Relying on largely automated and predictable recurring payments generated by subscriptions or installment plans for your products or services is good for your business and convenient for your customers.

However, when a customer’s initial payment or any recurring card charge is declined for any reason, this can lead to financial and reputational losses for your business and a lot of administrative hassle for all involved.

To avoid this, here are six strategies you can use to reduce recurring payment declines.

Support Multiple Payment Methods

To explain how supporting multiple payment methods helps your business reduce recurring payment declines, let’s look at how the online payment process usually works.

When a customer decides to purchase something on your website for the first time, they’ll either need to register (user name, email/phone number) or immediately proceed to give their payment information.

In any case, they’ll be prompted to select one of preferably many payment methods offered by your business, including credit and debit cards, digital wallets, ACH payments, and e-checks.

However, your customer will most likely choose to pay with their credit or debit card when agreeing to be regularly charged for subscription or installment payments.

So, what happens if, after they enter their credit or debit card info and click “Pay”, the system starts showing three dots (for what seems like an eternity) and finally produces some incomprehensible failure message?

In such cases, customers may jump ship, click on the X, and forget about it.

The simplest solution to this problem is to—in your clear and nicely worded “payment declined” message—remind the customer they can use other convenient payment methods to pay for your services or products and suggest they try using them.

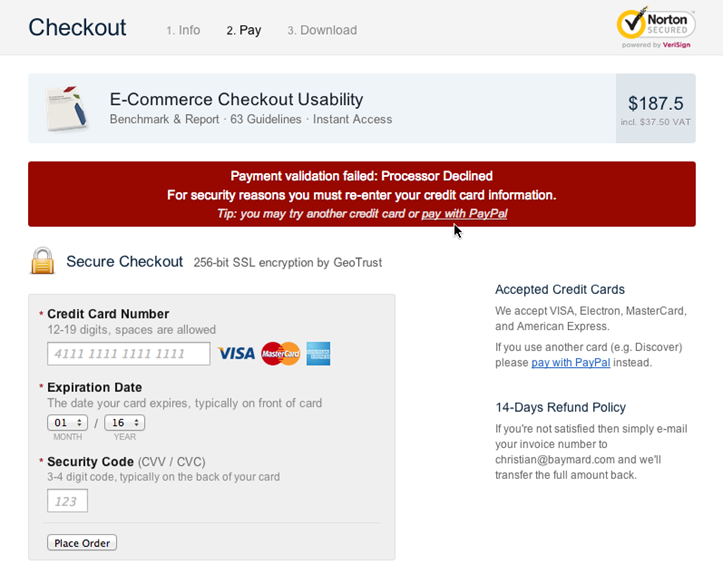

You can see a sample “card declined” message here, courtesy of the Baymard Institute.

This approach offers customers options beyond the initial card payment (declined for any technical, regulatory, or other reason), thus potentially reducing the number of abandoned transactions.

And that’s why ensuring your online payments platform—and therefore your business—supports multiple payment methods can help you keep new customers even when the initial payment fails.

According to Baymard, this happens to 5-10% of first-attempt online card payments.

Therefore, it’s good to suggest alternate payment methods or using the same card with a third-party checkout service like PayPal while ensuring your system repopulates the info the customer already typed in.

As for the cases when the customer’s initial card payment goes through, but one of the agreed-upon recurring payments is declined, we’ll discuss what you can do in the following sections.

Stay in Touch With Your Customers

To avoid the hassle caused by recurring billing declines, it’s best to use automated, targeted communication to alert the customer when their payment doesn’t go through.

Moreover, your business should use automated communication tools to proactively notify customers about upcoming payments, required payment info/account updates, and other payment-related changes.

Why?

