Let’s say you’re trying to complete an online purchase.

You use your phone but can’t complete the order, so you switch to a desktop. But, the website asks you to create an account.

You don’t see any security badges in the payment section, and you get redirected to an external payment portal.

You get charged once you enter your payment information, but there is no order confirmation.

Would you shop here again? If you wouldn’t, assume the same of your readers.

The good news is that you can avoid any of these issues with the right payment features.

Let’s look into the seven must-have online payment options for your business!

- Multiple User Login Options

- PCI Compliance

- SSL Certificate

- Integrated Payment Processors

- Security Seals

- Mobile Payments

- Payment Confirmation Messages

- Conclusion

Multiple User Login Options

Give your customers different options for signing in to your website.

You might want your users to have accounts to make marketing easier or ensure your customers get all the necessary notifications.

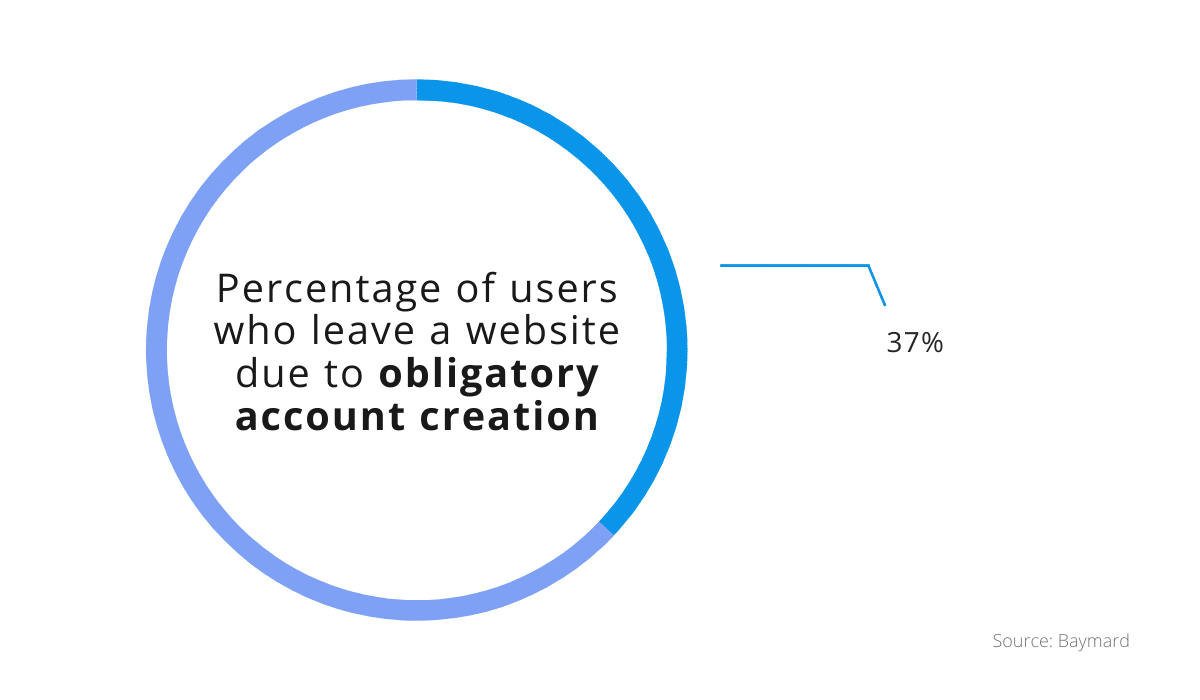

But if customers are forced to create an account to shop on your website, they might give up on the product.

After all, Baymard’s research found that 37% of customers abandon their cart when asked to create an account to place an order.

Source: RegPack

Customers find account creation a hassle and think it’s an obstacle to order placement.

Instead of forcing them to create accounts to place orders, offer your customers this option after they pay for their orders.

According to the same study, 38% of businesses do not provide this step, meaning they miss out on possible future revenue.

Customers are more likely to create an account after making a purchase, especially if offered benefits like order tracking, updates, and simplified returns.

