Service-based businesses are reliant on an efficient recurring billing system to manage their payment processing efforts.

The difficulties in running such a system lie in constantly having to keep up with a payment schedule, and making sure all fees are covered.

As your business expands, so will the complexities of managing an increasing number of payments and users, expanding the space for potential errors.

This article will focus on five of the most common invoicing mistakes managers make when processing recurring payments.

It will also offer practical advice on how to avoid those missteps and boost your management strategy.

Let’s begin by examining transparency.

- Not Explaining All the Charges

- Failing to Invoice Customers on Time

- Sending Invoices That Have Errors

- Invoicing the Wrong Customer

- Not Following Up on Unpaid Invoices

- How to Create Recurring Invoices Within Regpack

- Conclusion

Not Explaining All the Charges

One mistake businesses tend to make in invoicing is failing to adequately justify the charges included in the payment.

Now, it goes without saying you must have a legitimate reason behind every single charge. It’s against the law to do otherwise.

But you also have to make sure the customers understand what they are paying for. Being clear and transparent will make people trust you more.

As Katy Young, a managing partner of the Ad Astra Law Group, explains:

Source: Clio

It even led to her clients taking notice of the quality of her invoices, praising how professional-looking they were.

On the other hand, failing to include all pertinent details, particularly in case you have a recurring billing system, means your business risks frequent customer support calls inquiring about this issue.

In the event that they find your response not fitting, or possibly fail in getting through to customer service, they could even decide to ask for their money back.

Therefore, if you want to avoid jammed phone lines at best and a surge in returns and chargebacks at worst, you need to offer detailed explanations in your invoices.

In the next section, we will discuss how sending timely reminders of an upcoming payment can help you do the same.

Failing to Invoice Customers on Time

With recurring billing, it’s easy to make the mistake of putting invoicing emails last on the list of priorities.

After all, these are guaranteed payments, already agreed upon by the customer. Even if you forget to send an invoice now and again, you can send one if the payment fails.

However, if you regularly fail to invoice customers on time, it follows that you would frequently have to deal with late payments. Of course, this will have a negative effect on your business.

