Improving your accounts receivable management should be one of your priorities if you’re running a business.

The crucial thing to keep in mind about the money you are owed, which constitutes your accounts receivable, is that you can’t count on it until you actually collect it from your customers. The better you manage your accounts receivable, the more money your company has to work with.

Luckily, there are ways to manage your accounts receivable better. This article will focus on six that can make a significant difference in your business.

- Keep Customer Data Organized

- Have a Unified Billing Process

- Make Payments Easy

- Monitor Slow Paying Accounts

- Be Consistent with Your Payment Rules

- Create an AR Aging Report

- Conclusion

Keep Customer Data Organized

Managing accounts receivable can be a daunting task.

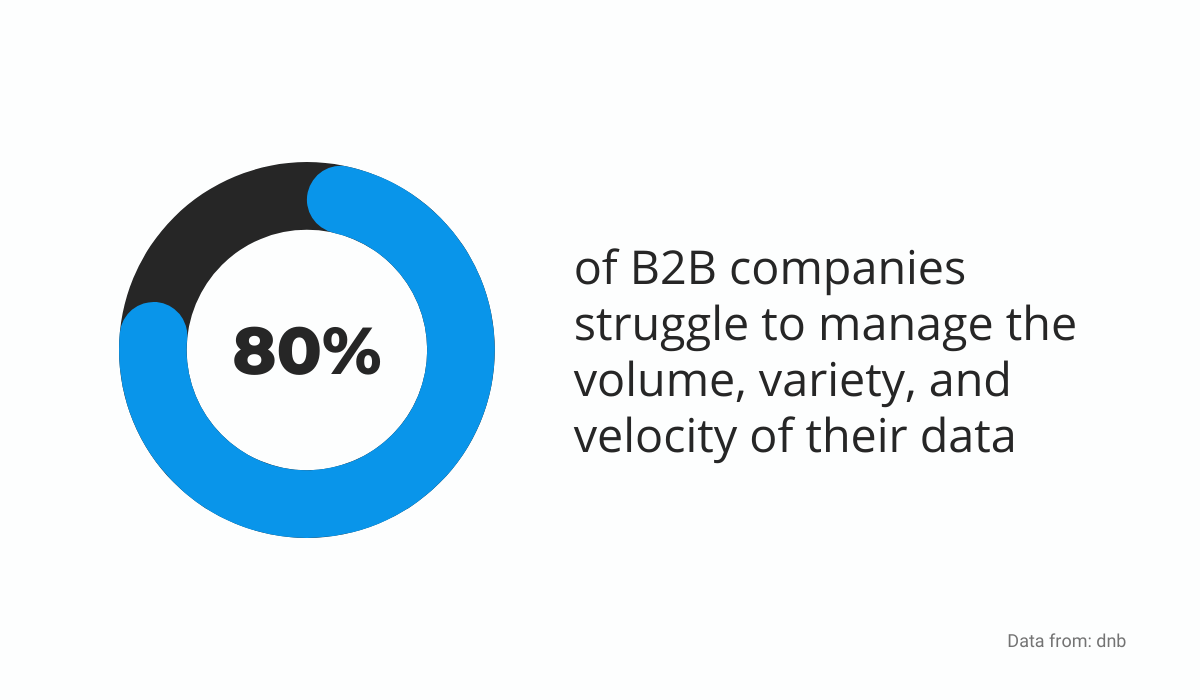

In fact, the sheer amount of customer data that the business collects can be overwhelming. That’s why you should find a way to organize it properly.

If different departments or teams within one department have their own customer database at your company, that indicates a problem with data silos.

When customer data is scattered between different spreadsheets, documents, files, and inboxes, you have separate silos for separate pieces of information.

That’s an inefficient way to track data and can cause problems for accounts receivable management.

According to research by Forrester, 80% of businesses struggle with managing their data.

Source: Regpack

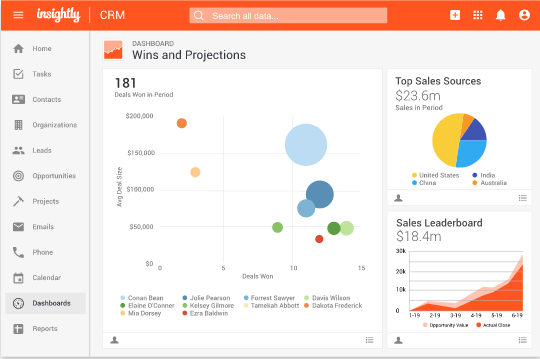

To break down data silos and eliminate all the problems that stem from them, you should consider using customer relationship management (CRM) software.

It can replace spreadsheets and files and store all customer data in one centralized place.

