Understanding and using a recurring payment model is vital for businesses keen on optimizing their revenue streams.

However, a cloud of myths and misconceptions often discourages companies from embracing this fast and secure model, so they stick to old-fashioned, manual billing methods instead.

This reluctance to upgrade can lead to a variety of problems, such as operational inefficiencies, increased reliance on manual labor, and even revenue loss.

In this article, we aim to clear the fog by analyzing these myths and providing the factual information you need to make an informed decision about integrating recurring payments into your operations.

Without further ado, let’s debunk the first myth.

Automation Is Less Reliable Than Employees

First off, there’s the question of reliability.

In today’s digital age, it’s surprising how mistrust in technology still lingers. One prevalent myth is the belief that human employees are far more accurate and reliable than automated systems.

I mean, why would someone opt for a software system that allows recurring payments, the workings of which they don’t fully understand, when they can rely on an experienced accountant with a CV like the one shown below?

A senior accountant with 15 years of experience versus using automation—the choice seems obvious, right?

Well, not quite.

Even the most experienced employees are prone to mistakes. We’re human, after all. We get tired, lose focus, and sometimes have other things on our minds.

Automation doesn’t suffer from these issues. Because of this, it is no surprise that the majority of information workers state that the most significant benefit of automation is reducing human error.

This benefit holds true across industries where automation is used not to replace employees but to enable them to move on from everyday and repetitive manual tasks and focus on more pressing issues.

According to one survey, 73% of finance leaders believe automation improves their operational efficiency and gives employees more time for valuable tasks.

So, let’s revisit that senior accountant we mentioned earlier.

Would you prefer them to review each payment manually, or would you rather have them oversee a complex automated billing system that ensures maximum efficiency?

The decision seems much clearer now, doesn’t it?

In summary, while the human touch in business operations is invaluable, automation offers a level of reliability and efficiency that even the most experienced employees can’t match.

Automating Payments Limits Control Over Payments

Let’s dive into another myth that often circulates in the business world.

Many believe that a hands-on approach to managing payments gives them more control and flexibility than automated solutions.

It’s easy to see why some might think this way is best, citing the following benefits of this approach.

A person manually handling payments can scrutinize each transaction, spot discrepancies quickly, and adapt to unique cases on the fly, right?

While this may sound ideal, human error can disrupt this notion. Even if mistakes weren’t a factor, there’s a limit to what humans can handle efficiently.

For example, you might find yourself sticking to a one-time payment model to lessen the workload on your staff, even if your business model would greatly benefit from switching to recurring payments.

Automation, on the other hand, offers many functions that match but often exceed the benefits of a manual approach.

Some of these are the following:

- Payment scheduling

- Automatic customer reminders

- Various payment options

- Analytics and reports

- Customer control options

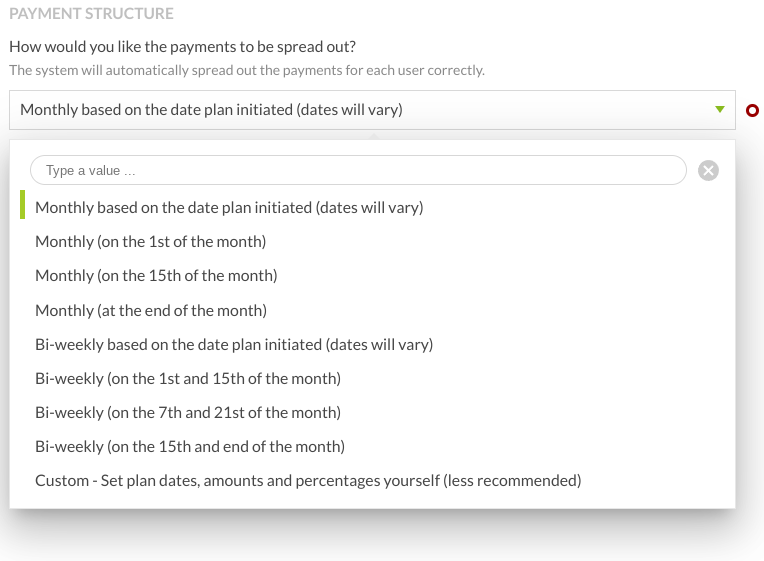

Take setting up recurring payments as an example.