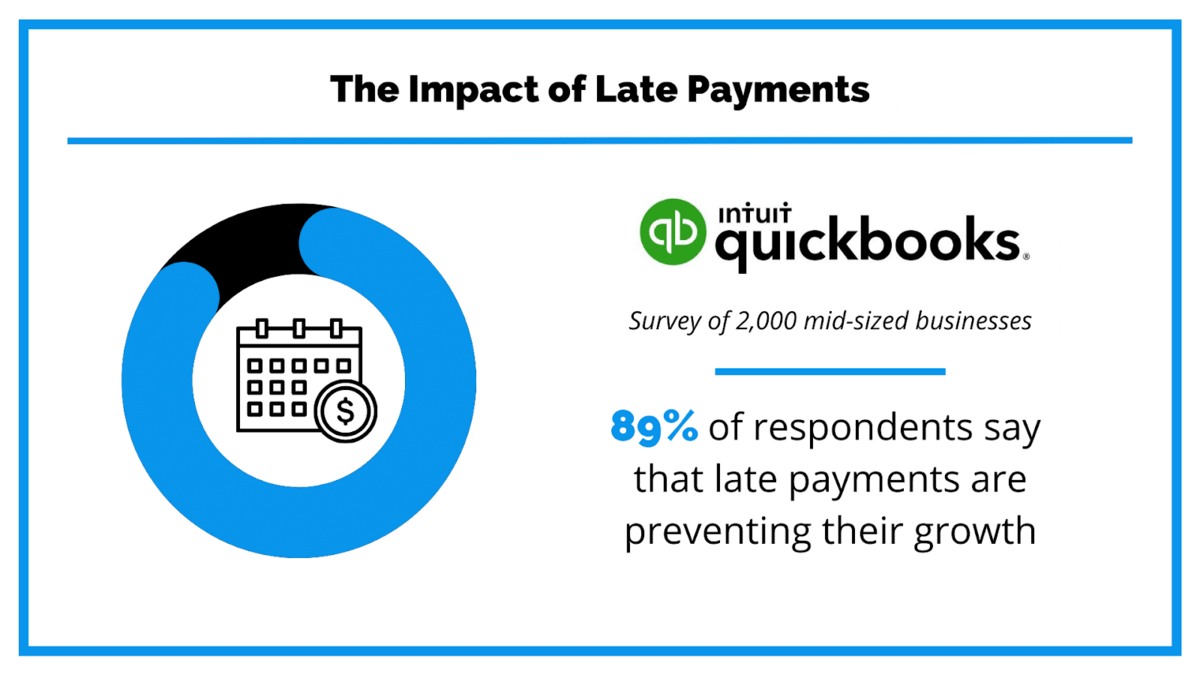

In their research on the impact of late payments on mid-sized businesses, QuickBooks found that a great majority of businesses considered late payments to be preventing their businesses from growing.

Data: QuickBooks / Illustration: Regpack

Even if your business does everything up to par, some customers will still end up missing their due dates.

Therefore, it is important that you try at least to smoothen out your part so as not to contribute to the problem.

The easiest way to do so is to set aside time specifically for sending invoices to customers.

Recurring payments already require working on a schedule, so just add one more entry to the weekly plan.

Sure, that’s additional work. However, it still beats having to deal with billing issues due to missed payments.

Ultimately, if you manage to ensure customers are getting their invoices in time to pay, you will avoid a good deal of late payments, saving your business time and trouble.

Sending Invoices That Have Errors

Managing any type of business or organization means learning to cope with one unavoidable fact of life—humans are prone to errors.

Unfortunately, managing invoices is no exception to this rule.

Manually entering the same repetitive sets of data is tedious. In these situations, mistakes can easily happen for various reasons.

A person could get bored, distracted, stressed out, or simply misread or mistype a few numbers.

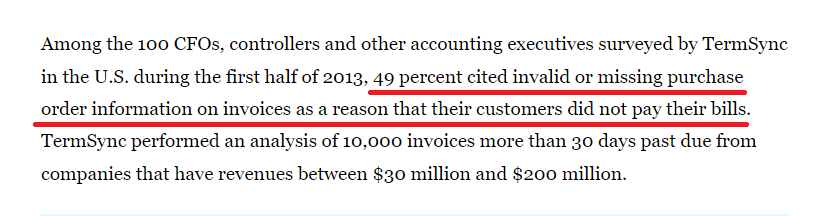

As research from CFO revealed, these small errors usually mount up to a bigger problem with considerable effects on your business.

