If your business offers any type of subscription or installment payment plans for your products or services, then automating your recurring billing processes is a must in today’s world.

Simply put, your business can—with the help of the right recurring billing software—increase staff efficiency, improve the customer experience, secure a more predictable cash flow, and boost revenues.

Naturally, with so many choices on the market, it can be difficult to determine what features such software should have for your business to realize all these benefits.

To help you with that, we’ll explore ten essential features you should consider when choosing the best recurring billing software for your business.

- Check if You Are Able to Set up a Merchant Account

- Prioritize Having Complete Control Over Pricing Plans

- Look Into the Supported Payment Methods

- Consider the Need for Multi-Currency Support

- Look for the Ability to Pause and Resume Payments

- Think About the Option to Apply Discounts

- See How the Recurring Billing Software Manages Invoices

- Understand the Importance of Reporting

- Ensure the Recurring Billing Software Is Secure

- Consider the Available Integration Options

- Conclusion

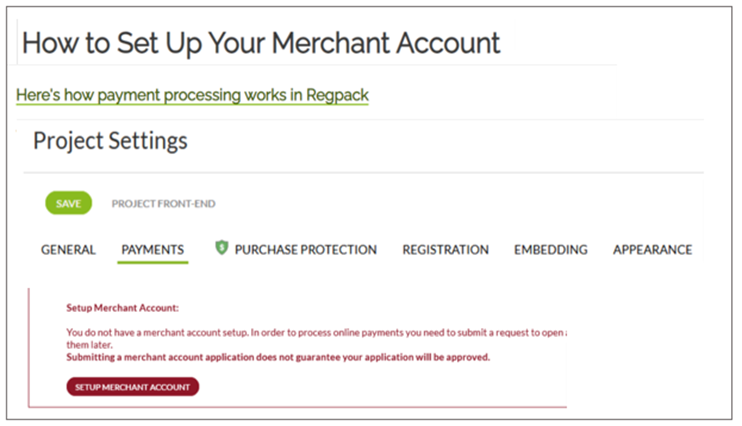

Check if You Are Able to Set up a Merchant Account

One of the first things you need to check when choosing a recurring billing software is whether it allows you to set up a merchant account.

Simply put, the biggest advantage of a merchant account over a standard business bank account is the ability to accept and process online payments, particularly for credit cards.

Additionally, a merchant account allows your business to set up recurring billing on your customers’ credit or debit cards and handle card chargebacks.

Without a merchant account, you would have to rely on third-party payment processors to process credit card payments, which can result in higher transaction fees and less control over the payment process.

And that’s why the recurring billing software of your choice should allow you to set up a merchant account by completing an application and submitting supporting documentation.

Source: Regpack

Another big plus of establishing a merchant account through your recurring billing software provider is that you can accept payments directly through your website instead of redirecting customers to a third-party payment gateway.

This translates into greater convenience for customers, which can positively affect sales.

Overall, setting up a merchant account allows you to accept all types of online payments, and the recurring billing software enables you to enjoy lower transaction fees, have more control over your payments, and increase customer trust.

Prioritize Having Complete Control Over Pricing Plans

The next thing to consider when looking for recurring billing software is whether it gives you complete control over your pricing plans by providing full customization options as needed.

In other words, recurring billing software should allow you to set up multiple pricing plans, billing schedules, free trials, one-time fees, and different subscription tiers.

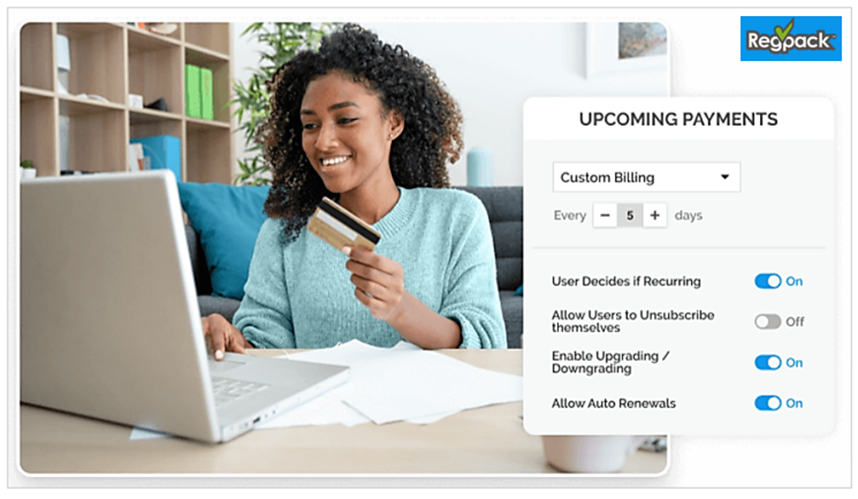

For example, our recurring billing and payment platform, Regpack, allows businesses to create and customize multiple pricing plans for their services or products.

