Whether the inflation rate is high or low, businesses feel its effects through increased costs, weakened cash flow, and reduced profits.

While the magnitude of these negative impacts will depend on the level of inflation, they all occur because money loses value as the cost of goods and services rises.

Naturally, these inflation-induced losses extend to the money a business earned but didn’t yet collect due to slow and inefficient billing processes.

That said, one of the key elements in improving these processes—and protecting a business from these losses—is recurring billing, i.e., the ability to charge customers automatically at set intervals.

In this article, we’ll look at the top four reasons why recurring billing can be a game-changer for businesses that want to face inflation-related challenges effectively.

- Automates Payment Processing

- Creates a Predictable Cash Flow

- Enables Acting On Growth Opportunities

- Reduces the Cost of Doing Business

- Conclusion

Automates Payment Processing

By automating the billing functions and payment processing, recurring billing software allows businesses to charge their customers timely and correctly, thus preventing many late payment issues exacerbated by inflation.

In other words, recurring billing software allows businesses to:

- create invoices and store customers’ payment details

- set up custom payment plans

- charge customers according to a recurring payment schedule

Simply put, when these processes—including secure processing of online payments—are largely automated with the help of software, the time it takes for businesses to get paid shortens, which minimizes the value-lowering effects of inflation on due payments.

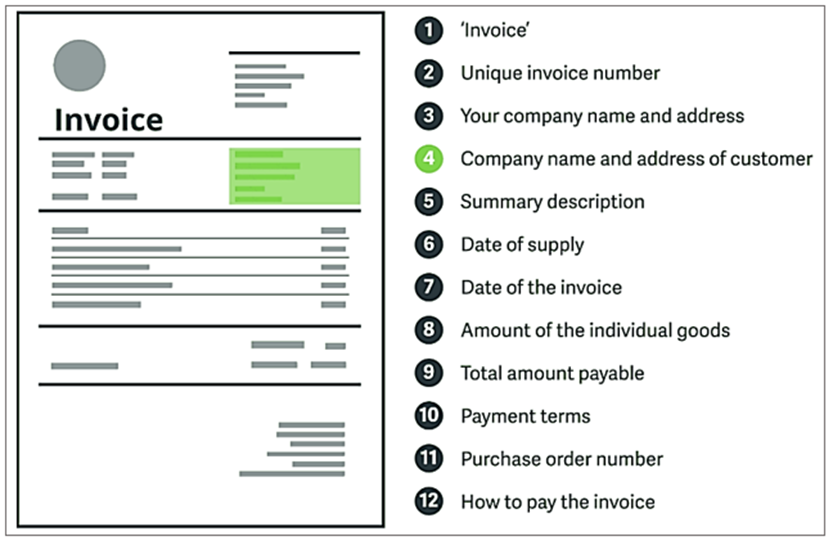

For example, such software improves the speed and accuracy of the invoicing process.

This is because most billing software solutions enable users to create and save invoice templates already customized for specific customers, ensuring that the customer’s payment information and other invoice details are accurate.

Source: Sage

Of course, this reduces the risk of delayed payments due to incorrect invoices, which are the reason behind more than 60% of all late payments.

This risk is further reduced—and the payment process even more automated—when businesses utilize recurring billing software to set up custom payment plans for their customers.

For instance, a business may create multiple predefined payment plans (e.g., full payment, installments, the deposit plus scheduled payments) that customers can choose from when making a payment.

This is particularly convenient for customers who—due to inflation and other factors—are not able or willing to pay for a product or service in one lump sum.

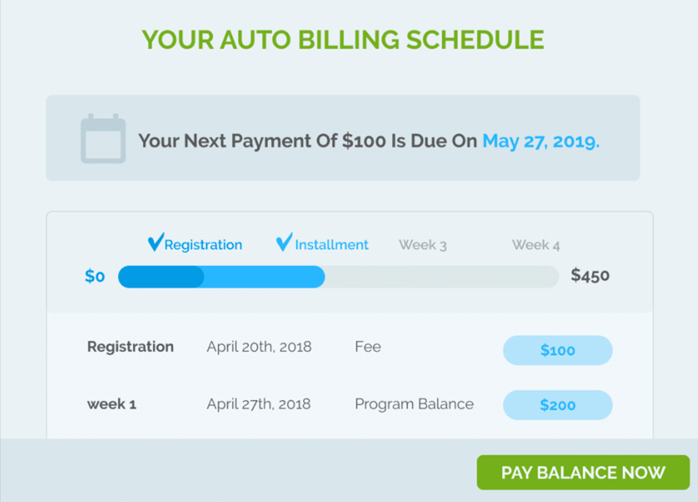

So, when customers opt for an installment payment plan, recurring billing software gives them online access to their own auto-billing schedule.