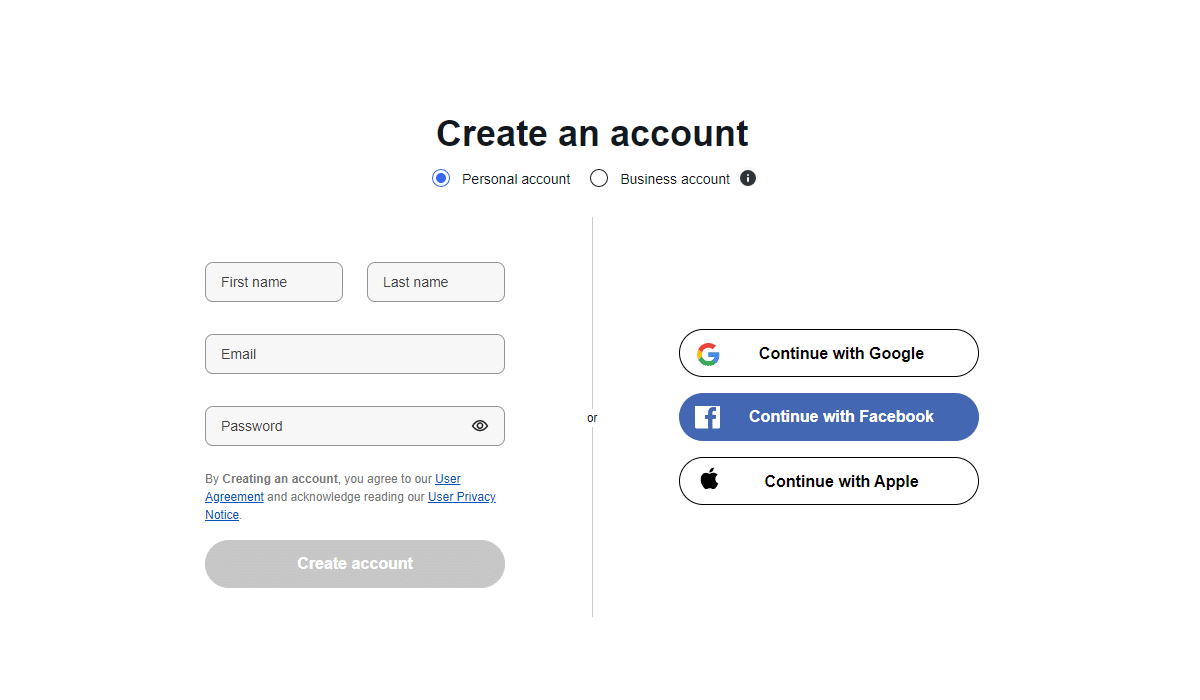

If account creation is required, make the process easier by allowing users to log in using a social media account such as Twitter or Facebook.

Take note of the greats! The e-commerce giant eBay lets users sign up with their first and last name and email address,

Source: eBay

Additionally, users can log in using Google, Facebook, or Apple. Therefore, new eBay users have four easy options to choose from when signing up.

It takes customers mere seconds to check in using social media, making the option faster than entering personal information on your website.

Your users will be more likely to sign up with their social media accounts if you stress that you will not misuse the data they’re entrusting you with, so don’t fail to do that.

Ensure that your checkout process offers more than one login option since the lack of choice deters customers.

PCI Compliance

If you want to legally accept payments and be a trusted vendor, you’ll need to comply with the Payment Card Industry (PCI) Compliance.

The PCI Security Standards Council has issued various Data Security Standards (DSS) obligatory for vendors who accept card payments.

These guidelines protect cardholder payment information across the world.

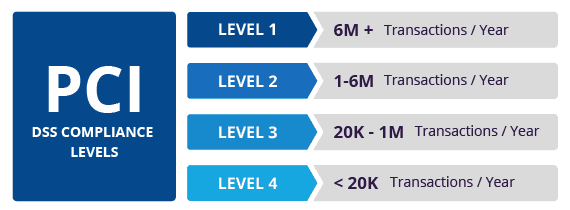

To understand what DSS you have to comply with, figure out your company’s compliance level using the number of yearly transactions.

Anything under 20,000 transactions a year puts you at the fourth compliance level.

Source: Fortytwo Security

If you fall between 20,000 and a million card transactions, you’re in level three.

Companies with one to six million transactions a year have level two compliance, and every company with more than six million transactions has to comply with level one requirements.