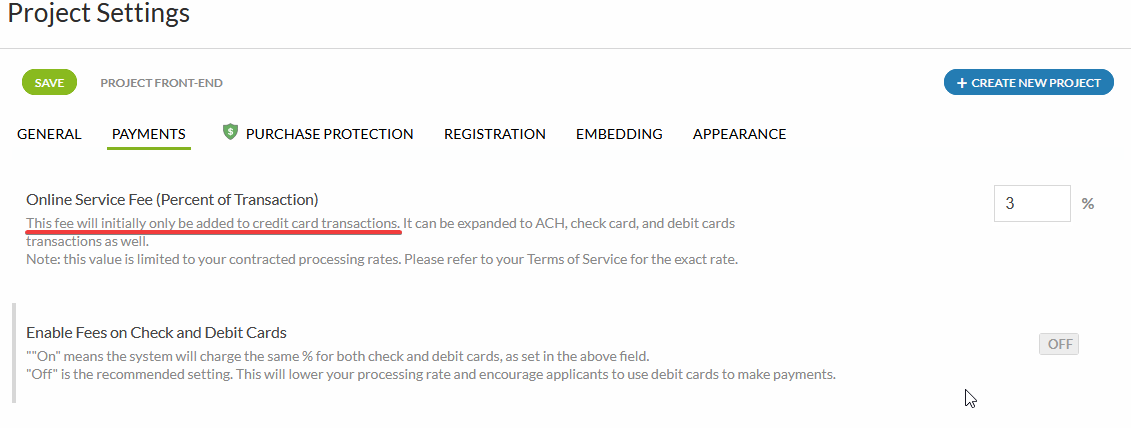

Instead of having limited control, you can fully customize your billing tool to suit your needs. The customization options allow you to fully adjust payment schedules, as shown above.

Or, you can even let your customers choose their billing frequency themselves.

Now that’s control.

Overall, the belief that automating payments limits control is based on outdated notions and misunderstandings, as automated payment solutions offer a range of features that not only match the control you get with a hands-on approach but often exceed it.

Implementing Recurring Payments Is Too Expensive

So, we’ve talked about the reliability and control that come with automated payment systems. But all these benefits must come with a hefty price tag, right?

Well, this question is a common fear.

Many businesses worry that payment processing tools will incur a high upfront cost or a steep monthly subscription fee. And let’s not forget the processing costs for each recurring payment.

While it’s true that there are costs involved, consider some of the benefits of recurring payments you get in return:

- Reduced administrative work

- Minimized human errors

- Fewer late or missed payments

- Increased customer retention

In simpler terms, you reduce the number of employees you need for manual number crunching, lower the number of errors they make, and ensure a structured, consistent cash flow with the powerful features of billing software.

