Whether your business offers school programs, events, camps, or another service entirely, switching to recurring billing can help you relieve stress and save money.

Using billing software to automatically charge your customers on a recurring basis will automate payment collection, prevent late payments, and generate predictable cash flow.

Read on to learn the fundamentals of recurring billing, including its two main types, which types of businesses should use this style of billing, its advantages, and how it works.

- What Is Recurring Billing

- What Are the Types of Recurring Billing

- What Types of Businesses Use Recurring Billing

- What Are the Advantages of Recurring Billing

- How Does Recurring Billing Work

- Conclusion

What Is Recurring Billing

Recurring billing is when a business automatically charges the customer for goods or services on a regularly scheduled basis — either weekly, monthly, or annually.

Compared to other billing models, recurring billing is efficient and free of human error. Plus, it allows for more accurate cash flow predictions.

If you’ve ever purchased an ongoing subscription with a magazine, software, or streaming service like Netflix or Spotify, you’ve been on the customer side of recurring billing.

Source: Spotify

After a certain predefined interval, your card on file is automatically charged, or the money deducted from your specified account.

And after all payments, you receive a confirmation email with an invoice attached.

There’s no work on the customer’s end to facilitate the transfer of funds to the provider, and the provider doesn’t have to do anything, either.

Their recurring billing software handles everything, from initiating and processing the payment to sending the payment receipt email.

This all continues smoothly until you cancel the relationship.

What Are the Types of Recurring Billing

Recurring billing can be divided into two major types: fixed recurring billing and variable accruing billing.

Let’s go over how they differ so you can choose the right one for your business.

Fixed Recurring Billing

With fixed recurring billing, businesses automatically charge the same amount of money from customers in every billing cycle.

Businesses that charge a fixed rate per cycle typically use this form of recurring billing.

For example, HBO’s streaming service charges $9.99 per month:

Source: HBO Max

Customers appreciate this form of recurring billing because every invoice is the same, allowing them to plan and stick to their budget.

This consistency also benefits the business owner, who can more easily predict cash flow and revenue numbers over the long term.

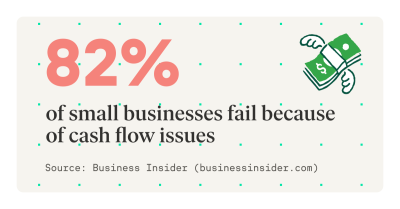

The consistency of payment also lowers the chances of a cash flow slump, which can be detrimental to small businesses:

Source: Keap

Additionally, businesses using fixed recurring billing can easily upsell customers to higher tiers or plans.

The costs of the upsell are easy to explain to the customers, and they often seem small when displayed next to the benefits of upgrading.

For instance, if a customer was paying $15.99 per month for a gold tier package, and saw an advertisement for a platinum tier at $19.99 per month, they could quickly do the math to see that this would cost them only $48 extra per year.

The cost of upgrading is hazier if they’re paying with variable recurring billing. It will depend on how much they use the product or service.

And that complexity can cause them to neglect thinking about upgrading. It’s just too much of a mental load.

Overall, the majority of service-based businesses—including schools, camps, and educational programs—use fixed recurring billing.

But that’s not to say that the other type, variable recurring billing, is without its use cases and advantages.

Variable Recurring Billing

In variable (or irregular) recurring billing, businesses automatically deduct a varying amount of money from the customer in each billing cycle, depending on the customer’s usage of the product or service.

This billing type sacrifices some stability to provide extra flexibility for customers.

It’s common amongst companies that use the usage-based pricing model, especially SaaS brands, like Snowflake and Slack.

