Electronic billing, also known as eBilling, is not a new concept, but it’s recently been growing in popularity.

It’s easy to see why when you consider that eBilling allows companies to get paid quickly and keep track of outstanding payments.

If you’re considering implementing eBilling in your organization or simply want to learn more about this billing method, you’ve come to the right place.

We’ll go over the elements of an eBill in greater detail, including its content and the process of electronically billing someone. Then we’ll talk about eBilling systems.

After you’ve finished reading, you should have a firm grasp of the eBilling process.

- What Is an eBill?

- What to Include in an eBill?

- What Is an Electronic Billing System?

- Types of eBilling Systems

- The Difference Between eBilling and eInvoicing

- What the eBilling Process Usually Looks Like

- Conclusion

What Is an eBill?

Paper bills are a thing of the past for those who have replaced the old with the new and implemented eBilling in their business.

The process connects the company and the customer electronically, allowing them to send invoices and payments online.

An eBill is an electronic bill generated by your system and delivered to customers via your website, online portals, or email.

Your clients can receive and pay bills electronically with eBilling. As a result, this billing method is faster and more efficient than traditional paper invoices.

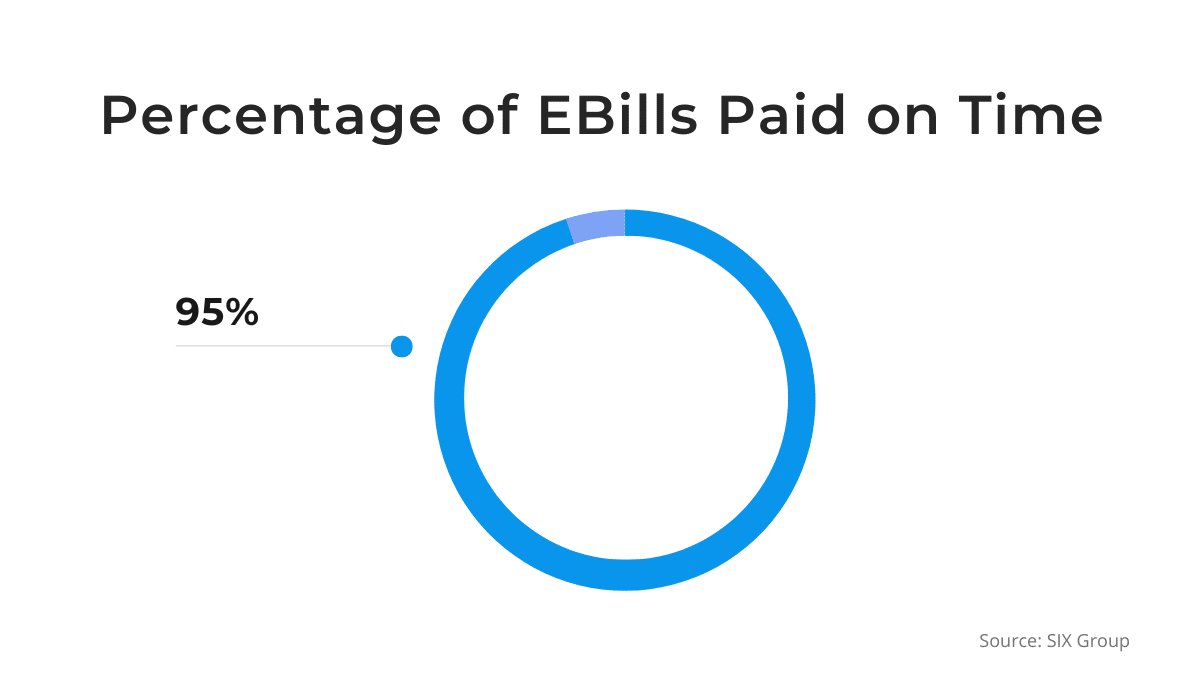

According to SIX Group research, only 5% of eBills are not paid on time. Therefore, eBills are 10-20% more efficient than paper invoices.

