Recurring payments are very attractive to online businesses, not only because they provide a kind of long term stability that other payment models often cannot guarantee, but also because they’re automated.

However, creating a strong payment structure requires more than just a quick setup, after which you relax and leave the system to do the rest of the work.

Instead, you need to find ways to maximize the potential of this model by developing strategies that utilize its capabilities and address its flaws.

To help, we bring you some useful tips for managing recurring payments with ease, which will hopefully lead to a more efficient and successful business.

- Have Transparent Policies

- Support as Many Payment Options as Possible

- Let Your Customers Choose the Billing Frequency

- Keep Security a Top Priority

- Communicate With Your Customers

- Reduce Revenue Leakage With Dunning

- Conclusion

Have Transparent Policies

One of the main benefits of implementing a recurring payments system for businesses is fast and convenient invoice management.

However, if you are not transparent with your payment policies, this system can easily backfire and turn into a logistical nightmare.

The thing is, customers aren’t always careful when subscribing to an online service.

They may misunderstand automated billing and figure they will have to confirm every payment after the first one.

Sometimes, businesses themselves engage in the dubious practice of making the details hard to find.

However, you should be aware that, if your policies are not clearly defined and visible to everyone, you risk dealing with a large volume of support issues.

Think about it.

Firstly, you would get numerous calls and emails from interested customers asking for pricing and payment information they should have been able to easily locate on the site.

Secondly, existing subscribers who feel they were charged unnecessarily will ask for refunds. Issuing them will affect your bottom line.

Conversely, not doing so will negatively impact their opinion of your business, leading to reputational issues.

Research from an online recruitment service provider Zippia found that a staggering 91% of customers refuse to do business with a company that left them unhappy.

And finally, truly disgruntled customers could go directly to your account holder to request chargebacks, hurting your relationship with the bank.

All of these issues add up to wasting plenty of resources on superfluous customer support and communication with the bank, only to end up in a worse standing with both.

Luckily, it is easy to avoid them.

All you have to do is accurately represent the information about your subscription service in a way that is hard for customers to overlook.

