If your business earns revenue by selling services or products to customers recurrently, i.e., using a subscription-based model, you’re already aware of this model’s benefits.

More specifically, these include the stability of income that recurring payments bring to your business and the convenience they provide your customers.

Naturally, as with all things in life, they also come with some caveats and challenges, particularly when it comes to improving your recurring revenue stream.

In this article, we’ll explore four proven strategies—and provide actionable tips—that can help your business maximize its revenue from recurring payments.

- Optimize Your Pricing Strategy

- Create More Opportunities for Upselling

- Minimize Involuntary Churn

- Improve Your Dunning Management

- Conclusion

Optimize Your Pricing Strategy

Your pricing strategy can be optimized—with or without price increases—to maximize your recurring revenue stream.

First of all, setting a fair price for your product or service can be a complex process that requires balancing multiple factors, of which production, labor, and advertising costs are only one element.

For example, businesses typically consider the value their product or service provides to customers, market demand, and the prices charged by competitors.

Additionally, businesses may need to optimize their pricing strategy based on the changes in the market, such as economic downturns or shifts in consumer behavior.

Of course, the easiest way to get more revenue from your existing and future subscribers is to increase the price of your service or product.

However, to avoid the potential negative consequences of such a move on your business, price hikes should be carefully considered, planned, and implemented.

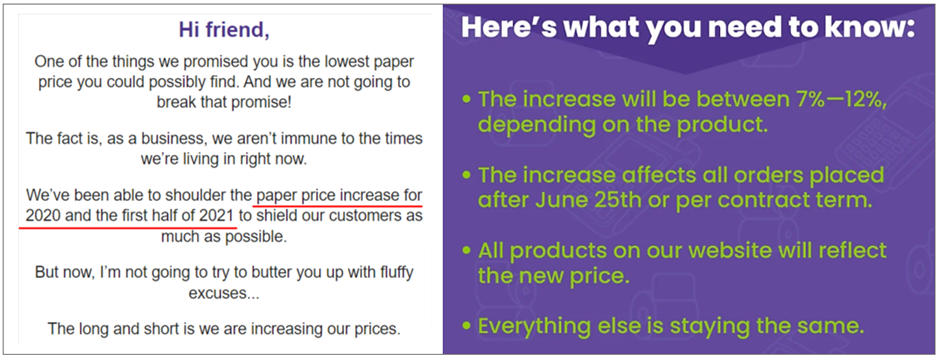

Source: Milled

When raising their prices, many companies choose to explain this universally loathed move as a consequence of improving their service or product or aligning operations with rising costs, be it due to inflation, business growth, or other factors.

Source: Milled

As you can see, the reasons cited for the price hike shown above are supply chain issues and the resulting inflation, and customers are clearly informed how much the increase will be and when it will take effect.

In any case, businesses should calculate a fair price for their recurring service/product delivery and—if they want to consider increasing their prices—provide customers with good reasons and/or enough value to justify the price increase.

Of course, there are other ways to optimize your pricing strategy and maximize your recurring revenue stream, without necessarily raising prices.

