If you’ve ever read finance-related texts, chances are you stumbled upon the term “liquidity.”

Maybe you found yourself unsure of what it really means.

What is it and why is it so omnipresent?

Simply put, it is one of the key metrics for measuring the financial health of a business.

In this article, we will explain what liquidity means and why it is so essential for small business owners.

- Liquidity Explained

- What Are Examples of Liquidity?

- Why Is Liquidity Important to Small Businesses?

- How to Calculate Liquidity

- How Can Liquidity Be Improved?

- Conclusion

Liquidity Explained

Liquidity is defined as the ease with which a company can trade its assets for cash within a year.

Or, in more simple terms, how quickly a company can sell something it owns for its current market value.

Why would a company need to sell its assets?

Because it needs cash to cover the existing liabilities. In other words, a company needs to have more assets than liabilities to be considered liquid.

What this basically means is that liquid companies own more than they owe.

Let us explore the difference between the two in more detail.

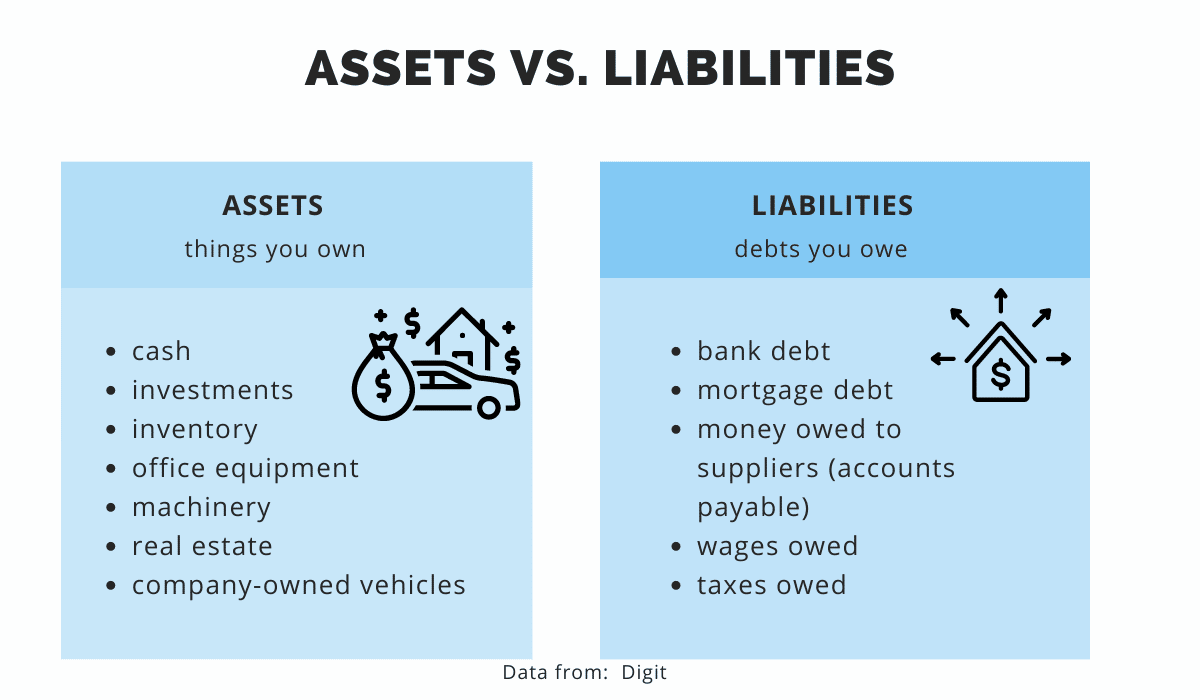

Assets are things that provide future value for a business, either by generating revenue or by reducing costs.

They can be tangible, such as office equipment or company-owned vehicles, or intangible, such as investments or intellectual property.

On the other hand, liabilities are future financial obligations that a company has towards others (vendors, employees, etc.).

They can be short-term (sometimes called current), such as salaries or accounts payable, and long-term, like mortgage debt and bonds.

A simple illustration of the differences can be seen below.

Source: Regpack

It’s important to note that assets and liabilities are also two components of a balance sheet, a core type of financial report.

Like in our image above, assets are shown on the left side, and liabilities, together with shareholder’s equity, are shown on the right side of a balance sheet.

The two columns balance out, hence the name.

Like liquidity, it can serve as an indication of the financial status of your company at a particular moment, for example, to an investor.

Now that we’ve covered the definitions, let’s dig deeper into some concrete examples of liquidity.

What Are Examples of Liquidity?

Assets are liquid if they can be converted into cash quickly and easily. Typical liquid assets include cash, stocks, personal savings, and accounts receivable.