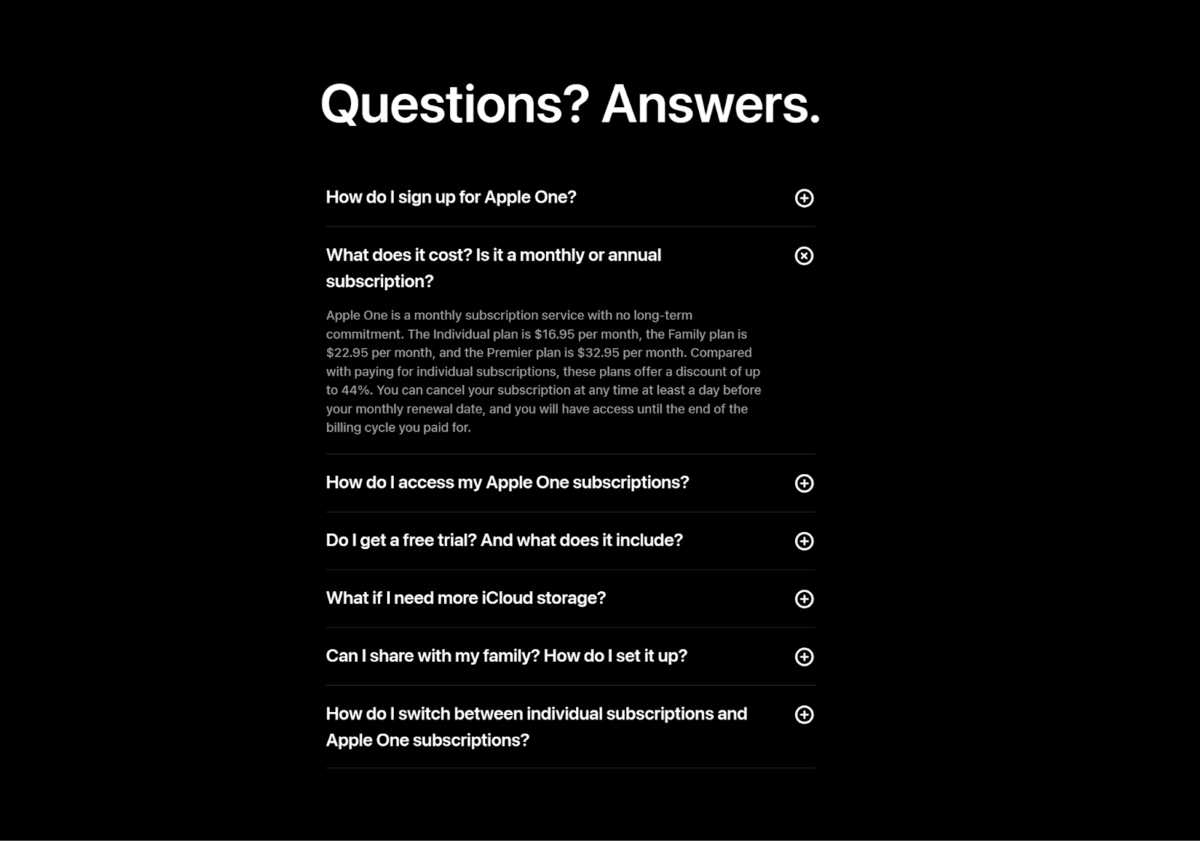

For example, a simple scroll down the short registration page for Apple One reveals this Q&A section:

Source: Apple One

Similarly to this, you need to include payment, cancellation, and refund policies, pricing plans, and terms and conditions for the free trial period.

Ultimately, not only will being fully transparent make for a more satisfied customer, but it will also free up your resources to be invested in other parts of the business.

Support as Many Payment Options as Possible

It is certainly beneficial to be open with your customers, but you also have to be open to their preferences, especially when it comes to offering various payment options.

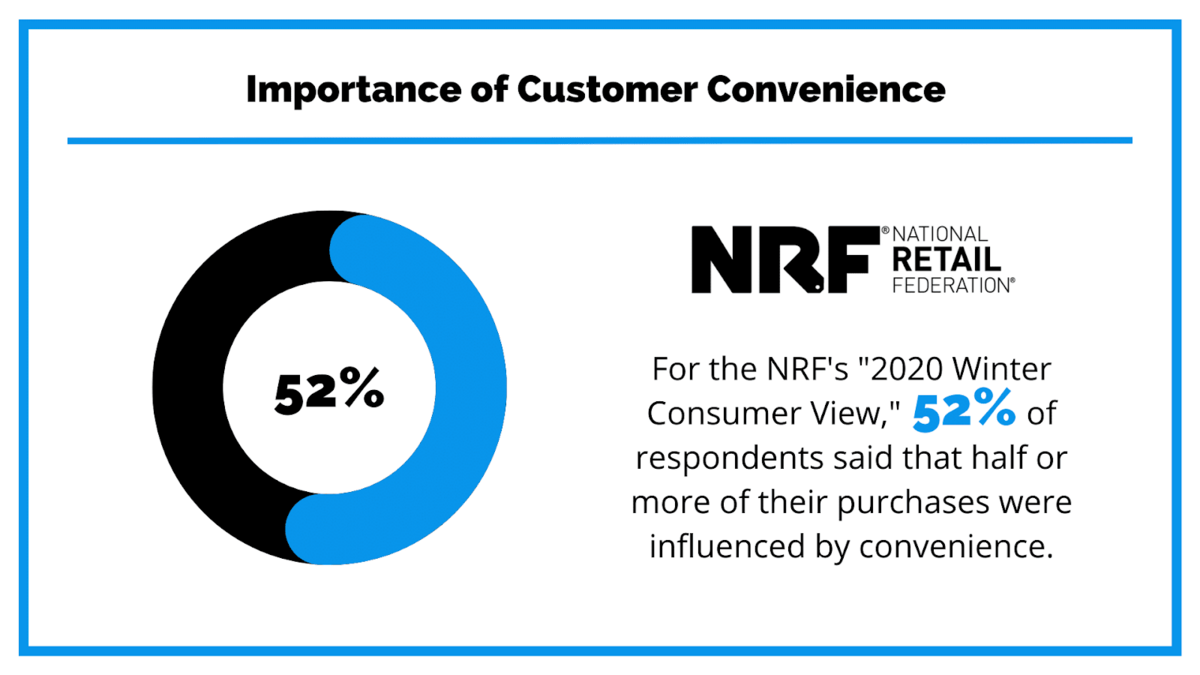

Today, many customers see convenience as a deciding factor when shopping for products online.