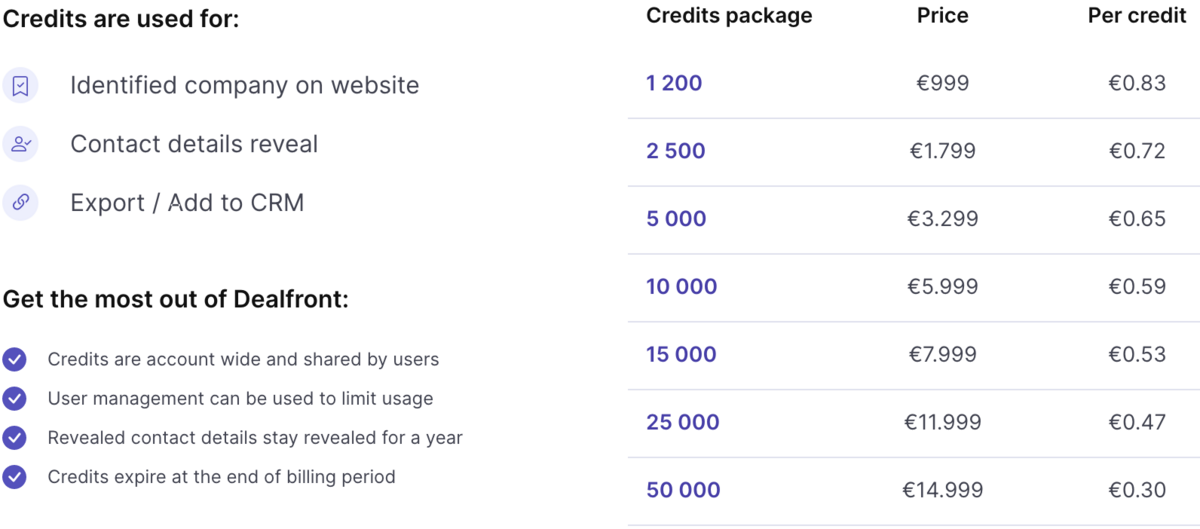

In usage-based pricing, customers are charged based on how much they use the product or service—e.g., hours spent on the platform, gigabytes used, or, in the case below, the number of credits:

Source: Dealfront

To illustrate variable recurring billing in practice, imagine that a yoga company charges $40 for every session that members attend, and bills customers on a recurring monthly basis.

If one of their customers went to three sessions during March, they’d be charged $120 at the end of the billing cycle. If they used five sessions during April, they’d pay $200.

Utility companies also use variable recurring billing. Customers are charged monthly but pay different amounts each time based on how much electricity or heat they used that month.

What Types of Businesses Use Recurring Billing

Many types of businesses, from small after-school programs to giant technology companies, leverage recurring billing to simplify their business’s billing process and improve revenue.

Below are some examples of business types that use using recurring billing:

| SaaS companies | Software-as-a-service brands like Salesforce or Slack often offer the option to make automatic payments at either monthly or annual intervals. |

| Membership businesses | Fitness centers, the Sock of the Month Club, Costco, and other businesses often charge a recurring fee for membership. |

| Services with payment plans | Higher-priced services like schools, camps, or event planners might divide large payments into smaller monthly installments that can be paid over time, making it easier for their customers. |

| Municipalities | Water, heating, and electricity companies often charge customers using variable recurring billing. |

Formerly confined to the accounting departments of larger businesses, recurring billing is now, thanks to billing software, a popular choice for smaller business owners who want to make paying more convenient for their customers.

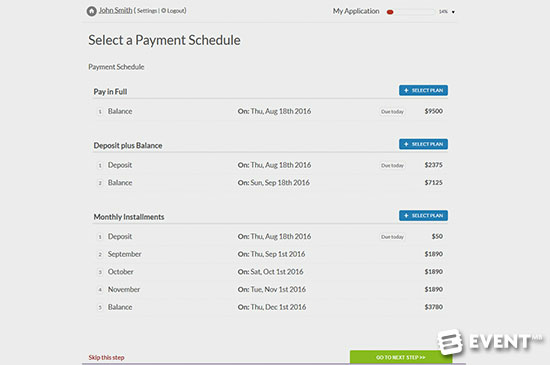

For example, if an after-school program director wanted to sign a new customer, but the buyer wasn’t able to pay the full sum in one payment, the director could offer them the choice between a few recurring payment plans that are more manageable:

Source: Regpack

Now that you know which types of businesses use and benefit from recurring billing, let’s get more clear about what those benefits actually are.

What Are the Advantages of Recurring Billing

Recurring billing’s three most significant benefits to business owners are streamlined billing, reduced late payments, and more predictable cash flow, all of which generate greater business efficiency for service-based business owners.

Automated Billing Process

When you use recurring billing software, the exact amount that the customer needs to pay for the product or service is automatically deposited into your business’ bank account at each billing date, without any need for manual intervention.

This saves time and frees your team up to tackle more complex and impactful projects.

Instead of collecting a bunch of payments at the end of a payment period, your team can do something like optimize your pricing model or think up how to improve your billing system.

Automated billing tools don’t stop at charging the customer.

They can also automatically send personalized confirmation emails to each customer, thanks to auto-populating email templates.

