If you need to collect ongoing payments from your customers, there are two major types of payment models to consider—recurring payments and direct debit.

The distinction between the two options may be slight, but it’s still worth spending some time learning about if you’re planning to overhaul your entire payment model and make the switch to recurring billing.

You don’t want to choose incorrectly.

Below, we’ll explain the difference between recurring payment and direct debit in terms of payment speed, failure rate, source of funds, and other factors.

We’ll also help you determine which method is best for your particular service-based business.

- What Are Recurring Payments

- What Is Direct Debit

- Recurring Payments vs. Direct Debit: Key Differences

- When Should You Choose Recurring Payments

- When Should You Choose Direct Debit

- Conclusion

What Are Recurring Payments

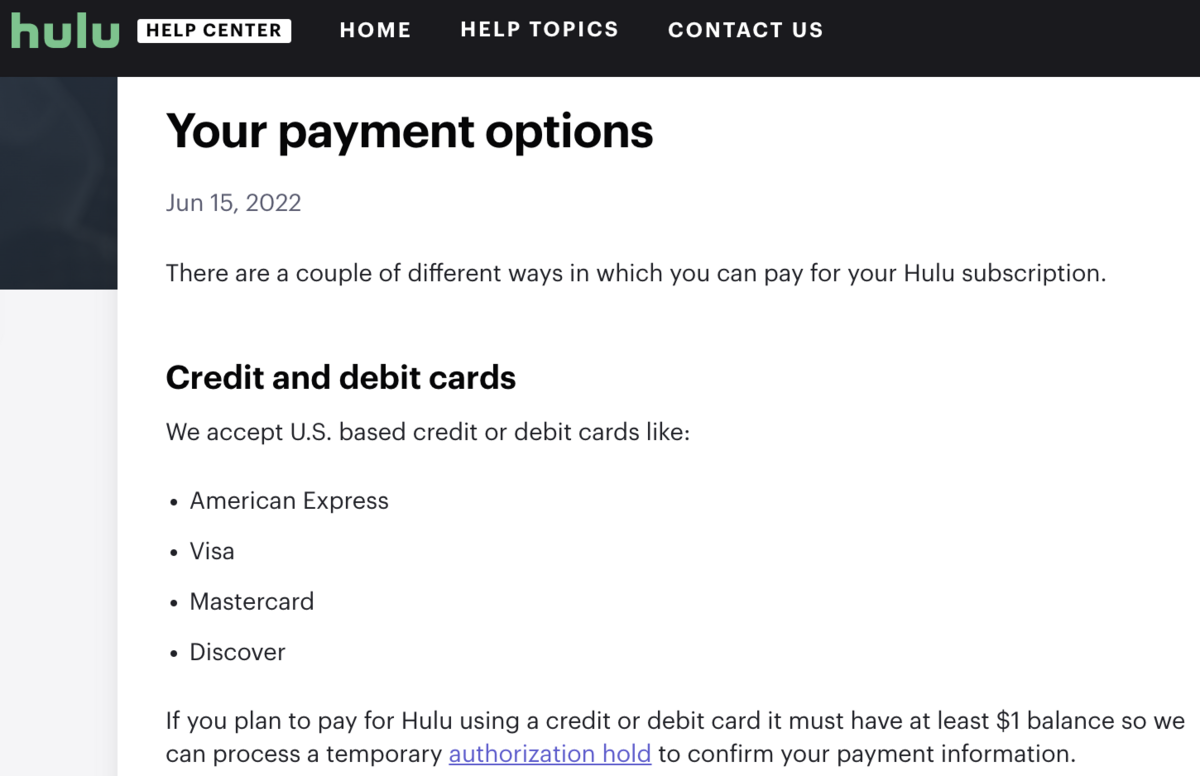

When a customer signs up for recurring payments, they’re giving your business the green light to charge their credit or debit card at agreed-upon intervals—typically monthly or annually.