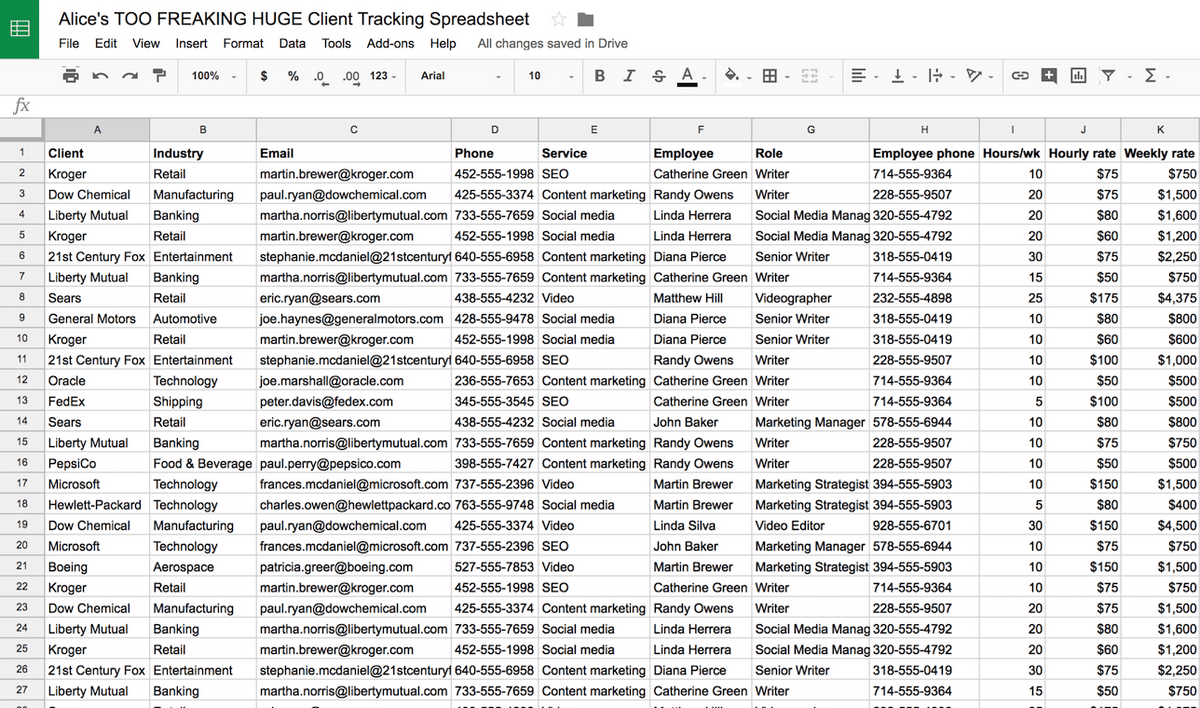

That way, your accounts receivable management system can go from looking like the one below…

Source: Medium

…to a system that’s tidy and much more manageable.

For example, Insightly is one of the many CRM software solutions that offer a range of features for storing and handling customer data.

Source: Insightly

As you can see, the software stores tasks, leads, projects, contact information, reports, correspondence history, and other customer data that accounts receivable teams use daily.

That kind of account receivable management can drive the whole business forward.

That was the case with 4over, an online wholesale print company.

Source: 4over

They used simple spreadsheets, but they realized they needed a better data organization solution, said Rita Ward.

They implemented CRM software, and the accounts receivable team could efficiently access customer information and share it with other departments.

Everyone benefited from the CRM software—telesales improved record-keeping, the business development department could easily track interactions with customers, and HR was able to systematize onboarding by keeping an eye on future projects.

Organizing customer data is vital to improving your accounts receivable management. However, its benefits reach beyond that, boosting the performance of the whole business.

Have a Unified Billing Process

A unified billing process is one of the most impactful practices you can implement to improve your accounts receivable management.

It is likely that your customers pay for your services using a range of methods; if you support their preferred payment method, it can be great for your accounts receivable for reasons we’ll examine in the next section.

However, implementing a unified billing process also means that managing your accounts receivable becomes more complex.

A billing process can be tedious, complicated, and time-consuming; the amount of paperwork, invoices, and calculations can eat up all of the time and resources that could be invested in something more meaningful.

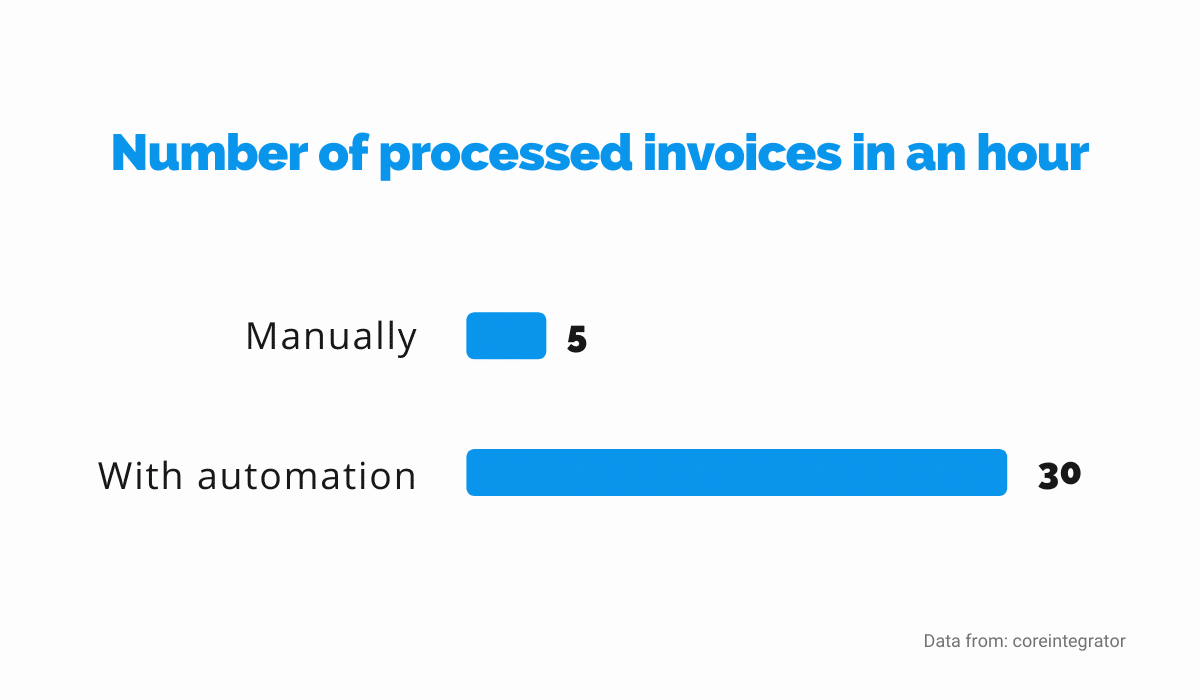

According to the industry average, one person can manually process five invoices per hour; that includes manual data entry, proofing it, correcting errors, and processing the invoice.