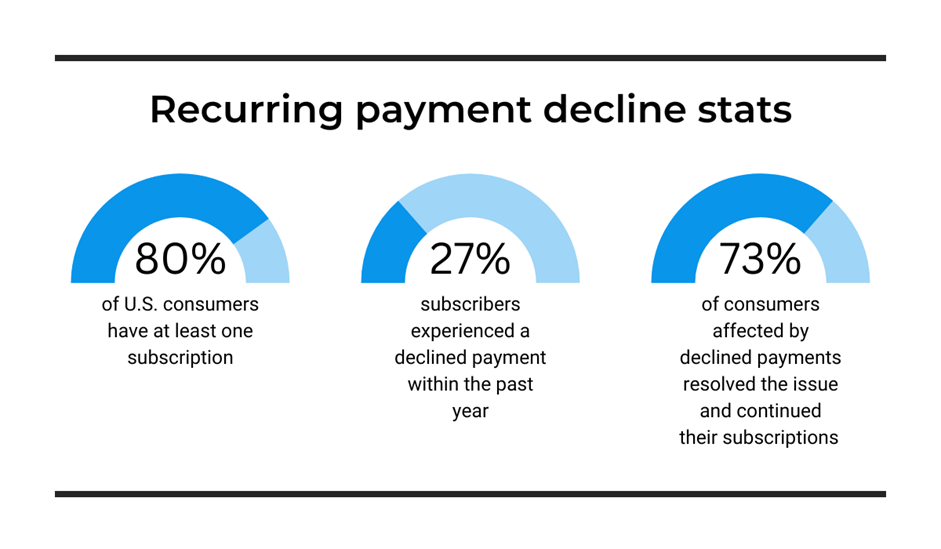

First, according to PYMNTS’s 2021 research, 27% of surveyed consumers who subscribe to multiple services experienced a declined card payment at least once in the past year.

Second, 73% of consumers affected by the “payment declined” issue said they successfully resolved it with their card issuer or subscription provider and continued enjoying their services and products.

When their card payment was declined, the way customers were informed greatly influenced their decision to terminate the subscription or continue using it (i.e., update card info or change recurring payment method).

In other words, almost a third of affected survey participants decided to either cancel or let their subscriptions run out when faced with a payment decline, and they may have done otherwise if they were notified in a timely and appropriate manner.

This just underlines the importance of regular communication with your subscribers or installment plan holders.

Messages like the one above are usually sent after each failed payment attempt (of which there may be more, as discussed later), allowing customers to update their payment information or resolve the issue with their card-issuing bank.

Therefore, to reduce the number and impact of payment declines, you should utilize email automation tools of your payment software to create event- or date-based triggers that will automatically notify the customer when:

- the due date of their recurring payment is coming up

- after their payment is successfully processed

- after their payment is declined (initially and after several attempts)

- you need to update their payment info as part of regulatory obligations

To recap, proactively notifying your customers about upcoming, received, and late payments, any payment declines, required updates, and other payment-related issues can help you keep customers who would otherwise leave when faced with a payment decline.

Utilize an Automatic Account Updater

Since many recurring payments are declined because the customer’s payment details changed and your business’s database was not updated, it’s best to ensure that changes in your customer’s credit/debit card information are automatically updated.

To do that, you should take advantage of automatic account updater programs established by major card companies like:

- MasterCard (Automatic Billing Updater

- Visa (Account Updater)

- American Express (Cardrefresher)

- Discover (Global Network Account Updater)

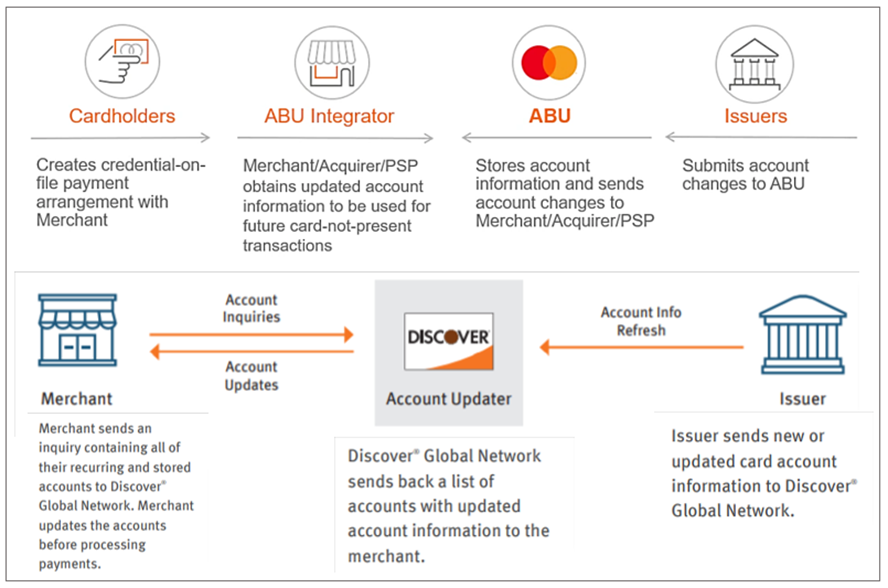

Although each of these automatic account updaters has its own requirements and conditions, they pretty much work in the same way.

For instance, here’s what MasterCard’s and Discover’s explanations of the account-updating process look like.

