Whether you’re starting a business or are already running it, chances are you’ll have repeat customers or subscribers who need to be billed on a recurring basis.

If that’s the case, using recurring billing software to automate your billing and payment processes is crucial for strengthening your cash flow, saving staff time, reducing billing errors, and improving customer experience.

Of course, when trying to find the right recurring billing software for your business, you’ll be faced with an overwhelming abundance of choices, options, and features.

In this article, we’ll walk you through nine key features you should look for in recurring billing software.

- Merchant Account Setup

- Automated Recurring Billing

- Multiple Payment Methods

- Multi-Currency Support

- Pausing and Resuming Payments

- Discount Application

- Automated Invoice Management

- Analytics and Reporting

- Multiple Integration Options

- Conclusion

Merchant Account Setup

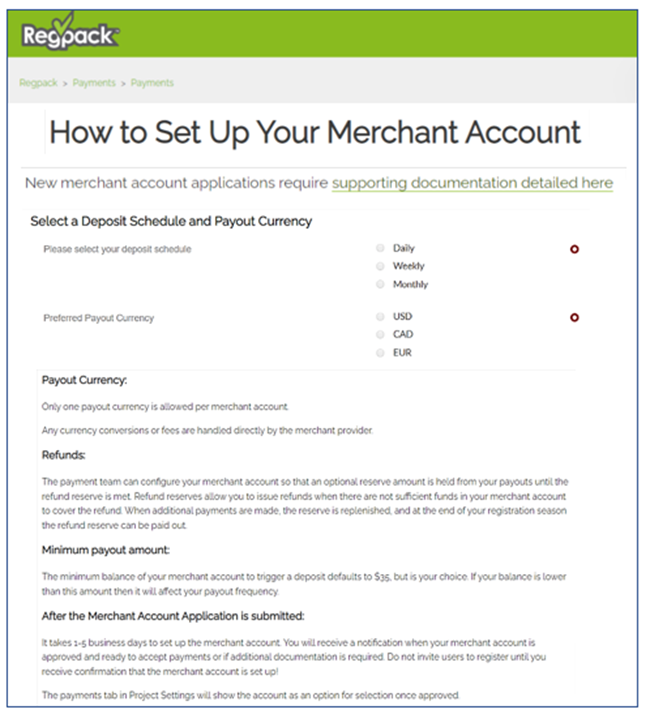

One important feature to look for is whether the recurring billing software provides businesses with the option to set up a merchant account.

So, what’s a merchant account?

According to Investopedia:

A merchant account is a type of business bank account that allows a business to accept and process electronic payment card transactions.

Merchant accounts are provided mainly by acquiring banks that connect a business with credit and debit card providers and allow them to accept other forms of electronic payment.

Naturally, your business might already have a merchant account or even select not to have one and use third-party payment processors like PayPal, Stripe, or Square instead.

Source: Paperform

Although this option may seem more convenient, it usually involves higher processing fees per transaction, which can negatively impact revenue as your business grows.

In addition, when third-party processors are involved, your customers are redirected to their websites to pay for your services or products.

In comparison, having a merchant account—and the right recurring billing software—enables you to embed the entire payment process on your website, thus increasing customer convenience and building trust.

In any case, your recurring billing software should allow you to use any of these three options, including setting up a merchant account through your software provider.

This process will differ slightly depending on your selected software but will involve submitting an application and—for new merchant accounts—supporting documentation.

Source: Regpack

Once your merchant account is set up and ready to accept payments, you can use the software to establish recurring billing plans for your customers, where their credit or debit card is automatically charged on a regular basis.

Another benefit of a merchant account is related to how much control you have over credit and debit card chargebacks, where your merchant bank will typically give you more opportunities to dispute them and provide evidence to support your case.

To summarize, look for recurring billing software with merchant account setup options because it enables your business to accept all forms of online payments—at lower transaction fees —directly on your website.

Automated Recurring Billing

Automated recurring billing is the primary reason you’re getting recurring billing software, and this core feature should give you complete control over your business’s pricing plans.

In other words, this feature should be flexible/customizable enough to allow you to automate your billing process, which includes:

- creating, customizing, and updating multiple pricing plans with different billing amounts and billing schedules for each plan

- setting up subscription tiers and free trials, and modifying individual subscription plans

- pausing and resuming recurring payments, applying discounts, and automating invoice management (covered below as separate sections)

Simply put, you can set up any pricing, billing, and payment parameters according to your business’s needs and customer preferences.