You’re probably familiar with recurring payments because it’s the preferred payment method of many popular subscription services, from SaaS tools to streaming accounts like Hulu:

Source: Hulu

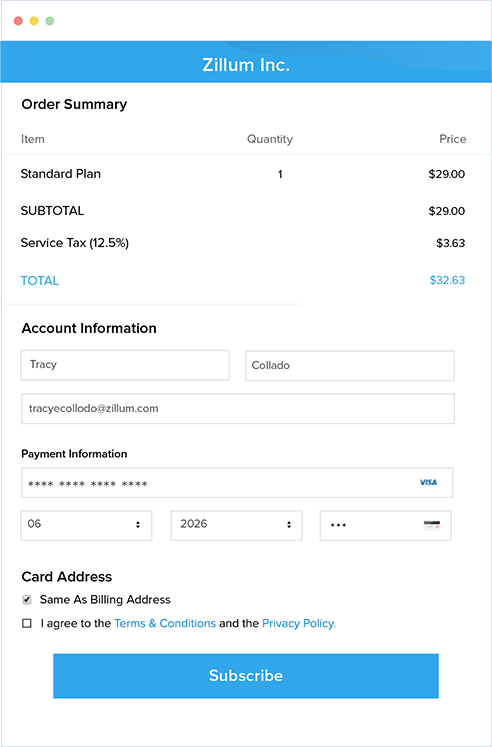

On the customer’s end, the process for opting in to recurring payments is simple and can usually be done online at checkout in under a minute.

Buyers select the autopay option, choose a payment frequency or schedule, check the terms and conditions box, and submit their credit or debit card information to the business via a form like the one below:

Source: Zoho

From that date on, funds are pulled from their card at recurring agreed-upon intervals until the contract agreement runs its course or is canceled.

There are many benefits to accepting recurring payments.

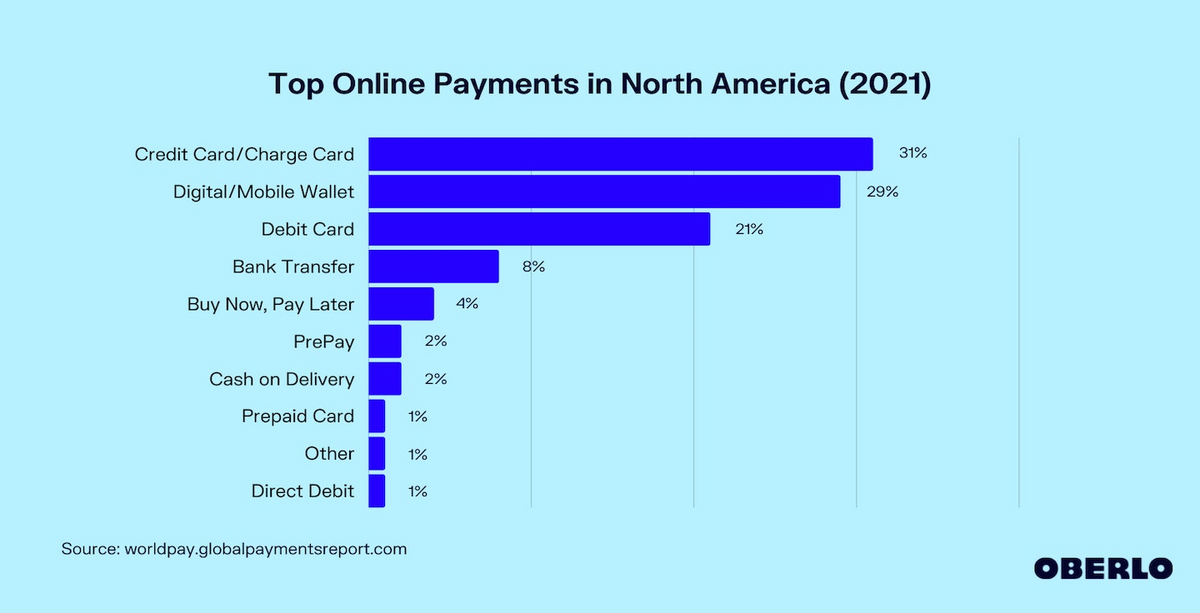

For starters, in a world where most people use credit cards as their go-to online payment method, recurring payments provide a lot of convenience for your customers, and this makes them more likely to stick around.

Source: Oberlo

Recurring payments also offer quick, next-day payment clearance, which makes them a great option for businesses that want to be able to quickly access the money they worked so hard to earn.

What Is Direct Debit

When a customer agrees to direct debit, they’re authorizing your business to draw funds directly from their bank account as needed, whether that’s for recurring charges, one-off charges, or a mix going forward.

It’s popular among landlords and management companies collecting rent, utility companies collecting bills, and some membership businesses collecting payment from customers.