In each case, the credit card company keeps a central database of all card accounts.

That database is updated by card issuers whenever a card expires, is lost or stolen, and is therefore reissued.

Then there are merchants who agree with customers that they will automatically charge their card for a limited (e.g., installment plan) or unlimited time (e.g., subscription).

Customers give their card info and billing details, and merchants use them to execute recurring payments.

To prevent payment declines, merchants need to keep their customer account information updated, preferably without customer involvement (inconvenience), and that’s where account updaters come in.

In essence, each credit card company’s updater is a simple tool that will automatically update your recurring and card-on-file payment accounts, allowing you to process recurring payments with no interruption.

For instance, you can watch a short video by American Express where they boil down their Cardrefresher into two steps—sending a list of payment accounts and receiving an updated list.

However, each account updater has different technical and administrative requirements for registered merchants and needs to be properly integrated with your payment processing software.

Unless you’re a large company with expert IT and accounting personnel, this is the task best left to your payment processing provider.

All you need to do is ensure that their payment processing solution (i.e., the payment gateway) includes account updater options.

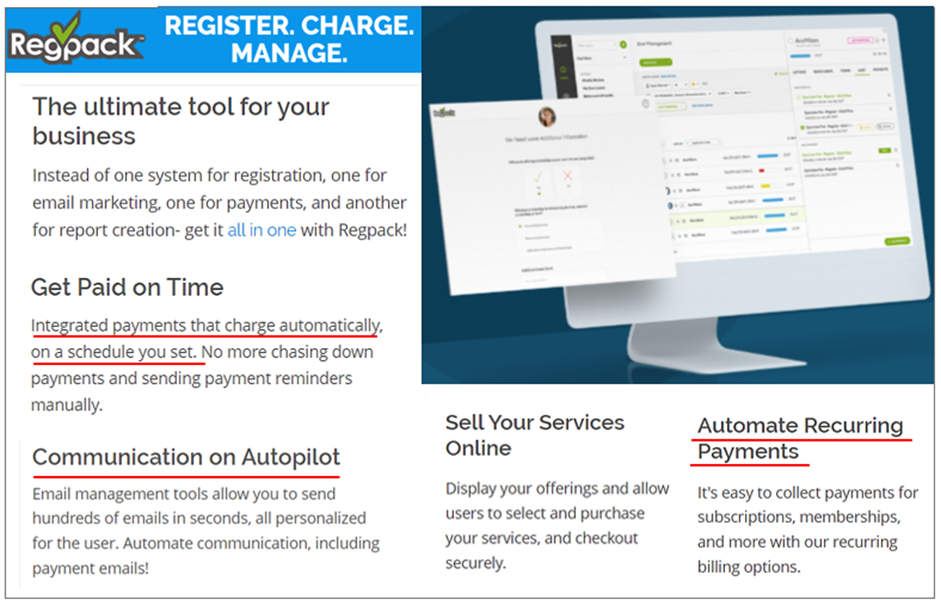

For example, when implementing our automated billing software, Regpack, you also get a dedicated project manager to help you digitize, automate, and streamline the entire payment process, including hook-ups with the said account updaters.

As you can see, Regpack is an all-in-one solution for online payments that includes creating custom registration and payment forms, securely processing recurring payments, and automating billing, invoicing, and email communication with customers.

To process your business’s online payments, Regpack uses a secure payment gateway, BlueSnap, meaning its account-updating services can be leveraged to link your customer accounts to automatic account updaters.

Overall, to avoid card payment declines, you should ensure your customers’ account info is automatically updated by connecting—with the help of your payment software provider —your system with automatic account updaters.

Make Use of a Recurring Indicator

A recurring indicator is another simple digital tool that tells the card issuers’ systems that the transaction is one of many regular ones, which can help minimize the number of payment declines.

In other words, a recurring indicator shows that the payment is part of an ongoing merchant-client relationship involving recurring subscription or installment payments.

When an issue with your customer’s credit card might trigger a payment decline, this indicator allows the card issuer’s system to recognize its recurring nature and process the payment.

For example, when a customer’s credit card expires, some card-issuing banks will decline all payments immediately, while others may approve recurring payments until the cardholder renews their card.

Naturally, the exact approach can vary depending on the type of card and the bank/financial institution that issued it.

Given this variety and different technical requirements and automation settings of credit card recurring indicators, it’s again best to ask your payment software provider for support.

In other words, you’ll need their help to integrate the recurring indicator rules set by credit card providers into your payment processes.