Source: SIX Group

Companies that use this billing method will see an increase in on-time payments.

This increase will impact their cash flow and help them stay afloat, which is why so many businesses prefer this billing method.

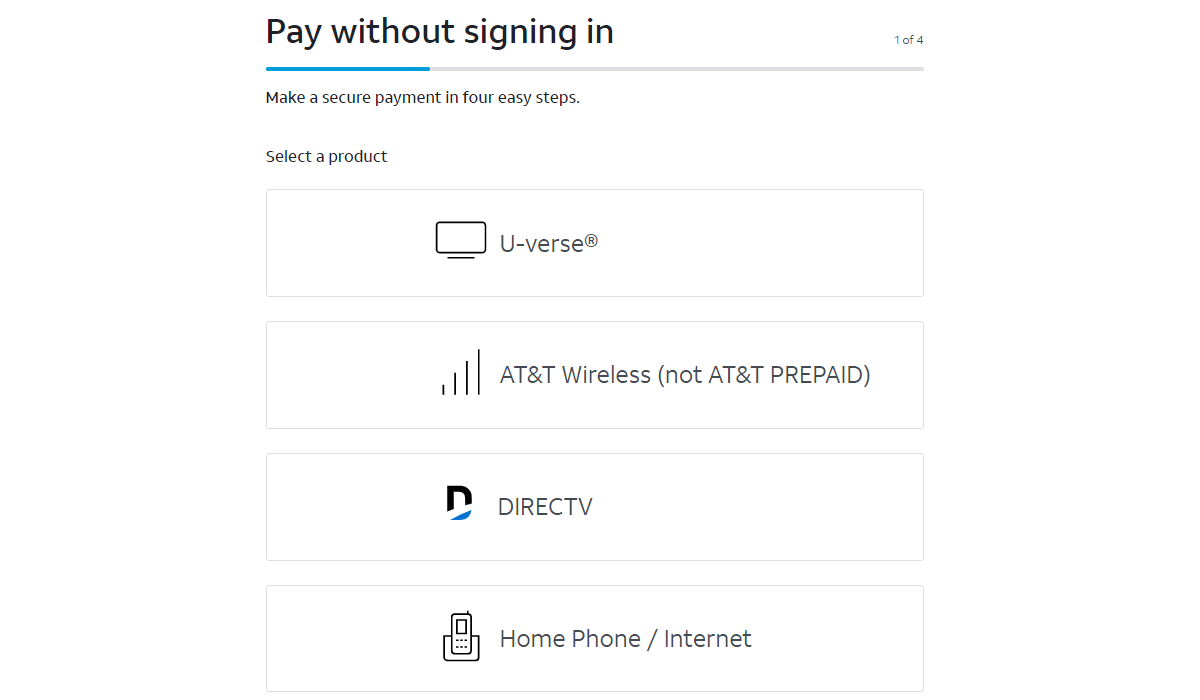

AT&T, the telecommunications giant, pioneered eBilling over 20 years ago. Customers do not need to sign in to pay through the AT&T payment portal, app, or website.

Source: ATT

To pay online, customers should simply select the product they are using and enter their AT&T phone or account number and zip code.

The company streamlines the process and ensures they get paid on time by providing these options.

The eBilling process is digital and can be completely automated, requiring little human intervention.

As a result, eBills are consistent and efficient, giving you more time to perform tasks you cannot automate.

However, to incorporate eBilling into your company’s payment processing, you’ll need to include a few integrations, such as:

- Billing

- Banking

- Customer’s bank billing

- An online portal for payment

In other words, you’ll need to build integrations so you can create and send bills, accept online payments from customers, and process those payments through a secure online portal.

Because of the time and money invested in these integrations, eBills are most commonly used by businesses that accept recurring payments.

Because such companies must invoice their customers each month, an automated solution makes sense for them.

What to Include in an eBill?

eBills are electronic invoices that include everything paper invoices do. They are sometimes regarded as electronic copies of paper invoices.