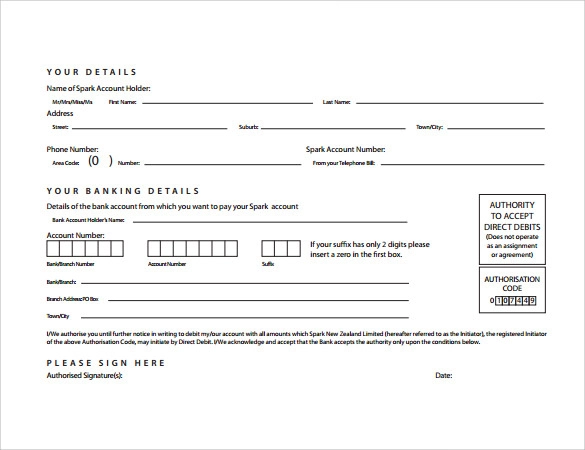

To sign up for direct debit, customers must fill out a Direct Debit Mandate Form:

Source: DocHub

Typically, they submit their bank account number, routing number, and other required bank information for authorization.

In most cases, the customer also chooses a preferred frequency and date to be charged by your business. You can control the choice by giving them some options on the form.

For frequency, a business might make the customers choose between monthly and annual charges.

And for a date, they may give customers a choice between the 7th, 15th, and 22nd, for example.

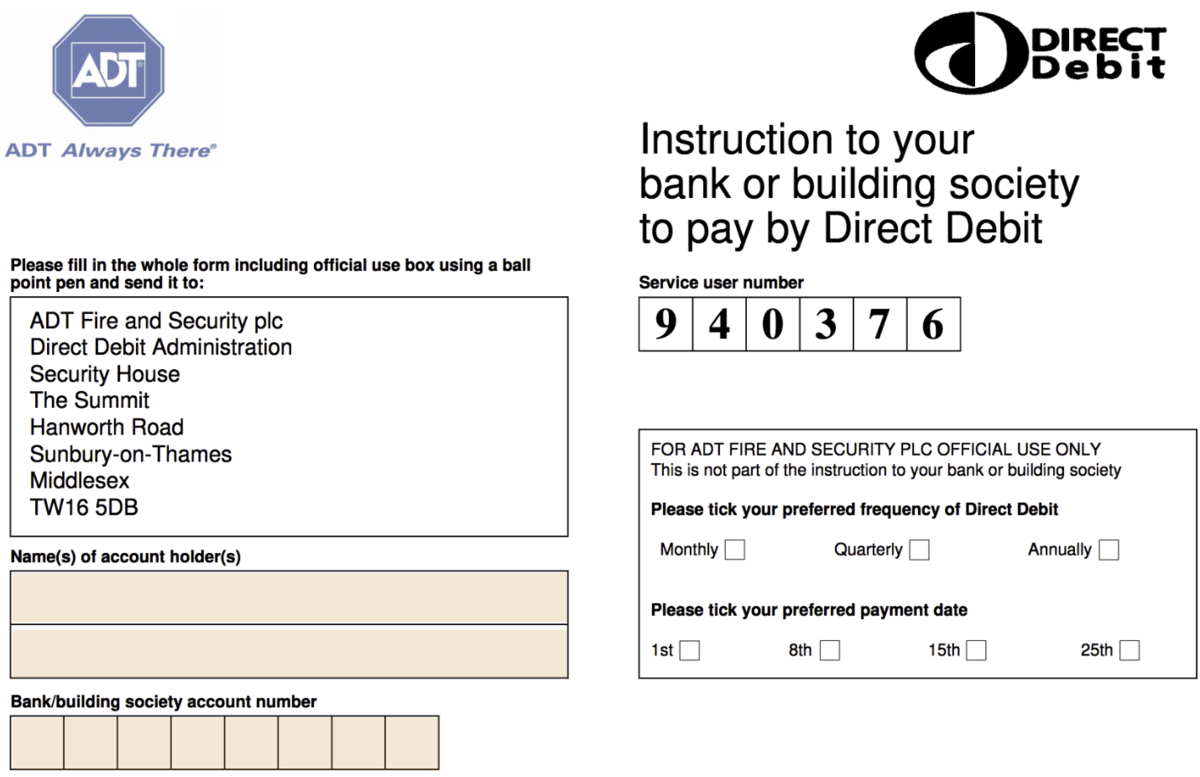

The direct debit form below gives customers four possible dates:

Source: DocHub

The major benefit of using direct debit is that it has low transaction fees and offers quality bank-assured customer protection.

