Today, most service-based and e-commerce companies wouldn’t be able to function efficiently without an automated billing system.

Simply put, as their business grows, without such a system, their billing and payment operations would either become too complex and expensive to run manually or crumble under rising pressure, leading to billing errors, late payments, and dissatisfied customers.

Conversely—as we’ll see—proper understanding, selection, and implementation of an automated billing system can help streamline billing processes without adding staff and extra resources while improving the overall customer experience.

To help you with that, we’ll explore the following fundamentals.

- What Is an Automated Billing System

- Why Should You Use an Automated Billing System

- How Does an Automated Billing System Work

- How to Choose the Right Automated Billing System

- How to Set up an Automated Billing System

- Conclusion

What Is an Automated Billing System

An automated billing system is a software solution designed to replace many routine billing and payment processing tasks that would otherwise be done manually with more automated workflows.

In other words, such software aims to minimize manual data entry and/or reduce the time needed to complete tasks such as:

- creating and sending invoices

- processing payments, tracking and recording transactions

- invoicing and charging subscription and recurring payments

- providing custom pricing options, payment plans, and multiple payment methods

- generating sales and payment reports

- transferring data to other software systems

Given the above, an automated billing system digitizes many functions typically not covered by other software solutions businesses use, such as accounting, project management (PM), or email marketing.

Source: Regpack

Simply put, all of the above-listed processes (and many more) would—without automated billing software—have to be handled by different software tools and other methods, leading to more errors, less productive staff, and potential regulatory non-compliance.

Moreover, integrating those processes to boost efficiency and gain actionable business insights would be much more complex, error-prone, and time-consuming without billing automation.

For example, a company may have to manually follow up with customers who are late on payments or may have to pay higher payment processing fees.

Of course, these issues can be handled, and costs tolerated when your business is just starting.

But as the number of your customers—particularly your subscribers or regularly invoiced clients—grows, these inefficiencies, increased risk of error, and higher costs can negatively affect your business’s productivity and bottom line.

To sum up, an automated billing software system enables your business to digitize, automate, and improve your billing and payment processes, minimizing repetitive manual tasks and facilitating data accuracy, exchange, and analysis.

Why Should You Use an Automated Billing System

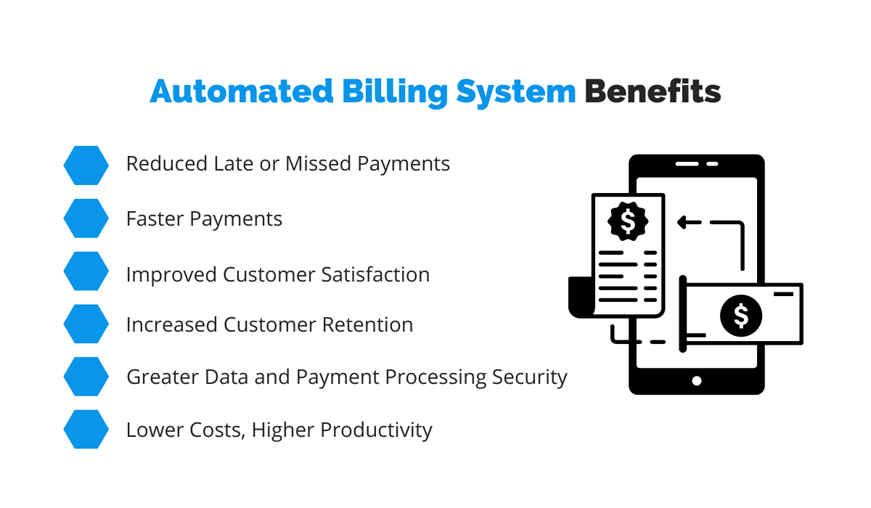

The range of benefits generated by an automated billing system could be discussed at length and take up most of this article, but they can be boiled down to more time for your employees and fewer problems with payments.

For example, since such systems will automatically send invoices, collect payments, and remind customers that their payment is upcoming or late, the time your staff spends on such administrative tasks will be greatly reduced.

Another direct benefit is that automatically generated invoices are more accurate and can be automated to be sent out on a specific date (or period, e.g., every month).

Here are just some of the main benefits of using an automated billing system:

Source: Regpack

For instance, the fact that invoices will be error-free and always sent on time contributes to faster payments, with fewer customers being late or missing their payments.

Likewise, the ability of your customers to choose their payment plan (lump sum, installments, etc.) and their preferred payment method (credit or debit card, other electronic payment options) will improve their satisfaction and help you retain them in the long run.