Such bills are typically sent as attachments via portals, websites, and email.

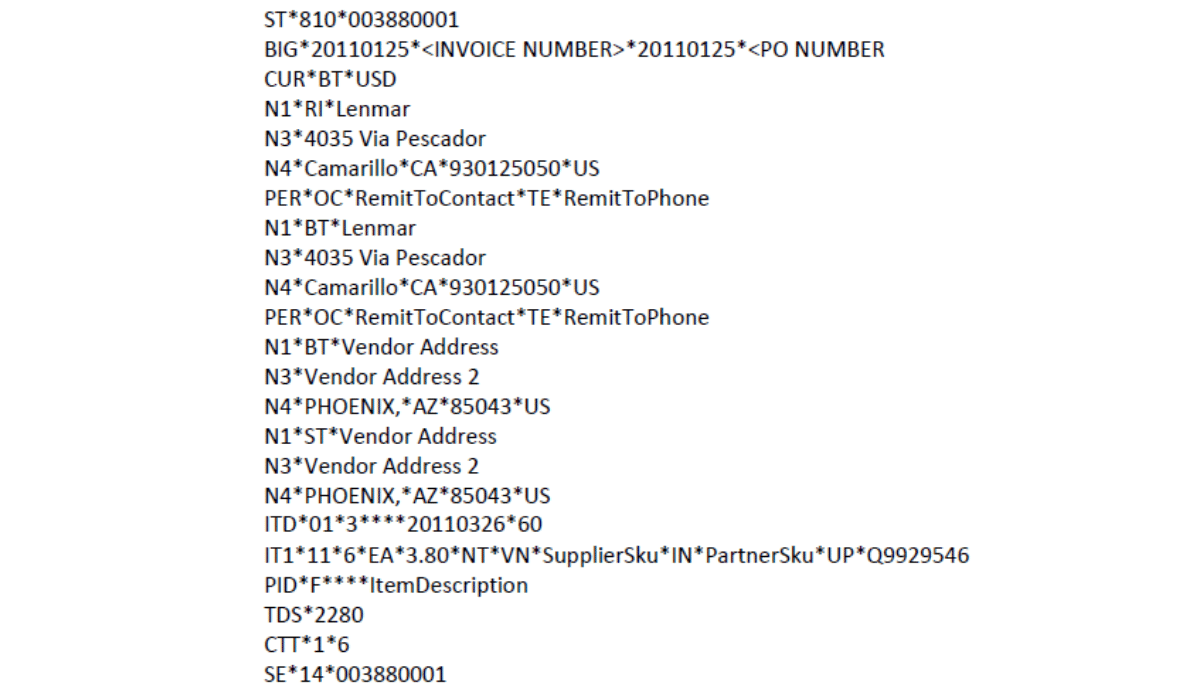

In the case of business-to-business (B2B) payments where your company is charging another business, bills are machine-readable documents in formats like EDI or XML for easier accounting software processing.

Here’s an example of an EDI invoice from Logic Broker.

Source: Logic Broker

The eBill information is presented in machine-readable code, whereas standard eBills are written with the end-user in mind.

Regardless of the format, eBills contain the same information as invoices, including:

- Business logo for easier identification

- Invoice number and date

- Company information

- Client data

- Product or service description

- Price and amount

- Taxes and applied discounts, if any

- eBill due date

- Payment details

- Terms and conditions

Some of this information, such as your logo, company details, and product description, aids the customer in quickly identifying your business and service.

Other pieces of information, like invoice details, price amount, taxes, and the due date, are included to speed up the payment process.