Cash

Looking back at our definition from the beginning of the previous paragraph, it’s clear that cash is a vital part of liquidity. It’s also in the “assets” column in the image above.

This is because cash is the most liquid asset. As SmartAsset describes, this is because cash is readily available to be used as a means to purchase goods or settle debts.

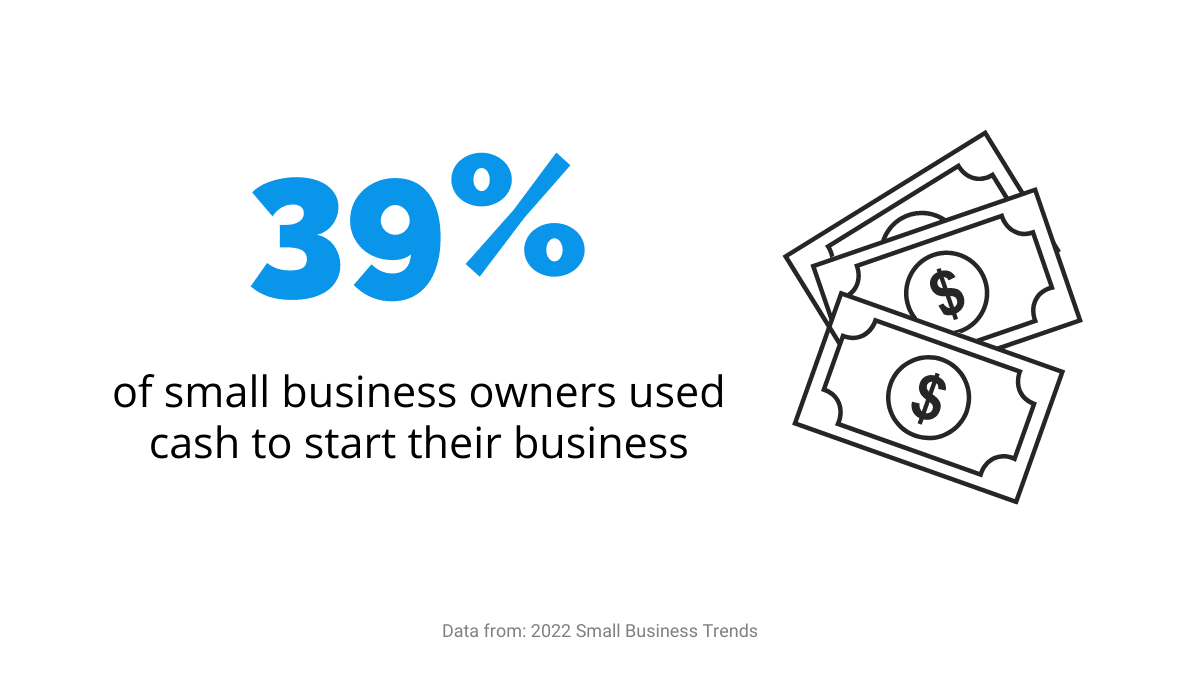

Because it is so liquid, cash is the most popular form of small business financing.

Nearly 40% of small business owners use it to start their business, according to Guidant’s 2022 Small Business Trends report.

Source: Regpack

The best part is that no conversion is necessary: cash is already cash. You probably have some in your wallet right now, and if you don’t, you can get it from an ATM in minutes.

However, as they point out in Forbes, this liquidity comes at a cost: the value of liquid assets doesn’t increase over time.

Quite the opposite, it can decrease due to inflation, so it is recommended to invest it in something that will increase in value as time goes by, such as real estate.

Admittedly, you will lose some liquidity, but it will enable you to have a failsafe system for periods of inflation, like the one we’re in right now, which is the highest in the past 40 years.

Stocks

Stocks are considered liquid because there’s a specialized market where you can exchange them for cash in seconds, the stock exchange.

They are traded on stock exchanges in large volumes daily, so there is demand, and everyone can easily see their value.

Let’s compare this to selling your house, which is not a liquid asset.

When determining its value, there are many factors to consider, and it will probably be on the market for months before you sell it.

Moreover, if you factor in all the investments for repair and furnishing, you will probably end up selling it for less than all the money you spent on it combined.

Therefore, your house can’t be traded for cash without losing value that easily.

When it comes to the value of stocks, it can (and does) change, often unpredictably, but stocks can still be exchanged with the same ease—it’s just that some owners might be less inclined to sell when the value decreases.

Savings Accounts

A bank account is considered liquid if there is no maximum withdrawal limit, which is usually the case for a savings account.