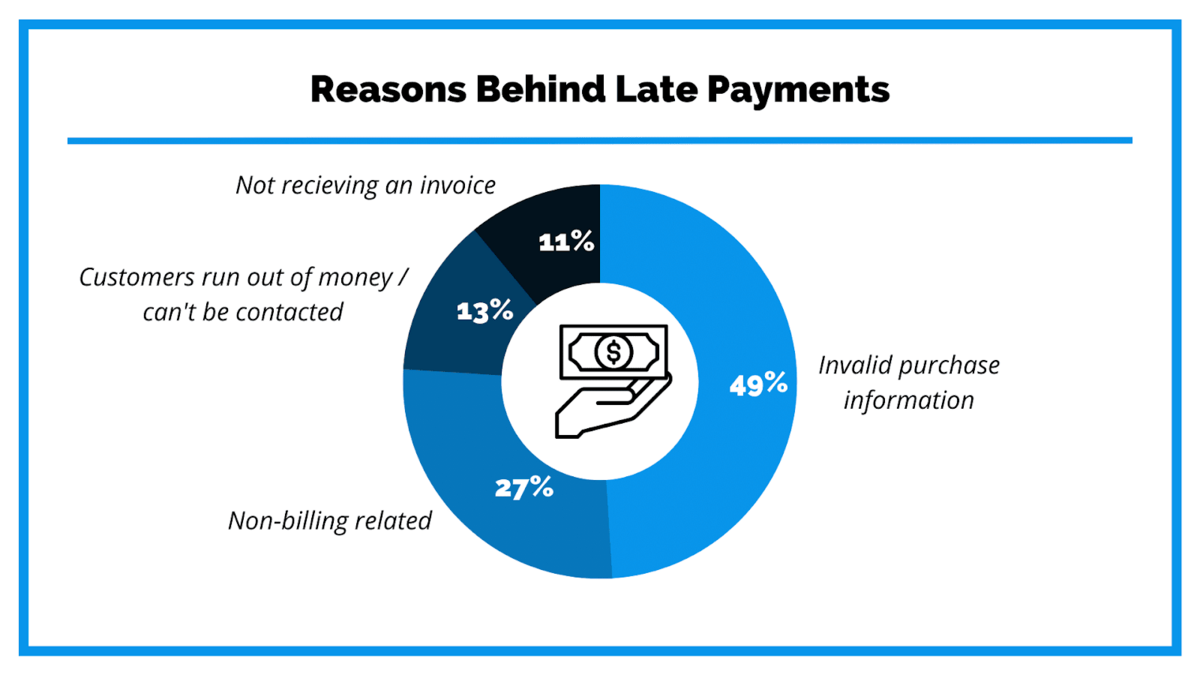

As part of their survey, half of the respondents put invalid or missing purchase order information as the top reason their customers failed to pay their bills.

Source: CFO

Because of recurring payments, you will have even more invoices to send, and that means greater potential for mistakes. A way to curb these issues is double-verification.

In short, this entails that every piece of data entered in the invoice is checked so that it matches the source.

When not focused on typing away at the keyboard for extended periods of time, it becomes a lot simpler to spot discrepancies between the two.

With a large number of regular users, you will have enough material to designate a specialized proofreader.

They can focus only on this aspect of payments, making them more efficient at the task.

In the same vein, it is equally as important to verify user contact information when sending the invoice, which is what we’ll discuss next.

Invoicing the Wrong Customer

When you mistakenly send invoices to the wrong customers, you are bound to end up with late payments.

Even if the customer has your payment information, they can use the missing invoice as a reason to hold off paying.

If not for good, at the very least until your business figures out the problem.

Some could go a step further and elect not to pay at all, which is not that rare of an occurrence.

In the CFO article we previously mentioned, it is also stated that 11% of the customers did not pay their bill because they never received the invoice in the first place.

Source: CFO / Illustration: Regpack

Recurring billing opens up the opportunity for this to happen even more often, as one mistake can carry over to several invoices.

Therefore, it is even more pertinent to address these kinds of oversights.

You might not figure out you even have a problem at first, as actual people receiving the mail could choose to ignore it.

After all, it’s not addressed to them, nor are they the ones being charged.

For this reason, the most reliable solution is basically the same as the one already discussed in the previous section, and that is verification.

Double-checking that the address you send invoices to matches the one in the user database will take care of most email-recipient-related issues.

Overall, not sending invoices to the intended recipients is a big mistake on the part of your business, and the one you can’t afford to make if you want to make recurring billing work.

Not Following Up on Unpaid Invoices

We already listed a few ways your business could mess up recurring billing, resulting in unpaid invoices. However, that paints only a small part of a much larger picture.