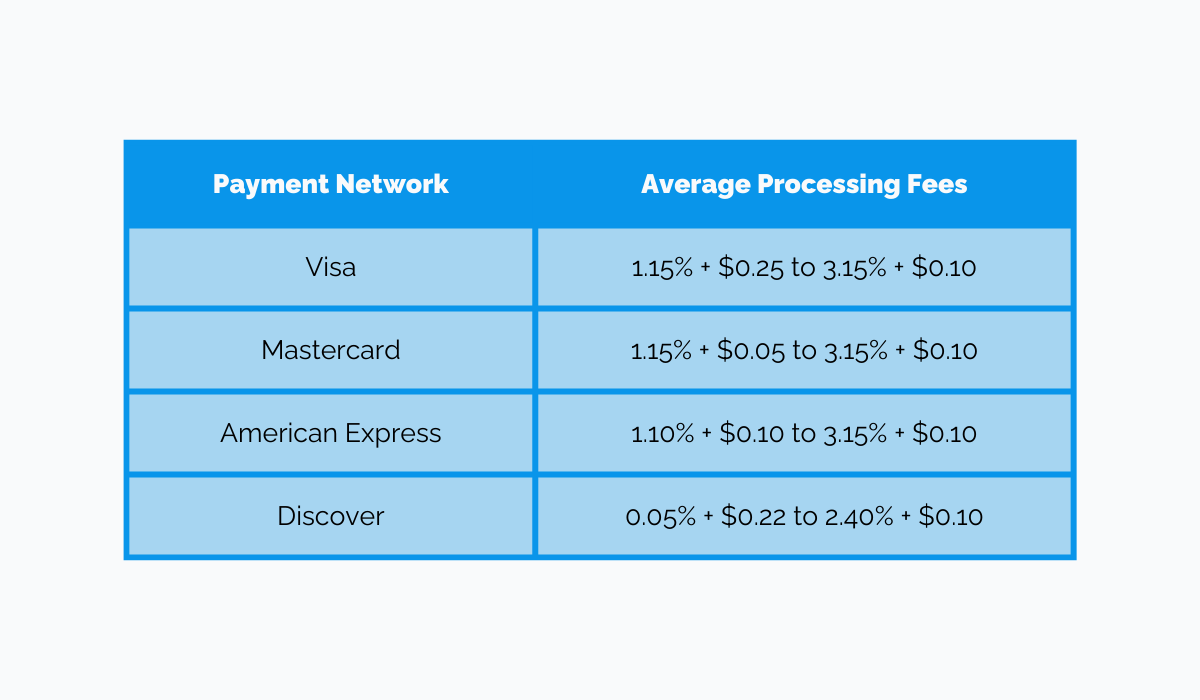

Moreover, the payment processing costs are not as astronomical as some might think.

Our estimates show that these fees can range from as low as 1.5% to about 3%. That’s only $1.50 to $3 for a $100 payment.

What’s more, let us remind you that some part of the fee is determined by the credit card issuer. The average processing costs for the most popular payment networks are displayed below.

If a customer pays with a credit card, you will incur these fees regardless of your payment system. But with automated billing systems, you can set up a service fee that’s automatically added to credit card payments.

This practice allows you to pass the processing costs onto the customer, which is entirely legal. It also gives customers the freedom to choose a different payment method without the added fee.

When you consider everything, the cost of implementing a recurring payment system isn’t as high as it initially seems, and the added features can even help you mitigate some costs more efficiently.

To conclude, before you write off recurring payments as too expensive, consider the long-term benefits and savings they can offer.

Recurring Payments Are More Likely to Be Declined

Another myth that has people second-guessing the dependability of recurring payments is the fear that these payments are more prone to failure.

The idea is that because payments aren’t handled directly and manually, there are more opportunities for something to go wrong.