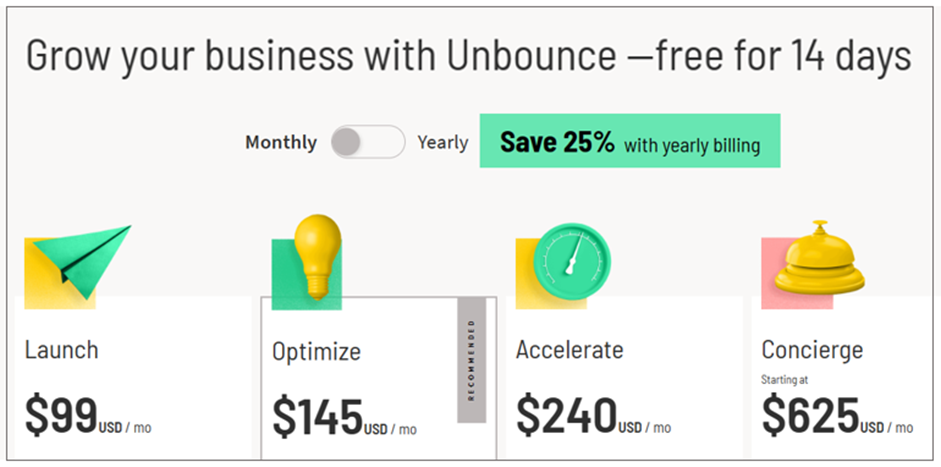

One possible solution when offering your subscription plans is to establish tiered pricing, like in this example.

Source: Unbounce

This pricing model involves offering multiple subscription tiers with different features and price points, allowing customers to choose the level of service that best meets their needs and budget.

Concurrently—as covered in the next section—it also allows your business to upsell customers to higher tiers as they get used to your service.

Other pricing methods that can be utilized to maximize revenue from recurring payments without raising prices include offering discounts for longer-term subscriptions (e.g., yearly subscription, as shown above), usage-based pricing, and the freemium model.

You can read more about them in our article on pricing models for subscription businesses.

For now, just remember that you should review your pricing strategy and consider how it can—with or without price increases—be optimized to maximize revenue from recurring payments.

Create More Opportunities for Upselling

If you’re selling a subscription service—even when it involves products—creating more opportunities for upselling can help your business maximize revenue from recurring payments.

As mentioned above, this is primarily achieved by offering different monthly and annual pricing plans, making it easy for customers to upgrade, and incentivizing them to do so.

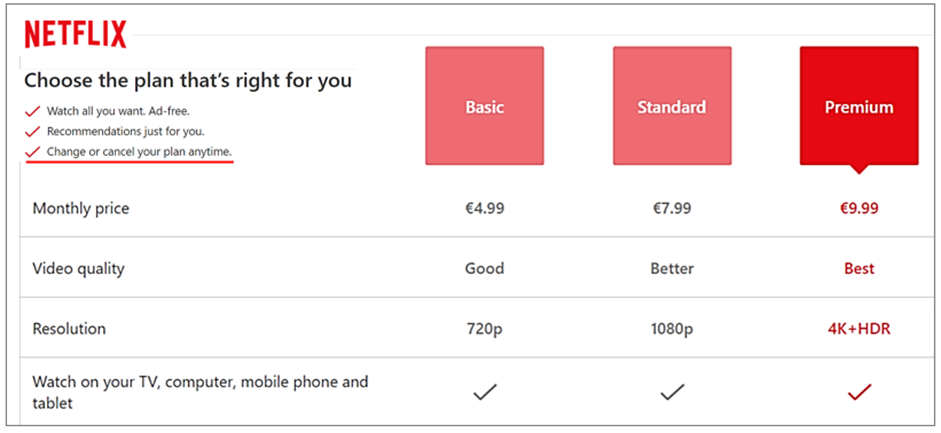

You’re surely familiar with this widely used model, be it a freemium app like Spotify—which you can use for free but can upgrade to a paid/ad-free version at any time— or a tiered pricing model like Netflix.

Source: Netflix

As you can see, Netflix’s signup page already highlighted what their upselling goal is (printed in a different color, described as “best”), but they don’t force the issue.

Instead, they encourage new subscribers to choose any plan that’s right for them (which they can change or cancel anytime).

In the case of software products and online services, upselling opportunities can be planned at the beginning—when defining your pricing strategy—by, for example, limiting some features of your offer that customers will likely need or want.

This way, your business creates a niche for upselling customers from a basic to a standard or premium plan.

Source: thebigday.my

Of course, the same upselling strategy can be applied when your product is already launched and has subscribers, usually by creating a new feature/service that’s made available only to premium users.

Naturally, different discounts for loyal customers and upgrades to an annual plan are also effective upselling tools, allowing your business to maximize revenue from recurring payments.

