If your business has a growing number of customers who subscribe to your products and services, or regularly buy them and pay in installments, chances are your manual billing processes are becoming too complex and time-consuming.

Therefore, they need to be automated.

Simply put, automated billing enables your business to streamline billing and payment operations usually not covered by other software solutions, like accounting.

However, many companies put off their transition to automated billing because of implementation challenges and staff resistance to change.

To help you overcome these issues, here are six major benefits of automated billing you should consider.

- Effortless Subscription Management

- Increased Cash Flow

- Time Saved on Administrative Tasks

- Improved Billing Accuracy

- Stronger Payment Security

- Improved Decision-Making

- Conclusion

Effortless Subscription Management

If your business relies on a subscription-based revenue model where clients pay a certain amount of money on a recurring basis, automated billing can make your subscription management a breeze.

In other words, instead of managing each subscription manually, automated billing software can handle it all and automate most—if not all—billing and payment processes associated with your subscribers.

For instance, a company that (still) doesn’t use automated billing likely needs to do all of the following manually:

- create and send invoices to subscribers every month (or another time period)

- track when subscribers made their payments

- monitor which subscribers have paid and which have not

- follow up with subscribers behind on their payments

- update the subscriber database to reflect changes in customers’ subscription status

Conversely, when that company starts using automated billing software like Regpack, all these manual processes would be minimized or even become redundant.

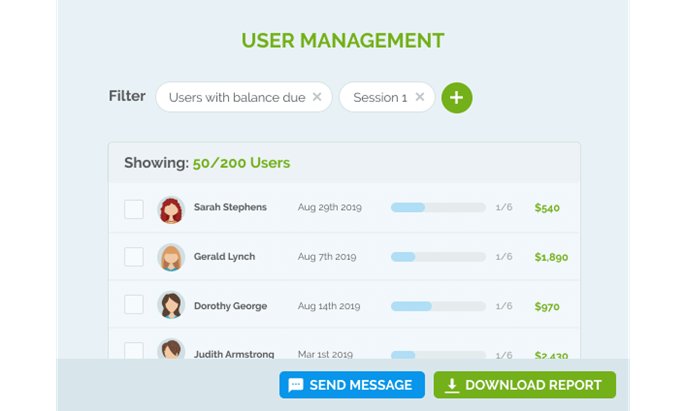

Source: Regpack

Simply put, Regpack allows you to set up multiple pricing plans, billing amounts, and billing schedules for your subscribers and automates the related processes, thus ensuring seamless subscription management.

For example, once the initial invoice is sent to a subscriber, Regpack can be configured to automatically send subsequent invoices (with updated invoice data) at predetermined intervals.

Then, the software will track payments and alert you when a subscriber’s payment is late.

Furthermore, it will allow you to set up automated email reminders for upcoming and missed payments, as well as payment confirmation emails, allowing you to automate the follow-up with subscribers.

Finally, most automated billing software solutions will automatically record any actions and changes in your subscribers’ status.

Of course, all this applies to one-time and recurring payments other than subscriptions, such as installment plans.

Therefore, businesses using the right automated billing software can create subscription plans and manage related billing and payment processing operations with much less manual work, making subscription management effortless.

Increased Cash Flow

By automating the creation and delivery of invoices, collection of payments, and sending of payment reminders, an automated billing system helps you increase your business’s cash flow by reducing late payments.

Moreover, having a more predictable cash flow allows you to better plan your future expenses and investments in growing your business, which can further improve your revenues.

Thus, automated billing gives you more insights into—and control over—your business’s financial position.

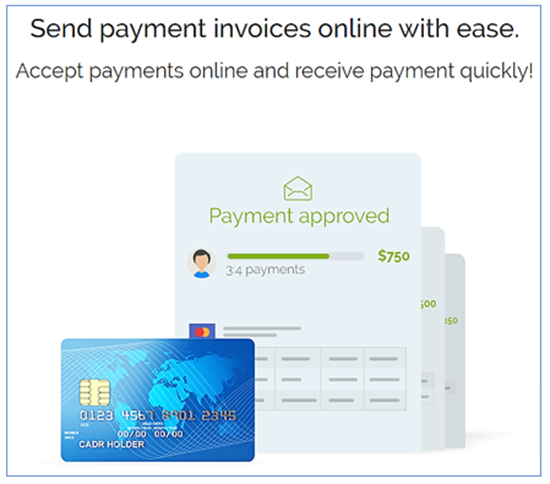

For instance, most automated billing software solutions will allow you to create an online customer payment portal for individual or group (e.g., family members) clients.