For instance, in Visa’s recurring payment scenario, the first transaction in a series is not flagged as recurring and is authenticated as all other transactions.

However, to quote them:

All subsequent authorization requests in the recurring series must be processed as Recurring Transactions, using the Recurring Indicator.

In comparison, MasterCard and American Express will ask merchants to mark the recurring indicator on both the initial and all subsequent transactions.

Wrapping up, the recurring indicator informs card issuers about regular payments so their systems can—when a payment decline issue arises—apply less strict criteria and approve the transaction, thus leading to fewer card payment declines.

Automatically Retry Failed Payments

When a card payment fails, your payment processing system should recognize the reason for the decline and automatically retry failed payments in some instances.

Basically, all declined transactions are classified by card companies as either hard or soft declines.

As their name suggests, hard declines (theft, loss, fraud) are unsuitable for automated payment retries.

Conversely, soft declines are often caused by temporary issues like lousy network connectivity or technical glitches, authorization failures, or the customer not activating their new card.

Therefore, such declines can usually be successfully processed on a subsequent attempt or after the customer takes appropriate action.

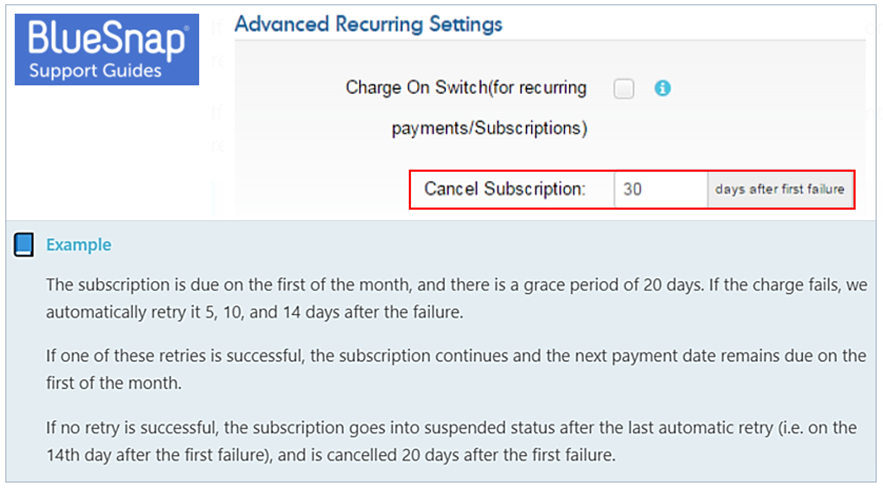

And that’s why you want to ensure your payment software can be configured to automatically retry soft-declined payments, for example, 5, 10, and 14 days after the initial failed transaction.

Likewise, as shown below, it should allow you to set a grace period, after which the system will cancel the subscription.

This feature of your integrated automated billing and payment processing solution allows you to reduce the number of declines caused by temporary issues and collect payments in one of the scheduled retries.

If the payment is not collected, your customer’s account will be canceled after a grace period you select.

To recap, utilizing your payment software to automatically retry failed payments and send trigger-based email communication allows you to minimize payment declines, improve customer convenience, and simplify dunning management.

Implement Fraud Prevention Measures

Last but not least, you should leverage all the security protocols and other anti-fraud measures used by your software provider to ensure your customers and your business are protected from card fraud, identity theft, and other data breaches.

That way, you’ll also be reducing the number of payment declines caused by the issuing bank’s fraud and risk concerns that often turn out to be false alarms.

Therefore, you should ensure your provider applies all the latest security standards and protocols, including firewalls, data encryption, and fraud detection tools, while enabling you to provide customers with a simple and fast payment experience right on your website.

Remember, any “digital” fraud prevention measures you want to implement will depend on your payment software’s data security and anti-fraud features, which underlines the importance of choosing an appropriate solution and a reliable provider.

When your business and your provider implement fraud prevention measures, the card issuers’ systems can seamlessly identify and verify transactions, helping you minimize payment declines caused by their often oversensitive “suspicious activity” settings.

Conclusion

To summarize this article’s highlights, these six strategies to reduce recurring payment declines can be best operationalized with the help of a single, integrated, automated billing solution that covers your entire payment process.

Among other features, it should enable your business to offer multiple payment methods, establish trigger-based email communication, utilize automatic account updaters and recurring indicators, automatically retry failed payments, and implement anti-fraud measures.

The result? Less recurring payment declines, translating to higher staff productivity, improved customer attraction and retention rates, and increased cash flow.