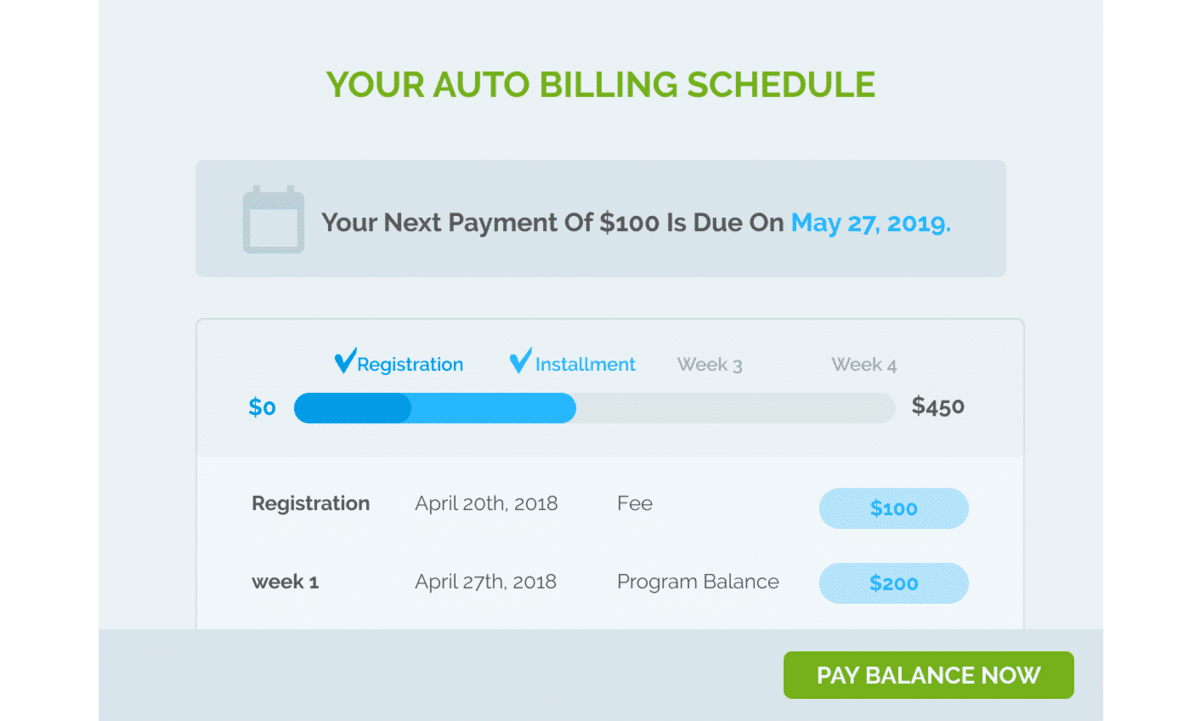

However, companies that limit their eBills to the information they used to include in their paper invoices are missing out on a world of opportunities.

For instance, your eBill can include a pay now button, allowing the client to pay online quickly.

Source: RegPack

The companies that include a QR payment code will have an even easier time getting customers to pay on time.

A simple scan of the code allows users to send an electronic payment.

Similarly, eBills can include a link to an FAQ page.

When a customer has a question about the payment after seeing the eBill, they can find an answer through a simple click without going out of their way to find the information.

You can also add links to your customer service contact form or anything else that might help your customers with payments.

What Is an Electronic Billing System?

An electronic billing system enables you to send and receive bills electronically while maintaining complete transparency.

Payments are simplified because you and your customer have access to the invoice and payment details.