Source: Regpack

Aside from the convenience and control this feature gives to customers, it also enables businesses to automatically charge customers according to a recurring schedule they select.

The result is real billing automation that further minimizes late or missed payments, which means businesses don’t need to worry about inflation reducing the value of received amounts.

Of course, not every recurring billing software will offer all these features, so businesses need to pinpoint their needs and research their options.

When doing so, they should consider our automated billing and payment solution, Regpack, which provides all of these features and more.

Source: Regpack

In a nutshell, Regpack automates the entire payment process through billing workflows and—in addition to invoice creation, custom payment plans, and automated billing schedules—provides:

- secure payment processing and collection

- automatic payment reminders

- analytics and reporting

- integration with other software solutions

Using Regpack’s auto-billing functionality, businesses have seen a 75% decrease in non-payment and a 35% increase in payment rates.

To sum up, automating payment processing with the help of recurring billing software allows businesses to increase the accuracy and speed of their billing and payment processes, which minimizes late payments and the related adverse impacts of inflation.

Creates a Predictable Cash Flow

Recurring billing creates a predictable cash flow because customers are automatically charged at the start of each billing cycle, and maintaining a stable cash flow is even more important during inflation.

In other words, knowing exactly when payments will be processed and the precise amount that will be credited to the company’s account will allow businesses to plan ahead and manage their expenses more efficiently.

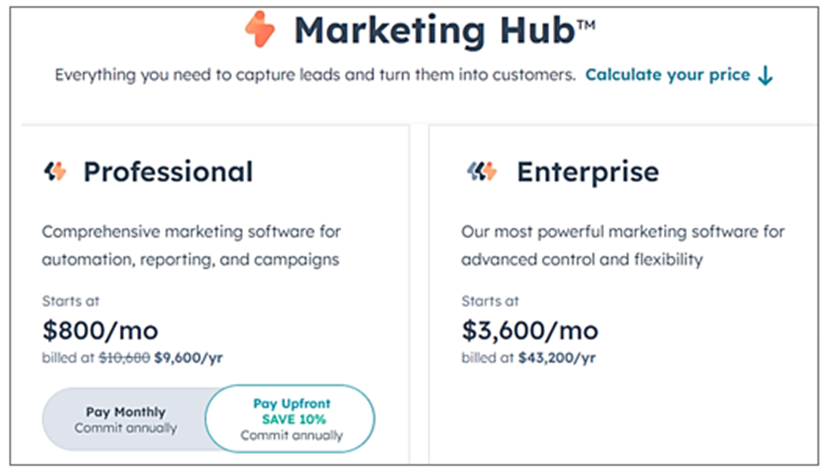

For instance, a marketing and sales platform charges $800 per month—like in the example below—for their subscription service, and they have, let’s say, 500 customers.

Source: HubSpot

With recurring billing, they know that at the beginning of each month (billing cycle), they will receive $400,000 in revenue.

This allows the company to plan its expenses based on this predictable cash flow, ensuring it has enough funds to cover ongoing costs, such as employee salaries, marketing expenses, and product development.

At times of high inflation—when cash flow is typically reduced and planning for the future is more difficult—recurring billing enables the company to maintain a stable cash flow, which can help them deal with inflation effects on their finances.

For instance, clients using Regpack’s recurring billing typically see a 25% improvement in cash flow.

Therefore, by automating the billing and payment process, recurring billing software provides a steady and predictable stream of income, which helps businesses plan ahead and create a solid financial foundation to weather the storm of inflation.

Enables Acting On Growth Opportunities

Another reason why recurring billing can be a game-changer for businesses that want to grow—especially during times of higher inflation rates—is because it enables businesses to act on growth opportunities.