Furthermore, since sensitive data and payment processing tasks are automated and encrypted, there’s much less chance of data breaches and fraud.

For example, automated billing software acts like a secure, regulation-compliant bridge between your website and payment gateways your customers will use to pay for services/products.

Of course, all these advantages ultimately turn into reduced costs, increased productivity, and strengthened cash flow.

To summarize, there are plenty of reasons to use an automated billing system to benefit your customers and employees alike, from less delinquent payments to more accurate and secure data processing.

How Does an Automated Billing System Work

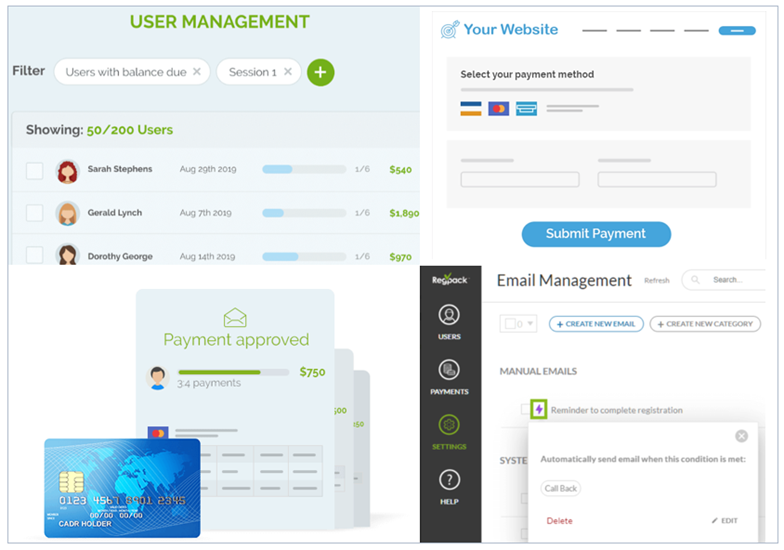

To best illustrate how an automated billing system works, we’ll view it from a customer’s perspective and describe the process from start to finish.

So, when a customer visits your website and decides to purchase a product or sign up for a service, your automated billing system will ask them to enter their payment information into an online payment form (preferably accessible directly on your website).

After they enter the info (e.g., credit card number and/or other relevant data) and click the “buy” button (however it’s phrased on your website), your automated billing system will encrypt and securely send that info for verification to relevant financial institutions.

Source: Creative Fabrica

If everything is okay (the info is accurate and the funds are available), the billing system will be notified, generate a digital invoice, and send it to your customer via email.

The customer can then review the invoice and choose to pay it online through a secure payment gateway integrated with the billing system.

Once the payment is received, the system automatically records the transaction and updates the customer’s billing information.

