Sometimes small business owners find themselves spending too much time working in their business, and not enough time working on it.

That’s fine if you want to maintain the status quo.

But if your goal is business growth, it’s important to consistently set attainable yet challenging financial goals for your business and work towards achieving them.

In the process, you’ll learn a lot, and once you reach them, or even just come close, your business will be in better financial health.

That said, here are nine financial goals that small business owners should set this month, quarter, or year.

- Better Management of Cash Flow

- Increasing the Profit Margin

- Reducing Debt

- Investing More in Marketing

- Reducing Overall Expenses

- Investing More Back Into the Business

- Optimizing the Service Pricing

- Saving up for the Future

- Diversifying Streams of Income

- Conclusion

Better Management of Cash Flow

Effective cash flow management is of the utmost importance for small businesses, especially when you consider that the reason 82% of them fail is poor cash flow management.

Source: Keap

If you improve your cash flow, you will also reduce the likelihood of suffering any shortages that prohibit you from covering your expenses and operating your business.

You’ll never have to worry about keeping the lights on or paying employees on time.

As for how to go about hitting this financial goal, there are some best practices you can follow:

| Negotiate quick payment terms | Consider bringing your payment terms down to 7 or 14 days upon receipt instead of the common 30-day duration. Try offering incentives like slight discounts for paying early. |

| Ask for longer accounts payable terms | Talk to your vendors and see if you can lengthen your payment terms as a thanks for your continued business or in return for a slightly higher rate. |

| Monitor your accounts receivable and payable | Every few weeks, run aging reports for accounts receivable and accounts payable so that you can get a sense of upcoming cash inflows and outflows and plan accordingly. |

| Analyze your cash flow patterns | Perform a cash flow analysis and review your cash flow history to uncover trends that help you predict future cash flow swings that you can then prepare for. |

After enacting these strategies, your small business should be better equipped to seize investment opportunities, weather hard financial times, and grow more effectively.

Increasing the Profit Margin

Your profit margin is an indication of how well your business is doing financially.

When you increase your profit margin, you’ll keep a greater portion of your earnings, which you can keep or strategically reinvest in your company.

Increasing your profit margin can also reduce the chances of coming into cash flow issues that can stall your operations and injure your small business.

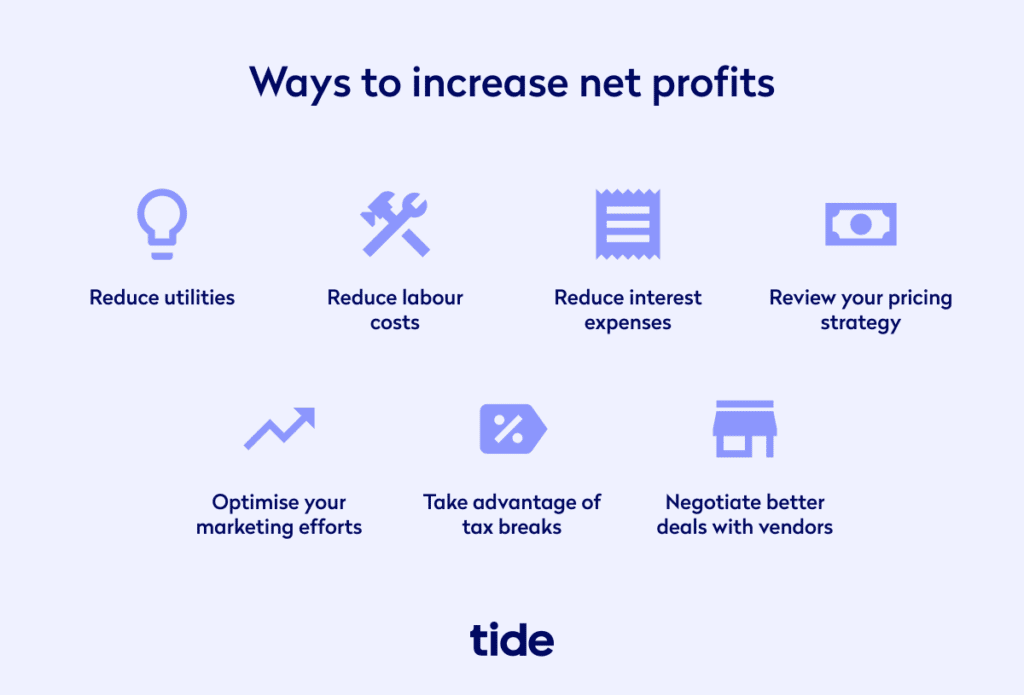

There are many ways a small business owner can improve their profit margin, as you can see below:

