In 2023, more customers than ever before are choosing to shop online. To meet their demands, it’s important for you as a business owner to sell your services online.

But online payments aren’t as simple as they might seem. In this article, we’ll explain how online payment software can streamline the process for you and your customers.

Then we’ll tell you what to look for in an online payment solution and introduce you to software that checks all the boxes.

- What Is Online Payment Software

- Why Do You Need Online Payment Software

- What Online Payment Options Can You Accept

- How Does Online Payment Software Work

- How to Choose the Right Online Payment Software

- Online Payment Software and Your Business

What Is Online Payment Software

Online payment software lets your customers pay for your service online. You can use it to create payment forms and generate payment confirmation emails.

But it also handles the behind-the-scenes work of transferring money from the customer’s bank to yours.

Below, we’ll get into how this software works and how it can help your business. But first, you need to understand a few key terms.

| Merchant account | When a customer pays, the money goes to your merchant account, which then deposits money into a separate business checking account. |

| Acquiring bank | Your acquiring bank is the bank where you hold a merchant bank account. |

| Issuing bank | The bank your customer’s money comes from is the issuing bank. If the customer pays with a credit card, the issuing bank is the one that issued them that card. |

| Payment gateway | A payment gateway is like the online version of the card readers you use at physical stores. This software collects payment information and checks the validity of the payment method and sends the payment to your payment processor. |

| Payment processor | Like the payment gateway, your payment processor is also a piece of software. It coordinates the transfer of money from the issuing bank to the acquiring bank. |

It’s important for you as an online business owner to be familiar with these and other common online payment terms.

Why Do You Need Online Payment Software

Online payment software plays several important roles for both you and your customers.

Let’s go over them together.

Meets Customer Expectations

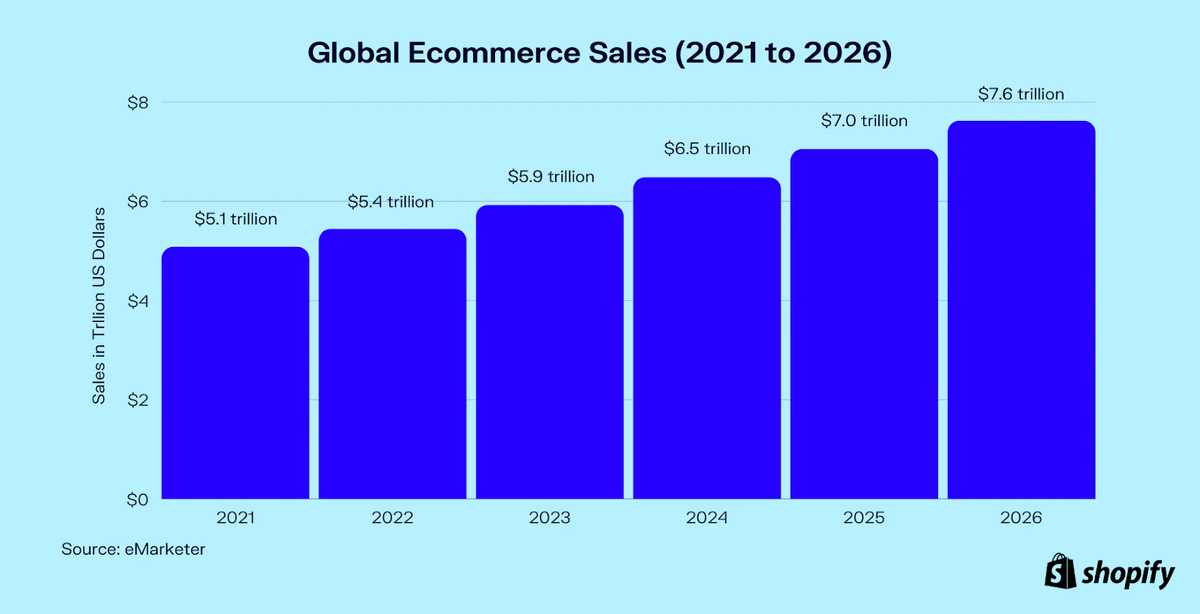

In recent years, e-commerce has made up almost 20% of worldwide retail sales. That comes out to over 5.2 trillion dollars in online payments in the US alone.