Source: Regpack

This Regpack feature—one of many useful features the software provides—enables businesses to set up several billing schedules (e.g., monthly, annually, or any other recurring period) and let clients choose one.

This way, those potential customers not ready for a long-term commitment (e.g., annual subscription) or not willing/able to make a one-time payment in full for your service can choose the schedule that best fits their needs.

This example underlines the importance of prioritizing the flexibility/customization your recurring billing software will provide regarding subscription or installment plan settings, upgrades and downgrades, and billing cycles.

In other words, it should give your business complete control over pricing plans so your customers can enjoy the convenience of selecting their own pricing plan.

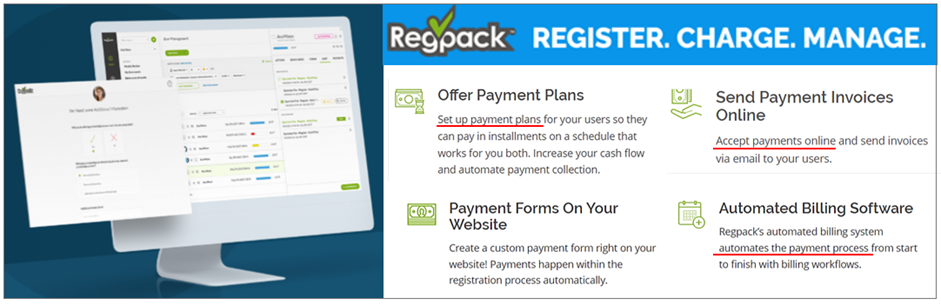

Look Into the Supported Payment Methods

As expected in this day and age, your recurring billing software should support a wide range of payment methods, including credit cards, debit cards, bank transfers, and digital wallets.

This allows your customers to pay using their preferred payment method, which improves their overall experience.

More specifically, offering a wide range of user-convenient payment options prevents potential customers from leaving because their favored payment method is not provided, which, according to research, 42% of US consumers will do.

Of course, this behavior results from the ultimate convenience users are used to when shopping or doing almost anything else online.

Therefore, you should look into the supported payment methods.

Source: Regpack

Of course, this feature of your recurring billing software should, as discussed, come in conjunction with the ability to set up a merchant account.

When these two features are combined, you can consider which payment methods your business’s target consumers favor and focus on offering them.

Overall, your recurring billing software should support multiple payment methods so customers can pay using their preferred option, thus ensuring a seamless purchasing experience and better sales results.