Source: Tide

The two overarching methods, however, are raising prices and cutting costs.

If you feel your service is creating more value than your price reflects, or if you’re seeing higher prices from your competitors, it’s a good idea to choose the price option.

Try raising prices for each new customer and tracking how they react. If customers still accept it, then you’re on the right track. Keep raising it.

If you’re getting pushback, perhaps it’s time to start building up credibility with accreditations, testimonials, case studies, and other evidence that shows your service is worth the price.

Cutting costs, on the other hand, can be a little trickier, since your business relies on certain inputs and processes that your team is familiar with.

The nice thing about being a small business, though, is that you are agile enough to adapt quickly.

So start by finding and cutting unnecessary expenses. Audit your teams to see what subscriptions and software tools they are barely using, then cancel them.

You could also consider switching to a smaller office and hiring remote workers to reduce rent.

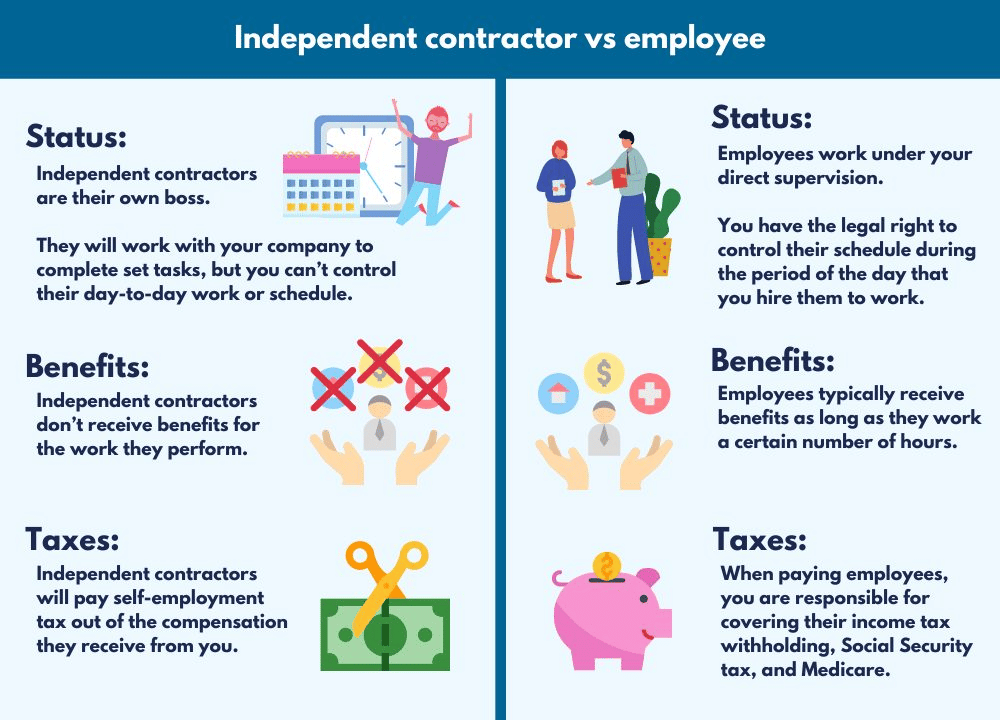

And don’t forget about independent contractors.

Source: Business Management Daily

Such contractors generally cost 30% less than full-time employees because you avoid paying for disability, benefits, payroll taxes, sick days, and more.