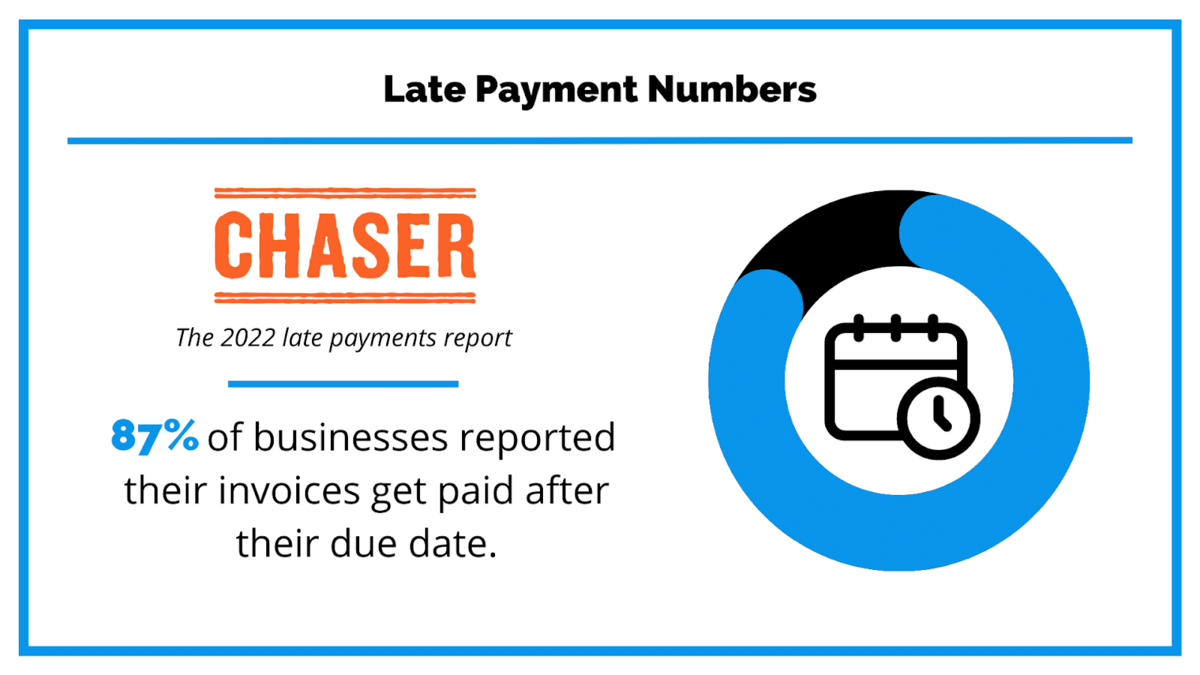

Chaser’s 2022 late payments report revealed that a large majority of businesses receive payments after they were due:

Data: Chaser / Illustration: Regpack

While some of these are undoubtedly caused by bad billing practices, customers’ actions or inaction when it comes to payments are still the primary culprits.

Wait a minute—you might be thinking—if you send an accurate invoice to the correct address, there’s nothing else to do, right?

Fortunately, there is.

Following unpaid invoices with reminders can remedy some of the late payment workload.

Firstly, it will reveal any mistakes that somehow managed to squeeze past your verification efforts.

Even though double-checks reduce the chance of error, research from GreenBook shows that the number still falls shy of reaching the full 100%.

Secondly, you will motivate the customer to pay faster by reminding them of their commitment.

In Chaser’s study from above, it’s also stated that businesses that follow up with most invoices are the ones getting paid the fastest.

That makes sense, especially for the users who forgot to pay or missed your invoice email altogether.

It’s also why you need to be polite in your communication.

A kind word goes a long way, and if you treat your customers with respect instead of attacking them, they will be motivated to respond in kind.

Ultimately, whether mistakes come from the business or the customers’ end, it’s on you to find working solutions.

Following payments up with appropriate and respectful reminders should make it a lot easier to remedy their part and stay in a good relationship with your business.

How to Create Recurring Invoices Within Regpack

If you implement the solutions we’ve mentioned in the article, it will unquestionably reduce the number of mistakes that occur in managing recurring billing.

However, more invoices multiplied by more time verifying and following up on each one equals significantly more work on account receivables tasks.

If you have no manpower or work hours to spare, your business could have a scaling problem.

That’s where automated billing software like Regpack comes in handy, to say the least.

For a start, invoicing is automatic. As in, the system automatically creates and sends receipts with necessary billing information to users as soon as the payment is made.

The information includes:

- Name of the user

- Name of your business

- The soft descriptor you set up

- The last 4 digits of the payment method

- The amount the user was charged

- Payment transaction ID #

- The payment method used

- Products the user paid for and whether or not they have been paid in full

- A list of all previous payments on the user’s account

This way, you avoid all issues due to faulty payment information. Additionally, as emails are the ones customers used for registration, they will always be sent to the correct customer.

If you need additional information included in your invoice, you can’t set up custom emails that will be sent concurrently with the automatic invoice.

Creating an email is simple. Just go to settings > email and click “Create new email”.