In fact, the National Retail Federation, the world’s largest retail trade association, published a report with the following results:

Source: NRF / Illustration: Regpack

Furthermore, 97% of the 3000 people surveyed claimed they backed out of a purchase because it was inconvenient for them.

What does this have to do with payment options?

Well, if you do not support a customer’s preferred mode of payment, that might just be the inconvenience that drives them away.

After all, why should they go through all the trouble setting up a new payment channel to subscribe to just one service?

Especially if your competitor has a similar-quality plan, but does offer the payment method of their choice.

Therefore, you should equip your business with tools to support as many payment options as possible. Classics like credit cards and debit cards go without saying.

However, there are also some modern digital solutions to consider.

For example, in recent years, eChecks are showing significant growth in usage.

A report from Nacha indicates that in 2021 alone, the ACH network processed 72.6 trillion worth of sales, up 8.7% from the preceding year.

A good bet would be to find a payment management platform that has built-in support for the payment types you need.

This will allow you to streamline your payment provider communication, as you will have only one player to deal with.

All in all, with a wide variety of options, your customers will be able to find a payment method best suited to their preferences, making them more likely to buy your product.

Let Your Customers Choose the Billing Frequency

When it comes to convenience, another good idea is to let customers decide on the billing frequency.

There are many payment intervals to choose from, each with its own advantages and drawbacks.

For example, annual billing means less invoice management as you only need to send one invoice per user a year.

However, fewer users will be able to afford to pay such a large installment at once.

On the opposite side, you have super-frequent billing, occurring on a bi-weekly, weekly, or even daily basis. This approach will lead to fewer refunds, as the bills are for much smaller amounts.

However, if your business pays fees per transaction, you could end up with significant losses compared to the longer-period models.

In other words, there is not just one optimal solution.

For that reason, you should offer your customers several pricing options based on their personal preferences and the needs of your business.

Customers will appreciate the flexibility of choosing the plan that is right for them. Consequently, they will have fewer reasons to be dissatisfied with your service.

You can even offer the possibility of setting up a custom payment plan.

Most larger payment providers have an option for modifying payment schedules, it would be a shame not to use them.

Of course, you can incentivize users to subscribe to the plan you find fits best with your management strategies.