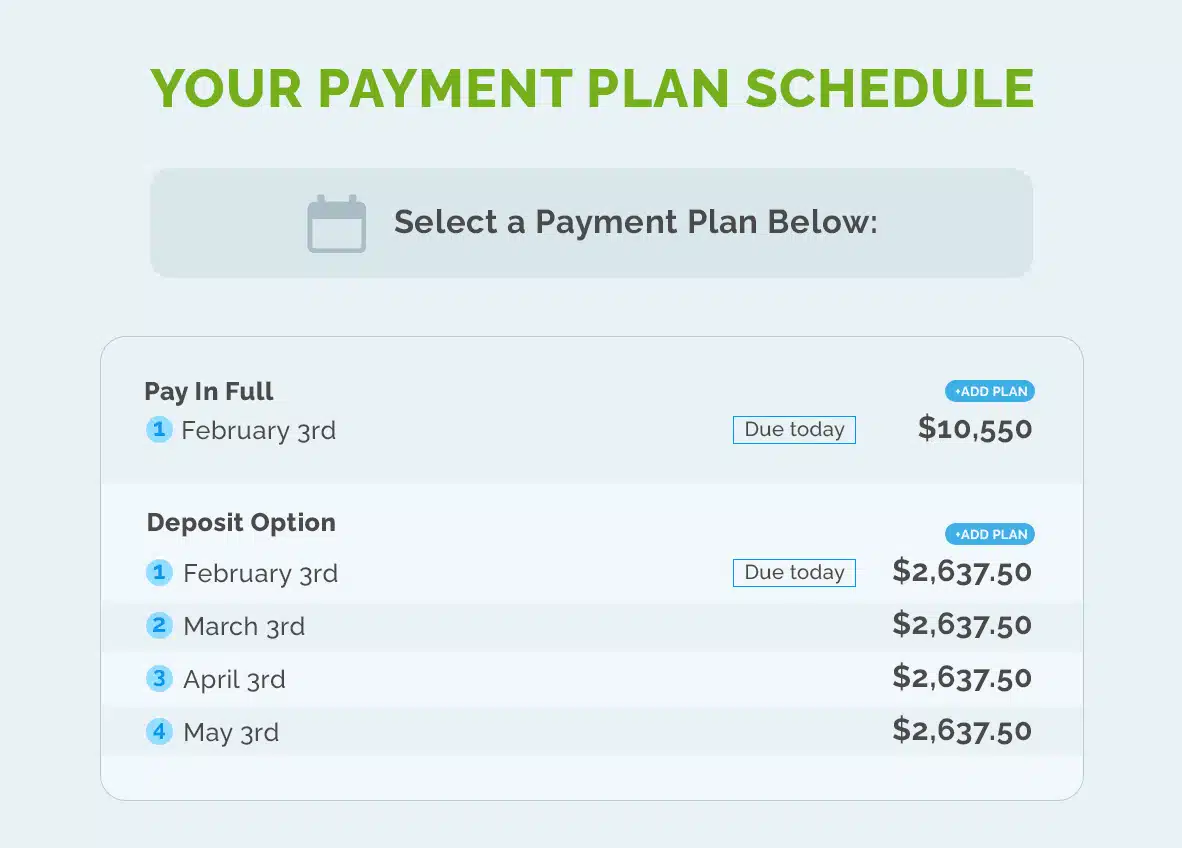

Many tools also allow you to create customized customer payment schedules and charge them accordingly.

This way, you can offer your customers more than one payment option, as shown below:

Source: Regpack

In this example, customers can choose either to pay in full or to enter into a recurring billing option where they’re charged monthly. This flexibility enhances the customer experience.

Another part of the billing process you can automate with recurring billing software is creating and sending payment reminder emails, which reduce the likelihood of late payments.

By automating these repetitive tasks, you also reduce human error. Customers are always charged the right amount at the right time.

And reminder emails are sent according to the rules you’ve set up, so they always appear in the customer’s inbox right when you want them to.

Less human error means less work putting out the fire, whether that’s talking down an annoyed customer who was overcharged or trying to get money back from one you overpaid.

In short, an automated billing process that you manage with recurring billing software will greatly improve your company’s productivity.

Fewer Late Payments

For smaller businesses that don’t have hundreds of clients, late payments can seriously disrupt their cash flow and threaten their ability to maintain operations.

They can also be a constant source of tension between you and a customer if you have to regularly ask them for payment after the due date has passed.

