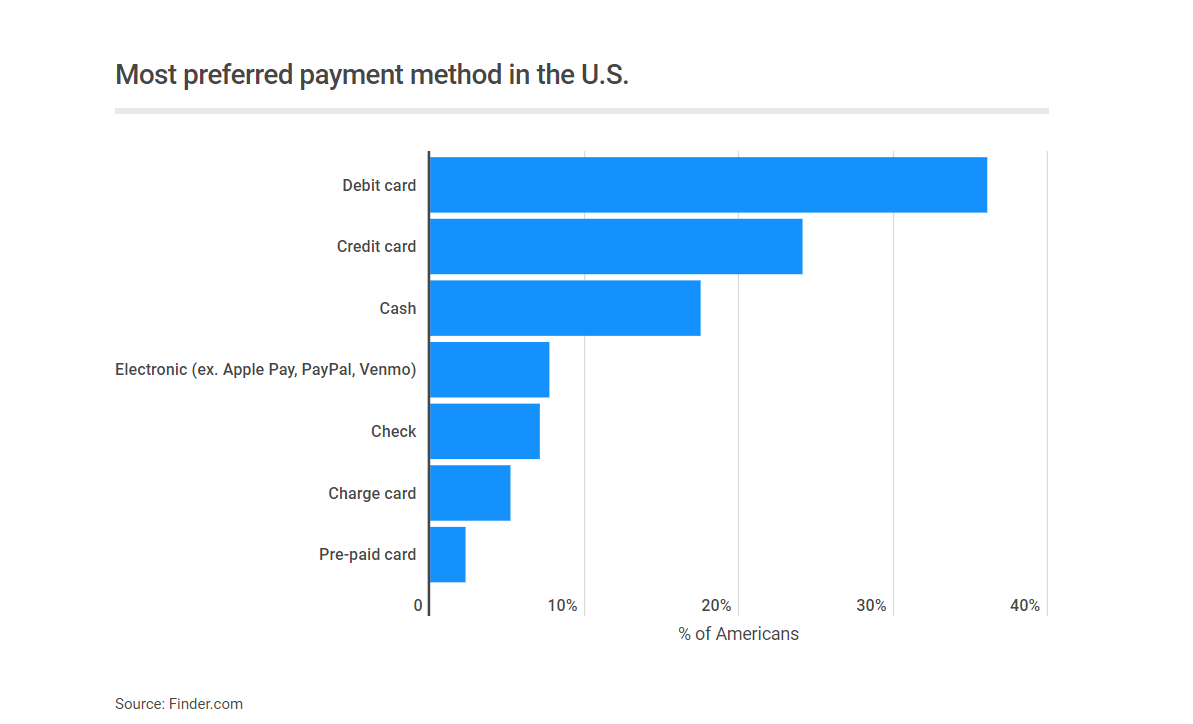

If you’re struggling with non-paying customers, you may want to examine which payment methods they like using. The following graph from a Finder survey shows which payment method the U.S. consumers preferred in 2020.

Source: Finder

As you can see, debit and credit card payments are the top choices for customers, together accounting for 60% of all payments.

To make the payment process more enjoyable—or at least tolerable—to your customers, you could adjust the payment methods you accept according to your customer base.

A safe bet is to enable debit and credit card payments. These seem to be popular among various customer groups. Still, some niche businesses can have customers who predominantly belong to one or two age groups.

As age is a significant predictor of payment methods, you may find exploring your customer base helpful.

For example, if you have many younger customers, you should consider accepting mobile payments because young Americans are driving the growth of mobile transactions.

We’ve compiled a list of preferred payment methods across age groups to help you identify the first choices of your customers.

| Age group | Current age | Preferred method | Source |

| Seniors | 66+ | Cash and checks | Due |

| Baby boomers | 45–65 | Cash and cards | FISGlobal |

| Generation X | 33–44 | Debit and credit cards | FISGlobal |

| Millennials | 25–32 | Mobile wallets and cards | FISGlobal |

| Generation Z | 8–24 | Debit cards and cash | Oliver Wyman |

Remember, there’s no guarantee a non-paying customer will settle outstanding payments as soon as you introduce their favorite means of payment, but you will certainly make future payments more manageable.