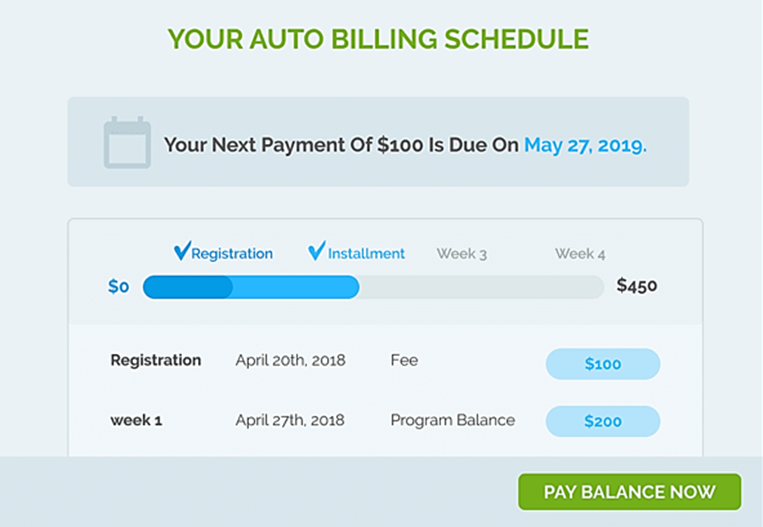

For example, our automated billing software, Regpack, allows you to automate your billing workflows from start to finish.

Source: Regpack

As you can see, there are various billing parameters that you can customize when creating a pricing model for your services or products, whether it’s a monthly subscription, an installment plan, a one-off payment, or any other scheduled payment.

In other words, Regpack’s automated billing feature enables your business to offer several billing schedules.

This is particularly useful when offering higher-priced services or products as it can attract clients who would otherwise pass on your offer as they’re unable or unwilling to make a full payment at once.

When recurring payments are concerned, clients get online access to their own payment portals.

Source: Regpack

Suffice it to say, Regpack clients who utilize automated billing functions have reported up to 75% fewer non-payments, a 35% jump in timely payment rates, and a 25% improved cash flow.

So, the recurring billing software you choose should give you complete control over your business’s pricing plans and provide the flexibility/customization options necessary to automate the related billing processes.

Ultimately, this feature reduces the need for manual work, minimizes billing errors, and lets businesses customize billing schedules as needed, which can boost revenues and create a more predictable cash flow.

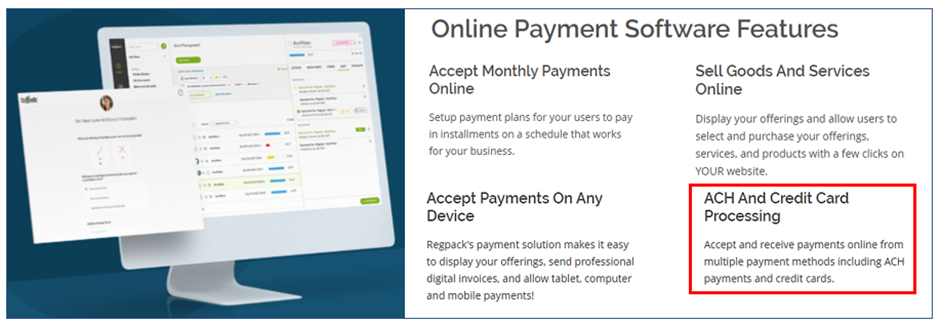

Multiple Payment Methods

This feature of your recurring billing software—supporting multiple payment methods—is a natural extension of the automated billing feature we just covered.

For your customers, this means they can pay using their preferred payment method, such as a credit card, debit card, automated clearing house (ACH) payment, bank transfer, or any other online payment method your business might offer.

Source: Regpack

Naturally, this is not only an added convenience you provide to your clients but also a preventive measure for those who might leave their shopping cart because their preferred payment method is unavailable.

One study found that 42% of US consumers would do that.

Clearly, this is another reason to offer multiple payment methods.