Source: Shopify

As you can see in the graph above, by 2026, economists expect that number to grow to 7.6 trillion.

Therefore, it’s important to invest in online payment software that can meet that growing demand.

Adds Convenience

Online payment software adds convenience for both you and your customers.

With this software, customers can use the payment method they prefer—credit, debit, etc. And they can pay in their own currency.

With online payment software, you don’t have to process payments manually.

And good payment software like Regpack helps you set up automatic trigger-based emails to your customers. Those options free up your time.

Jud, the owner of Stone Mountain Adventures in Central Pennsylvania, explains how Regpack’s payment processing software adds convenience for him and his customers:

Overall, we were very pleased with the different options and the options for the monthly payment plans that we can offer our families.

I usually send out an email the day before to let families know there will be a charge on their payment plan, so that feature has been very helpful.

I think some families are happy to pay the whole thing right up front, but some families spread it out. So it’s great to have that option in the system.

Automatic emails and payment plans can make a big difference for your business, just as they do for Jud.

Decreases Costs

Manual payments are expensive, especially if you own a small business. You have to print paper invoices, manually process checks, and pay for postage.

What is more, you also have to chase down payments and go back and forth with customers to correct mistakes. This costs you both money and time.

Manual payments also make it difficult for you to get a birds-eye view of your financial situation. How much money did you make this month? Where did that money come from?

With online payment software, you no longer have to gather this information by hand. Instead, the software tracks your finances for you.

If you know which areas of your business are most profitable, you can concentrate your efforts there.

What Online Payment Options Can You Accept

Online payment software gives you the flexibility to offer several online payment options.

You can offer credit, debit, and gift card payments, but it doesn’t end there. There are also several modern payment methods at your disposal.

Digital Wallets

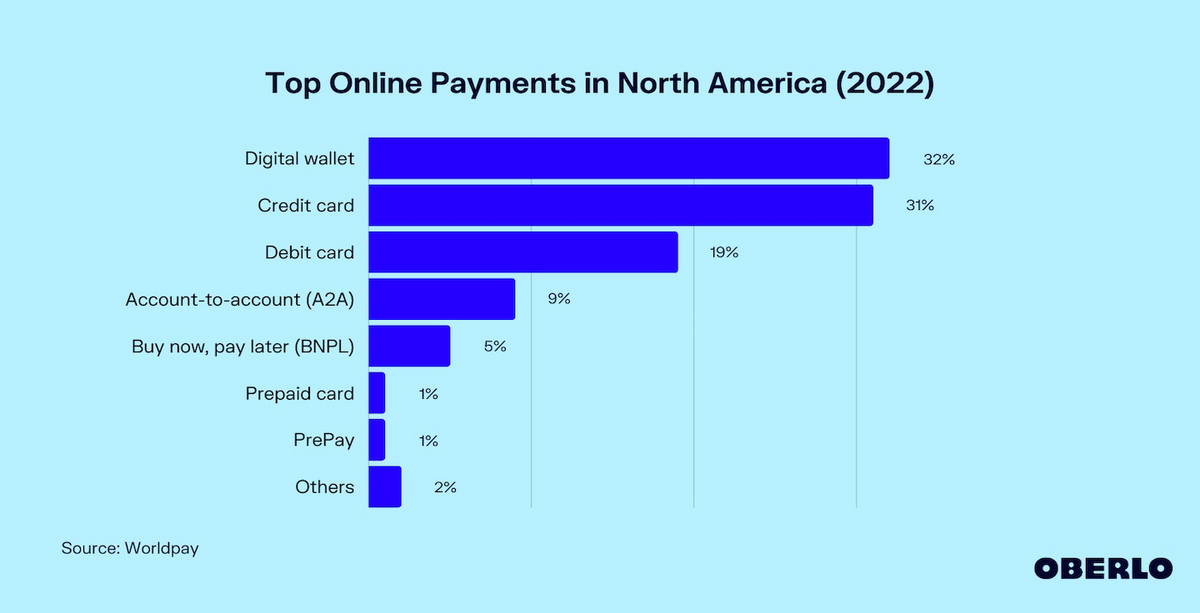

A recent study revealed that 32% of online payments used a digital wallet. As the graph below shows, it’s the most popular payment method:

Source: Oberlo

To attract and keep these shoppers, you need to offer this payment method. And online payment software lets you do that.