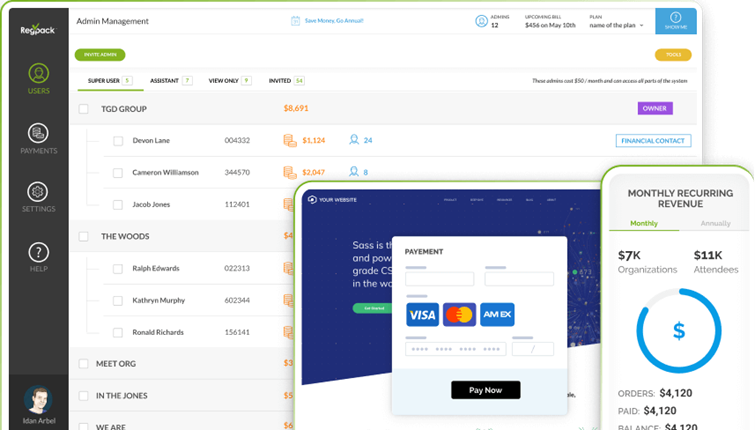

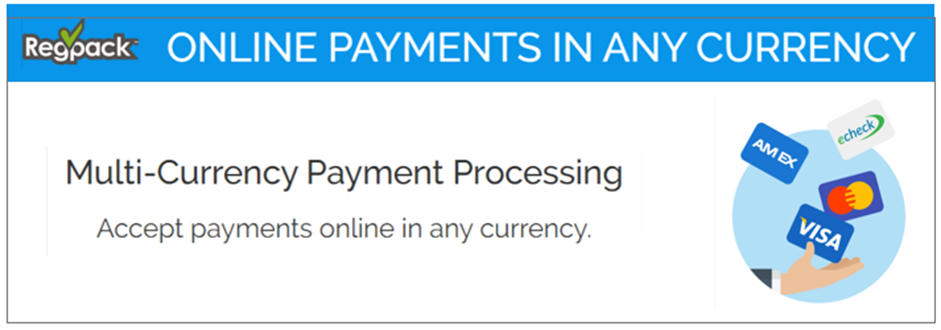

Consider the Need for Multi-Currency Support

If you’re planning to sell your services or products worldwide, you should consider whether your recurring billing software offers multi-currency support so your customers can pay in their own currency.

In other words, it should enable you to charge your customers in any currency they want and get the funds in the currency you want.

This feature is an extension of providing convenient payment options and improving customer experience to enhance international sales.

At the same time, the proper multi-currency support from your recurring billing system provider saves you the hassle of tricky account transfers, unfavorable conversion rates, and hidden fees.

Source: Regpack

For example, because Regpack automates and processes your recurring payments from start to finish, its support team—including your account manager—can help you handle any foreign currency payment or conversion issue that might come up.

Moreover, Regpack will track and update changes in currency conversion and payment processing fees made by banks and credit card companies and lay out the costs for your business in a timely manner.

To sum up, if your business wants to sell globally, you should consider what multi-currency support your recurring billing provider offers.

Look for the Ability to Pause and Resume Payments

When considering what recurring billing software would best fit your needs, the ability to pause and resume recurring payments at the customer’s request should be a factor.

For example, if your business sells subscription boxes or meal kit delivery subscriptions, customers may wish to pause their subscription if they go on vacation and resume it when they return.

The same principle applies to many subscription-based businesses, such as fitness apps or online education platforms.

Therefore, your recurring billing software should allow users to easily pause and resume payments at will.

Source: Regpack

As you can see in the image above, you can even give users options to unsubscribe themselves or allow automatic subscription renewals.

Overall, this pause/resume feature—similar to subscription upgrades and downgrades—should enable your business to easily handle any changes in customer subscriptions and automate the resulting changes in recurring billing.

Think About the Option to Apply Discounts

It’s clear by now that recurring billing software should allow your business to apply discounts to recurring payment plans.

Of course, this option is critical when applying different pricing strategies to attract new customers, retain existing ones, or encourage customers to upgrade to a higher pricing tier.

Source: DailyTut

This means your recurring billing software should enable you to define the amount or percentage of any discount and determine whether it applies to the customer’s entire shopping cart or just to specific products/services.

Additionally, you should be able to automatically display or hide your product or service on specific dates, which can be used to initiate and end early bird discounts.

Similarly, you can set up coupons or discount codes that, when entered, add discounts to a user’s shopping cart.

Considering the importance discounts have in attracting and retaining customers, the option to apply discounts is a must-have feature of your recurring billing software.

See How the Recurring Billing Software Manages Invoices

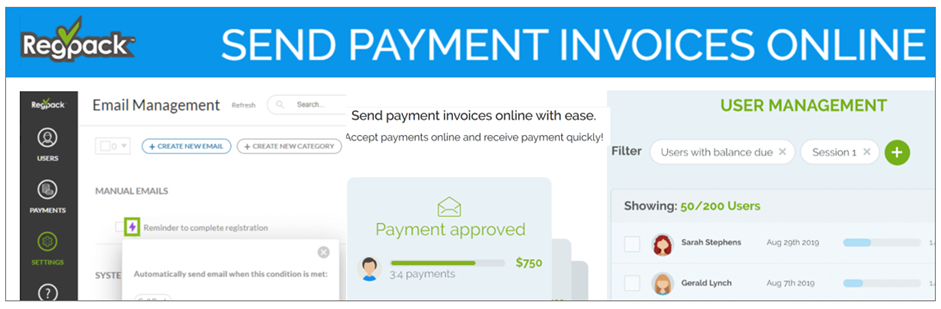

Of course, a big part of managing recurring payments is devoted to generating accurate invoices and sending them to customers on time, both of which can—as the business grows —be jeopardized when done manually.

Therefore, your recurring billing software should automate invoice creation and management, including sending and tracking payments.

Likewise, such software should enable you to set automatic payment reminders—emails sent to customers a specific period before their payment is due.