However, although all these models provide maximum flexibility and convenience for customers, they make tracking and billing of these changes more complicated than charging a one-tier flat rate subscription fee.

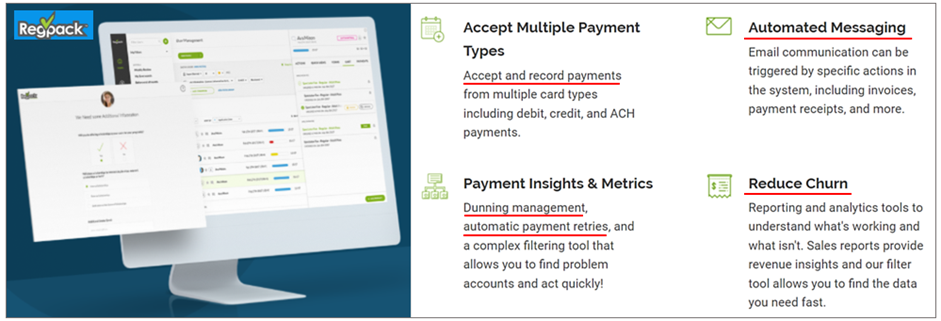

This complexity is easily managed using recurring billing software like Regpack, which allows you to integrate and automate tracking and management of all these subscription plan changes and billing cycles.

Source: Regpack

In fact, running a successful online subscription business and maximizing revenue through upselling without the help of one or more software solutions is, nowadays, just not possible.

So, armed with the right software, businesses can consider how different pricing plans and discounts can be used to increase the number of their higher-tier (better-paying) customers by creating more upselling opportunities.

In doing so, businesses can also consider providing customers with the option of customizing their current pricing plan by adding additional features, users, etc.—at a price—without the need to upgrade.

Overall, your business can maximize recurring billing revenues by strategically establishing pricing plans, offering new features or services, and providing targeted discounts, i.e., creating more upselling opportunities.

Minimize Involuntary Churn

As opposed to voluntary churn—customers quitting their subscription willingly—involuntary churn occurs when a customer’s subscription is canceled without their knowledge due to payment failure.

Here’s a typical example.

A customer provided their billing info upon subscription, and the business uses that info for recurring billing purposes.

When a customer’s credit or debit card account information changes for whatever reason—card expiration, loss or theft, account closure, etc.—and they do not update the said billing info, that business ends up with outdated payment information.

After the payment is declined by the credit card company, and—provided that the billing info is not updated—this can, after several failed attempts, trigger the automatic termination of the customer’s subscription.

To avoid this, businesses should use account updaters—services provided by credit card companies which will automatically update the customer’s card information when that information changes or expires.

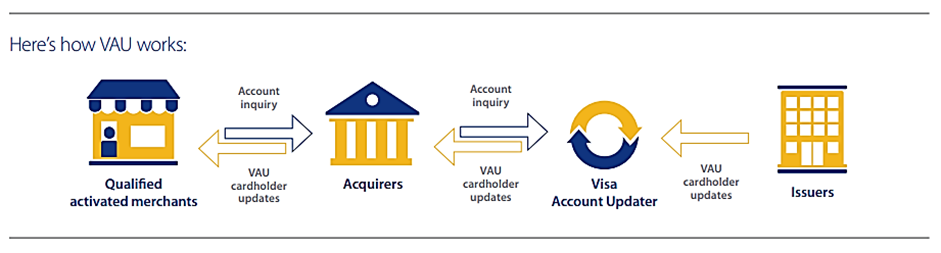

For example, here’s how Visa’s Account Updater (VAU) works:

Source: Visa

Long story short, your business (merchant) signs up for the service via your acquirer—merchant bank.

Then, when a recurring payment is a few days away, you submit an account inquiry—check for account info changes—to your acquirer, who then submits it to VAU.