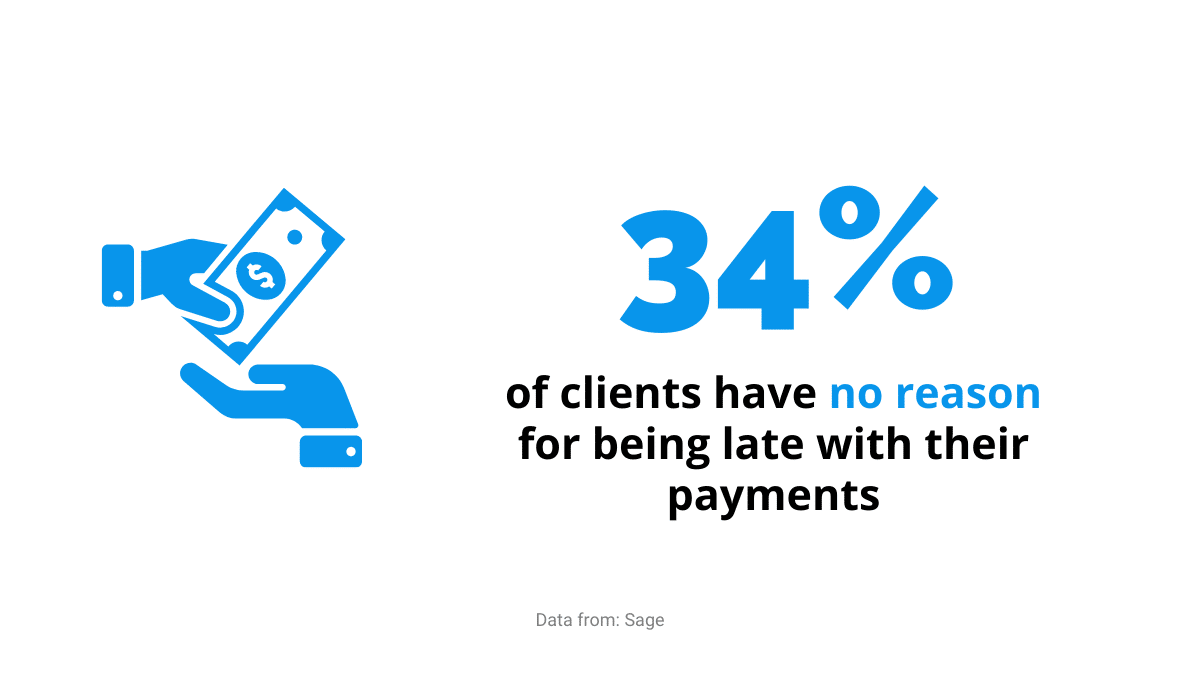

Unfortunately, late payments are all too common, and many of them aren’t due to any reason other than the customer’s forgetfulness.

Source: Regpack

Therefore, it’s important to make it impossible for customers to forget to pay your business, and recurring billing helps you do just this.

Because customers are charged automatically on a scheduled basis, without involving you or them whatsoever, you’ll almost always collect payments on time, provided that their payment method on file is correct and has sufficient funds.

A customer could be out playing tennis while their payment is processed and their money is transferred into your account.

The benefits of fewer late payments are many. For starters, you won’t have to spend time and resources to collect late payments from customers who missed the deadline.

You won’t have to craft and send late payment emails that strike that perfect balance between assertiveness and forgiveness.

Nor will you have to call up a customer who’s five days late on their $1,000 bill and have an awkward conversation with them about “resolving the issue”.

Another advantage is that your company will have fast access to the cash it needs to run your business effectively—to pay staff, to buy supplies, etc.

Lastly, when you use recurring billing software to automatically collect payments from customers, you won’t have to dwell on who owes what and when they’ll finally pay, an uncomfortable habit of mind that Scrooge knew all too well.

Predictable Cash Flow

Recurring billing provides a more predictable and reliable cash flow, putting businesses in a better economic position and helping them navigate fluctuations in the market.

Knowing exactly when payments will be processed and the exact amount that will be deposited into the business’s bank account in each billing cycle will help you manage your existing finances and make informed decisions about your future financial endeavors.

For example, you’ll have the revenue data at hand to accurately determine whether or not an investment in a new piece of equipment or technology is feasible two months from now.

In addition to predictable cash flow, using recurring billing is also a way to increase your company’s cash flow, since the convenience it provides for customers allows you to sign more of them and keep them longer.

