Evaluating automated billing software can be difficult. There are hundreds of tools on the market, each with its own unique set of features.

And because these tools often offer more features than you’ll need, it can be easy to get lost in the weeds.

Therefore, in an effort to streamline your search and help you stay focused, we’ve written an article covering the eight most crucial features of automated billing software.

We’ll tell you what these features are, how they work, and why they’re so important so that you can feel more confident when researching different tools.

- Automated Invoicing

- Multiple Payment Methods

- Multi-Currency Support

- Secure Payment Processing

- Automated Payment Reminders

- Recurring Billing

- Analytics and Reporting

- Multiple Integration Options

- Conclusion

Automated Invoicing

Creating and sending invoices manually is a lot of work.

Tracking which invoices you’ve sent, and which you still need to send, is enough to drive a person crazy, especially if you have a lot of customers on auto-billing.

Therefore, your automated billing software should be able to automatically generate invoices and send them directly to customers by email.

Source: Big Commerce

After a customer is charged through auto-pay, your billing software should be able to draw order and customer details from the database, fill in an invoice template with that data, and then send the invoice to the customer, all without you lifting a finger.

This feature prevents human error, such as forgetting to send the invoice or sending an incorrect invoice, both of which happen too often.

This feature also frees your team up to spend time working on more impactful projects than creating invoices.

Also, customers will appreciate receiving the invoice immediately after being charged for your service.

They won’t have to wonder what this charge is for while your team works in the background to build an invoice that explains it.

Overall, automated invoicing is an essential feature for businesses looking to streamline their payment collection with automated recurring billing.

Multiple Payment Methods

It doesn’t matter if an ice cream shop has forty different flavors. If they only accept cash payments, plenty of would-be customers are going to opt for the store that also accepts cards and mobile payments instead.

Customers want to be able to pay using their preferred methods.

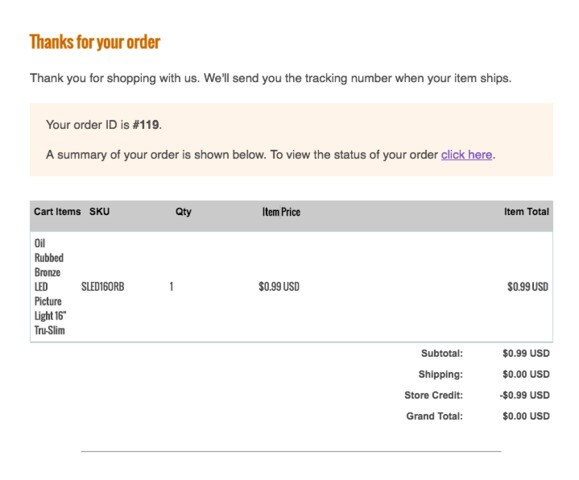

When it comes to online payments, the most preferred methods are the following:

Source: Oberlo

In light of these facts, your automated billing solution must enable you to accept multiple payment methods from your customers.

It should, at the very least, enable you to accept ACH bank transfers, credit cards, debit cards, and even digital wallet transactions.

When you give your customers payment choices, they’ll appreciate your flexibility, and tell their friends how easy it is to work with your brand.

Another payment feature to look for in an automated billing system is custom payment schedules, which empower you to create and offer different payment plans to your customers so that not everyone has to pay all at once.