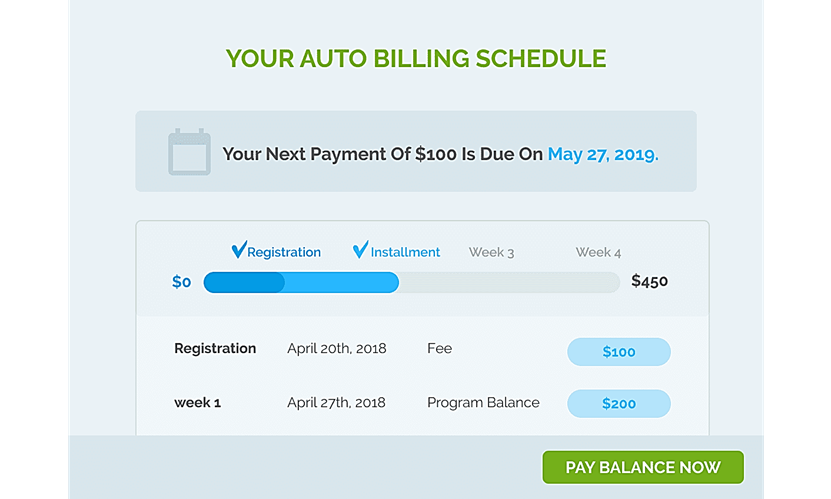

Here’s an example.

Source: Regpack

This gives your customers a convenient way to track invoices, monitor due dates, update payment information, and manage account details.

Best of all, such self-service portals enable customers to easily pay their outstanding invoices directly within the portal, saving them time and improving their user experience.

Naturally, such convenience increases the percentage of timely paid invoices, resulting in an improved cash flow for your business.

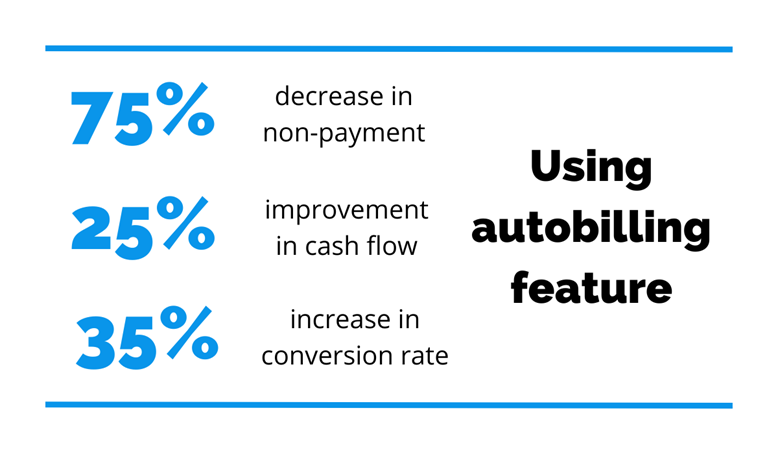

For instance, Regpack clients using this auto-billing feature report that late or missing payments dropped by 75%, and their cash flow improved by 25%.

Moreover, the rate of converting potential customers into paying ones increased by 35%.

Source: Regpack

In light of this, any deployment issues or employee resistance you might face when implementing an automated billing system pale in comparison with these improvements.

To sum up, automated billing helps you strengthen cash flow by reducing late payments, enabling clients to conveniently pay invoices through their own portal, and allowing you to plan improvements that can attract new and retain existing customers.

Time Saved on Administrative Tasks

As it’s already clear from previous sections, one of the biggest benefits of automated billing is the time your business will save on administrative tasks.

More specifically, automated billing software does almost everything automatically without the need for any manual intervention, so your staff will have more time to focus on other, more productive tasks, such as customer service or product development.

In other words, they won’t have to spend their time manually invoicing, collecting payments, and sending payment reminders to each customer individually.

Instead, they will set the initial billing parameters and let automated billing software do the rest.