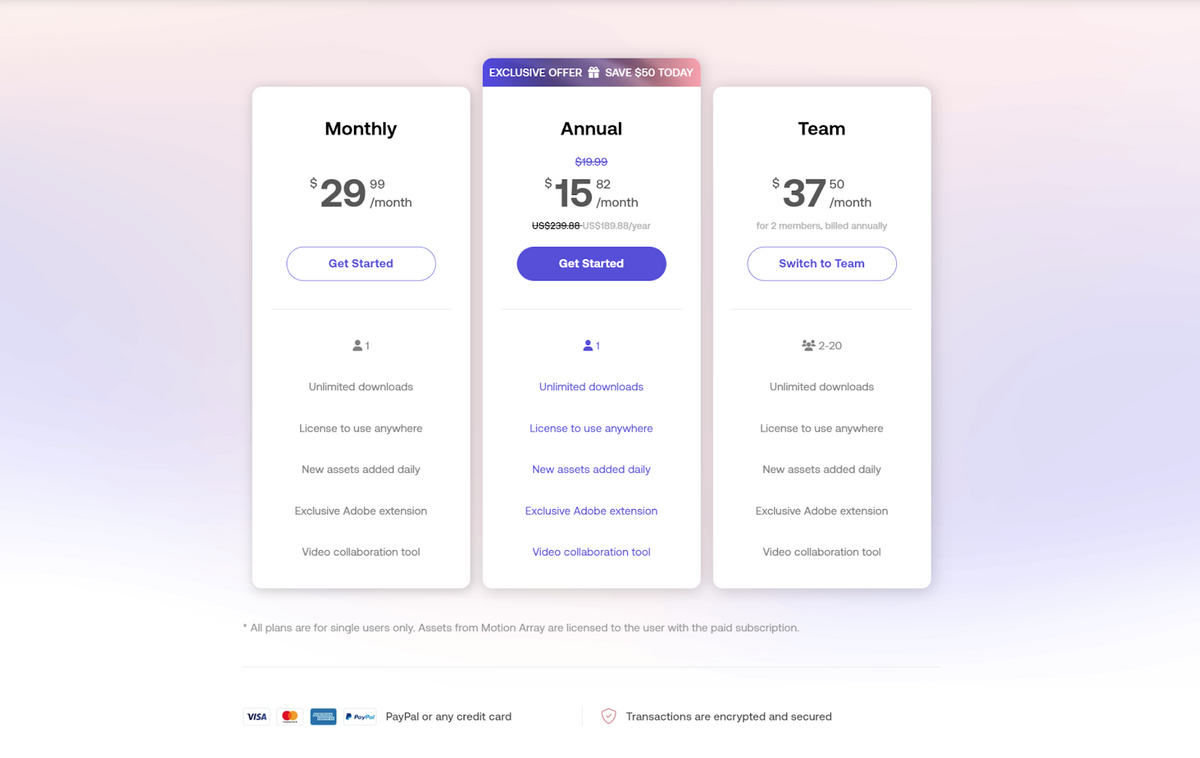

Discounts and special offers can often point customers in the direction you want them to go in. For example, take a look at Motion Array’s subscription plans:

Source: Motion Array

In addition to having a reduced price for an annual subscription, they have an exclusive offer that makes it 50% more affordable than paying month by month.

Even customers used to paying on a monthly basis could see this as too good of an opportunity to miss out on, ultimately opting for the annual plan instead.

To sum up, offering multiple pricing plans will give the customers the convenience they have come to expect from online vendors, while also allowing enough control over the outcomes.

Keep Security a Top Priority

Running a subscription service puts you in charge of a great deal of sensitive customer information.

Therefore, it’s your responsibility to protect it by setting up proper security measures.

Threats stemming from cyber attacks are on the rise, and online businesses are the primary target.

There are too many types of attacks to cover each one here, but generally, their objective is to recover valuable user data for financial gains.

And do not think you are invulnerable to an attack.