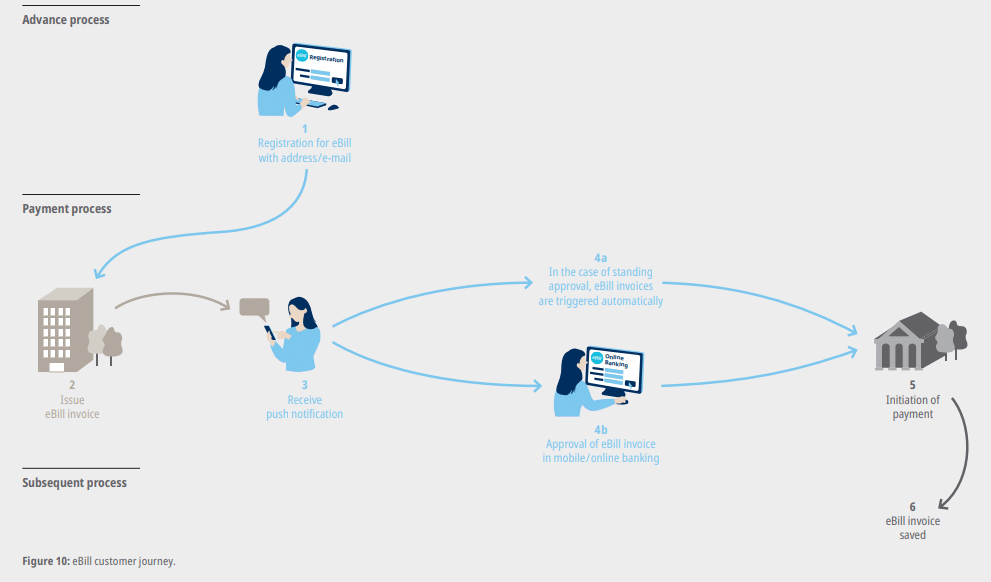

To function correctly, an eBilling system must integrate with a couple of other systems, such as your company’s enterprise resource planning (ERP) or accounting software, banking software, and payment system.

Following all of these integrations, your eBilling system retrieves data from your accounting software and generates invoices. The system then sends eBills to customers.

Source: Six Group

Customers can pay electronically because of integrations with their billing systems, and you can receive payments in the same way through integrations with your banking software.

To summarize, good eBilling technology should allow you to invoice customers, provide you with a payment gateway for transactions, and have a dashboard that displays all relevant data.

When you have all of that, the process becomes seamless, and you can have an overview of paid and outstanding eBills.