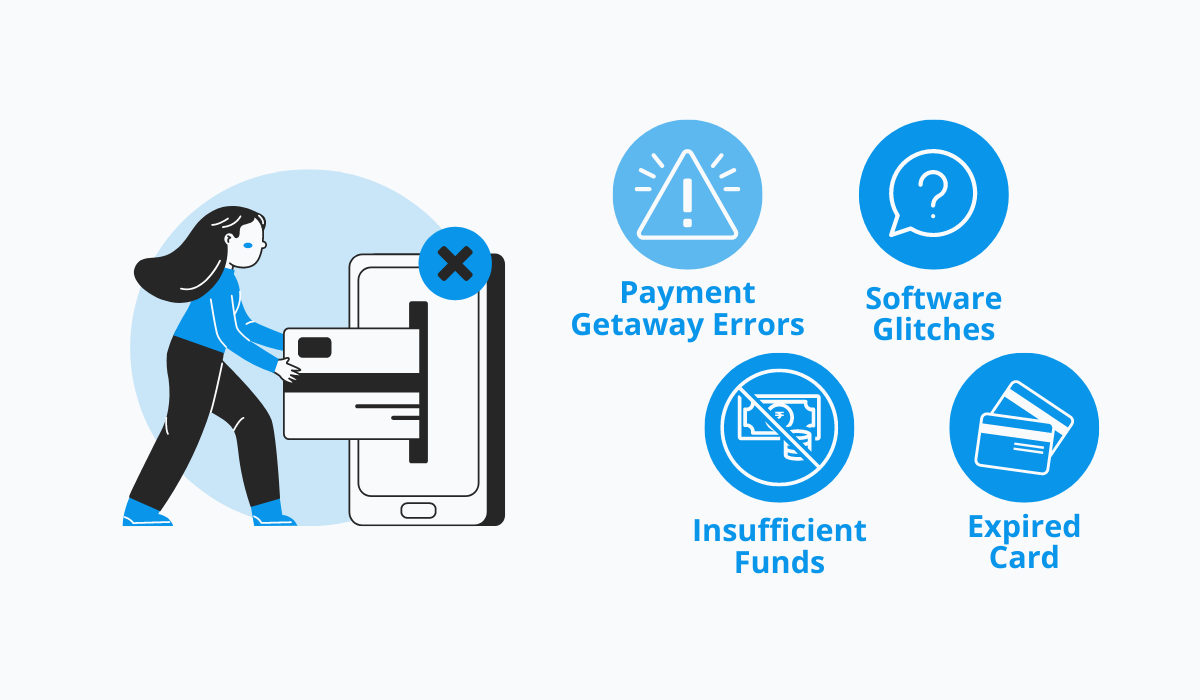

The image above lists some common concerns with recurring payments and why they could be declined.

Some of these concerns revolve around software glitches and payment gateway errors. These errors can occur due to a variety of reasons, such as server downtime, API issues, or even simple coding errors.

Others worry that recurring payments are more vulnerable due to the potential of insufficient funds from the customer’s end, incorrect payment details, or expired payment cards. These issues can indeed be more challenging to address in a recurring payment model.