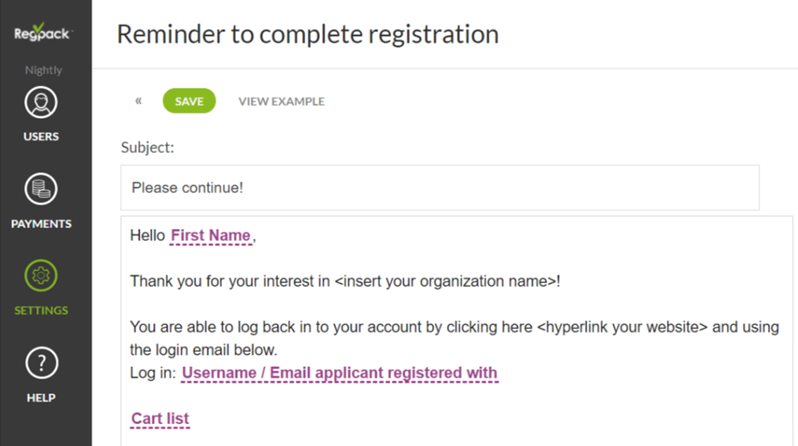

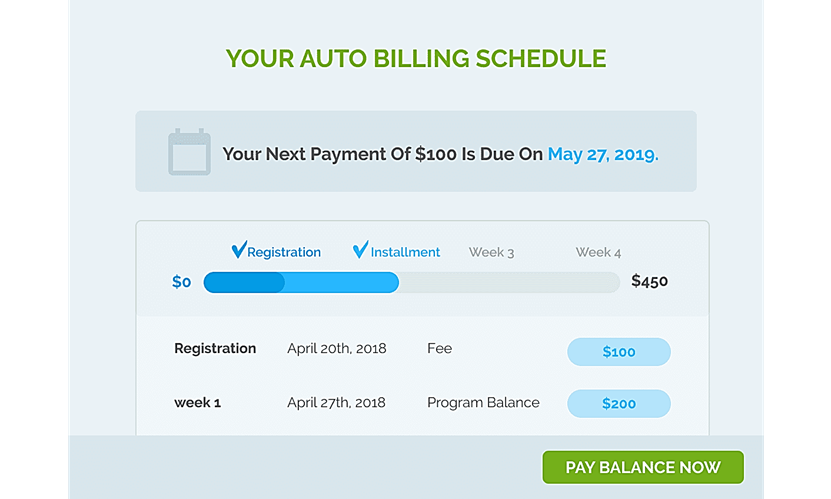

Typically, your automated billing software will also allow you to set up automated invoices (e.g., invoices sent monthly for recurring orders), payment confirmation emails, upcoming and past-due payment alerts, or reminders to complete their registration.

Source: Regpack

Naturally, such automatically sent emails help your business save time, reduce billing errors, improve accuracy and reliability, and enhance the customer experience.

Moreover, most automated billing systems will also provide customers with their own payment portal where they can track invoices and payment due dates and use this self-service feature to pay their outstanding invoices.

Finally, on the business side, your billing system will save a copy of every sent invoice and record every paid invoice in the central database (i.e., the sales ledger).

Overall, an automated billing system integrates multiple internal functions and external payment stakeholders (banks, credit card companies, etc.) to provide your business with end-to-end invoice management and secure payment processing.

How to Choose the Right Automated Billing System

Now that we know what an automated billing system is, what it can do for your business, and how it works, it’s time to explore what features it should have and which ones best suit your needs.

In other words, before you start looking for the right automated billing system, ensure you and your team consider the specific needs of your business and determine the available budget.

After that, you should look not only for software solutions that have the required features (which will likely be provided by many, if not all, solutions) but also consider how user-friendly and practical they are.

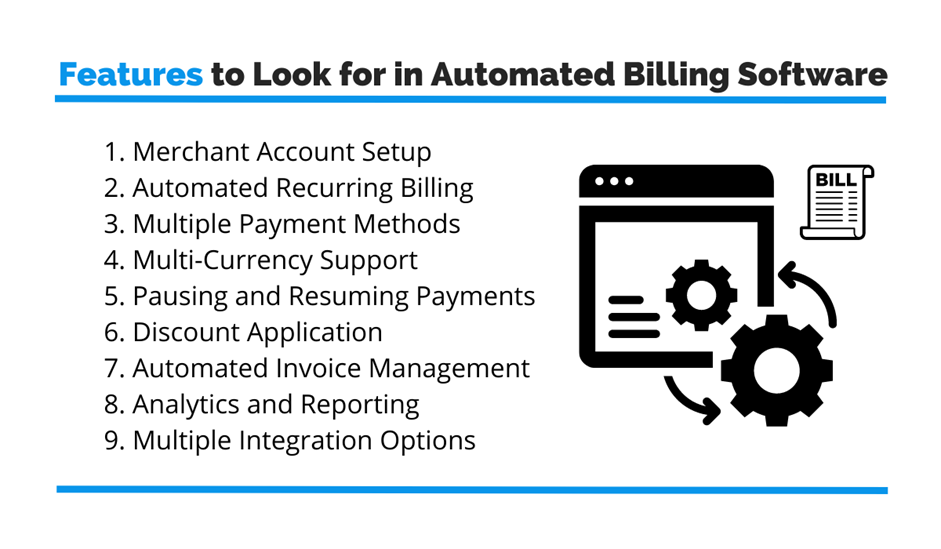

Here’s a list of key features your automated billing system should have:

Source: Regpack

Since some of the above features, like multiple payment methods and multi-currency support, are self-explanatory, we’ll touch upon only a few that might need an explanation.

On top of our list is whether your software provides an option to set up a merchant account with the help of your software provider.

Without going into details, a merchant account enables your business to accept and process various types of online payments, from credit and debit cards to e-checks and digital wallets.

In essence, this feature enables you to avoid the often substantial payment processing fees charged by third-party payment processors like PayPal or Stripe and run the entire checkout process directly on your website.

Source: Regpack

As for the automated recurring billing feature, it helps your business streamline repetitive billing tasks associated with customers who are subscribed to your services/products or are paying in installments.

Other must-have features include pausing/resuming recurring payments at the customer’s request, applying all kinds of discounts, and managing invoices and other automated email notifications we mentioned.

Furthermore, your system should enable you to filter and analyze the data it collects and generate custom reports, which helps your business make data-based decisions.