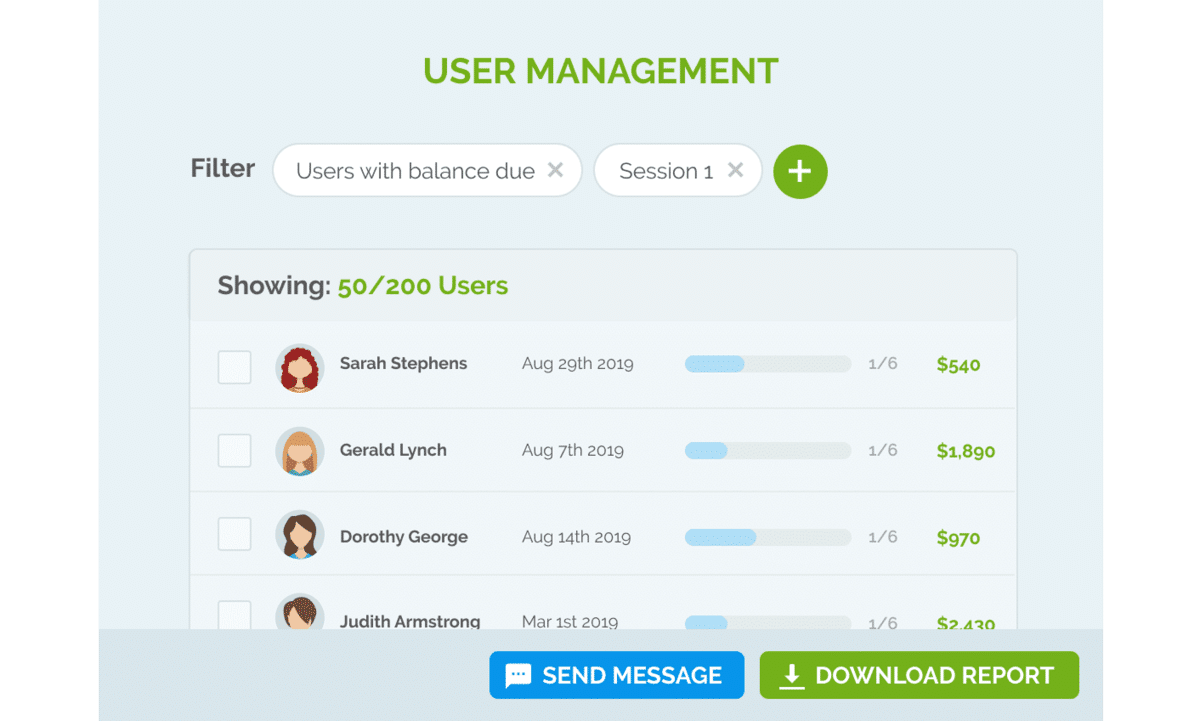

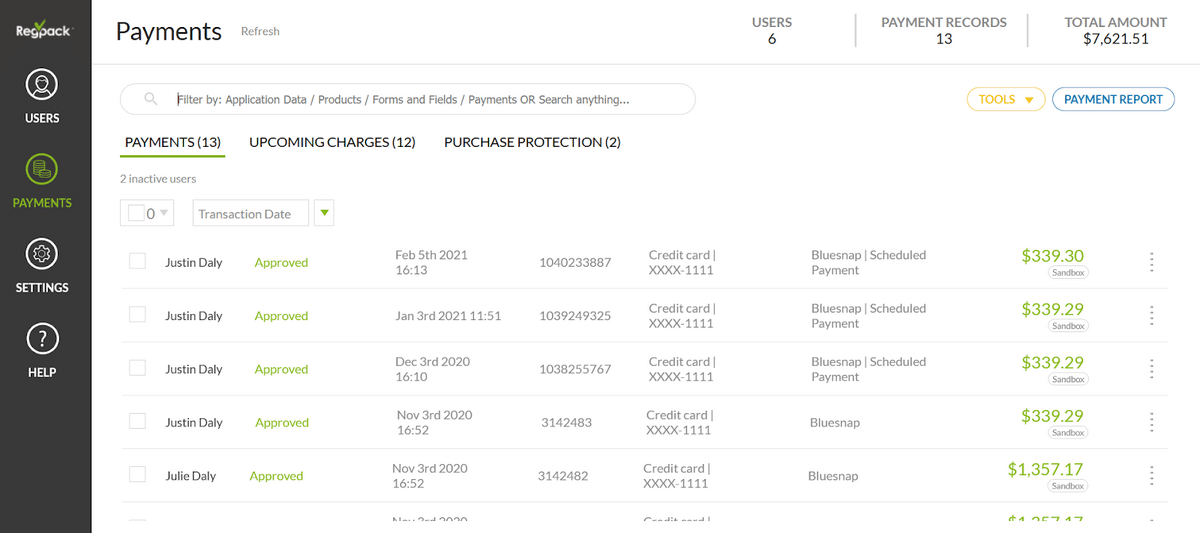

Source: RegPack

Automated billing software like RegPack allows you to manage users and filter them based on outstanding payments, so you can always check your customer’s current payment situation as well as their payment history with your company.

Whatever software or system you use for eBilling, ensure it provides a good overview of the necessary data and integrates with the required software.

Types of eBilling Systems

There are numerous types of eBilling. Biller-direct and bank-aggregator options are the most common.

A biller-direct option is when the biller, or the company that sells the products or services, bills customers directly via an in-house or outsourced billing system.

You have more autonomy, can hire your billing staff, and have immediate access to all necessary information with an in-house billing system.

Companies that use this system either use billing software or create their own to bill and charge customers.

On the other hand, an outsourced billing system is a third party you pay to handle your billing.

Outside billers typically have a larger staff, more industry knowledge, and provide standardization.

Customers can visit the biller’s website, an online portal, or receive the eBill via email with a bill-direct option.

All these options allow the customer to get the bill directly and pay it the same way.

Source: RegPack

On the other hand, bank-aggregator systems rely on bank aggregators, “entities that allow individuals to share and access data from one financial institution to another in the consolidated networks of account aggregators.”