The funds are there at your disposal and you can either withdraw them or move them to your checking account.

However, there are technically still some restrictions on saving accounts in the USA.

The first one is that, under the Bank Secrecy Act (BSA), banks must report all withdrawals of $10,000 in a single day. The aim is to prevent fraud and money laundering.

So, if you want to withdraw more than that, bear in mind that you will have to explain why and provide documents to support your claim.

The second is that, even though the six-per-month limit on withdrawals from savings accounts was removed from the federal Regulation D in 2020, some banks decided to keep it.

The limit was introduced to counter the financial insecurity resulting from the COVID-19 pandemic by helping banks maintain reserve requirements.

Therefore, you should check if your bank removed it as well to avoid paying any potential additional fees.

Accounts Receivable

Accounts receivable are considered liquid because they usually become cash within a year.

The sale has already taken place, and your clients only need to pay the invoice, so the conversion into cash is likely to happen soon.

Even if they pay late, you are essentially very close to cash, all you need to do is send a reminder or grant a short-term extension.

The fact that accounts receivable are liquid means that you can use them as collateral when requesting funding, especially if they will be paid in 30 or 60 days, which is considered a short period.

Smaller companies typically get funding by selling the financial rights for their accounts receivable to the lender.

The lender gives the company money immediately and then collects that amount when the creditors pay their dues.

Why Is Liquidity Important to Small Businesses?

Now that we’ve explained it, let’s examine why it’s important to small business owners.

One of the most important reasons is that liquidity shows how capable your company is of settling its debts. Having your debts under control is vital for business survival and growth.

Knowing exactly how your company is doing will allow you to make better-informed decisions and direct its course.

This is especially important for small businesses.

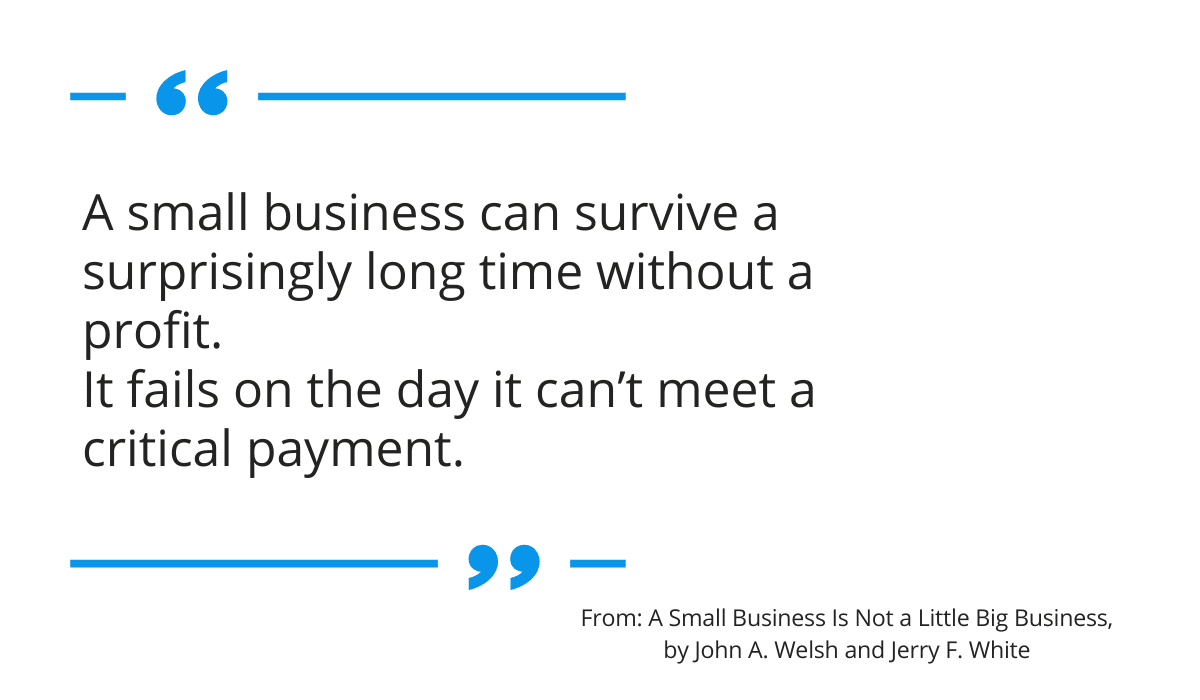

In their paper A Small Business Is Not a Little Big Business, John A. Welsh and Jerry F. White argue that “Liquidity is a matter of life or death for the small business.”

Source: Regpack

It is argued that one of the possible reasons why small businesses struggle with liquidity is the fact that they need to take bigger risks than big companies as they operate in less stable environments.