Reducing Debt

If you reduce your debt, you’ll end up paying less in interest over the long run.

Plus, it also should be easier to make your monthly payments, which allows you to boost your business credit score and get funding more easily in the future.

If, on the other hand, you stumble into hard times and are unable to make debt payments on time, you might have a financial crisis on your hands.

Fortunately, with prudence and discipline, business debt can be reduced and eliminated.

To begin, assess your business debt.

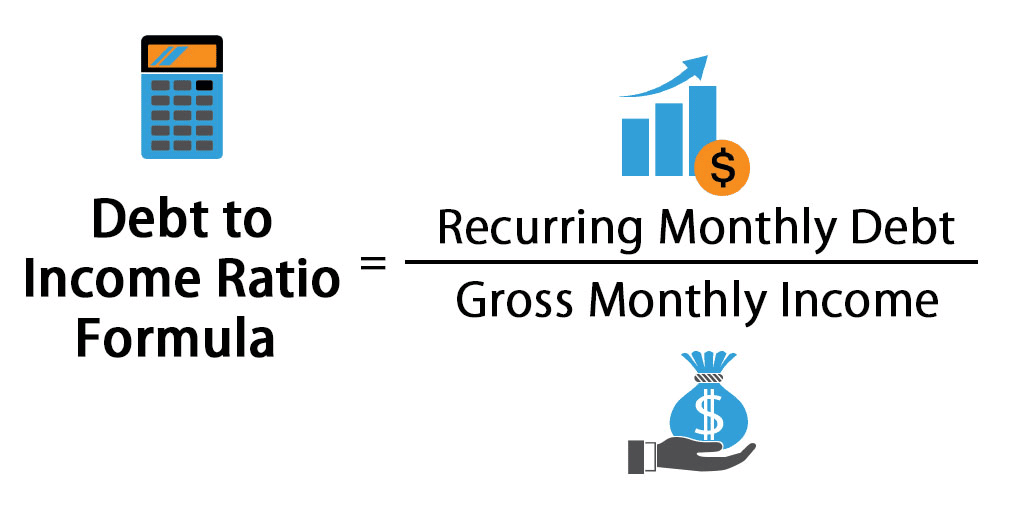

Write out all the debts you owe, and then calculate your debt-income ratio, which tells you if you have the working capital to continue covering your debt.

Source: Educba

Now that you have an overview of the situation, pick which debts you want to focus on eliminating.

Financial wisdom states that you should focus on the one costing you the most in fees and interest.

Two of the best ways to pay off debt more quickly are to raise revenue or cut costs, so that you have more cash to put towards paying off your debt.

And, if you want to take this very seriously, use zero-based budgeting, where any leftover profits are used to pay down the debt.

Another method you could try is re-negotiating your rates with vendors.

If you’ve been paying on time and your business is doing well, they might consider accommodating you, since they don’t want to lose you as a future borrower.

Investing More in Marketing

Because there’s so much to focus on while running a small business, many owners neglect improving their marketing strategy.

But this is a mistake, since investing in marketing can greatly increase their number of customers, which in turn improves their bottom line.

Not to mention, improved marketing can improve brand recognition, which enables businesses to charge customers more for their products and services, thereby improving profit margin as well.

And getting customers through marketing channels, especially digital marketing, is more sustainable than word-of-mouth, and, once set up, more passive than outbound sales.

That said, here are the three best bang for your buck marketing investments for small businesses:

| Run Facebook ads | FB ads are an inexpensive way to advertise your business to your target audience. |

| Rank your Google My Business listing | If you’re a local business, getting ranked on Google is a must. When people search for a service in your area that’s provided by your business, yours will appear in the search results and maps. |

| Start a Blog | SEO-based content marketing is one of the best ways to organically attract high-quality leads to your website. |

In sum, small businesses need to start looking at marketing as an investment in their future rather than a luxury expense that can be cut without consequences.

Reducing Overall Expenses

When you reduce your business’s overall expenses, your profit margins increase, and you end up with more money to invest back into your business.