This helps reduce late payments, for which action-triggered emails can also automatically be sent to the customer (with a grace period of your choice).

Source: Regpack

Again, your business invoicing operations should be automated through online payments and digital invoices, which helps avoid time-consuming and error-prone manual invoicing processes.

As such, the ease and efficiency with which your recurring billing software allows you to manage invoices is an essential factor in choosing the best solution for your invoicing needs.

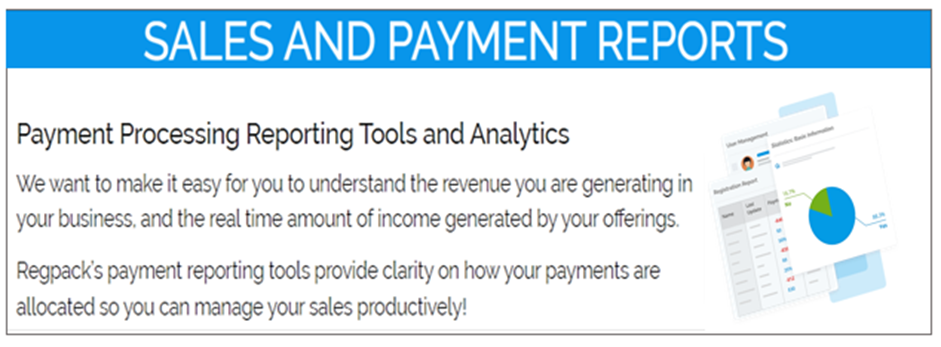

Understand the Importance of Reporting

Today, most businesses understand that the data collected by recurring billing software are a rich source of valuable insights about their customers, operations, and financial situation.

Therefore, recurring billing software should allow businesses to generate customized reports so they can make data-driven, better-informed decisions.

This reporting feature can be used to analyze relevant information on—for example—revenue, customer churn, payment failure rates, and most popular pricing plans and payment methods.

Source: Regpack

When a business understands the importance of reporting—and properly utilizes information filtering and report-generating capabilities—it can extract valuable insights and make data-driven decisions about pricing, product development, and customer service.

All in all, the ability to generate customized reports should be an integral part of your recurring billing software.

Ensure the Recurring Billing Software Is Secure

Today, protecting your customers and your business from identity theft, payment fraud, data breaches, and other cyberattacks is crucial for complying with different regulations and standards and strengthening customer trust.

It is also one of the critical elements needed to provide a seamless user experience everyone expects.

And, when your recurring billing software is secure, you essentially outsource a large part—although not all—of privacy protection, online security, and regulatory compliance matters to your software provider.

Source: Regpack

Naturally, nobody should take security more seriously than billing software providers that process private customer information and sensitive payment data.

Therefore, it’s crucial to ensure that your recurring billing software complies with the latest online security standards and regulations and has strong features and rigorous rules that protect your customers’ and your business’s data from cyberattacks and fraud.

Consider the Available Integration Options

Last but not least, you should consider how easily the recurring billing software you choose can be integrated with other software solutions your business is already using.

In other words, data from the recurring billing system will be needed for other purposes, which means you need to know that data can be exported to other software tools and third-party applications used in everyday operations.

For instance, you may need your billing and payment software to work well with your accounting solution, project management system, or email marketing tool.

Most often, communication between two software programs is enabled by the software provider supplying an open application programming interface (API) that will allow your IT staff to integrate different digital systems.

Source: Regpack

The point of seamlessly integrating recurring billing with other software is—of course—increased efficiency.

Simply put, being able to transfer relevant data from one digital tool to another streamlines your workflows and saves time on manual data entry.

For instance, let’s say you use QuickBooks as your accounting software.

By integrating it with your recurring billing software via an open API, you can keep your financial records up to date, improve your overall financial management, and better understand your cash flow.

To sum up, when looking for the software best for your business, consider your data-sharing needs, keeping in mind the other software tools you’re already using—and check the available integration options your top candidates provide.

Conclusion

Given the above, it’s clear that the best recurring billing software for your business is the one that meets your business’s specific needs and preferences while also providing customers with a smooth purchasing and billing experience.

To find such software, you should look for solutions that provide the features we described and consider how user-friendly their interface and user support are and how well they fit your needs.

The time and effort invested in choosing the right solution will be paid back many times over through increased staff efficiency, enhanced customer experience, more stable cash flow, and higher profits.