Being smaller means that they have supply constraints, which leads to cash shortages, aka illiquidity.

Your liquidity is important to others as well. Anyone considering investing in your company, or even approving your loan, will look into it.

High liquidity will show them that you make financially sound decisions and have enough resources to survive tough times.

As mentioned earlier, liquid assets are also vital because in times of crisis you can turn them into the cash you so desperately need to pay off any expenses you might be struggling with.

A savings account would work even better in this case, as the funds that you saved are already there for you to withdraw when your company is struggling.

There’s no waiting period as with applying for a loan, nor do you have to take any additional steps, like with selling stock.

ZenBusiness advises saving a month or two worth of cash for cases of emergency, as well as devising a plan of what else you can do to get cash soon when needed.

How to Calculate Liquidity

There are three ways to calculate liquidity: current ratio, quick ratio, and cash ratio.

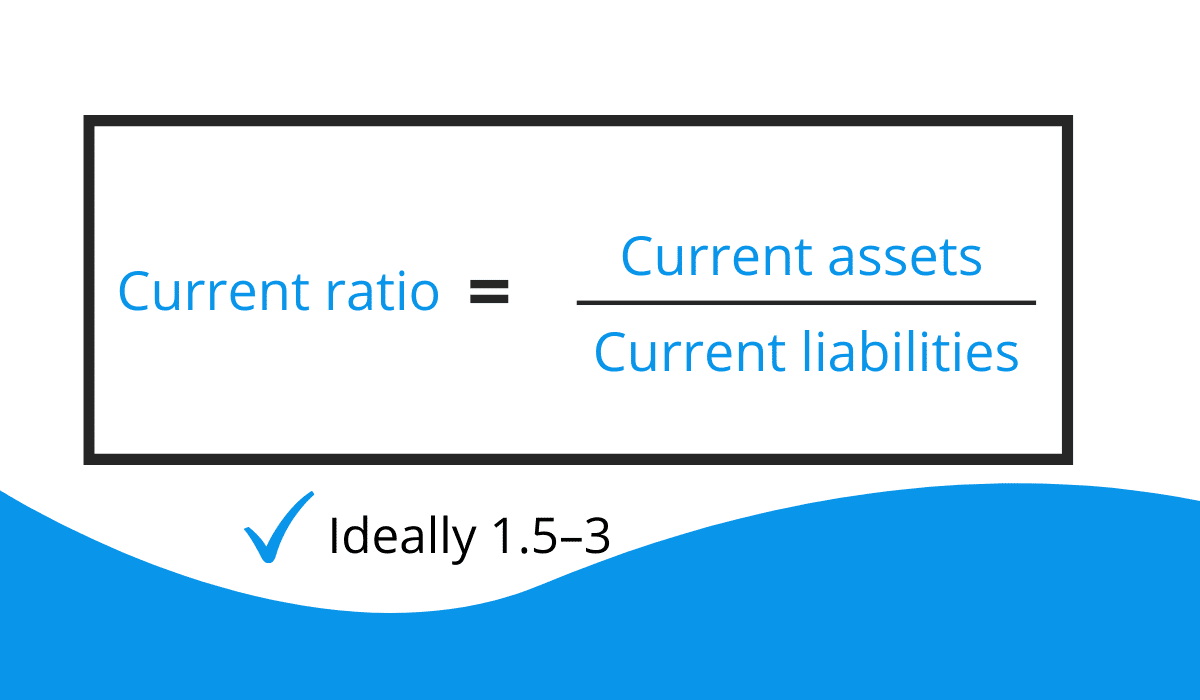

Current Ratio

Known also as the working capital ratio, this ratio is calculated by dividing your current assets by your current liabilities.

Source: Regpack

Let’s say your company has $18,000 in assets and $ 23,000 in liabilities. Using the formula above, we get 0.78.

The fact that your ratio is less than 1 might indicate problems as you don’t have enough assets to cover your liabilities.

Bench explains that that’s not always the case. Some industries simply take longer to pay their suppliers, but collect payments quickly, which is why their ratio is smaller.

In general, the ideal current ratio is 1.5–3. Even though you might think that having a ratio over 3 is good, it actually might be a signal that you’re not using your working capital properly.

You can decrease it by spending cash, but spend it optimally, e.g., to increase efficiency by buying new equipment.