As a result, instead of logging into each institution’s app, customers can log into their aggregator’s interface and pay more billers through the same app.

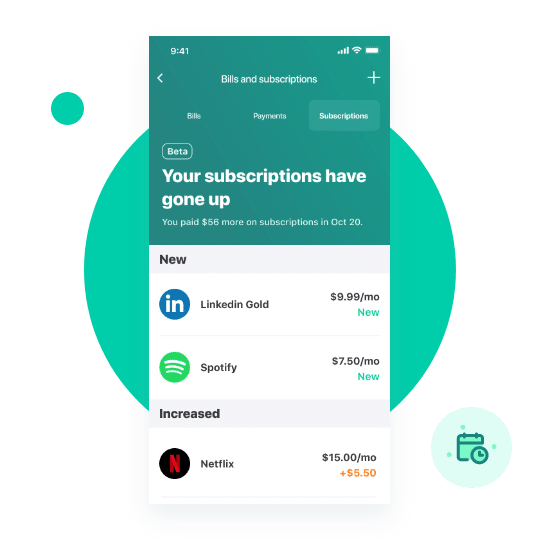

Mint, an app that allows you to gather all of your financial data and subscriptions in one place, is an example of such an entity.

Source: Mint

Mint displays users’ bills, payments, and subscriptions, determining how much they owe and to whom.

You can pay for services like Netflix, LinkedIn Gold, or Spotify from the same dashboard with such an app.

Electronic payments are possible in both the biller-direct and bank-aggregator systems. You simply need to decide which option best meets the needs of your business.

The Difference Between eBilling and eInvoicing

Even though some people use the terms eBilling and eInvoicing interchangeably, they are not the same. In fact, the latter is a part of the former.

EInvoicing refers to electronic invoice creation and processing, usually in a B2B context. Your company creates an invoice and sends it to the company or end customer, who then pays it.

On the other hand, eBilling refers to the entire process of creating eBills, sending them to customers, charging them, and entering the data into your payment system.

To put it simply, eBilling is the process of electronic invoicing and charging customers, while eInvoicing is the process of sending an invoice to the customer electronically.

Some refer to eInvoicing as the simple version of eBilling because it includes creating an invoice and sending it electronically.