In other words, by freeing up the time that would otherwise be spent on manual payment processing, businesses can focus on brainstorming, planning short-term and long-term growth initiatives, and taking advantage of growth opportunities.

Moreover, recurring billing software provides businesses with a wealth of payment data, enabling them to analyze where they have been, where they are, and where they are going.

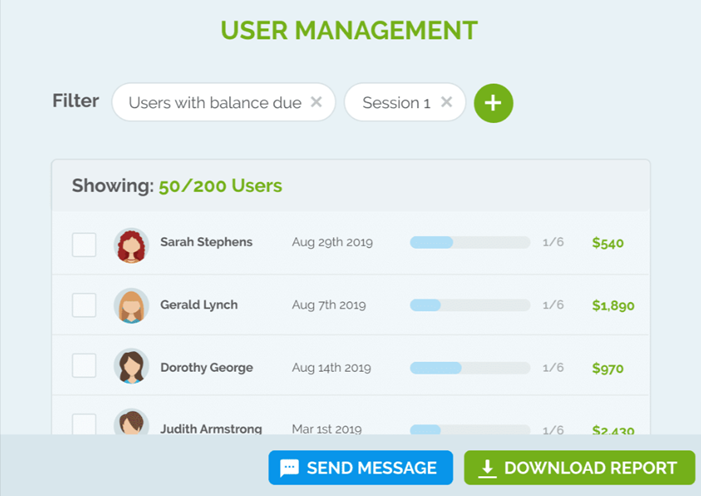

For example, a company can use software to filter data and generate sales and payment reports according to any criteria it wants to analyze, such as how many users it has and how much revenue they generate each month.

Source: Repack

Using this payment data, a company can identify how inflation affects customer behavior, such as which payment plans and payment options are most popular compared to the period of low inflation.

Then, the company can make data-driven decisions about how to grow during inflation.

For instance, it may decide to offer new payment plans more suitable for customers’ needs during inflation, provide discounts, and invest in marketing campaigns that will highlight these new payment options and target new customer segments.

Overall, recurring billing software enables businesses to act on growth opportunities by freeing up time, automating billing and payment processing, and providing valuable payment data that can inform data-driven decisions about going forward during inflation.

Reduces the Cost of Doing Business

Because recurring billing automates the payment process, there is no need for resource-intensive and time-consuming manual payment processing, so the company’s operating costs will be reduced.

In other words, businesses can save valuable time and resources that would otherwise be spent on manual payment processing and assign their staff to tasks that bring more value, such as customer service, sales, and marketing.

Moreover, automation allows businesses to avoid billing mistakes—often resulting from manual data entry errors—that will negatively impact their bottom line, particularly during periods of high inflation.

Finally, recurring billing software enables companies to accept online payments more efficiently, which can help reduce their payment processing fees.

For example, a company would— depending on the payment processor and the type of transaction—typically be charged a 3-5% processing fee for manual payments.

On the other hand, it would have to pay 1-3% for processing online payments.

Regpack charges a flat processing fee of 1.5% for all transactions.

Source: Regpack

In addition to more affordable processing fees, recurring billing software like Regpack allows businesses to set their own service fee percentages (if any), which can help companies cut their processing fees even further.

For instance, if a company adds a service fee only for credit card transactions, this encourages customers to pay with a debit card, e-check, or an automated clearing house (ACH).

That way, they can avoid higher processing fees charged by credit card companies.

To summarize, recurring billing enables businesses to:

- automate their payment processing, saving valuable time and resources

- avoid costly billing and payment errors

- reduce payment processing fees

Naturally, all these abilities reduce the cost of doing business, meaning that companies can better manage the impact of inflation on their bottom line, focus on strategies to grow their business, and stay competitive even during uncertain times of high inflation.

Conclusion

Businesses facing inflation can use recurring billing as a way to automate payment processing, create a predictable cash flow, act on growth opportunities, and reduce the cost of doing business.

In other words, whether inflation is high or low, your business can utilize recurring billing software to lower operating costs, strengthen cash flow, improve efficiency, and increase profits, all of which are crucial for effectively addressing inflation-related challenges.