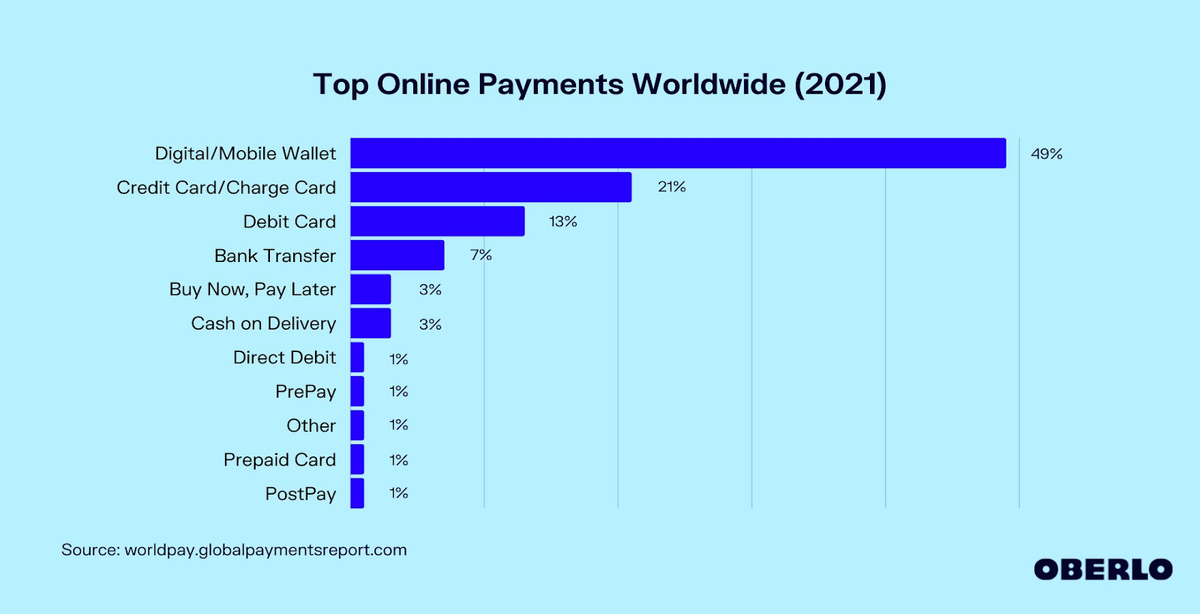

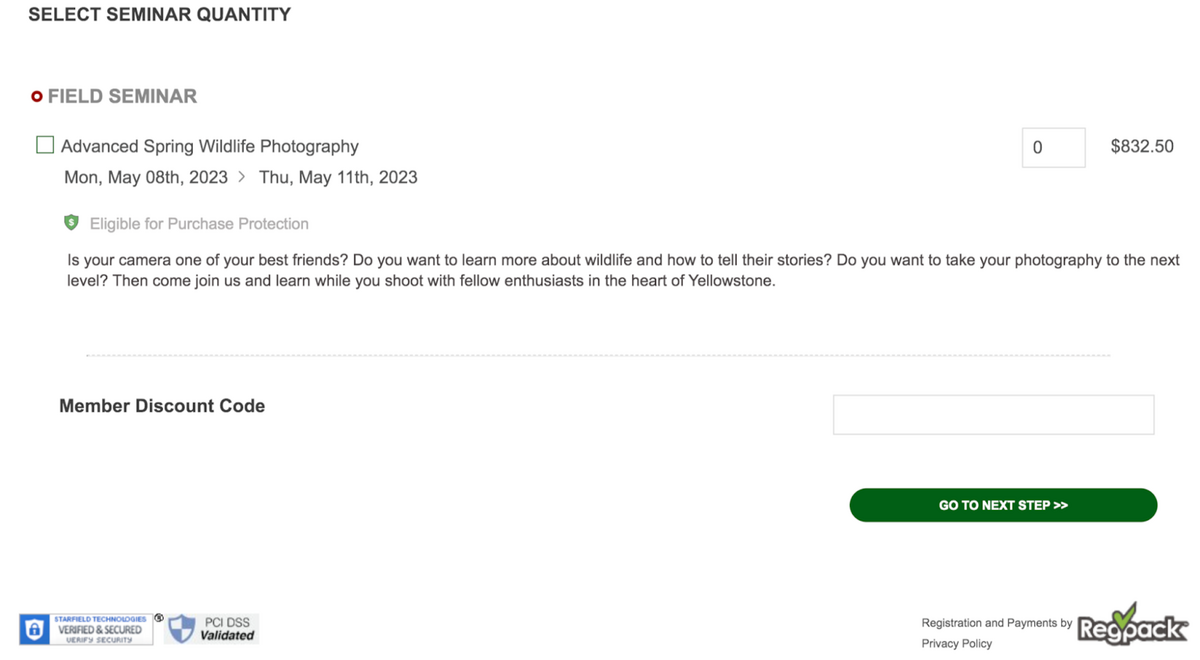

For example, here’s an online checkout process offering three payment plans:

Source: Regpack

Customers can either pay in full, pay in two payments, or pay in monthly installments, thereby spreading the cost over several months.