Implement Mobile Payments

One way to get around missed customer payments is to increase your flexibility in accepting payments. You can do this by implementing mobile payments. The security and convenience they provide can eliminate multiple factors that lead to non-payment.

If you want to reduce the number of non-paying customers, you should dig until you find the underlying reason for missed payments.

Chances are you’ll notice that customers miss payments because the process was simply too complicated for them.

Customers are now used to paying with a click and a tap, something they can do from their phones.

Exactly this is the main selling point of mobile payments; customers can order goods and services without handling cash or entering their card information for each purchase.

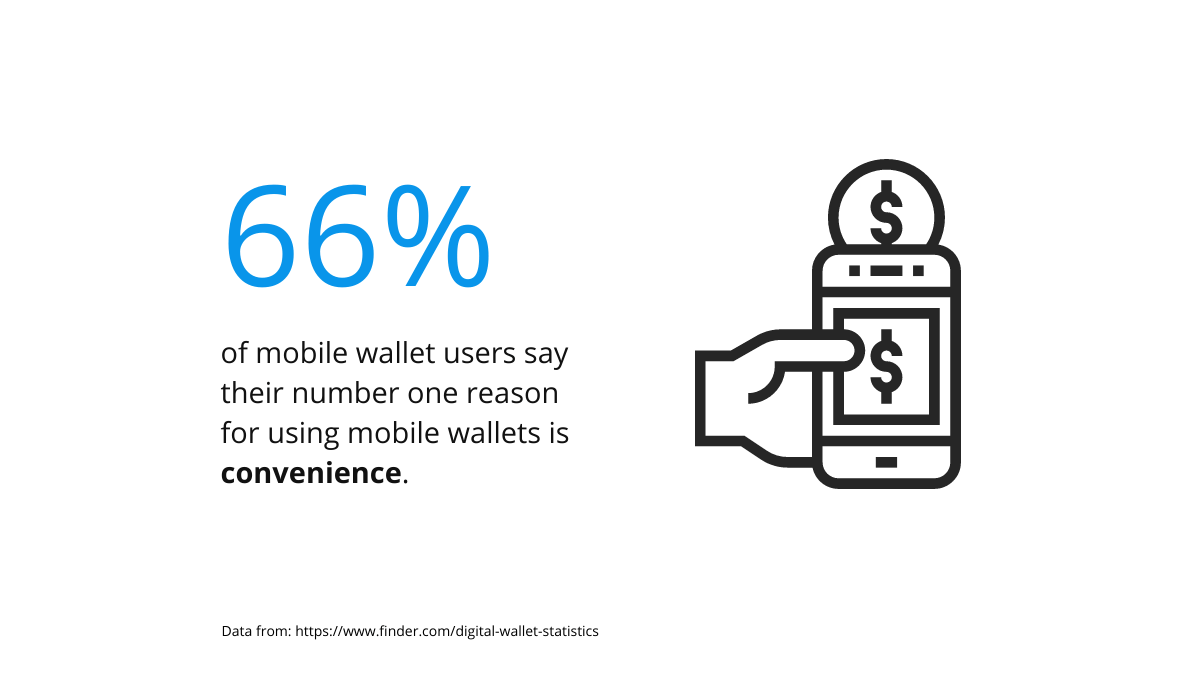

More than 98 million Americans state that convenience is the biggest benefit of mobile payments, even more significant than increased security or tracking expenditures.

Source: Regpack

By implementing mobile payments, you enable the customers to pay you immediately after ordering. If we spend so much time using our phones anyway, why not give customers a simple way to complete the payment from their phone while they’re at it.

The most frequently used mobile wallets in America are Apple Pay, Starbucks (only used in Starbucks coffee shops but despite that one of the most used wallets), Google Pay, and Samsung Pay.