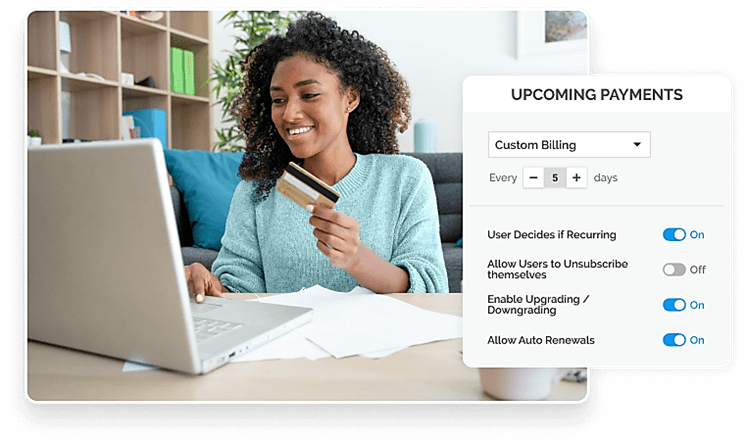

Source: Regpack

As shown above, automated billing settings can be customized for each user or user group or all users.

For example, depending on your pricing policy, you can let users decide if they want to set up recurring payments and allow them to unsubscribe themselves.

Furthermore, you can configure the software to enable upgrades, downgrades, and auto-renewals of their subscription/recurring order.

Naturally, these are just some billing and payment parameters your staff can set in advance, thus saving them time and effort that would otherwise be spent on manual data entry every month (or another billing period).

Likewise, your employees can now filter users according to different criteria to quickly identify and address any billing issues.

Source: Regpack

Of course, when invoice creation and delivery, payment processing, and any changes to your clients’ payment plans are largely automated, this results in significant time savings.

For instance, Regpack’s clients report their employees save about 60 working hours per month despite their business growing and adding customers.

Overall, automated billing ensures your administrative staff will have more time—and less stress—for managing otherwise manual and time-consuming billing and payment processes.

Improved Billing Accuracy

Because automated billing software generates invoices automatically, they are less susceptible to human error, which helps your business improve billing accuracy.

What’s more, since invoices are sent automatically, they’ll always be sent on time and to the correct email address.

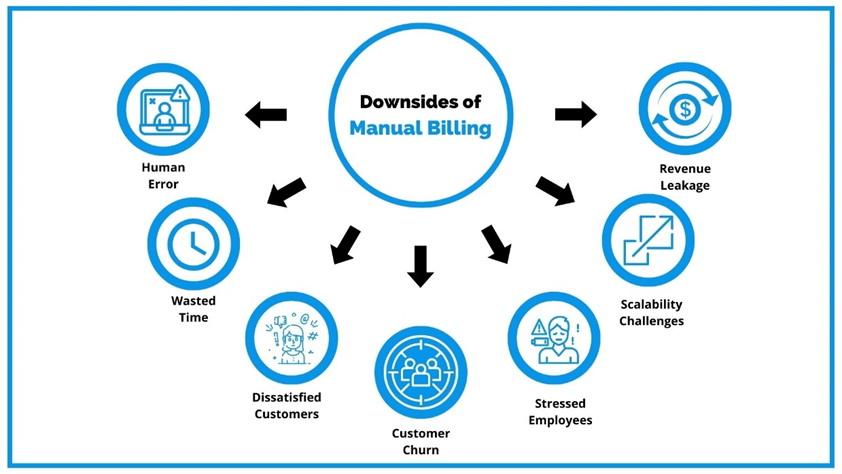

To illustrate what automated billing means in practice, let’s consider how a manual billing process works.

Without automation, your staff would have to enter data into an invoice template or spreadsheet every time a new invoice needs to be issued.

This means they will have to copy/paste the customer’s payment details and invoice amount or enter new data in case of any changes to their subscription or standing order.

Naturally, this process is time-consuming and prone to errors even when your business has a smaller number of clients, and problems just pile up as your business grows.

Here’s an overview of some typical downsides of manual billing:

Illustration: Regpack Data: Subscription Flow

As you can see, manual billing can not only lead to incorrect invoices (which account for over 60% of late payments) but it can also tarnish your business’s reputation, leading to dissatisfied customers who then leave (churn).

Of course, manually preparing invoices for hundreds or thousands of customers also causes employee stress associated with scalability challenges.

Finally, all this results in lost revenue and missed opportunities for attracting and retaining customers.

Conversely, when your invoicing operations are automated through digital invoices sent by email and convenient online payment methods, you can avoid those costly downsides of manual billing.