Offering personalized payment schedules raises your brand’s payment method flexibility to a whole other level, and makes it easier for your potential customers to commit to the ongoing relationship.

Multi-Currency Support

No one wants to have to use a currency conversion math equation to figure out the cost of the payment for your business.

Your automated billing software should therefore offer multi-currency support so that your buyers can pay using their own currency.

This makes your customers happier and streamlines the payment process. Plus, your buyers will feel like your company cares equally about all of its buyers, not just the local ones.

Of course, this feature is especially important if your business is cross-border and you have customers from other parts of the world.

When searching for an automated billing tool, ensure that it supports the currencies that your customers commonly use.

If, for example, 15% of your buyers live in India, the automated billing platform should support the Indian Rupee.

Also, take into account your growth plans. Are you thinking of expanding into another country’s market? If so, make sure the software supports their currency as well.

The best platforms will also provide you with an account manager who can help you set up multi-currency transactions and help you troubleshoot any payment issues.

Secure Payment Processing

Another feature that you can’t go without is secure payment processing, which keeps your customers’ sensitive financial data safe from harm’s reach.

The automated billing software must be PCI compliant. This means it should adhere to the technical and operational requirements put in place by the PCI Security Standards Council.

A company that’s PCI-compliant uses advanced data security measures such as tokenization, data encryption, antivirus software, and firewalls to keep payment data secure.

Not only does this help you protect your business from costly data breaches, but a PCI-compliant badge can signal to customers that you’re a safe business to trust with their card information.

Many companies that use a PCI-compliant billing software solution will display this badge at check out, as Yellowstone Forever does below in the bottom left-hand corner of their form:

Source: Yellowstone.org

Don’t open yourself or your customers up to the risk of identity theft or data breaches. Make sure that your automated billing software is taking data security seriously.

Automated Payment Reminders

One of the best ways to avoid late customer payments and the resulting cash flow issues is to remind customers about their upcoming payments.

Of course, if you have a lot of customers and multiple deadlines, this can be time-consuming, not to mention difficult to remember to do.

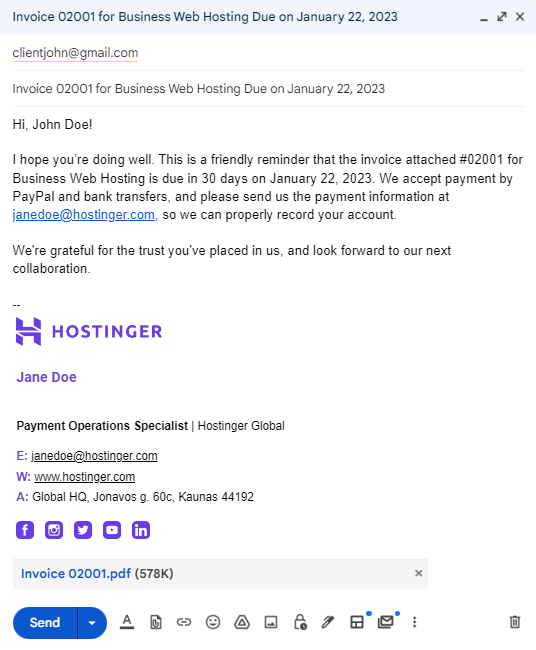

Therefore, it’s great to find billing software that will take this off your hands and automatically send customers payment reminders before their payments are due.