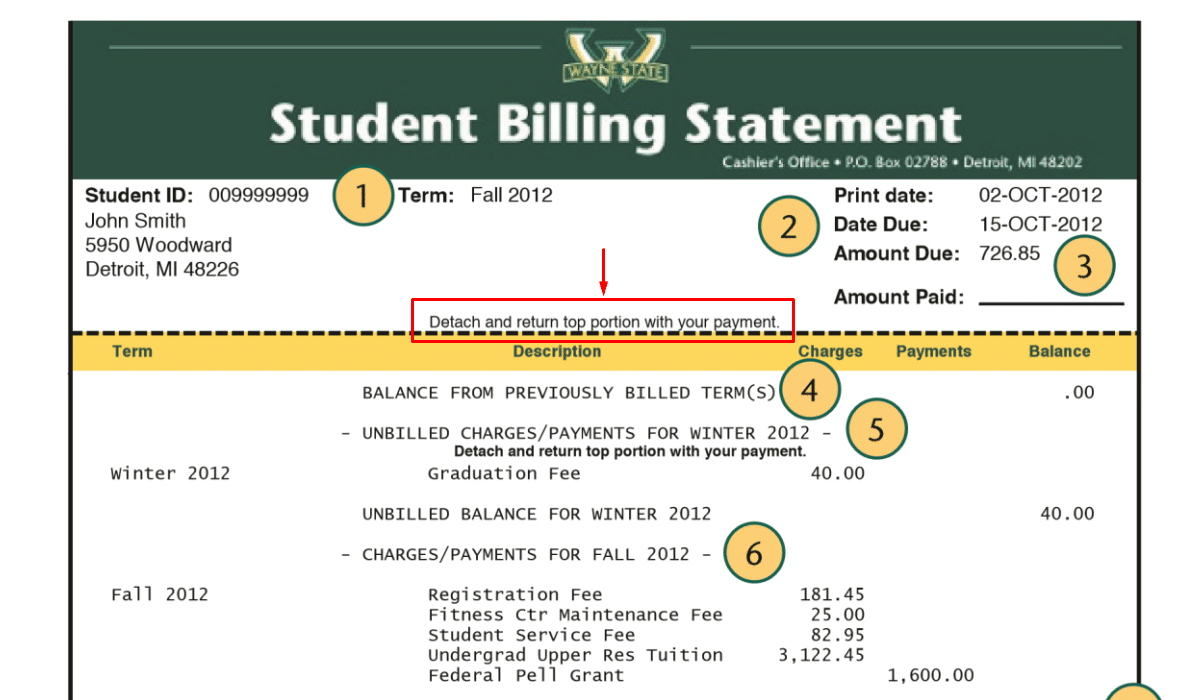

Here’s an eInvoice Wayne EDU students receive.

The text on the invoice instructs the students to detach the top part of the invoice and return it to the university with a payment check, which is how these invoices usually work.

Source: Wayne

However, Wayne EDU also offers the options of credit or debit card payment and the school’s Cashier Office.

Therefore, only a part of the process is digital, while the payment and its processing are still manual, which makes a difference between eBills and eInvoices.

While eBills look similar to eInvoices, they offer instant and easy electronic payment, which is why more and more companies are turning to them.

Moreover, they allow the biller to stay on top of their payments, including the outstanding ones.

Source: Regpack

Through a payment dashboard, the biller can quickly check who has paid on time, who was late, and which customers still haven’t paid.

In other words, the biller gets to see additional information and better understand the entire eBilling process.

What the eBilling Process Usually Looks Like

A good eBilling process is entirely electronic, with multiple steps enabled by integrations with payment and banking systems.

The first step in the eBilling process is to generate an eBill using your ERP or accounting software data.

You can create the bill manually, but it is far more efficient to automate the process entirely. The information you will use includes everything related to the purchase, such as:

- Items or services sold

- Order date

- Payment information

- Customer data

With this information, you can charge the customer correctly and provide them with enough data to understand why they are paying you.

Your accounting and financial system will pull the prices of the items or services and calculate the due date and total payment amount automatically.

When the eBill is complete, you send it to the customer electronically.

Online deliveries are faster than traditional mail because the eBill can reach the customer in seconds via your website, a portal, or customer email.

No matter where the client is, they receive your eBill instantly.

Then, your customer processes the invoice. If you’re billing a company, the accounts payable (AP) department will make a note of the bill and enter it into their system.

If your end customer is not a company, they’ll usually download the invoice and keep it somewhere safe.

If you use billing software, you can use it to notify the customer of the eBill delivery or remind them of the payment date.

Since you can automate these reminders, you can use them to keep informing customers of their outstanding invoices, i.e., the bills that weren’t paid by their due date.

Your customer will then pay you electronically using the payment information you provided in your eBill.

Some businesses accept instant payments via a click-to-pay button. Others include barcodes or QR codes in the eBill to expedite the process and receive compensation faster.

Your system processes the payment and closes the outstanding bill once the customer pays.

As a result of this step, you will be able to generate payment reports on the customer, which will include their payment status and history.

These steps are electronic, significantly reducing the time it takes to bill and collect payment from a customer.

Many businesses now have eBilling systems or software with similar features, such as Regpack.

Conclusion

If your company issues many bills and wants a better overview of all issued and paid invoices, eBilling is the way to go.

Even if you have to spend time and money getting the right software and integrating it with your existing AP processes, eBilling will significantly benefit you.

Some of the things you get from eBilling are automated bill creation and sending, easier payments and faster processing, as well as a more accurate overview of payments.

Look into billing software and embark on a journey to faster, more convenient payments!