Source: Regpack

Moreover, most billing software solutions can be set to automatically check for errors and inconsistencies, thus reducing the need for manual review.

All in all, automated billing software improves the accuracy of your invoices and their delivery, ensuring your customers will receive their invoices on time and free of errors, which translates into their timely payments and your business’s increased cash flow.

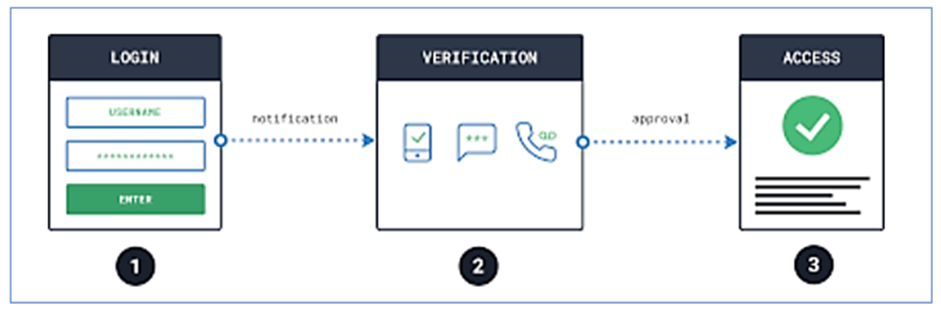

Stronger Payment Security

Automated billing software must adhere to the highest security standards and use the latest security measures so your business and your customers benefit from stronger payment security.

In other words, an automated billing system—as opposed to manual data processing—provides much fewer opportunities for data breaches, payment fraud, identity theft, and other online and offline security risks.

First, it does so by complying with security standards such as Payment Card Industry Data Security Standard (PCI DSS), the EU’s General Data Protection Regulation (GDPR), and the California Consumer Privacy Act (CCPA).

Second, automated billing software is typically protected by a range of security measures like encryption, firewalls, fraud detection, and two-factor authentication.

Source: Merchant Fraud Journal

Simply put, the security of your customers’ sensitive private and payment data (name, address, credit card number, bank account info, etc.) is crucial for accepting online payments without exposing your customers and your business to cyber-risks.

An extra security measure provided by automated billing software is the ability to set admin access levels and permissions.

In other words, you get to decide which of your employees can view and/or modify sensitive customer data and configure the billing system accordingly.

All this means that instead of having to maintain all these payment security protocols, i.e., monitor them for the latest changes and implement them in your billing process, an automated billing software solution does it for you.

Therefore, automated billing helps you ensure secure payment processing for your customers and protects your business’s and your customer’s data, which is a crucial aspect of any business that wants to sell its services or products online.

Improved Decision-Making

Since automated billing software collects data in one centralized online database, it gives your business the opportunity to gain important insights through comprehensive reports, ultimately leading to improved decision-making.

Conversely, when your customers’ billing and payment data is kept in several different places (e.g., spreadsheets, accounting and CRM software, email management solutions), it’s much harder to make data-driven strategic decisions about your business.

In other words, automated billing software integrates all the data relevant for making better-informed business decisions in one place (online database).

From there, you can filter, search, and manage data as you see fit and then generate detailed reports about various aspects of your business.

Source: Regpack

In fact, the reporting feature of your automated billing software should allow you to extract relevant information and create reports about your users, sales, products/services, payments (made and due), and more.

What’s more, you should be able to filter the data in reports according to your criteria and cross-reference that selected info with other types of reports.

For example, you can run a payment report just for a specific service or product or just for specific user groups.

To illustrate how this works, here’s a quick overview of the common reports in Regpack.

Source: Regpack on YouTube

These reports are crucial for monitoring the financial health of your business and identifying weak and strong points of your operations, as well as deciding on your future business moves.

In summary, automated billing software’s analytics and reporting feature provides your business with valuable insights needed to make better-informed decisions about managing and growing your business.

Conclusion

Having covered these six benefits of automated billing, it’s clear why—despite any implementation challenges or staff resistance—many businesses are opting for automated billing software.

As a reminder, the right automated billing system will enable you to effortlessly manage your customers’ subscriptions and other payment plans, increase your cash flow, and save time on administrative tasks.

Furthermore, it will improve billing accuracy, enhance payment security, and allow you to make informed business decisions.

We hope this article helped you overcome any doubts about whether your business should implement an automated billing system.