Source: Hostinger

In the system, you should be able to define when you want those reminder emails to go out. Is it 30 days before the due date, like in the picture above?

Or one email five days before and one email on the due date.

Wherever you choose, the system follows your orders, using pre-existing email templates and customer data to craft and send personalized reminder emails.

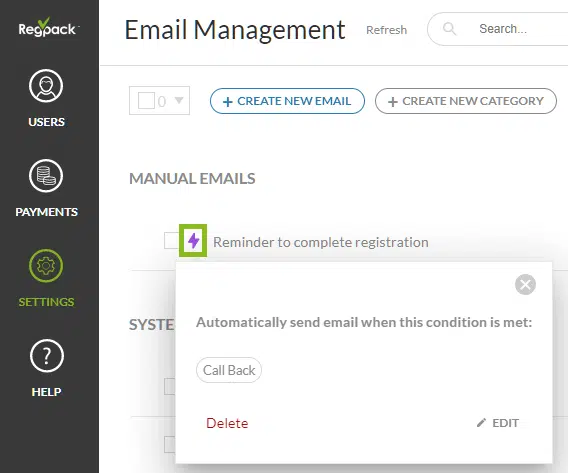

For example, Regpack’s conditional email automation allows you to choose the event that’ll trigger sending the email:

Source: Regpack

With this feature, you can also configure the software to send payment reminder emails to those customers who have missed the deadline.

This helps automate part of the late payment collection process.

In sum, instead of setting a calendar reminder to remind yourself to send a reminder email, find a billing software that will send these emails for you, so that you can get on with the more important aspects of your job while feeling confident that your customers will pay on time.

Recurring Billing

The automated billing software should enable businesses to set up recurring billing, where customers are automatically charged at recurring intervals via their chosen payment methods.

Customers only have to submit their payment details once, and then the payments happen automatically.

Recurring billing software offers a lot of benefits to businesses.

It automates payment collection, reduces the likelihood of late payments, and creates a more convenient payment experience for customers.

To illustrate, if a company offers a $15 per month subscription, during online purchases, the customers can choose the monthly auto-pay option, submit their card details, and then forget about payment for the remainder of the relationship.

Another use-case could be a school with a high cost, say $2000. The school could offer customers the ability to pay that in six monthly installments of $200 per month.