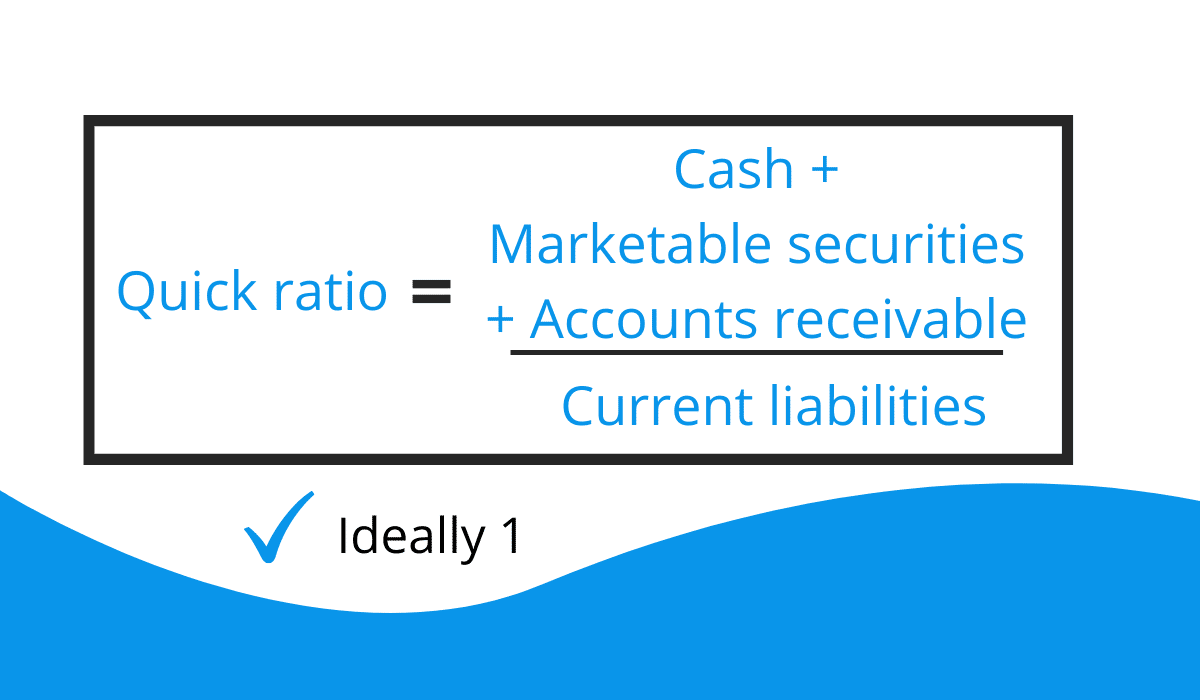

Quick Ratio

Known also as the acid test ratio, the quick ratio is considered more conservative than the current ratio because it takes into account only the most liquid assets.

It doesn’t include inventory as it takes longer to sell than other assets.