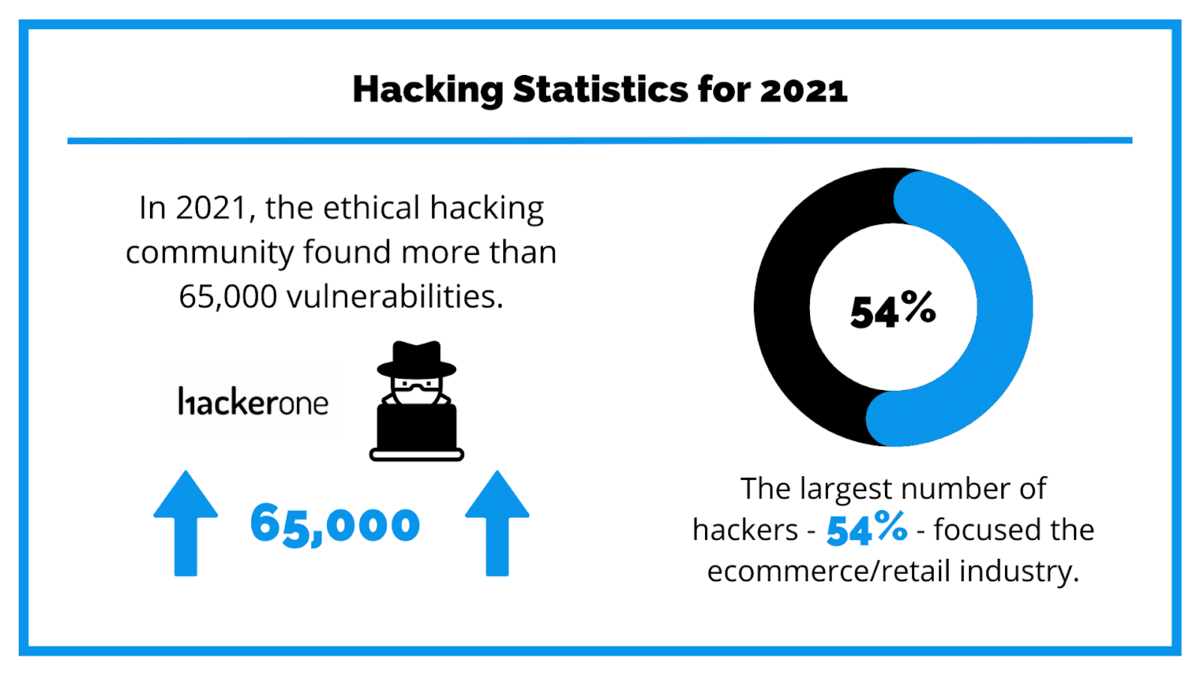

The cybersecurity company HackerOne does an annual survey of ethical hackers to get their view on the cybersecurity landscape, and here are some of the latest findings:

Source: HackerOne / Illustration: Regpack

If you take these numbers lightly, you might find yourself on the losing side of a cyberattack.

Having valuable personal data from your users stolen will result in a bleeding subscriber count and a damaged reputation.

On top of that, you are probably going to have to pay fines, causing substantial financial losses to your business.

To elaborate, according to IBM’s report, an average cost of a data breach amounts to $4.35 million dollars.

Luckily for you, it costs considerably less to invest in proper security measures. You just need to pay attention to your payment provider having the proper features for your business.

For example, you should invest in a recurring payment platform that is PCI-compliant.

That is the minimum requirement to work with card companies and carries hefty fines if you fail to comply. Additionally, you should also ensure user data is encrypted.

This provides an extra layer of protection that will keep your subscriber information safe even in case of a leakage.

Ultimately, the quality of security can make a huge difference when it comes to your reputation and financial standing, which makes it a vital component of your management strategy.

Communicate With Your Customers

We’ve already mentioned the importance of being upfront with those interested in purchasing your product.

Well, that same transparency should be extended for the duration of their subscription.

After all, you want to avoid catching users off-guard with information that directly affects their wallets. Subscription pricing plans are bound to change, especially if you are just starting out.

Bear in mind, you will probably have to repeatedly test your prices against the market to find the optimal one.

However, that is part and parcel of running a subscription service. Therefore, do not be afraid to inform your customers of the developments, even if they go against what they would want.

Obviously, anyone can share good news, such as a price drop.

A bigger challenge, and one you will have to face, is notifying users of less welcome changes.

Yes, your subscribers probably won’t like the idea of paying more for a service they already use.

On the other hand, sometimes raising prices is inevitable, and if you do so without notice, you could be faced with cancellations, refunds, and general dissatisfaction with the service.

In the fifth edition of their State of the Connected Customer report, Salesforce found that:

Source: Salesforce/Illustration: Regpacks

Not only that, but the same percentage of customers agreed that the experience a company provides is as important as their product or services.

With that in mind, all you need is a system in place to inform users about changes in an honest and timely manner, and they will probably stick with you in a time of crisis.

As for the method, emails are easy to use and they’re still considered a trusted channel of communication for maintaining close business-customer relationships.

All in all, clear and consistent communication will not only help you avoid payment issues from frustrated customers, but it will also increase their trust in your business, prompting them to stay with you for longer.