Source: Regpack

On the other hand, you can streamline that with an automated billing solution.

The result is an average of 30 processed invoices per hour. However you look at it, the difference is considerable.

But there’s much more to an automated billing process than speedy invoice processing. For example, Regpack is a cloud-based system that securely stores all the billing information in one place.

It’s easy for your team to access it, automatically send invoices and streamline the billing process in general.

That makes managing accounts receivable much easier.

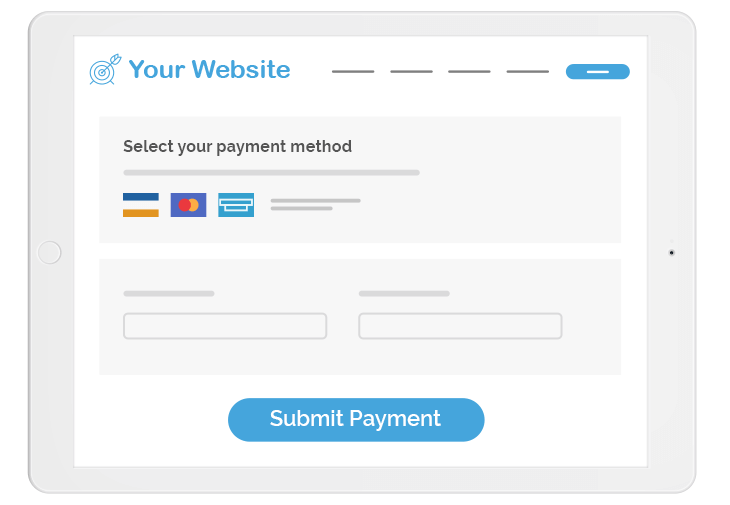

A unified billing process isn’t only convenient for your business; it’s handy for your customers, too.

Features like integrated payment processing allow them to pay you with a click of a button, which significantly simplifies the process.

Also, the payment is automatically recorded, so your accounts receivable are instantly in order.

Source: Regpack

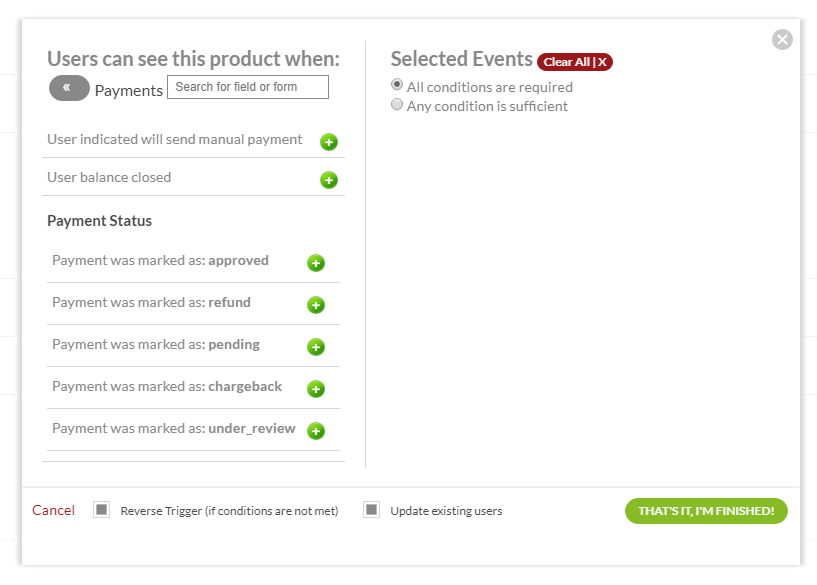

Even if the payment is late for some reason, with an automated billing system like Regpack, you can set up triggers to perform a specific action based on the payment status.

For example, once the customer makes a payment, they receive a confirmation email.

That can also significantly improve your accounts receivable management—nothing slips through the cracks.

Below is an example of possible trigger conditions that you can select.

Source: Regpack

In short, a centralized billing process gives you more control over your accounts receivable.

Important information doesn’t get lost; you don’t have to chase documents and wonder what happened to payments.

Much of the chaos is eliminated so you and your team can focus on more important processes to better your business.

Make Payments Easy

When it comes to customers, never underestimate the power of convenience. The easier you can make for them to pay you, the better.

One of the fundamental ways you can make payments easy is to offer more payment options, as mentioned briefly in the previous section.

Instead of receiving payments exclusively in cash and checks like in the old days, you can accept multiple payment methods, including credit cards, digital wallets, wire transfers, etc.

Those options speed up the payment process, and they’re convenient for the customers.

However, ensure that you’re using an automated billing system to eliminate errors in payment processing.