One disadvantage is that the payment clearance rate can be pretty slow, sometimes extending past six days.

Recurring Payments vs. Direct Debit: Key Differences

The most significant difference between recurring payments and direct debit has to do with where the payments are coming from.

While the recurring payment model draws funds from the customer’s debit or credit card, the direct debit model takes funds directly from the customer’s bank account.

And this distinction leads to notable differences in the cancellation process, payment clearance rate, fees, and other categories we’ll explore below:

| Recurring Payments | Direct Debit | |

| Source of Funds | Credit or debit card | Bank account |

| Payment Clearance Rate | Fast, 24-hour payment clearance | Slow, can take multiple business days to clear |

| Cancellation Process | The customer cancels the arrangement through the business | The customer can cancel the arrangement through their bank |

| Payment Failure Rate | Medium-low. Debit and credit cards are slightly more susceptible to failure, e.g., expiring cards, payment limits, etc. | Low. Bank accounts often have sufficient funds and are less subject to failure |

| Transaction Fees | Low fee cost—recurring monthly fee | Lower fee cost—low transaction fees |

| Customer Protection | Safe—customers can easily ask for a refund if using a credit card, but there are some restrictions with debit cards | Safer—with the bank as an intermediary, they can quickly get a refund if they dispute a suspicious charge |

| Customer Concerns | Most customers feel okay about submitting credit or debit information | Some buyers might be hesitant to provide their bank account details |

| One-Off Payments | Not used to collect one-time payments from customers | Can be used to collect one-time payments from buyers |

To sum up the differences, recurring payments offer much faster payment clearance, but direct deposit, by a slight margin, wins the other three categories, offering lower fees, better customer protection, and lower payment failure rates.

When Should You Choose Recurring Payments

If immediate access to funds is critical to you and your business’s ability to function at its best, choose recurring payments as your recurring billing method.

Recurring payments offer a payment clearance rate of under 24 hours, on average days faster than direct debit.

This quick payment access can help you avoid cash flow slumps that interrupt operations.

You’ll avoid those nagging thoughts about how the money you’re owed is so close but at the same time so far, being tossed around and processed in the banks.

If the majority of your customers prefer to pay using cards, this is another good reason to use recurring payments, since it will charge the customer’s cards on a predefined basis.

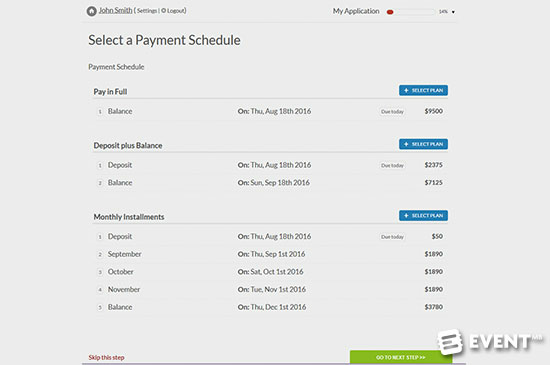

Accepting recurring payments is also easy for businesses to set and forget, especially if you’re using recurring payments software like Regpack, a tool built for service-based businesses looking to give customers a convenient payment experience.

It offers users the ability to create different recurring payment schedules to offer their customers as they go through the online checkout process:

Source: Regpack

The software also makes it easy to analyze payment data to identify common causes of payment failure or bottlenecks in the payment collection process.

Intel like this can help you offset some of the shortcomings of recurring payments, like its slightly higher payment failure rates when compared with direct debit.