Digital wallets are apps that function as a go-between for you and your customers. They store payment information like card numbers so customers can conveniently pay for your services.

Popular digital wallets include Apple Pay, PayPal, and Google Wallet.

ACH Payments

ACH (automated clearing house) payments involve a more direct transfer of money between banks. Like other online payments, they do have to go through a payment processor.

Direct deposit is one of the most popular types of ACH payment. Customers appreciate the option to pay with this often free or low-cost method.

Payment Plans

Last, online payment software lets you offer various payment plans to your customers.

One of the most popular is a deferred payment plan, which lets customers buy your service and pay for it later.

Over 360 million shoppers across the world use deferred payment plans. If you can afford to defer your income, this is a great long-term strategy for increasing your sales.

Now that you know what online payment software can do for you, we’ll tell you more about how this software works.

How Does Online Payment Software Work

Online payments should be quick and easy for your customers. But what’s really going on behind the scenes of the online payment process is a little more complex.

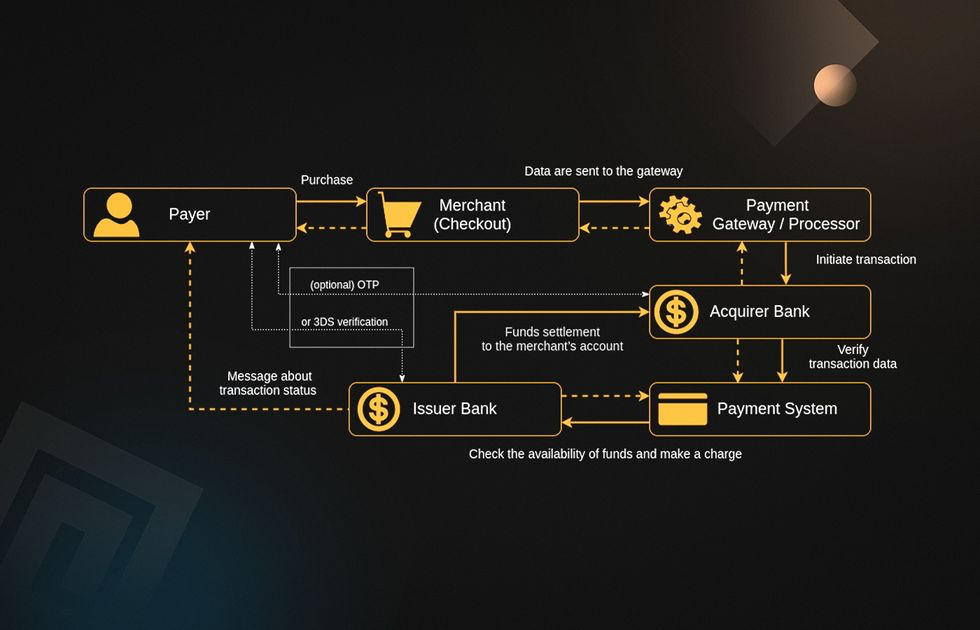

Here’s an overview of how the process works.

Source: Acropolium

As you can see in the chart above, when a customer submits a payment, it triggers a series of actions.

We’ll use a credit or debit card payment as an example (though the process is very similar for other payment types).

- The payment gateway verifies the card and encrypts the card information.

- The payment gateway sends the card information to the payment processor.

- The payment processor verifies the availability of the funds with the card network.

- The card network approves the payment.

- The payment processor instructs the issuing bank to transfer the money to the acquiring bank (merchant account).

- The issuing bank approves the payment and transfers the funds.

- The merchant account transfers the money into your company’s checking account. This usually happens periodically in batches rather than immediately after the transaction.