Plus, if you get your expenses in order, you’ll rarely run into situations where you’re strapped for cash or forced to take out a loan.

One of the best ways to reduce expenses is by improving your operating efficiency.

When you get work done faster and with fewer resources, be it labor, external consulting, or equipment, you’ll end up saving money.

Often, many of the administrative tasks that eat up a small business’s time and money can be automated with inexpensive software products.

For example, if a billing team was sending out invoices manually, they can save time using an automated billing tool, like Regpack, that will streamline the process, while eliminating costly human error as well.

This way, when the business grows and the invoices increase, the business won’t necessarily have to hire new employees to manage the work since the current employees are working so quickly.

Many SaaS platforms also come with a customer success rep who will act as an advisor.

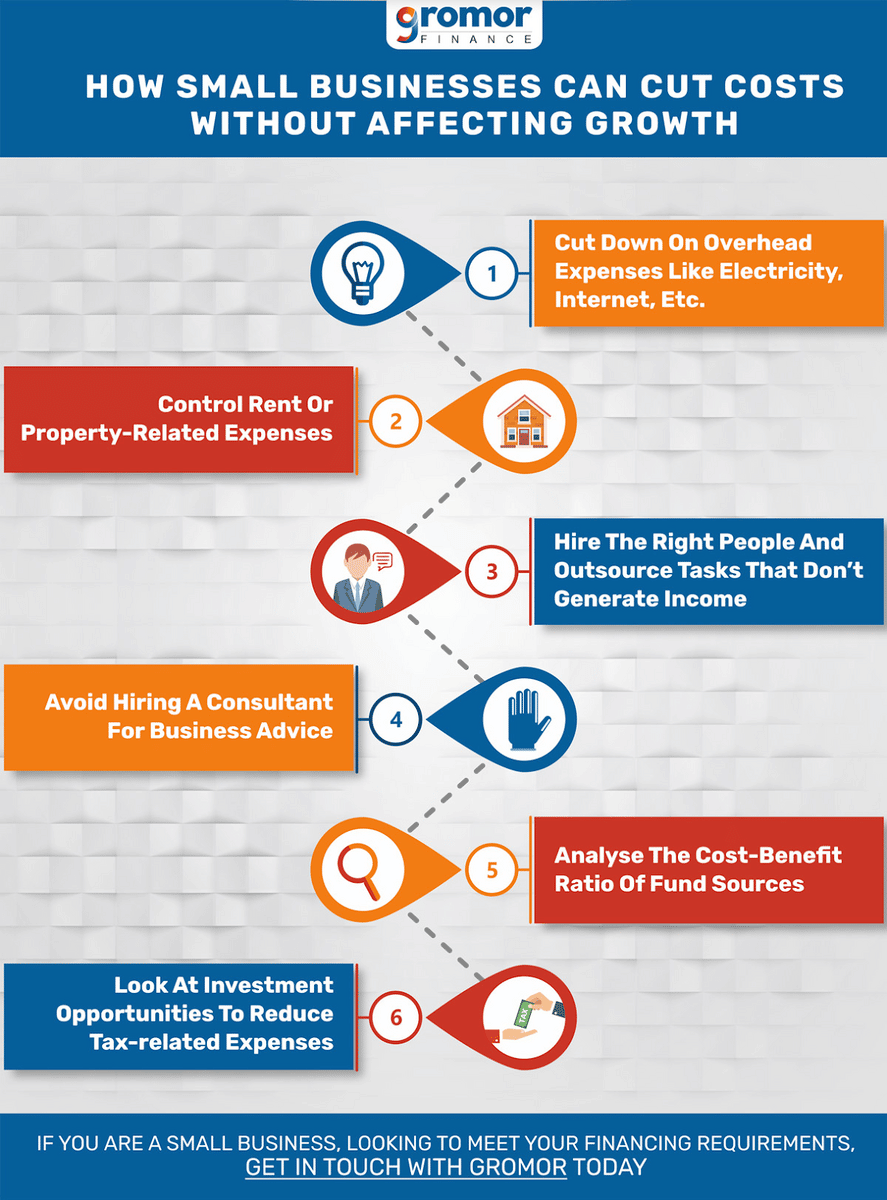

Source: Gromor

This can save you from the high costs of hiring consultants—something small businesses should avoid when trying to reduce costs.