What do these levels mean, though? The higher the level, the tighter the security has to be.

Levels two to four have to fill out a Self-Assessment Questionnaire (SAQ).

Those with level one compliance also have to hire a security assessor for a yearly report on security because of the high number of processed payments.

Regardless of the compliance level, every vendor that accepts card payments must meet the basic twelve PCI requirements. These include:

- Installing and maintaining a firewall

- Not using default passwords and security parameters

- Keeping the stored payment data secure

- Encrypting the same data across public networks

- Using anti-virus software

- Giving everyone with access to payment data a unique ID

- Restricting access to stored payment data

If your company meets all twelve requirements, you will be found PCI compliant and therefore considered capable of protecting the stored payment data.

All businesses that accept card payments need to be PCI compliant in this date and age. Otherwise, their weak security poses a risk to the company and the customers.

SSL Certificate

If you want to accept payments online while keeping the payment data safe, you’ll need an SSL certificate.

The encryption technology that safeguards the buyer’s personal information, including payment details, is known as a Secure Socket Layer (SSL) certificate.

Whatever information clients share with the site is safely encrypted thanks to this certificate.

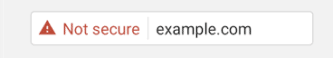

Without this security layer, you can’t expect customers to trust you enough to provide you with their payment information.

If your consumers use Google Chrome, for example, the browser will warn them that your site isn’t safe.

Would you buy something from a website that looks like this on your phone or tablet?

Source: Goodman Creatives

Because of the “not secure” label, every visitor is aware that it is unsafe to enter personal information on the website.

Customers can quickly check if your site is secure even if their browser doesn’t alert them. All they have to do is look at the URL.

Protected websites use https:// in their URL, while those without an SSL certificate use http://.

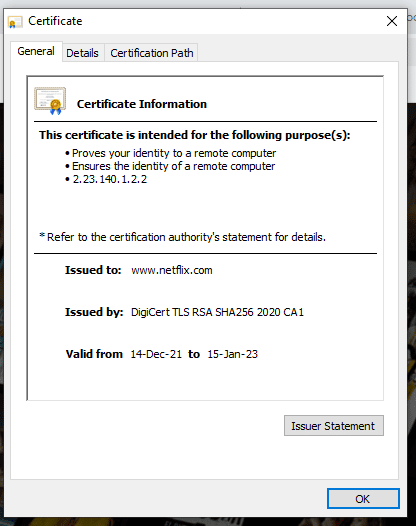

For example, a glance at Netflix’s URL will show you the site is secure, as will clicking on the lock icon to check security details.

Source: Netflix

Those who want to learn more about the website’s certificate can click on the security information, and the credentials will appear in a pop-up window.

Source: Netflix

The SSL certificate information lists its purpose, the entity it was issued to, the issuer, and the validity date.

If you get a security certificate for your website, your customers will be able to check these details and make sure your website is a safe place to enter their private data and shop.

In short, if you want your consumers to trust you with their personal information, you need an SSL certificate.

Integrated Payment Processors

Use an integrated payment processor to increase payments on your website.

When you take the time to integrate a payment processor, you can rest assured that it will work seamlessly with all of your other systems.

Some companies use outside payment gateways, like PayPal.

However, such gateways usually redirect customers to their website, which means users have to leave your website to pay you.

This type of redirecting might raise suspicions about payment security. If you have a high volume of orders, it will be easier to have an integrated payment processor instead.

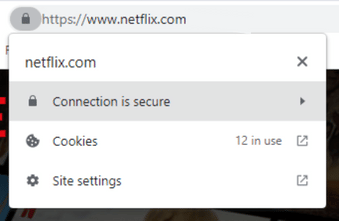

When you offer the option to use a variety of payment methods on your website, your customers can shop and pay without leaving the site.

They will give out their personal information to you through your website and not an outside party.

Source: Regpack

Besides, you can make changes to the look and feel of your payment processor.

If you want it to have the same theme, fonts, and options as the rest of your website, you can easily do that, ensuring uniformity across all website pages.

Software like Regpack allows you to create and customize a payment portal on your website in just a couple of steps.

You can offer features like automated billing if you want to charge customers automatically every month and even customize payment plans.