So, make sure to implement these among your payment options if you want to make paying accessible to your clients.

If you have tech-savvy customers, there is no reason to restrict your business to mobile payments only. There are other ways you can accept online payments other than mobile wallets. These are:

- Payment gateways

- ACH payments

- Email invoicing

A great benefit of offering online and mobile payments is the fact that technology is so present in our lives. For many people, checking their phones is the first thing in the morning and the last thing before sleep.

If you have an opportunity to request payments on the device they already use heavily, you should use it to your advantage.

Send Invoices Right Away

The simplest way to put an end to forgotten payments is to automate invoicing. No more “but I didn’t receive the invoice” excuses!

Surprisingly, the top reason why American consumers don’t make their credit card payments on time is not the lack of money. It’s the fact that they simply forget to pay.

Similar reasons can be found with customers who delay the payment of other purchases.

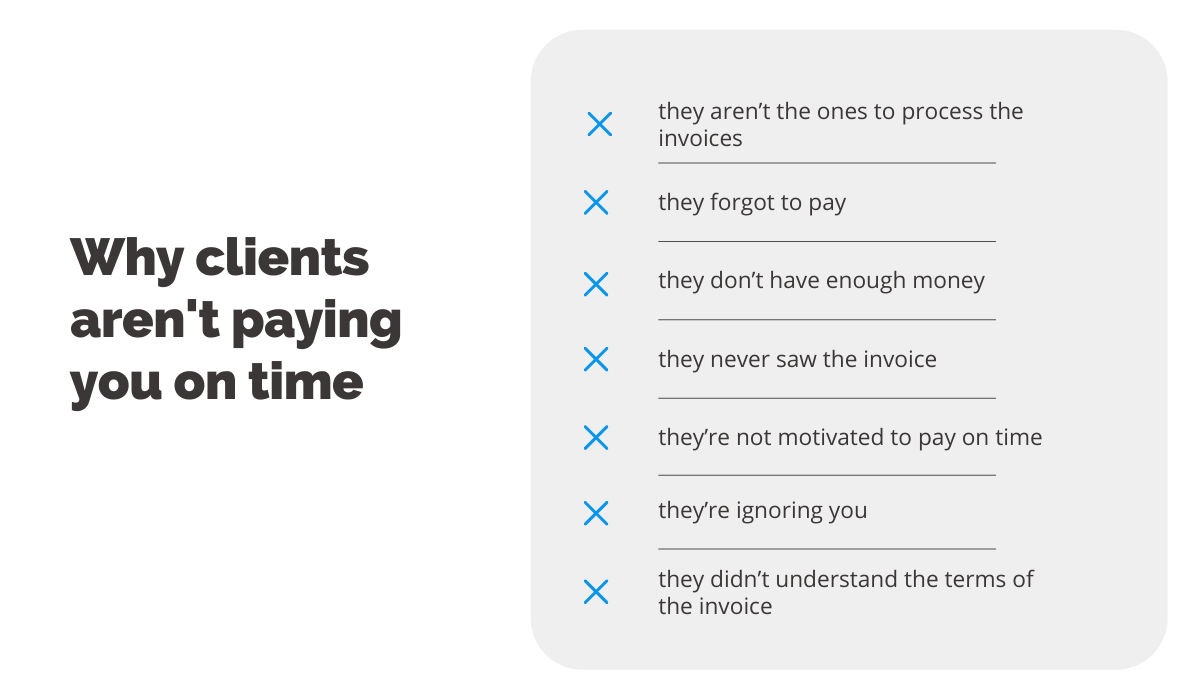

Check out the following image to see other common reasons people don’t pay on time.

Source: Regpack

As you can see, reasons can range from ones relating to merchants, such as not setting clear payment terms, to those relating to customers, such as forgetting or ignoring the payment.

If forgetting to pay is the case with your customers as well, you’re in luck. As opposed to some other reasons people don’t pay, this one is quite easy to fix.