Investing More Back Into the Business

One of the most effective ways to grow your business is to step up the earnings you’re putting back into the business.

Best practice recommends reinvesting anywhere from 20%-30% of your profits. However, some companies focused on growth, go even higher than that.

They know it’s a surefire method to improve areas of their business and drive revenue.

The first step to accomplishing the goal of investing more money back into your business this year than last is to increase your profits so that you have more funds to invest.

Do this by cutting expenses, increasing sales, or improving other financial metrics.

Then, you need to assess your business to uncover what investments would create the greatest per dollar impact.

Start by checking which areas of your business are failing to meet certain KPIs or goals and could therefore use a boost in productivity or effectiveness.

For instance, if your sales team keeps failing to generate enough leads, it might be smart to use that money to build out a content marketing strategy or to purchase sales software that speeds up cold outreach.

In general, though, you can’t really go wrong investing in the below areas:

| Your people | Job training improves your team’s prowess, salary boosts increase talent retention, and better recruiting practices enable you to attract great people. |

| Technology | Automation, artificial intelligence, and better data management help your business operate more efficiently. |

| Sales and marketing | Take more of your industry’s market share by expanding your sales and marketing teams and equipping them with the right tools, strategies, and tech. |

In conclusion, businesses that have goals for increasing total reinvestment will drive growth and continue to improve throughout the coming years.

Optimizing the Service Pricing

If you price your services too high, you may be missing out on sales—too low, and your profit margins suffer.

If you take steps to find the best price for your service, that spot where value, profit, and customer desire overlap, you’ll increase your revenue.

The best place to start with pricing is by checking to see what competitors are charging, while also taking into account what it costs you to render the service.

This can give you a starting point price, but, for most small businesses, there’s still work to do to optimize it.

More specifically, you have to engage in value-based price optimization analysis, where you analyze customer and market data to find a price point that reflects the value of your service.

Because this process can be rather cumbersome and mathematically challenging, many businesses choose to use a pricing software like Price Intelligently, which will analyze customer reviews, transaction history, and other data points to figure out what customers value, and then give you pricing insights based on the findings.

They’ll also help you monitor the performance of your pricing going forward. This touches on an important aspect of pricing: the job is never over.

You have to keep a close eye on your market and the industry and consistently adapt your price to fit the changing environment and your customers’ willingness to pay.

Saving up for the Future

Prudent small businesses often put aside some of their profits into savings accounts, thereby creating a lifeline in case hard economic or financial times hit them and their business.

Having funds stored in an interest-bearing account means you’ll have a liquid source of money that you can access when you need it, and it’s less costly to draw from a savings account for unexpected expenses or cash flow issues than to take out a loan.

As for how much to save, conventional wisdom says to put at least 10% of your monthly profits into your savings account, until you’ve saved up anywhere from six to nine months of operating expenses.

That should provide you with a sound financial cushion.