Reduce Revenue Leakage With Dunning

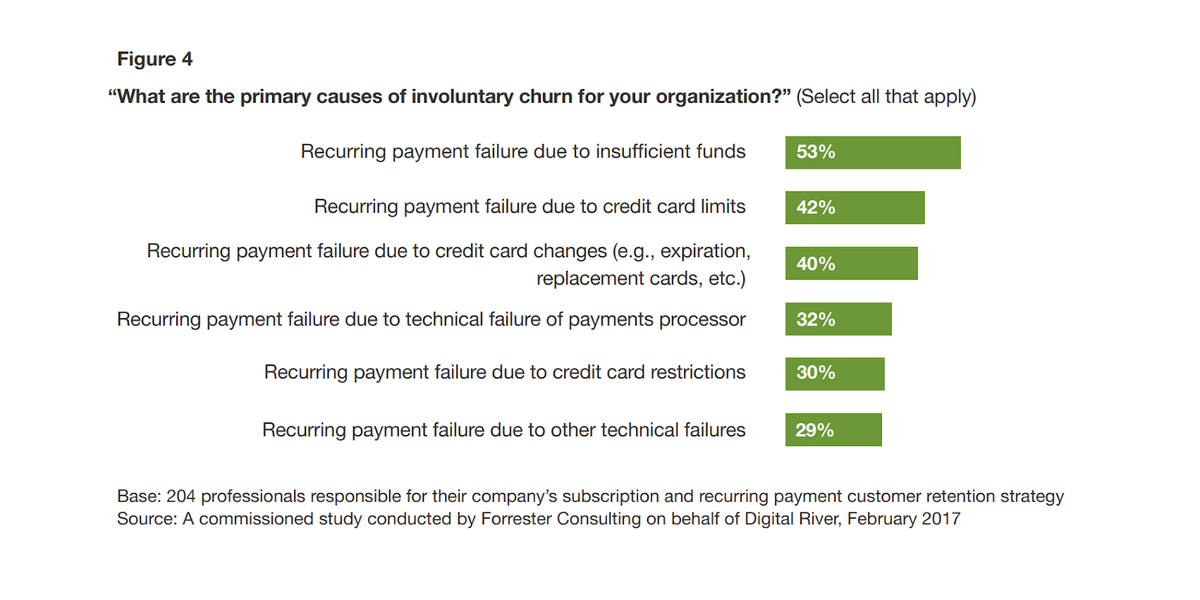

If you read anything about recurring payments, you will know that the most prominent side effect of recurring payments is involuntary churn.

Basically, this happens when a user wants to continue their subscription, but is prevented from doing so due to payment failure issues.

Here are some common examples of involuntary churn causes:

Source: Digital River

To successfully prevent and resolve most of these problems, you should use dunning.

Dunning is a communication-based approach to involuntary churn management. The proactive part of it includes sending out payment reminder emails, as well as card expiration emails.

Making users aware of upcoming billing or card expiration dates will allow them to update the payment information on time to avoid failures.

Therefore, you will have fewer interruptions in service.

But what should you do in cases of payments that have already failed?

In short, set a policy for how many days the customer has to update their payment information. Of course, it should be enough time to give them a fair opportunity to correct the mistake.

On the other hand, you don’t want to get swindled by customers exploiting your goodwill, so be careful not to overextend your patience.

For a more streamlined system, you can also decide on the number and tone of any emails you want to send in the grace period.

Whatever your ultimate strategy, a subscription management platform with email capabilities like Regpack could go a long way in helping you make the best of it.

Regpack offers a user-friendly database of users that is directly linked to their email platform.

You can effortlessly send emails to users automatically or manually, as well as filter the users you want to send them to.

Another useful feature is using triggers to send emails. What this allows you to do is define conditions that, when met, result in sending an automatic email to users.

Some examples of triggers are an approved transaction, an upcoming billing date, or a failed payment.

This way, you will minimize the need for human involvement, improving your business’s workflow.

In conclusion, you can use dunning to manage failed payments more effectively, resulting in less involuntary churn and more satisfied customers.

Conclusion

To implement recurring payments into your subscription business, you need to be aware of the effect it can have on customers, as well as on your management efforts.

The six tips outlined in this article can assist you to enhance the benefits and reduce the disadvantages of the recurring payment model.

That way, you guarantee the best possible outcome for your business.