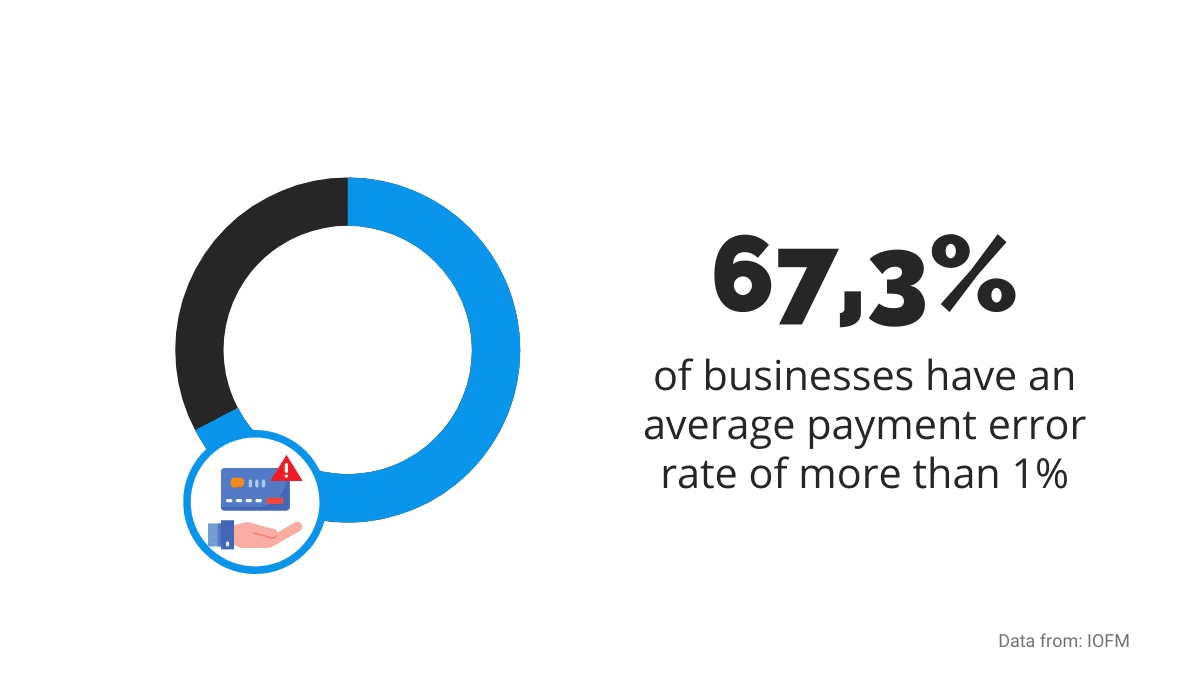

Source: Regpack

According to one study, more than two-thirds of businesses have an average payment error rate of more than 1%.

As a general rule, everything above 0,5% is considered a sign of inefficiency, so you should deal with it for the sake of the financial health of the business.

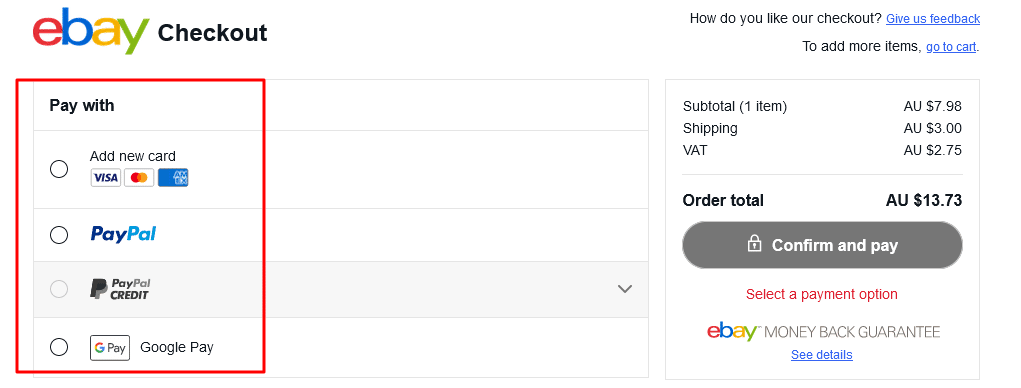

That being said, offering more payment options to customers is a crucial factor in making payments as easy as possible.

Research indicates that you should at least allow a range of digital wallets, credit and debit cards, since they make up nearly 80% of the most used payment methods worldwide.

For example, here’s what eBay offers in their checkout to the customers.

Source: eBay

As you can see, they have three cards and three digital wallets as payment options, which is most likely enough for the vast majority of customers.

You can go a step further and offer a buy now, pay later (BNPL) option.

As the name suggests, it allows customers to purchase something and pay for it at a future date.

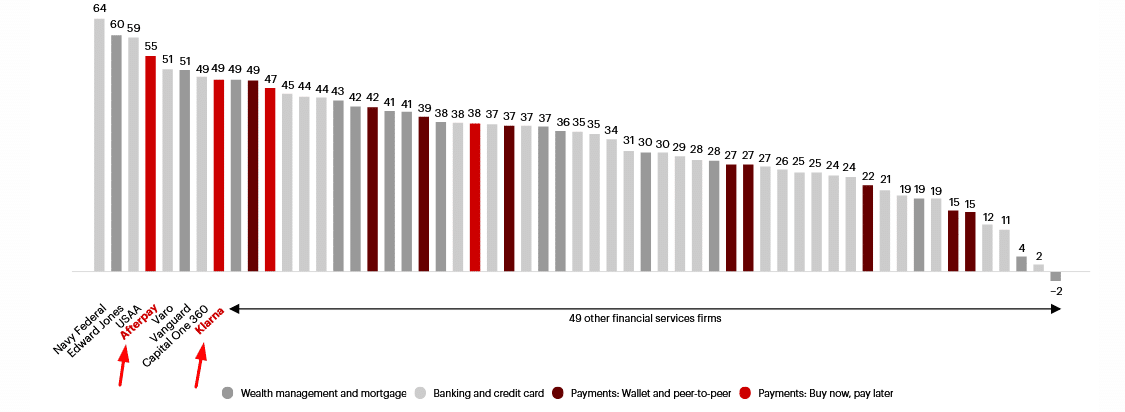

According to Bain & Company, the popularity of BNPL is rapidly rising, especially in the online environment and among younger customers.

Source: Bain

As you can see in the graph above, two of the companies that offer it, Afterpay and Klarna, are already among the top eight financial services providers, according to their Net Promoter Score, which serves as a measure of the customers’ likelihood to recommend a brand.

And businesses are increasingly adopting it as the payment method they offer next to the more traditional ones.