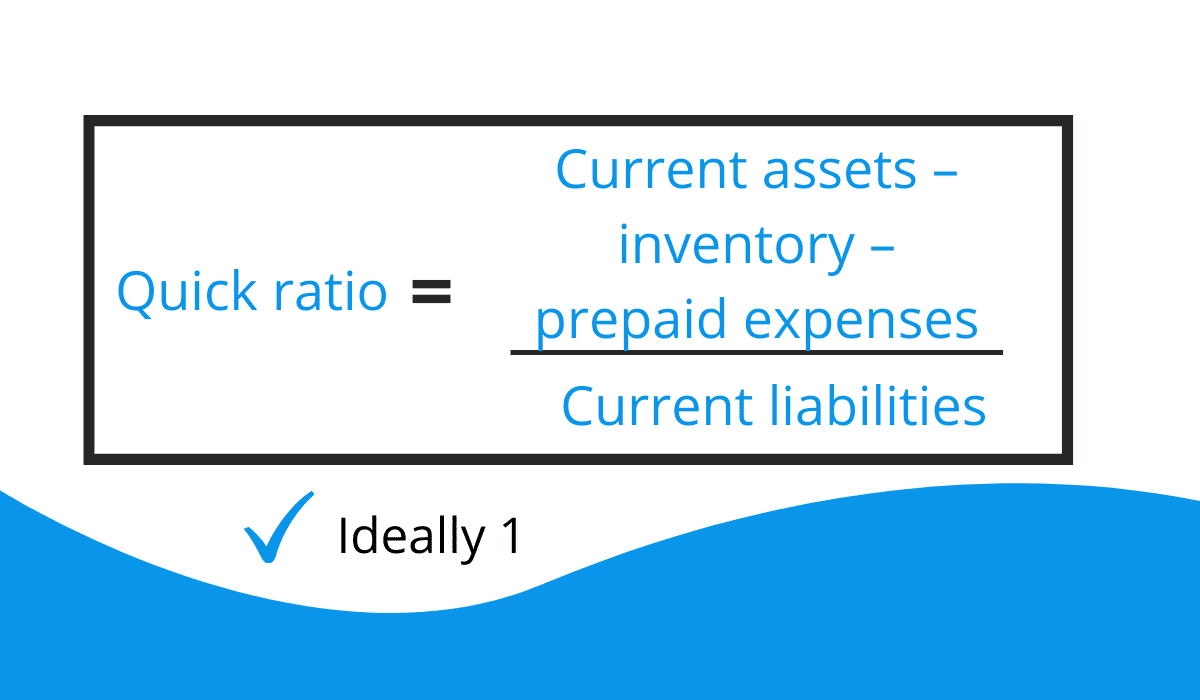

There are two ways to calculate it.

One includes adding cash to marketable securities and accounts receivable and dividing it by current liabilities:

Source: Regpack

The other is subtracting inventory and prepaid expenses from current assets and dividing it by current liabilities:

Source: Regpack

In this case, the ratio of 1 is considered normal. It means that your company has enough liquid assets to cover its liabilities.

As they are not just any assets, but liquid, they can quickly be sold to cover liabilities if the need arises.

Similar to the current ratio, anything below that is a negative sign as it means you aren’t able to do that, whereas a significantly higher ratio indicates that the cash you have is stagnant.

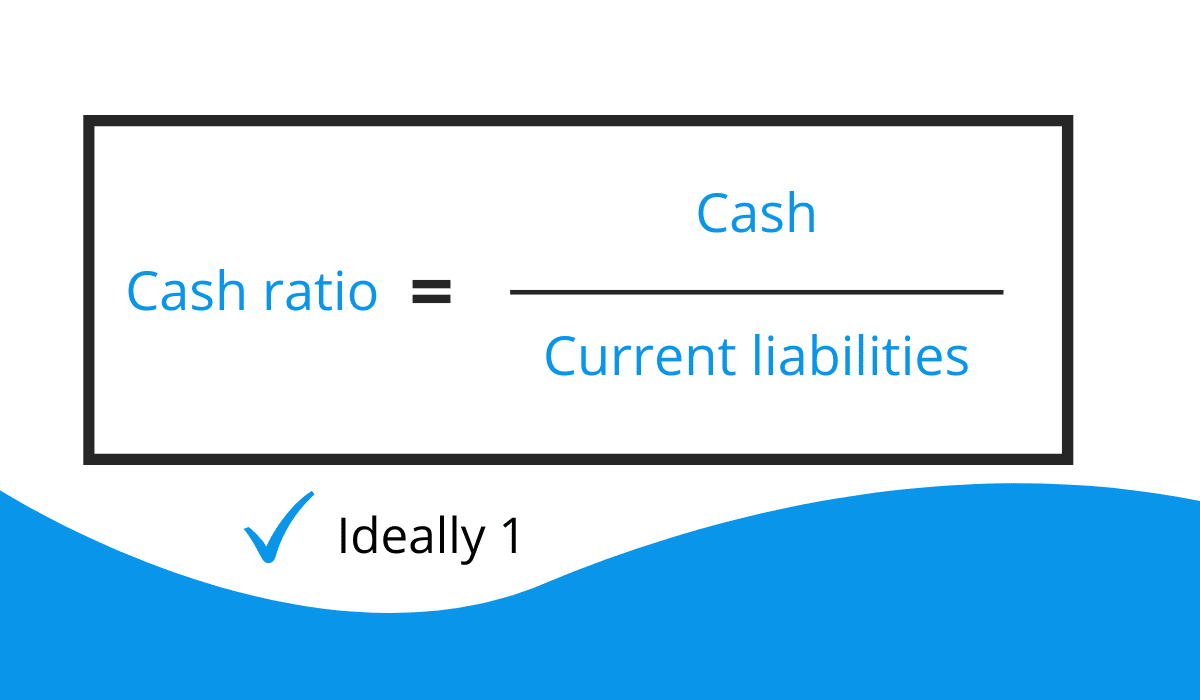

Cash Ratio

The cash ratio is the strictest of the three liquidity metrics because it considers only the cash that a company has to cover its liabilities.

As a result, it’s not used as frequently as the other two because it’s not realistic to expect companies to have that much cash readily at their disposal.

Source: Regpack

Not only is it unrealistic to have so much cash, but Investopedia also notes that it’s unwise because that cash could be put to better use elsewhere.

Even though the ideal number is 1, keep in mind that values higher or lower than that don’t necessarily indicate poor management or use of resources.

It could mean, for example, that a company’s using cash for expansion.

How Can Liquidity Be Improved?