How Does Recurring Billing Work

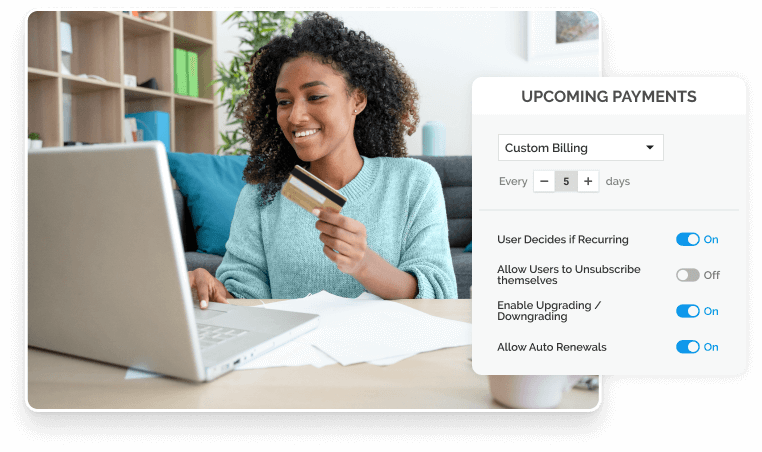

Businesses use automated billing software to get customers onto recurring billing plans and to charge them on a recurring basis after they’ve signed up.

These tools offer online purchase forms, integrated payments, automatic charges, and even payment confirmation emails.

Here’s an example of how getting a customer onto a recurring billing plan generally works.

A customer is on your checkout page to purchase your service.

They first agree to set up a recurring billing plan, often by checking a recurring billing option on an online order form —a form that you can create in your software and host on your site.

For example, here’s how you can set rules for the checkout forms in Regpack’s system:

Source: Regpack

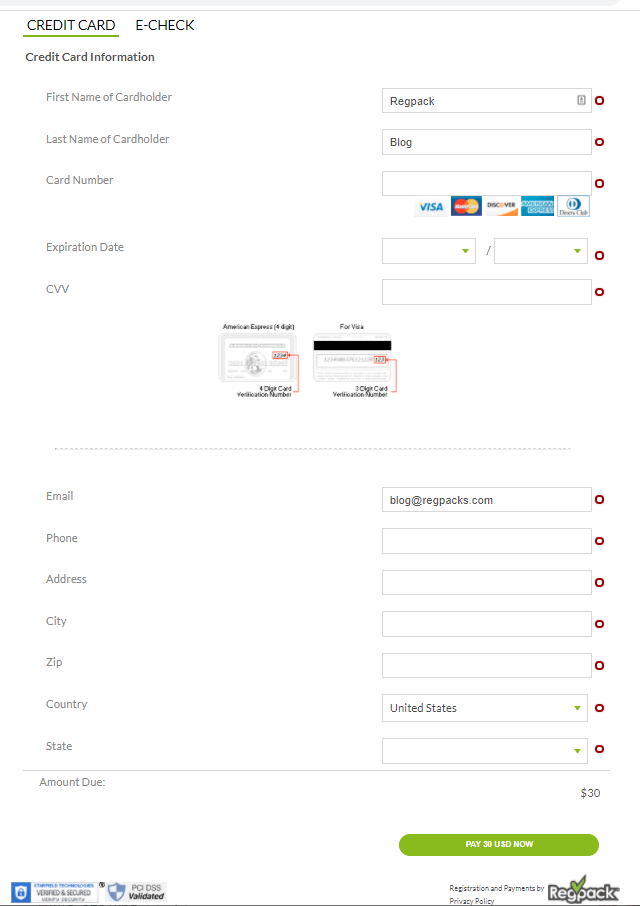

After selecting the recurring billing option, the buyer picks their desired recurring payment schedule, if you offer multiple options, then provides you with their payment information (bank, credit card, or debit card details) in a form like the one below:

Source: Regpack

When the customer submits the online form, all the information goes to your recurring billing software, which will, from now on, charge them automatically at the set intervals and process the payment securely.

Conclusion

Switching to recurring billing will save your company time and money, and reduce churn by making payment convenient and out of mind for your customers.

It’s a great option for any service-based business looking to automate billing tasks and processes and is simple to set up with the right recurring billing software.

Check out our recurring billing software guide to learn about the core features of these tools, best practices for using them, and some factors to consider when evaluating billing software.