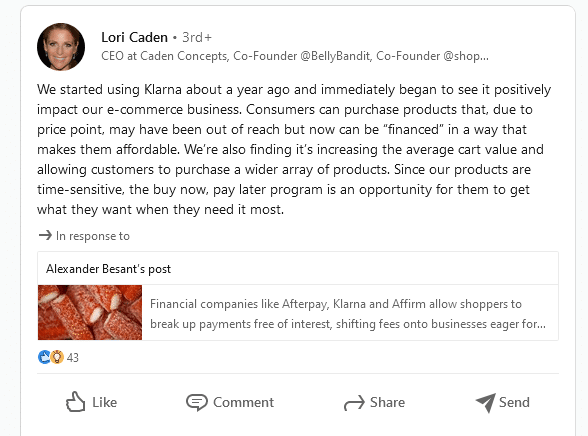

As Lori Caden puts it, it’s convenient for the customers and good for the business and revenue.

Source: LinkedIn

Whatever payment methods you choose to offer, make sure that you meet your customers’ needs.

That way, payment will be easier, and your accounts receivable management will improve accordingly.

Monitor Slow Paying Accounts

You can have the best possible billing process and a dozen payment options, and invoice every customer correctly and on time, but some of the payments will still be late.

Although commonplace, late payments certainly aren’t something that you should take lightly. Slow-paying accounts can impact your cash flow and amount to big problems in the long run.

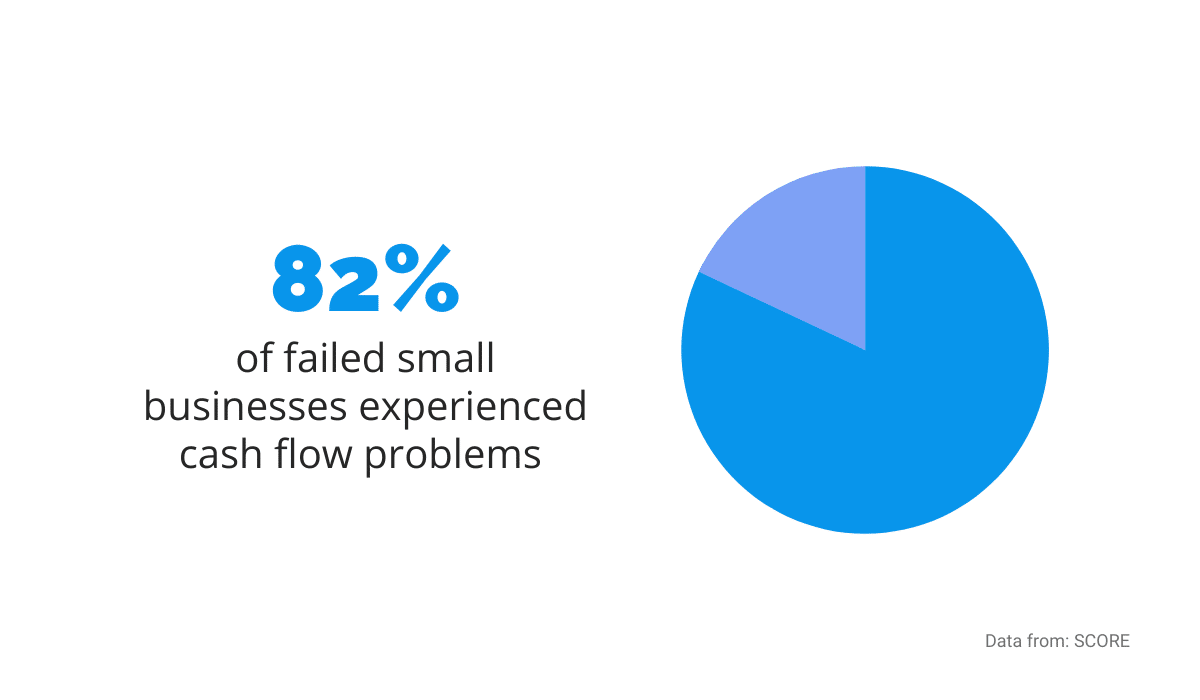

After all, according to the data, cash flow problems are the number one reason small businesses fail; among those that do, 82% experienced cash flow problems.

Source: Regpack

By monitoring accounts that can cause revenue issues for your business, you can minimize the chances of not collecting your payments.

As you can imagine, not getting paid for your services can’t be good for your accounts receivable.

That’s why it’s important to keep an eye on the accounts and act quickly if you detect payment issues.

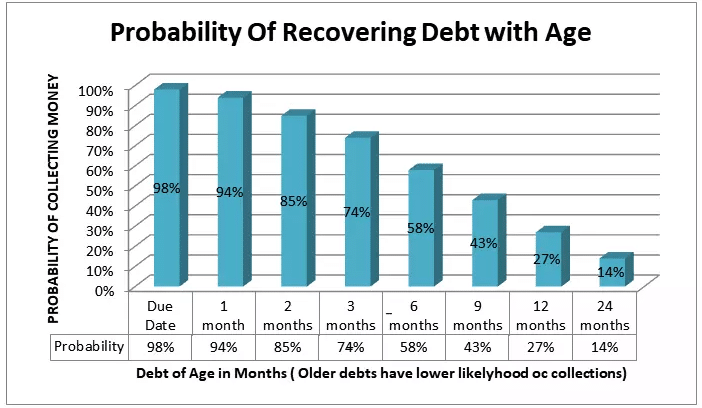

According to research by CCLA, cited on Nexa Collections, the longer the payment is uncollected, the smaller the chances of you ever collecting it.

Source: nexacollect

As you can see, there’s a very high chance of collecting the payment on the due date, but from there on, it’s declining.

The lesson here is clear—the sooner you act, the higher the chances of collecting your compensation.

Monitoring slow-paying accounts is crucial for acting quickly in the cases of late payments.