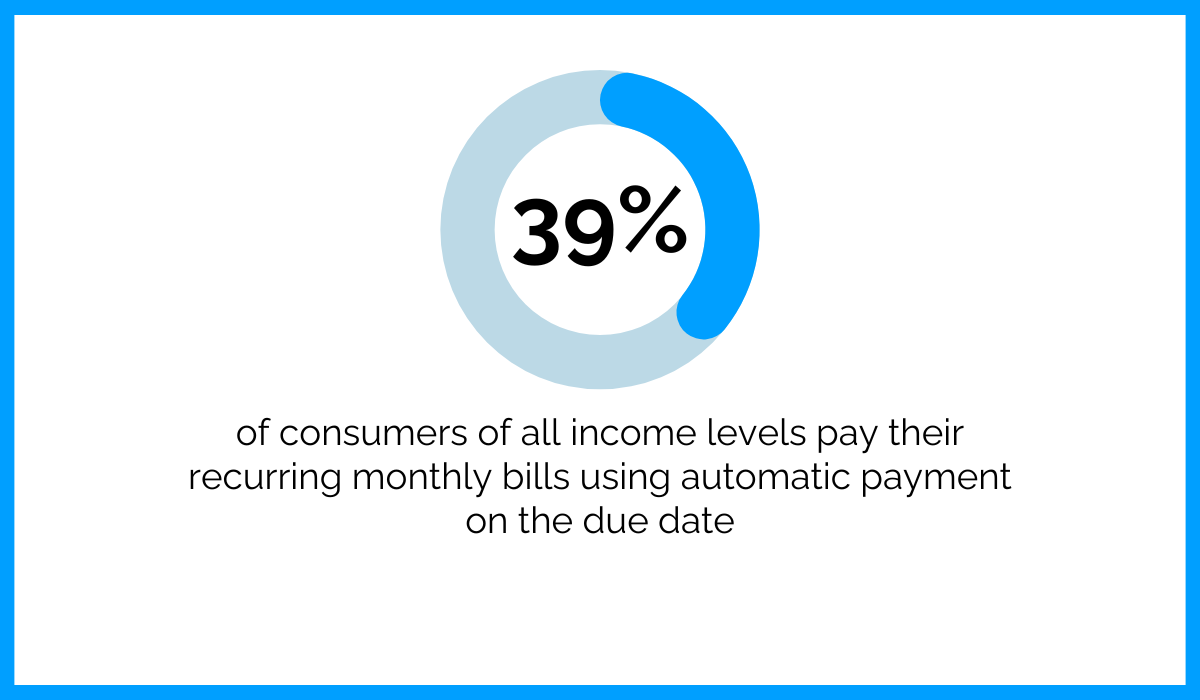

However, it’s crucial to remember that recurring payments aren’t a new phenomenon. They’ve been around for a while, and a significant percentage of consumers manage to pay their recurring bills on the due date.

In fact, almost 40% of consumers regularly pay their recurring monthly bills on time, whether by using their bank’s payment system or through the biller’s website. So, while choosing an automated billing system might seem risky, you just need to do your research and find a reliable option that can handle declined payments effectively.

Selecting a tool with a robust payment gateway can provide features like an automatic account updater to ensure account details are always correct. It can also offer payment retries, giving a grace period for payments—especially useful during bank holidays when payments can’t be processed, like Christmas and New Year’s.

High-quality automated billing systems are designed to handle a variety of issues, so with the right tool, you can mitigate most of these potential risks—making them a safe and reliable choice for your business.

Setting up Recurring Payments Is Too Difficult

For our fifth myth, we have the complexity of this payment method.

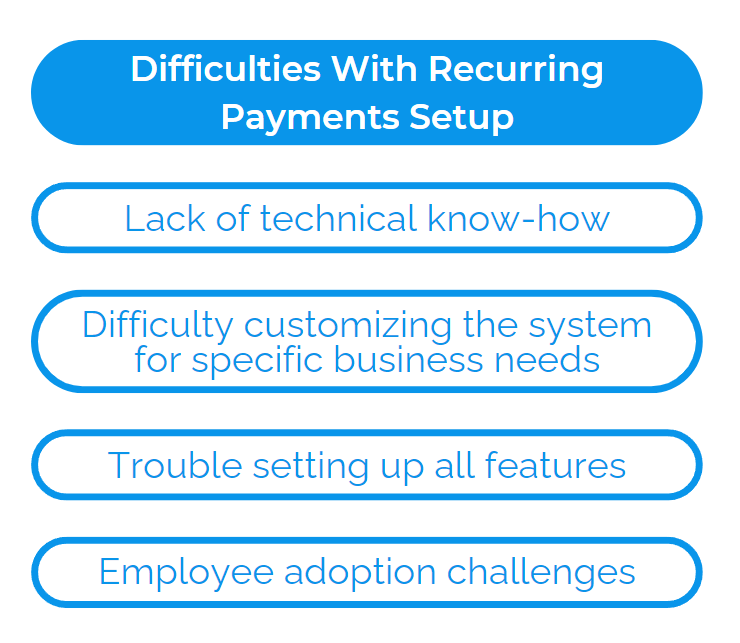

Even if you’re on the edge of considering an automated payment system, one thing that might hold you back is the perceived difficulty in setting up recurring payments and getting them to work efficiently and without issue.

The image above illustrates some valid concerns. After all, not everyone is tech-savvy enough to navigate the complexities of setting up a payment tool, let alone customizing its many features. And even if they were, there’s the additional challenge of training staff to use and adapt to the new system.

However, if you opt for our automated billing software, Regpack, you can put those concerns to rest. Yes, our tool comes with a plethora of valuable and powerful features that you’ll need to learn. But we also have a dedicated project manager to help you set up the software.