Of course, your choice of payment methods will depend on factors mainly related to your target customer’s preferences, as well as the contractual requirements and processing fees of different payment providers, such as credit card companies.

The point is that your recurring billing software should support multiple payment methods of your choice and facilitate this process by, among other things, allowing you to set up merchant accounts.

Furthermore, your software should also automate payment processing from end to end, thus also streamlining your checkout process and improving customer experience.

Source: Regpack

Naturally, your software provider should offer competitive payment processing fees or, better yet, a flat rate fee.

Overall, offering multiple online payment methods and payment plans convenient for your customers—and ensuring secure payment processing—are all necessary features for creating a seamless user experience and better sales results.

Multi-Currency Support

As its name suggests, this feature pertains to your recurring billing software enabling customers to pay in their own currency.

Naturally, this is vital if your business sells—or plans to sell—to customers worldwide.

This feature eliminates the need for currency conversion on the part of your customers, and you still get the funds in the currency you want.

Besides extending customer convenience and boosting international sales, this feature also helps you avoid hidden currency conversion fees and unfavorable rates.

Source: Regpack

In addition, your software provider’s support team—or your account manager—should be ready to help you handle any tricky foreign currency transfers or billing/charging issues.

They should also transparently communicate any changes in conversion rates and fees charged by banks and credit card companies.

Long story short, if your business wants to sell outside the US, you need recurring billing software—and the software provider’s team—that supports payments in multiple currencies.

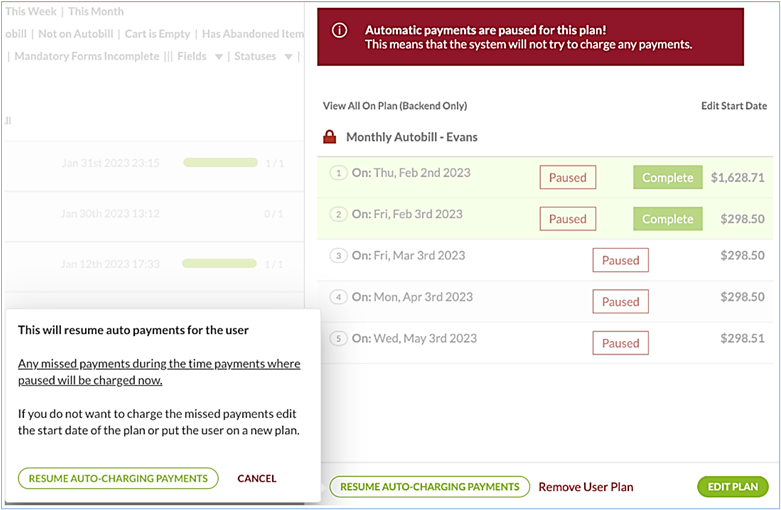

Pausing and Resuming Payments

As mentioned, this feature of your recurring billing software is part of automated billing functionalities and allows you to pause and resume regular payments as needed.

Considering all the reasons your customers could wish to pause their payments, this is a practical feature that enables you to accommodate their wishes, build trust, and retain them as customers in the long term.

For example, if a customer is paying in installments and runs into financial hardship, you can pause their payments for a specific period, allowing them to pay their balance at a later date.

Source: Regpack

In such cases, the automated billing system will charge any paused payments that have become due when auto payments are resumed.

The same principle works for subscriptions.

For example, if your subscriber is going on holiday, this feature will allow you to pause their subscription and resume it upon their return without charging them for the period they were away.

Therefore, this pause/resume feature of your automated billing software should enable your business to manage any changes in your customer’s recurring payments, giving you a valuable tool to improve customer retention.

Discount Application

Of course, discounts are powerful tools for attracting new and retaining existing customers, as well as upgrading them to premium versions of your service or product.

That’s why your recurring billing software should allow you to apply discounts in all their forms, including those for recurring payment plans.

More specifically, you should be able to:

- define the percentage or amount of a discount

- determine if it applies to the customer’s entire order or specific services/products

- set the time when a discount will start and end (early bird discounts)

- establish discount coupons or codes that add discounts when entered

Ultimately, your software should enable you to apply discounts however you see fit and automate payment and invoicing adjustments for all your customers, specific groups, or individuals.

Source: Regpack

Again, discounts are essential to any business’s pricing strategy geared towards attracting new and retaining existing customers.