Now that we’ve covered liquidity and what constitutes a good liquidity ratio, let’s explore what you can do if yours is less than ideal.

There are several ways to improve liquidity that aren’t related to finding more work.

Let’s see what you can do.

Take a Loan

Many people shy away from loans as they see them as something that always has negative connotations.

However, if used strategically, loans can be a great way to improve the liquidity of a small business, both when you’re struggling and when you’re doing so well that you’re considering expansion.

Source: Regpack

As many companies unfortunately learned during the COVID-19 pandemic, unforeseen events can affect your company even if you do everything right.

You reduce your costs, sell assets, and still don’t have enough money to cover your employees’ salaries.

A small business loan is the perfect solution to help you overcome these challenges and get you back on track.

Similarly, your business could be doing well and you may think it’s the perfect time to expand, only to discover you lack the necessary funds.

It’s better to use the momentum and take out a loan than to risk losing time amassing the resources on your own. The perfect time will never come unless you make an effort.

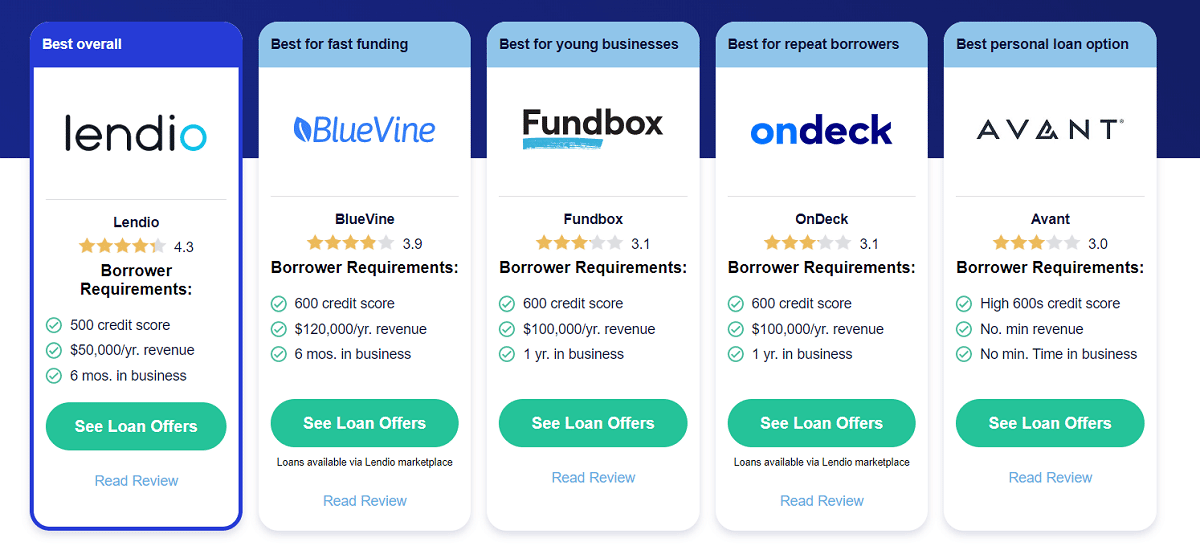

When you start exploring loan options, bear in mind that there are many banks providing a number of different types of loans.

The maximum amount available at most banks is $100,000–250,000, while a loan with the U.S. Small Business Association (SBA) can get you up to $5 million.

The top 5 options, according to Business.org, are the following:

Source: Business.org

You can use this to find the best choice for your particular situation and industry. Also, explore the alternatives, consider each offer carefully, and look out for additional fees.

Reduce Overhead Expenses

Unlike operating expenses, which are directly related to your profit, overhead expenses are things like rent, utilities, and insurance that don’t generate profit directly but are still needed to keep your business running.

Reducing them is an excellent way for your business to save money and increase liquidity.

The first thing is to calculate your overhead costs. Your accountant might already be using this metric, but if not, you can use Indeed’s 6-step guide for calculating overhead costs to help you.

As rent is normally your highest overhead cost, this is the first thing to cut. If the remote setup is possible for your business, consider allowing your employees to work from home.

You won’t just be saving on rent money, but also on all other office-related expenses, such as utilities and maintenance.

If you’re not ready to commit that much just yet, you can try a hybrid option.

For instance, you can inquire if some employees are interested in working from home full-time while others work from the office, or create a schedule so that everyone can alternate working from home in different weeks.

That way, you get unused office space that you can, for instance, sublet or utilize to generate revenue in other ways, which can significantly reduce your total amount of rent due.

Additionally, an often overlooked overhead expense is printing. Working from home and moving to the cloud means that you no longer have to buy paper and ink, or conduct printer repairs.