Forgot a specific function and need help? No worries. You can either reach out to our customer support team or, if you prefer a more independent approach, we have video tutorials that can guide you through most of our modules.

For those who want to explore Regpack to its fullest potential, we have an extensive help center.

Our help center covers everything from the initial setup to frequently asked questions and more. So, whether you’re a novice or a pro, you’ll find all the resources you need to make the most out of our software.

As you can see, setting up a recurring payment system doesn’t have to be an impossible task. With the right tool and the right support, it can be a smooth and straightforward process.

Sensitive Information Is at a Far Greater Risk

Finally, let’s address the elephant in the room: security concerns.

The myth that recurring payments put your customers’ data at a greater risk than traditional payment methods is a stubborn one that still persists. And, to be fair, the proponents of this myth often back up their concerns with data such as the one presented below.

According to Verizon, almost all digital data breaches are financially motivated, and malicious individuals aim to steal bank and payment card information and sensitive personal information for their own benefit.

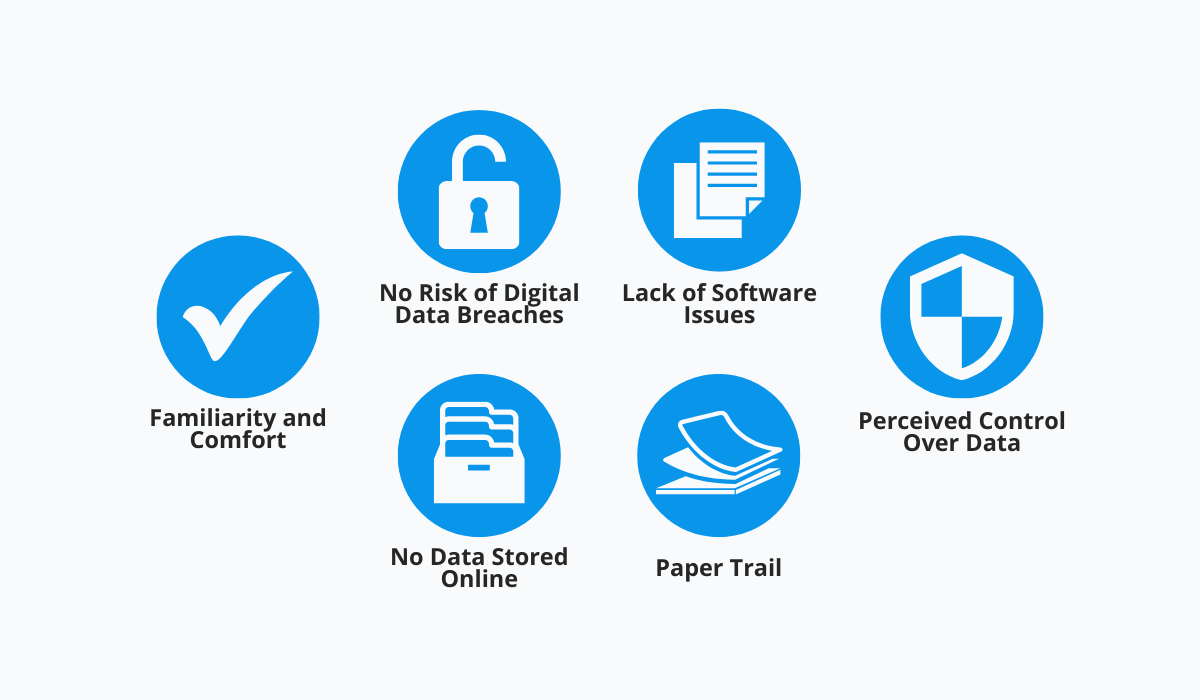

In theory, one way to protect yourself from these breaches is by sticking to the traditional way of doing things.

The image above suggests that this practice can seemingly provide greater security and control over data. It can even offer a paper trail that leads to any malicious individuals in case data is compromised.

However, the familiarity and comfort of a hands-on approach to managing payments can mask the risks.