A reason people forget to pay can be the fact that they order a product, and by the time the invoice arrives a few days later, they’ve already moved on with their day-to-day activities.

The solution to this problem is to minimize the time between completing the order and receiving the invoice.

This doesn’t mean you have to be chained to your computer monitoring orders and purchases. Set up an automatic invoicing system so your customers can make the payment right after ordering.

Automatic invoices also eliminate the possibility of a merchant forgetting to send an invoice.

Automating as many administrative elements as possible helps you focus on running your business more effectively.

Well, invoices are fairly easy to automate, especially with RegPack.

Start by filling in an invoice template. When you fill in all the fields with your information, the system will email customers an invoice after they make an order, and fill it in with the price of a specific product, together with the payee’s name.

That way, they will get the invoice right away and will be able to pay it immediately.

If you’re selling a subscription, you can also use our automated billing system.

Automated billing makes late payments a non-factor. All in all, the best way to handle non-paying customers is to prevent the possibility of them forgetting to pay or not receiving the invoice, and you can do that with automated invoicing and billing.

Offer Discounts

Sometimes it isn’t the method of payment that deters customers from paying; it’s the price. Consider offering discounts to make your products more accessible.

If you run a business, you’ve probably dealt with consumer psychology, possibly without realizing it.

The way you present your products or communicate with customers all shape the way they perceive your products and services.

Would you rather book a culinary course valued at $300 and then discounted to $280, or the one with the original price of $270?

If you’re anything like an average customer, you’d probably choose the discounted one.

By buying a discounted product at a price even higher than a non-discounted one, we feel like we’re getting more value; that we’re buying a product of higher value and quality.

You can leverage this psychological hack to combat non-payment.

By offering discounts codes or coupons to lower the prices, you don’t only make your product more accessible; you’re instilling a sense of selling more value at a lower price.