Sell Unused Assets

As most small businesses are looking for ways to save, you’ll likely find interested clients for almost anything you put up for sale, from desks and chairs to computers.

New businesses will probably be interested in second-hand furniture as they don’t want to spend a lot of money if they’re just starting out.

A good idea is to join groups for such businesses on Facebook, for instance, and post your things there.

You could even run a sponsored ad on Facebook on Instagram to target your buyers.

Selling unused items will also reduce the cost of repairing them, so it’s a win-win situation.

Send Invoices Early

Sound invoice management is an essential tool for improving liquidity.

When your clients pay late, you cannot pay your suppliers, which means that your cash flow and therefore your liquidity will be disturbed.

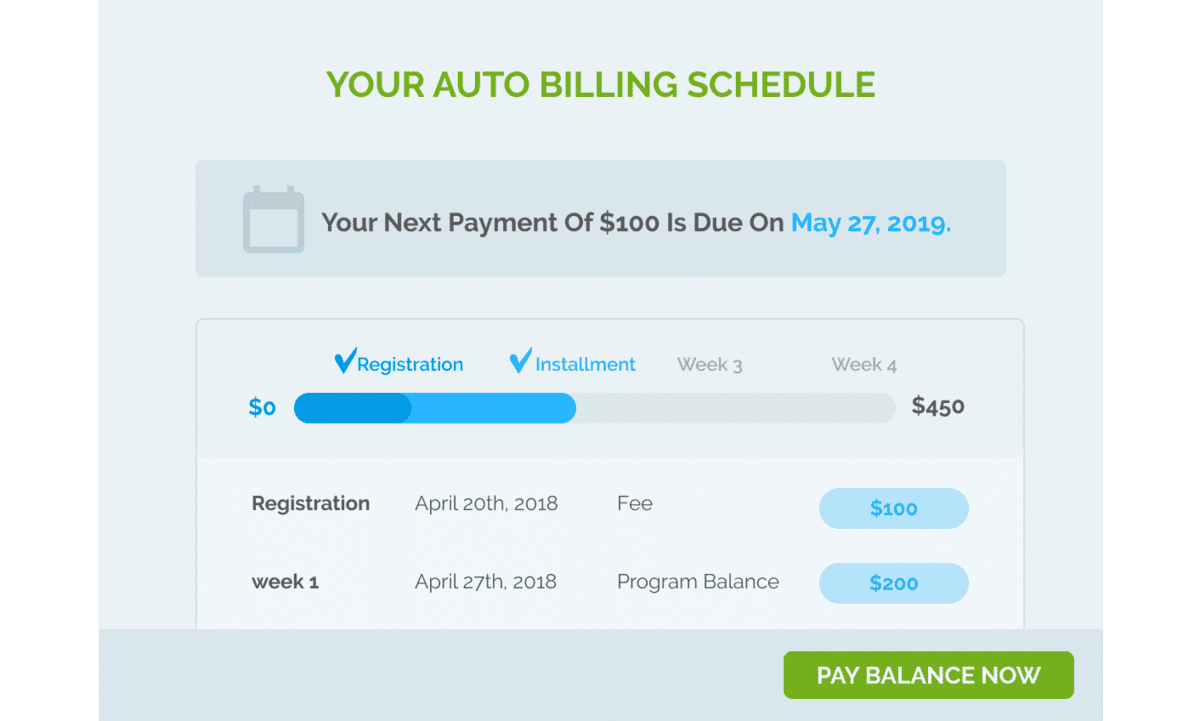

The easiest way to get paid on time is to automate billing and have invoicing software send invoices early.

Using a solution like Regpack, you can create a billing schedule to do all that work for you.

Regpack allows you to accept multiple payment types, create custom invoices, send reminders and accept payment in a secure and straightforward way.

Source: Regpack

For instance, depending on your billing cycle, on the first day of the month, you can send out invoices that are due on the 15th.

Then, a few days before a payment is due, the software can send automatic reminders to politely inform customers of their obligations.

To maximize your chances of getting paid fast even further, you can offer an early payment discount.

You can have a set discount or scale it based on how early the client pays, e.g., 1% off for as many days they pay before the due date.

This will undoubtedly be interesting to your clients, just be careful not to offer a discount that’s too big, which will end up costing you money rather than saving it.

Conclusion

Ensuring that a small business is liquid is vital for its survival because liquid companies are more trustworthy to investors and more likely to get funding from lenders.

That’s why we’ve gone over some of the key metrics to calculate it, such as the current ratio, and offer some tips on improving it, for example, selling unused assets and taking a loan.

Use them to improve the financial stability of your company and optimize your business to get loads of investment opportunities.