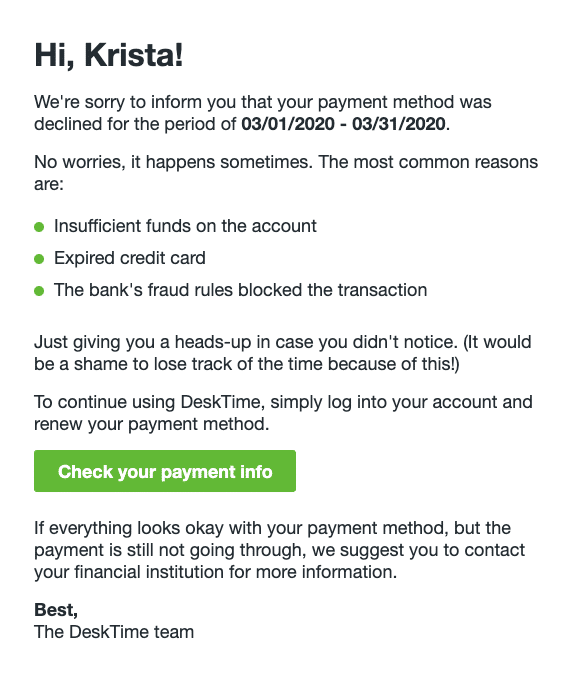

You should consider setting up an automated payment reminder system that can send emails at your desired interval.

An automated billing system like Regpack will offer that feature, making it easy to compose your reminder emails and let the software take care of sending them to your customers.

Below is an example of a late payment email.

As you can see, the payment failed, and the customer is now reminded of their options.

Source: Baremetrics

If the payment is significantly late, you can be firmer but still professional in your emails—your accounts receivable management won’t get any easier if you lose your customers due to unprofessional behavior.

However, you can consider preventing late paying by offering incentives for customers who pay early.

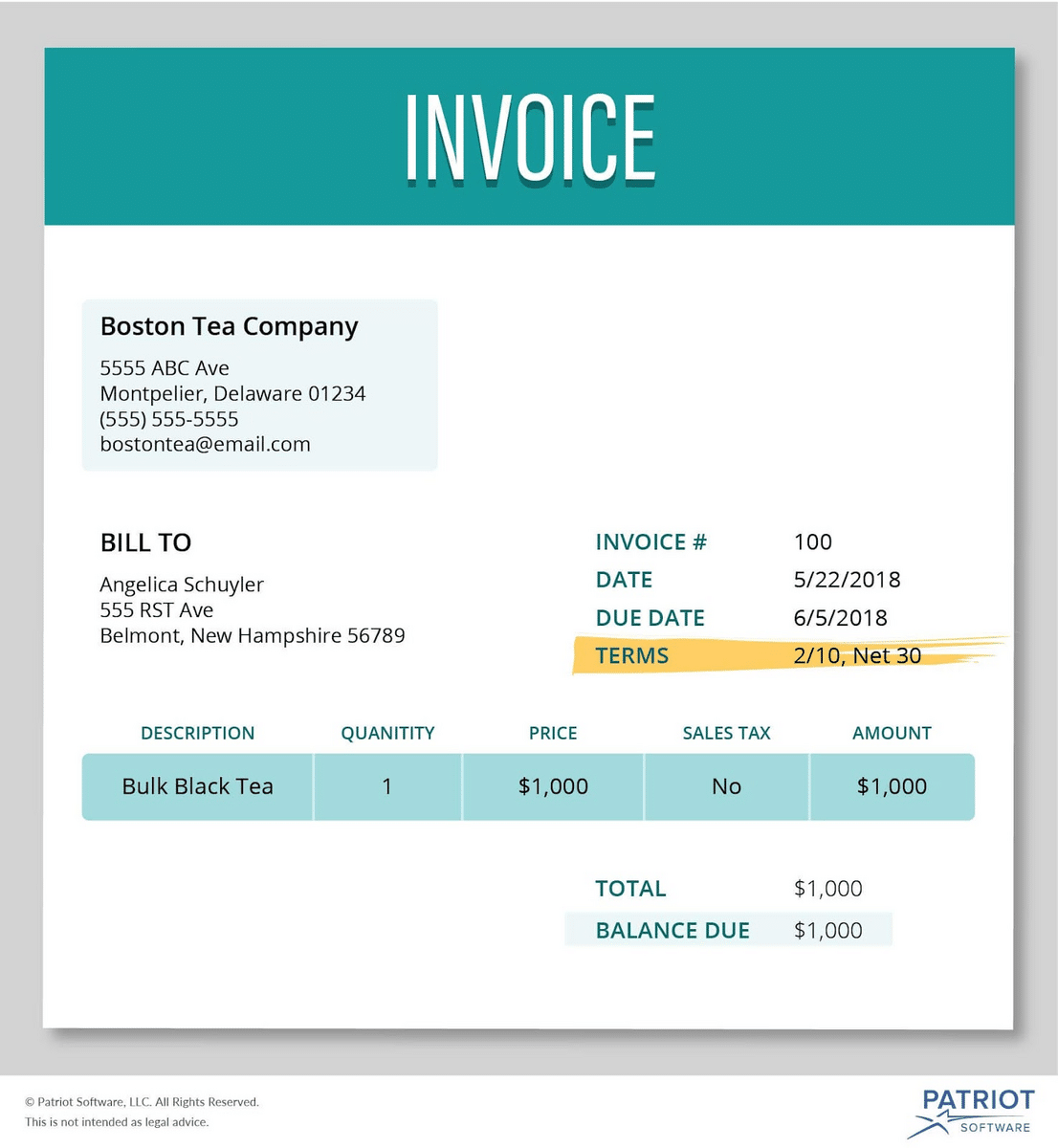

For example, you can include a discount if they pay quickly enough, like the one highlighted on the invoice below.