VAU runs the data through its database, checks for updates, and forwards the updated data back to you, and now you can update the customer account info and bill them correctly.

Naturally, this service helps minimize involuntary churn, allowing your business to maximize revenue from recurring payments.

Of course, other credit card companies have their own programs for automatically updating customer account info.

For instance, MasterCard’s Automatic Billing Updater works in a similar way but also has the option of merchants either submitting inquiries or setting up automatic update notifications.

Ultimately, these services—other than helping businesses minimize involuntary churn—are offered as an added convenience for customers who want to avoid the hassle of missed payments and payment info updates.

Source: BECU

In other words, various account updaters help reduce failed payments, service disruptions, and inconvenience for businesses and customers alike.

Therefore—to minimize involuntary churn and maximize revenue from recurring payments—your business should consider signing up for and using account updaters.

Improve Your Dunning Management

Another way to maximize revenue from your subscriptions is to improve your dunning management, i.e., your process of recovering failed payments.

According to Investopedia, dunning is:

…the process of business owners communicating with customers in an effort to collect money owed for goods or services provided.

However, even before communication with customers starts, there are steps you can take to recover failed payments.

In other words, you should have a system in place to distinguish between the so-called hard and soft declines and automatically retry payments for soft declines.

Soft payment declines are usually temporary issues caused by card expiry, technical or processing issues, insufficient funds, and other reasons that may be resolved in a few days without subjecting your customers to undue trouble.

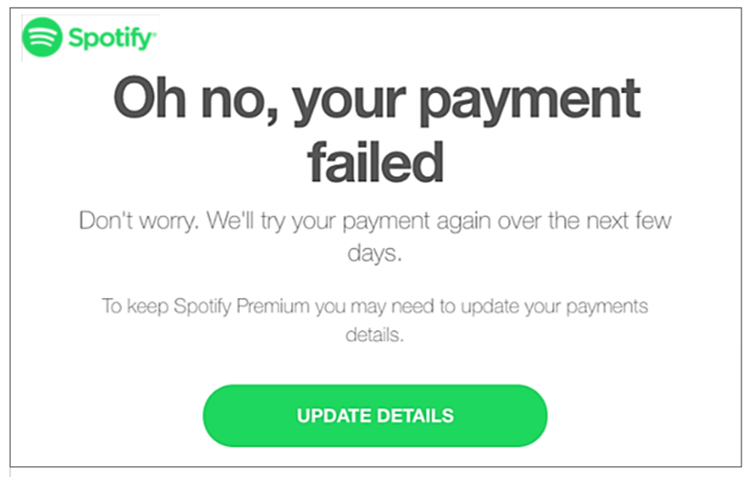

But, when a payment fails, it’s also best to notify your customer, thus informing them there was an issue with their card so they can update payment details if they want.

Source: customer.io

A message of this nature would be considered your first dunning email.

From there—depending on whether the issue is resolved—this would be followed by other emails reminding the customer to update payment details or choose another payment method because otherwise, their subscription will be canceled.

Of course, an integrated recurring billing and payment processing software with strong email management features—like Regpack—can streamline your entire subscriber signup and recurring payment process, including dunning emails.

Source: Regpack

As you can see, Regpack’s system can be set up to automatically retry soft declines, as well as send email notifications triggered by specific actions, such as failed payments.

In fact, businesses using Regpack to sell subscriptions right from their website report a 25% reduction in client churn and a 30% increase in cash flow.

Overall, improving your dunning management by automating soft decline retries and email notifications with the help of subscription management software will benefit your business greatly.

Conclusion

As discussed, you should consider how the strategies presented in this article can be applied to your business and which can be improved to maximize your revenue from recurring payments.

As a reminder, this can include optimizing your pricing strategy, creating more opportunities for upselling, minimizing involuntary churn, and improving your dunning management.

Supported with the right tools and methods, implementing these strategies will enable your business to better manage recurring payments, thus maximizing revenue and improving your bottom line.