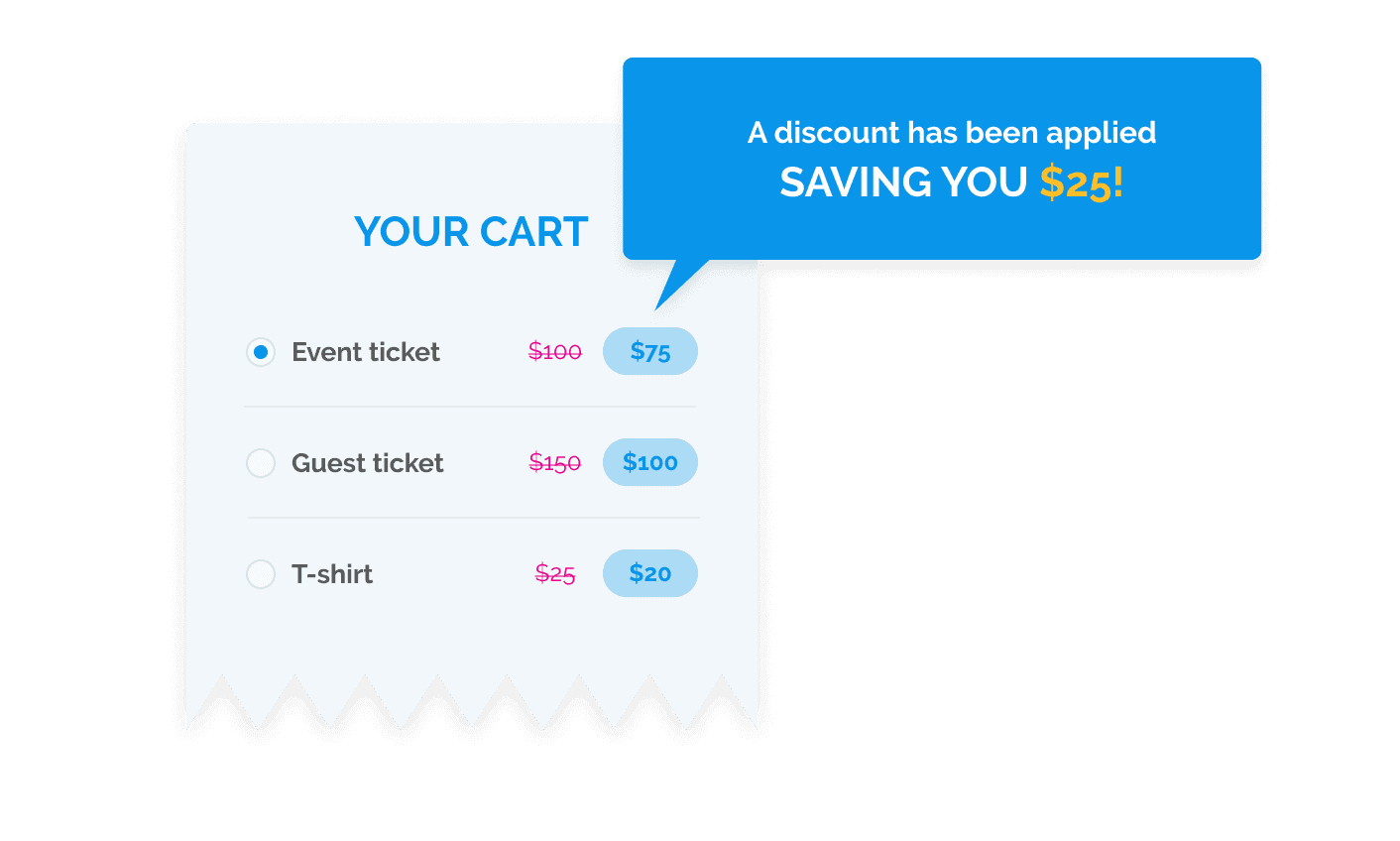

Our payment solution can help you with discounts as well. You set the percentage, and the system calculates the rates. You can do this for the user’s entire cart or for specific items.

Source: Regpack

Of course, you still have to make profits, so be mindful not to offer more discounts than is lucrative.

Other than offering arbitrary discounts, there are more ways to use discounts to tackle non-payment.

If you’re struggling with late payments, you may want to offer an early payment discount. It doesn’t have to be high. Even a small discount can incentivize customers to pay less now than a full price later.

You can also offer discounts for paying with your preferred payment method.

Request Upfront Payments

The most direct method of handling non-paying customers is preventing non-payment before it occurs. You can do this by requesting up-front payments.

Not having clients is certainly challenging. But it’s even worse to deliver a product and not get paid for it. When that happens, you lose time and resources you could have used with paying customers.

To make avoiding payment more difficult, you can request paying upfront. Whether you request full or partial payment in advance, you will have some resources to operate with. You will also be able to calculate more precise revenue forecasts.