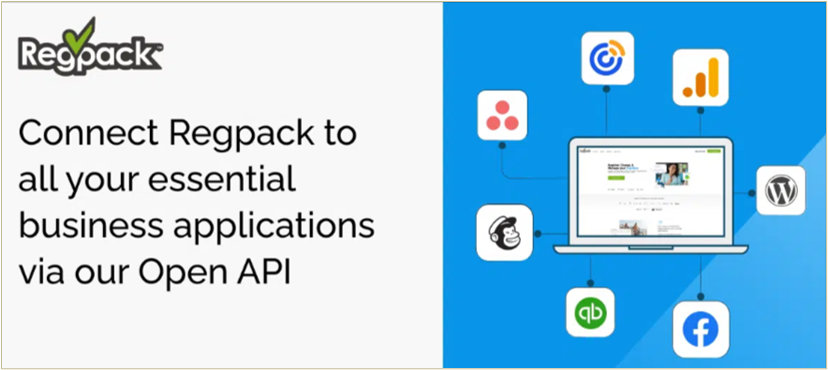

Finally, such a system should provide multiple integration options that allow you to connect it with other software solutions your business uses, such as accounting software.

Source: Regpack

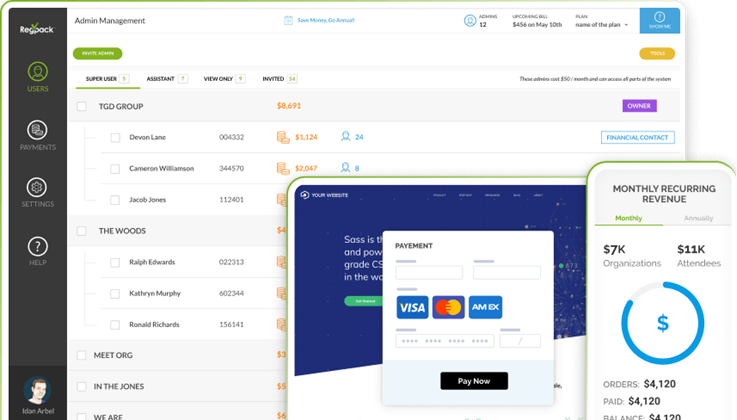

Having covered the vital features of your automated billing software, it’s time to provide an example of a solution that has all the above-listed features and more—Regpack.

In a nutshell, Regpack aims to streamline all your customer registration, billing, and payment processing operations within a single cloud platform.

In other words, it allows your business to set up different payment plans, offer multiple payment methods, and configure many other parameters like upgrading or downgrading a customer’s subscription or allowing them to unsubscribe.

Source: Regpack

Of course, when looking for the best automated billing software for your business, you’ll encounter many solutions more or less similar to Regpack, and we invite you to weigh their pros and cons before deciding.

All in all, choosing the right automated billing system will involve identifying your company’s needs and budget, determining whether it has the essential features you need, and comparing short-listed candidates in terms of how user-friendly and affordable they are.

How to Set up an Automated Billing System

Once you’ve selected the right automated billing system for your business, you’ll need to set it up to automate your billing process.

Suffice it to say, those companies that successfully transition to automated billing can, according to Business Insider, expect to lower their invoice processing costs by as much as 81% and increase the invoice processing speed by up to 73%.

So, let’s look at the steps needed to establish an automated billing system, the first of which—choosing the software solution—we have already covered.

After that, you should set up electronic invoicing, i.e., the transition from manual-based billing processes to automatically creating and delivering digital invoices to your clients, along with scheduling automatic payment reminders and other notifications.

Then—if your billing system provides this feature—it’s a good idea to launch a customer payment portal like the one shown here.

Source: Regpack

Long story short, such payment portals provide customers with greater convenience, increased visibility into their billing info and history, improved payment security, and enhanced control over their accounts.

The last step is to set up your reporting parameters, which will allow you to monitor your business’s relevant key performance indicators (KPIs) and analyze different aspects of customer and payment data.

In summary, you can set up an automated billing system by following these steps and, once the system parameters are set, use automated billing and payment processes to notify other software programs.

At the same time, you’ll provide your customers with the most convenient way to manage their payments (i.e., a self-service portal) without them needing to contact your customer support.

Conclusion

So, we first explained what an automated billing system is, how it works, and what benefits it provides for your business.

Then we moved to more hands-on sections where we discussed how to choose the right billing system and how to set it up.

Having taken this tour with us, we hope this article helps you select and implement the best automated billing software system for your business and reap the benefits like improved customer experience, faster payments, and enhanced cash flow.