For this reason, your recurring billing software should provide maximum flexibility in applying discounts and enable you to automate the resulting changes in billing amounts and invoices, which brings us to the next key feature.

Automated Invoice Management

Automated invoice management is all about improving the accuracy and speed of invoicing customers by relieving your staff from time-consuming, repetitive, and error-prone manual invoicing processes.

In other words, your recurring billing software should allow users to automatically generate invoices and send them directly to customers.

In the case of recurring payments, they should be able to decide at which intervals invoices should be sent to customers (with automatically updated invoice info, naturally).

Source: Regpack

Furthermore, automated invoicing parameters can be set to send action/date-triggered payment emails.

For example, a customer who made a payment can receive an automatic payment confirmation email with transaction details.

Likewise, since your recurring billing software is tracking scheduled payment dates, you can set up automatic emails that will remind customers their payment is approaching, as well as notify them if their payment is late.

As said, automatic invoice management reduces invoicing errors, the main culprit behind unpaid invoices.

When coupled with ensuring digital invoices and email reminders are sent on time, it’s clear that automating invoicing operations helps minimize late payments, which makes it a must-have feature of your recurring billing software.

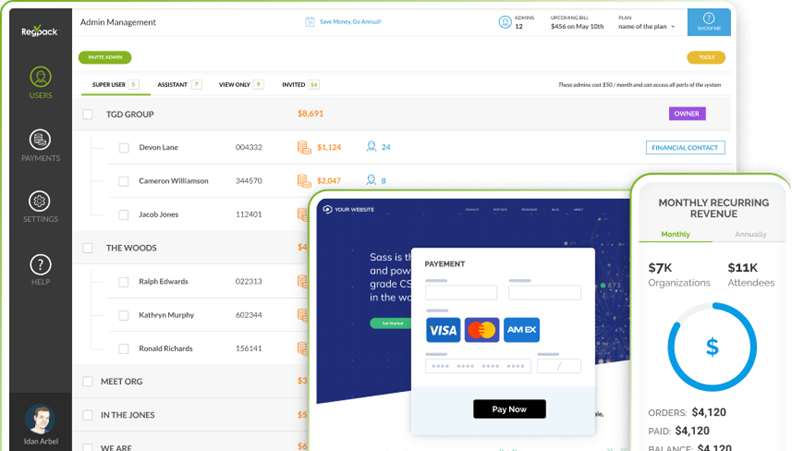

Analytics and Reporting

Analytics and reporting allow you and your team to utilize the data collected by the recurring billing software to make data-based and, therefore, better-informed business decisions.

More specifically, this feature enables you to filter information according to different criteria, analyze different aspects of your recurring billing operations, and generate various custom reports.

Source: Regpack

Using this feature, you can analyze revenue by product/service, customer retention rates, percentage of timely and failed payments, most popular pricing plans, and much more.

All in all, analytics and reporting are essential for businesses that see recurring billing data as a source of valuable insights that allow them to improve their operations and enhance profits.

Multiple Integration Options

Like analytics and reporting allow you to use recurring billing data to advance your business, multiple integration options enable you to integrate this data with other software systems your business is already using.

Naturally, this primarily refers to your accounting software but may include other solutions, such as project management (PM) or customer relationship management (CRM) software.

To enable communication between their solution and other software programs, recurring billing software providers typically provide an open application programming interface (API) that enables the integration.

Source: Regpack

For instance, Regpack’s Open API has an interesting capability in the form of webhooks that tell the recurring billing system to notify another software when a specific event happens.

This means that, for example, an accountant using QuickBooks as their accounting software can set up a webhook in Regpack that triggers an automatic notification whenever a customer’s recurring payment fails.

In a nutshell, you should look for recurring billing software that provides multiple integration options so your business can make data-driven, better-informed decisions.

Conclusion

To summarize, if your recurring billing software has these nine core features, you can count on your business being able to streamline billing and payment operations on both ends.

In other words, your customers will enjoy a much smoother user experience, from the entire checkout process embedded on your website to multiple payment methods, multi-currency support, and so on.

At the same time, you and your time will benefit from a range of automated processes that save time and minimize errors, allowing your business to increase staff efficiency, strengthen cash flow, and achieve higher profits.