An integrated payment processor will help you accept payments directly on your website.

Security Seals

Security seals are a fantastic way to reassure your customers their payment information is safe on your website.

If you don’t manage to convince users of data security by the time they go into checkout, 18% will abandon their cart without placing an order.

Therefore, you could be losing almost a fifth of potential business without a security seal.

Websites with security or trust seals are considered safe by the seal issuer.

These sites typically run daily virus checks and weekly scans to stay aware of all security issues. In other words, sites with trust seals put effort into payment security.

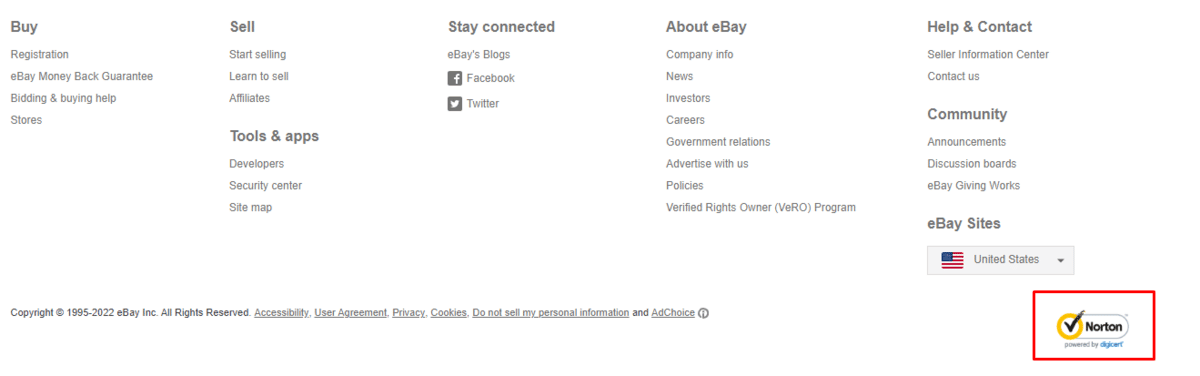

Some companies, like eBay, display the seal in their website’s footer.

Source: eBay

The Norton security seal will be visible in the lower right corner of any eBay page you visit, reminding you of how safe the site is.

When you get your security seal, consider showing it on all pages.

Some businesses focus their efforts on the checkout section and display the security seals there. The customers who are about to pay see the seal that guarantees protection.

Neither one of these options is wrong—it’s just a matter of what works best for your business needs.

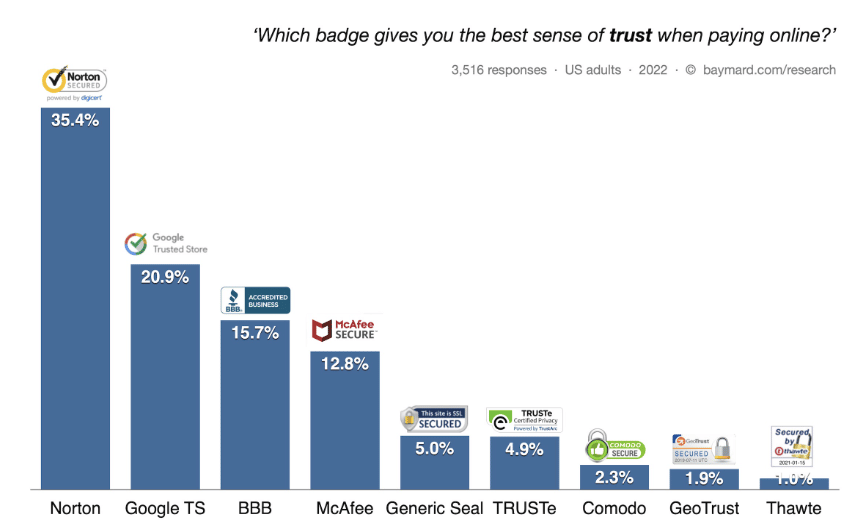

According to Baymard, SSL seals, like Norton, are the ones most trusted by customers.

Source: Baymard

Therefore, getting one of the more trusted SSL seals could do wonders for your business and help convince your customers their payment information is safe when they shop on your site.

Whatever security seal you choose, make sure it is noticeable on your website, as this increases your chances of attracting customers.