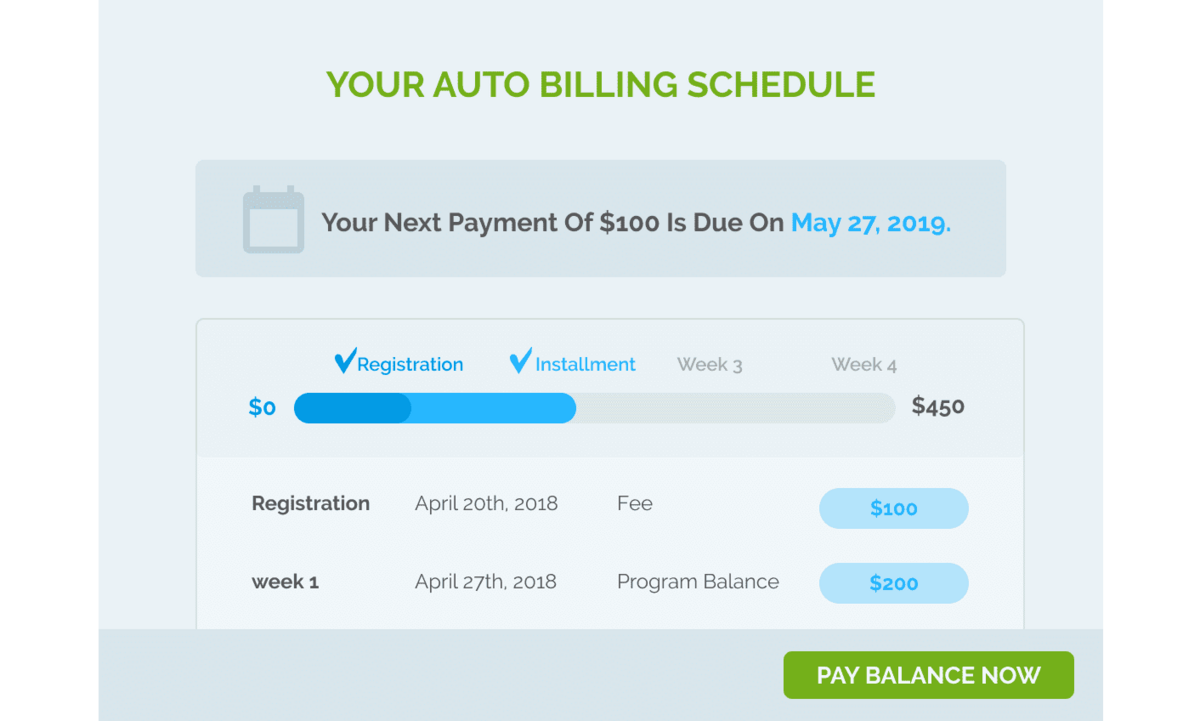

Regpack is an automated billing software that specializes in recurring billing.

Its users can set up multiple pricing plans, billing amounts, and billing schedules, to provide customers with freeing payment flexibility.

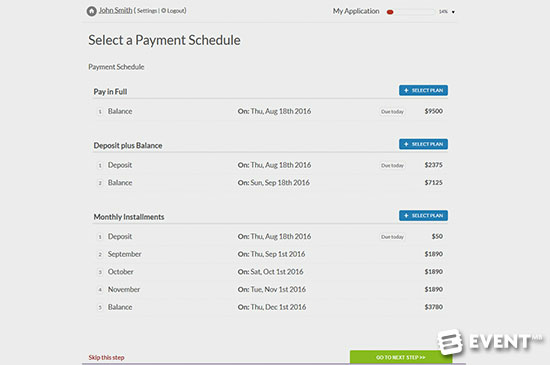

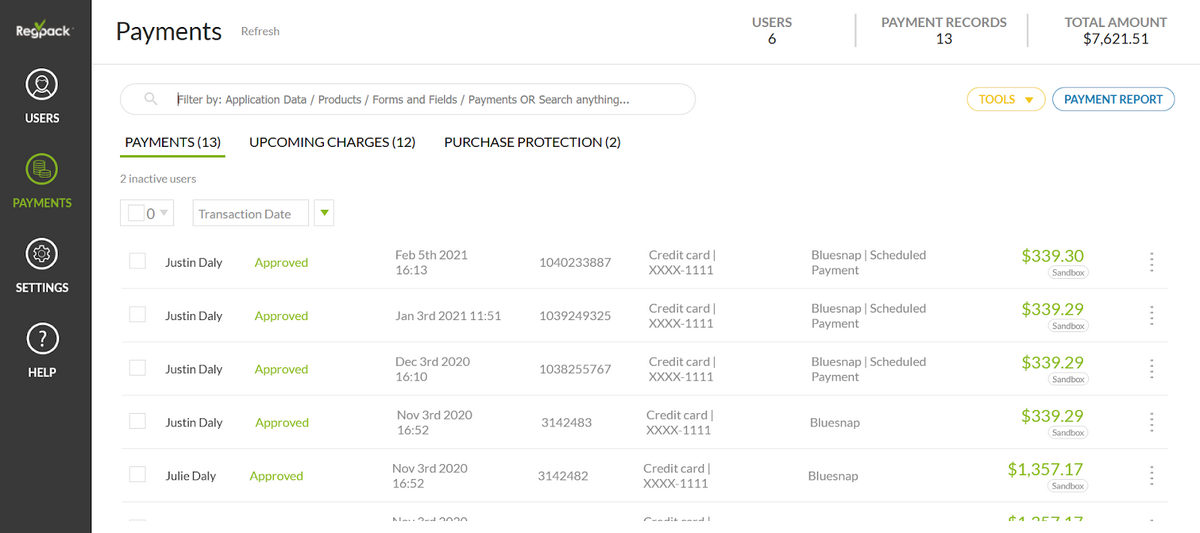

Customers can even log into a user portal where they can check the status of their payments and see which payments they have left in their auto-billing schedule:

Source: Regpack

Recurring billing is likely the feature that’s going to have the greatest reducing effect on your team’s workload, so prioritize it in your search for the right automated billing tool.