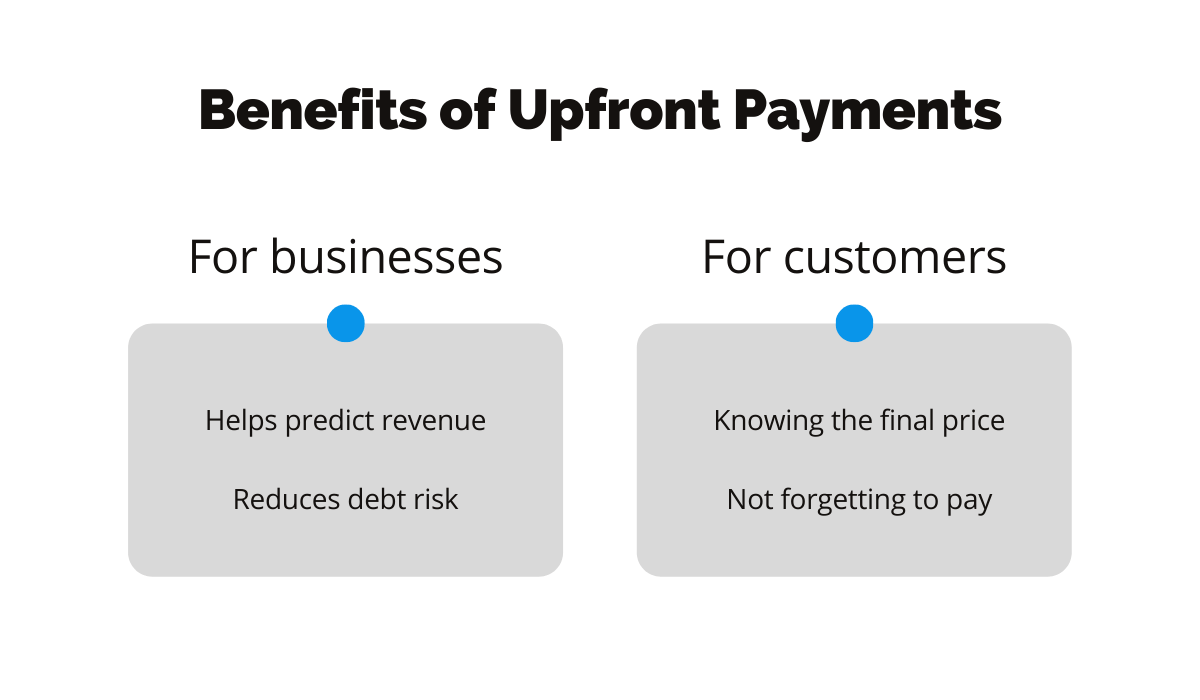

Upfront payments can be beneficial for customers, too.

First of all, they eliminate the risk of forgotten payments. By letting your customers pay in advance, they will no longer deal with the pestering thoughts at the back of their minds that they are about to forget an obligation.

An additional benefit for customers who pay the full price upfront is knowing the final price they’re paying, with no hidden fees or subsequent alterations.

Source: Regpack

Some merchants may feel awkward when asking for up-front payments. Remember, that does not dilute the quality of your service.

On the contrary, customers can take their upfront payment as a confirmation that you will provide top-notch service. They’ve already paid, so it’s only fair that you reciprocate.

Companies large and small can ask for up-front payments. Freelancers, small businesses, and even luxury brands practice advance payment. If Tesla can request this method of payment, so can you.

Set Up Dunning Emails

If all proactive measures fail, you can rely on dunning to help you deal with non-paying customers. The easiest way to do this is by setting up dunning emails.

Dunning is a practice of communicating with customers in an effort to collect money owed for the provided products or services.

As we’ve established, there are different reasons customers don’t pay for the things they’ve ordered from you.

Spending the funds elsewhere, forgetting to pay, or simply avoiding payment for as long as possible all have the same effect: you’re not receiving the owed payment regardless of the reason.

But, sometimes the issues with payments are not intentional, like when a customer decides to use recurring payments, but their card expires. They probably won’t notice the payments are not going through in such cases, but you will.

This is where you want to implement dunning management. When Baremetrics adopted a dunning management software, they managed to recover $30,000 in one year.