Mobile Payments

Any business that accepts payments should have mobile-friendly checkouts. Otherwise, they’ll lose out on business.

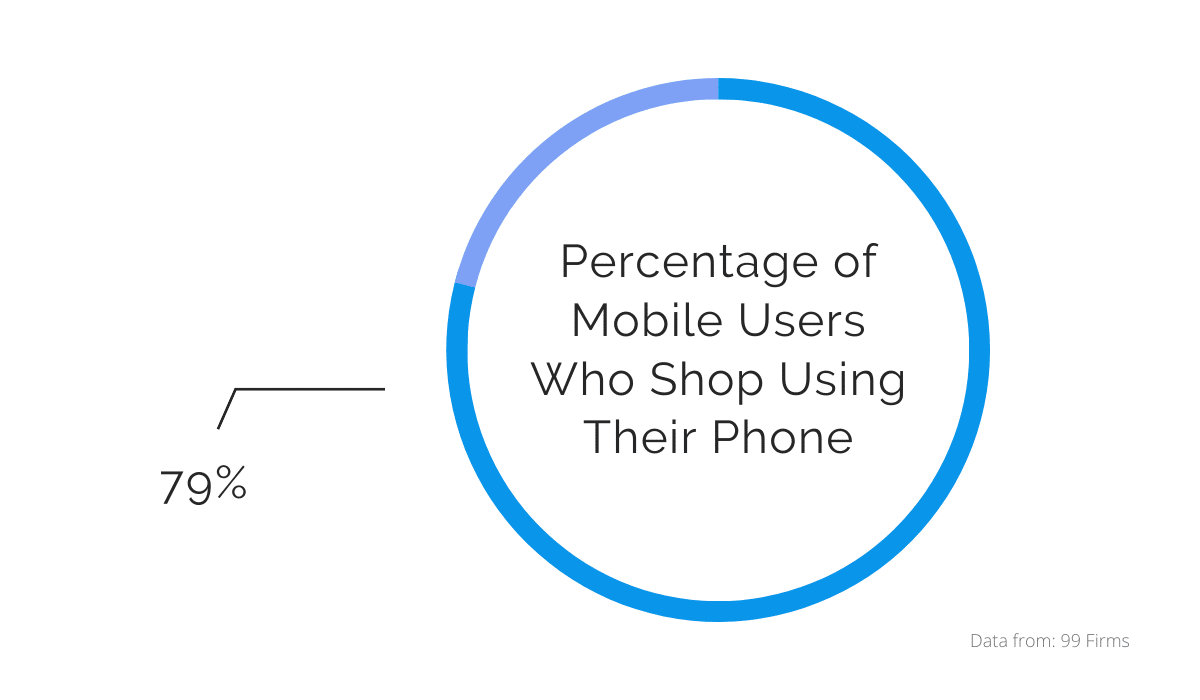

Statistics show that people no longer shop only on their desktops. In fact, 79% of mobile phone users use their phones to shop.

Source: Regpack

Since people clearly enjoy and practice mobile shopping, most businesses allow it through a browser or an app.

The companies optimize the mobile checkout so anyone can access it through their phone.

If your business is trying to expand and target more customers, make your checkout and payment section accessible to mobile users.

Why miss out on all those customers who are used to mobile shopping?