Traditional methods are not immune to human error or even simple misplacement of sensitive documents. And while you avoid digital data breaches and software issues, there’s always the risk of internal data tampering and fraud, which can go unnoticed until it’s too late.

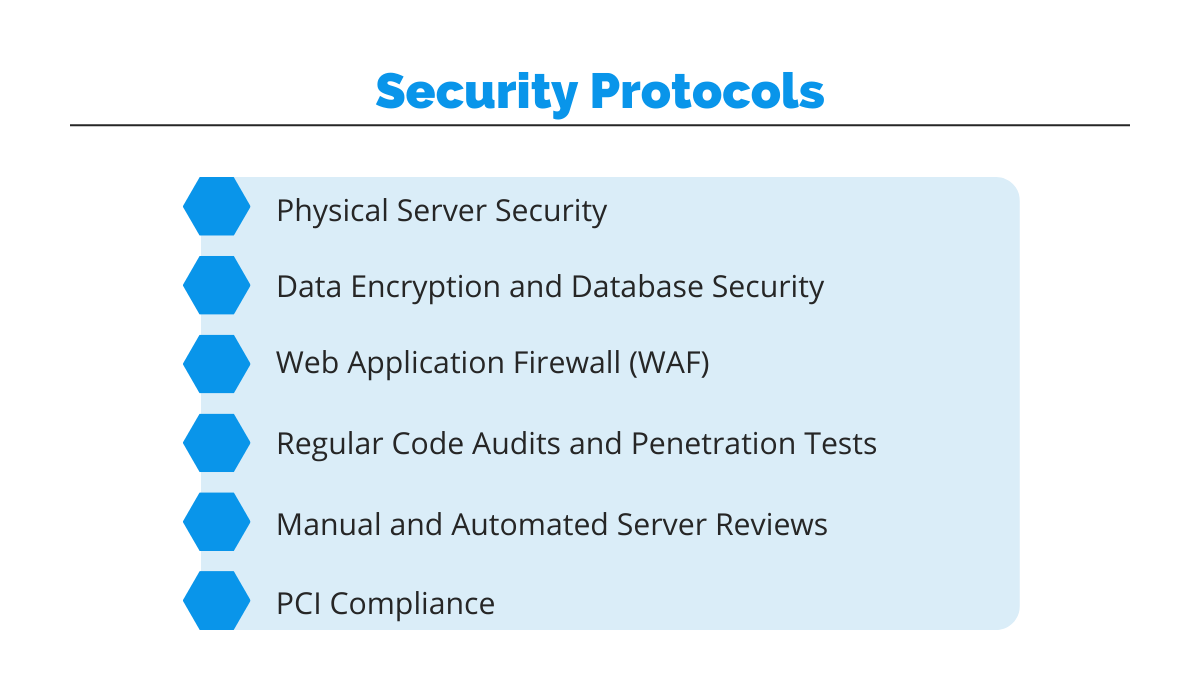

In contrast, payment systems that offer recurring billing have extensive security protocols in place that can make them the more secure alternative.

These protocols range from physically securing databases to encrypting all data and regularly testing the security of their systems.

Many automated systems are PCI compliant, which means they adhere to stringent security standards designed to ensure that all companies that accept, process, store, or transmit credit card information maintain a secure environment.

In summary, while the fear of compromising sensitive information is valid, it’s crucial to weigh these concerns against the robust security measures that modern recurring payment systems offer.

So, pick a highly secure tool, and don’t let outdated myths keep you from adopting a more efficient and profitable billing system.

Conclusion

In this article, we’ve debunked six myths about recurring payments that revolve around the reliability and effectiveness of this model, along with some misconceptions about its implementation and security.

Hopefully, you now have a clearer, more accurate understanding of how recurring payments actually function.

Armed with this information, you are well-equipped to make better decisions for your business and streamline your operations instead of holding onto outdated beliefs that may hurt you in the long run.

It’s time to let go of the myths and embrace the facts. So, go ahead and utilize the efficiency and security that come with recurring payments.