Source: patriotsoftware

In this example, the customer gets a 2% discount if they pay within ten days after the date on the invoice.

There are many ways to handle slow-paying customers, but monitoring payments is the best way to identify them on time, and thus simplify your management of accounts receivable.

Be Consistent with Your Payment Rules

Consistently implementing your payment rules can go a long way in improving your accounts receivable management.

If you don’t follow through on your own rules, you can quickly lose control over the payments, which can spell trouble for your business.

A business that adheres to clear procedures projects a professional image.

Your customers are aware of the how, what and when of doing business with you, so there’s less waiting and confusion about payments.

That’s especially helpful in case there is a dispute with the customer over the payment.

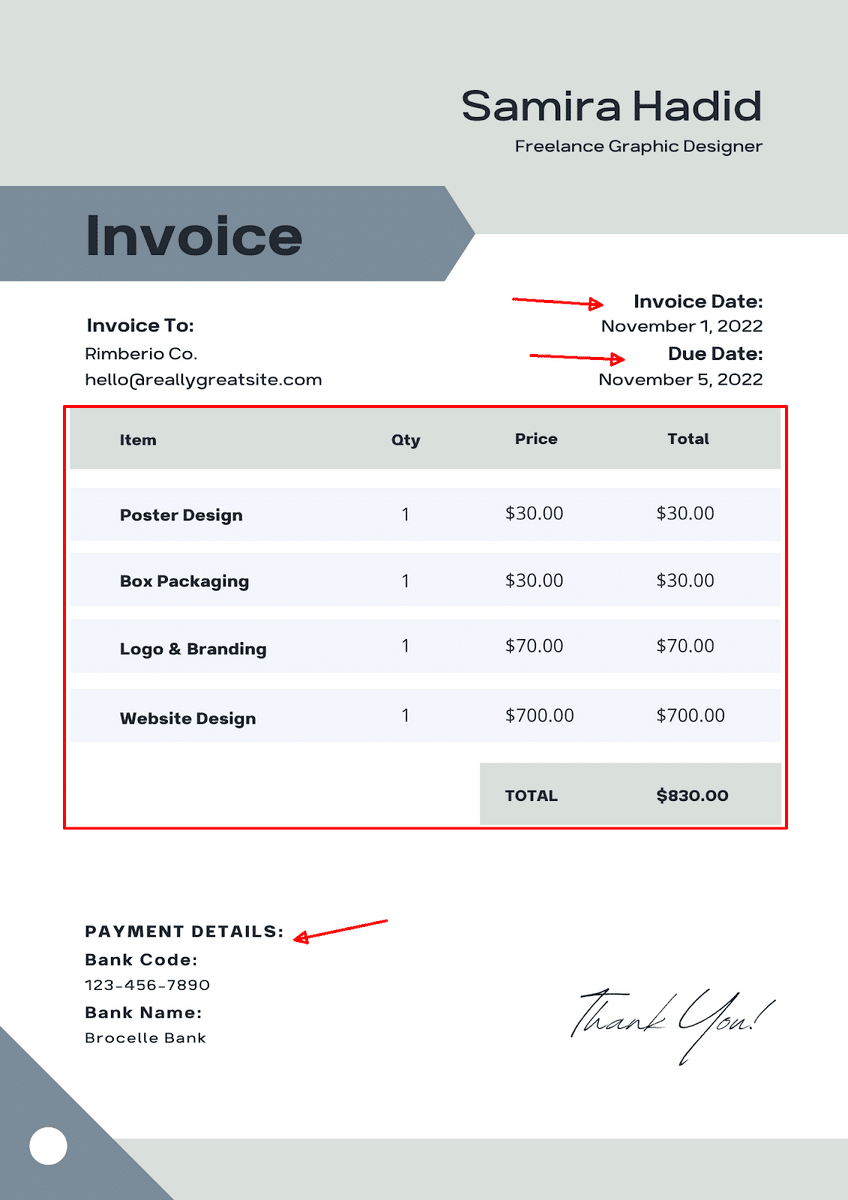

For example, take a look at the example of an invoice below and the highlighted elements.

Source: Canva

As you can see, the invoice has the vital information the customer needs to know in order to make a payment (the due date and the bank details), as well as what’s charged (details of the items).

Having all the terms out in the open can give you an upper hand in handling customer complaints and late payments alike.

For instance, along with the payment reminder emails we mentioned in the earlier section, you can have a clear and firm final notice email that states the consequences of being significantly overdue.

It can look something like this.

Source: Regpack

The important elements of a final notice email are all present—details about the invoice it refers to, the amount of the debt, information about payment details, and the consequences of not meeting the conditions.

However, it’s not enough just to send the final notice; the important part is being consistent with the rules you set.

In this case, if you mention legal proceedings, you should follow through with them as soon as the need arises.

There are many collection agencies that you can turn to if it comes to that.

Some of them specialize in small and medium businesses, like Rocket Receivables.

Source: rocketreceivables

Your relationship with your late-paying customer is probably beyond repair at this point, but there is a chance that you’ll get your money, which can help get your finances in order.

Consistency is a virtue when it comes to your payment rules.

If they’re all over the place, the same could be said for your account receivable management. You should define how you want to manage your payments and stick to those rules.

Create an AR Aging Report

Ideally, you wouldn’t need an accounts receivable aging report because every customer would pay on their due date.

However, you probably know that that isn’t realistic, and a document like this can help you manage your accounts receivable.