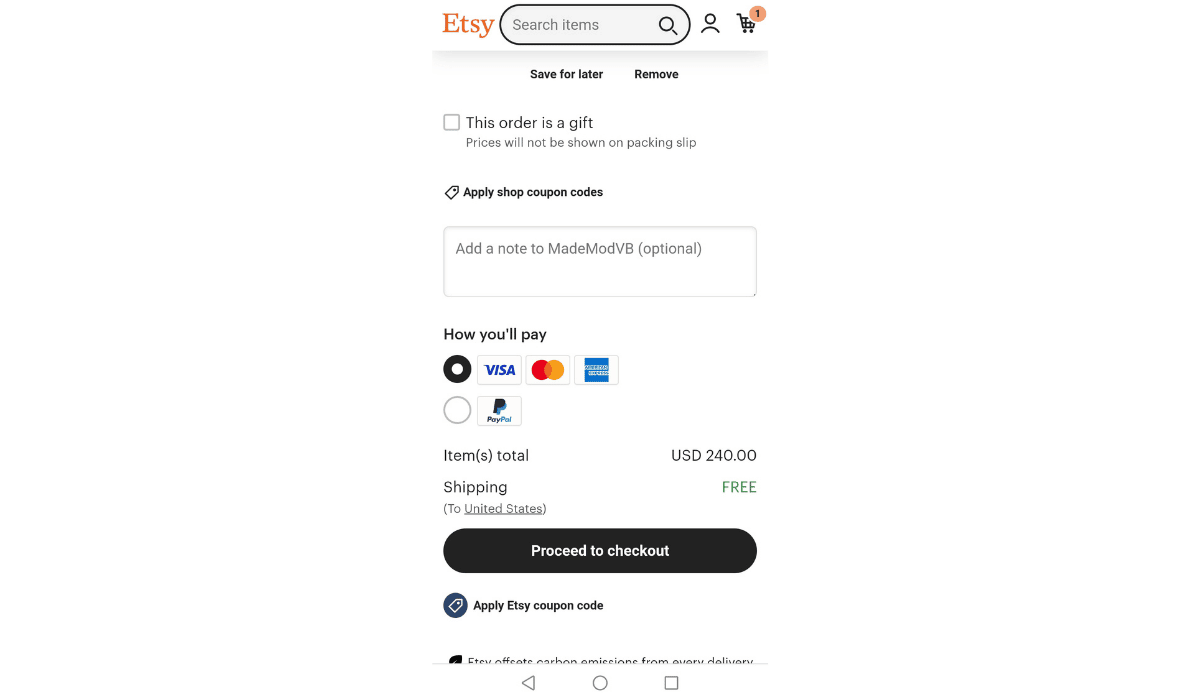

Sites like Etsy make it very easy for customers to add items to the cart and proceed to checkout.

You can shop on Etsy without creating an account, which saves time for users, and you can pay with different cards, or using PayPal.

Source: Etsy

Note that if you offer a mobile app, you’ll have to have additional functions to provide in-app payments.

But, if that is something your customers would use, it will be the right move for your payments.