As you can see, online payment software is a necessary part of an online transaction. Since it’s so important, we’ll walk you through how to choose the best software for your business.

How to Choose the Right Online Payment Software

First, choose online payment software that provides a simple checkout process.

Studies show that 17% of shoppers abandon their cart if the checkout process is too complicated. Many customers also give up on their purchase if they run into unexpected costs.

Source: Oberlo

That means you could lose almost half of your customers if you fail to disclose fees early in the shopping process.

Let them know how much taxes and shipping cost so they won’t be surprised.

You don’t want to spend time and money marketing your service, only to lose your customers at the last minute.

Additionally, you should look for online payment software that is PCI DSS (payment card industry data security standard) compliant.

Data theft is one of the most frequent cybercrimes, and it often occurs while data is being transferred.

To protect your customers’ data during the online payment process, choose payment software that encrypts it.

In addition to those features, online payment software should:

- Work reliably, without frequent glitches

- Be user-friendly

- Accept several common payment methods

- Integrate with your website

- Offer data-driven insights into your sales

- Process payments directly on your site

- Disclose any required fees

In the following section, we’ll describe how our own solution, Regpack, meets these requirements.

Our Recommendation

For an online payment software that checks all the boxes, we recommend Regpack. Regpack is a reliable, user-friendly payment processor.

Our online payment software provides your customers with a seamless payment experience. They can pay on almost any device, with any currency, using several payment methods.

Additionally, they can set up automatic recurring billing or a payment plan that works for them. Finally, they can even register and pay for several people at once.

Our software also helps you maximize your business’s efficiency and income. It lets you create custom payment forms and embed them directly on your website.

That keeps customers from having to navigate to a third-party site to pay, which can result in cart abandonment.

A recent study showed that companies using Regpack had:

Source: Regpack

That’s almost a third more completed orders, retained customers, and income.

We also help you send professional invoices and recurring emails to customers.

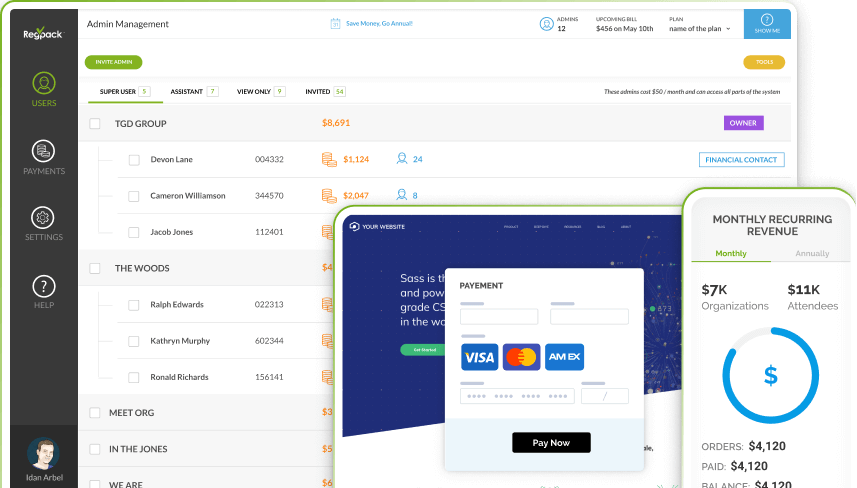

Our software even generates payment reports like the one below so you can see where your income is coming from.

Source: Regpack

This Regpack dashboard displays a company’s monthly recurring revenue. It then further breaks the numbers down by group and user.

Most importantly, we take security seriously. Our software is PCI-2 compliant, and we have a security team dedicated to keeping your payment information safe and confidential.

Online Payment Software and Your Business

In sum, choosing the right online payment software is crucial to the success of your business.

Good payment software is secure and reliable. It builds your customers’ trust—and it’s also seamless and intuitive for you to set up.

It lets you offer custom payment forms and payment plans.

As a business owner, you have a lot on your plate. Online payment software can handle your point-of-sale logistics—and that’s one less thing for you to worry about.