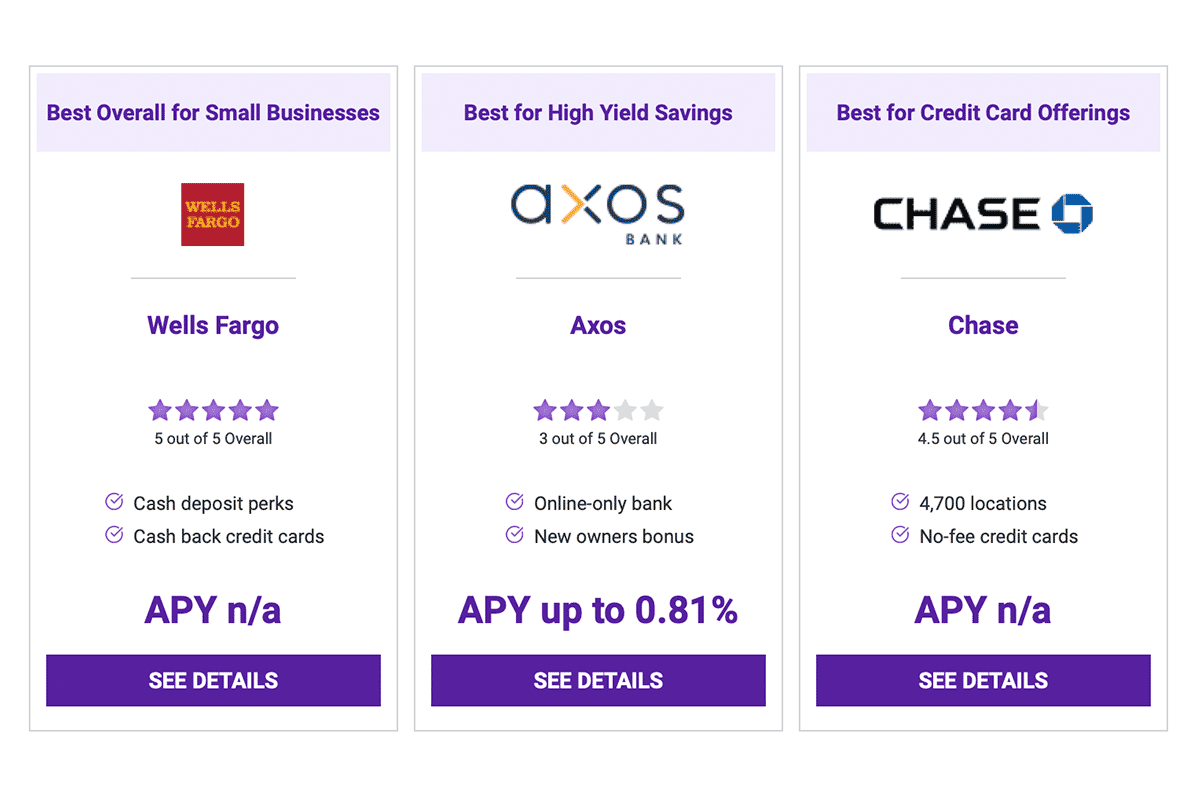

When selecting a bank, there are some attributes to look for. First, prioritize a higher annual percentage yield, as it means you’ll earn more money in interest.

Second, ensure the bank doesn’t have too many hidden fees like those for maintenance, account inactivity, or withdrawal.

Lastly, use a bank that’s FDIC-insured, since this will provide extra security in case something goes wrong with the bank. Some banks also offer cash perks.

Check out the three best banks for small businesses below:

Source: The Penny Hoarder

If you follow these savings best practices, you will have more peace of mind while running and growing your business.

Diversifying Streams of Income

You’ve likely heard the saying “don’t put all your eggs in one basket.” This holds for small businesses as well.

Generally, the more income streams your business has, the less financial risk you face.

If one service starts to lose customers or goes through a slump because of the economic downturn, you’ll likely have others that are still making you money.

Income diversification deserves to be one of your financial goals this year.

Many service-based businesses, especially those in the education space, can create another stream quite quickly by creating online courses, recorded or live, and offering them to customers for a price.

Source: Peloton

This not only ensures your business will still make money if there’s an event, like a pandemic, that prevents people from meeting with you in person, but also helps you reach new customers who would have never come to your store in the first place due to location or preference.

There are numerous other creative ways to diversify your income streams, from offering subscription services to getting involved in affiliate marketing, where you make money from directing customers to other products or services they might enjoy.

Often, all it takes is some ingenuity, courage, and discipline to create another revenue stream for your small business.

Conclusion

When you set financial goals for your small business, you start to feel more motivated, more assertive, and more in control of its destiny.

Whether it’s improving your profit margin, reducing debt, or putting more money towards marketing, pick a goal for this quarter and start taking action to achieve it.

Before you get to work, it helps to read up on small business financial best practices so that you’re informed to make intelligent decisions and confident enough in that knowledge to follow through.