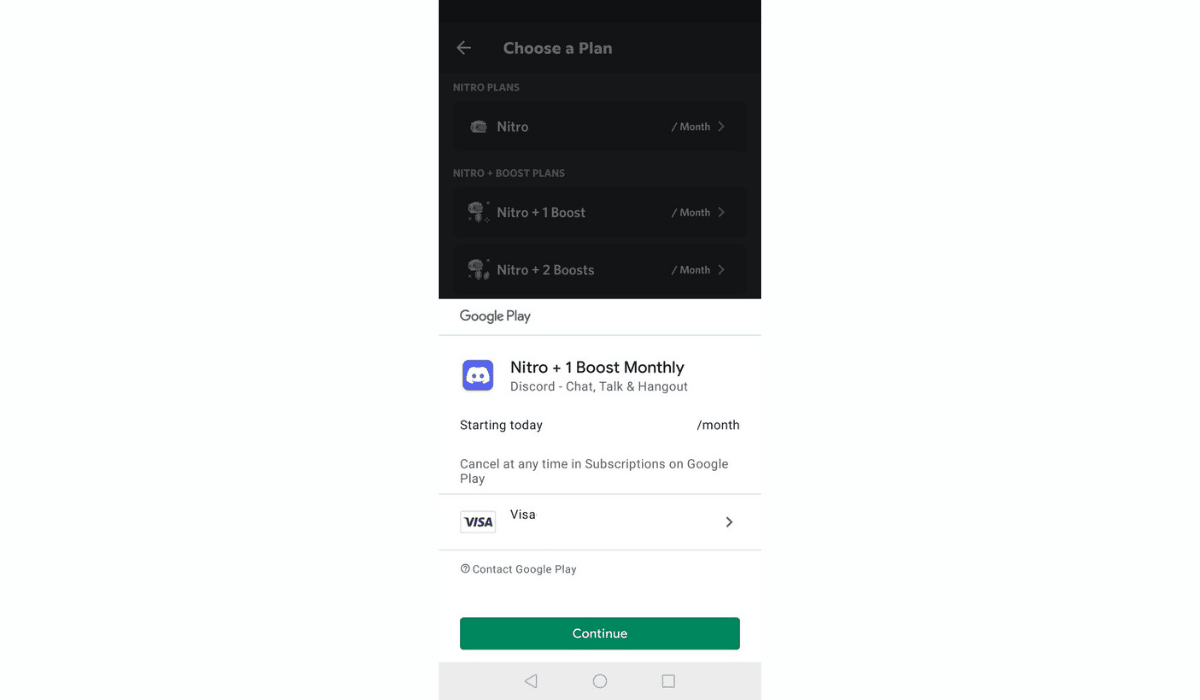

For example, if Discord users want to purchase a Nitro subscription, they need to choose a payment plan (prices removed in the picture).

Source: Discord

Since the mobile app enables in-app purchases, a pop-up window will appear, showing the customer what they have chosen to buy and offering available payment options, in this case, a VISA card.

However, users can click on the payment option and change it to something else the app allows.

Therefore, if you opt to enable in-app purchases, you’ll have to tweak the application to accept different types of payments.

Businesses that understand the value of mobile payments invest in them and simplify the process for customers. Is this something your company can do?

Payment Confirmation Messages

Imagine this: you visit a website for the first time, look around, and see something you like. The site makes it easy for you to enter your payment information and pay on the spot.

But, you don’t get a payment confirmation even though you’ve been charged.

What would your reaction be? You’d most likely be irritated or inconvenienced.

In a day and age when it’s so simple to include payment confirmation messages on your site, that would be entirely understandable.

Businesses should always inform customers of their order status, including payment receipt and processing.

Informing customers is crucial since it assures them you have received their payment and are working on their order.

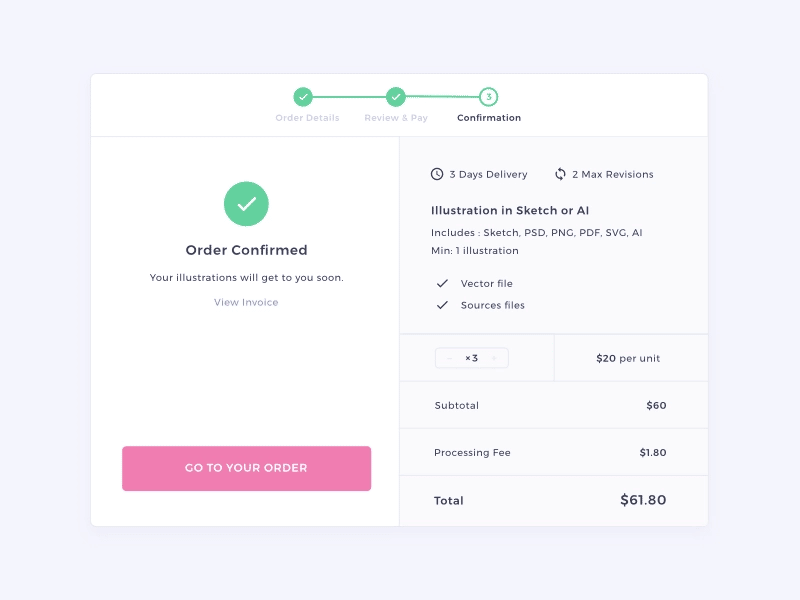

Here’s a sleek example of an order confirmation screen to give you a better idea of what it can look like.

Source: Dribbble

The site informs the customer their payment has been processed, and the order confirmed. Using the green checkmark is a fantastic way to draw attention.

Right under the confirmation, the customer gets a link to their invoice.

Most companies nowadays send payment confirmation emails as well. Software like Regpack performs this activity automatically.

Regpack fills a template with customer details and order information and sends it to customers, confirming their purchase.

If you’re interested in creating your confirmation emails, check out these templates you can modify to suit your business needs.

If you accept payments on your website, you’ll need to invest in payment confirmations.

These confirmations are the best way to ensure customers their payment was received and processed correctly.

Conclusion

Let’s go back to our initial scenario.

As customers, we ran into various problems, including the inability to pay with our phones, being forced to create an account, being redirected to a payment gateway, and not getting a payment confirmation.

With simple modifications and non-costly investments like Regpack software, you can avoid problems that deter your customers from shopping on your website.