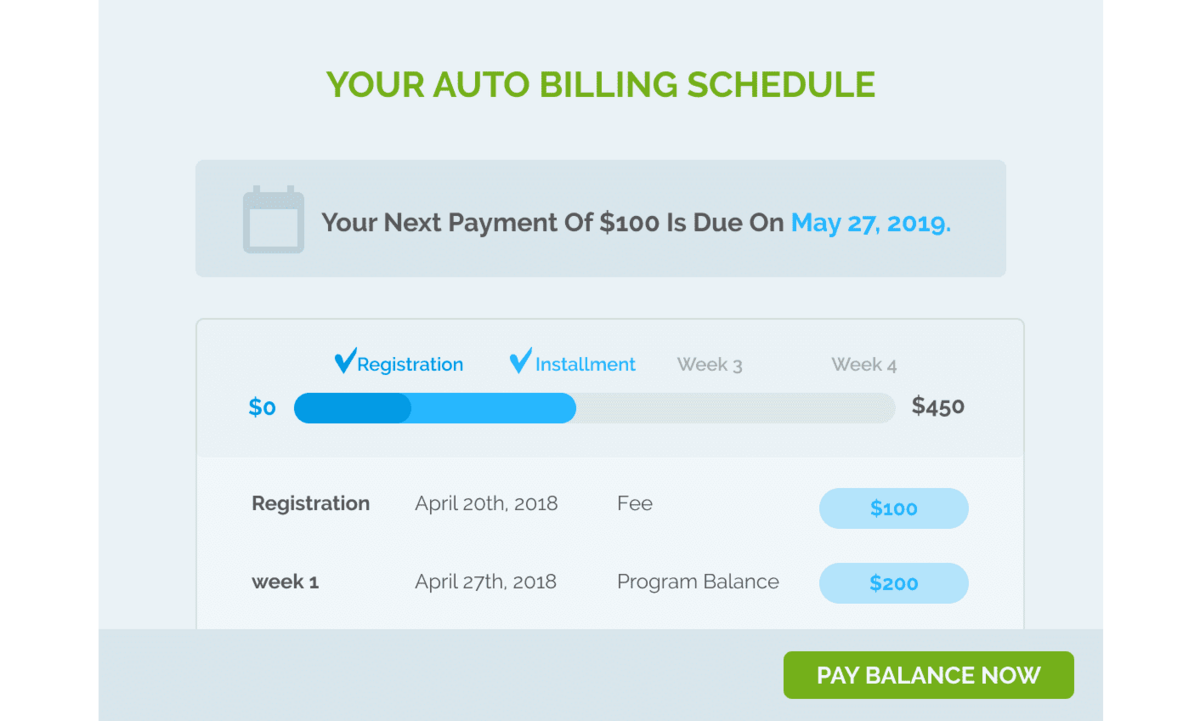

Not to mention, your customers will love the ability to check their payment progress and upcoming payments through their user portal:

Source: Regpack

Additionally, with the right recurring payments software, you can automate many of the other repetitive tasks associated with recurring billing, such as sending invoices or emails about upcoming charges.

Regpack, for example, will automatically email customers personalized invoices after they’ve been charged for that interval’s payment.

This allows your team to focus on more complex and creative projects than filling out and sending invoices.

In short, recurring payments are an excellent choice for businesses that want to collect their payments immediately after the customer’s card is charged, and that plan to automate much of the billing process through software.

When Should You Choose Direct Debit

Direct debit is a good choice for businesses that want to offer better protection for themselves and their customers and don’t mind waiting several days for payments to clear.

With the bank handling the payment processing and security, you can be confident that sensitive financial information is safe.

Plus, the bank can serve as the intermediary for charge disputes.

These conflicts with customers can become complicated without a bank, just like dealing with a tricky divorce situation might be troublesome without a lawyer present.

The fees for direct debit transactions are also less than recurring payment fees, which charge anywhere from 2%-3.5% per recurring payment.

For example, Square charges 3.5% + .15 cents each time you collect a payment using a card on file.

Another reason you might want to use direct debit as your billing method is if your business wants to mitigate payment failures.

Perhaps you’re dealing with an unusually high number of customers who often go past their credit limits, switch credit cards, or do other things that make credit card payments fail.

Direct debit has a much lower payment failure rate than recurring payments because bank accounts, unlike cards, rarely expire or have any limitations that would cause a payment to fail.

Conclusion

Recurring billing is a great way to create predictable cash flow for your business and delight customers with the hands-off convenience of the payment model.

Choosing between the two major types of recurring billing—recurring payments from cards, and direct debit from the customers’ bank accounts—comes down to whether you care more about payment clearance speed or transaction fees.

If you want your money quickly and don’t mind paying a little extra for it, you’ll want to go with recurring payments.

However, if you want to save as much money as possible and don’t mind waiting for the funds to transfer to your account, direct debit is probably your best option.

To learn more about recurring billing and how to do it in a way that reduces busywork and improves the customer experience, check out our helpful guide on recurring billing best practices.