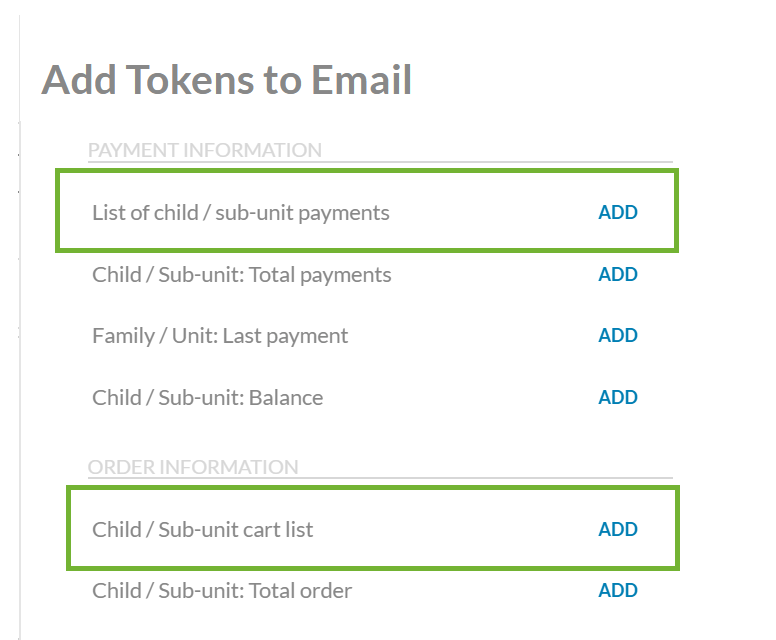

Other than naming and writing out the text, you can add tokens that will adapt to include individuals’ user and data information.

Source: Regpack

As shown above, if you are managing groups or families, you can also have their individual information included in the invoice, which is a rarity.

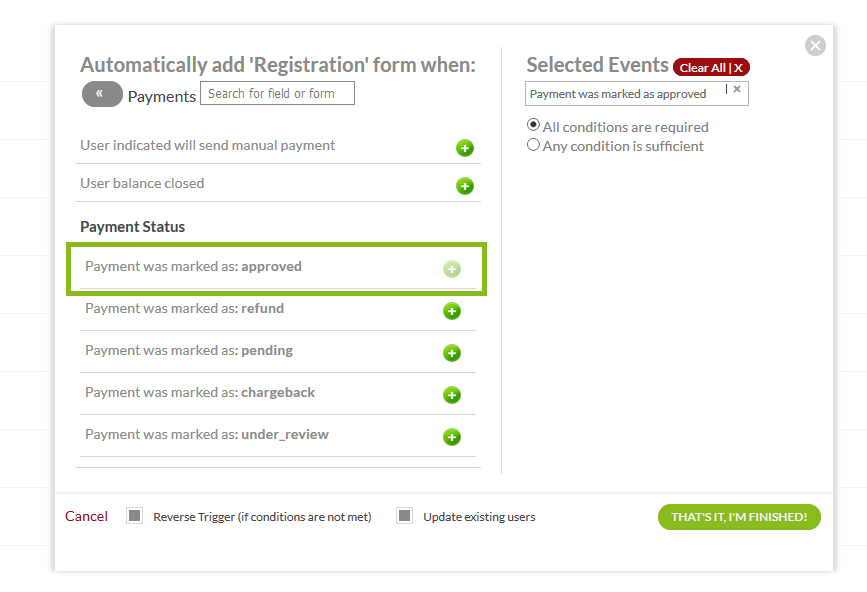

Once you have the template ready, Regpack allows you to assign it a trigger.

Triggers are certain actions a user makes, like making a payment. When the trigger is activated, the system automatically sends out emails connected to the trigger.

This, of course, includes approved payments.

Source: Regpack

However, it also includes other useful triggers, like pending payment. You can use this option for follow-up emails, rounding up the whole process.

All in all, Regpack combines the benefits your business gets from recurring billing with the added bonus of reducing the amount of time employees spend on boring, repetitive tasks.

Conclusion

Recurring billing allows businesses to have users subscribe to their service for months in advance, guaranteeing long-term commitment.

While providing peace of mind, it also means you have to keep up with the responsibilities of securing the payments.

Those responsibilities entail upgrading your business processes with solutions to the most common mistakes occurring with recurring payments.

You can start implementing them to see fast improvements in your business.

Additionally, if you grow to have too many users to manage efficiently, an automated recurring billing software solution such as Regpack can do the job for you.