Analytics and Reporting

Your automated billing software should offer business intelligence features like analytics and reporting so that you can make data-backed decisions about process and strategy, predict cash flow, and spot inefficiencies.

These platforms should make it easy to run custom and pre-built reports that use the customer data you’ve collected.

For example, you should be able to run a report to identify the customers who have the highest rate of late payments or to calculate the number of sales you’ve made in the last quarter.

You should then be able to filter these reports to view them in ways that help you gain insight.

For example, in a payment report, you should be able to view the payments by group, by date range, by product, or even by a specific customer.

Additionally, it should be a breeze to find out which customers have paid and which haven’t at any given time:

Source: Regpack

A robust automated billing platform will also enable you to create a custom dashboard that displays the need-to-know metrics and KPIs, whether that’s the registration form conversion rate or total outstanding invoices.

When you have customer payment data and a tool that makes running analyses simple, you’re going to be able to quickly find answers to important questions about various aspects of your business.

And the accurate, data-based answers you receive from the software will help you run your business more intelligently.

Multiple Integration Options

The automated billing software should have multiple integration options, allowing you to connect it with other software and third-party applications that your business is already using.

Source: Liquid Web

Most of the benefits of system integration, like better data analysis and real-time data, occur because of the seamless and automatic transfer of data from one system to another.

If, for example, your billing software connects with your CRM, both will operate from the same data.

When you send an automated payment reminder email from your billing software, this will be reflected in your CRM immediately.

And any data that’s collected in the CRM — names, titles, etc. — will automatically go into the billing platform.

The two systems talk to each other. You won’t have to manually update the data.

This automatic transfer of data between systems also means that each of your teams will be using the same data to make their decisions, regardless of which platform they use.

You’ll therefore avoid misalignment and reap the benefits:

Source: Medium

Let’s walk through an example of misalignment to see how it can be damaging. Imagine a case where the billing system and student enrollment software aren’t connected.

The billing tool might state correctly that the student has paid their invoice, while the enrollment software might say the opposite because no one has manually updated the field yet.

This little inaccuracy might cause an admissions manager to reach out to the student to ask about their late payment, causing a whole lot of confusion for the student and wasted time for the employee.

If the systems were integrated, this scenario would’ve been prevented.

As for which integrations to look for, that’ll depend on which tools you already use. But there are some types of software that you’ll probably want your billing platform to connect with.

These include CRMs, customer support and help desk platforms, web analytics tools, marketing software, and event management tools.

Your billing software should also connect with your bank account so that it can transfer payments directly into it after processing them.

These integrations shouldn’t be difficult to do either. A solid billing platform will make it simple to configure integrations.

They’ll use an automated wizard that guides you through the process of connecting your different tools.

Some billing software may even provide you with an account manager. These employees will help you set up your integrations if you run into any trouble along the way.

Others allow you to build automated and custom workflows between software applications through an open API.

In sum, it’s critical that you find a tool that will enable you to connect the various software systems you use, as this will improve operational efficiency and give you access to accurate data in all your software platforms.

Conclusion

When evaluating billing software, make sure it offers recurring billing, automated invoicing, multi-currency support, and the other key features we’ve outlined in this article.

Of course, take into consideration your specific needs as well. Don’t just follow any list of features someone gives you, even if that someone is an expert on the topic.

A good practice is to jot down the 2-3 big issues that you want to solve with billing software, then identify the several features that will help you solve these issues.

These features will be your must-haves. Don’t buy a piece of software unless it has them, or some alternative that works just as well.