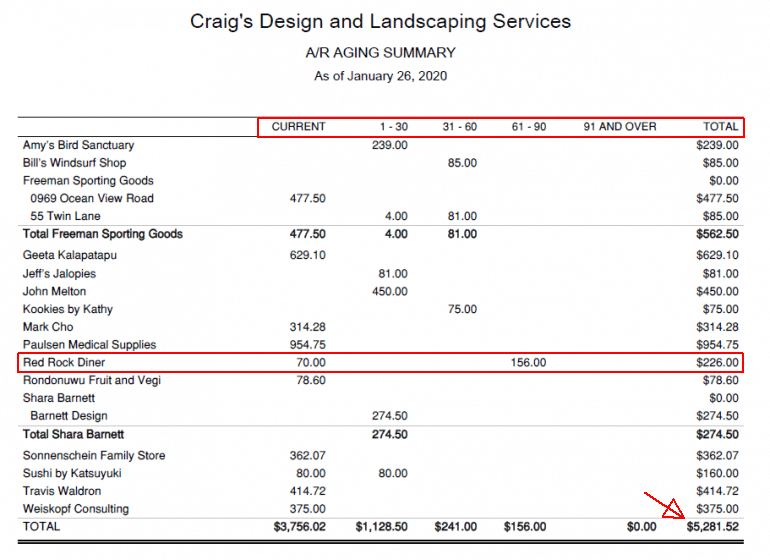

With an aging report, you can track the payment status of your customers. It lists all your customers and the amount they’re due.

Also, the helpful part is the time increments; usually, an aging report has columns for 30-day periods so you can see how much money each customer is due in different periods.

Below is an example of an aging report in which you can see these elements.

Source: nerdwallet

On the left-hand side, you can see the list of the customers. There are columns from left to right for different time periods we’ve mentioned.

For example, Red Rock Diner has $70 of current debt, and they’re past due between 61 to 90 days on their $156 debt.

The current debt column means that the customer is not yet overdue, so ideally, the aging report would have the majority of the amounts due in this column.

There’s a total amount due for every customer on the right, which sums up the total debt from all customers at the bottom right side of the aging report.

Regularly creating aging reports can be very helpful in managing your accounts receivable. By knowing the payment status of every customer, you can predict cash flow and plan your actions accordingly.

Also, you can see which customers are prone to late payments and adjust payment terms for them.

For example, suppose you’re creating an aging report every month. A customer who’s constantly in the 61-90 days column might benefit from a due date adjustment or an incentive for earlier payment.

The point is that you can have a clearer understanding of your accounts receivable with the data an aging report provides you with.

That’s where technology can make your life easier once again.

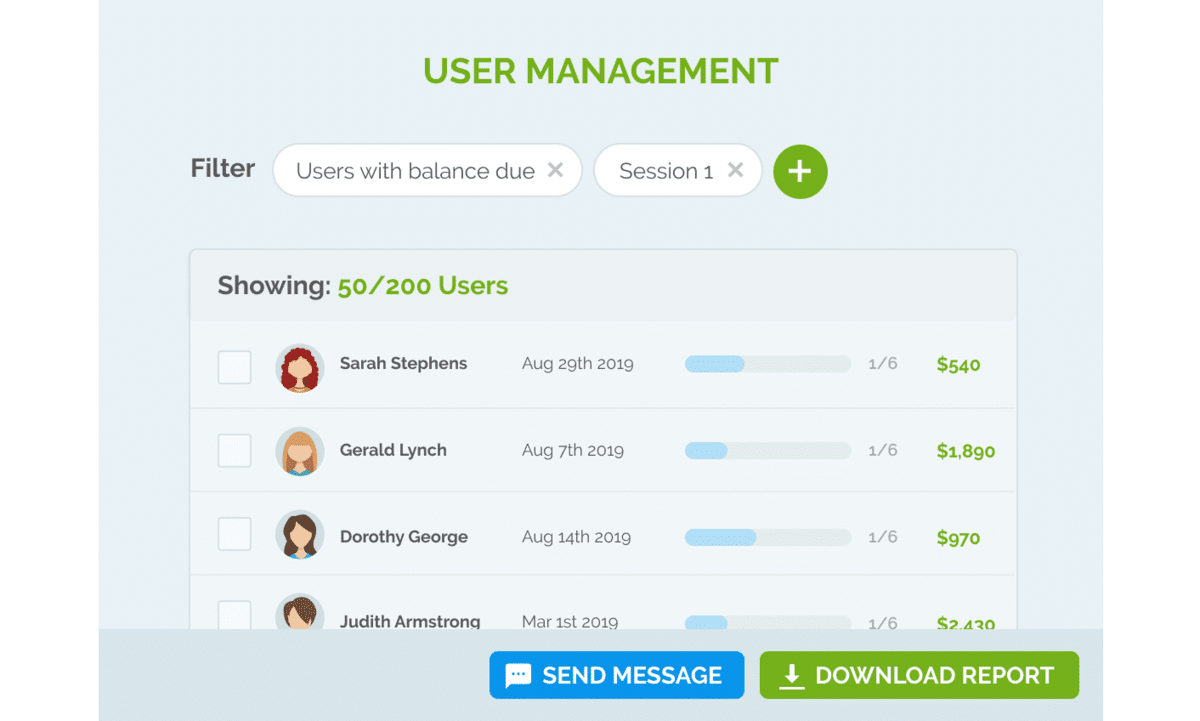

For instance, with Regpack, you can create reports that show you the payment status of your customers.

You can use various filters to determine which customers are late, how much they owe and extract other valuable information.

Source: Regpack

An aging report is one of the most helpful tools for improving your accounts receivable management.

With the information it provides you, you can take appropriate action for the financial betterment of your business.

Conclusion

How you manage your accounts receivable can steer your business in different directions.

Use efficient systems and processes we’ve described in this article, and you will have a consistent cash flow, good relationships with your customers, and the potential to grow your business.

On the other hand, neglect your accounts receivable, and it won’t take long before financial issues start sinking your business.

If you follow our advice on how to improve your accounts receivable management, there’s no doubt in which direction you’ll go.