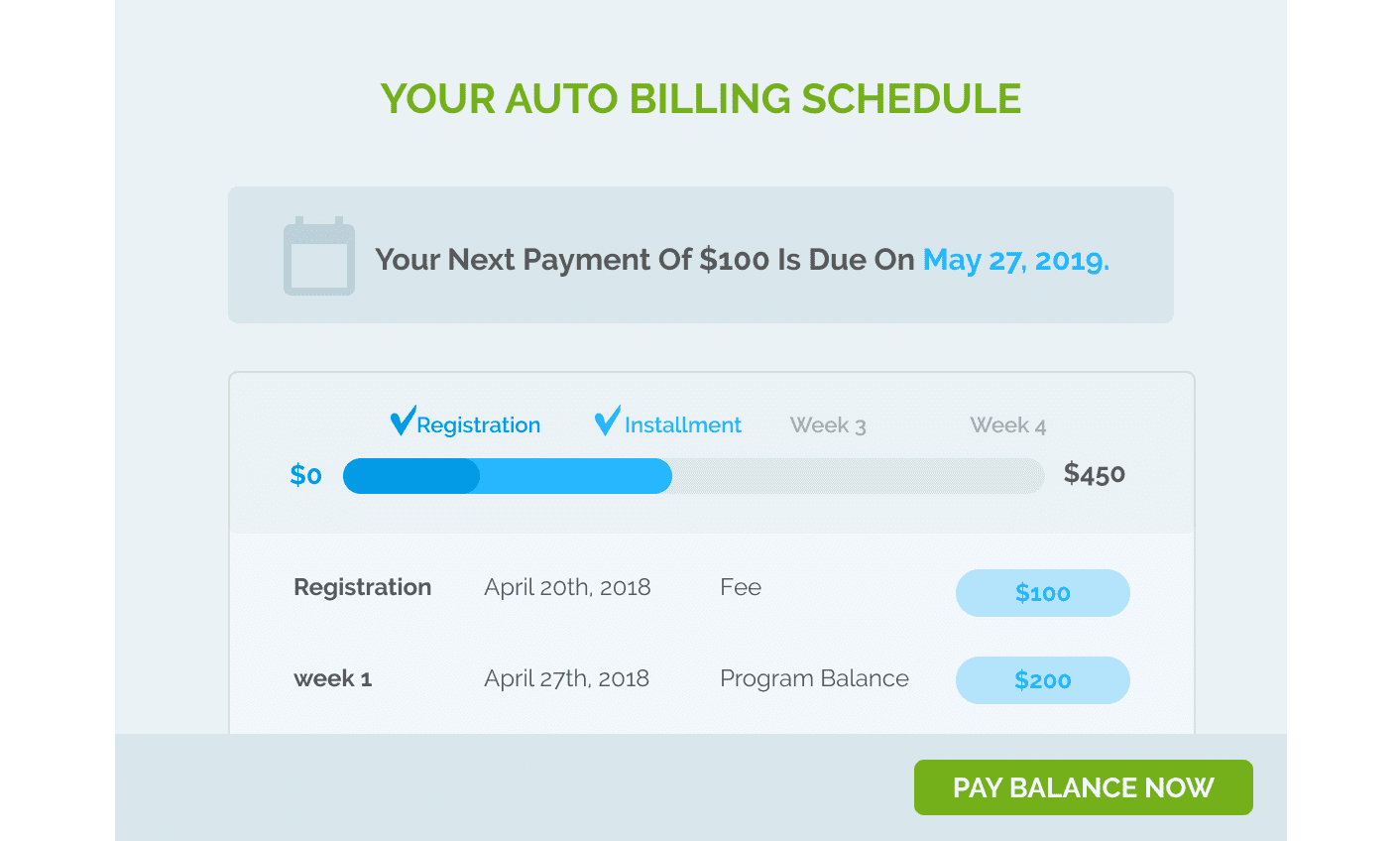

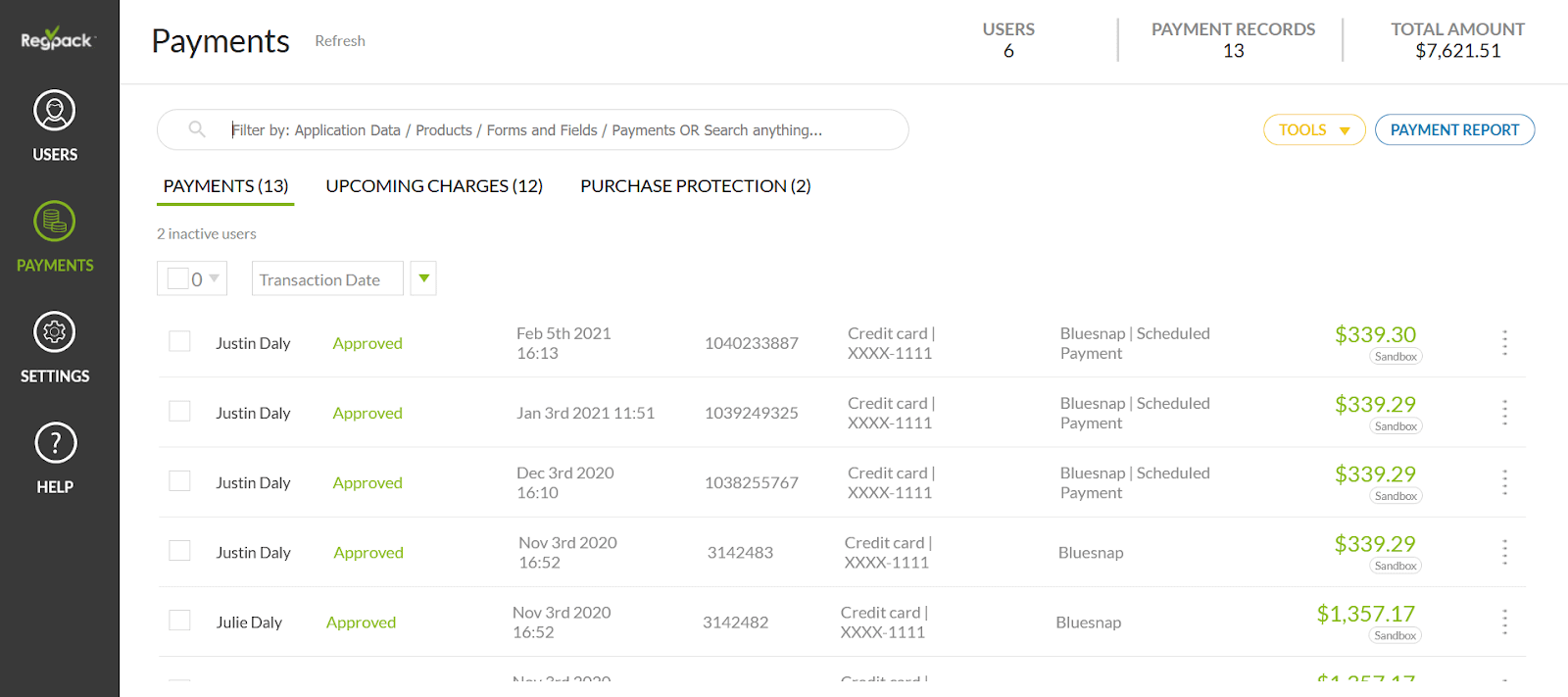

A good dunning management solution will detect overdue invoices so you know which customers are not paying on time. Here’s what the payment overview looks like on Regpacks.

Source: Regpack

You can set up our system to send automatic emails reminding customers to pay after an overdue payment is detected. Create a template to serve as a basis, and the system will fill in the data for each individual customer.

Now, demanding payment can be a tricky area, so approach it carefully to keep up a positive relationship with your customers. Take a look at how Spotify worded their message:

Source: Customer.io

Their email is short and to the point. It conveys a payment failure and asks the customer to update their payment info so that they can keep using the service. No negative emotions are expressed; only a simple reminder.

You too could send emails such as this one. Compose a template that best verbalizes the message and leave all future reminders to our automated communication system.

Conclusion

Like always, prevention is better than a cure. You can prevent non-payment by identifying and offering payment methods your customers use. Consider implementing mobile payments as well because they are on a steady rise.

You can reduce the chance of customers forgetting to pay by sending invoices immediately or enabling up-front payments.

Don’t forget about various discounts–use them to make your prices more appealing. Finally, if non-payment occurs, send dunning emails to get the owed money.

A great benefit of technology is that you don’t have to handle non-payment manually; there are ways to automate the process.

If you’re ready to join our clients who have seen a 75% decrease in non-payment after using our automated billing functionality, shoot us an email!